- THE ECB BLOG

The 2021-2022 inflation surges and monetary policy in the euro area

11 March 2024

In 2021-22 inflation surged due to the direct and indirect effects of the energy shock, together with a set of pandemic-related factors and the Russian invasion of Ukraine. In this post on The ECB Blog, Chief Economist Philip R. Lane looks at the monetary policy actions taken by the ECB in response to these extraordinary inflation shocks.

Introduction

In this blog post, I review the monetary policy decisions of the ECB between April 2021 and December 2023 in responding to the extraordinary inflation shocks that occurred in 2021 and 2022.[2] While the 2021 recovery from the 2020 pandemic trough resulted in a widespread inflation surge across advanced economies, the February 2022 Russian invasion of Ukraine constituted a distinct additional shock that accounted for most of the extraordinary surge in inflation during 2022, especially in Europe.

My overall aim is to describe and explain the actual monetary policy path that was decided by the Governing Council of the ECB. In particular, I do not review the set of alternative policy paths that could have been selected under various counterfactual scenarios.[3] I also do not attempt to provide an extensive dissection of the competing explanations for the surges in inflation that occurred between the middle of 2021 and late 2022 and the subsequent disinflation during 2023.[4]

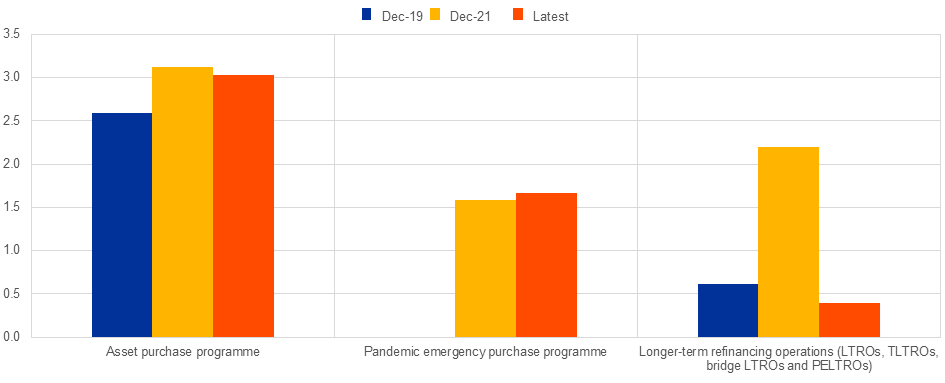

To set the scene, Chart 1 shows the dynamics of headline and core inflation, extended forward through 2026 on the basis of the December 2023 Eurosystem staff projections. Relative to its pandemic low point in late 2020, inflation started to increase in early 2021, rising above the two per cent medium-term target in July 2021. Inflation continued to climb through the rest of 2021 and most of 2022, peaking at 10.6 per cent in October 2022. Since late 2022, inflation has declined, and it stood at 2.9 per cent in December 2023. According to the December 2023 Eurosystem staff projections, inflation is expected to stabilise around the two per cent target from about the middle of 2025 onwards.

Chart 1

Headline inflation, core inflation and Eurosystem staff projections

(annual percentage changes)

Source: Eurosystem staff macroeconomic projections exercise.

Notes: HICP refers to headline inflation and HICPX to HICP excluding food and energy. Realised HICP and HICPX are at a monthly frequency, and HICP and HICPX projections are at a quarterly frequency. The latest observations for realised HICP and HICPX are for December 2023.

