Emerging market vulnerabilities – a comparison with previous crises

Published as part of the ECB Economic Bulletin, Issue 8/2018.

Against the background of financial market volatility in some emerging market economies (EMEs) since April, this box reviews key vulnerabilities in EMEs. Specifically, it assesses their resilience to external shocks compared to previous crisis episodes.

Since April many EMEs have been subject to bouts of financial market volatility amid expectations of faster US monetary policy tightening and a stronger US dollar, coupled with rising uncertainty related to global trade tensions. Acute stress has been limited to Argentina and Turkey so far, but most EMEs have seen financial conditions tighten over the year. Fund flows data show that global investors have started to retrench from EMEs since April. At the same time, EME stock markets have declined sharply, unwinding the gains of the 2017 rally, and EME sovereign spreads have widened. There is, however, significant heterogeneity across EMEs, and so far investors seem to have differentiated between countries based on their fundamentals.

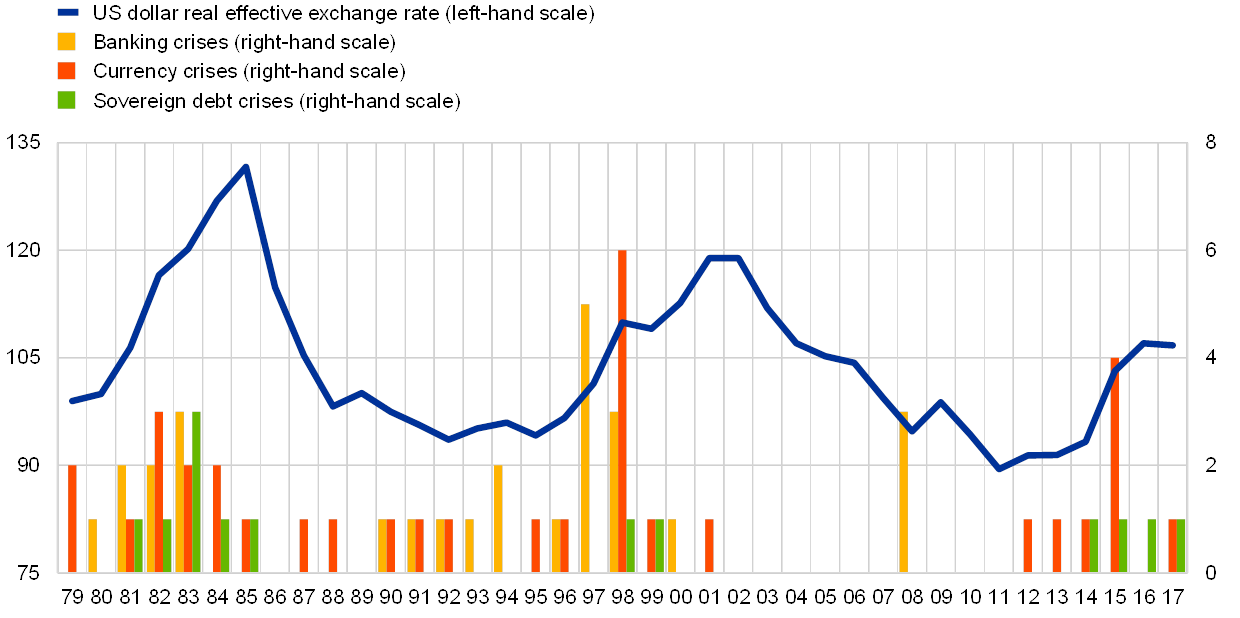

These developments have sparked concerns about the outlook for EMEs and raised questions as to whether these countries may be subject to a repeat of previous crisis experiences, such as the Asian crisis of the late 1990s. The Asian crisis, which was triggered by the devaluation of the Thai baht in July 1997, resulted in a reappraisal of risk and rapid contagion to several other countries in Asia. Those economies faced sudden stops in capital inflows and severe recessions, representing one illustration of widespread balance-of-payments problems coupled with financial sector weaknesses. While the causes of the Asian crisis were varied, a common characteristic of many of the countries affected was reliance on short-term external debt denominated in foreign currency coupled with pegged-exchange rate regimes and financial sector fragilities. Historically, EME crises have tended to be accompanied by periods of US dollar appreciation which exposed countries to large unhedged currency mismatches between their US dollar-denominated assets and liabilities (see Chart A).[1] Current circumstances, with ongoing US monetary policy normalisation and a strengthening US dollar, have heightened concerns that similar fragilities could leave some EMEs exposed to a repeat of such balance of payments concerns.

