Overview

The coronavirus (COVID-19) pandemic has dramatically affected global and euro area economic activity since early 2020. Following a significant drop in the first quarter, euro area real GDP fell by 11.8% in the second quarter, although this was less than expected in the June 2020 Eurosystem staff projections. This unprecedented collapse in activity reflects the adverse impact of strict lockdown measures implemented in most euro area countries around mid-March. The impact was subsequently tempered by the gradual relaxation of these measures from May onwards as well as by behavioural changes in response to the pandemic. Real-time high frequency indicators started to rebound in May. This suggests a strong yet incomplete rebound of real GDP, which is projected to grow by 8.4% in the third quarter. Thereafter, the baseline rests on the key assumption of a partial success in containing the virus, with some resurgence in infections over the coming quarters necessitating continued containment measures, albeit less so than in the initial wave, until a medical solution becomes available by mid-2021. These containment measures, together with elevated uncertainty and worsened labour market conditions, are expected to continue to weigh on supply and demand. Nevertheless, substantial support from monetary, fiscal and labour market policies, all of which have been strengthened since the June 2020 Eurosystem staff projections, should maintain incomes and limit the economic scars which may follow the resolution of the health crisis. Such policies are also assumed to be successful in averting large financial amplification channels. Under these assumptions, real GDP in the euro area is projected to fall by 8.0% in 2020 and to rebound by 5.0% in 2021 and by 3.2% in 2022. By the end of the projection horizon, the level of real GDP would stand 3½% below its expected level in the pre-COVID-19 December 2019 Eurosystem staff projections.

Turning to inflation, in the short term the previous collapse in oil prices, the appreciation of the euro and a temporary reduction in the VAT rate in Germany imply euro area headline HICP inflation around zero for the coming months. In 2021 base effects in the energy component and, to a lesser extent, the expected reversal of the VAT rate cut in Germany subsequently cause a mechanical rebound. HICP inflation excluding energy and food is projected to decline until the end of this year. Disinflationary effects are expected to be broad-based across the services and goods sectors, as demand remains weak. However, continued upward cost pressures related to supply side limitations are expected to partly offset these effects. Over the medium term, inflation is projected to increase: oil prices are assumed to pick up and demand should recover, despite diminishing upward pressures from adverse supply effects linked to the pandemic and despite the appreciation of the euro. Overall, HICP inflation is expected to increase from 0.3% in 2020 to 1.0% and 1.3% in 2021 and 2022, respectively.[1]

In view of the uncertainty about how the pandemic will evolve, two alternative scenarios have been prepared. The mild scenario sees the shock as temporary, with a swift implementation of a medical solution allowing a further loosening of the containment measures. In this scenario, real GDP would decline by 7.2% this year, then rebound strongly in 2021. By the end of the horizon, real GDP would slightly exceed the level expected in the December 2019 Eurosystem staff projections, with inflation reaching 1.8% in 2022. In contrast, the severe scenario with a strong resurgence of the pandemic implies a return to stringent containment measures. These weigh severely on economic activity and cause substantial and permanent losses to activity. In this scenario, real GDP falls by 10% in 2020. By the end of the horizon, it stands around 9% below its level in the December 2019 Eurosystem staff projections, with inflation at only 0.7% in 2022.

1 Key assumptions and policy measures underlying the projections

The baseline rests on a number of critical assumptions concerning the evolution of the pandemic. The resurgence of infections seen in some European regions in recent weeks is assumed to broaden and intensify over the next few quarters, requiring a continuation of containment measures and/or behavioural changes by economic agents. By virtue of the experience gained on how to deal with the pandemic, these responses are assumed to become more efficient, implying lower economic costs than in the initial wave. In addition, a satisfactory medical solution (such as a vaccine) is assumed to be found by mid-2021, with a gradual widespread deployment by the end of 2021. The economic recovery is assumed to be initially largely focused on manufacturing and some service sectors, while other services, e.g. arts, entertainment, accommodation and recreation, would continue to be particularly hampered. Similar assumptions about the evolution of the pandemic underlie the international projections (see Box 2).

Significant monetary, fiscal and labour market policy measures will help support incomes, reduce job losses and bankruptcies, and will be largely successful in containing adverse real-financial feedback loops. In addition to the successive monetary policy measures taken by the ECB since March, including the recalibration of the pandemic emergency purchase programme (PEPP) in June, the baseline includes discretionary fiscal measures related to the COVID-19 crisis amounting to approximately 4.5% of GDP in 2020 (about 1.0 percentage point more than assumed in the June 2020 Eurosystem staff projections). These measures include extensive short-time work schemes and wage subsidies which cushion the impact of the collapse in activity on employment and labour incomes. In particular, firms receive substantial subsidies and capital transfers. Although some fiscal measures have been extended and new packages have been adopted for 2021 and included in the baseline, many of the emergency fiscal measures currently in place are still assumed to be temporary. In addition, partial or total government guarantees, in particular for loans, amounting to a total envelope of about 20% of GDP should contribute to alleviating liquidity constraints. The impact of the €750 billion Next Generation EU (NGEU) recovery fund is included in the baseline to the extent that it has lowered sovereign yields in some countries and also through confidence effects. In terms of fiscal assumptions, the baseline only reflects its impact to the extent that some of the recently adopted national measures may be funded by the NGEU. Beyond this, the baseline projections do not incorporate future measures which have not yet been adopted and which may be financed out of the NGEU programme, given the uncertainty surrounding governments’ spending plans during the projection horizon. Importantly, both the monetary policy measures as well as the government credit and capital instruments act as backstops, notably reducing the tail risks of adverse real-financial feedback loops. Nevertheless, lower profits for firms might lead to increased insolvencies and credit frictions resulting in some adverse financial amplification effects, especially after the government loan guarantees expire. Therefore the baseline includes some moderate effects from tighter financing conditions.

2 Real economy

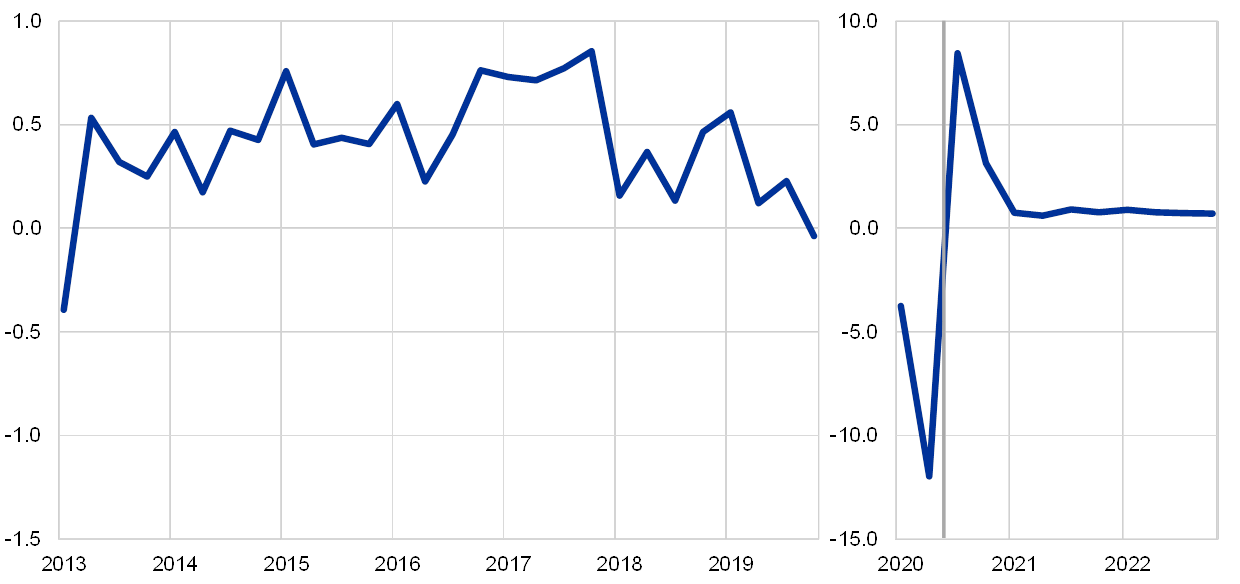

Real GDP registered an unprecedented decline in the second quarter of 2020. According to Eurostat, real GDP fell by 11.8% in the second quarter, extending the decline incurred in the first quarter and pushing real GDP down by about 15% compared with the fourth quarter of 2019 (see Chart 1). All euro area countries recorded very negative quarterly growth rates in the second quarter, notably France, Italy and Spain among the larger countries. Available data suggest that producers of motor vehicles, investment goods and transport, as well as arts, entertainment and recreation activities incurred the largest losses in the second quarter, although to a different extent across countries.

Chart 1

Euro area real GDP

(quarter-on-quarter percentage changes, seasonally and working day-adjusted quarterly data)

Note: In view of the unprecedented volatility in real GDP in the course of 2020, the chart shows a different scale from early 2020 onwards. The vertical line indicates the start of the projection horizon. This article does not show ranges around the projections. This reflects the fact that the standard computation of the ranges (based on historical projection errors) would not, in the present circumstances, provide a reliable indication of the unprecedented uncertainty surrounding the current projections. Instead, in order to better illustrate the current uncertainty, alternative scenarios based on different assumptions regarding the future evolution of the COVID-19 pandemic and the associated containment measures are provided in Box 3.

High-frequency as well as forward-looking indicators suggest a strong yet incomplete rebound in activity in the third quarter. Surveys compiled by the European Commission as well as the Purchasing Managers’ Indices (PMIs) have rebounded from the troughs recorded in April 2020. The PMI composite output rebounded to an average of 53.4 in July/August from a low of 13.6 in April and an average of 31.3 in the second quarter, signalling a rebound of real GDP in the third quarter. High-frequency indicators, such as electricity consumption, GPS-based mobility indicators or credit card payments started to converge back to pre-crisis levels as euro area countries lifted the lockdown measures. This also points to a strong increase in real GDP in the third quarter. Overall, activity in the third quarter is expected to rise by 8.4%, implying a recovery of around half of the loss experienced in the first half of the year.

Despite the assumption of some resurgence of the pandemic and some containment measures remaining in place, the recovery is projected to continue during the next few quarters. The further rebound is based on the assumption that the impact of containment measures will slowly decrease, uncertainty will gradually decline, foreign demand will recover and policies will be supportive. Nevertheless, real GDP will only gradually recover towards pre-crisis levels. This implies that, by the end of the projection horizon, real GDP would stand around 3½% below the level expected in the December 2019 Eurosystem staff projections, the latter taken as denoting the path of the economy in the absence of the COVID-19 pandemic.

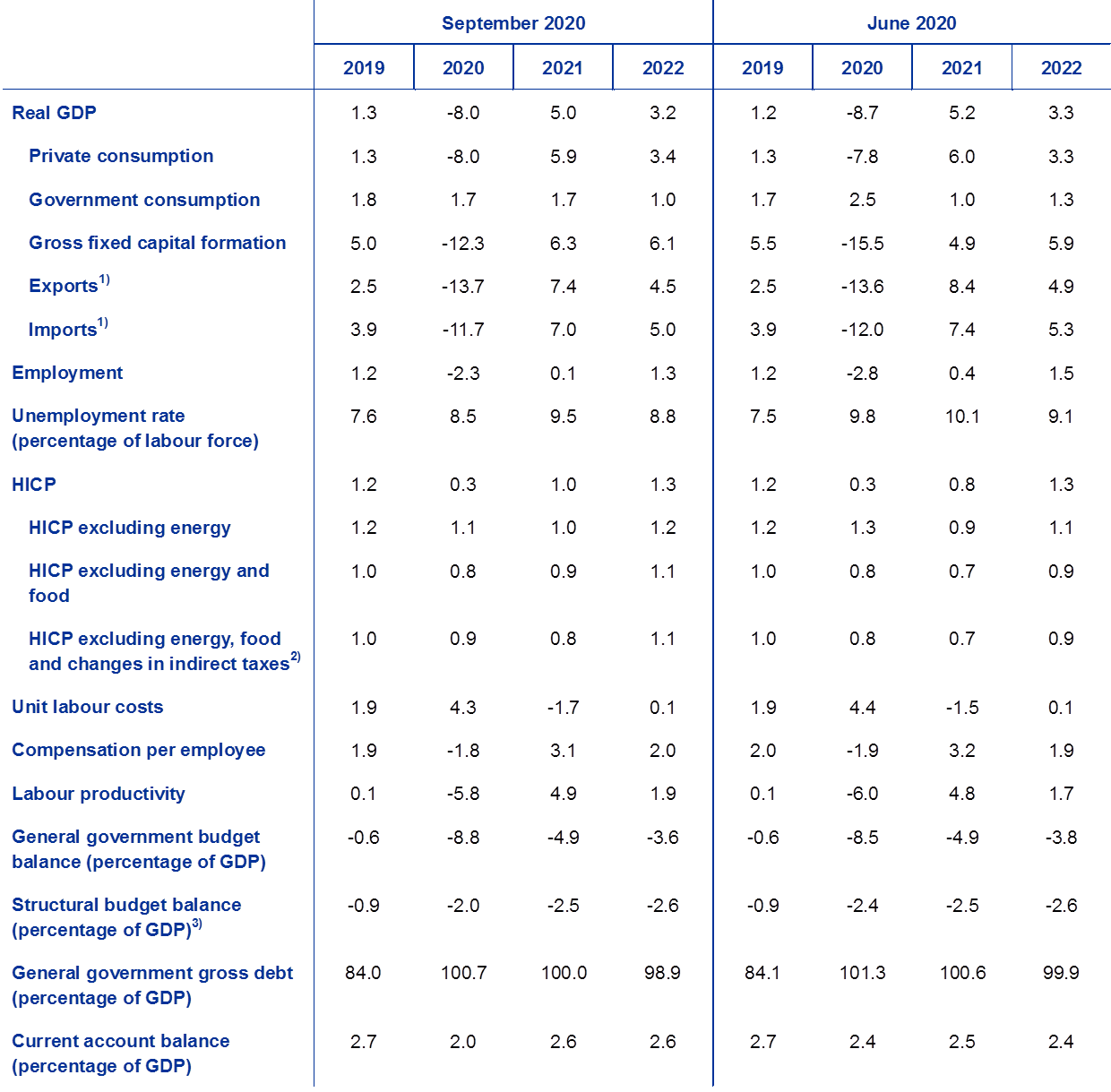

Table 1

Macroeconomic projections for the euro area

(annual percentage changes)

Note: Real GDP and components, unit labour costs, compensation per employee and labour productivity refer to seasonally and working day-adjusted data. This table does not show ranges around the projections. This reflects the fact that the standard computation of the ranges (based on historical projection errors) would not, in the present circumstances, provide a reliable indication of the unprecedented uncertainty surrounding the current projections. Instead, in order to better illustrate the current uncertainty, alternative scenarios based on different assumptions regarding the future evolution of the COVID-19 pandemic and the associated containment measures are provided in Box 3.

1) This includes intra-euro area trade.

2) The sub-index is based on estimates of actual impacts of indirect taxes. This may differ from Eurostat data, which assume a full and immediate pass through of tax impacts to the HICP.

3) Calculated as the government balance net of transitory effects of the economic cycle and temporary measures taken by governments. The structural balance does not reflect the budgetary impact of temporary measures related to the COVID-19 pandemic.

Turning to the components of GDP, private consumption is expected to decline by a historical record of 8.0% in 2020. Private consumption declined very strongly in the first half of 2020, with sales of motor vehicles as well as spending on holidays and meals in restaurants having been hit the hardest. Although losses in real disposable income related to the lockdowns were largely cushioned by public transfers, the decline in consumption was amplified by a combination of forced savings and precautionary savings. On the one hand, forced savings resulted from the fact that households whose income was unaffected were not able to buy non-essential goods and services. On the other hand, precautionary savings increased due to the steep decline in consumer confidence and an unprecedented increase in uncertainty about the economic and employment outlook.

Looking forward, private consumption is expected to rebound robustly in the second half of 2020, as substantial fiscal transfers continue to bolster disposable income and as the saving behaviour starts to normalise following the lockdowns. Private consumption is projected to continue recovering in 2021 and to surpass its pre-crisis level only during 2022. This rebound will be supported by an expected gradual decline in uncertainty, while elevated unemployment and an unwinding of net fiscal transfers will act as a drag on the recovery of consumer spending.

Box 1

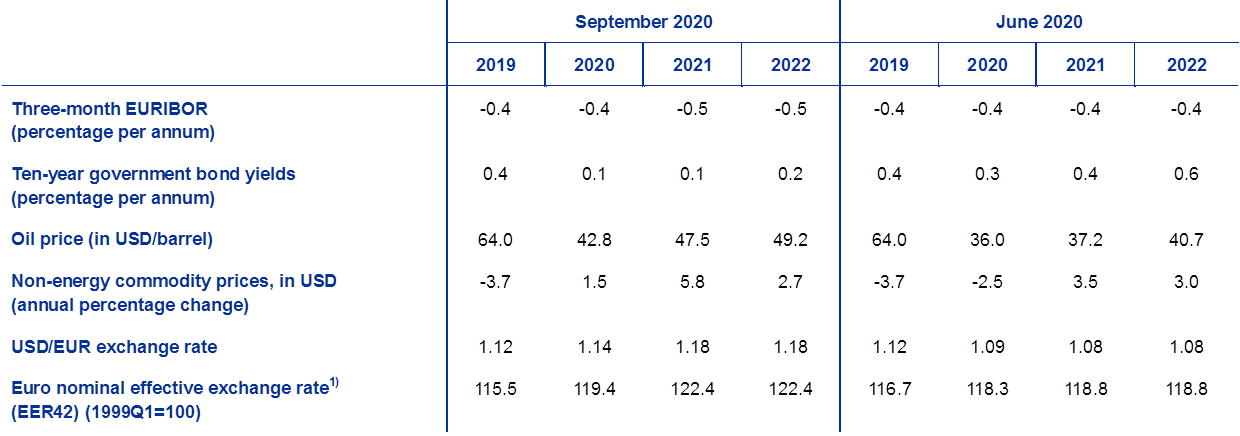

Technical assumptions about interest rates, exchange rates and commodity prices

Compared with the June 2020 Eurosystem staff projections, the current technical assumptions include significantly higher oil prices, a stronger effective exchange rate of the euro and lower long-term interest rates. The technical assumptions about interest rates and commodity prices are based on market expectations with a cut-off date of 18 August 2020. Short-term interest rates refer to the three-month EURIBOR, with market expectations derived from futures rates. The methodology gives an average level for these short-term interest rates of -0.4% in 2020 and -0.5% in 2021 and 2022. The market expectations for euro area ten-year nominal government bond yields imply an average annual level of 0.1% for 2020 and 2021, and 0.2% for 2022.[2] Compared with the June 2020 Eurosystem staff projections, market expectations for short-term interest rates have declined slightly, while euro area ten-year nominal government bond yields have been revised down by around 30 basis points for 2021-22.

As regards commodity prices, the projections consider the path implied by futures markets by taking the average of the two-week period ending on the cut-off date of 18 August 2020. On this basis, the price of a barrel of Brent crude oil is assumed to decline from USD 64.0 in 2019 to USD 42.8 in 2020 and to increase to USD 49.2 by 2022. This path implies that, in comparison with the June 2020 Eurosystem staff projections, oil prices in US dollars are significantly higher over the entire horizon. The prices of non-energy commodities in US dollars are estimated to rebound over the projection horizon.

Bilateral exchange rates are assumed to remain unchanged over the projection horizon at the average levels prevailing in the two-week period ending on the cut-off date of 18 August 2020. This implies an average exchange rate of USD 1.18 per euro over the period 2021-22, which is significantly higher than in the June 2020 Eurosystem staff projections. The assumption for the effective exchange rate of the euro has been revised up by 3.1% since the June 2020 Eurosystem staff projections.

