Financial stability considerations arising from the interaction of coronavirus-related policy measures

Published as part of the Financial Stability Review, November 2020.

Fiscal, prudential and monetary authorities have responded to the coronavirus pandemic by providing unprecedented support to the real economy. Importantly, the combination of policy actions has done more to limit the materialisation of risks to households and firms than each policy individually. Exploiting policy complementarities and ensuring the most effective combination of policies will, however, be equally important when authorities start to phase out the various relief measures. The differences in the enacted fiscal and labour market measures across the largest euro area economies, as well as their phase-out schedules, further complicate the challenge of obtaining the most effective policy combination.

1 Introduction

In 2020 euro area monetary, fiscal and prudential authorities enacted unprecedented measures in response to the pandemic. The sheer size of the measures, as well as their mutually beneficial effects, has provided vital support to the economy.[1] Monetary policy measures have supported the supply of credit to the real economy and ensured favourable financing conditions. At the same time, fiscal policies have helped many borrowers to bridge urgent liquidity needs and have stabilised aggregate demand. In turn, this has supported financial stability by preventing many firms and households from defaulting on their loans. Finally, the release of prudential requirements has helped banks to transmit the fiscal support to the real economy by maintaining lending in the downturn and facilitated the transmission of the monetary policy stimulus.

Among the five largest euro area countries, the scale and combination of measures varies substantially, as do their phase-out schedules. While there are many common features in the crisis-related policy responses across the euro area countries, there are notable cross-country differences in the magnitude, estimated economic impact and currently envisaged phase-out schedules of various relief measures. This is especially the case with regard to fiscal and labour market measures, but also in terms of how the euro area-wide monetary and prudential measures have an impact on the economies.

This special feature analyses the synergies between the enacted policies, cross-country heterogeneity and financial stability considerations related to the phasing-out of relief measures. First, it provides a brief overview of the enacted fiscal, monetary and prudential measures. Second, it analyses the synergies among the various relief measures, while, finally, it addresses financial stability considerations related to potential cliff effects when phasing out the various policy measures. To emphasise the cross-country differences in the policy responses, the special feature focuses on the five largest euro area economies (France, Germany, Italy, the Netherlands and Spain).

2 Enacted policy measures

The ECB has announced monetary policy measures aimed at maintaining accommodative financing conditions. The pandemic-related monetary policy measures include the pandemic emergency purchase programme (PEPP), targeted longer-term refinancing operations (TLTRO III) at more favourable terms and conditions,[2] non-targeted pandemic emergency longer-term refinancing operations (PELTROs) and the easing of the collateral rules.[3]

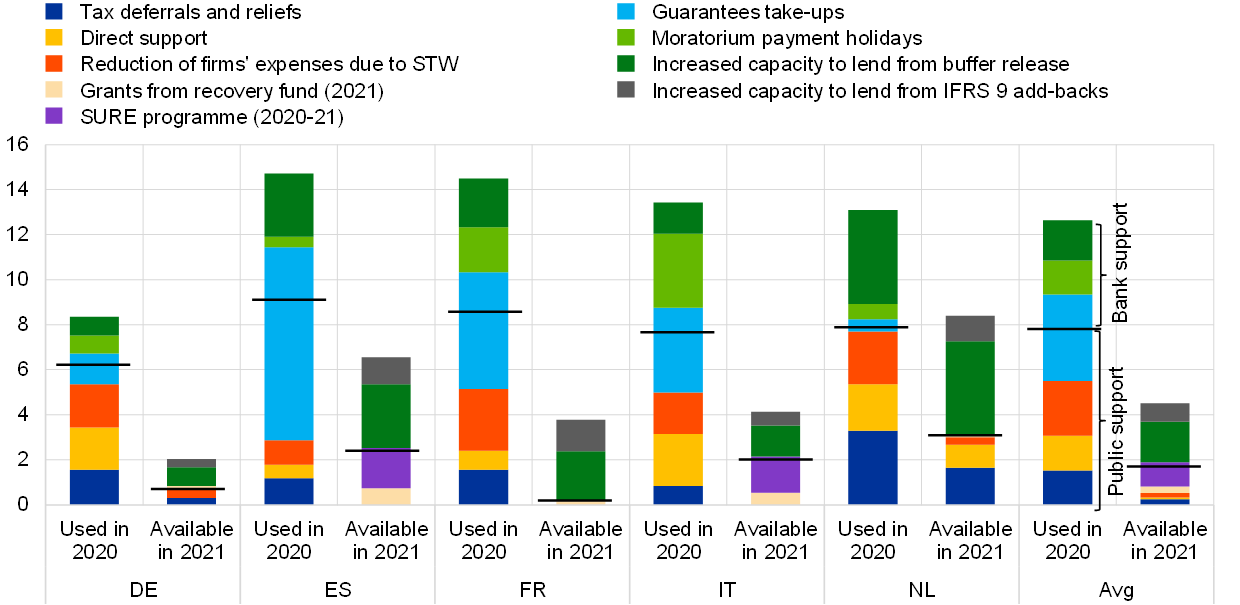

Fiscal authorities have launched loan guarantee and short-time working schemes, special tax deferrals and direct support to households and firms. In some countries, measures have also been taken to restrain firms from laying off employees (e.g. Italy and Spain) or temporarily lift obligations to file for insolvency (Germany).[4] Public loan guarantee schemes[5] and moratoria on loan obligations[6] have also been implemented on a large scale in the euro area to provide relief to borrowers. In addition to national policies, further fiscal and labour market-related relief measures have been agreed at the EU level.[7] Overall, for the five largest euro area economies in 2020, transfers to the real economy by fiscal authorities amounted to about 8% of real GDP (see Chart A.1).[8] In 2021 an additional 2% of real GDP support is expected.

Complementing the monetary and fiscal policy actions, prudential authorities have freed up bank capital to absorb losses and to support the flow of credit to the real economy. The main prudential measures have included the release of capital buffers, guidance to reduce procyclical provisioning[9] and measures to preserve banks’ loss-absorbing capacity by restricting dividend distributions.[10]

Chart A.1

Transfers to the real economy are large, but the composition differs across countries

Support to the non-financial private sector already disbursed in 2020 and available in 2021

(percentages of nominal GDP)

Sources: ECB, European Commission, Bruegel, national authorities and ECB calculations.

Notes: The horizontal black lines divide the support provided by public sources (below the black line) from the support provided by banks (above the black line). For guarantees, it is taken into account that the risk is shared between banks and the public sector. The chart shows take-ups or uses of the measures until the cut-off date (14 October 2020). For 2021 it reports the envelopes of currently agreed policies (e.g. SURE and grants from the EU recovery fund). The support to the real economy from the relaxation of prudential measures is accounted for in both years, as no replenishment is currently envisaged for either year. For these measures, the chart reports the available extra lending capacity for banks, which does not correspond to the effective extra lending provided to the real economy. All derived measures (e.g. moratoria and the capacity to lend) are calculated without any dynamic model, but are based on current balance sheet data and accounting equations. Not all available policies are reported as the envelope is not defined for some of them (e.g. tax deferrals in some countries). STW: short-time working schemes.

The policy response varies across euro area countries. Fiscal and some prudential measures are set at national level and have varied across countries in terms of envelopes and eligibility criteria. Some countries have relied heavily on short-time working schemes to support firms and household incomes, while others have made greater use of moratoria and guarantee schemes (see Chart A.1).[11]

3 Combined impact of complementary measures

The fiscal, monetary and prudential policy measures aim to support economic activity by reducing the financial stress faced by households and corporates. The various relief measures all share the aim of helping firms and households. Their positive effect on the payment performance of bank borrowers indirectly supports the soundness of banks, at least in the short run.[12] To assess the extent to which the different policy measures provide mutual support and thereby enhance overall policy effectiveness, simulations based on a novel approach linking micro-level estimations with a macro model are employed.

Vulnerable households are supported by measures that buttress incomes, prevent unemployment from rising and alleviate debt servicing needs. Short-time working schemes have not only supported the repayment of debt, but have also helped demand more generally, including from less-indebted households which tend to be particularly prevalent in countries where households have relatively lower income. Moratoria on household loans have provided respite on debt repayments in a situation where income has temporarily declined and uncertainty about employment prospects has been rising; however, substantial vulnerabilities across countries remain (see Chart A.2, left panel).[13]