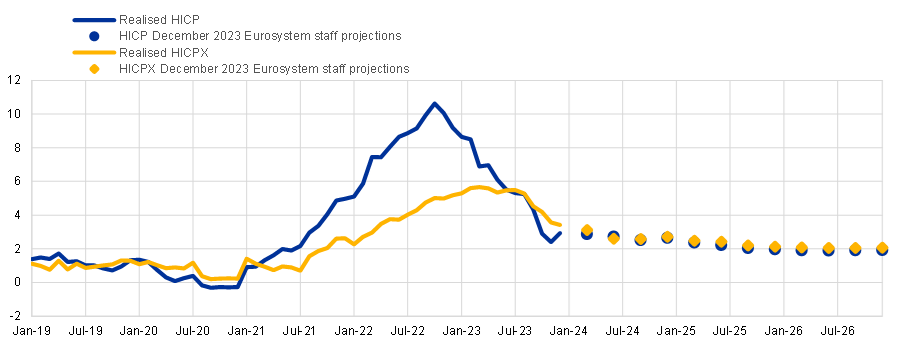

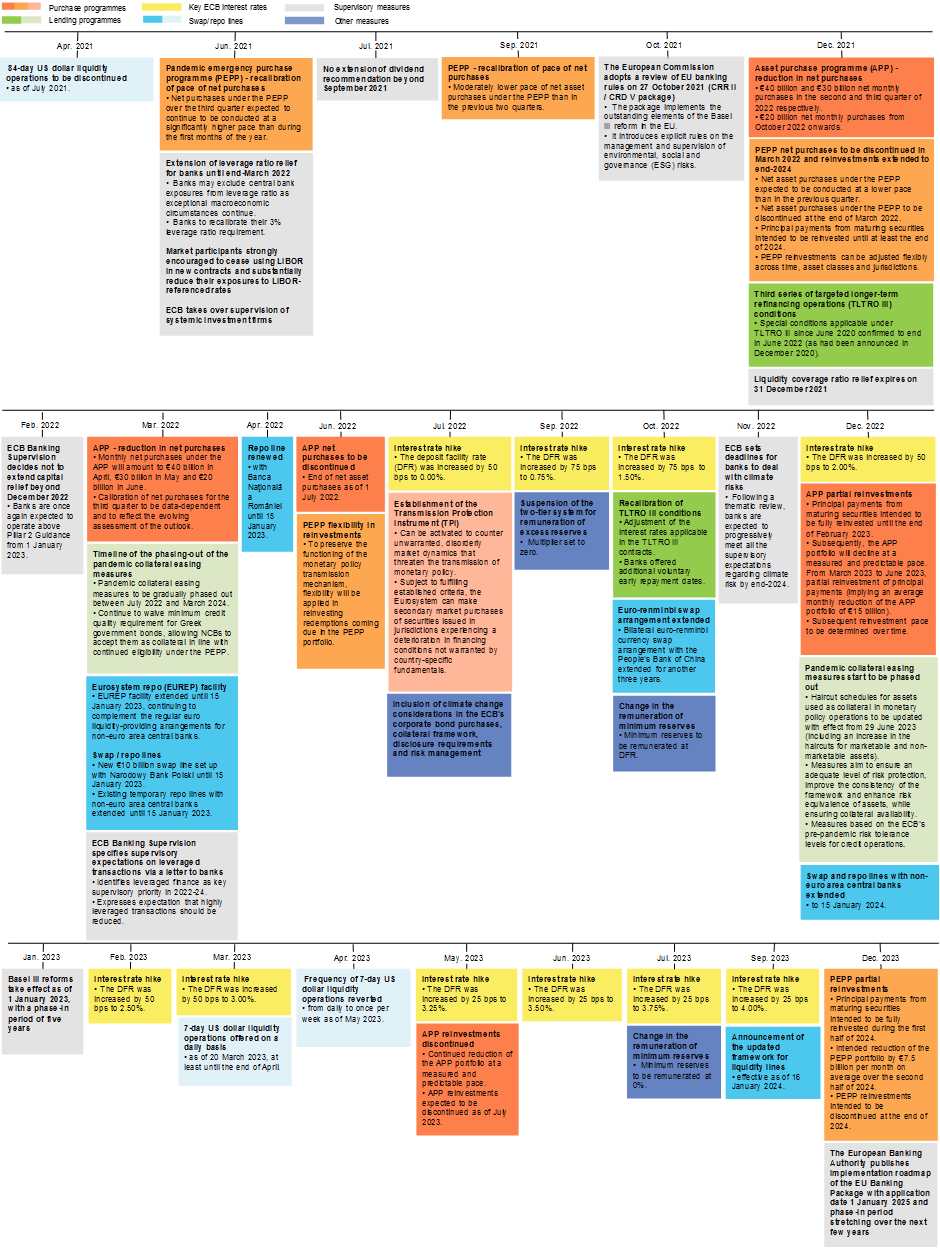

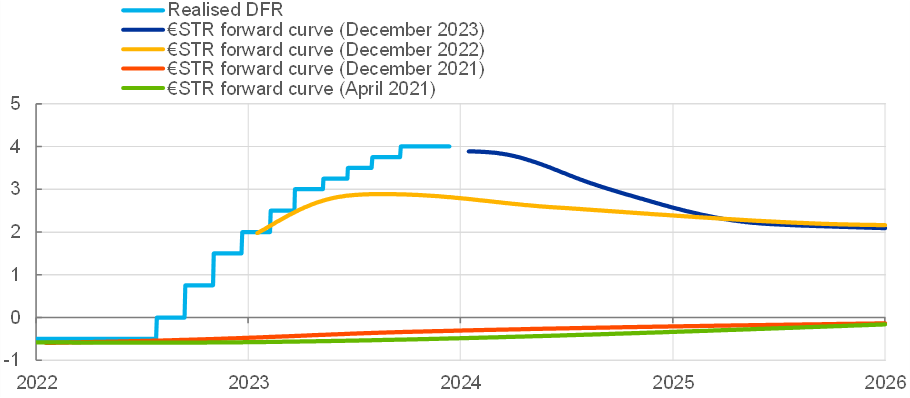

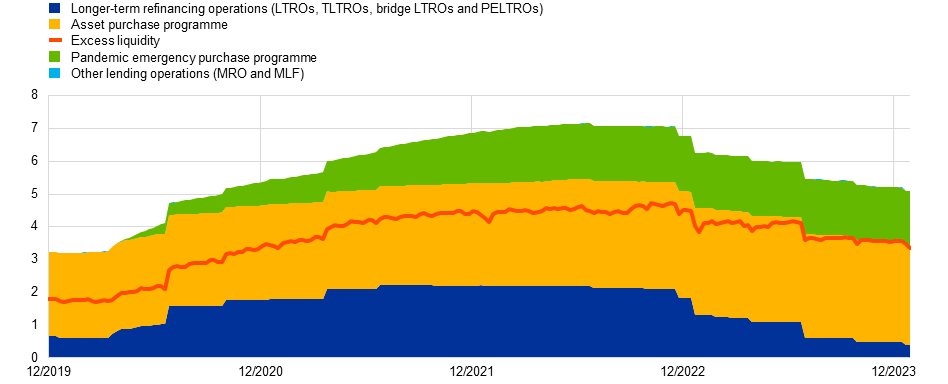

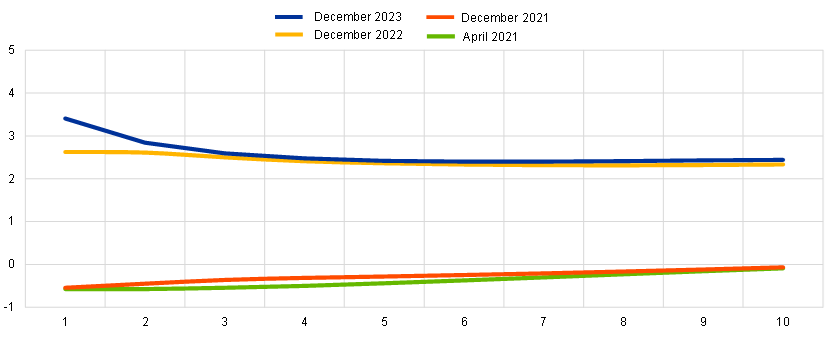

Table 1 reports the monetary policy decisions of the ECB over this period, together with the decisions on the termination of various pandemic-related measures, such as the easing of collateral policies. Chart 2 plots the deposit facility rate (DFR), which is the policy rate determining money market conditions under conditions of abundant liquidity, and the euro short-term rate (€STR) money market forward curves at different points in time. Charts 3 and 4 show the evolution of the balance sheet policies used by the ECB: the asset purchase programme (APP); the pandemic emergency purchase programme (PEPP); and the targeted longer-term refinancing operations (TLTROs).

Table 1

ECB monetary policy and other measures between April 2021 and December 2023

Source: ECB staff.

Note: The interest rate applied in the main refinancing operations and marginal lending facility were always increased by the same amount.

Chart 2

The ECB policy rate and the €STR forward curve

(percentages per annum)

Sources: Bloomberg and ECB calculations.

Notes: The lines for April and December 2021 refer to 21 April 2021 and 15 December 2021, respectively. The curves for December 2022 and December 2023 refer to 14 December 2022 and 13 December 2023, respectively.

The latest observation is for 13 December 2023 for realised DFR.

Chart 3

Evolution of excess liquidity and selected Eurosystem assets since December 2019

(EUR trillions)

| ||

Source: ECB. Note: LTRO stands for “longer-term refinancing operation”; TLTRO stands for “targeted longer-term refinancing operation”; PELTRO stands for “pandemic emergency longer-term refinancing operation”; MRO stands for “main refinancing operation” and MLF stands for “marginal lending facility”. The latest observation is for 29 December 2023. Chart 4The evolution of monetary policy outright portfolios and targeted lending operations (EUR trillions)

|

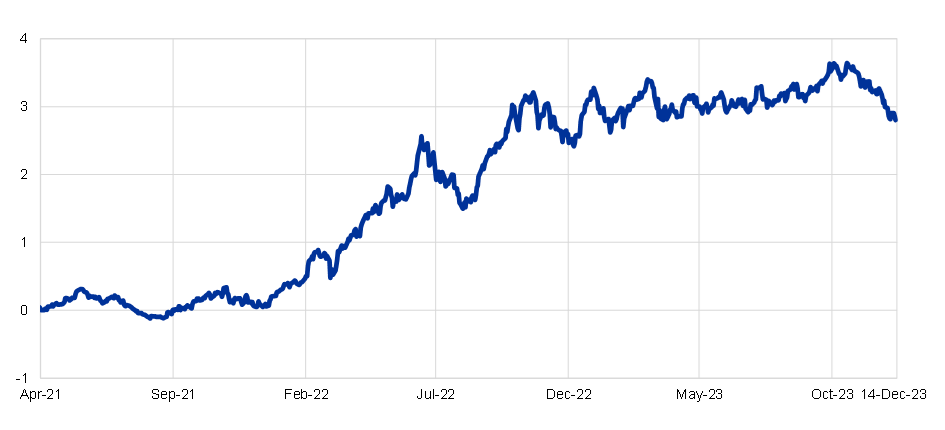

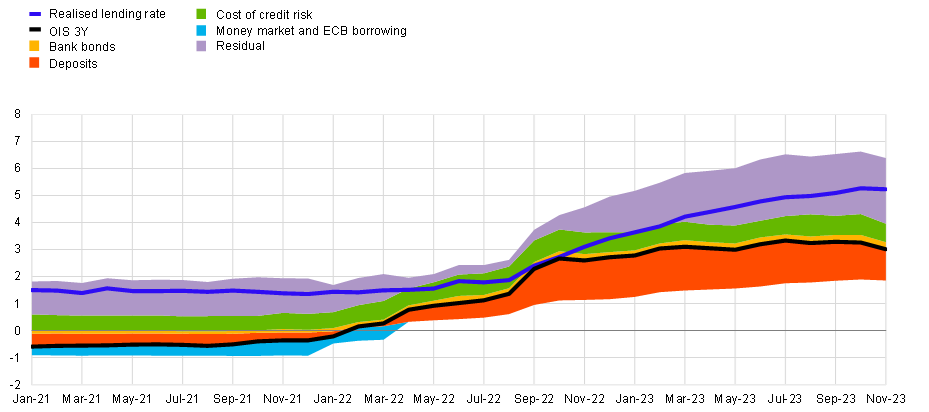

In terms of the transmission of monetary policy through the financial system, Chart 5 shows the overnight index swap (OIS) yield curve at these points in time, while Charts 6 and 7 plot the evolution of the average ten-year sovereign yield and the average bank lending rate to firms. In addition to price indicators, monetary policy also operates through its impact on the willingness of banks to supply credit: the ECB’s loan supply indicator is shown in Chart 8.[5]

Chart 5

Euro area OIS yield curve

(percentages per annum)

Sources: LSEG and ECB calculations.

Notes: The curves for April and December 2021 refer to 21 April 2021 and 15 December 2021, respectively. The curve for December 2022 refers to 14 December 2022 and the curve for December 2023 refers to 13 December 2023. Latest observation: 13 December 2023.

Chart 6

Euro area ten-year GDP-weighted sovereign yield

(percentages per annum)

Source: LSEG, Bloomberg and ECB calculations.

Note: The latest observation is for 14 December 2023.

Chart 7

Lending rate to non-financial corporations and its components

(percentages per annum)

|

Sources: ECB (BSI, MIR), Bloomberg, Moody’s and ECB calculations.

Notes: The chart decomposes the realised lending rate to non-financial corporations (blue line) into contributions from bank cost components. The residual between the realised lending rate and the various cost components identifies a measure of intermediation margin. Deposits, bank bonds and money market and ECB borrowing are expressed as spreads vis-à-vis the base rate (i.e. the three-year OIS rate, black line), weighted by their respective importance in banks’ funding mix. The latest observations are for November 2023.

Chart 8

Loan supply indicator

(index)

Sources: BLS and ECB calculations.

Notes: Loan supply indicator (LSI) for bank lending to firms, as in Altavilla, C., Darracq-Paries, M. and Nicoletti, G. (2019). The series is a five quarter-centred moving average. Positive values indicate a tightening, while negative values indicate an easing. The latest observation is for Q3 2023.

A narrative chronology of monetary policy decisions, 2021-2023

To recap the pandemic monetary policy of the ECB since March 2020, the ECB engaged in extensive asset purchases (primarily through the pandemic emergency purchase programme (PEPP) that was launched in response to the pandemic) and targeted refinancing operations (supported by an easing of collateral rules and a cut in the lending rate in the TLTRO III programme to 50 basis points below the deposit facility rate).[6] In contrast to some other major central banks, the pandemic did not trigger policy rate cuts, since the main policy rate (the deposit facility rate) already stood at -0.5 per cent since September 2019. Since late 2020, the execution of asset purchases under the PEPP was guided by the criterion of maintaining favourable financing conditions. In addition to supporting the recovery and boosting inflation from the pandemic low of -0.3 per cent at the end of 2020, the highly accommodative monetary policy was also intended to avoid the risk of an adverse feedback loop between the real economy and financial markets that could have been triggered if monetary support had been assessed to be insufficient (Lane, 2020; Lane, 2021a).

By late 2020, it was understood that the rollout of vaccines should result in a progressive easing of the pandemic burden over the course of 2021, although the base case of gradual improvement was surrounded by uncertainties about the pace of vaccinations and the risk that new variants might render the vaccines ineffective. Indeed, as is shown in Chart 9, many pandemic restrictions remained in place and there was considerable uncertainty about how the pandemic exit process would unfold at both European and global levels. The adverse impact of the pandemic on the financial health of the most-affected sectors added to the uncertainty, especially in view of the considerable lags in the availability of data on corporate balance sheets.