Technical assumptions

1) The effective exchange rate of the euro used in the September 2020 ECB staff projections refers to 42 trading partners compared to 38 trading partners used in the June 2020 Eurosystem staff projections.

Housing investment is also expected to contract sharply in 2020. This is especially the case for countries which experienced stricter lockdown measures. The adverse effects on housing demand of lower disposable income, weaker consumer confidence and higher unemployment are expected to lead to persistently subdued housing investment. This is expected to stand more than 2% below its pre-crisis level at the end of the projection horizon.

Business investment is expected to collapse in 2020 and to gradually recover to pre-crisis levels only in 2022. Business investment is estimated to have collapsed in the first half of 2020 in the face of the lockdowns, and also as global and domestic demand collapsed and uncertainty surged. A very limited rebound is expected to start in the second half of 2020, with the speed of the recovery diverging substantially across countries, mostly reflecting the differences in the size of the initial collapse. Faced with heightened uncertainty, firms are likely to postpone investment. As such, business investment for the euro area is expected to reach its pre-crisis level only towards the end of the projection horizon.

The gross indebtedness of non-financial corporations (NFCs) is projected to increase significantly in 2020 before declining moderately but remaining above its pre-crisis level at the end of the horizon. The initial increase in NFCs’ gross indebtedness is attributable to the marked fall in corporate profits in the first half of 2020 and the resulting increased recourse to debt financing to compensate for liquidity shortfalls. The observed increase in the corporate debt ratio is expected to limit business investment growth over the projection horizon, as firms have to improve their balance sheets. Nevertheless, NFCs’ gross interest payments have declined to record low levels in the past years and are expected to increase only gradually in the next few years, allaying possible debt sustainability concerns.

Box 2

The international environment

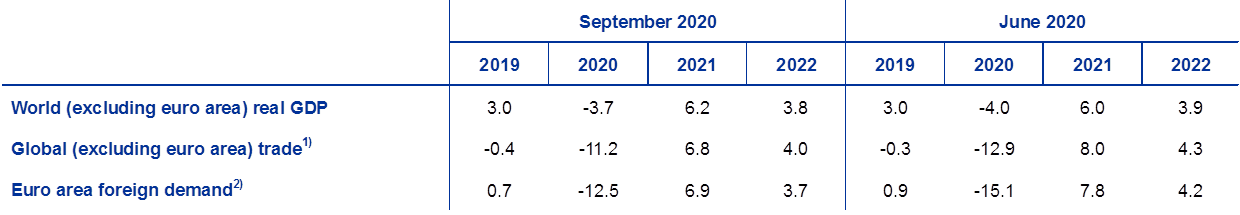

In line with the gradual lifting of containment measures since mid-May, global activity has started to recover, as confirmed by survey data. The COVID-19-related containment measures caused an unprecedented and synchronised fall in global output and trade in the second quarter of 2020. This is also confirmed by incoming national accounts data. For global trade, these data point to a double-digit contraction which, however, is less sharp than anticipated in the June 2020 Eurosystem staff projections. Given that restrictions were eased and production started to normalise, global economic activity and trade are expected to rebound from the low levels of the second quarter. In August, the global composite output PMI (excluding the euro area) rose for a fourth consecutive month, up to 52.6 from 50.2 in July and from a low of 28.7 in April. The rebound is broad-based across the manufacturing and services sectors. On the trade side, the global manufacturing PMI new export orders (excluding the euro area) rose in August for a fourth consecutive month, pointing to a continued rebound in world trade in the third quarter.

Global real GDP (excluding the euro area), after contracting by 3.7% in 2020, is projected to rebound and grow at 6.2% in 2021 and 3.8% in 2022. The recovery in the level of activity, however, is incomplete. Some forms of social distancing are assumed to remain in place and a medical solution is expected only by mid-2021. The global baseline assumes some continuation of the rise in infections which, however, are more localised than in the first wave and dealt with by more targeted containment measures. The latter, thanks to learning from past experience, are less disruptive for economic activity than before. The lingering uncertainty about the evolution of the pandemic and its economic fallout will weigh on consumer sentiment. Compared with the June 2020 Eurosystem staff projections, global real GDP growth (excluding the euro area) has been revised marginally upwards for 2020 and 2021 and is largely unrevised for 2022.

Global trade (excluding the euro area) is projected to contract by 11.2% in 2020 before rebounding by 6.8% in 2021 and continuing to grow at 4% in 2022. The sharp fall in global imports (excluding the euro area) in 2020 reflects both their strong pro-cyclicality, especially during economic downturns, and also the peculiar nature of the COVID-19 crisis. Disruptions in global production chains and increased trade costs as part of the containment measures have taken a toll on global trade. Looking ahead, while global trade is expected to bounce back along with economic activity, some scarring effects will materialise. In the near term, government decisions to keep selective travel restrictions in place, at least until a medical solution is found, may weigh further on trade via higher trade costs. Furthermore, as the COVID-19 pandemic has exposed the dependence of several countries on external suppliers, this may result in policies aiming to diversify global suppliers so as to avoid mono-dependence or to re-shore production, thus negatively affecting complex global value chains. The profile for the level of global imports in the June 2020 Eurosystem staff projections is broadly confirmed, thus pointing to a significant loss in trade over the projection horizon, compared with the pre-crisis baseline. In growth terms, however, the less sharp contraction in imports the first half of 2020 is assumed to be followed by a less steep rebound. Euro area foreign demand is projected to decline by 12.5% in 2020 and to grow by 6.9% in 2021 and 3.7% in 2022 (compared with 7.8% and 4.2% in 2021 and 2022 respectively in the June 2020 Eurosystem staff projections).

The international environment

(annual percentage changes)

1) Calculated as a weighted average of imports.

2) Calculated as a weighted average of imports of euro area trading partners.

Euro area exports have been hit harder by the COVID-19 pandemic than imports, due to the global collapse in sectors to which the euro area is particularly exposed, implying negative net exports in 2020. Exports are estimated to have been severely affected in the first half of 2020, as a direct consequence of lockdown measures to contain the pandemic. The COVID-19 outbreak has particularly disrupted supply chains in the export-oriented automotive, machinery and chemical sectors, weighing on key export sectors of the euro area more than on export sectors of other regions. Travel and tourism restrictions led to the collapse of exports of hospitality and transport services, but the lifting of many restrictions within the euro area and some easing vis-à-vis the rest of the world have more recently contributed to a partial recovery of exports in these sectors. Overall, euro area exports are expected to grow broadly in line with the recovery in euro area foreign demand, although at a slower rate than in the June 2020 Eurosystem staff projections in view of the loss in price competitiveness due to the recent strengthening of the euro exchange rate. Imports are expected to decline less than exports in 2020, as major exporters are hit particularly hard by the global drop in demand for automobiles and investment goods. As a result, net exports are projected to be negative in 2020. From the third quarter of 2020 onwards, as global conditions normalise, the rebound in exports is somewhat stronger than in imports, implying a positive contribution of net exports to GDP growth over the following quarters. From mid-2021 onwards both exports and imports grow in tandem, implying a neutral contribution of net exports to growth over the remainder of the projection horizon.