Corporate defaults and insolvencies are mitigated by measures that support liquidity and contain expenses. Moratoria and short-time working schemes temporarily reduce corporate expenses, while guaranteed loans can be used to roll over debt, pay expenses or adjust production to the new environment. Simulations of corporate liquidity needs indicate the potential for guarantees and moratoria, but most importantly short-time working schemes, to substantially increase the horizon over which non-financial firms can service their liabilities (see Chart A.2, right panel), until corporate cash flows recover and firms are able to resume payments. The impact of policies has been stronger in Italy and Spain than in France and Germany. This reflects the larger share of firms (about 36% in Spain and 40% in Italy) that would cease to be able to service their liabilities without policy support within two months of the pandemic shock, as well as a stronger decrease in corporate cash flows in these two countries. The effectiveness of the policy support in averting defaults would fall over the longer term, as protracted stress would render some firms non-viable.[14]

Chart A.2

Vulnerabilities remain in the household and corporate sectors

Sources: Eurostat, Eurosystem Household Finance and Consumption Survey, Bureau van Dijk – Orbis database and ECB calculations.

Notes: Corporate liquidity distress horizon indicates how long a company would be able to service its current liabilities as they fall due, given its cash holdings and the projected cash inflows and outflows, taking into account the reduced turnover since the outbreak of the pandemic and assuming that liabilities would not be rescheduled. Firms are allocated to buckets, and the width of each bucket is set to two months. The first bucket includes companies that will run out of cash in less than two months. For example, over 25% of German firms would face liquidity distress in less than two months without policy support, and the policy support would reduce the share of such firms to about 6%. Results are reported only for the four largest euro area countries due to data quality issues.

The macro-financial impact of the different policies can be simulated using a macroeconomic model enhanced by bank, firm and household-level modules.[15] The granular module for the banking sector relies on a simplified European Banking Authority (EBA) stress-test methodology[16] and uses supervisory data as a starting point for a sample of around 400 banks (less significant institutions and significant institutions) at the highest level of consolidation. The default probabilities of households and corporates are first estimated based on granular corporate and household models, which rely on Orbis data[17] and the Eurosystem Household Finance and Consumption Survey (HFCS),[18] and are then incorporated into the dynamic stochastic general equilibrium (DSGE) model. The baseline scenario used for the calculations is consistent with the September 2020 ECB staff macroeconomic projections, abstracting from the estimated impact of the policies assumed in the projections. The policy assumptions have been updated on the basis of the most recent data available for the five largest euro area countries. The incorporation of monetary policy measures follows the approach described in the May 2020 issue of the Financial Stability Review.[19]

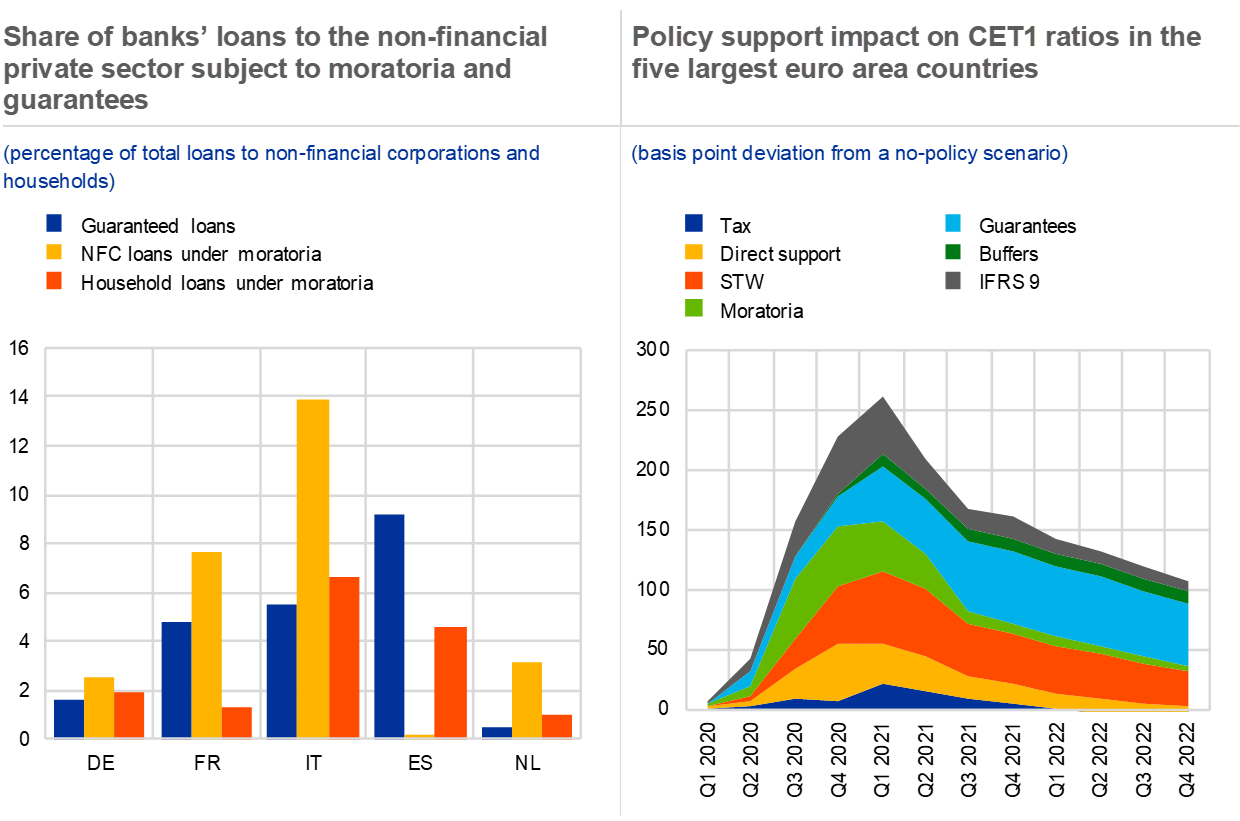

Support measures have helped maintain bank lending capacity and reduce the risk of severe financial instability. The measures have together provided significant support to bank solvency ratios in 2020 and should continue doing so in 2021 (about 230 basis points in cumulative terms; see Chart A.3, left panel). The factors supporting the Common Equity Tier 1 (CET1) ratio of banks, and hence their lending capacity, vary over time and across countries. In 2020 the relief arises mainly from a combination of short-time working schemes, moratoria and direct support to households and corporates, as these policies were more readily available and provided direct liquidity support or expense relief. In France and Spain, where guaranteed loans replaced part of the loan book, guarantee schemes should also reduce bank capital depletion in 2020. In 2021 a large part of the additional support relies on guarantees and short-time working schemes (via indirect demand effects), monetary policy and the use of add-backs under IFRS 9 transitional arrangements.[20]

Taken together, the enacted policy measures are expected to significantly improve economic growth. The overall relief to real GDP is estimated to be more than 3 percentage points for both 2020 and 2021 compared with the GDP level without policy support (see Chart A.3, right panel). A large part of the relief, for both households and corporates, relates to fiscal, labour and other temporary support policies. In 2020 measures allowing for a temporary suspension of payments by corporates (tax relief, moratoria and short-time working schemes) or for liquidity under generous conditions (direct support) played a key role in Germany, Italy and the Netherlands; guaranteed loans to corporates are of particular importance in Spain and France. The guarantees also stimulate aggregate demand; this mechanism works with a lag, meaning that the greatest effect might be achieved in 2021. The recent prolongation of short-time working schemes in several countries would likewise help to sustain aggregate demand and growth in 2021. Monetary policy and the relaxation of prudential buffers[21] would provide further additional support to the real economy in 2021, as banks might need to dip into their buffers and credit conditions might tighten as fiscal policies are phased out.[22]

Chart A.3

Heterogeneous timing and composition of the relief provided to the banking sector and the real economy by different policy measures

Sources: ECB staff simulations based on Darracq Pariès et al. (2019) augmented with corporate, household and banking modules based on micro data from Bureau van Dijk – Orbis database, the HFCS and FINREP/COREP, and ECB calculations.

Notes: The left and right charts report the average yearly impact on banks’ CET1 ratios and real GDP levels respectively. As active policy support built up in the last three quarters of 2020, the annual average impact is lower than the average impact over the last three quarters of 2020. By contrast, for 2021 four quarters of active policy support enter the average annual impact. In the charts, “IFRS 9” refers to the impact of the add-back due to the amendments to the transitional arrangements of IFRS 9; “Monetary” refers to the impact of the PEPP and TLTRO III; “Buffers” refers to the relaxation of the requirements regarding the Pillar 2 guidance, Pillar 2 requirement, countercyclical capital buffer and systemic risk buffer; and “STW” refers to short-time working schemes. The calculations are based on the September 2020 ECB staff macroeconomic projections.