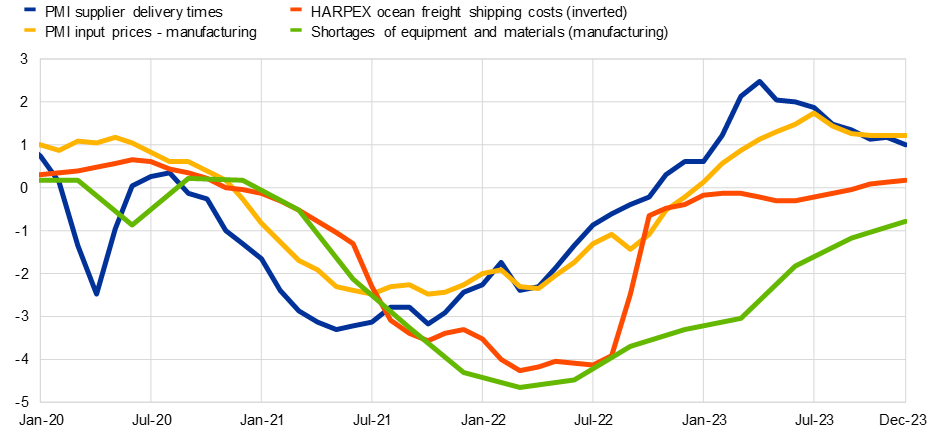

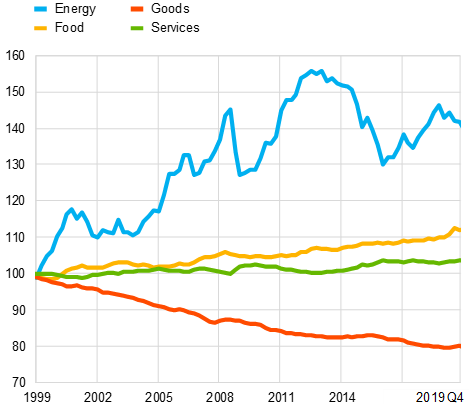

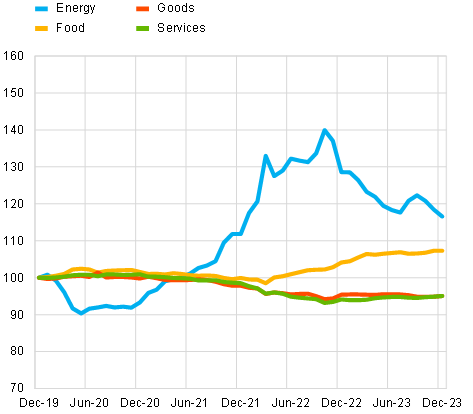

The increase in inflation during the first half of 2021 could be attributed to the weakening of the deflationary forces that took hold in the most acute phase of the pandemic in the spring of 2020 and the inevitability of temporary supply-demand mismatches as sectors re-opened and re-closed in response to the various pandemic waves. Chart 10 shows a range of bottleneck indicators, while Chart 11 plots the large relative price movements over this period. In particular, the easing of such mismatches over time should be associated with a decline in price pressures: that is, it was assessed that such bottlenecks would result in only a short-lived inflation spike. In addition, the asymmetric nature of restrictions on contact-intensive services sectors and the associated global shift in the composition of demand from services to goods generated atypically-large sectoral relative price movements. Given pervasive downward nominal rigidities and the lags in the transmission of monetary policy, such sectoral price movements constitute shocks to the overall price level under flexible inflation targeting regimes that seek to deliver the inflation target over the medium term, especially in view of the scale of the demand depression that would have been required to stabilise inflation at the target in the near term.

Chart 9

Mobility index

Source: Google mobility trend indicator.

Notes: The series are displayed as weekly moving averages. The index was discontinued in October 2022. The latest observation is for 15 October 2022.

Chart 10

Supply bottleneck indicators

(standardised)

Sources: Eurostat, S&P Global, European Commission (DG ECFIN) and ECB calculations.

Notes: Latest observations: Q4 2023 (survey conducted in October) for EC equipment shortages and December 2023 for PMI and HARPEX freight costs. Negative values mean more severe bottlenecks.

Chart 11

Price developments relative to HICP for different subcomponents

(index: Q4 1998=100) | (index: December 2019=100) |

|---|---|

|  |

Source: Eurostat.

Notes: Seasonally adjusted data for HICP, food, goods and services. Seasonally adjusted series for energy not available. Goods refers to non-energy industrial goods (NEIG).

Latest observation: December 2023.

Accordingly, in view of the accumulated slack during the pandemic, the still low level of medium-term inflation expectations and muted wage pressures, the initial rise in inflation in the first half of 2021 did not lead to significant revisions in the expected medium-term inflation path. In particular, the March 2021 staff macroeconomic projections expected inflation to average 1.5 per cent in 2021, 1.2 per cent in 2022 and 1.4 per cent in 2023.[7] Given the subdued medium-term inflation outlook and the rise in market yields in the early part of 2021 (assessed to be a spillover from US conditions), the purchasing pace under the PEPP was actually stepped up at the March 2021 monetary policy meeting in order to preserve favourable financing conditions as the underpinning for medium-term inflation dynamics.[8]

By the time of the June 2021 meeting, there was increasing confidence in the success of the vaccine programmes and a strong economic recovery was expected in the second half of 2021. However, output still remained far below the pre-pandemic level and, while bottlenecks were progressively worsening and oil prices were climbing, these forces were still assessed to be short-lived in nature. This was also reflected in market pricing: for instance, the oil futures curve indicated a significant reversion in energy prices in 2022. The June 2021 staff macroeconomic projections expected inflation to average 1.9 per cent in 2021, 1.5 per cent in 2022 and 1.4 per cent in 2023. The scale of the projected undershoot in the outer years of the projection horizon was among the largest in the history of Eurosystem projections, which is primarily attributable to the muted energy price projections in June 2021 compared to the subsequent spectacular increase in oil and gas prices.

The overall narrative of temporary bottlenecks and the normalisation of energy prices with no significant change in the medium-term inflation outlook still held at the July 2021 meeting, although the scale of the near-term inflation spike continued to be upwardly revised, with inflation expected to be significantly above the two per cent target in the second half of 2021.

Following the 8 July 2021 conclusion of the ECB’s monetary policy strategy review, the 22 July 2021 meeting also saw the re-formulation of interest rate forward guidance.[9] In particular, the Governing Council stated that it “expects the key ECB interest rates to remain at their present or lower levels until we see inflation reaching two per cent well ahead of the end of our projection horizon and durably for the rest of the projection horizon, and we judge that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target”. In terms of the overall monetary policy stance, this rate forward guidance was supplemented by the commitments to continue net asset purchasing under the APP until shortly before the interest rate would be lifted and net asset purchasing under the PEPP until the coronavirus crisis phase would be over.

This monetary policy configuration reflected the still subdued medium-term inflation outlook and the conclusion of the monetary policy strategy review that proximity to the lower bound requires “especially forceful or persistent monetary policy measures to avoid negative deviations from the inflation target becoming entrenched.”[10] While there had been some upward revisions in the longer-term inflation expectations reported in expert surveys and contained in market pricing by the time of the July 2021 meeting, these indicators continued to be significantly below the target level and the revisions could be interpreted as constituting some initial progress in re-anchoring expectations from below towards the newly-announced symmetric two per cent inflation target.

The monetary policy strategy statement also recognised that this policy approach “may also imply a transitory period in which inflation is moderately above target”, which was also reflected in the rate forward guidance quoted above. In addition, the strategy statement that the appropriate monetary policy response to a deviation of inflation from the target is context-specific and depends on the origin, magnitude and persistence of the deviation. In terms of the rate forward guidance, the rate lift-off criteria required that the target was projected to be attained on a durable basis within the projection horizon but also that underlying inflation had sufficiently picked up to reinforce confidence in the attainment of the target. Among other scenarios, these criteria were designed to exclude a monetary policy response to a temporary surge in headline inflation that was not reflected in underlying inflation or was not projected to persist throughout the projection horizon.

By September 2021, the economic recovery had further advanced, but the new Delta variant generated new uncertainty about the course of the pandemic. The bottlenecks that had affected early and intermediate stages of production were now becoming evident in the consumer prices for goods and the labour market was also strengthening, as evident in emerging vacancies in some sectors and unemployment falling to 7.7 per cent. Inflation expectations were still increasing but could still be interpreted as welcome re-anchoring from below, possibly aided by the July announcement of the symmetric two per cent target and the enhanced rate forward guidance. The new staff projections expected inflation at 2.2 per cent in 2021, 1.7 per cent in 2022 and 1.5 per cent in 2023.

Still, the incremental change in the inflation outlook was reflected in two steps. First, the risk assessment in the monetary policy statement included an acknowledgement that “if supply bottlenecks last longer and feed through into higher than anticipated wage rises, price pressures could become more persistent”. Second, net asset purchases under the PEPP were scaled down to a “moderately lower pace”.

