Economic growth is supporting financial stability but markets are vulnerable to a sudden increase in volatility

- Risks of a repricing of global risk premia remains significant

- Bank profitability prospects still challenged by structural vulnerabilities

- High private and public debt burdens could give rise to debt sustainability concerns in some countries

- Financial stability risks partly mitigated by improved economic conditions

Systemic stress indicators for the euro area have remained low over the past six months, according to the latest Financial Stability Review of the European Central Bank. Better growth prospects as well as lower fiscal and external imbalances contributed to reduced systemic stress indicators for the euro area, , according to the biannual report published today.

The risk of a rapid repricing in global markets nevertheless remains. Continued compression of risk premia, subdued volatility and signs of increased risk-taking behavior in global financial markets are all sources of concern, as they may sow the seeds for large asset price corrections in the future.

Profitability challenges remain for euro area banks. Market pressure on euro area banks has eased further since May, but for a large number of banks their valuations are still low compared with global peers. In some regions, profitability prospects are still dampened by large stocks of non-performing loans (NPLs). A number of structural challenges are also weighing on the profitability outlook for banks. These include overcapacity, a lack of income diversification and cost inefficiencies.

Over the past six months the ongoing economic recovery has supported the outlook for the sustainability of euro area sovereign debt. Renewed political uncertainty could lead to higher risk premia being demanded on sovereign bonds, potentially triggering debt sustainability concerns in some countries. Risks stemming from elevated debt levels are also present in the non-financial private sector, given the high levels of indebtedness of the euro area non-financial corporate sector, both by historical and by international standards.

Risks to euro area financial stability may also emerge from the investment fund sector. This sector has further increased its risk-taking in recent years. Asset allocations have been rebalanced towards lower-rated and higher-yielding assets. At the same time, the liquidity buffers held by bond funds have gradually been shrinking across all segments of the investment fund market. The continued increase in risk-taking, coupled with limited buffers, heightens the potential for fund redemptions to adversely affect market conditions if a repricing of global risk premia does take place.

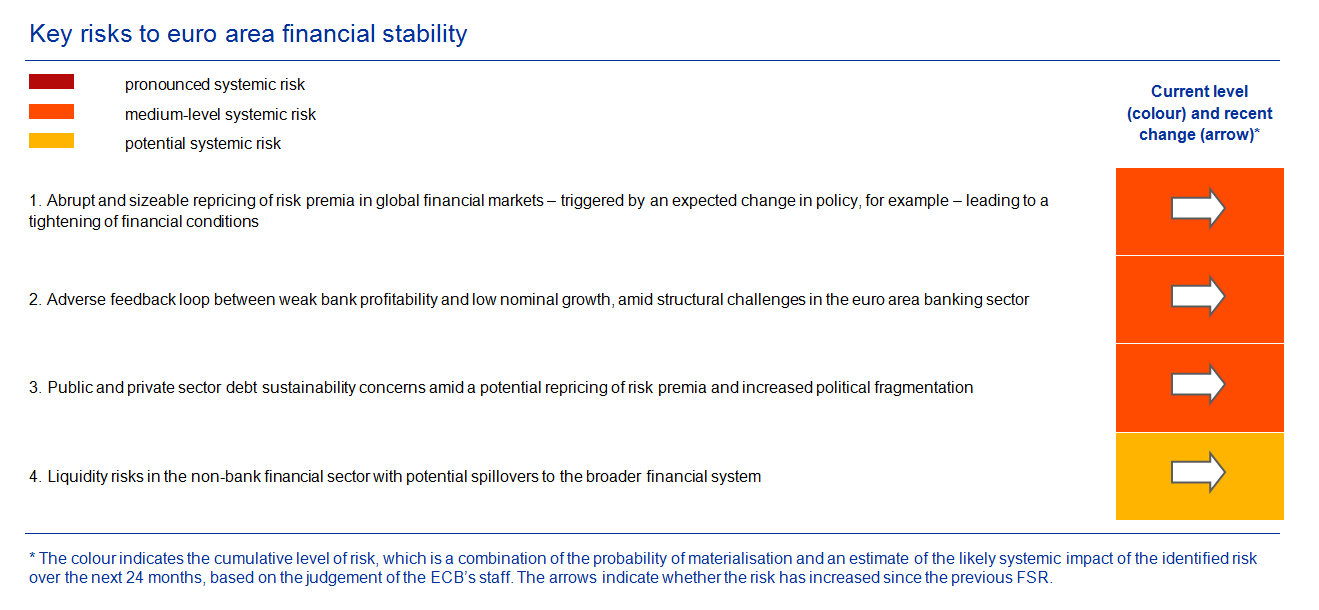

In this environment, the Review singles out four main risks to financial stability in the euro area over the next two years (see table).

The Review also contains four special features. The first special feature discusses the use of NPL transaction platforms. The second provides an overview of euro area cross-border banking over the past decade. The third examines recent developments in repo markets and how regulatory reform is affecting the functioning of these markets. The fourth examines the low volatility in financial markets and considers potential triggers and amplifiers that could lead to higher volatility in the future.

For media queries, please contact Peter Ehrlich, tel.: +49 69 1344 8320.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts