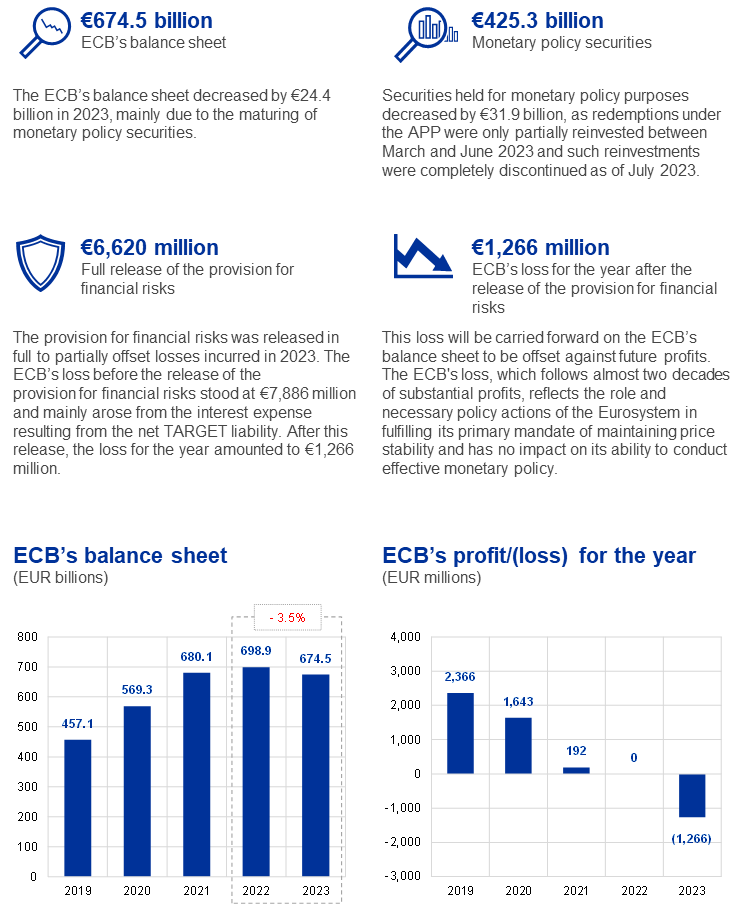

Key figures

1 Management report

1.1 Purpose of the ECB’s management report

The management report[1] is an integral part of the ECB’s Annual Accounts and is designed to provide readers with contextual information related to the financial statements.[2] Given that the ECB’s activities and operations are undertaken in support of its policy objectives, the ECB’s financial position and result should be viewed in conjunction with its policy actions.

To this end, the management report presents the ECB’s main tasks and activities, as well as their impact on its financial statements. Furthermore, it analyses the main developments in the balance sheet and the profit and loss account during the year and includes information on the ECB’s net equity. Finally, it describes the risk environment in which the ECB operates, providing information on the specific risks to which the ECB is exposed, and the risk management policies used to mitigate risks.

1.2 Main tasks and activities

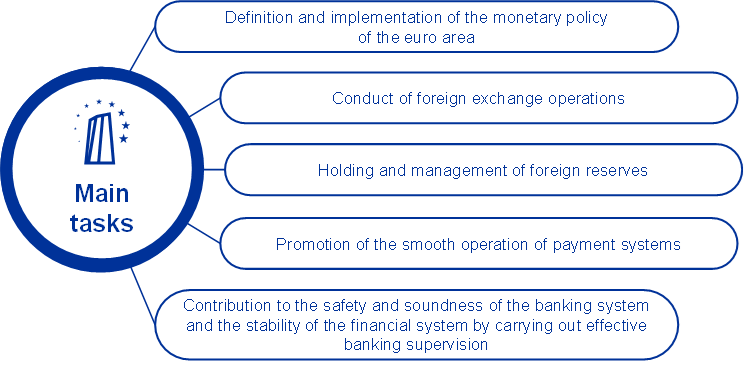

The ECB is part of the Eurosystem, which comprises, besides the ECB, the national central banks (NCBs) of the Member States of the European Union (EU) whose currency is the euro.[3] The Eurosystem has the primary objective of maintaining price stability. The ECB performs its tasks as described in the Treaty on the Functioning of the European Union[4] and in the Statute of the European System of Central Banks and of the European Central Bank (Statute of the ESCB)[5] (Figure 1). The ECB conducts its activities in order to fulfil its mandate and not with the intention of generating profit.

Figure 1

The ECB’s main tasks

The Eurosystem’s monetary policy operations are recorded in the financial statements of the ECB and of the euro area NCBs, reflecting the principle of decentralised implementation of monetary policy in the Eurosystem. Table 1 below provides an overview of the main operations and functions of the ECB in pursuit of its mandate, and their impact on the ECB’s financial statements.

Table 1

The ECB’s key activities and their impact on its financial statements

Implementation of monetary policy

Liquidity provision in foreign currency | Liquidity provision to non-euro area central banks in euro |

|---|---|

The ECB acts as an intermediary between non-euro area central banks and the Eurosystem NCBs by means of swap transactions aimed at offering short-term foreign currency funding to Eurosystem counterparties.3 These operations are recorded in the balance sheet items “Liabilities to non-euro area residents denominated in euro” and “Other claims within the Eurosystem (net)” / “Other liabilities within the Eurosystem (net)”, as well as in off-balance-sheet accounts. Interest accruals are included in the ECB’s profit and loss account as “Other interest income” or “Other interest expense”. | The Eurosystem may provide euro liquidity to non-euro area central banks by means of swap and repo transactions in exchange for eligible collateral.4 For the ECB, the swap operations are recorded in the balance sheet items “Claims on non-euro area residents denominated in foreign currency” and “Liabilities to non-euro area residents denominated in euro” or “Other claims within the Eurosystem (net)” / “Other liabilities within the Eurosystem (net)”, as well as in off-balance-sheet accounts. Interest accruals are included in the ECB’s profit and loss account as “Other interest income” or “Other interest expense”. |

Conduct of foreign exchange operations and management of foreign reserves

Foreign exchange operations and management of foreign reserves |

|---|

The ECB’s foreign reserves are presented on the balance sheet, mainly under “Gold and gold receivables”, “Claims on non-euro area residents denominated in foreign currency” and “Claims on euro area residents denominated in foreign currency”, while any related liabilities would be presented under “Liabilities to euro area residents denominated in foreign currency” and “Liabilities to non-euro area residents denominated in foreign currency”. Foreign exchange transactions are reflected in off-balance-sheet accounts until the settlement date. Net interest income, including coupon accruals and amortised premiums and discounts, is included in the profit and loss account under the item “Interest income on foreign reserve assets”. Unrealised price and exchange rate losses exceeding previously recorded unrealised gains on the same items and realised gains and losses arising from the sale of foreign reserves are also included in the profit and loss account under the items “Write-downs on financial assets and positions” and “Realised gains/losses arising from financial operations” respectively. Unrealised gains are recorded on the balance sheet under the item “Revaluation accounts”. |

Promotion of the smooth operation of payment systems

Payment systems (TARGET) |

|---|

Intra-Eurosystem balances of euro area NCBs vis-à-vis the ECB arising from TARGET5 are presented together on the balance sheet of the ECB as a single net asset or liability position under “Other claims within the Eurosystem (net)” or “Other liabilities within the Eurosystem (net)”. TARGET balances of non-euro area NCBs vis-à-vis the ECB are recorded on the balance sheet under “Liabilities to non-euro area residents denominated in euro”. Balances of ancillary systems6 connected to TARGET through the TARGET-ECB component are recorded on the balance sheet under “Liabilities to other euro area residents denominated in euro” or “Liabilities to non-euro area residents denominated in euro”, depending on whether the managing entity is established in or outside the euro area. Interest accruals are included in the profit and loss account under “Other interest income” or “Other interest expense”. |

Contribution to the safety and soundness of the banking system and the stability of the financial system

Banking supervision – the Single Supervisory Mechanism |

|---|

The annual expenses of the ECB in relation to its supervisory tasks are recovered via annual supervisory fees levied on the supervised entities. The supervisory fees are included in the profit and loss account under the heading “Net income/expense from fees and commissions”. Furthermore, the ECB is entitled to impose administrative penalties on supervised entities for failure to comply with applicable EU banking law on prudential requirements (including ECB supervisory decisions). The related income is recorded in the profit and loss account under the heading “Net income/expense from fees and commissions”. |

Other

1) Further details on the Eurosystem’s monetary policy instruments and, more specifically, on the open market operations can be found on the ECB’s website.

2) Further details on securities lending can be found on the ECB’s website.

3) Further details on the currency swap lines can be found on the ECB’s website.

4) Further details on the Eurosystem’s euro liquidity operations against eligible collateral can be found on the ECB’s website.

5) Further details on TARGET can be found on the ECB’s website.

6) Ancillary systems are financial market infrastructures that have been granted access to the TARGET-ECB component by the Governing Council, provided they fulfil the requirements defined in Decision (EU) 2022/911 of the ECB of 19 April 2022 concerning the terms and conditions of TARGET-ECB and repealing Decision ECB/2007/7 (ECB/2022/22) (OJ L 163, 17.6.2022, p. 1), as amended. The unofficial consolidated text with the list of amendments can be found here. Further details on ancillary systems can be found on the ECB’s website.

1.3 Financial developments

1.3.1 Balance sheet

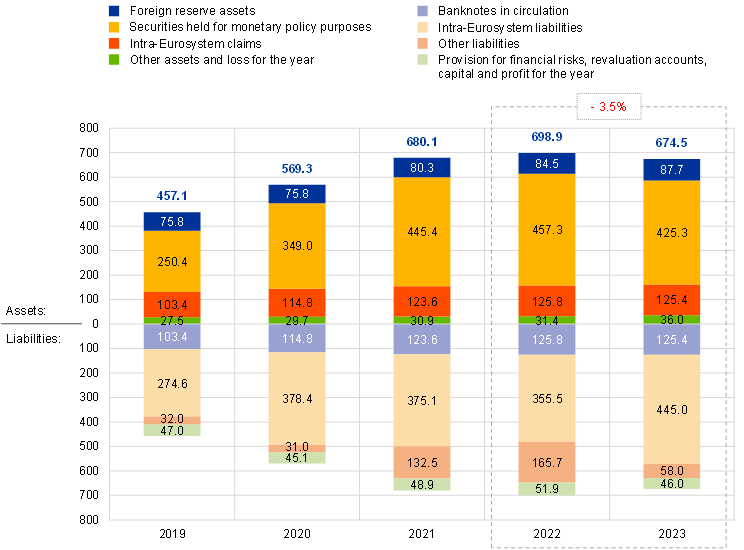

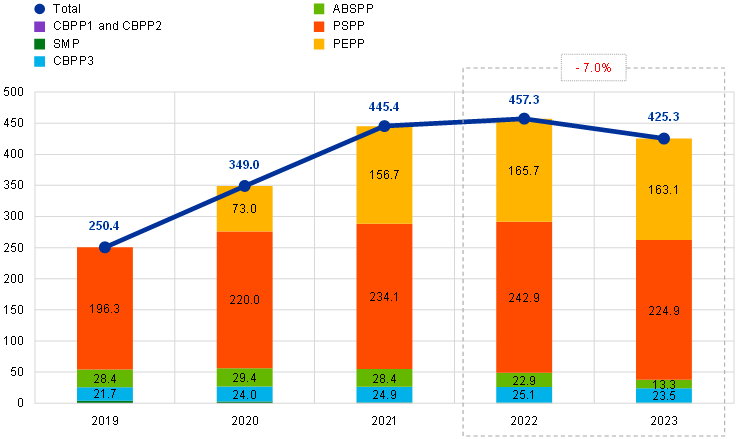

The ECB’s balance sheet expanded significantly in the period from 2019 to 2022, mainly owing to outright purchases of securities by the ECB in the context of the implementation of the monetary policy of the Eurosystem (Chart 1). In particular, the main drivers of the substantial expansion in 2020 and 2021 were net purchases of securities under the asset purchase programme (APP)[6] and the launch of the pandemic emergency purchase programme (PEPP)[7] in March 2020. Net purchases of securities under the PEPP and the APP were discontinued as of the end of March 2022 and 1 July 2022 respectively, leading to a more moderate increase in the ECB’s balance sheet in 2022.

Chart 1

Main components of the ECB’s balance sheet

(EUR billions)

Source: ECB.

In 2023 the ECB’s balance sheet decreased by €24.4 billion to €674.5 billion, mainly owing to the gradual decline of APP holdings as a result of the only partial reinvestment of principal payments from maturing securities in this portfolio between March and June 2023 and the complete discontinuation of such reinvestments as of July 2023.

Euro-denominated securities held for monetary policy purposes made up 63% of the ECB’s total assets at the end of 2023. Under this balance sheet item, the ECB holds securities acquired in the context of the Securities Markets Programme (SMP), the CBPP3, the ABSPP, the PSPP and the PEPP. The securities purchased under these programmes are valued on an amortised cost basis subject to impairment.

Based on the relevant Governing Council decisions, the Eurosystem continued reinvesting, in full, the principal payments from maturing securities under the PEPP throughout the year, and under the APP until the end of February 2023. From the beginning of March until the end of June 2023, the Eurosystem reinvested only partially the principal payments from maturing securities under the APP and as of July 2023 discontinued these reinvestments. As a result of these decisions, the portfolio of securities held by the ECB for monetary policy purposes decreased by €31.9 billion to €425.3 billion (Chart 2) with the PSPP, ABSPP and CBPP3 holdings under the APP decreasing by €18.0 billion, €9.5 billion and €1.6 billion respectively, driven by redemptions. The PEPP portfolio decreased by €2.6 billion, mainly owing to the net impact of the amortisation of premiums and discounts[8] on securities held in the portfolio.

The Governing Council intends[9] to continue to reinvest, in full, the principal payments from maturing securities purchased under the PEPP during the first half of 2024. It then intends to reduce the PEPP portfolio at Eurosystem level by €7.5 billion per month on average over the second half of the year and to discontinue reinvestments at the end of 2024. The Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

Chart 2

Securities held for monetary policy purposes

(EUR billions)

Source: ECB.

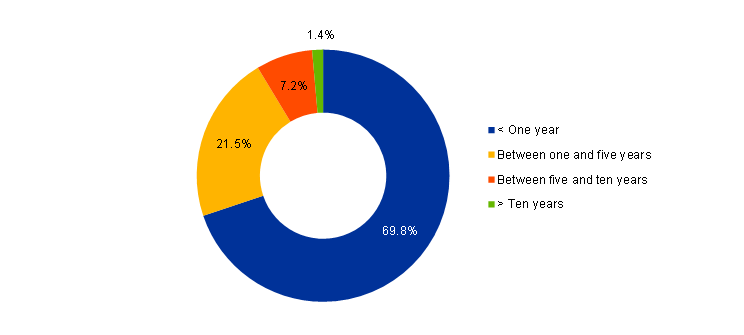

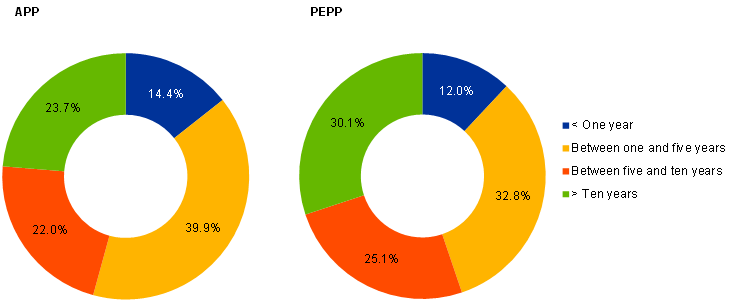

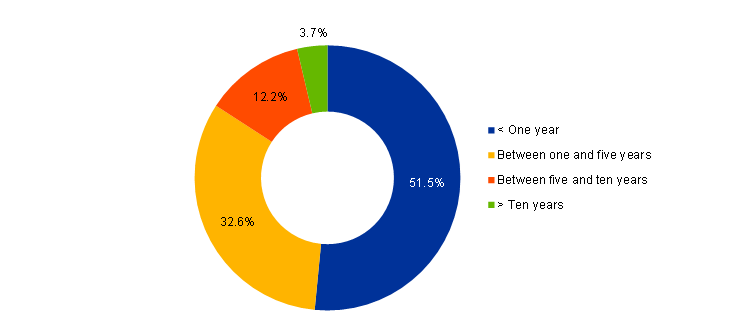

For the active programmes of securities held for monetary policy purposes, namely the APP and the PEPP, securities held by the ECB at the end of 2023 had a diversified maturity profile[10] (Chart 3).

Chart 3

Maturity profile of the APP and the PEPP

Source: ECB.

Note: For asset-backed securities, the maturity profile is based on the weighted average life of the securities rather than the legal maturity date.

In 2023 the total euro equivalent value of the ECB’s foreign reserve assets, which consist of gold, special drawing rights, US dollars, Japanese yen and Chinese renminbi, increased by €3.3 billion to €87.7 billion.

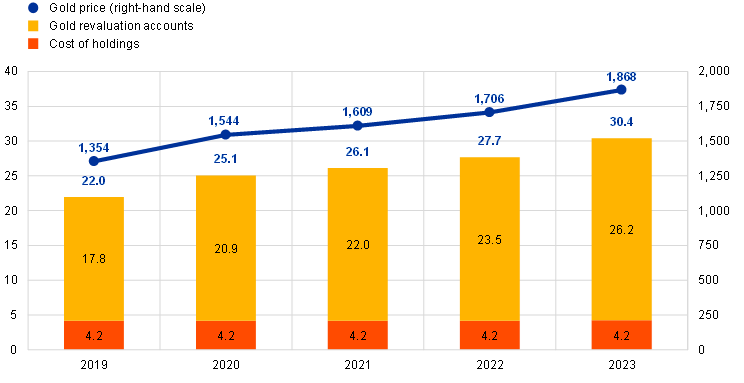

The euro equivalent value of the ECB’s holdings of gold and gold receivables increased by €2.7 billion to €30.4 billion in 2023 (Chart 4) owing, primarily, to an increase in the market price of gold in euro terms. This increase also led to an equivalent rise in the ECB’s gold revaluation accounts (see Section 1.3.2 “Net equity”). In addition, upon the adoption of the single currency by Croatia with effect from 1 January 2023, Hrvatska narodna banka transferred to the ECB gold with a value of €96 million.

Chart 4

Gold holdings and gold prices

(left-hand scale: EUR billions; right-hand scale: euro per fine ounce of gold)

Source: ECB.

Note: “Gold revaluation accounts” does not include the contributions of the central banks of the Members States that joined the euro area after 1 January 1999 to the accumulated gold revaluation accounts of the ECB as at the day prior to their entry into the Eurosystem.

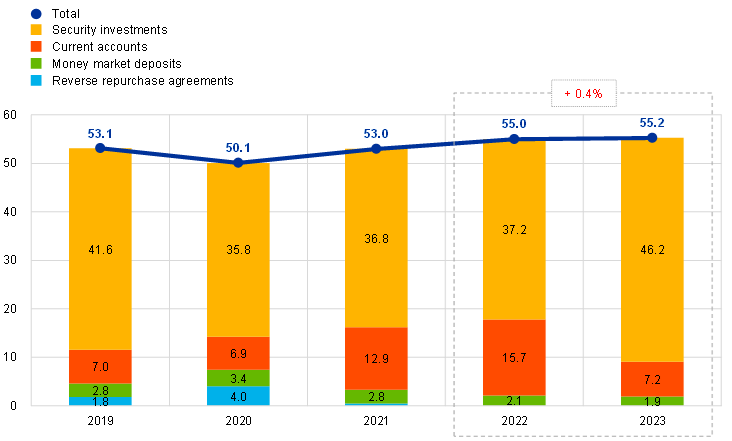

The ECB’s foreign currency holdings[11] of US dollars, Japanese yen and Chinese renminbi increased in euro terms by €0.2 billion to €55.2 billion (Chart 5), mainly owing to the income earned during the year, primarily on the US dollar portfolio. In addition, upon the adoption of the single currency by Croatia with effect from 1 January 2023, Hrvatska narodna banka transferred to the ECB foreign reserve assets denominated in US dollars with a value of €544 million. The increase in the total value of foreign currency holdings was partially offset, mainly by the depreciation of the US dollar and the Japanese yen against the euro.

Chart 5

Foreign currency holdings

(EUR billions)

Source: ECB.

The US dollar is the main component of the ECB’s foreign currency holdings, accounting for 81% of the total at the end of 2023.

The ECB manages the investment of its foreign currency holdings using a three-step approach. First, a strategic benchmark portfolio is designed by the ECB’s risk managers and approved by the Governing Council. Second, the ECB’s portfolio managers design the tactical benchmark portfolio, which is approved by the Executive Board. Third, investment operations are conducted in a decentralised manner by the NCBs on a day-to-day basis.

The ECB’s foreign currency holdings are mainly invested in securities and money market deposits or are held in current accounts (Chart 6). Securities in this portfolio are valued at year-end market prices.

Chart 6

Composition of foreign currency investments

(EUR billions)

Source: ECB.

The purpose of the ECB’s foreign currency holdings is to finance potential interventions in the foreign exchange market. For this reason, the ECB’s foreign currency holdings are managed in accordance with three objectives (in order of priority): liquidity, safety and return. Therefore, this portfolio mainly comprises securities with short maturities (Chart 7).

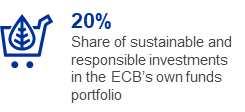

The value of the own funds portfolio increased by €1.0 billion to €22.1 billion (Chart 8), primarily owing to (i) the reinvestment of interest income generated on this portfolio and (ii) the increase in the market value of euro-denominated securities held in this portfolio as a result of the decline in euro area bond yields at the year-end (Chart 17).

The portfolio mainly consists of euro-denominated securities which are valued at year-end market prices. In 2023 government debt securities accounted for 77% of the total portfolio.

The share of green investments in the own funds portfolio continued to increase, rising from 13% at the end of 2022 to 20% at the end of 2023. The ECB plans to further increase this share over the coming years.[12] Since 2021 purchases of green bonds in secondary markets are complemented by investments in the euro-denominated green bond investment fund for central banks launched by the Bank for International Settlements in January 2021.

Chart 8

The ECB’s own funds portfolio

(EUR billions)

Source: ECB.

The ECB’s own funds portfolio predominantly consists of investments of its paid-up capital and amounts set aside in the general reserve fund and in the provision for financial risks. The purpose of this portfolio is to provide income to help fund those ECB operating expenses that are not related to the delivery of its supervisory tasks.[13] It is invested in euro-denominated assets, subject to the limits imposed by its risk control framework. This results in a more diversified maturity structure (Chart 9) than in the foreign reserves portfolio.

Chart 9

Maturity profile of the ECB’s own funds securities

Source: ECB.

At the end of 2023 the total value of euro banknotes in circulation was €1,567.7 billion, virtually the same as at the end of 2022. The ECB has been allocated an 8% share of the total value of euro banknotes in circulation, which amounted to €125.4 billion at the end of the year. Since the ECB does not issue banknotes itself, it holds intra-Eurosystem claims vis-à-vis the euro area NCBs for a value equivalent to the value of the banknotes in circulation allocated to it.

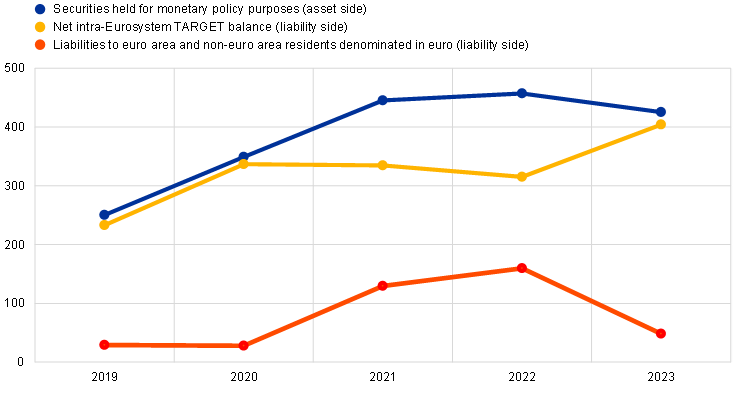

The ECB’s intra-Eurosystem liabilities, which mainly comprise the net TARGET balance of euro area NCBs vis-à-vis the ECB and the ECB’s liabilities with regard to the foreign reserve assets transferred to it by the euro area NCBs when they joined the Eurosystem, increased by €89.6 billion to €445.0 billion in 2023.

The development of the intra-Eurosystem liabilities is mainly driven by the evolution of the net TARGET liability. The main factors contributing to the changes in the net TARGET liability during the period 2019-2023 were purchases and redemptions of monetary policy securities, which are settled via TARGET accounts, and changes in liabilities to euro area and non-euro area residents denominated in euro (Chart 10). In 2023 the cash inflows from redemptions of monetary policy securities were lower than the cash outflows related to the decrease in liabilities to euro area and non-euro area residents denominated in euro, leading to an overall increase in the net TARGET liability.

Chart 10

Net intra-Eurosystem TARGET balance, liabilities to euro area and non-euro area residents denominated in euro and securities held for monetary policy purposes

(EUR billions)

Source: ECB.

Note: For the purpose of this chart, “Liabilities to euro area and non-euro area residents denominated in euro” consists of “Other liabilities to euro area credit institutions denominated in euro”, “Liabilities to other euro area residents denominated in euro” and “Liabilities to non-euro area residents denominated in euro”.

In 2023 the ECB’s other liabilities fell by €107.7 billion to €58.0 billion owing to the decrease in liabilities to euro area and non-euro area residents denominated in euro. Specifically, there were reductions in (i) deposits accepted by the ECB in its role as fiscal agent[14], (ii) balances of non-euro area ancillary systems connected to TARGET through the TARGET-ECB component and (iii) cash received as collateral against the lending of PSPP and public sector PEPP securities.

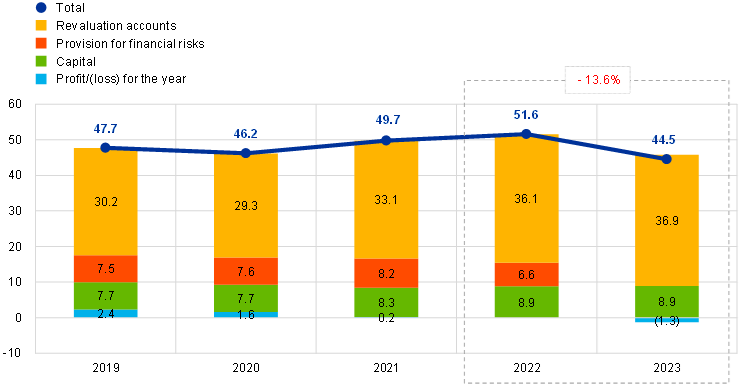

1.3.2 Net equity

The ECB’s net equity consists of its capital, any amounts held in the provision for financial risks and the general reserve fund, the revaluation accounts[15], any accumulated losses from previous years and any profit/loss for the year.[16]

At the end of 2023 the ECB’s net equity totalled €44.5 billion (Chart 11), which was €7.0 billion lower than at the end of 2022 owing to the losses incurred during 2023. The provision for financial risks was fully used to cover part of these losses, reducing the loss for the year to €1.3 billion. The decrease in the ECB’s net equity arising from the 2023 losses was partially offset by (i) the increase in the revaluation accounts, mainly as a result of the rise in the market price of gold in euro terms in 2023, and (ii) the contributions from Hrvatska narodna banka to the paid-up capital, the revaluation accounts and the provision for financial risks following the adoption of the single currency by Croatia with effect from 1 January 2023.

Chart 11

The ECB’s net equity

(EUR billions)

Source: ECB.

Note: “Revaluation accounts” includes total revaluation gains on gold, foreign currency and securities holdings, but excludes the revaluation account for post-employment benefits.

Changes in the ECB’s net equity during the year are presented in Table 2.

Table 2

Changes in the ECB’s net equity

(EUR millions)

Capital | Provision for financial risks | Revaluation accounts | Profit/(loss) for the year | Total net equity | |

|---|---|---|---|---|---|

Balance as at 31 December 2022 | 8,880 | 6,566 | 36,118 | - | 51,564 |

Payment of the remainder of the capital subscription by Hrvatska narodna banka | 69 | 69 | |||

Contribution to the provision for financial risks by Hrvatska narodna banka | 53 | 53 | |||

Revaluation accounts | 743 | ||||

Gold | 2,634 | ||||

Foreign currency | (2,562) | ||||

Securities and other instruments | 378 | ||||

Contribution to the revaluation accounts by Hrvatska narodna banka1 | 293 | ||||

Release from provision for financial risks | (6,620) | (6,620) | |||

Loss for the year | (1,266) | (1,266) | |||

Balance as at 31 December 2023 | 8,948 | - | 36,861 | (1,266) | 44,543 |

1) Upon the adoption of the single currency by Croatia, Hrvatska narodna banka contributed to the balances of all the revaluation accounts of the ECB as at 31 December 2022. The figure in this table excludes the contribution to the revaluation account for post-employment benefits, in line with the definition of “Revaluation accounts” in this section.

Unrealised gains on gold and foreign currencies and unrealised gains on securities that are subject to price revaluation are not recognised as income in the profit and loss account but are recorded directly in revaluation accounts shown on the liability side of the ECB’s balance sheet. The balances in these accounts can be used to absorb the impact of any future unfavourable movement in the respective prices and/or exchange rates and thus strengthen the ECB’s resilience against the underlying risks. In 2023 the revaluation accounts for gold, foreign currencies and securities increased by €0.7 billion to €36.9 billion, mainly owing to higher revaluation balances for gold as a result of the rise in the market price of gold in euro terms. The revaluation balances for foreign currencies decreased, mainly owing to the depreciation of the US dollar and the Japanese yen against the euro (Chart 12).

Chart 12

The main foreign exchange rates and gold price over the period 2019-23

(percentage changes vis-à-vis 2019; year-end data)

Source: ECB.

In view of its exposure to financial risks (see Section 1.4.1 “Financial risks”), the ECB may set aside a provision for financial risks to be used to the extent deemed necessary by the Governing Council to offset losses that arise as a result of this exposure. The size of this provision is reviewed annually, taking a range of factors into account, including the level of holdings of risk-bearing assets, the projected results for the coming year and a risk assessment. The provision for financial risks, together with any amount held in the ECB’s general reserve fund, may not exceed the value of the capital paid up by the euro area NCBs. At the end of 2022 this provision amounted to €6,566 million. Upon the adoption of the single currency by Croatia, Hrvatska narodna banka contributed €53 million to the provision for financial risks with effect from 1 January 2023, increasing its size to €6,620 million. At the end of 2023, following the annual review, the Governing Council decided to release this provision in full to partially offset losses incurred in 2023. The Governing Council may decide to replenish the provision for financial risks, in the context of its annual review, once the ECB returns to making a profit.

The ECB’s loss for the year, after the release of the provision for financial risks, was €1.3 billion (see Section 1.3.3 “Profit and loss account”). The Governing Council decided to carry forward this loss on the ECB’s balance sheet to be offset against future profits.

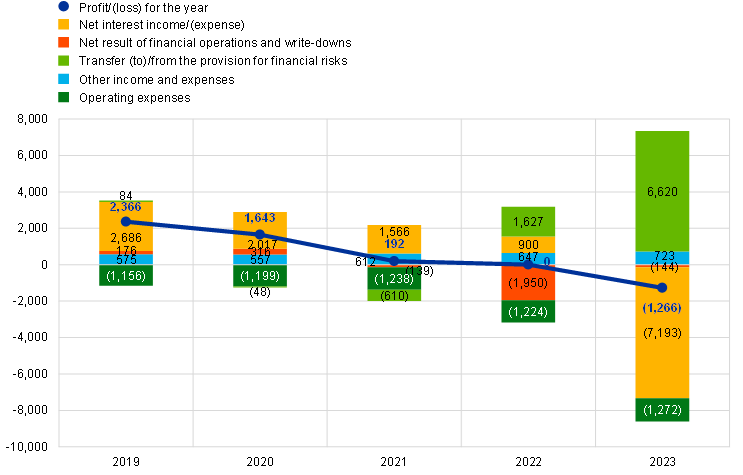

1.3.3 Profit and loss account

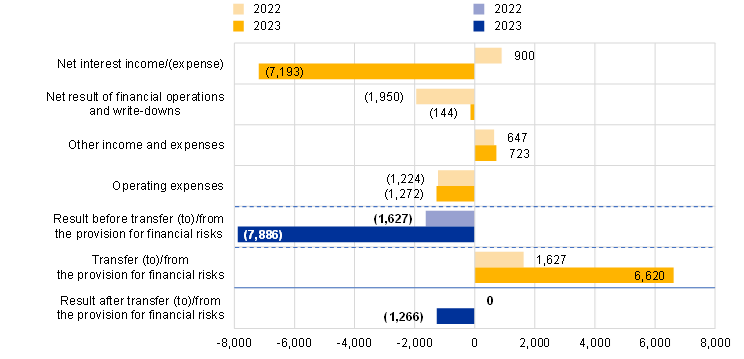

The ECB’s result has gradually fallen since 2019 (Chart 13). In 2020 and 2021 this decrease was mainly driven by lower income generated on foreign reserve assets and on securities held for monetary policy purposes. In 2022 and 2023 the reduction in the ECB’s result was primarily due to the materialisation of interest rate risk, as the rise in interest rates in the euro area led to an immediate increase in the interest expense paid by the ECB on its net TARGET liability, while the income earned on the ECB’s assets did not increase to the same extent or at the same pace (see Section 1.4.1 “Financial risks”).