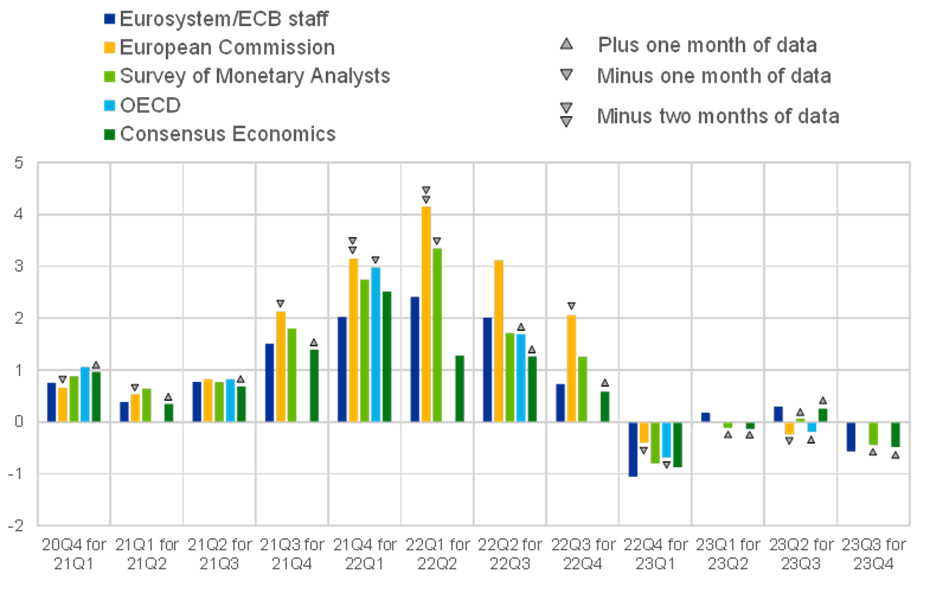

The autumn of 2021 saw a marked change in inflation dynamics. As shown in Chart 12, the intensification of inflation was not foreseen in the September projections (nor in the projections of other forecasters). This was the first in a series of sizeable one-quarter-ahead inflation forecast errors across the September 2021, December 2021, March 2022 and June 2022 projection rounds. As shown in Chart 13, the primary factor in autumn 2021 was the unexpected surge in energy prices.

Chart 12

One-quarter-ahead HICP forecast errors – comparison with other forecasters

(percentage points)

|

Sources: Eurosystem/ECB staff projections, Consensus Economics, Survey of Monetary Analysts (SMA), European Commission, OECD and Eurostat.

Notes: See also Chahad et al. (2023). For other forecasters, the errors are shown for publications where the corresponding cut-off date is closest to that of the Eurosystem/ECB staff projections. For the SMA, the median of survey respondents is shown. The arrows indicate differences in the months of available HICP data at the cut-off point for each publication relative to the Eurosystem/ECB staff projections. An upward arrow indicates one additional month of data, a downward arrow indicates one month less data, and two downward arrows indicate two months less data. Quarterly projections from the OECD are only available twice per year and therefore no error is shown in the first and third quarters. Notes on 2023Q3 for 2023Q4 errors: The European Commission did not publish quarterly forecasts in its Summer 2023 forecast, so there is no error depicted in the chart. The cut-off date for the Eurosystem/ECB staff projections was 30 August 2023. Although this was one day before the publication of the euro area HICP flash estimate for August 2023, flash releases for five euro area countries (covering 45% of the euro area HICP) were included implying no deviation from the Eurostat release for headline HICP.

Chart 13

Decomposition of recent one-quarter-ahead HICP inflation errors in the Eurosystem/ECB staff projections

(percentage points)

|

Source: ECB calculations.

Notes: See also Chahad et al. (2023). “Total error” is the outturn minus the projection. “Indirect impact of energy prices on non-energy inflation” is the sum of the indirect effects of oil, gas and electricity prices. (For oil, these are based on the elasticities derived from the Eurosystem staff macroeconomic models, and for gas and electricity these are computed assuming an elasticity proportional to the oil price shock.) “Impact of non-energy related assumptions” represents the assumptions for short and long-term interest rates, stock market prices, foreign demand, competitors’ export prices, food prices and the exchange rate.

For the euro area, the energy sector is characterised by a high net import content, such that the energy price shock constituted a severe terms of trade deterioration. While energy prices pushed up inflation in the short run, the adverse income effects of a terms of trade decline are typically assessed to lower price pressures in the medium term. Still, the joint impact of the energy price surge, the ongoing intensification of bottleneck pressures and the mismatch generated by a recovery in domestic demand that was outpacing constrained supply meant that there were considerable near-term inflation pressures. The October 2021 monetary policy statement recognised that inflation would rise further from the 3.4 per cent September print in the near term but assessed that inflation would decline in the course of 2022. Furthermore, in addition to the prolongation of bottlenecks, the risk assessment identified a stronger-than-expected return to full capacity as a further possible source of additional price pressures.

In autumn 2021, some central banks started to adjust their monetary policy settings. However, by and large, the global debate recognised that the policy risks differed across central banks. In particular, it was generally recognised that ongoing monetary accommodation was appropriate in the euro area, since the rise in inflation had not translated into the main drivers of medium-term price pressures (wage growth, longer-term inflation expectations) and the assessment that inflation shocks were temporary in nature appeared well founded.[11] On a comparative basis, the euro area was further behind in the recovery from the pandemic, did not have the same fiscal stimulus as in the United States and inflation expectations were still pinned down by the long period of below-target inflation. Moreover, especially in view of the ongoing uncertainties about the state of corporate balance sheets in the sectors most affected by the pandemic, it was recognised that the pandemic exit was not sufficiently secure to risk a premature shift away from favourable financing conditions.

The December 2021 meeting represented a significant pivot for the ECB. The new staff projections assessed that inflation would not only remain above target in the near term but would not be very far from the target even at the end of the projection horizon: inflation was foreseen to rise from 2.6 per cent in 2021 to 3.2 per cent in 2022 before falling back to 1.8 per cent in 2023 and 2024. Although inflation was still projected to fall below target in the outer years of the forecast (with longer-term inflation expectations still persistently below the target), the relatively limited end-of-horizon shortfall (1.8 per cent compared to the target of 2.0 per cent) and the extended period above target in 2021 and 2022 were sufficient to warrant the scaling down of quantitative easing. In particular, it was decided to announce that net purchases under the PEPP would stop at the end of Q1 2022. To smooth the deceleration in quantitative easing, there was a partial step up in the announced purchases under the APP for Q2 2022 but reverting to the pre-pandemic pace of €20 billion per month from the start of Q3 2022. While this configuration still indicated that the policy rate was not expected to be increased any time soon, this was also in line with market pricing of the forward curve and the yield curve (Charts 2 and 3).[12]

Still, the announced end to net purchases under the PEPP and the significant deceleration in the overall pace of net asset purchases constituted a significant shift in the orientation of the ECB’s monetary policy stance and provided greater policy optionality in the event that medium-term inflation pressures picked up during the course of 2022.[13] At the same time, it was also considered that there remained downside risks to the economic recovery, with the advent of the Omicron variant the policy stance also had to guard against an excessively sharp shift in financing conditions. This included a clarification that the end of PEPP net purchases did not mean that flexibility in the conduct of monetary policy would be excluded for the future. In particular, the monetary policy statement explained that: “Within our mandate, under stressed conditions, flexibility will remain an element of monetary policy whenever threats to monetary policy transmission jeopardise the attainment of price stability”.

The February 2022 monetary policy meeting took place in the context of December and January inflation prints that, at 5.0 per cent and 5.1 per cent respectively, were substantially above the levels foreseen in the December projections. As shown in Chart 13, the forecast errors for Q1 2022 could be attributed to further unexpected surges in energy prices, which had increased due to the rising threat of Russian aggression against Ukraine, now also accompanied by upward surprises in food inflation and the broadening of price pressures to more sectors, including due to the indirect impact of rising energy prices on input costs across the economy. While there was tentative evidence that bottlenecks had peaked at the end of 2021, the ECB corporate telephone survey suggested that the repair of supply chains would be a slow process.[14] It was also assessed that, although there had been significant lockdown measures in the opening weeks of 2022, the Omicron variant would not delay the pandemic recovery for too long. Indicators of longer-term inflation expectations also moved closer to the two per cent target, while there was some initial evidence of a pick-up in wage growth, albeit from a low level.

In view of these considerations, the monetary policy statement strengthened its inflation risk assessment by stating that: “Compared with our expectations in December, risks to the inflation outlook are tilted to the upside, particularly in the near term.” In terms of the approach to monetary policy, the statement also signalled that the Governing Council was prepared to adjust its policy measures as needed: “In view of the current uncertainty, we need more than ever to maintain flexibility and optionality in the conduct of monetary policy”.[15] In the wake of this meeting, the forward curve shifted upwards in anticipation of a faster-than-expected move towards lifting the policy rate, while there was an intensification of the discussion concerning the conditions under which it would be appropriate for the ECB to end quantitative easing and begin raising the policy rate.[16]

The 24 February 2022 unjustified Russian invasion of Ukraine constituted a multi-dimensional shock. In addition to the high dependence of the euro area on Russian gas and oil imports, the uncertainty triggered by this war led to repricing in European bond and equity markets. It would also turn out to be associated with a discrete and persistent shift in consumer inflation expectations: the median three-year-ahead inflation expectation in the ECB’s Consumer Expectations Survey jumped from 2 per cent to 3 per cent in the March 2022 survey.

The March 2022 monetary policy meeting had to assess the impact of the war under a range of scenarios. At the same time, it was also increasingly clear that the euro area economy was firmly on the exit path from the pandemic, with a strong recovery in tourism and other contact-intensive services expected with the end of lockdown measures. The sequence of large upside inflation surprises – primarily driven by upside surprises to energy prices – also informed the new projections exercise. In the baseline staff projections, inflation was projected to average 5.1 per cent in 2022, 2.1 per cent in 2023 and 1.9 per cent in 2024.

In addition to the baseline projections, the ECB staff also published alternative war scenarios. While inflation would be considerably higher and the economy much weaker in the near term under more severe scenarios, inflation was still projected to decrease progressively and settle around the target in 2024. At the same time, although these scenarios saw convergence to the target, the risk assessment recognised that the war could also drive inflation higher over the medium term.

