Introducing statistical in-house credit assessment systems (S-ICASs) as an additional source of credit assessments under the general collateral framework

Published as part of the ECB Economic Bulletin, Issue 3/2025.

The credit quality assessment of collateral assets for Eurosystem credit operations is based on the Eurosystem Credit Assessment Framework (ECAF).[1] Credit operations are a key element of the Eurosystem’s monetary policy operations. The Eurosystem has a statutory requirement to lend to banks and other counterparties only against adequate collateral.[2] Currently, the ECAF builds on credit assessment information from three sources: the in-house credit assessment systems (ICASs) of national central banks (NCBs), external credit assessment institutions (ECAIs) and the internal ratings-based (IRB) systems of Eurosystem counterparties.[3]

The introduction of NCBs’ statistical in-house credit assessment systems (S-ICASs) from 2026 as an additional ECAF-accepted source under the general collateral framework will strengthen the internal credit assessment capabilities of the Eurosystem and broaden the available set of potential collateral.[4],[5] The Eurosystem’s internal sources – ICASs and S-ICASs – assess the creditworthiness of non-financial corporations as debtors/guarantors of credit claims for collateralised credit operations. S-ICASs specifically target micro, small and medium-sized enterprises (SMEs), some of which might not be assessed by any other ECAF source.

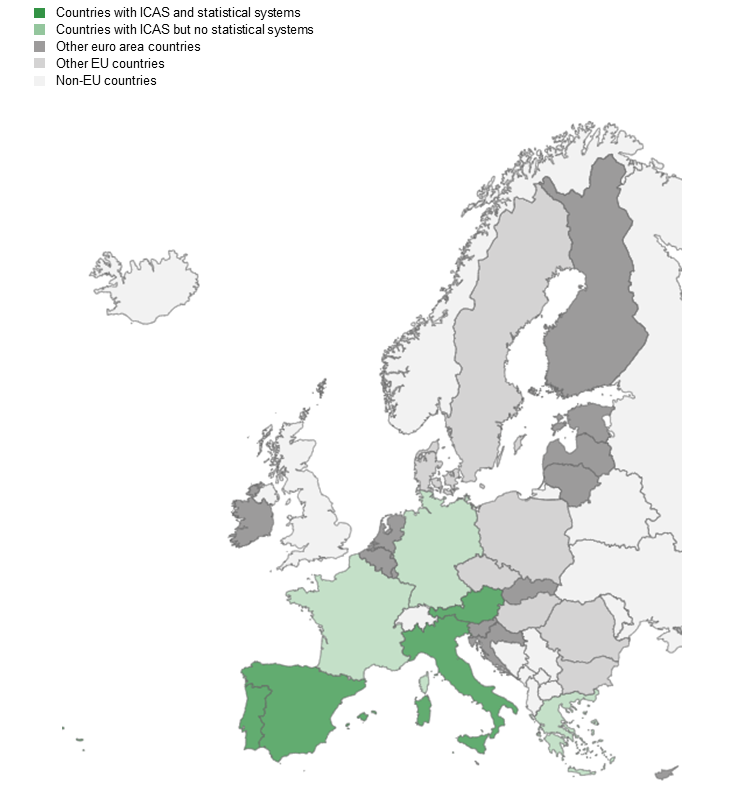

The statistical systems of NCBs were accepted as part of the temporary collateral framework to broaden the set of available collateral mainly in response to the COVID-19 pandemic.[6] Five statistical systems were operated by NCBs during the pandemic, of which four were newly introduced at that time. The acceptance and expansion of NCBs’ statistical systems proved to be an efficient way to increase the availability of collateral for monetary policy operations during the pandemic. Currently, four NCBs operate statistical systems under the temporary framework: the Banca d’Italia, the Banco de España, the Banco de Portugal and the Oesterreichische Nationalbank (Figure A). To avoid disruptions and ensure a smooth transition to the new regime, NCBs will be allowed to continue using existing statistical systems under the current conditions until their acceptance under the general collateral framework is concluded.

Figure A

Countries with NCB ICASs and statistical systems currently in operation

The acceptance of S-ICASs under the general framework is based on a newly developed harmonised framework, which will enhance risk efficiency, address level-playing-field considerations and improve crisis preparedness. The harmonised framework builds on the existing framework for ICASs, complemented with the requirements and safeguards that are needed to ensure the good performance of quantitative systems with little or no expert assessment.[7] Quantitative information typically used in the assessment includes financial ratios based on financial reports, indicators linked to the group structure, and payment behaviour. Expert assessment would entail, for instance, the analysis of public information and detailed reports from firms. The main features of the harmonised framework include: (i) the scope of firms to be rated (SMEs, excluding those with large exposures); (ii) methodological requirements for assessing the firms (including with regard to climate change considerations); (iii) strong governance of the systems in line with industry best practices; (iv) detailed monitoring of the systems by NCBs; and (v) robust validation procedures.[8] Furthermore, to ensure that sufficient and harmonised information is available for the credit assessments, only domestic firms with exposures reported to AnaCredit can be rated by an S-ICAS.[9] Guidelines have been established for sharing S-ICAS systems among NCBs, which could be an efficient way to expand the use of S-ICASs across the Eurosystem and to help avoid collateral shortages during crisis situations.

See “Eurosystem credit assessment framework (ECAF)” on the ECB’s website.

See Article 18.1 of the Statute of the European System of Central Banks and of the European Central Bank.

See Auria, L. et al., “Overview of central banks’ in-house credit assessment systems in the euro area”, Occasional Paper Series, No 284, ECB, October 2021.

The general collateral framework is governed by Guideline (EU) 2015/510 of the European Central Bank of 19 December 2014 on the implementation of the Eurosystem monetary policy framework (General Documentation Guideline) (ECB/2014/60) (recast) (OJ L 91, 2.4.2015, p. 3).

See “ECB announces changes to the Eurosystem collateral framework to foster greater harmonisation”, press release, ECB, 29 November 2024; and “Decisions taken by the Governing Council of the ECB (in addition to decisions setting interest rates) – January 2025”, ECB, 31 January 2025.

The temporary collateral framework is governed by Guideline of the European Central Bank of 9 July 2014 on additional temporary measures relating to Eurosystem refinancing operations and eligibility of collateral and amending Guideline ECB/2007/9 (ECB/2014/31) (2014/528/EU) (OJ L 240, 13.8.2014, p. 28).

S-ICASs rely mostly on quantitative approaches, while ICASs incorporate a qualitative assessment by an expert analyst on top of a quantitative approach. S-ICASs are therefore less resource-intensive than ICASs in their daily operations.

For details on best practices on governance and validation, see, for example, the European Banking Authority's Supervisory handbook on the validation of rating systems under the internal ratings based approach (EBA/REP/2023/29).

AnaCredit is a dataset containing detailed information on individual bank loans in the euro area. See Regulation (EU) 2016/867 of the European Central Bank of 18 May 2016 on the collection of granular credit and credit risk data (ECB/2016/13) (OJ L 144, 1.6.2016, p. 44).