The ECB’s loss for 2023, which followed a long period of substantial profits, reflects the role and necessary policy actions of the Eurosystem in fulfilling its primary mandate of maintaining price stability and has no impact on its ability to conduct effective monetary policy. In the previous years the ECB’s balance sheet expanded significantly, mainly driven by the purchase of securities under the asset purchase programmes. On the asset side, most monetary policy securities currently held were purchased during a period of low interest rates and have long maturities and fixed coupons. These will continue to generate relatively low interest income, not immediately affected by changes in key ECB interest rates. At the same time, the cash settlement of these purchases via TARGET led to a rise in the ECB’s net TARGET liability, which is remunerated at the rate on the main refinancing operations (MRO rate). In order to combat inflation in the euro area, this rate began to be raised in 2022, resulting in an immediate increase in the ECB’s interest expense.

The ECB is likely to incur further losses over the next few years as a result of the materialisation of interest rate risk, before returning to making sustained profits. The occurrence and magnitude of these losses are uncertain and will largely depend on the future evolution of key ECB interest rates and the size and composition of the ECB’s balance sheet. However, the ECB’s capital and its substantial revaluation accounts, which together amounted to €45.8 billion at the end of 2023 (see Section 1.3.2 “Net equity”), underline its financial strength, and, in any case, the ECB can operate effectively and fulfil its primary mandate of maintaining price stability regardless of any losses.

Chart 13

Main components of the ECB’s profit and loss account

(EUR millions)

Source: ECB.

Note: “Other income and expenses” consists of “Net income/expense from fees and commissions”, “Income from equity shares and participating interests”, “Other income” and “Other expenses”.

In 2023 the ECB used the full amount of €6,620 million set aside in the provision for financial risks to partially offset losses incurred during the year. After the release of this provision, the ECB’s loss stood at €1,266 million (2022: zero). The main driver of this loss was the significant net interest expense (Chart 14).

Chart 14

Drivers of the ECB’s result for 2022 and 2023

(EUR millions)

Source: ECB.

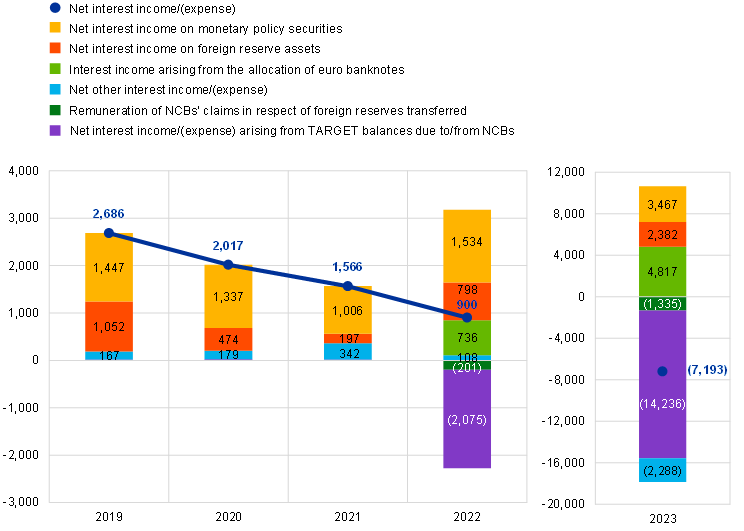

The ECB’s net interest expense amounted to €7,193 million in 2023, compared to net interest income of €900 million in 2022 (Chart 15). This was mainly due to the interest expense arising from the ECB’s net TARGET liability. The net other interest expense and the interest expense related to the remuneration of euro area NCBs’ claims in respect of foreign reserves transferred to the ECB also contributed to this decrease. These expenses were partially offset by higher interest income arising from (i) the ECB’s claims related to the allocation of euro banknotes within the Eurosystem, (ii) securities held for monetary policy purposes and (iii) foreign reserve assets.

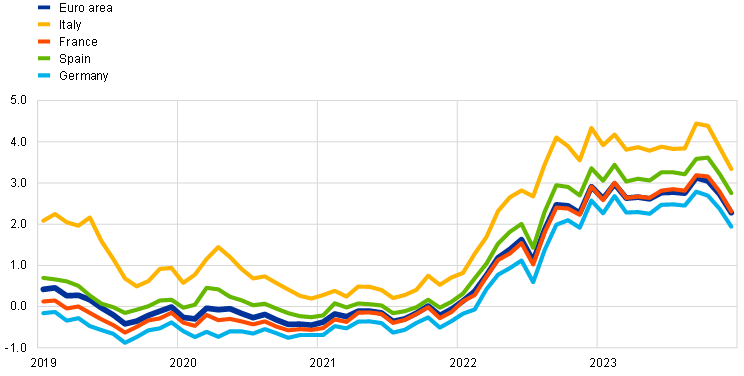

Chart 15

Net interest income/(expense)

(EUR millions)

Source: ECB.

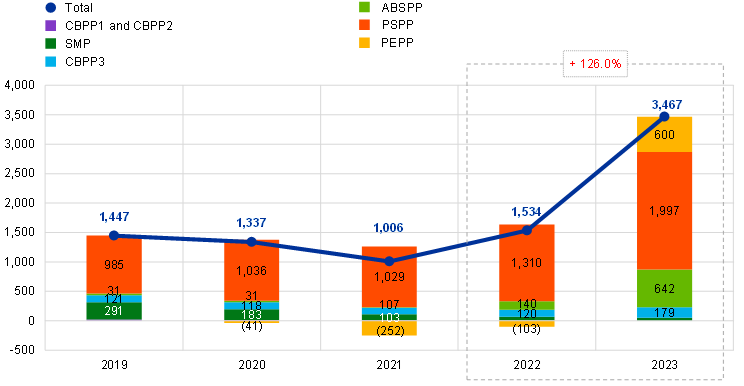

Net interest income generated on securities held for monetary policy purposes increased by €1,933 million to €3,467 million in 2023 (Chart 16) owing to higher net interest income from securities held under the APP (under the CBPP3, ABSPP and PSPP) and the PEPP. Net interest income from the APP holdings rose by €1,247 million to €2,818 million in 2023, while the PEPP portfolio generated net interest income of €600 million in 2023, compared to a net interest expense of €103 million the year before. These developments were mainly driven by the significant increase in euro area interest rates and bond yields which began in 2022 (Chart 17) and which (i) allowed reinvestments under the APP and the PEPP at higher yields than the historical yields of the respective portfolios and (ii) had a positive impact on the coupon on securities with variable interest rates (mainly held under the ABSPP). Lower premium amortisation, particularly on public sector securities acquired in the past, also contributed to the increase. Net interest income on the SMP decreased by €16 million to €49 million owing to the decline in the size of the portfolio as a result of maturing securities.

Chart 16

Net interest income/(expense) on securities held for monetary policy purposes

(EUR millions)

Source: ECB.

Chart 17

Seven-year sovereign bond yields in the euro area

(percentages per annum; month-end data)

Source: ECB.

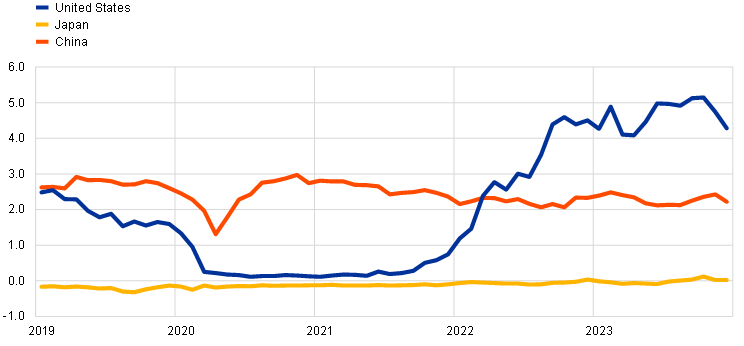

Net interest income on foreign reserve assets increased by €1,583 million to €2,382 million, predominantly as a result of higher interest income from securities denominated in US dollars. The average interest rate earned on the ECB’s US dollar portfolio increased in 2023 compared to the previous year owing to (i) sales and redemptions of lower-yield bonds purchased in the past and (ii) purchases of securities with higher yields following the increase in US dollar bond yields since the end of 2021 (Chart 18).

Chart 18

Two-year sovereign bond yields in the United States, Japan and China

(percentages per annum; month-end data)

Source: LSEG.

Interest income arising from the allocation of euro banknotes to the ECB and interest expense stemming from the remuneration of NCBs’ claims in respect of foreign reserves transferred increased by €4,081 million to €4,817 million and by €1,133 million to €1,335 million respectively in 2023. The changes were the result of increases in the MRO rate, which is the rate used for the calculation of interest on these balances. The MRO rate reached 4.5% at the end of 2023, while the annual average rate increased from 0.6% in 2022 to 3.8% in 2023.

The net interest expense arising from TARGET balances due to/from NCBs increased by €12,161 million to €14,236 million in 2023. The increase was mainly driven by the higher average MRO rate in 2023, which is used for the remuneration of the ECB’s intra-Eurosystem TARGET balances.

The net other interest expense of €2,288 million in 2023 compares with net other interest income of €108 million in the previous year. This change was mainly due to the remuneration of deposits accepted by the ECB in its role as fiscal agent and the remuneration of balances of euro area ancillary systems. In the second half of 2022, once the applicable remuneration rates turned positive, the ECB started to pay interest on these items. In 2023 the remuneration rates and average balance of these items rose further, leading to an increase in the interest expense. This interest expense was partially offset by the higher interest income earned on the own funds portfolio as a result of rising yields in the euro area (Chart 17).

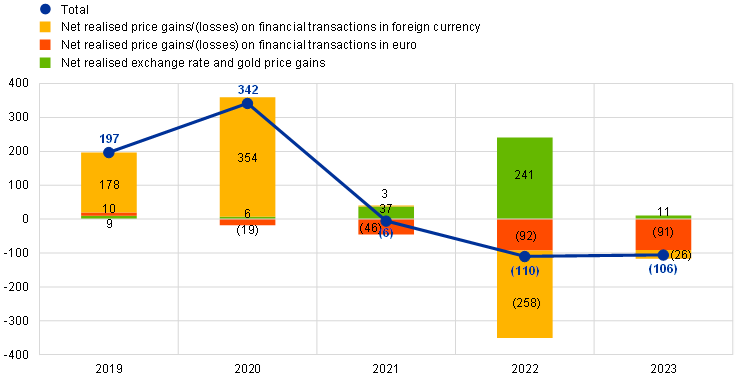

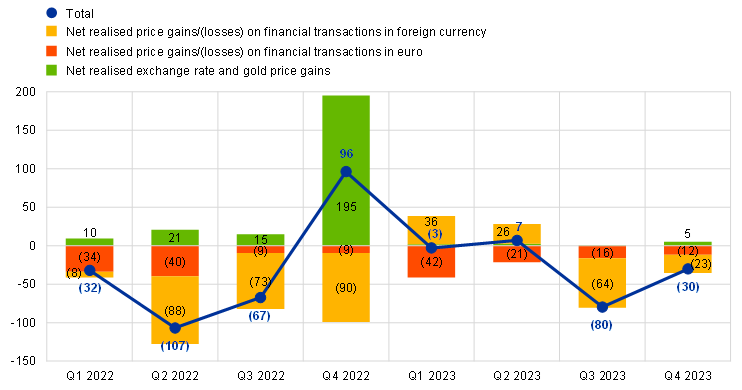

Net realised losses arising from financial operations decreased by €4 million to €106 million in 2023 (Chart 19). These losses mainly resulted from (i) outstanding premiums on securities held in the ABSPP that were repaid before maturity and (ii) net realised price losses on sales of US dollar-denominated securities in the second half of 2023 (Chart 20) whose market value was negatively affected by the increase in US dollar bond yields during this period (Chart 18).

Chart 19

Realised gains/losses arising from financial operations

(EUR millions)

Source: ECB.

Chart 20

Quarterly realised gains/losses arising from financial operations in 2022 and 2023

(EUR millions)

Source: ECB.

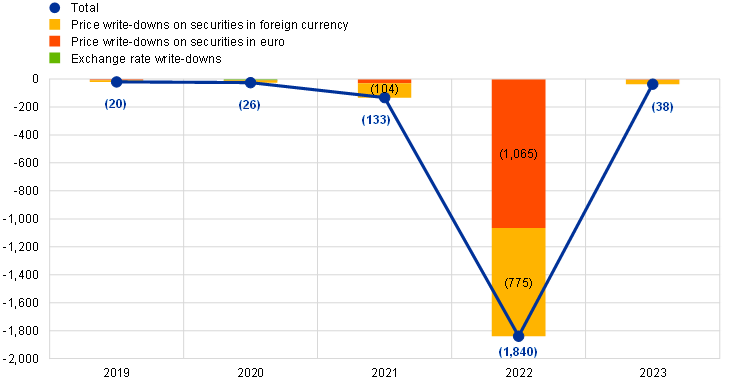

Unrealised revaluation losses are expensed in the form of write-downs at the year-end in the ECB’s profit and loss account. In 2023 these write-downs amounted to €38 million, mainly stemming from unrealised price losses on a number of securities held in the US dollar and own funds portfolios. In 2022 these losses were substantially higher at €1,840 million (Chart 21), as the corresponding yields had increased significantly, resulting in a large reduction in the market value of the majority of securities held in the own funds and US dollar portfolios at the end of that year.

Chart 21

Write-downs on financial assets and positions

(EUR millions)

Source: ECB.

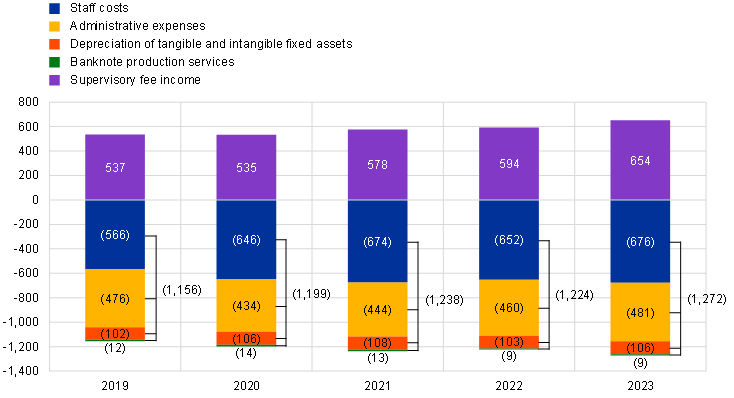

The total operating expenses of the ECB, including depreciation and banknote production services, increased by €48 million to €1,272 million (Chart 22). The increase compared to 2022 was mainly due to higher staff costs resulting from the higher average number of staff in 2023, predominantly in banking supervision, as well as salary adjustments. This increase was partially offset by lower costs in relation to post-employment benefits, mainly as a result of a lower current service cost following the annual actuarial valuation. Administrative expenses increased, mainly owing to higher expenses for external consultancy support and the return to full levels of activity following the pandemic, in particular in banking supervision, while also reflecting the impact of inflation.

Banking supervision-related expenses are fully covered by fees levied on the supervised entities. Based on the actual expenses incurred by the ECB in the performance of its banking supervision tasks, supervisory fee income for 2023 stood at €654 million.[17]

Chart 22

Operating expenses and supervisory fee income

(EUR millions)

Source: ECB.

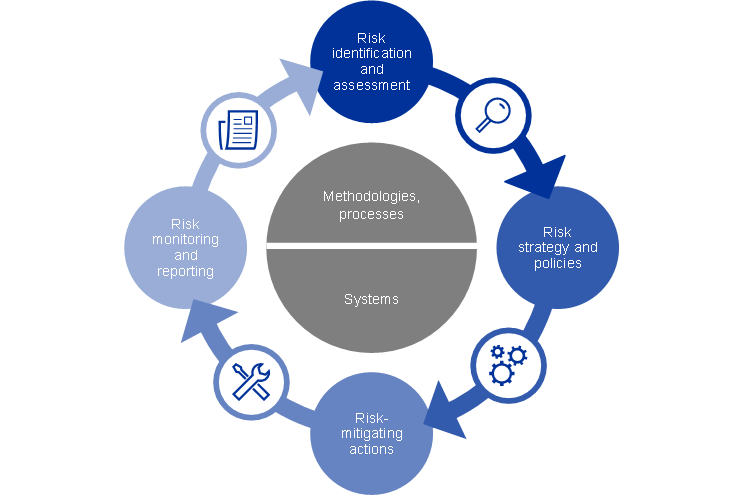

1.4 Risk management

Risk management is a critical part of the ECB’s activities and is conducted through a continuous process of (i) risk identification and assessment, (ii) review of the risk strategy and policies, (iii) implementation of risk-mitigating actions and (iv) risk monitoring and reporting, all of which are supported by effective methodologies, processes and systems.

Figure 2

Risk management cycle

The following sections focus on the risks, their sources and the applicable risk control frameworks.

1.4.1 Financial risks

The Executive Board proposes policies and procedures that ensure an appropriate level of protection against the financial risks to which the ECB is exposed. The Risk Management Committee (RMC), which comprises experts from Eurosystem central banks, contributes to the monitoring, measuring and reporting of financial risks related to the balance sheet of the Eurosystem and defines and reviews the associated methodologies and frameworks. In this way, the RMC helps the decision-making bodies to ensure an appropriate level of protection for the Eurosystem.

Financial risks arise from the ECB’s operations and associated exposures. The risk control frameworks and limits that the ECB uses to manage its risk profile differ across types of operation, reflecting the policy or investment objectives of the different portfolios and the risk characteristics of the underlying assets.

To monitor and assess the risks, the ECB relies on a number of risk estimation techniques developed by its experts. These techniques are based on a joint market and credit risk simulation framework. The core modelling concepts, techniques and assumptions underlying the risk measures draw on industry standards and available market data. The risks are typically quantified as the expected shortfall (ES)[18], estimated at the 99% confidence level over a one-year horizon. Two approaches are used to calculate risks: (i) the accounting approach, under which the ECB’s revaluation accounts are considered as a buffer in the calculation of risk estimates in line with applicable accounting rules; and (ii) the financial approach, under which the revaluation accounts are not considered as a buffer in the risk calculation. The ECB also calculates other risk measures at different confidence levels, performs sensitivity and stress scenario analyses and assesses longer-term projections of exposures and income to maintain a comprehensive picture of the risks.[19]

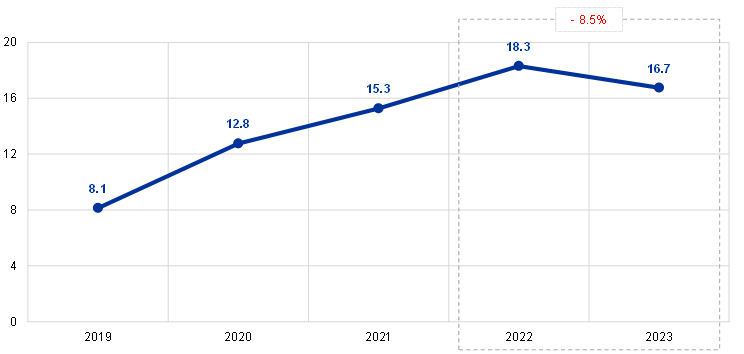

The total risks of the ECB decreased during the year. At the end of 2023 the total financial risks of the ECB’s balance sheet, as measured by the ES at the 99% confidence level over a one-year horizon under the accounting approach, stood at €16.7 billion, which was €1.6 billion lower than the risks estimated as at the end of 2022 (Chart 23). The decrease in risk reflects the reduction in the ECB’s holdings under the APP, initially through the only partial reinvestment of principal payments from maturing securities between March and June 2023, followed by the complete discontinuation of reinvestments as of July 2023.

Chart 23

Total financial risks (ES 99%, accounting approach)

(EUR billions)

Source: ECB.

Note: The total financial risks as at the end of 2023 were calculated following methodological advances whereby interest rate risk arising from mismatches between the interest rate earned on assets and the interest rate paid on liabilities was also included as a risk contributor in the ES 99% measurement in addition to the regular monitoring of net income projections. The 2022 estimate was recalculated to ensure comparability.

Credit risk arises from the ECB’s monetary policy portfolios, its euro-denominated own funds portfolio and its foreign reserve holdings. While securities held for monetary policy purposes are valued at amortised cost subject to impairment and are therefore, in the absence of sales, not subject to price changes associated with credit migrations, they are still subject to credit default risk. Euro-denominated own funds and foreign reserves are valued at market prices and, as such, are subject to credit migration risk and credit default risk. Credit risk remained largely stable relative to 2022.

Credit risk is mitigated mainly through the application of eligibility criteria, due diligence procedures and limits that differ across portfolios.

Currency and commodity risks arise from the ECB’s foreign currency and gold holdings. The currency risk remained broadly stable compared with 2022.