These projections warranted a further deceleration in the pace of quantitative easing. The €40 billion pace for Q2 that had been announced in December was replaced by a step-down schedule of €40 billion in April, €30 billion in May and €20 billion in June. Furthermore, it was announced that QE would end in the third quarter if, as was expected, the incoming data would not indicate any weakening in the medium-term inflation outlook. With the end of QE now in sight, it was also decided at this meeting to provide some guidance as to the subsequent timing and pace of rate hikes.[17] In particular, any rate adjustments would take place “some time after” the end of QE and would be gradual. The “some time after” phrase was intended to create extra optionality in the timing of the lift-off decision, since the long-standing guidance that QE would end only “shortly before” the first rate hike could have been misinterpreted to mean that the decision to end QE was irrevocably connected to a pre-determined decision to also quickly hike rates thereafter.

Although it could be argued that the March 2022 baseline projections broadly fulfilled the rate forward guidance criteria, the agreed policy sequencing by which QE would end before rate hiking would begin meant that it was not immediately policy relevant at the March 2022 monetary policy meeting to decide whether the rate forward guidance criteria were satisfied, especially in view of the high war-related uncertainty that surrounded this meeting.

As shown in Chart 12, the inflation outturn in Q2 2022 far exceeded the March staff projections (and the projections of other forecasters). The scale of the war-related shocks to energy prices and food prices accounted for most of this forecast error, although the under-prediction of core inflation was also starting to make an increasing contribution. In turn, the under-prediction of core inflation reflected some mix of the indirect impact of the large energy and food shocks on the costs facing other sectors, the demand recovery in supply-constrained contact-intensive service sectors and the extra space created for price increases by the move up in near-term inflation expectations in the wake of a sequence of increasingly high inflation prints.[18]

In this context, the April 2022 monetary policy statement reinforced the Governing Council’s expectation that QE would end in the third quarter. It also outlined how the Governing Council would incorporate the high level of uncertainty into its decision making process: through maintaining “optionality, gradualism and flexibility” in the conduct of monetary policy.[19] After an extended phase in which future decisions had been guided by the schedule of net asset purchases and the rate forward guidance criteria, the approaching end of QE and the fulfilment of the rate forward guidance conditions meant that it was timely to signal that future monetary policy decisions should be taken on a meeting-by-meeting basis to maximise optionality. At this juncture, there was little evidence about the potential impact of the relatively rapid switch from high volumes of QE to zero net asset purchases, such that it was appropriate to underline gradualism for the reasons laid out by Brainard (1967).[20] Especially in the context of the history of the uneven transmission of monetary policy in the euro area, it was also important to maintain clarity that the ECB would be flexible in the conduct of monetary policy, if warranted.

Between the April and June monetary policy meetings, it was increasingly evident that contact-intensive sectors such as tourism and hospitality were experiencing strong reopening effects after the prolonged shutdowns, with surging demand mismatched with still constrained supply. In contrast, bottlenecks were constraining the manufacturing and food sectors, compounded by the ongoing shutdown in China and the impact of the Russian invasion of Ukraine. According to the June 2022 Eurosystem staff projections, inflation would average 6.8 per cent in 2022, 3.5 per cent in 2023 and 2.1 per cent in 2024, with core inflation at 2.3 per cent in 2024. Although near-term growth was marked down, the growth outlook was still robust at 2.8 per cent in 2022, 2.1 per cent in 2023 and 2.1 per cent in 2024.

In the context of this updated set of projections and the significant inflation surprises in Q2 2022, the Governing Council decided to end QE at the beginning of the third quarter. In addition, it formally concluded that the rate forward guidance criteria were fulfilled and announced its intention to raise the key policy rates by 25 basis points at the July meeting. Furthermore, it outlined that it expected that a further increase (possibly by a larger increment) at the September meeting and, beyond September, a gradual but sustained path of further increases in interest rates would be appropriate.

This set of policy announcements was in line with the policy approach outlined in the April meeting in which “optionality, gradualism and flexibility” would guide the conduct of monetary policy. The June monetary policy statement added “data dependence” to this list, since the high level of uncertainty implied that the application of the principles of optionality, gradualism and flexibility should take into account the information contained in the incoming data flow. [21] In particular, the conjunctural environment could be interpreted as a “high learning” setting in which an unusually-wide set of future inflation and growth paths could be envisaged, such that Bayesian updating on the basis of incoming data would be an essential element in a disciplined approach to policy calibration.

The June set of policy announcements signalled that the exit from the effective lower bound would involve a sequence of policy rate hikes but that the cumulative adjustment in interest rates would be data dependent. In addition to the high uncertainty about inflation and growth dynamics, it was evident that bond market risk premia were also increasing due to elevated uncertainty about whether the Governing Council would introduce an ex ante policy instrument to reinforce its commitment to flexibility in the implementation of monetary policy. In response to the surge in market volatility after the June monetary policy meeting, the Governing Council released a statement on 15 June that committed to an acceleration of preparatory work for the design of an anti-fragmentation instrument, while also applying flexibility in the reinvestment of the PEPP portfolio. This announcement had a calming effect on markets and the Transmission Protection Instrument (TPI) was officially announced at the 21 July monetary policy meeting.[22]

It was decided at the July meeting that the first rate hike should be 50 basis points, rather than the 25 basis points that had been flagged at the June meeting. This revision took account of the further inflation surprise in June and the reduced uncertainty about the transmission of monetary policy due to the introduction of the TPI. By delivering an exit from the negative interest rate zone that had been in place since 2014, a more substantial first hike also had a symbolic value in signalling the shift in monetary policy orientation.[23] Rather than try to indicate any particular increment for future hikes, the July statement also guided that future rate decisions would be taken on a meeting-by-meeting basis. It also dropped the reference to gradualism: having executed a smooth end to QE and curtailed transmission risks through the TPI announcement, uncertainty about the impact of monetary policy had diminished, while the risk of inflation staying significantly above target for a prolonged period had increased, such that it would be problematic if the speed of monetary policy normalisation were to be excessively curtailed.

Since monetary policy works through its influence on the entire yield curve, it is important to appreciate that a meeting-by-meeting approach to monetary policy essentially has two elements (Lane, 2022e). First, it allows for meeting-by-meeting re-assessments of the medium-term path for interest rates that is required to deliver the target.[24] In particular, during the hiking phase of the monetary policy cycle, a primary influence on the interest rate decision in any one meeting is the size of the gap between the prevailing interest rate and the estimated peak rate. Second, at a tactical level, the exact calibration of the interest rate decision should also take into account the appropriate speed to close that gap. Especially under conditions of high uncertainty, each of these factors can shift in a material way from one meeting to the next: first, there may be a revision in the projected peak rate; and, second, the appropriate speed in closing the gap may accelerate or decelerate.

Turning to the appropriate speed in closing the gap between the prevailing policy rate and the appropriate peak rate, uncertainty about the transmission of policy rate changes to overall financing conditions, such that it makes sense to allow the financial system to absorb rate changes in a step-by-step manner. At the same time, in calibrating a multi-step hiking sequence, the appropriate size of the individual increments will be larger, the wider the gap to the terminal rate and the more skewed the risks to the inflation target.[25] In particular, since the initial policy rate setting was highly accommodative and the policy challenge was to ensure the timely elimination of above-target inflation dynamics, there was a logic in taking atypically-large steps in moving from accommodative towards a “normal” level of rates. A multi-step adjustment path towards the peak rate also makes it easier to undertake mid-course corrections if circumstances change. In particular, if the incoming data (new shocks, updates on the relative strength of opposing adjustment forces) were to call for a downward shift in the peak rate, this would be easier to handle under a step-by-step approach. This consideration has greater force the closer the gap to the range of plausible terminal rates, which would call for smaller increments as rates moved above normal into restrictive territory.

The summer of 2022 saw a yet further surge in gas prices. The mismatches in contact-intensive sectors (especially tourism) between constrained supply and recovering demand added to inflationary pressures. More generally, the broadening of price pressures across sectors (including due to the indirect impact of energy on the cost bases of other sectors) also fuelled self-validating inflationary pressures by which rising near-term inflation expectations encouraged firms to raise prices more frequently and by larger increments. The September projections saw significant upward revisions to inflation, with inflation foreseen at 8.1 per cent in 2022, 5.5 per cent in 2023 and 2.3 per cent in 2024. In the context of easing bottlenecks and the momentum from the pandemic re-opening dynamic, the assessment of the adverse terms of trade shock and the impact of monetary tightening saw only a limited downward revision in output growth to 3.1 per cent in 2022, 0.9 per cent in 2023 and 1.9 per cent in 2024.

In this context, the Governing Council opted at the September and October monetary policy meetings to move quickly in the normalisation of monetary policy with a pair of 75 basis point hikes. In bringing the main policy rate to 150 basis points, the Governing Council at the October meeting assessed that the cumulative rate hiking had made “substantial progress in withdrawing monetary policy accommodation”.[26] However, since 150 basis points still stood below the range of peak policy rates indicated by simulation exercises, the October statement also maintained an expectation to raise rates further, with the future rate path based on the evolving outlook for inflation and the economy.[27]

The December staff projections saw a further substantial upward revision in the expected inflation path to 8.4 per cent in 2022, 6.3 per cent in 2023, 3.4 per cent in 2023 and 2.3 per cent in 2024.[28] In addition, the Governing Council maintained its assessment that risks to the inflation outlook remained primarily on the upside. Against this backdrop, it was decided to not only further hike rates by 50 basis points but also signal that “interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive to ensure a timely return of inflation to our two per cent medium-term target”.