Although unemployment has increased less in recent months than the June 2020 Eurosystem staff projections had anticipated, the labour market situation is expected to worsen substantially. The increase in the unemployment rate in the second quarter was significantly lower than expected, while the decline in headline employment was only slightly weaker than expected. These recent developments imply a much sharper than expected drop in the labour force, which partly reflects the fact that some workers who lost their jobs were classified as “inactive” given the reduced opportunities to search for work during the lockdown. Also, a reduction in hiring opportunities may have led to discouragement, with many people moving out of the labour force. This downward effect on the labour force is assumed to reverse gradually in the following quarters. As the labour force starts to normalise and short-time work schemes expire, the unemployment rate is projected to increase from 7.3% in the first quarter of 2020 to 9.5% in 2021 before declining to 8.8% in 2022, as the economy recovers. This assumes that the job retention policies are largely successful in keeping short-time workers in employment, with a limited transition into unemployment for those exiting from job retention schemes. While the decline in employment in terms of persons has been cushioned by an extensive recourse to short-time work schemes in many countries, total hours worked are expected to have contracted much more sharply in the second quarter, reflecting the fact that many people were employed but worked far fewer hours. Thereafter, total hours worked are expected to increase faster than employment in terms of persons, as many workers return to a more normal working pattern.

Labour productivity per person employed is projected to decline in 2020 and then to recover over the projection horizon. The steep decline in output and the intensive use of short-time work schemes in euro area countries imply a sharp decline in labour productivity per person in the first half of 2020. Labour productivity per person is projected to reverse sharply in the second half of the year. In contrast, the growth profile of labour productivity per hour worked is much more muted during the pandemic, as total hours worked are expected to closely follow GDP developments. As of the second half of 2021, labour productivity is projected to follow a broadly stable growth path.

Compared with the June 2020 Eurosystem staff projections, the projection for real GDP growth has been revised up in 2020 and remains largely unchanged over the rest of the horizon. Real GDP growth has been revised up for 2020, mainly on account of a better than expected outcome in the second quarter. Thereafter a number of adverse factors have a downward impact on growth. These include lower euro area foreign demand from the third quarter of 2020 onwards, lower competitiveness of euro area exports following the recent appreciation of the euro and higher oil prices. The downward impact of these factors is broadly offset by positive impacts related to the monetary policy measures announced by the ECB in June 2020, additional fiscal stimulus, and confidence effects related to the NGEU recovery fund.

Box 3

Alternative scenarios for the euro area economic outlook

The high uncertainty surrounding the impact of the COVID-19 pandemic on the euro area economic outlook warrants an analysis based on alternative scenarios. This box outlines two scenarios, representing alternatives to the September 2020 ECB staff projections baseline, in order to illustrate a range of plausible impacts of the COVID-19 pandemic on the euro area economy.

The scenarios vary according to different assumptions about the pandemic and how the economy will respond. These assumptions concern the evolution of the pandemic, the severity and duration of containment measures, as well as the implementation and the effectiveness of a medical solution. Assumptions about the economy concern the behavioural responses of economic agents adjusting to economic disruptions and the longer-lasting effects on economic activity, once all containment measures have been lifted. The broad narratives for the development of these factors also determine the scenario-specific projections for euro area foreign demand as well as for lending rates. Other conditioning assumptions, such as those for the oil price, the exchange rate and fiscal policy, are the same as for the baseline.

The mild scenario assumes that after the recent rise in infections, the virus is successfully contained, while the severe scenario assumes a strong resurgence of the pandemic. The narratives for both scenarios remain broadly similar to the ones in the June 2020 Eurosystem staff projections. The mild scenario assumes a stabilisation of infections after the recent rise and very successful economic responses by authorities and economic agents. The severe scenario envisages a strong resurgence of the pandemic, leading governments to restore stringent containment measures. The sustained efforts to prevent the spread of the virus in the severe scenario would continue to significantly dampen activity across sectors of the economy until a medical solution becomes available. The latter is assumed to occur by mid-2021 but its implementation would not be effective in containing the virus in the severe scenario. Compared with the narrative in the baseline, the severe scenario features a more sizeable and more prolonged weakness in activity across sectors. This is to some extent amplified by increased insolvencies, which lead to credit frictions that adversely affect the borrowing costs and access to finance of households and firms.

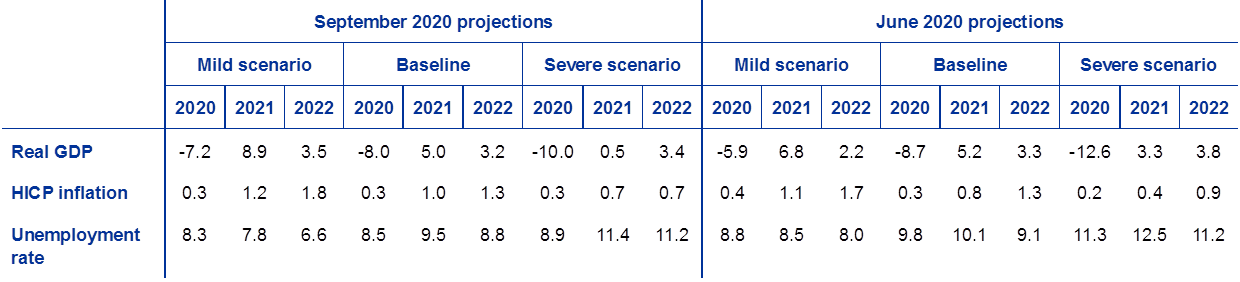

Table A

Alternative macroeconomic scenarios for the euro area

Note: Unemployment rate is measured as a percentage of labour force.

These scenarios for the euro area are based on the same broad narratives for the global economy and thus for euro area foreign demand. Euro area foreign demand would fall in 2020 by around 8.6% and 15.5% under the mild and the severe scenarios, respectively. Looking further ahead, losses in euro area foreign demand compared with its baseline level are likely to persist up to the end of 2022 under the severe scenario.

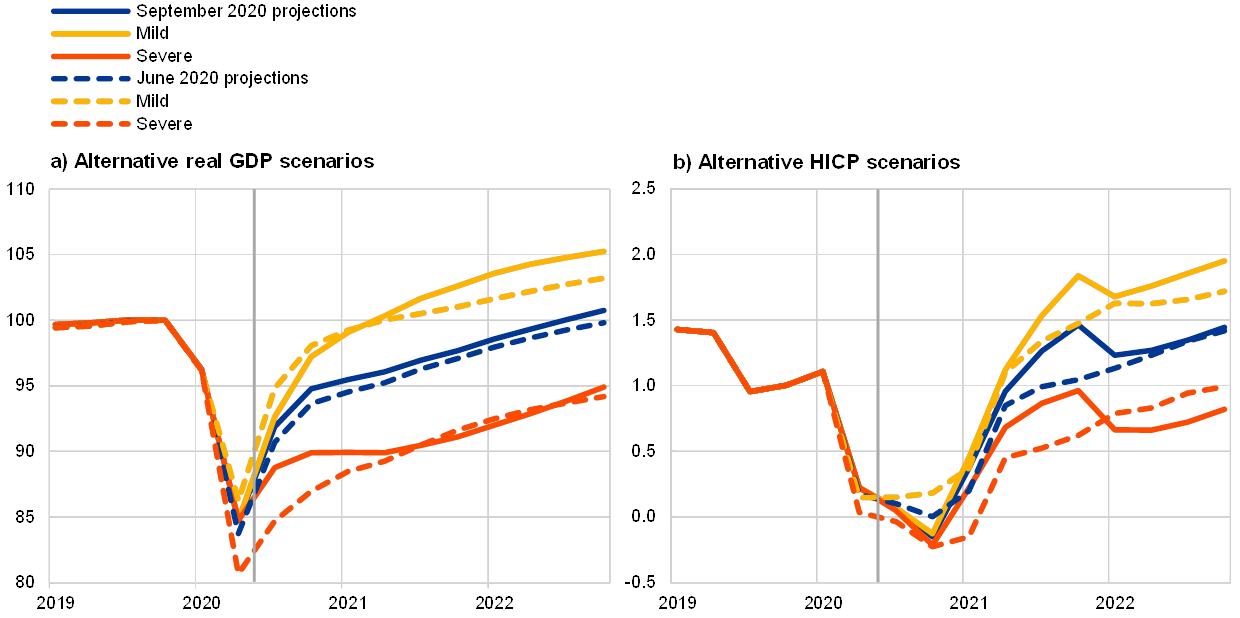

Euro area real GDP rises by between 4.8% in the severe scenario and 9.4% in the mild scenario in the third quarter, but growth moderates in the fourth quarter under both scenarios (see Chart A). The scenarios point towards a strong rebound in economic activity in the third quarter, although real GDP is still projected to stand well below its pre-crisis level in the third quarter of 2020 under both the mild and the severe scenarios. Real GDP growth moderates to 5.0% and 1.3% in the fourth quarter, respectively, in the mild and the severe scenarios. The weaker rebound under the severe scenario is because stricter containment measures are assumed to be necessary in view of the very limited success in containing the virus and its strong resurgence.

Chart A

Alternative scenarios for real GDP and HICP inflation in the euro area

(index: Q4 2019 = 100 (left-hand chart); year-on-year rate (right-hand chart))

Note: The vertical line indicates the start of the projection horizon.

Real GDP is projected to rebound more strongly under the mild scenario than under the severe one on average over 2021-22 (see Table A). Under the mild scenario, as containment measures allow for a gradual normalisation of economic activity, real GDP is projected to rebound strongly in 2021. This is helped by the assumed deployment of an effective medical solution by mid-2021, which ensures a relatively strong pace of recovery also in 2022. Real GDP would recover to well above its baseline level in the course of 2021 and would end up being around 4.5% higher than the baseline by the end of 2022. In contrast, under the severe scenario, the resurgence of infections, the limited success of containment measures and the assumed persistent economic damage would continue to weigh on economic activity throughout the horizon. The profile for economic activity is expected to be virtually flat in 2021, while real GDP would fall 5.8% below the baseline by the end of 2022.

Euro area labour markets would recover under the mild scenario, as policies would largely succeed in preventing hysteresis effects that are only partially contained in the severe scenario. Under the mild scenario, employment is projected to start recovering already in the third quarter of 2020. In contrast, under the severe scenario, employment will fall until the second quarter of 2021 before starting to recover. Like GDP, employment is expected to clearly exceed its baseline level by the end of 2022 in the mild scenario, while it is projected to remain below that level under the severe scenario. In line with the profile of employment, the unemployment rate in the severe scenario in 2022 would exceed the baseline level by 2.4 percentage points, whereas it would be 2.2 percentage points below that level in the mild scenario.

As regards HICP inflation, there is little difference between the two scenarios in the short term. In 2020, headline inflation declines to 0.3% in both scenarios. As long as the duration of the downturn is uncertain, there may be little inclination to immediately change price setting.

Beyond the short term, inflation varies more between the two scenarios due to differences in the balance of demand and supply. Both downward demand and upward supply effects on inflation are expected to be larger in the severe than the mild scenario but excess supply is envisaged to be higher in the severe scenario than in the mild one, depressing inflation. HICP inflation in 2021 and 2022 is expected to be 1.2% and 1.8% under the mild scenario and 0.7% in both years under the severe scenario.

3 Prices and costs

HICP inflation is expected to increase from 0.3% in 2020 to 1.0% in 2021 and 1.3% in 2022 (see Chart 2).The low headline inflation rate in 2020 reflects, in particular, a sharp drop in HICP energy prices – given the fall in oil prices since the global COVID-19 outbreak began – the appreciation of the euro as well as a cut in VAT rate in Germany for six months starting in July 2020. Despite the partial recovery in oil prices in recent months, HICP energy inflation is expected to provide a large negative contribution to headline inflation in 2020. Over the remainder of the projection horizon, the assumed increases in oil prices and some upward effects from environmental tax increases imply a rise in HICP energy inflation. Following the temporary surge in HICP food inflation in April 2020 caused by the outbreak of COVID-19, food prices on a monthly basis started to moderate already as of May, as lockdowns were eased and supply constraints loosened. Annual food price inflation is expected to decrease in the course of this year before increasing gradually over the remainder of the horizon.