In view of the policy role of these assets, the ECB does not hedge the related currency and commodity risks. Instead, these risks are mitigated through the existence of revaluation accounts and the diversification of the holdings across different currencies and gold.

The ECB’s foreign reserves and euro-denominated own funds are mainly invested in fixed income securities and are subject to mark-to-market interest rate risk, given that they are valued at market prices. The ECB’s foreign reserves are mainly invested in assets with relatively short maturities (see Chart 7 in Section 1.3.1 “Balance sheet”), while the assets in the own funds portfolio generally have longer maturities (see Chart 9 in Section 1.3.1 “Balance sheet”). The interest rate risk of these portfolios, as measured under the accounting approach, decreased compared to 2022, reflecting developments in market conditions.

The mark-to-market interest rate risk of the ECB is mitigated through asset allocation policies and the revaluation accounts.

The ECB is also subject to interest rate risk arising from mismatches between the interest rate earned on its assets and the interest rate paid on its liabilities, which has an impact on its net interest income. This risk is not directly linked to any particular portfolio but rather to the structure of the ECB’s balance sheet as a whole and, in particular, the existence of maturity and yield mismatches between assets and liabilities. In addition to its inclusion in the regular total financial risk measurement over a one-year horizon, this risk is monitored by means of projections of the ECB’s profitability over a medium to long-term horizon.

This type of risk is managed through asset allocation policies and is further mitigated by the existence of unremunerated liabilities on the ECB’s balance sheet.

This notwithstanding, this risk materialised in 2023, resulting in financial losses being projected over the next few years, after which the ECB is expected to return to making sustained profits. The projected losses are mostly driven by a reduction in the net interest income of the ECB. A large share of the medium to long-term assets with fixed rate coupons were acquired when interest rates were very low or even zero, and funded mainly by short-term liabilities, which are remunerated at the MRO rate. As interest rates started rising in mid-2022, the cost of the liabilities rose above the interest earned on the assets. Consequently, the previous year’s net interest income turned into a net interest expense.

The risks associated with climate change are gradually being incorporated into the ECB’s risk management framework. In 2022 the Eurosystem conducted the first climate stress test of the Eurosystem balance sheet[20], which allowed a preliminary estimate of the impact of this risk on the ECB’s balance sheet to be obtained. In the coming years climate stress testing will be performed on a regular basis, with the next exercise envisaged for 2024.

1.4.2 Operational risk

The Executive Board is responsible for and approves the ECB’s operational risk[21] management (ORM) policy and framework. The Operational Risk Committee (ORC) supports the Executive Board in the performance of its role in overseeing the management of operational risks. ORM is an integral part of the ECB’s governance structure[22] and management processes.

The main objective of the ECB’s ORM framework is to contribute to ensuring that the ECB achieves its mission and objectives, while protecting its reputation and assets against loss, misuse and damage. Under the ORM framework, each business area is responsible for identifying, assessing, responding to, reporting on and monitoring its operational risks, incidents and controls. In this context, the ECB’s risk tolerance policy provides guidance with regard to risk response strategies and risk acceptance procedures. It is linked to a five-by-five risk matrix based on impact and likelihood grading scales using quantitative and qualitative criteria.

The environment in which the ECB operates is exposed to increasingly complex and interconnected threats and there are a wide range of operational risks associated with the ECB’s day-to-day activities. The main areas of concern for the ECB include a wide spectrum of non-financial risks resulting from people, systems, processes and external events. Consequently, the ECB has put in place processes to facilitate ongoing and effective management of its operational risks and to integrate risk information into the decision-making process. Moreover, the ECB is continuing to focus on enhancing its resilience, taking a broad view of risks and opportunities from an end-to-end perspective, including sustainability aspects. Response structures and contingency plans have been established to ensure the continuity of critical business functions in the event of any disruption or crisis.

1.4.3 Conduct risk

The ECB has a dedicated Compliance and Governance Office as a key risk management function to strengthen the ECB’s governance framework in order to address conduct risk.[23] Its purpose is to support the Executive Board in protecting the integrity and reputation of the ECB, to promote ethical standards of behaviour and to strengthen the ECB’s accountability and transparency. An independent Ethics Committee provides advice and guidance to high-level ECB officials on integrity and conduct matters and supports the Governing Council in managing risks at executive level appropriately and coherently. At the level of the Eurosystem and the Single Supervisory Mechanism (SSM), the Ethics and Compliance Committee (ECC) works towards achieving coherent implementation of the conduct frameworks for NCBs and national competent authorities (NCAs).

In 2023 the ECC set up a Conduct Risk Task Force to compare the existing conduct rules and the monitoring and reporting processes in place at the ECB, NCBs and NCAs. The aim of the task force is to define minimum common standards and to provide a simple conduct risk framework which can be extended and strengthened over the years.

2 Financial statements of the ECB

2.1 Balance sheet as at 31 December 2023

ASSETS | Note | 2023 | 2022 |

|---|---|---|---|

Gold and gold receivables | 1 | 30,419 | 27,689 |

Claims on non-euro area residents denominated in foreign currency | 2 | 55,876 | 55,603 |

Receivables from the IMF | 2.1 | 2,083 | 1,759 |

Balances with banks and security investments, external loans and other external assets | 2.2 | 53,793 | 53,844 |

Claims on euro area residents denominated in foreign currency | 2.2 | 1,450 | 1,159 |

Other claims on euro area credit institutions denominated in euro | 3 | 17 | 12 |

Securities of euro area residents denominated in euro | 4 | 425,349 | 457,271 |

Securities held for monetary policy purposes | 4.1 | 425,349 | 457,271 |

Intra-Eurosystem claims | 5 | 125,378 | 125,763 |

Claims related to the allocation of euro banknotes within the Eurosystem | 5.1 | 125,378 | 125,763 |

Other assets | 6 | 34,739 | 31,355 |

Tangible and intangible fixed assets | 6.1 | 1,023 | 1,105 |

Other financial assets | 6.2 | 22,172 | 21,213 |

Off-balance-sheet instruments revaluation differences | 6.3 | 552 | 783 |

Accruals and prepaid expenses | 6.4 | 10,905 | 7,815 |

Sundry | 6.5 | 88 | 438 |

Loss for the year | 1,266 | - | |

Total assets | 674,496 | 698,853 |

Note: Totals in the financial statements and in the tables included in the notes may not add up due to rounding. The figures 0 and (0) indicate positive or negative amounts rounded to zero, while a dash (-) indicates zero.

LIABILITIES | Note | 2023 | 2022 |

|---|---|---|---|

Banknotes in circulation | 7 | 125,378 | 125,763 |

Other liabilities to euro area credit institutions denominated in euro | 8 | 4,699 | 17,734 |

Liabilities to other euro area residents denominated in euro | 9 | 20,622 | 63,863 |

General government | 9.1 | 143 | 48,520 |

Other liabilities | 9.2 | 20,479 | 15,343 |

Liabilities to non-euro area residents denominated in euro | 10 | 23,111 | 78,108 |

Liabilities to non-euro area residents denominated in foreign currency | 11 | 24 | - |

Deposits, balances and other liabilities | 11.1 | 24 | - |

Intra-Eurosystem liabilities | 12 | 445,048 | 355,474 |

Liabilities equivalent to the transfer of foreign reserves | 12.1 | 40,671 | 40,344 |

Other liabilities within the Eurosystem (net) | 12.2 | 404,377 | 315,130 |

Other liabilities | 13 | 9,498 | 5,908 |

Off-balance-sheet instruments revaluation differences | 13.1 | 68 | 430 |

Accruals and income collected in advance | 13.2 | 8,030 | 3,915 |

Sundry | 13.3 | 1,401 | 1,562 |

Provisions | 14 | 67 | 6,636 |

Revaluation accounts | 15 | 37,099 | 36,487 |

Capital and reserves | 16 | 8,948 | 8,880 |

Capital | 16.1 | 8,948 | 8,880 |

Total liabilities | 674,496 | 698,853 |

2.2 Profit and loss account for the year ending 31 December 2023

Note | 2023 | 2022 | |

|---|---|---|---|

Interest income on foreign reserve assets | 23.1 | 2,382 | 798 |

Interest income arising from the allocation of euro banknotes within the Eurosystem | 23.2 | 4,817 | 736 |

Other interest income | 23.4 | 56,552 | 11,001 |

Interest income | 63,751 | 12,536 | |

Remuneration of NCBs’ claims in respect of foreign reserves transferred | 23.3 | (1,335) | (201) |

Other interest expense | 23.4 | (69,609) | (11,434) |

Interest expense | (70,944) | (11,636) | |

Net interest income | 23 | (7,193) | 900 |

Realised gains/losses arising from financial operations | 24 | (106) | (110) |

Write-downs on financial assets and positions | 25 | (38) | (1,840) |

Transfer to/from provisions for financial risks | 6,620 | 1,627 | |

Net result of financial operations, write-downs and risk provisions | 6,476 | (322) | |

Net income/expense from fees and commissions | 26 | 650 | 585 |

Income from equity shares and participating interests | 27 | 1 | 1 |

Other income | 28 | 72 | 61 |

Total net income | 6 | 1,224 | |

Staff costs | 29 | (676) | (652) |

Administrative expenses | 30 | (481) | (460) |

Depreciation of tangible and intangible fixed assets | (106) | (103) | |

Banknote production services | 31 | (9) | (9) |

Profit/(loss) for the year | (1,266) | - |

Frankfurt am Main, 13 February 2024

European Central Bank

Christine Lagarde

President

2.3 Accounting policies

Form and presentation of the financial statements

The financial statements of the ECB have been drawn up in accordance with the following accounting policies,[24] which, in the view of the Governing Council of the ECB, achieve a fair presentation of the financial statements, reflecting at the same time the nature of central bank activities.

Accounting principles

The following accounting principles have been applied: economic reality and transparency, prudence, recognition of post-balance-sheet events, materiality, going concern, the accruals principle, consistency and comparability.

Recognition of assets and liabilities

An asset or liability is only recognised in the balance sheet when it is probable that any associated future economic benefit will flow to or from the ECB, substantially all of the associated risks and rewards have been transferred to the ECB, and the cost or value of the asset or the amount of the obligation can be measured reliably.

Basis of accounting

The accounts have been prepared on a historical cost basis, modified to include the market valuation of marketable securities (other than securities currently held for monetary policy purposes), gold and all other on-balance-sheet and off-balance-sheet assets and liabilities denominated in foreign currency.

Transactions in financial assets and liabilities are reflected in the accounts on the basis of the date on which they were settled.

With the exception of spot transactions in securities, transactions in financial instruments denominated in foreign currency are recorded in off-balance-sheet accounts on the trade date. At the settlement date, the off-balance-sheet entries are reversed, and transactions are booked on-balance-sheet. Purchases and sales of foreign currency affect the net foreign currency position on the trade date, and realised results arising from sales are also calculated on that date. Accrued interest, premiums and discounts related to financial instruments denominated in foreign currency are calculated and recorded daily, and the foreign currency position is also affected daily by these accruals.