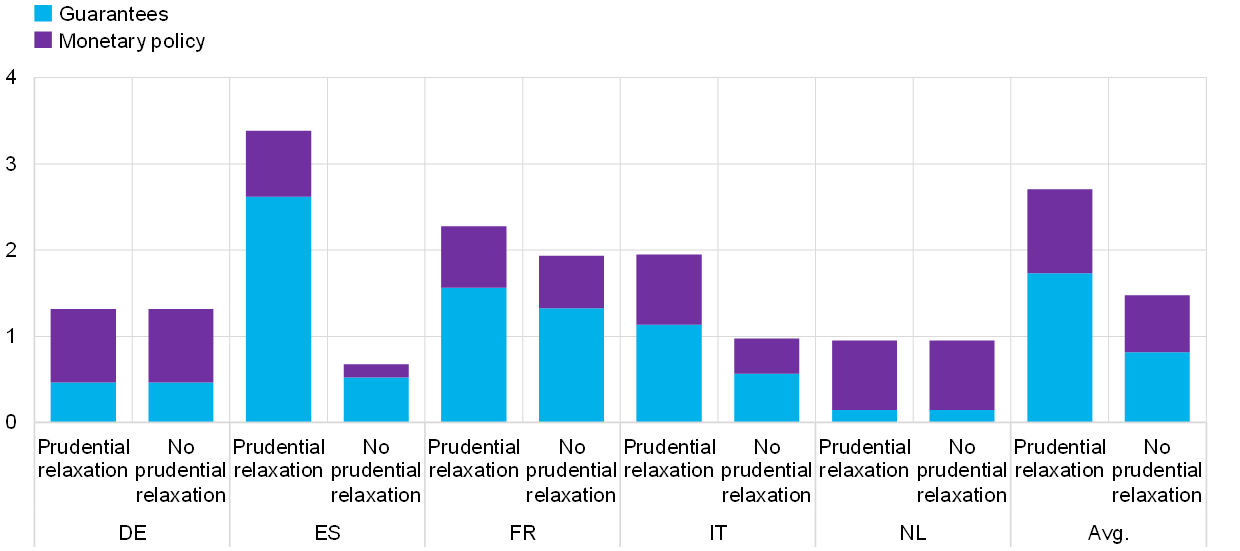

Prudential policies have facilitated the use of fiscal measures. Government loan guarantee schemes cover part of the credit risk associated with guaranteed loans. The relaxation of prudential policies has provided capital space to cover the remaining credit risk that was left with the banks. That capital space might also mitigate the adverse effects of moratoria on banks’ capital-generation capacity due to the temporary reduction of net interest income.[23] Under the assumption that banks would be willing to fully use the temporary prudential policy flexibility to lend and absorb losses, simulations indicate that this additional space would have a meaningful positive effect on economic activity. Without prudential policies, the mitigating contribution of guarantee schemes to the real GDP level at the end of 2021 would be close to one percentage point lower (see Chart A.4). The contributions of prudential policies are more evident in Spain and Italy where management buffers were relatively smaller and would have been eroded by more losses as the pandemic had a stronger economic impact, and smaller alternative mitigating measures such as direct support, tax deferrals and short-time working schemes were in place.

At the same time, the prudential measures have reinforced the effectiveness of the additional extraordinary monetary policy easing. Simulations indicate that the mitigating contribution of monetary policy measures, and their impact on banks’ liquidity and funding, to the real GDP level at the end of 2021 would be about 0.3 percentage points lower without prudential policies (see Chart A.4).[24] As for fiscal policies, differences in the cross-country interaction between prudential and monetary policies should be attributed to the loss-absorption capacity of each banking system and to the economic impact of the crisis.

Chart A.4

Prudential policies enhanced the mitigating impact of fiscal and monetary policies

Contributions of guarantees and monetary policy to real GDP levels by end-2021 with and without relaxation of the prudential buffer requirements

(level deviation, percentage points)

Sources: See Chart A.3.

Notes: The chart compares the impact of guarantees and monetary policy on real GDP levels first assuming the contemporaneous relaxation of prudential buffer requirements, then abstracting from it. All other policies which are assumed to be activated in Chart A.3 are also assumed to be activated, even if the results for them are not shown.