This decision struck a balance. In one direction, the downshift from a 75 basis points increment to a 50 basis points increment recognised that smaller steps would be appropriate as the level of the policy rate moved into restrictive territory and moved closer to estimates of the peak rate. A smaller increment also reflected some reduction in inflation tail risks, in view of the declines (from spectacular peaks) in oil and gas prices in autumn 2022. In the other direction, the projections indicated that inflation would remain far above the target for much of the projection horizon, including due to upward revisions in the assessed persistence of underlying inflation dynamics. In particular, although the underlying shocks were expected to fade out, the scale of the cumulative increase in the price level and input costs meant that a multi-year adjustment phase could be expected before reaching the new long-term equilibrium real wage levels and relative price levels. Especially in view of some complacency in the run-up to the meeting in market assessments of the future inflation and rate paths, it was important to signal that the Governing Council judged that there was still substantial ground to cover to reach the appropriate peak rate.

In particular, while the December 2022 staff projections expected very sizeable disinflation during the course of 2023 due to a combination of base effects, the easing of supply bottlenecks and the completion of the re-opening phase of the pandemic recovery, there was still considerable uncertainty about the strength and persistence of the dynamic propagation of the 2022 inflation shock. While a multi-year adjustment phase was inevitable, in which firms that had experienced declines in profit margins due to rising input costs and workers that had suffered a reduction in living standards due to the sharp increase in consumer prices would seek to rebuild the real value of their earnings and incomes, a restrictive monetary policy would limit the extent and duration of the deviation of inflation from the target by dampening demand and stabilising medium-term inflation expectations.[29]

The second half of 2022 had seen the smooth absorption of the end of QE in euro area bond markets. Accordingly, the Governing Council at the December meeting also announced that the APP portfolio would only be partially reinvested from March 2023 onwards. Together with sizeable TLTRO repayments, this meant that the Eurosystem balance sheet was scheduled to shrink markedly during 2023. While the additional monetary tightening through the impact of lower bond holdings on term premia and a lower stock of central bank reserves on credit dynamics would be taken into account, these measures were intended as gradual and predictable steps towards balance sheet normalisation, with the level of the policy rates as the active marginal instrument determining the monetary policy stance.

The steady pace of lifting rates into restrictive territory was continued through a further 50 basis point hike at the February 2023 meeting, which also flagged that a further 50 basis point hike was intended for the March 2023 monetary policy meeting, that would bring the main policy rate to 300 basis points. Since the March 2023 projections still assessed that inflation would return to the target only gradually (inflation was projected at 5.3 per cent in 2023, 2.9 per cent in 2024 and 2.1 per cent in 2025), despite the welcome and substantial drop in the energy price path, and that the slowdown in the euro area economy would be only temporary and quite limited in scale (growth at 1.0 per cent in 2023, 1.6 per cent in both 2024 and 2025), the intended 50 basis point hike at the March meeting was confirmed, even against the backdrop of banking turmoil in the United States and Switzerland.

Since the financial market tensions implied additional uncertainty around the baseline assessments of inflation and growth, the March monetary policy statement did not indicate a directional bias for future interest rate decisions. In any event, even in the absence of the global financial market turmoil, the cumulative scale of the rate hiking over a compressed time period and the narrowing of the gap to the plausible range for the appropriate peak rate meant that it was appropriate to shift towards a more incremental approach to adjusting the monetary stance.

In particular, the March statement explained that policy rate decisions would be determined by the “assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission”. The first criterion would draw on all available economic and financial data to update expectations and risk assessments of the future inflation path; the second criterion would assess whether inflation outturns (suitably filtered to capture the persistent – or underlying – component of inflation) were on track to ensure a timely return of inflation to the target; the third criterion would be essential in calibrating rate decisions, since the required scale of rate hiking would depend on the observed impact of monetary tightening on financing conditions, the real economy and pricing decisions.[30]

At the May meeting, a 25 basis point hike was agreed. The shift towards a smaller increment reflected the narrowing of the gap to the plausible range of peak rates, the ongoing improvement in the energy situation, the progress indicated by the cumulative decline in inflation in the opening months of 2023 (which was faster than expected in the December 2022 projections) and the gathering evidence of the substantial impact of monetary tightening on credit dynamics.[31] However, the ongoing pass-through of earlier energy price hikes into economy-wide prices, the pick-up in wage inflation (as workers gradually obtained pay increases to compensate for the loss in living standards due to the 2021-2022 inflation surge) and the assessment that inflation risks were still to the upside warranted the further hike. Moreover, the May statement also suggested that the stance was not yet sufficiently restrictive, stating that future policy rate decisions “will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to our two per cent medium-term target and will be kept at those levels for as long as necessary.”

The inclusion of the duration of restrictiveness as well as the level of restrictiveness as determining the monetary policy stance was a natural evolution in the communication of the rate strategy.[32] In particular, the Governing Council was entering a phase in which it would have to decide the appropriate balance between the number of further rate hikes and the duration of holding at the peak rate for a sufficiently long period to ensure the timely return of inflation to the target. In one direction, all else equal, a higher peak rate might deliver a faster return to target but at the cost of a greater sacrifice of foregone output and employment and might imply greater financial stability tail risks. In the other direction, all else equal, a lower peak rate would have to be maintained for a longer period in order to ensure a sufficiently timely return of inflation to target but might entail lower economic costs and lower financial stability tail risks.

At the June meeting, the Governing Council decided on a further 25 basis point hike (bringing the main policy rate to 350 basis points) and maintained its orientation that rates had not yet reached sufficiently restrictive levels. Furthermore, given the smooth balance sheet normalisation process so far, the Governing Council also decided to discontinue APP reinvestments from July onwards. The further rate hike was assessed to be warranted by the range of incoming data and the new set of staff projections. Despite the further improvement in the energy situation, the ongoing declines in headline inflation and indications of strong monetary transmission, the June staff projections slightly revised upwards the projected inflation path (5.4 per cent in 2023, 3.0 per cent in 2024 and 2.2 per cent in 2025) and only marginally reduced the expected output path (0.9 per cent in 2023, 1.5 per cent in 2024 and 1.6 per cent in 2025). The upward revision to the inflation outlook was based on the assessment that the speed of disinflation would be slower than previously expected, since the robust labour market should reinforce the strength of real wage catch-up dynamics and the underlying inflation data did not yet indicate widespread compression of profits. While the baseline path for inflation was raised, the risk assessment no longer emphasised an upside skew to the same degree as in previous meetings.

A further 25 basis point increase was decided at the July meeting, bringing the main policy rate to 375 basis points.[33] While further declines in energy prices and headline inflation, together with increasing evidence of the tightening in monetary conditions, meant there was increasing confidence that the overall inflation trajectory was moving in the right direction (which was reinforced by the small one-quarter-ahead projection errors in the March and June projection exercises), it remained concerning that inflation would remain well above target for an extended period, especially given the associated risks to the stability of inflation expectations. In particular, while external sources of inflation (the origin of the inflation surge) were clearly easing, domestic price pressures from rising wages and still robust profit margins were still strong. Since the persistence of these domestic price pressures remained uncertain, it was assessed to be appropriate to further restrict the monetary stance. At the same time, the orientation signal in relation to future rate decisions was weakened, with the guidance that rates “will be set at sufficiently restrictive levels …” replacing “will be brought to levels sufficiently restrictive … .”

The September staff projections foresaw an upward revision in inflation projections for 2023 and 2024 (to 5.6 per cent and 3.2 per cent respectively), primarily due to the higher path for energy prices that had developed over the summer months. At the same time, there was a downward revision for growth prospects for both 2023 and 2024 (to 0.7 per cent and 0.8 per cent respectively). The choice between holding the main policy rate at 375 basis points or moving up to 400 was finely balanced. The September meeting continued the sequence of rate hikes, with a further 25 basis point increase that lifted the main policy rate to 400 basis points. However, this decision was bracketed with the assessment that the Governing Council considered that “the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target”.

At the margin, it was assessed to be safer to move up to 400 basis points rather than to pause at 375 and “wait and see” whether an additional hike would be validated by the data flow between now and future meetings. In particular, the decision was motivated by the highly uncertain environment and the significant disinflation that was still required to return to the target in a timely manner. Still, it was also important to communicate that the cumulative increase in rates had reached a sufficiently restrictive level such that the duration of restrictiveness could act as the marginal stance adjustment mechanism, rather than necessarily relying on additional further rate hikes.

In particular, drawing on the baseline staff projections, a range of model-based simulations suggested that a deposit facility rate of 400 basis points, so long as it was understood to be maintained for a sufficiently long duration, should be consistent with a return of inflation to target within the projection horizon (Lane, 2023c).[34] The views of external experts in the September round of the Survey of Monetary Analysts (SMA) were also clustered in the (375,400) interval in terms of a peak policy rate. This path for policy rates was also broadly reflected in market pricing of the forward rate curve.

In deciding between 375 and 400 basis points as the appropriate “holding” rate, it was determined that the additional rate hike should reinforce progress towards the target for two basic reasons. First, if the economy evolved according to the staff projections baseline case, the decision to hike should bolster confidence that inflation would return to target within the projection horizon. Second, a higher level of the interest rate would more strongly limit the amplification of any upside shocks to the inflation path, in view of the interaction dynamics between inflation shocks and the overall demand environment. It followed that, all else being equal, a more secure pace of disinflation and greater insurance against upside risks would also reinforce the anchoring of inflation expectations, which remained a precondition for the disinflation process to keep up its pace.