HICP inflation excluding energy and food is expected to moderate to 0.8% on average in 2020 before picking up as of the second half of 2021. Over the coming months, disinflationary effects are expected to be broad-based across the prices of services and goods, as demand will remain subdued or hampered by measures to contain the spread of the virus. The downward pressures from weak demand and the VAT rate reduction in Germany are expected to be only partly offset by upward price and cost pressures from still ongoing supply side disruptions and shortages arising from, for example, disrupted global value chains, social distancing measures and reductions in supply. Over the medium term, HICP inflation excluding energy and food is expected to gradually pick up as upward price pressures from rising demand in the context of the progressing economic recovery are expected to strengthen despite the downward impact of the appreciation of the euro. As regards supply side factors, while upward pressures from adverse supply effects linked to the pandemic diminish, the exit of firms could push up profit margins in some markets beyond their cyclical improvements. Indirect effects from the assumed recovery in oil prices will also support the pick-up in underlying inflation. Finally, upward base effects due to the reversal of the German VAT rate cut imply an upward impact on the annual rates for underlying inflation in the third and four quarters of 2021.

Chart 2

Euro area HICP

(year-on-year percentage changes)

Note: The vertical line indicates the start of the projection horizon. This chart does not show ranges around the projections. This reflects the fact that the standard computation of the ranges (based on historical projection errors) would not, in the present circumstances, provide a reliable indication of the unprecedented uncertainty surrounding the current projections. Instead, in order to better illustrate the current uncertainty, alternative scenarios based on different assumptions regarding the future evolution of the COVID-19 pandemic and the associated containment measures are provided in Box 3.

Growth in compensation per employee is projected to turn negative in the short term but to recover in line with economic activity in 2021 and display growth rates of around 2% in 2022. Compensation per employee decreased sharply in the second quarter of 2020 reflecting the massive and abrupt drop in hours worked per employee during the lockdowns and the only partial compensation of the income losses by short-time work schemes in most countries. However, the developments in compensation per employee exaggerate the loss in labour income because in a number of countries the government support is recorded under transfers rather than compensation per employee. After the lockdowns, compensation per employee is expected to bounce back, albeit not to the level recorded before the lockdowns, and to continue to rise gradually over the remainder of the projection horizon.

Growth in unit labour costs is projected to be subject to strong fluctuations over the projection horizon, reflecting the sharp movements in labour productivity growth. The loss in labour productivity in the second quarter of 2020, due to GDP falling by more than employment, pushes up unit labour costs significantly. The subsequent rebound in labour productivity implies a strong fall in unit labour costs. Beyond the crisis-related volatility, unit labour costs are subsequently expected to move broadly sideways.

Profit margins are expected to broadly buffer the strong swings in unit labour costs over the projection horizon. As a result, they are envisaged to bounce back notably following a decline in the second quarter. Following some moderation in the second half of 2021, unit profits are expected to exceed the pre-crisis level towards the end of the projection horizon, in an environment of almost no upward pressures from unit labour costs.

Import prices are expected to fall markedly in 2020 but to rebound somewhat in 2021 and 2022. This profile is significantly affected by movements in oil prices, for which the past declines and the slope of the oil price futures curve imply a large negative growth rate in 2020 but positive annual rates as of the second quarter of 2021 and in 2022. The positive import price inflation rate as of 2021 also reflects some upward price pressures from both non-oil commodity prices and rising underlying global price developments more generally. In contrast, the recent appreciation of the euro puts downward pressure on the import deflator over the whole horizon.

Compared with the June 2020 Eurosystem staff projections, the projection for HICP inflation is unchanged for 2020, revised up for 2021 and remains unchanged for 2022. HICP energy inflation is revised up for 2020 and 2021 given the recent recovery in oil prices – also in euro terms – but downward in 2022 in view of a flatter oil price futures curve compared with that in the previous Eurosystem staff projections. By contrast, HICP food inflation is revised down for 2020 – reflecting a faster than previously expected moderation in food prices in the second half of the year following the surge related to the COVID-19 crisis – and it is marginally revised down for 2021 and 2022. HICP inflation excluding energy and food is broadly unrevised for 2020, as the impact of a temporary VAT rate reduction in Germany in the second half of the year is broadly offset by stronger recent data outturns. However it is revised upwards thereafter, as the downward impact of the appreciation of the euro effective exchange rate is more than offset by the combined upward impact of the reversal of the German VAT cut in 2021, indirect effects of stronger oil prices as well as higher activity and lower unemployment projections. The latter, in turn, partly reflect the impact of the ECB’s monetary policy measures announced in June 2020 and additional fiscal stimulus.

4 Fiscal outlook

The fiscal support to mitigate the macroeconomic impact of the COVID-19 crisis remains substantial in 2020, with additional stimulus considered in the baseline compared with the June 2020 Eurosystem staff projections. The fiscal stance[3] is assessed to be highly expansionary in 2020. This is mainly underpinned by the extraordinary fiscal measures taken by all euro area countries in response to the pandemic. For the euro area as a whole, these measures amount to about 4½% of GDP, most of which is additional spending in the form of transfers and subsidies to firms and households, including under short-time work schemes (STWS). Compared with the June 2020 Eurosystem staff projections, additional COVID-19-related measures of about 1% of GDP have been incorporated in the baseline for 2020, mostly on account of transfers and subsidies.

The fiscal support is currently projected to unwind to a large extent in 2021, but less than in the June 2020 Eurosystem staff projections, as some measures have been extended and other new packages adopted for 2021. Based on government-approved or legislated measures at the cut-off date for fiscal assumptions, most of the pandemic-related measures are temporary and expire at the end of 2020. Consequently, the fiscal stance for 2021 indicates a substantial tightening. However, the baseline incorporates more stimulus in 2021 compared with the June 2020 staff projections, part of which is temporary.

The euro area budget deficit and the debt ratio are projected to increase substantially in 2020 and to decline somewhat in 2021 and 2022. The increase in the budget deficit in 2020 stems from the fiscal emergency measures and the negative cyclical component, which reflects the worsening of the macroeconomic conditions. The improvement in 2021 mainly relates to the partial unwinding of the fiscal emergency measures, as well as the less detrimental cyclical component. The surge in the debt ratio in 2020 to more than 100% of GDP is due to the debt-increasing interest rate-growth differential (snowball effect) and the high primary deficit. Over 2021-22, the debt-increasing contribution from continued primary deficits is more than offset by a favourable snowball effect, leading to a somewhat declining debt ratio for the euro area. Compared with the June 2020 Eurosystem staff projections, the fiscal projections for the euro area show a higher budget deficit path over 2020-21, mainly on account of the loosened cyclically adjusted balance. This is partly compensated for by an improved cyclical component and somewhat lower interest payments, reflecting the more favourable financial assumptions. The debt ratio is revised downwards mainly on account of the more favourable interest rate-growth differential.

Box 4

Sensitivity analysis

Projections rely heavily on technical assumptions regarding the evolution of certain key variables. Given that some of these variables can have a large impact on the projections for the euro area, examining the sensitivity of the latter to alternative paths of these underlying assumptions can help in the analysis of risks around the projections.