4 Phase-out strategies, cliff effects and risks ahead

Most of the enacted policy measures are planned to expire by the end of 2021. Direct support and tax deferral measures have already been phased out in some countries, and new applications for public loan guarantees would be possible only until end-2020 in many countries. The phase-out of short-time working schemes and loan moratoria[25] varies more across countries, ranging from the end of 2020 to the end of 2021 (see Chart A.5). In addition, several measures will not only stop providing liquidity to firms and households when phased out, but may also trigger the reimbursement of temporary relief granted. This applies not only to moratoria and tax deferrals, but also to guaranteed loans with shorter maturities.

Chart A.5

Most of the policies will be phased out by the first half of 2021

Timeline for the phase-out of different policies

Sources: National authorities and EBA notifications.

Notes: Cut-off date: 14 October 2020. Guaranteed loans mature at the latest by end-2030 in Germany and Italy, end-2026 in France and the Netherlands and end-2028 in Spain. Loan moratoria expiration dates are calculated as an average of different phase-out dates within both public and private moratorium schemes (Germany, France, Spain and the Netherlands) or the average of phase-out dates weighted by the take-up of moratoria within different schemes (Italy).

Ending measures abruptly could lead to cliff effects on households’ and corporates’ income, with knock-on effects for economic activity in 2021. The simultaneous termination of policy measures could trigger a protracted downward shift in the recovery path. Such cliff-edge effects would be concentrated in the first half of 2021 (see Chart A.6, left panel), and are projected to reduce the supportive impact on real GDP for the five largest countries on average by around 2% of real GDP (see Chart A.6, right panel). On aggregate, the main sources of potential cliff effects are reductions in short-time working schemes, direct grants and tax support, reflecting their relevance in sustaining income and thus expenditures at the household and corporate levels. However, owing to the different policy mixes, their individual importance varies substantially across countries.

Chart A.6

Exiting measures simultaneously may induce cliff effects in policy support, with stronger GDP reductions in countries relying more on loan moratoria and grants

Sources: See Chart A.3.

Notes: The left panel reports the quarterly profile of some of the contributions to the real GDP reported in Chart A.3 (right panel). See notes to Chart A.3 for the abbreviations.

These cliff effects would be exacerbated if tighter pandemic containment measures led to a renewed decline in corporate and household incomes. Simulations in this special feature were based on the September 2020 ECB staff macroeconomic projections,[26] which rest on the assumption of a continuation of pandemic containment measures, but with lower economic costs than in the initial wave. If the recovery included in the projections fails to materialise, but turns out to be more protracted instead, the cliff effects could be substantially larger and potentially postponed by the prolongation of current policy measures.

Countries relying more on moratoria, direct support and tax deferrals appear more exposed to cliff effects in policy support for 2021. Across the largest euro area countries, simulations suggest that such effects would be most pronounced in the Netherlands, mainly owing to the phasing-out of a large part of the direct support coupled with the ending of tax deferrals and short-time working schemes (see Chart A.6, right panel). Likewise in Italy, the broadly simultaneous expiration of the majority of loan moratoria, exit from short-time working schemes and ending of direct support would indicate a substantial drop in the support to the recovery in 2021. In Germany, the extension of short-time working schemes until the end of 2021 would only partially cushion the exit from quite generous direct support measures and tax deferrals. By contrast, the strong reliance in France and Spain on guarantee schemes mitigates the cliff effects in 2021, while the impact could be further alleviated by the extension of short-time working schemes in these countries.[27] Overall, tax relief measures will be an important determinant of the timing and magnitude of a cliff effect in policy support for the majority of countries. But there is a lot of uncertainty regarding the exact magnitude of the volume affected and the timing of the phase-out, as in some jurisdictions this can be determined by tax authorities on a case-by-case basis over an extended time frame.

Along with the reduction in support to the real economy, the phasing-out of policy measures could adversely affect banks’ balance sheets and capitalisation. As large parts of euro area banks’ loan books are currently subject to moratoria or public guarantees (see Chart A.7, left panel), phasing out these schemes could have an adverse impact on credit risk and banks’ ability to lend to the real economy (see Chart A.7, right panel). Apart from the reduction in short-time working schemes, direct grants and tax support, the phasing-out of moratoria and the potential default of assets subject to the amended IFRS 9 transitional arrangements contribute the most to the projected decline in the policy support to banks’ CET1 ratios.