Gold and foreign currency assets and liabilities

Assets and liabilities denominated in foreign currency are converted into euro at the exchange rate prevailing on the balance sheet date. Income and expenses are converted at the exchange rate prevailing on the recording date. The revaluation of foreign exchange assets and liabilities, including on-balance-sheet and off-balance-sheet instruments, is performed on a currency-by-currency basis.

Revaluation to the market price for assets and liabilities denominated in foreign currency is treated separately from the exchange rate revaluation.

Gold is valued at the market price prevailing at the balance sheet date. No distinction is made between the price and currency revaluation differences for gold. Instead, a single gold valuation is accounted for on the basis of the price in euro per fine ounce of gold, which, for the year ending 31 December 2023, was derived from the exchange rate of the euro against the US dollar on 29 December 2023.

The special drawing right (SDR) is defined in terms of a basket of currencies and its value is determined by the weighted sum of the exchange rates of five major currencies (the US dollar, euro, Chinese renminbi, Japanese yen and pound sterling). The ECB’s holdings of SDRs were converted into euro using the exchange rate of the euro against the SDR as at 29 December 2023.

Securities

Securities held for monetary policy purposes

Securities currently held for monetary policy purposes are accounted for at amortised cost subject to impairment.

Other securities

Marketable securities (other than securities currently held for monetary policy purposes) and similar assets are valued either at the mid-market prices or on the basis of the relevant yield curve prevailing on the balance sheet date, on a security-by-security basis. Options embedded in securities are not separated for valuation purposes. For the year ending 31 December 2023, mid-market prices on 29 December 2023 were used.

Marketable investment funds are revalued on a net basis at fund level, using their net asset value. No netting is applied between unrealised gains and losses in different investment funds.

Illiquid equity shares and any other equity instruments held as permanent investments are valued at cost subject to impairment.

Income recognition

Income and expenses are recognised in the period in which they are earned or incurred.[25] Realised gains and losses resulting from the sale of foreign currency, gold and securities are recorded in the profit and loss account. Such realised gains and losses are calculated by reference to the average cost of the respective asset.

Unrealised gains are not recognised as income and are transferred directly to a revaluation account.

Unrealised losses are recorded in the profit and loss account if, at the year-end, they exceed previous revaluation gains accumulated in the corresponding revaluation account. Such unrealised losses on any one security or currency or on gold are not netted against unrealised gains on other securities or currencies or gold. In the event of such unrealised losses on any item recorded in the profit and loss account, the average cost of that item is reduced to the year-end exchange rate or market price.

Impairment losses are recorded in the profit and loss account and are not reversed in subsequent years unless the impairment decreases and the decrease can be related to an observable event that occurred after the impairment was first recorded.

Premiums or discounts arising on securities are amortised over the securities’ remaining contractual life.

Reverse transactions

Reverse transactions are operations whereby the ECB buys or sells assets under a repurchase agreement or conducts credit operations against collateral.

Under a repurchase agreement, securities are sold for cash with a simultaneous agreement to repurchase them from the counterparty at an agreed price on a set future date. Repurchase agreements are recorded as collateralised deposits on the liability side of the balance sheet. Securities sold under such an agreement remain on the balance sheet of the ECB.

Under a reverse repurchase agreement, securities are bought for cash with a simultaneous agreement to sell them back to the counterparty at an agreed price on a set future date. Reverse repurchase agreements are recorded as collateralised loans on the asset side of the balance sheet, but are not included in the ECB’s security holdings.

Reverse transactions (including securities lending transactions) conducted under a programme offered by a specialised institution are recorded on the balance sheet only where collateral has been provided in the form of cash and this cash remains uninvested.

Off-balance-sheet instruments

Currency instruments, namely foreign exchange forward transactions, forward legs of foreign exchange swaps and other currency instruments involving an exchange of one currency for another at a future date, are included in the net foreign currency position for the purpose of calculating foreign exchange gains and losses.

Interest rate instruments are revalued on an item-by-item basis. Daily changes in the variation margin of open interest rate futures contracts are recorded in the profit and loss account. The valuation of forward transactions in securities is carried out by the ECB based on generally accepted valuation methods using observable market prices and rates, as well as discount factors from the settlement dates to the valuation date.

Fixed assets

Fixed assets, including intangible assets, but excluding land and works of art, are valued at cost less depreciation. Land and works of art are valued at cost. The ECB’s main building is valued at cost less depreciation subject to impairment. For the depreciation of the ECB’s main building, costs are assigned to the appropriate asset components, which are depreciated in accordance with their estimated useful lives. Depreciation is calculated on a straight-line basis over the expected useful life of the asset, beginning in the quarter after the asset is available for use. The useful lives applied for the main asset classes are as follows:

Buildings | 20, 25 or 50 years |

Plant in building | 10 or 15 years |

Technical equipment | 4, 10 or 15 years |

Computers, related hardware and software, and motor vehicles | 4 years |

Furniture | 10 years |

The depreciation period for capitalised refurbishment expenditure relating to the ECB’s existing rented premises is adjusted to take account of any events that have an impact on the expected useful life of the affected asset.

The ECB performs an annual impairment test of its main building and right-of-use assets relating to office buildings (see “Leases” below). If an impairment indicator is identified, and it is assessed that the asset may be impaired, the recoverable amount is estimated. An impairment loss is recorded in the profit and loss account if the recoverable amount is less than the net book value.

Fixed assets costing less than €10,000 are written off in the year of acquisition.

Fixed assets that comply with the capitalisation criteria, but are still under construction or development, are recorded under the heading “Assets under construction”. The related costs are transferred to the relevant fixed asset headings once the assets are available for use.

Leases

The ECB acts both as a lessee and a sub-lessor.

The ECB as a lessee

For all leases for which the ECB is a lessee and which involve a tangible asset, the related right-of-use asset and lease liability are recognised on the balance sheet at the lease commencement date, i.e. once the asset is available for use, and are included under the relevant fixed asset headings of “Tangible and intangible fixed assets” and under “Sundry” (liabilities) respectively. Where leases comply with the capitalisation criteria, but the asset involved is still under construction or adaptation, the incurred costs before the lease commencement date are recorded under the heading “Assets under construction”.

Right-of-use assets are valued at cost less depreciation. In addition, right-of-use assets relating to office buildings are subject to impairment (regarding the annual impairment test, see “Fixed assets” above). Depreciation is calculated on a straight-line basis from the commencement date to either the end of the useful life of the right-of-use asset or the end of the lease term, whichever is earlier.

The lease liability is initially measured at the present value of the future lease payments (comprising only lease components), discounted using the ECB's incremental borrowing rate. Subsequently, the lease liability is measured at amortised cost using the effective interest method. The related interest expense is recorded in the profit and loss account under “Other interest expense”. When there is a change in future lease payments arising from a change in an index or other reassessment of the existing contract, the lease liability is remeasured. Any such remeasurement results in a corresponding adjustment to the carrying amount of the right-of-use asset.

Short-term leases with a duration of 12 months or less and leases of low-value assets below €10,000 (consistent with the threshold used for the recognition of fixed assets) are recorded as an expense in the profit and loss account.

The ECB as a sub-lessor

For all leases for which the ECB is a sub-lessor, the ECB grants to third parties the right to use the underlying asset (or a part of such asset), while the lease between the original lessor and the ECB (head lease) remains in effect. The sub-lease is classified as a finance or operating lease[26] by reference to the right-of-use asset arising from the head lease, rather than by reference to the underlying asset.

The sub-leases for which the ECB is a sub-lessor are classified as a finance lease and the ECB derecognises from “Tangible and intangible fixed assets” the right-of-use asset relating to the head lease (or a part of such asset) that is transferred to the sub-lessee, and recognises under “Sundry” (assets) a sub-lease receivable. The lease liability relating to the head lease remains unaffected by the sub-lease.

At the commencement date, the sub-lease receivable is initially measured at the present value of the future lease payments accruing to the ECB, discounted using the discount rate used for the head lease. Subsequently, the sub-lease receivable is measured at amortised cost using the effective interest method. The related interest income is recorded in the profit and loss account under “Other interest income”.

The ECB’s post-employment benefits, other long-term benefits and termination benefits

The ECB operates defined benefit plans for its staff and the members of the Executive Board, as well as for the members of the Supervisory Board employed by the ECB.

The staff pension plan is funded by assets held in a long-term employee benefit fund. The compulsory contributions made by the ECB and the staff are reflected in the defined benefit pillar of the plan. Staff can make additional contributions on a voluntary basis in a defined contribution pillar that can be used to provide additional benefits.[27] These additional benefits are determined by the amount of voluntary contributions together with the investment returns arising from those contributions.

Unfunded arrangements are in place for the post-employment and other long-term benefits of members of the Executive Board and members of the Supervisory Board employed by the ECB. For staff, unfunded arrangements are in place for post-employment benefits other than pensions and for other long-term benefits.

Net defined benefit liability

The liability recognised in the balance sheet under “Sundry” (liabilities) in respect of the defined benefit plans, including other long-term benefits and termination benefits[28], is the present value of the defined benefit obligation at the balance sheet date, less the fair value of plan assets used to fund the related obligation.

The defined benefit obligation is calculated annually by independent actuaries using the projected unit credit method. The present value of the defined benefit obligation is calculated by discounting the estimated future cash flows using a rate which is determined by reference to market yields at the balance sheet date on high-quality euro-denominated corporate bonds that have similar terms to maturity to the related obligation.

Actuarial gains and losses can arise from experience adjustments (where actual outcomes are different from the actuarial assumptions previously made) and changes in actuarial assumptions.

Net defined benefit cost

The net defined benefit cost is split into components reported in the profit and loss account and remeasurements in respect of post-employment benefits shown in the balance sheet under “Revaluation accounts”.

The net amount charged to the profit and loss account comprises:

- the current service cost of the defined benefits accruing for the year;

- the past service cost of the defined benefits resulting from a plan amendment;

- net interest at the discount rate on the net defined benefit liability;

- remeasurements in respect of other long-term benefits and termination benefits of a long-term nature[29], if any, in their entirety.

The net amount shown under “Revaluation accounts” comprises the following items:

- actuarial gains and losses on the defined benefit obligation;

- the actual return on plan assets, excluding amounts included in the net interest on the net defined benefit liability;

- any change in the effect of the asset ceiling, excluding amounts included in the net interest on the net defined benefit liability.

These amounts are valued annually by independent actuaries to establish the appropriate liability in the financial statements.

Intra-ESCB balances/intra-Eurosystem balances

Intra-ESCB balances result primarily from cross-border payments in the European Union (EU) that are settled in central bank money in euro. These transactions are for the most part initiated by private entities (i.e. credit institutions, corporations and individuals). They are settled in TARGET – the Trans-European Automated Real-time Gross settlement Express Transfer system – and give rise to bilateral balances in the TARGET accounts of EU central banks. Payments conducted by the ECB and the national central banks (NCBs) also affect these accounts. All settlements are automatically aggregated and adjusted to form part of a single position for each NCB vis-à-vis the ECB. These positions in the books of the ECB represent the net claim or liability of each NCB against the rest of the European System of Central Banks (ESCB). The movements in TARGET accounts are reflected in the accounting records of the ECB and the NCBs on a daily basis.

