- THE ECB BLOG

Rate hikes: How financial knowledge affects people’s reactions

15 August 2024

How quickly do consumers react to rate hikes? The answer depends in part on how much they know about financial matters. This ECB Blog post shows that the better informed they are, the quicker their reaction.

When central banks raise interest rates they aim to dampen demand in the economy, which ultimately helps keep inflation at bay. Consumers are key for that. They make decisions every day: how much to spend on groceries, where to go on vacation, or whether to buy the latest trends in fashion. In this post we focus on another aspect of how people manage their money. When do they think it’s a good time to put money into their savings account – delaying consumption – and when is it a good time to take out a loan – bringing consumption forward in time?

To investigate this question we used the Consumer Expectation Survey (CES), which has approximately 20,000 participants each month. Every month the ECB asks consumers in eleven euro area countries, including Germany, France, Spain and Italy, about their experiences and expectations regarding the economy, inflation, income and labour markets. The CES collects information on perceptions about the optimal timing of financial decisions (such as saving and borrowing) and expectations about interest rates. We distinguished between two separate groups of participants according to their financial literacy. Financial literacy is measured in the CES according to a standardised set of questions developed by Lusardi and Mitchell (2011). The CES asks three multiple-choice questions to help us assess consumers’ understanding of a) interest rate compounding, b) nominal vs. real values and c) portfolio risk diversification. We categorised those respondents with higher scores as “highly financially literate” and the other participants as having “low financial literacy”. We also asked all participants where they expected mortgage and savings rates would be in twelve months. Our last two questions were: “Do you consider now a good time to borrow?” and “Do you consider now a good time to put money into a savings account?”.

A significant change in monetary policy happened during the last two years in which the participants received these questions: The ECB raised its key policy interest rate from -0.5% in July 2022 to 4.0% in September 2023 to fight high inflation. Our survey results show consumers have adjusted their interest rate expectations for mortgages and savings in accordance with this monetary policy tightening. We also found that financial literacy levels have a substantial effect on how quickly consumers adjust and how they think about good timing for borrowing or saving. Households that are more financially literate adjust their savings and borrowing decisions much more quickly and extensively than those that are less financially literate, even though interest rate expectation dynamics are similar across both groups.

How did people respond to the increase in interest rates?

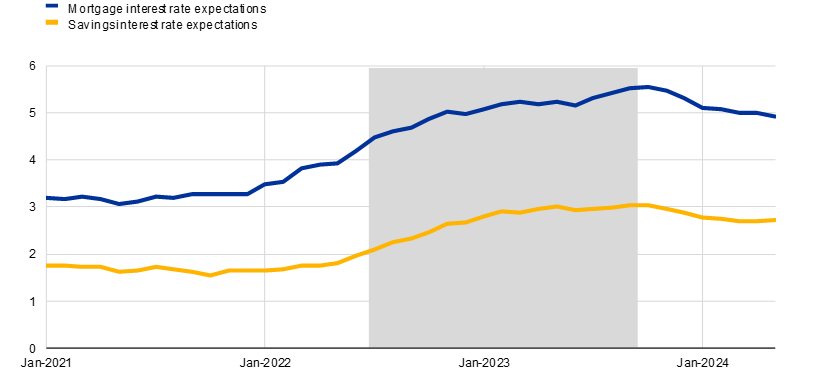

Starting in early 2022, expected interest rates for mortgages and deposits increased substantially in anticipation of, and then alongside, the ECB’s rate policy tightening. Chart 1 shows that consumers adjusted their interest rate expectations for mortgages and savings upwards starting in late 2021, when the ECB announced the end to net asset purchases under its pandemic emergency purchase programme (PEPP). Their expectations about interest rates for mortgages increased from 3.3% in October 2021 to 5.5% in October 2023. Likewise, interest rate expectations for savings increased from 1.6% to 3.1% over the same period. From July 2022 to September 2023 the ECB raised its key interest rates ten times in a row to combat high inflation (grey shaded area). Between October 2023 and June 2024, interest rate expectations for mortgages and savings declined to 4.9% and 2.8%, respectively, in anticipation of monetary policy easing (the ECB cut its key policy rates by 25 basis points in June 2024).

Chart 1

Interest rate expectations over time

Percent

Source: ECB Consumer Expectations Survey (CES).

Notes: Mean interest rate expectations on mortgages and savings. Weighted estimates. Each month the CES asks respondents the following two questions to collect information on their expectations about interest rate for mortgages and savings: a) In 12 months from now, what do you think will be the interest rate on mortgages in the country you are currently living in? b) ) In 12 months from now, what do you think will be the interest rate on savings accounts in the country you are currently living in? The grey shaded area depicts the successive interest rate hiking period, i.e., July 2022- September 2023. Latest observation: May 2024.

Adjusted interest rate expectations also affected overall perceptions of the optimal timing for saving and borrowing. The percentage of all respondents saying that it was a good time to borrow fell from 24% at the beginning of the tightening cycle to 12.7% in October 2023. Over the same period, the percentage saying that it was a good time to put money into a savings account increased from 26.9% to 40.9%. Consumers’ perceptions of good timing therefore partially adjusted following the path of monetary policy.

The importance of financial literacy

There is, however, heterogeneity among consumers depending on their level of financial knowledge. Those with high levels of financial literacy increased their expectations about mortgage and savings rates by 1.2 and 0.8 percentage points, respectively, from July 2022 to September 2023. For the same period, consumers with low levels of financial literacy increased their expectations about mortgage and savings rates by 0.6 and 1.2 percentage points, respectively. So both groups increase their interest rate expectations quite substantially. But when it comes to the perception of what to do and when to do it, we see a larger difference.

Chart 2

Good time to borrow – by financial literacy

Percentage of consumers

Source: ECB Consumer Expectations Survey (CES).

Notes: Weighted estimates. Each month the CES asks respondents if they think now if it is a good time or a bad time to borrow money from a bank on a 5-point scale, i.e., “very bad”, “bad”, “neither good nor bad”, “good” and “very good”. The chart depicts the percentage of consumers answering it is “good” or “very good” to borrow by high and low level of financial literacy. Latest observation: January 2024

Chart 3

Good time to save – by financial literacy

Percentage of consumers

Source: ECB Consumer Expectations Survey (CES).

Notes: Weighted estimates. Each month the CES asks respondents if they think now if it is a good time or a bad time to save money in savings accounts on a 5-point scale, i.e., “very bad”, “bad”, “neither good nor bad”, “good” and “very good”. The chart depicts the percentage of consumers answering it is “good” or “very good” to save by high and low level of financial literacy. Latest observation: January 2024

Charts 2 and 3 show the percentages of respondents with high and low financial literacy that consider it a good time to borrow or to save. Consumers with high levels of financial literacy adjust their perceptions of when to borrow or save more than consumers with low levels of financial literacy, despite the fact that both groups exhibit similar dynamics in terms of interest rate expectations.

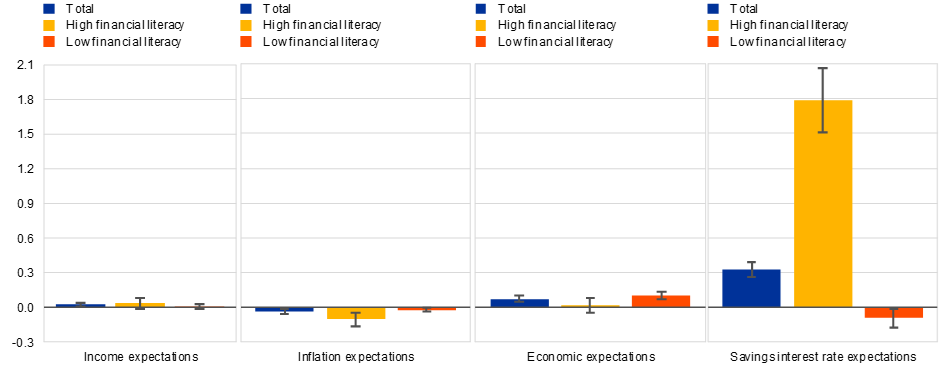

Chart 4 shows that expectations relating to mortgages and savings are by far the highest contributing factor to whether a respondent thinks it is a good time to borrow or save. However, the effect on the total adjustment is mainly driven by the strong response of consumers with a high level of financial literacy, for which the link between their adjusted interest rate expectations (after the tightening) and their responses about whether it is a good time to borrow and save is much stronger. Other expectations have much less of an effect.

Chart 4

Estimated coefficients from a linear probability model

Percentage pointsGood time to borrow

Good time to save

Source: ECB Consumer Expectations Survey (CES).

Notes: Weighted estimates. Panel A shows the estimated coefficients derived from a linear probability regression model in which a household’s individual perception of being a good time to borrow is regressed on its expectations about income growth, inflation, economic growth and interest rates on mortgages over the next 12 months. Panel B shows the estimated coefficients derived from a linear probability regression model in which a household’s individual perception of being a good time to save is regressed on its expectations about income growth, inflation, economic growth and interest rates on savings over the next 12 months. Both models control for individual, wave and country-fixed effects, as well as household income, liquidity, access to credit and financial situation. The reported bands correspond to 95% confidence intervals. Latest observation: January 2024

Conclusion

We find that consumers adjust their interest rate expectations following the path of monetary policy. However, CES data reveal that consumers with a high level of financial literacy adjust their perceptions of whether it is a good borrowing or saving environment more quickly than those with a low level of financial literacy. This is in line with other economic literature which points to the importance of financial literacy in terms of economic outcomes and expectations.[1]

Therefore, the way monetary tightening affects consumers’ actions is not only dependent on information reaching consumers but also on their level of financial literacy. This in turn implies that improving financial literacy could have the potential to support the translation of central bank policies into actions by consumers.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Low financial literacy affects the ability to save; see Lusardi (2008). Lusardi (2013) finds that more financially literate individuals are much less likely to have engaged in high-cost borrowing. Finally, financial literacy has a positive and significant impact on households' individual returns on savings accounts, see Deuflhard, Georgarakos and Inderst (2014)