The potential risks for EMEs are important for the global outlook. Compared to two decades ago, EMEs play, in aggregate, a significantly more prominent role in the global economy. They account for more than half of global GDP (at purchasing power parity) and gross capital flows. Developments in these economies could therefore have a sizeable impact on other countries through a variety of channels, including trade, financial and confidence channels.

Chart A

The role of the US dollar in EMEs

(left-hand scale: index, 1980=100; right-hand scale: number of crises)

Sources: Laeven and Valencia (2012), Standard and Poor’s, Bloomberg, Haver Analytics and ECB staff calculations.

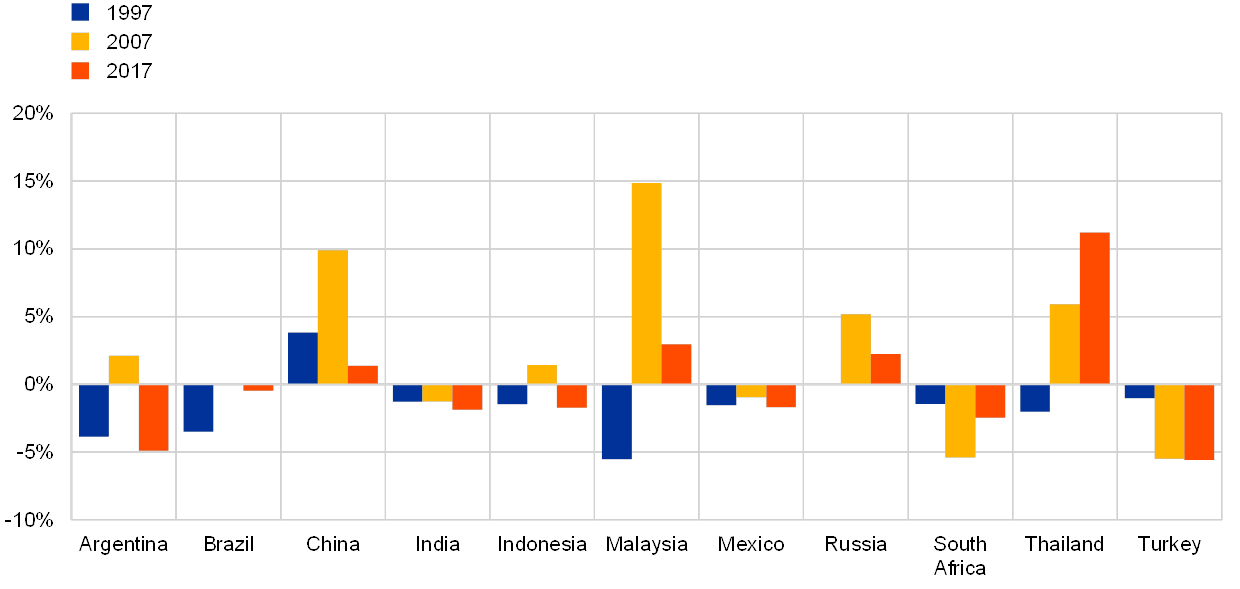

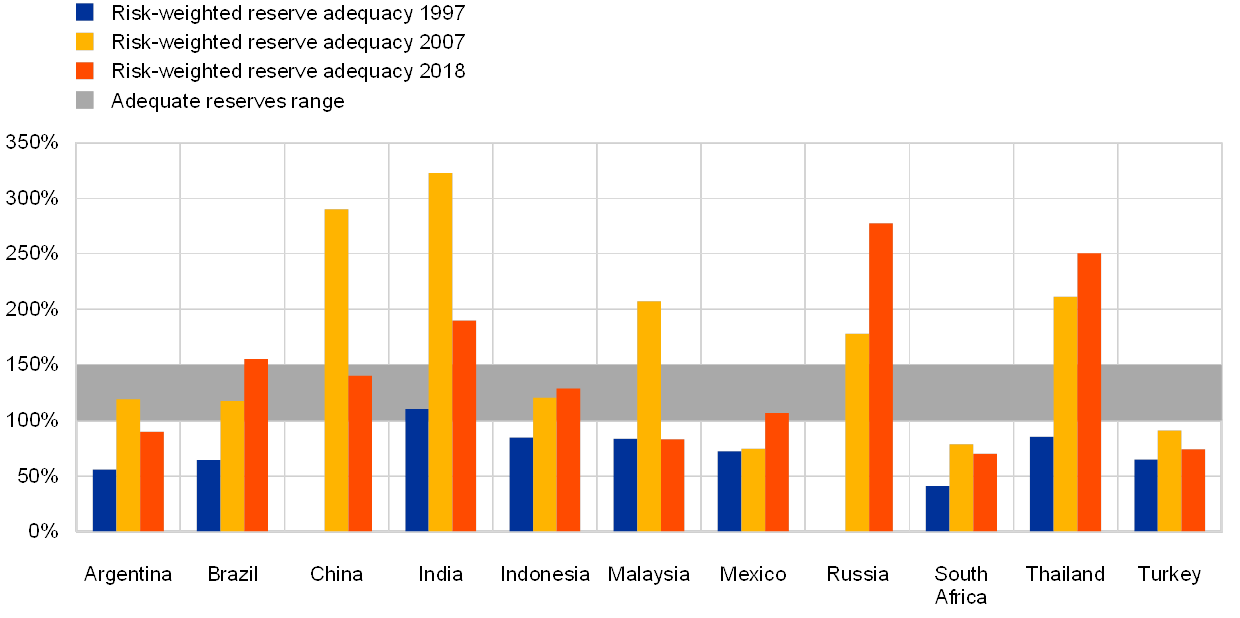

Compared to twenty years ago, many EMEs have reduced their external vulnerabilities and improved their policy frameworks. Some EMEs have seen an improvement in their current account positions and some even run current account surpluses. Some oil exporting countries in particular have benefited from the oil price rise in the 2000s. Since the global financial crisis, however, current account positions have slightly widened again and there are still some countries with deficit positions (see Chart B). Policy frameworks have also evolved. A large proportion of EMEs have adopted inflation-targeting monetary policy frameworks, which can help to anchor inflation expectations and stabilise business cycles. Most EMEs now also have more flexible exchange rate regimes. In addition, many EMEs