This sensitivity analysis aims to assess the implications of alternative oil price paths. The technical assumptions for oil price developments underlying the baseline, based on oil futures markets, predict an increasing profile for oil prices, with the price per barrel of Brent crude oil reaching about USD 50 by 2022. Two alternative paths of the oil price are analysed. The first is based on the 25th percentile of the distribution provided by the option-implied densities for the oil price on 18 August 2020, which is the cut-off date for the technical assumptions. This path implies a gradual decrease of the oil price to USD 37.1 per barrel in 2022, which is 24.5% below the baseline assumption for that year. Using the average of the results from a number of staff macroeconomic models, this path would have a small upward impact on real GDP growth (around 0.1 percentage point in both 2021 and 2022), while HICP inflation would be 0.1 percentage point lower in 2020, 0.5 percentage points lower in 2021 and 0.4 percentage points lower in 2022. The second path is based on the 75th percentile of the same distribution and implies an increase in the oil price to USD 58 per barrel in 2022, which is 17.9% above the baseline assumption for that year. This path would entail HICP inflation higher by 0.1 percentage point in 2020, 0.5 percentage points in 2021 and 0.2 percentage points in 2022, while real GDP growth would be slightly lower (by 0.1 percentage point in 2021 and 2022).

Box 5

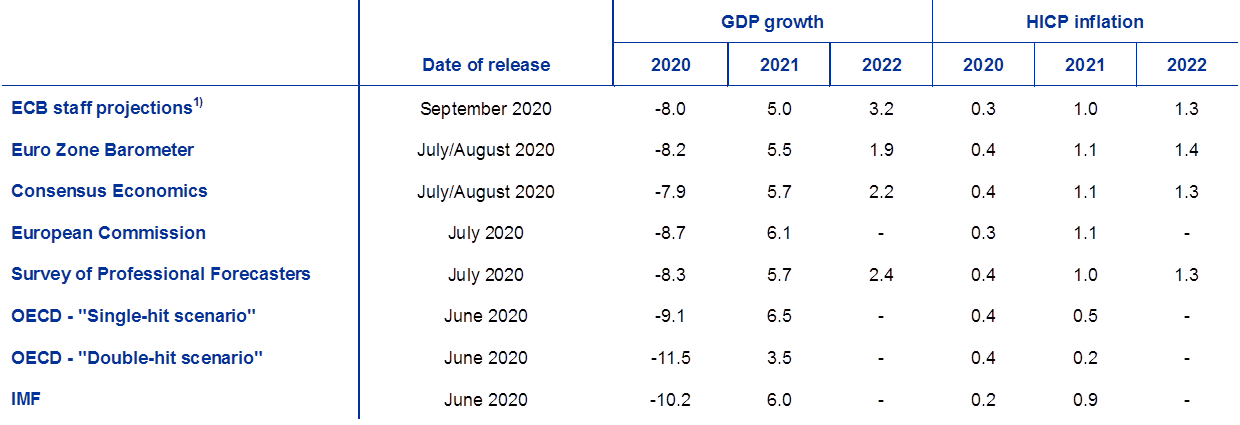

Forecasts by other institutions

A number of forecasts for the euro area are available from both international organisations and private sector institutions. However, these forecasts are not strictly comparable with one another or with the ECB staff macroeconomic projections, as they are finalised at different points in time. They are also based on different assumptions about the likely spread of COVID-19. Additionally, these projections use different and partly unspecified methods to derive assumptions for fiscal, financial and external variables, including oil and other commodity prices. Finally, there are differences in working day adjustment methods across different forecasts (see the table).

The ECB staff projections for real GDP growth and HICP inflation are broadly within the range of recent forecasts from other institutions and private sector forecasters. The current projection for real GDP growth is higher than those of most other forecasters in 2020 and lower in 2021. The projection for HICP inflation is very close to those of other forecasters across the projection horizon, with the exception of the OECD scenarios in 2021.

Comparison of recent forecasts for euro area real GDP growth and HICP inflation

(annual percentage changes)

Sources: MJEconomics for the Euro Zone Barometer, 17 August 2020, data for the year 2022 is taken from the July 2020 survey; Consensus Economics Forecasts, 14 August 2020, data for the year 2022 is taken from the July 2020 survey; European Commission Summer 2020 (Interim) Economic Forecast; ECB Survey of Professional Forecasters, 2020Q3, conducted between 30 June and 6 July 2020; OECD June 2020 Economic Outlook 107. Double-hit scenario refers to one in which a second less intensive wave of the virus breaks out in 2020Q4, while in the "single-hit" scenario containment measures successfully overcome the current outbreak. The table includes both scenarios as the OECD puts equal weight on the two without defining a single baseline; IMF World Economic Outlook, 24 June 2020.

1) The ECB staff macroeconomic projections report working day-adjusted annual growth rates, whereas the European Commission and the IMF report annual growth rates that are not adjusted for the number of working days per annum. Other forecasts do not specify whether they report working day-adjusted or non-working day-adjusted data. This table does not show ranges around the ECB staff projections. This reflects the fact that the standard computation of the ranges (based on historical projection errors) would not, in the present circumstances, provide a reliable indication of the unprecedented uncertainty surrounding the current projections. Instead, in order to better illustrate the current uncertainty, alternative scenarios based on different assumptions regarding the future evolution of the COVID-19 pandemic and the associated containment measures are provided in Box 3.

© European Central Bank, 2020

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

PDF ISSN 2529-4466, QB-CE-20-002-EN-N

HTML ISSN 2529-4466, QB-CE-20-002-EN-Q

- The cut-off date for technical assumptions, such as those on oil prices and exchange rates, was 18 August 2020 (see Box 1). The macroeconomic projections for the euro area were finalised on 27 August 2020. The current macroeconomic projection exercise covers the period 2020-22. Projections over such a long horizon are subject to very high uncertainty, and this should be borne in mind when interpreting them. See the article entitled “An assessment of Eurosystem staff macroeconomic projections” in the May 2013 issue of the ECB’s Monthly Bulletin. See http://www.ecb.europa.eu/pub/projections/html/index.en.html for an accessible version of the data underlying selected tables and charts.

- The assumption for euro area ten-year nominal government bond yields is based on the weighted average of countries’ ten-year benchmark bond yields, weighted by annual GDP figures and extended by the forward path derived from the ECB’s euro area all-bonds ten-year par yield, with the initial discrepancy between the two series kept constant over the projection horizon. The spreads between country-specific government bond yields and the corresponding euro area average are assumed to be constant over the projection horizon.

- The fiscal policy stance is measured as the change in the cyclically-adjusted primary balance net of government support to the financial sector.

- 10 September 2020