After ten consecutive rate hikes, the October monetary policy decision was to hold rates constant. This was in line with the September guidance and was supported by the incoming data along several dimensions. First, headline inflation fell markedly in September, not only on account of the predictable base impact of the high price increases in early autumn 2022 falling out of the index but also due to initial signs that food and core inflation rates were also easing. Accordingly, these inflation outturns reinforced confidence that the September baseline projections were not under-predicting inflation dynamics. Second, the global upward shift in longer-end yields provided extra monetary tightening, while the new Bank Lending Survey confirmed additional tightening through the banking transmission channel. Third, the deterioration in the geopolitical situation due to the tragic conflict triggered by the terrorist attacks in Israel added to downside risks to the growth outlook, with only limited risk of upside pressures on energy prices.

The hold was maintained at the December meeting. There were further broad-based declines in inflation in October and November, at a pace exceeding the September baseline. These were reflected in downward revisions to the 2023 and 2024 inflation projections (to 5.4 per cent and 2.7 per cent respectively). Also taking into account the further marginal downgrades to the growth outlook for 2023 and 2024 (to 0.6 per cent and 0.8 per cent respectively) and the evidence of strong monetary transmission, the December meeting reconfirmed the assessment that the current level of the main policy rate, if maintained for a sufficiently long period, should be sufficient to ensure the timely return of inflation to the target.[35] Indeed, in the run-up to the meeting, there was considerable repricing of market interest rates, in anticipation that the ECB (and other global central banks) could shift to easing the monetary stance during the course of 2024. The 5 January release of the December flash estimate provided further evidence of inflation deceleration: the Q4 average of 2.7 per cent was well below the September projection and also below the December projection.

In the December 2022 projections, considerable disinflation had been foreseen for 2023 due to the base impact of the very high energy price increases in 2022 falling out of the index, with a stabilisation in energy prices also contributing to food disinflation and core disinflation. Moreover, the post-pandemic easing of bottlenecks and the fading out of the intense impact of post-pandemic reopening effects on contact-intensive services were also foreseen to contribute to disinflation. This disinflation was predicated on inflation expectations remaining anchored, including through the dampening impact of monetary tightening on price and wage setting.

As it turned out, the scale of disinflation in 2023 exceeded these estimates. Energy prices not only stabilised but fell considerably during the course of 2023, including due to the impact of global monetary tightening on world activity levels and commodity prices. Consistent with the repeated downgrades of 2023 and 2024 growth estimates and very weak credit dynamics, the strength of monetary transmission was likely also initially under-estimated. In addition, the downward revisions to 2023-2024 growth also reflected unexpectedly-weak global demand for European exports (including due to global monetary tightening) and the under-estimation of the adverse impact of the 2021-2022 decline in real incomes and the terms of trade on consumption and investment dynamics.

To wrap up this narrative account of 2021-2023 monetary policy decisions, it is useful to examine the evolution of long-term inflation expectations over this period (Chart 14).[36] Between the middle of 2021 and early 2022, there was a remarkable shift in long-term inflation expectations, with survey respondents moving away from long-held views that inflation would indefinitely remain below the two per cent target. While there certainly was a marked increase in the fraction of survey respondents that expected inflation to remain above target in the long-term, the majority of respondents assessed that the inflation shock opportunistically served to re-anchor long-term inflation expectations at the target by demonstrating that inflation risks were two-sided. In turn, reinforced by the target-consistent monetary policy decisions during this period, the stabilisation of inflation expectations has provided an important anchor in the disinflation process.

Chart 14

Evolution of long-run inflation expectations over survey rounds

(percentages of respondents)

|

Source: Survey of Monetary Analysts.

Note: The three groups are based on the HICP long-run forecasts provided by respondents to the macroeconomic projections question of the SMA.

Conclusions

The aim of this blog post has been to provide a narrative guide to the ECB’s monetary policy decisions during 2021-2023 in response to the inflation surges that took place in 2021 and 2022. Looking to the next phase of monetary policy, ensuring the convergence of inflation to the target on a sustainable basis will determine the future path of policy rates. The retrospective analysis of this period will doubtless be much analysed and researched in the years to come, with alternative forecasting techniques retrofitted and many counterfactual policies examined.

In reviewing monetary policy decisions during this period, any study has to take on three types of uncertainty. First, there is uncertainty in diagnosing the nature of the inflation shocks that occurred during this period. Second, there is uncertainty about the propagation of these inflation shocks through various second-round adjustment mechanisms. Third, there is uncertainty about the transmission of monetary policy, especially in the context of possible non-linearities in transitioning from super-accommodative policy settings to restrictive policy settings. Since there is an array of interdependencies across these different types of uncertainties, a wide range of scenarios can be examined and the design of optimal monetary policy also has to incorporate the variation over time in these risk factors, especially taking into account data-dependent learning from meeting to meeting. In turn, in calculating the sensitivity of inflation and output realisations to alternative monetary policy paths, it is necessary to take into account the full yield curve in the transmission of monetary policy, with anticipations of future rate decisions playing a key role in addition to the current rate setting. For this reason, minor variations in the timing of rate decisions are unlikely to materially affect inflation outcomes.

This blog post was also published as Lane, P.R. (2024), “The 2021-2022 inflation surges and monetary policy in the euro area”, in English, B., Forbes, K. and Ubide, Á. (eds.), Monetary Policy Responses to the Post-Pandemic Inflation, CEPR Press, February, pp. 65-95.

Check out The ECB Blog and subscribe for future posts.

References

Acharya, V.V., Crosignani, M., Eisert, T. and Eufinger, C. (2023), “How Do Supply Shocks to Inflation Generalize? Evidence from the Pandemic Era in Europe”, NBER Working Paper, No 31790, October.

Altavilla, C., Rostagno, M. and Schumacher, J. (2023), “Anchoring QT: Liquidity, Credit and Monetary Policy Implementation”, CEPR Discussion Paper, No 18581, November.

Altavilla, C., Darracq Pariès, M. and Nicoletti, G. (2019), “Loan supply, credit markets and the euro area financial crisis”, Journal of Banking & Finance, Vol. 109(C), December.

Amatyakul, P., De Fiore, F., Lombardi, M.J., Mojon, B. and Rees, D. (2023), “The contribution of monetary policy to disinflation”, BIS Bulletin, No 82, December.

Arce, O., Ciccarelli, M., Kornprobst, A. and Montes-Galdon, C. (2024), “What caused the euro area post-pandemic inflation?”, Occasional Paper Series, ECB, forthcoming.

Bernanke, B.S. and Blanchard, O.J. (2024), “Analysing the inflation burst in eleven economies”, in English, B., Forbes, K. and Ubide, Á. (eds.), Monetary Policy Responses to the Post-Pandemic Inflation, CEPR Press, February, pp. 291-303.

Blanchard, O.J. and Bernanke, B.S. (2023), “What Caused the US Pandemic-Era Inflation?”, NBER Working Paper, No 31417, June.

Bordalo, P., Gennaioli, N. and Shleifer, A. (2022), “Overreaction and Diagnostic Expectations in Macroeconomics”, The Journal of Economic Perspectives, Vol. 36(3), pp. 223-244.

Brainard, W.C. (1967), “Uncertainty and the Effectiveness of Policy”, American Economic Review, Vol. 57(2), pp. 411-425, May.

Cavallo, A., Lippi, F. and Miyahara, K. (2023), “Large shocks travel fast”, CEPR Discussion Paper, No 18413, September.

Chahad, M., Hofmann-Drahonsky, A.-C., Page, A. and Tirpák, M. (2023), “An updated assessment of short-term inflation projections by Eurosystem and ECB staff”, Economic Bulletin, Issue 1, ECB, 2023.

Darracq Pariès, M., Motto, R., Montes-Galdon, C., Ristiniemi, R., Saint-Guilhem, A. and Zimic, S. (2023), “A model-based assessment of the macroeconomic impact of the ECB’s monetary policy tightening since December 2021”, Economic Bulletin, Issue 3, ECB, 2023.

De Fiore, F., Mojon, B., Rees, D. and Sandri, D. (2023), “Monetary policy frameworks away from the ELB”, BIS Working Papers, No 1156, December.

Galstyan, V. (2023), “Understanding the Joint Dynamics of Inflation and Wage Growth in the Euro Area”, Research Technical Papers, No 11RT23, Central Bank of Ireland, December.

Guerrieri, V., Marcussen, M., Reichlin, L. and Tenreyro, S. (2023), “The Art and Science of Patience: Relative prices and inflation”, Geneva Reports on the World Economy, No 26, CEPR Press, September.

Lagarde, C. (2022a), “Monetary policy in an uncertain world”, speech at The ECB and Its Watchers XXII Conference, Frankfurt am Main, 17 March.

Lagarde, C. (2022b), “Price stability and policy transmission in the euro area”, speech at the ECB Forum on Central Banking 2022, Sintra, 28 June.

Lagarde, C. (2022c), “Monetary policy in the euro area”, Karl Otto Pöhl Lecture, Frankfurter Gesellschaft für Handel, Industrie und Wissenschaft, 20 September.

Lagarde, C. (2023a), “The path ahead”, speech at The ECB and Its Watchers XXIII Conference, Frankfurt am Main, 22 March.

Lagarde, C. (2023b), “Breaking the persistence of inflation”, speech at the ECB Forum on Central Banking, Sintra, 27 June.

Lane, P.R. (2019), “Determinants of the real interest rate”, remarks at the National Treasury Management Agency, Dublin, 28 November.

Lane, P.R. (2020), “Monetary policy in a pandemic: ensuring favourable financing conditions”, speech at the Economics Department and IM-TCD, Trinity College Dublin, 26 November.

Lane, P.R. (2021a), “The monetary policy response in the euro area”, in English, B., Forbes K. and Ubide, Á. (eds.), Monetary Policy and Central Banking in the Covid Era, CEPR Press, 6 March 2021, pp. 81-91.

Lane, P.R. (2021b), “The compass of monetary policy: favourable financing conditions”, speech at Comissão do Mercado de Valores Mobiliários, 25 February.

Lane, P.R. (2021c), “The monetary policy strategy of the European Central Bank”, Revue d’économie financière, Vol. 144(4), October, pp. 67-79.

Lane, P.R. (2022a), “Inflation Diagnostics”, The ECB Blog, 25 November.

Lane, P.R. (2022b), “The transmission of monetary policy”, speech at the SUERF, CGEG/COLUMBIA/SIPA, EIB, SOCIÉTÉ GÉNÉRALE conference on “EU and US Perspectives: New Directions for Economic Policy”, New York, 11 October.

Lane, P.R. (2022c), “Bottlenecks and monetary policy”, The ECB Blog, 10 February.

Lane, P.R. (2022d), “Inflation in the near-term and the medium-term”, opening remarks at MNI Market News Webcast, 17 February.

Lane, P.R. (2022e), “Monetary policy in the euro area: the next phase”, remarks at the Annual Meeting 2022 of the Central Bank Research Association, Barcelona, 29 August.

Lane, P.R. (2023a), “The euro area hiking cycle: an interim assessment”, Dow Lecture at the National Institute of Economic and Social Research, 16 February.

Lane, P.R. (2023b), “The banking channel of monetary policy tightening in the euro area”, remarks at the Panel Discussion on Banking Solvency and Monetary Policy, NBER Summer Institute 2023 Macro, Money and Financial Frictions Workshop, Cambridge, Massachusetts, 12 July.

Lane, P.R. (2023c), “Disinflation and monetary policy in the euro area”, speech at the Money Marketeers of New York University, New York, 21 September.

Reis, R. (2022), “Inflation and Expectations: Rise and Responses”, speech at the ECB Forum on Central Banking.

Schnabel, I. (2022), “Finding the right sequence”, speech at a virtual policy panel on “Unwinding QE” at the first annual Bank of England Agenda for Research (BEAR) conference, Frankfurt am Main, 24 February.

I would like to thank Janina Desoi for her support in the preparation of this blog post. For their technical input in the preparation of Table 1 and Charts 1 to 14, I am also grateful to Elisa Saporito, Anna-Camilla Hofmann-Drahonsky, Maria Dimou, Franziska Huennekes, Wouter Wakker, Lorenzo Ferrante, Bruno Fagandini, Ryan Minasian, Pedro Neves, Martina Pallotti, Emanuel Skeppås, Matteo Sirani, Lucas Queiroz, Laura Fras and Giulia Martorana. Oscar Arce, Fabian Eser, Christophe Kamps, Massimo Rostagno and Frank Smets provided helpful comments.

The views expressed in this blog post are personal and should not be interpreted as representing the collective view of the ECB’s Governing Council. This blog post can be viewed as a successor contribution to Lane (2021a) that reviewed the ECB’s monetary policy during the most intense phase of the pandemic, covering the monetary policy meetings from March 2020 through March 2021.

On alternative monetary policy paths, see, among others, Acharya et al. (2023) and De Fiore et al. (2023). A full-scale counterfactual analysis of this period would also have to examine a range of alternative fiscal paths.

See also Lane (2022a), Acharya et al. (2023), Blanchard and Bernanke (2023), Cavallo et al. (2023), Galstyan (2023), Guerrieri et al. (2023), Arce et al. (2024, forthcoming), Bernanke and Blanchard (2024, forthcoming).

For analyses of the transmission of the ECB’s monetary policy during this episode, see Altavilla et al. (2023), Darracq Pariès et al. (2023) and Lane (2022b, 2023a, 2023b).

This rate would be paid to the banks that reached the targeted lending performance threshold.

The projections of other forecasters were broadly similar, as has been the case throughout this episode.

See Lane (2021b).

See Lane (2021c) for my assessment of the monetary policy strategy review.

See paragraph 6 of the ECB’s monetary policy strategy statement.

For a representative example, see the discussion in the October 2021 IMF Regional Economic Outlook for Europe. However, Reis (2022) has highlighted that the right tail in the distribution of inflation expectations could be a leading indicator. In tracking these right-tail indicators, two conjectures are especially relevant. In one direction, more attentive traders, experts and individuals may identify more quickly a persistent shift in inflation dynamics, while inattentive participants adjust more slowly. Under such scenarios, right-tail measures will be leading indicators for a generalised revision in long-term inflation expectations. However, under other scenarios, the right tail might be populated by those who overreact to high spot inflation readings and misperceive as permanent what turns out to be a temporary increase in the inflation rate. In these scenarios, the right-tail will not serve as an accurate leading indicator of generalised long-term inflation expectations (Bordalo et al., 2022). Accordingly, the interpretation of right-tail measures is closely bound to the general analysis of the relative contribution of temporary and persistent forces in inflation dynamics.

The median expectation among the participants in the Survey of Monetary Analysts (SMA) in January 2022 was for inflation in 2023 to fall to 1.7 per cent, in line the December staff projections. In fact, only two respondents expected inflation to be above two per cent in 2023 at that time, with the highest estimate at 2.7 per cent. Given the low inflation expectations, SMA participants in the January 2022 survey expected the DFR to increase slowly, reaching only 0.75 per cent by 2027.

The December 2021 monetary policy statement also modified the standard recitation that the Governing Council stood ready to adjust all of its instruments to deliver the medium-term target by specifying that instruments could be adjusted “in either direction”. This signalled that the Governing Council was as attentive to the emerging risk of above-target inflation in the medium term as to the long-standing chronic risk of returning to below-target inflation in the medium term.

Lane (2022c) provides an assessment of bottlenecks from the perspective of February 2022.

As explained by President Lagarde at the February press conference, the high level of uncertainty would require the ECB to be data-dependent in making its monetary policy decisions. The concept of data dependence would be further developed in subsequent monetary policy meetings.

See, amongst others, Lane (2022d) and Schnabel (2022).

This meeting also saw the deletion of the directional bias that rates would remain at their “present or lower” levels until the rate forward guidance criteria had been fulfilled.

The intrinsic persistence of inflation due to staggered price and wage setting, lags in monetary transmission and the medium-term orientation of the inflation targeting regime meant that an increase in near-term inflation expectations was fully consistent with solidly anchored medium-term inflation expectations, since large-enough inflation shocks could be expected to unwind only over a multi-year horizon.

See also Lagarde (2022a).

In addition to uncertainty about the market impact of the rapid shift in the scale and expected timeline for quantitative easing, the prospective shift away of policy rates from a long period near the effective lower bound might be expected to have a different impact to a standard policy tightening cycle to the extent that the financial system had adapted to a “low for long” regime. In addition, rate hiking would take place under conditions of excess liquidity, which alters the impact of policy rates via banking sector transmission channels.

See also Lagarde (2022b).

See the 21 July 2022 ECB press release on the TPI.

The exit from negative interest rates also meant that the tiered remuneration system of excess liquidity (introduced in September 2019) should be revised, as was flagged in the July monetary policy statement.

The Governing Council does not publish a projection of future policy rates but considers a range of forward rate path scenarios as part of its deliberations. See Lane (2022e) on the pros and cons of publishing conditional paths for future policy rates.

See also Lagarde (2022c).

See Lane (2019) for pre-pandemic estimates of the equilibrium real interest rate for the euro area.

In line with the July commitment to review the remuneration of excess liquidity, the October statement also announced a revision in the interest rate on TLTRO loans and a shift in the remuneration rate for minimum required reserves (from the MRO rate to the DFR rate). Additional TLTRO voluntary repayment options were also provided.

The 2022 inflation rate would have been even higher in the absence of the large-scale energy subsidies and other cost-of-living measures rolled out by euro area governments. However, the scheduled unwinding of these temporary measures was calculated to push up projected inflation further out in the projection horizon, especially in 2024.

Monetary policy is best interpreted as jointly operating on demand and inflation expectations. In the absence of dampening demand, the stabilising impact of monetary policy tightening on inflation expectations is necessarily limited. Equally, the stabilisation of inflation expectations in itself dampens demand since, all else equal, a lower expected inflation rate raises the real interest rate.

See also Lagarde (2023a).

The strong transmission of monetary policy was flagged from February 2023 onwards in the monetary policy statements. See also Lane (2023a, 2023b).

See also Lagarde (2023b).

The July meeting also included a decision to lower the remuneration rate on minimum required reserves from the deposit facility rate to zero per cent. This decision would improve the efficiency of monetary policy by reducing the overall amount of interest that needed to be paid on reserves in order to implement the appropriate stance, while preserving the effectiveness of monetary policy by maintaining the same degree of control over the monetary policy stance and ensuring the full pass through of interest rate decisions to money markets.

The ECB maintains a range of macroeconomic models. In identifying target-consistent rate paths, it is important to take into account the nature of the shocks driving inflation and the full set of influences determining monetary conditions (including balance sheet reduction and the global monetary policy stance). The running of single-equation Taylor-type monetary policy rules can provide some insights, but the single-equation approach is less well suited when shocks are atypical, balance sheet policies are being revised and global monetary policy is also responding to the inflation shock.

In the context of stable bond market conditions and increasing distance from the pandemic crisis period, it was also decided to advance the normalisation of the Eurosystem’s balance sheet. While full reinvestment of the PEPP portfolio would continue in the first half of 2024, there would be a step down to partial reinvestment in the second half (reducing the PEPP portfolio by €7.5 billion per month on average) and intended full discontinuation of reinvestments under the PEPP at the end of 2024.

Chart 14 focuses on the inflation expectations reported in the Survey of Monetary Analysts. There are similar patterns in other expert surveys and in market-based indicators. The surveys of households and firms are also consistent with fairly stable long-term inflation expectations.