accumulated reserves in the aftermath of the Asian crisis and have continued to do so since the global financial crisis. The IMF risk-weighted metric of reserve adequacy, which benchmarks reserves not only against traditional metrics such as imports and short-term external debt but also against broad money to take into account the risk of capital flight, suggests that many EMEs appear better placed to cope with sudden stop or sudden flight shocks (see Chart C).[2] Nonetheless, there are some countries whose reserves are still below the suggested minimum reserve adequacy requirements.

Chart B

Current account balance

(percentages of GDP)

Sources: IMF and ECB staff calculations.

Note: The latest observations are for 2017.

Chart C

Adequacy of reserves

(percentages)

Sources: IMF and ECB staff calculations.

Notes: Reserve adequacy is computed on the basis of the IMF risk-weighted methodology, i.e. as a function of exports (to capture potential losses of reserves due to a drop in external demand or to a terms-of-trade shock), short and long-term debt (as a measure of interest payments and rollover risk) and broad money (as a measure of the scope for capital flight). The measure accounts for the exchange rate regime and capital account openness. A metric between 100% and 150% indicates that reserves are adequate. Owing to unavailability of data on short-term debt on a remaining maturity basis, the data shown for 1997 for Brazil, Indonesia, Mexico, Turkey and Malaysia are actually for 2001, 2001, 2001, 1999 and 2001, respectively.

