Euro area monthly balance of payments (December 2016)

- In December 2016 the current account of the euro area recorded a surplus of €31.0 billion.[1]

- In the financial account, combined direct and portfolio investment recorded net acquisitions of assets of €22 billion and net reductions of liabilities of €101 billion.

Current account

The current account of the euro area recorded a surplus of €31.0 billion in December 2016 (see Table 1). This reflected surpluses for goods (€31.7 billion), primary income (€5.3 billion) and services (€4.6 billion), which were partly offset by a deficit for secondary income (€10.6 billion).

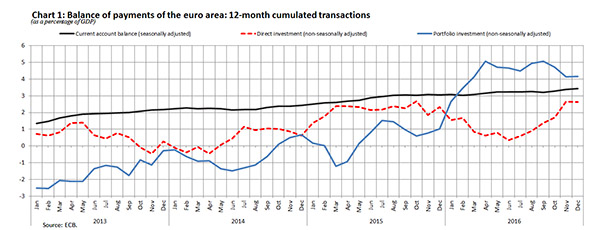

According to the preliminary results for 2016 as a whole, the current account recorded a surplus of €364.7 billion (3.4% of euro area GDP), compared with one of €319.3 billion (3.1% of euro area GDP) in 2015 (see Table 1 and Chart 1). All the components of the current account increased. There were increases in the surpluses for goods (from €348.2 billion to €372.2 billion), services (from €58.9 billion to €69.1 billion) and primary income (from €42.1 billion to €52.4 billion), as well as a slight decrease in the deficit for secondary income (from €129.9 billion to €129.0 billion).

Financial account

In December 2016 combined direct and portfolio investment recorded net acquisitions of assets of €22 billion and net decreases of liabilities of €101 billion (see Table 2).

Euro area residents recorded net acquisitions of €7 billion of direct investment assets as a result of net acquisitions of equity (€32 billion) that were partly offset by net disposals of debt instruments (€25 billion). Direct investment liabilities decreased by €45 billion as a result of net disinvestment in both euro area equity (€17 billion) and debt instruments (€28 billion) by non-euro area residents.

As regards portfolio investment assets, euro area residents made net acquisitions of foreign securities amounting to €14 billion. This resulted from net purchases of equity (€2 billion) and debt securities (€12 billion), specifically net purchases of short-term debt securities (€20 billion) that were partly offset by net sales of long-term debt securities (€8 billion). Non-euro area residents recorded net disposals of euro area portfolio investment liabilities of €55 billion. This was the result of net sales/amortisations of euro area short-term (€27 billion) and long-term (€40 billion) debt securities, which were partly offset by non-euro area residents’ net acquisitions of euro area equity (€11 billion).

The euro area net financial derivatives account (assets minus liabilities) recorded positive net flows of €6 billion.

Other investment recorded net disposals of €217 billion in assets and €227 billion in liabilities. The net disposal of foreign assets by euro area residents is mainly attributable to net disposals by the MFI sector (excluding the Eurosystem) (€192 billion) and other sectors (€33 billion), which were partly offset by net acquisitions of the Eurosystem (€8 billion). Similarly, the net decrease in liabilities is explained by net disposals of the MFI sector (excluding the Eurosystem) (€280 billion) and other sectors (€21 billion). The general government also decreased its liabilities by €7 billion. These were offset to a limited extent by net incurrences of liabilities of the Eurosystem (€80 billion).

In 2016 as a whole, combined direct and portfolio investment recorded net increases of €669 billion in assets and net decreases of €52 billion in liabilities, compared with net increases of €1,225 billion and €875 billion respectively in 2015. This resulted from a significant decrease in the direct investment activity of both euro area residents abroad and non-residents in the euro area, with the net acquisition of assets decreasing from €820 billion to €292 billion and the net incurrence of liabilities from €577 billion to €14 billion.

The most significant development in portfolio investment was a shift on the liability side from net acquisitions of euro area debt securities by non-euro area residents of €30 billion to net sales/amortisations of €192 billion.

According to the monetary presentation of the balance of payments, the net external assets of euro area MFIs decreased by €209 billion in 2016, compared with a decrease of €49 billion in 2015. This reflected an increase in the surplus in the current and capital account balance (from €304 billion to €364 billion), which was offset by net financial transactions by non-MFIs. In particular, the cumulated transactions in portfolio investment liabilities issued by non-MFI euro area residents showed a shift from net purchases of debt securities by non-euro area investors (€92 billion) to net sales/amortisations (€128 billion).

In December 2016 the Eurosystem’s stock of reserve assets increased by €1.1 billion to €707.7 billion (see Table 3). This can be explained by net acquisitions of reserve assets (€6.1 billion) and positive exchange rate developments (€0.9 billion), which were partly offset by negative price revaluations (€6.0 billion), particularly of monetary gold.

Data revisions

This press release incorporates revisions for October and November 2016. These revisions have not significantly altered the figures previously published.

Additional information

Time series data: ECB’s Statistical Data Warehouse (SDW)

Methodological informationMonetary presentation of the balance of payments

Next press releases:- Monthly balance of payments: 22 March 2017 (reference data up to January 2017);

- Quarterly balance of payments and international investment position: 6 April 2017 (reference data up to the fourth quarter of 2016)

Annexes

Table 1: Current account of the euro area

Table 2: Balance of payments of the euro area

Table 3: Reserve assets of the euro area

For media enquiries, please contact Rocío González, tel.: +49 69 1344 6451.

[1]References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are neither seasonally nor working day-adjusted.

Banca centrale europea

Direzione Generale Comunicazione

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

La riproduzione è consentita purché venga citata la fonte.

Contatti per i media