Chart A.7

A large share of banks’ loan books is affected by guarantees and moratoria, with banks’ capital adversely affected by the phasing-out of policy support

Sources: Left panel: ECB (balance sheet item statistics), EBA, banks’ financial statements, national authorities and ECB calculations; right panel: see Chart A.3.

Notes: Left panel: data up to end-September or end-October 2020. Household loans under moratoria figures for France, Spain and the Netherlands also include loans to self-employed workers that are subject to moratoria. Right panel: see the notes to Chart A.6 applying to CET1 ratio levels instead of real GDP levels. See the notes to Chart A.3 for the abbreviations.

The cliff effects presented in this special feature are relevant for prudential authorities’ future decisions on the replenishment of capital buffers. It will be important for prudential authorities to take account of assessments of potential cliff effects on the financial system and the broader economy from the phasing-out of support measures. This will be pertinent for the speed and timing of the tightening of supervisory requirements and the replenishment of macroprudential buffers.

Overall, there are substantial short-term risks associated with the withdrawal of policy support, while medium-term risks of protracted policy support should also not be ignored. The enacted policies have been instrumental in preserving financial stability and reducing the impact of the pandemic on the real economy. Looking ahead, exiting from the extraordinary support should be timed carefully, given the very sizeable cliff effects for the economy and the banking sector, and the interactions between the monetary, fiscal and prudential policies. However, the efficiency of policy measures is likely to diminish if the economic stress persists. Furthermore, maintaining policy support could lead to a misallocation of capital and preserve non-viable firms, which could have a detrimental impact on long-run growth prospects and financial stability. These conclusions point to an emerging trade-off between the short-term needs to maintain support and the medium-term risks.

- See also Box 8 entitled “Macroeconomic impact of financial policy measures and synergies with other policy responses”, Financial Stability Review, ECB, May 2020.

- For banks meeting the lending threshold of 0% introduced on 12 March 2020, the interest rate can be as low as -1%. See the press release entitled “ECB announces easing of conditions for targeted longer-term refinancing operations (TLTRO III)”, 12 March 2020.

- See the press releases entitled “ECB announces new pandemic emergency longer-term refinancing operations”, 30 April 2020, and “ECB takes steps to mitigate impact of possible rating downgrades on collateral availability”, 22 April 2020.

- See the Italian Decree-Law of 17 March 2020 (Article 46); the Spanish Royal Decree-Law 8/2020 of 17 March 2020 on extraordinary urgent measures to face the economic and social impact of COVID-19; and the German Act to Mitigate the Consequences of the COVID-19 Pandemic under Civil, Insolvency and Criminal Procedure Law of 27 March 2020 and its conditioned extension to end-2020, 2 September 2020.

- See Box 7 entitled “Public loan guarantees and bank lending in the COVID-19 period”, Economic Bulletin, Issue 6, ECB, 2020.

- Euro area countries have introduced either public moratoria based on specific national legislation, private industry-wide loan moratorium schemes led by national banking associations, or a combination of both. Most of the moratorium schemes are compliant with the April 2020 EBA Guidelines for legislative and non-legislative moratoria on loan repayments applied in the light of the COVID-19 crisis and benefit from favourable prudential treatment, i.e. loans under moratoria do not need to be classified as forborne or distressed restructured. A moratorium implies a suspension of principal and/or interest payments to banks. Under public moratorium schemes, banks must accept a request for moratorium if certain eligibility criteria are satisfied.

- The EU will provide funds to support the economic recovery under the Next Generation EU package (up to €750 billion until 2026) and to preserve employment under the Support to mitigate Unemployment Risks in an Emergency (SURE) programme (up to €100 billion until 2021). See Box 8 entitled “The fiscal implications of the EU’s recovery package”, Economic Bulletin, Issue 6, ECB, 2020.

- The analysis in this special feature is based on information available up to 14 October 2020.

- See the press release entitled “ECB Banking Supervision provides temporary capital and operational relief in reaction to coronavirus”, 12 March 2020, and “Macroprudential measures taken by national authorities since the outbreak of the coronavirus pandemic” on the ECB’s website.

- See the press release entitled “ECB extends recommendation not to pay dividends until January 2021 and clarifies timeline to restore buffers”, ECB Banking Supervision, 28 July 2020, and Recommendation of the European Central Bank of 27 July 2020 on dividend distributions during the COVID-19 pandemic (ECB/2020/35) (OJ C 251, 31.7.2020, p. 1).