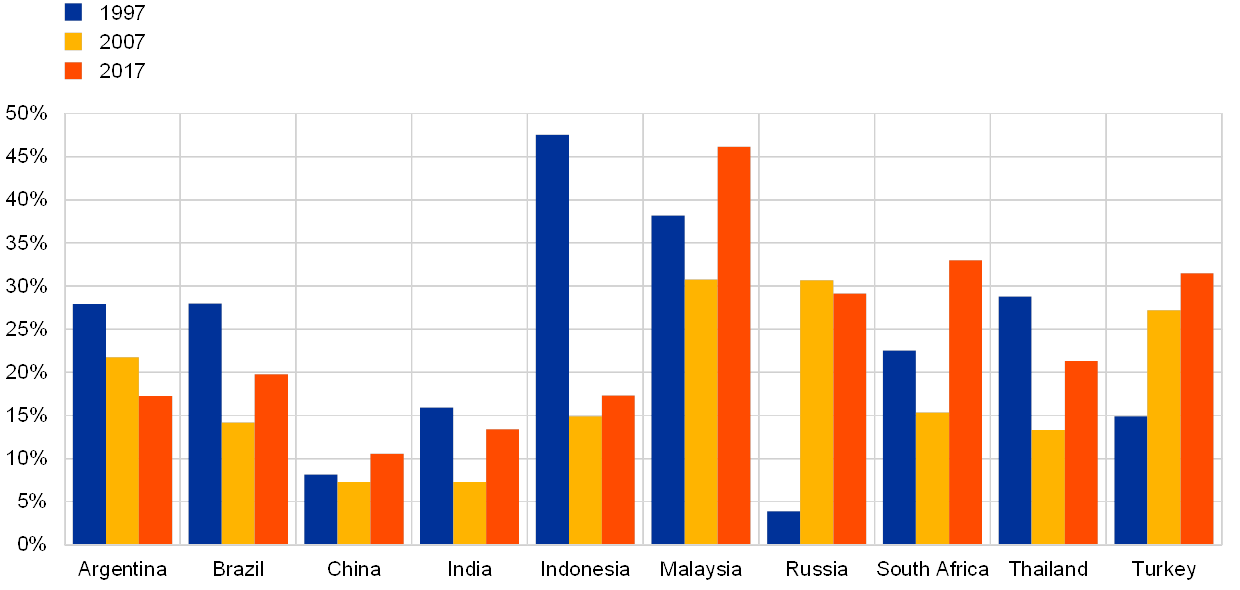

Nonetheless, while most EMEs have reduced their reliance on foreign currency funding compared to the late 1990s, US dollar-denominated liabilities in EMEs have increased since the Great Recession. EMEs’ stock of US dollar-denominated debt has risen over the past ten years as firms have taken advantage of favourable global financial conditions (see Chart D).[3] To the extent that these positions are unhedged, this represents a financial stability concern in the event of a further strengthening of the US dollar. Indeed, there is evidence from financial markets that, more recently, the growth in US dollar-denominated liabilities also appears to have been associated with increased sensitivity of financial conditions in EMEs to US financial developments. In the late 1990s tighter financial conditions in the United States tended to be transmitted strongly to EMEs, whereas this sensitivity diminished in the wake of the Asian crisis, before picking up again in recent years (see Chart E).

Chart D

US dollar-denominated gross external liabilities

(percentages of GDP)

Sources: Bénétrix, Lane and Shambaugh (2015) and ECB staff calculations.