Intra-Eurosystem balances of euro area NCBs vis-à-vis the ECB arising from TARGET, as well as other intra-Eurosystem balances denominated in euro (e.g. the ECB’s interim profit distribution to NCBs, if any), are presented on the balance sheet of the ECB as a single net asset or liability position under either “Other claims within the Eurosystem (net)” or “Other liabilities within the Eurosystem (net)”. Intra-ESCB balances of non-euro area NCBs vis-à-vis the ECB, arising from their participation in TARGET,[30] are disclosed under “Liabilities to non-euro area residents denominated in euro”.

Intra-Eurosystem balances arising from the allocation of euro banknotes within the Eurosystem are included as a single net asset under “Claims related to the allocation of euro banknotes within the Eurosystem” (see “Banknotes in circulation” below).

Intra-Eurosystem balances arising from the transfer of foreign reserve assets to the ECB by NCBs joining the Eurosystem are denominated in euro and reported under “Liabilities equivalent to the transfer of foreign reserves”.

Banknotes in circulation

The ECB and the euro area NCBs, which together constitute the Eurosystem, issue euro banknotes.[31] The total value of euro banknotes in circulation is allocated to the Eurosystem central banks on the last working day of each month in accordance with the banknote allocation key.[32]

The ECB has been allocated an 8% share of the total value of euro banknotes in circulation, which is disclosed in the balance sheet under the liability item “Banknotes in circulation”. The ECB’s share of the total euro banknote issue is backed by claims on the NCBs. These claims, which bear interest,[33] are disclosed under the item “Claims related to the allocation of euro banknotes within the Eurosystem” (see “Intra-ESCB balances/intra-Eurosystem balances” above). Interest income on these claims is included in the profit and loss account under the item “Interest income arising from the allocation of euro banknotes within the Eurosystem”.

Interim profit distribution

An amount that is equal to the sum of the ECB’s income on euro banknotes in circulation and income arising from the securities held for monetary policy purposes purchased under (i) the Securities Markets Programme; (ii) the third covered bond purchase programme; (iii) the asset-backed securities purchase programme; (iv) the public sector purchase programme; and (v) the pandemic emergency purchase programme is distributed in January of the following year by means of an interim profit distribution, unless otherwise decided by the Governing Council.[34] Any such decision shall be taken where, on the basis of a reasoned estimate prepared by the Executive Board, the Governing Council expects that the ECB will have an overall annual loss or will make an annual profit that is less than this income. The Governing Council may also decide to transfer all or part of this income to a provision for financial risks. Furthermore, the Governing Council may decide to reduce the amount of the income on euro banknotes in circulation to be distributed in January by the amount of the costs incurred by the ECB in connection with the issue and handling of euro banknotes.

Post-balance-sheet events

The values of assets and liabilities are adjusted for events that occur between the annual balance sheet date and the date on which the Executive Board authorises the submission of the ECB’s Annual Accounts to the Governing Council for approval, if such events materially affect the condition of assets and liabilities at the balance sheet date.

Important post-balance-sheet events that do not affect the condition of assets and liabilities at the balance sheet date are disclosed in the notes.

Changes to accounting policies

In 2023 there were no changes to the accounting policies applied by the ECB.

Other issues

In accordance with Article 27 of the Statute of the ESCB, and on the basis of a recommendation of the Governing Council, the Council of the EU initially approved the appointment of Baker Tilly GmbH & Co. KG Wirtschaftsprüfungsgesellschaft, Düsseldorf (Federal Republic of Germany) as the external auditors of the ECB for a five-year period up to the end of the financial year 2022. In 2023 the Council of the EU, based on a recommendation by the Governing Council, approved an extension of this period by two additional years until the end of the financial year 2024.

2.4 Notes on the balance sheet

Note 1 - Gold and gold receivables

This item comprised the ECB’s holdings of gold:

2023 | 2022 | |

|---|---|---|

Quantity | ||

Ounces of fine gold1 | 16,285,778 | 16,229,522 |

Price | ||

US dollar per fine ounce of gold | 2,063.950 | 1,819.700 |

US dollar per euro | 1.1050 | 1.0666 |

Market value (€ millions) | 30,419 | 27,689 |

1) This corresponds to 506.5 and 504.8 tonnes in 2023 and 2022 respectively.

The increase in the euro equivalent value of ECB’s gold holdings was primarily due to the rise in the market price of gold in euro terms (see “Gold and foreign currency assets and liabilities” in Section 2.3 “Accounting policies” and note 15 “Revaluation accounts”). Additionally, upon the adoption of the single currency by Croatia with effect from 1 January 2023, Hrvatska narodna banka transferred to the ECB 56,256 ounces of fine gold with a value of €96 million.

Note 2 - Claims on non-euro area and euro area residents denominated in foreign currency

Note 2.1 - Receivables from the IMF

This asset represents the ECB’s holdings of SDRs and amounted to €2,083 million as at 31 December 2023 (2022: €1,759 million). It arises as the result of a two-way SDR buying and selling voluntary trading arrangement with the International Monetary Fund (IMF), whereby the IMF is authorised to arrange sales or purchases of SDRs against euro, on behalf of the ECB, within minimum and maximum holding levels. For accounting purposes, SDRs are treated as a foreign currency (see “Gold and foreign currency assets and liabilities” in Section 2.3 “Accounting policies”). The ECB’s holdings of SDRs increased in 2023, predominantly as a result of a transaction that took place in the context of the above-mentioned voluntary trading arrangement.

Note 2.2 - Balances with banks and security investments, external loans and other external assets; and claims on euro area residents denominated in foreign currency

These two items consist of balances with banks and loans denominated in foreign currency, and investments in securities denominated in US dollars, Japanese yen and Chinese renminbi.

2023 | 2022 | Change | |

|---|---|---|---|

Claims on non-euro area residents | |||

Current accounts | 7,161 | 15,687 | (8,526) |

Money market deposits | 474 | 985 | (512) |

Security investments | 46,158 | 37,172 | 8,986 |

Total claims on non-euro area residents | 53,793 | 53,844 | (52) |

Claims on euro area residents | |||

Current accounts | 25 | 34 | (10) |

Money market deposits | 1,426 | 1,125 | 301 |

Total claims on euro area residents | 1,450 | 1,159 | 291 |

Total | 55,243 | 55,004 | 239 |

The total value of these items increased in 2023, mainly owing to the income earned during the year, primarily on the US dollar portfolio. Additionally, upon the adoption of the single currency by Croatia with effect from 1 January 2023, Hrvatska narodna banka transferred to the ECB foreign reserve assets denominated in US dollars with a value of €544 million. However, the total increase was almost entirely offset by the depreciation of the US dollar and the Japanese yen against the euro.

The ECB’s net foreign currency holdings[35] were as follows:

2023 | 2022 | |

|---|---|---|

US dollars | 52,590 | 49,590 |

Japanese yen | 1,089,844 | 1,090,312 |

Chinese renminbi | 4,545 | 4,440 |

No foreign exchange interventions took place during 2023.

Note 3 - Other claims on euro area credit institutions denominated in euro

As at 31 December 2023 this item consisted of current account balances with euro area residents amounting to €17 million (2022: €12 million).

Note 4 - Securities of euro area residents denominated in euro

Note 4.1 - Securities held for monetary policy purposes

As at 31 December 2023 this item consisted of securities acquired by the ECB within the scope of the Securities Markets Programme (SMP), the third covered bond purchase programme (CBPP3), the asset-backed securities purchase programme (ABSPP), the public sector purchase programme (PSPP) and the pandemic emergency purchase programme (PEPP).

Start date | End date | Decision | Universe of eligible securities1 | |

|---|---|---|---|---|

Completed/Terminated programmes | ||||

CBPP12 | July 2009 | June 2010 | ECB/2009/16 | Covered bonds of euro area residents |

CBPP22 | November 2011 | October 2012 | ECB/2011/17 | Covered bonds of euro area residents |

SMP | May 2010 | September 2012 | ECB/2010/5 | Public and private debt securities issued in the euro area3 |

Asset purchase programme (APP)4 | ||||

CBPP3 | October 2014 | active | ECB/2020/8, | Covered bonds of euro area residents |

ABSPP | November 2014 | active | ECB/2014/45, | Senior and guaranteed mezzanine tranches of asset-backed securities of euro area residents |

PSPP | March 2015 | active | ECB/2020/9 | Bonds issued by euro area central, regional or local governments or recognised agencies as well as by international organisations and multilateral development banks located in the euro area |

CSPP5 | June 2016 | active | ECB/2016/16, | Bonds and commercial paper issued by non-bank corporations established in the euro area |

Pandemic emergency purchase programme (PEPP) | ||||

PEPP | March 2020 | active | ECB/2020/17, | All asset categories eligible under the APP |

1) Further eligibility criteria for the specific programmes can be found in the Governing Council’s decisions.

2) At the end of 2022 and the end of 2023, the ECB did not have any holdings of securities under the first and second covered bond purchase programmes (CBPP1 and CBPP2). However, in 2022 the ECB still recorded interest income from these portfolios, since the last holdings under the CBPP1 and the CBPP2 matured in July 2022 and September 2022 respectively.

3) Only public debt securities issued by five euro area treasuries were purchased under the SMP.

4) The reinvestments under the asset purchase programme (APP) were discontinued as of 1 July 2023.

5) The ECB does not acquire securities under the corporate sector purchase programme (CSPP).

Until the end of February 2023[36], the Eurosystem continued reinvesting, in full, the principal payments from maturing securities purchased under the asset purchase programme (APP)[37]. Subsequently, the APP portfolio declined at a measured and predictable pace. Until the end of June 2023, the decline amounted to €15 billion per month on average, as the Eurosystem did not reinvest all of the principal payments from maturing securities. In June 2023 the Governing Council decided[38] to discontinue the reinvestments under the APP as of July 2023. Thereafter, the APP portfolio declined due to maturing securities.

With regard to the PEPP[39], the Eurosystem continued reinvesting, in full, the principal payments from maturing securities purchased throughout the year. The Governing Council intends[40] to continue to reinvest, in full, the principal payments from maturing securities purchased under the PEPP during the first half of 2024. It also intends to reduce the PEPP portfolio by €7.5 billion per month on average over the second half of 2024 and to discontinue reinvestments at the end of the same year. In addition, the Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

The securities purchased under these programmes are valued on an amortised cost basis subject to impairment (see “Securities” in Section 2.3 “Accounting policies”).

The amortised cost of the securities held by the ECB and their market value[41] (which is not recorded on the balance sheet or in the profit and loss account and is provided for comparison purposes only) were as follows:

2023 | 2022 | Change | ||||

|---|---|---|---|---|---|---|

Amortised | Market | Amortised | Market | Amortised | Market | |

Completed/Terminated programmes | ||||||