- See Box 7 entitled “The COVID-19 crisis and its implications for fiscal policies”, Economic Bulletin, Issue 4, ECB, 2020.

- Moratoria help avert defaults by viable borrowers facing temporary liquidity difficulties but who are likely to remain viable once their cash flows recover. From a longer perspective, payment moratoria weaken bank soundness by masking concerns about the solvency and viability of borrowers, which may lead banks to underestimate credit risk. The expiry of moratoria may also, depending on the revised timing of postponed payments, generate cliff effects for borrowers, thus deferring but not averting the credit losses.

- For a detailed discussion on the impact of policy measures on households, see Section 1.3.

- For a more in-depth assessment of the corporate financial situation and the impact of policy measures, see Section 1.4.

- Specifically, the estimates are based on Darracq Pariès, M., Kok, C. and Rancoita, E., “Macroprudential policy in a monetary union with cross-border banking”, Working Paper Series, No 2260, March 2019, augmented with granular modules for the banking, corporate and household sectors relying on stress-testing methodologies.

- More precisely, market risk, operational risk and some components of profit and loss such as fee and commission income are not included in the analysis.

- Firms’ default probabilities by country-sector combination are estimated based on liquidity and solvency criteria, using granular firm-level Orbis data for 1.3 million firms across the euro area. Corporate cash inflows are projected for each firm separately, using sector-specific reductions in cash flows in line with the findings from surveys carried out by national authorities since March 2020 and the September 2020 ECB staff macroeconomic projections. These surveys suggest that the cash inflows reached a trough in April 2020 and had significantly, but not fully, recovered by July 2020. The projected further recovery of corporate cash flows by early 2021 implies the resumption of wage and debt payments without external support. Policy support is assumed to reduce wage expenses and financial expenses related to loan repayments, and to increase cash holdings through additional borrowing supported by guarantees.

- For households, the methodology for the simulations follows a similar liquidity-based approach. Households whose financial margin, after deducting liquid assets, would be negative are assumed to be unable to service their debt. See also Ampudia, M., van Vlokhoven, H. and Żochowski, D., “Financial fragility of euro area households”, Working Paper Series, No 1737, ECB, October 2014.

- See Box 8 entitled “Macroeconomic impact of financial policy measures and synergies with other policy responses”, Financial Stability Review, ECB, May 2020.

- In the simulations, it is assumed that all banks would apply the amended transitional arrangements.

- The analysis assumes that banks are willing to use released buffers and to operate below buffer requirements. For an in-depth discussion on the usability of prudential buffers, see Macroprudential Bulletin, ECB, October 2020, and Chapter 5 of this issue of the FSR.

- The monetary policy impact would correspond to an average impact on lending of 1% per year, in line with Altavilla, C., Barbiero, F., Boucinha, M. and Burlon, L., “The great lockdown: pandemic response policies and bank lending conditions”, Working Paper Series, No 2465, ECB, September 2020.

- In addition, moratoria schemes benefited from regulatory clarifications allowing banks to not treat loans under moratoria as non-performing, thereby avoiding higher capital requirements and provisions for the loans under these payment holidays (see the “Statement on the application of the prudential framework regarding Default, Forbearance and IFRS9 in light of COVID-19 measures”, EBA, 25 March 2020, for the specific amendment of the EBA Guidelines on the definition of non-performing loans).

- For the evaluation of monetary policy, see also Box 8 entitled “Macroeconomic impact of financial policy measures and synergies with other policy responses”, Financial Stability Review, ECB, May 2020.

- In a press release dated 21 September 2020, the EBA announced the phasing-out of its Guidelines on legislative and non-legislative moratoria on loan repayments, with an end-September 2020 deadline for newly agreed moratoria.

- See “ECB staff macroeconomic projections for the euro area”, 10 September 2020.

- A new, long-term partial activity scheme was introduced in France from 1 July 2020, with a maximum limit of 24 consecutive months. It has to be renewed every six months through collective agreements with trade unions (see Decree No 2020-926 relating to the specific partial activity mechanism in the event of a lasting reduction in activity (in French)). The furlough scheme in Spain (ERTE) has been prolonged until 31 January 2021.