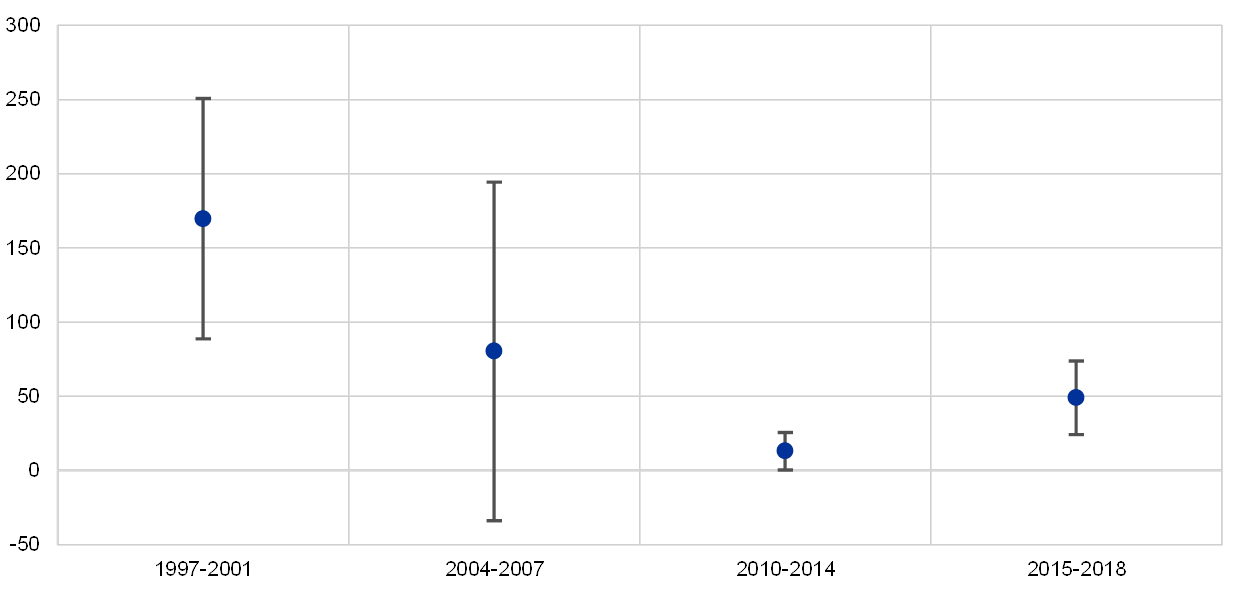

Chart E

Response of EME sovereign spreads to US financial tightening

(basis points)

Sources: Bloomberg, Haver Analytics and ECB staff calculations.

Notes: The response, given in basis points after 22 business days with a 95% confidence interval, is based on local projections using a fixed-effects panel regression for JP Morgan Emerging Markets Bond Index (EMBI) global sovereign spreads. The explanatory variable is the Bloomberg US financial conditions index. The countries included in the panel are Argentina, Brazil, China, Mexico, Malaysia, the Philippines, Russia, Turkey, and South Africa. The latest observation is for 31 August 2018.

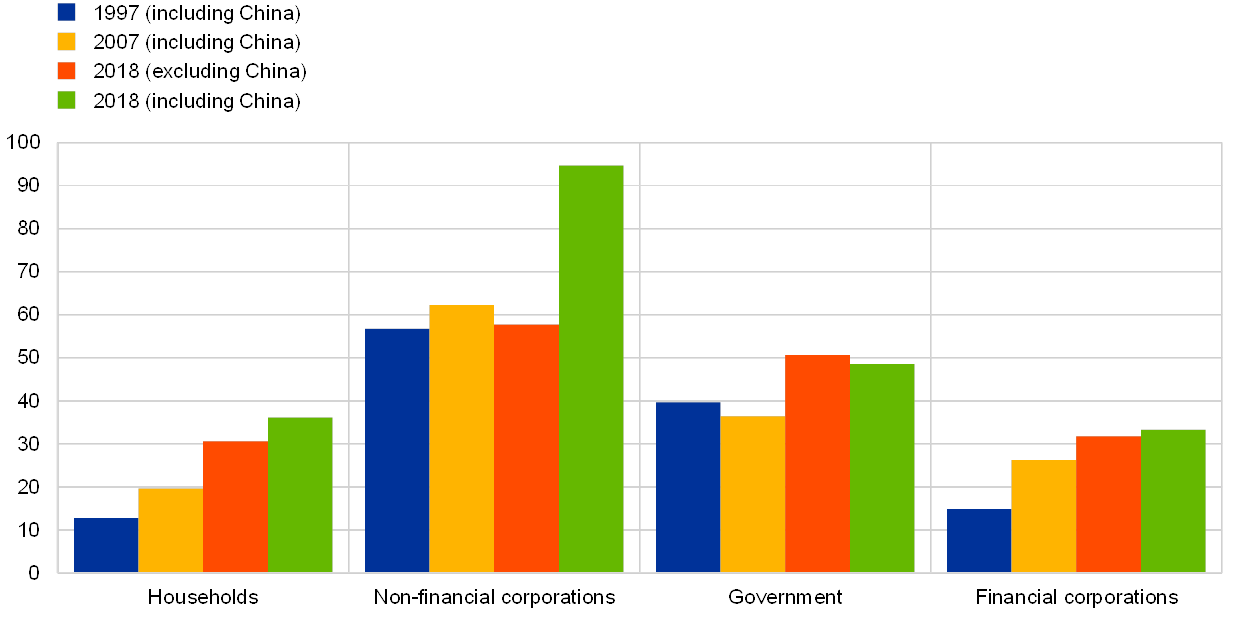

At the same time, domestic imbalances seem to have worsened in some EMEs, as illustrated by rising local currency debt issuance and shrinking policy space. While external vulnerabilities may have declined, other fragilities may have increased, as illustrated, for instance, by higher local currency debt issuance, rising private sector leverage and deteriorating fiscal positions. Debt-to-GDP ratios have significantly increased compared to their levels twenty years ago. In particular, debt rose rapidly in the aftermath of the Global Recession as a consequence of favourable global financial conditions. The bulk of the increase took place in the Chinese corporate sector. The credit-to-GDP ratio in China has risen to levels that may pose potential financial stability concerns.[4] In addition to the corporate sector, EME household leverage has risen, tripling compared to the mid‑1990s (see Chart F).[5] Moreover, there is less fiscal and monetary policy room for manoeuvre, given that countries had to intervene with fiscal and monetary policy stimuli during the Great Recession. Fiscal space for commodity exporting countries deteriorated notably after commodity prices fell in 2014. Policy room for manoeuvre may be even more constrained in those EMEs with large and unhedged foreign currency-denominated debt.[6]

Chart F

EME indebtedness by sector

(percentages of GDP)

Sources: Institute of International Finance and ECB calculations.

Notes: Figures are for the first quarter of the year concerned. The EME dataset comprises 30 emerging market countries (EM‑30), including Argentina, Brazil, Chile, China, Colombia, the Czech Republic, Egypt, Ghana, Hong Kong, Hungary, India, Indonesia, Israel, Kenya, Lebanon, Malaysia, Mexico, Nigeria, Pakistan, the Philippines, Poland, Russia, Saudi Arabia, Singapore, South Africa, South Korea, Thailand, Turkey, Ukraine and the United Arab Emirates.

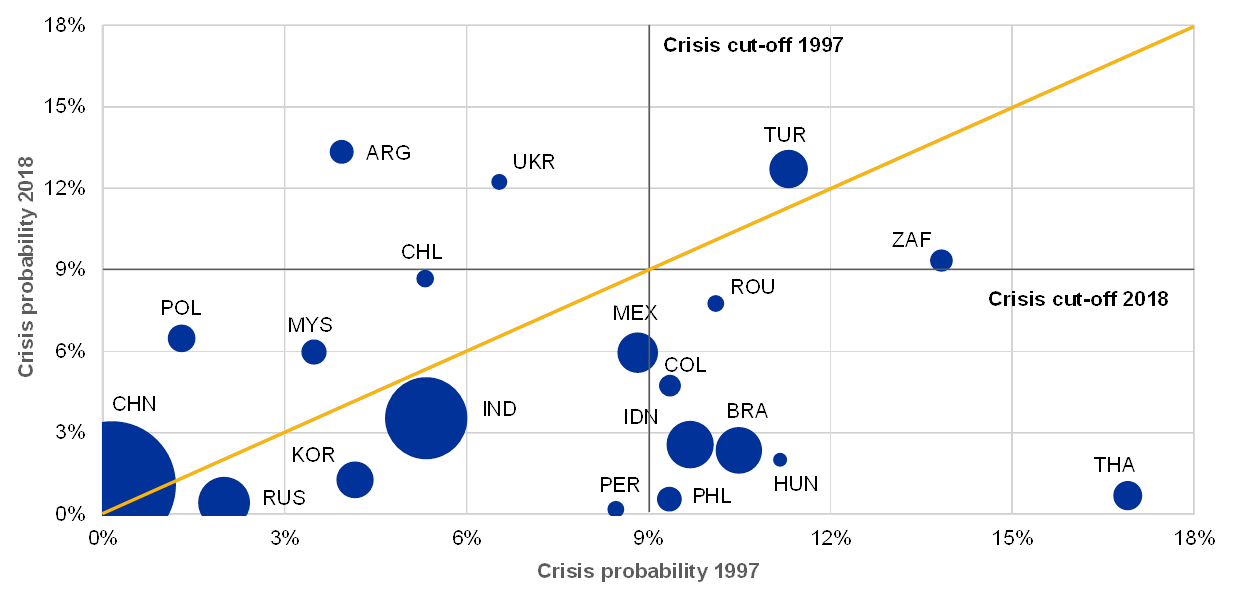

In order to assess whether EMEs are less prone to a severe crisis today, we compute the probability of a crisis occurring in 2018 and contrast it with the probability of a crisis occurring in 1997. The crisis probability captures the overall vulnerability of a country, summarising EME fundamentals in one single dimension encompassing the most relevant macro-financial vulnerabilities, i.e. those helping predict severe systemic crises in EMEs and which are related to traditional balance-of-payment risks as well as domestic financial imbalances. More specifically, the parsimonious early warning model uses the best crisis predictors found in the early warning models literature, i.e. lagged values of GDP growth, inflation, current account to GDP, private credit to GDP, reserves to short-term debt. The one-year-ahead crisis probabilities are estimated with a binary logit model, where the dependent variable is a very severe crisis (currency, systemic banking or sovereign crisis) defined as in Laeven and Valencia (2012).[7] That being said, early warning models have limitations. The accuracy of the model is dependent upon potential feedback effects of changes in policies and expectations. Moreover, early warning models only incorporate indicators that were good predictors of past crises; they do not include new indicators that could be useful predictors of future crises. One such new indicator could be EME corporate sector leverage.

Overall, the model suggests that, while the picture is mixed across countries, EME fundamentals have broadly improved compared to the mid‑1990s. Importantly, EMEs with sounder fundamentals account for a large share of the global economy. The empirical evidence suggests that the fundamentals of most EMEs have to some extent improved relative to 1997, in particular for countries with an increasing weight in the global economy (see Chart G). Overall, Asian EME fundamentals improved the most, suggesting that lessons had been learned after the 1997 crisis.[8] However, the model identifies Argentina and Turkey, which have recently experienced financial market turmoil, as being more vulnerable than in 1997. In addition, the example of China highlights the need to evaluate model results cautiously. The crisis probability predicted by the model for 2018 is relatively low because China has a moderate current account surplus, low inflation, strong growth, large foreign exchange reserves coverage and low levels of external debt. At the same time, China has seen a rapid rise in leverage over the past decade, a factor which might not be sufficiently picked up by the model.[9]

Chart G

EME crisis probabilities, 2018 against 1997

(percentages)

Source: ECB staff estimates.

Notes: The probability of a crisis (currency, sovereign or systemic banking crisis) occurring in 2018 or 1997 is estimated with a binary logit model where the crisis dependent variable is defined as in Laeven and Valencia (2012). In the absence of historical data to estimate crisis probabilities in 1997 for China and South Korea, the chart shows crisis probabilities as of 1998 and 1999, respectively. For Russia, Brazil and Turkey, past crisis probabilities are as of 1998 and 2001, respectively, corresponding to the years these countries experienced crises. The optimal cut-off for issuing a crisis signal is derived from Youden’s J statistic. The sizes of the country bubbles reflect the respective countries’ share in global GDP in purchasing power parity terms in 2017.

Overall, while most EMEs appear to have broadly sounder fundamentals and to be better placed today to withstand shocks than twenty years ago, risks remain. Although EMEs now have improved external positions, domestic risks seem to have been building up, in particular in the aftermath of the Global Recession. While some EMEs are still facing traditional balance-of-payments problems, others may face financial instability stemming from an overleveraged domestic financial sector and shrinking policy space.

- For an in-depth discussion of the “original sin”, i.e. the inability of countries to borrow abroad in their domestic currency, see Eichengreen, B, Hausmann, R. and Panizza, U., “Original Sin: The Pain, the Mystery and the Road to Redemption”, paper prepared for the Inter-American Development Bank conference on “Currency and Maturity Matchmaking: Redeeming Debt from Original Sin”, Washington, D.C., November 2002; and Eichengreen, B., Hausmann, R. and Panizza, U., “Currency Mismatches, Debt Intolerance and the Original Sin: Why They Are Not the Same and Why it Matters”, in Edwards, S. (ed.), Capital Controls and Capital Flows in Emerging Economies: Policies, Practices and Consequences, National Bureau of Economic Research, University of Chicago Press, 2007, pp. 121‑170.

- One should, however, not overlook the costs of accumulating reserves. Traditionally, these costs are related to the sterilisation (or opportunity) costs of holding reserves and the cost to the global economy associated with the build-up of global imbalances, but for empirical evidence that reserve accumulation might also be inflationary owing to moral hazard and incentive effects, see Chiṭu, L., “Reserve accumulation, inflation and moral hazard: Evidence from a natural experiment”, Working Paper Series, No 1880, ECB, February 2016.

- See Bénétrix, A.S., Lane, P.R. and Shambaugh, J.C., “International Currency Exposures, Valuation Effects, and the Global Financial Crisis”, Journal of International Economics, Volume 96, Supplement 1, July 2015, pp. S98-S109.

- See, for example, Aldasoro, I., Borio, C. and Drehmann, M., “Early warning indicators of banking crises: expanding the family”, BIS Quarterly Review, March 2018; and Dieppe, A., Gilhooly, R., Han, J., Korhonen, I. and Lodge, D. (eds.), “The transition of China to sustainable growth – implications for the global economy and the euro area”, Occasional Paper Series, No 206, ECB, January 2018.

- In some countries, this increase may arguably be partly a reflection of a developing financial system. While the ratio may not be seen as problematic in many advanced economies, EMEs tend to have lower debt tolerance. See, for example, “Fiscal policy, public debt and monetary policy in emerging market economies”, BIS Papers, No 67, October 2012; and Reinhart, C., Rogoff, K. and Savastano, M., “Debt Intolerance”, Brookings Papers on Economic Activity, Vol. 1, 2003, pp. 1‑74.

- For more details and empirical evidence, including on the “Fischer view” of optimal conduct of monetary policy in dollarised countries in times of crisis, see, for example, Chiṭu, L., “Was Unofficial Dollarisation/Euroisation an Amplifier of the ‘Great Recession’ of 2007‑2009 in Emerging Economies?”, Comparative Economic Studies, Vol. 55, No 2, June 2013, pp. 233‑265.

- The model uses a relatively long time sample of almost half of century, a well-established definition of crisis in the literature as the dependent variable (see Laeven, L. and Valencia, F., “Systemic Banking Crises Database: An Update”, IMF Working Papers, No 12/163, June 2012) and a comprehensive country sample of 50 systemically important countries. The crisis probability for 2018 is based on 2017 data. The post-crisis bias is dealt with by excluding the crisis years. The optimum cut-off that divides the estimated probabilities obtained from the logit model into crisis and non-crisis observations is derived from Youden’s J statistic. With an AUROC of 0.8163 with a standard error of just 0.048, the model can be judged as having predictive power.

- The early warning model does not signal a crisis for South Korea and Malaysia in 1997, which tends to support the hypothesis of a non-rational/non-fundamental contagion of those countries at that time.

- Fragilities in China are heightened because fast-rising credit has been accompanied by increased complexity and leverage in the financial system. For more details, see Dieppe, A., Gilhooly, R., Han, J., Korhonen, I. and Lodge, D. (eds.), op. cit.