Bond market liquidity and swap market efficiency – what role does the repo market play?

Published as part of the ECB Economic Bulletin, Issue 1/2020.

This box assesses the relevance of repo markets for bond and swap markets, thereby adding to the discussion on the role of repo markets in the wider financial system. In a repurchase agreement, or “repo”, securities are sold and an agreement is entered into to repurchase them at a later date. Typically, repos are used by market participants to obtain funding using bonds as collateral. They can also be used to source specific securities against cash collateral. Repo markets play a key role in facilitating the flow of cash and securities around the financial system, thereby providing liquidity to other markets. [1] A well-functioning repo market supports the implementation of monetary policy as it propagates interest rate decisions through the financial system. At the same time, turmoil in repo market may spill over to other markets and amplify financial market stress. This box is concerned with the effects of repo market disruptions on bond markets and the interest rate swap market. Given the importance of these markets in the financial system, their proper functioning and the potential for repo market turmoil to affect it matters from both a financial stability and a monetary policy perspective.[2]

The analysis provides empirical evidence that repo market liquidity is an important determinant of bond market liquidity and arbitrage opportunities in swap markets. Repo market liquidity plays a key role in supporting the liquidity of bonds used as collateral in repo transactions. This important link between funding and market liquidity has been discussed since the seminal contribution by Brunnermeier and Pedersen.[3] Repo markets also play an important role in the pricing and hedging of interest rate swaps.[4]

The box investigates the effects of a sudden reduction in repo market liquidity at the end of a quarter on the liquidity of bond markets and arbitrage in swap markets. Repo market liquidity generally falls at quarter or year-ends. This is primarily driven by banks “window-dressing”, i.e. making balance sheet adjustments to improve specific regulatory metrics that they need to report and disclose on these days.[5] As repos typically have a very short maturity (one to five days), they are often used to swiftly adjust the balance sheet of a bank by reducing leverage at quarter and year-ends, affecting the repo markets as transaction volumes drop.[6]

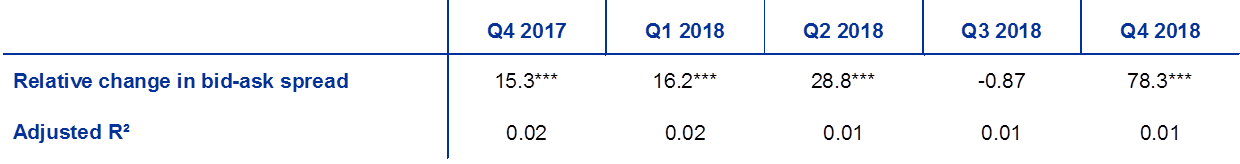

The results of the first exercise show that bond market liquidity – measured by bid-ask spreads – decreases significantly when repo markets are facing a sudden reduction in liquidity. The bid-ask spread is the difference between the bid price and the ask price of a security. It is a measure of transaction costs and tends to decrease when a security is more liquid. Chart A shows that during the last few trading days of 2018 (when repo market liquidity significantly dropped) the bid-ask spread increased significantly for bonds which are used very often as collateral in repo markets and hence are judged to generally benefit from funding liquidity in the repo market (represented by the “treatment group”). Bonds which are very infrequently used as collateral and therefore do not benefit from funding liquidity in the repo market (the “control group”) were not affected and their bid-ask spread remained at the same level.[7] These results are confirmed using an estimated model which measures the difference between the increase in the bid-ask spread for the treatment group and the increase for the control group.[8] Table A shows the regression results for the five quarters considered. The bid-ask spread increase is significantly higher for the treatment group at all quarter-ends, and even more so at year-end.[9]

Chart A

Bid-ask spread of the treatment and control groups at the end of 2018

(percentage points)

Sources: ECB (money market statistical reporting dataset) and Thomson Reuters.

Notes: The y-axis shows the spread between the bid and the ask price. It is calculated for each security and then averaged for the treatment and the control group respectively.

Table A

Effects of lower repo market liquidity on the bid-ask spread per quarter

(basis points)

Source: ECB staff calculations.

Notes: The table shows the result of a difference-in-differences type of regression on bid-ask spreads. The estimated coefficient measures the difference between the increase in the bid-ask spread for the treatment group and the increase for the control group.

*** denotes significance at the 1% level.

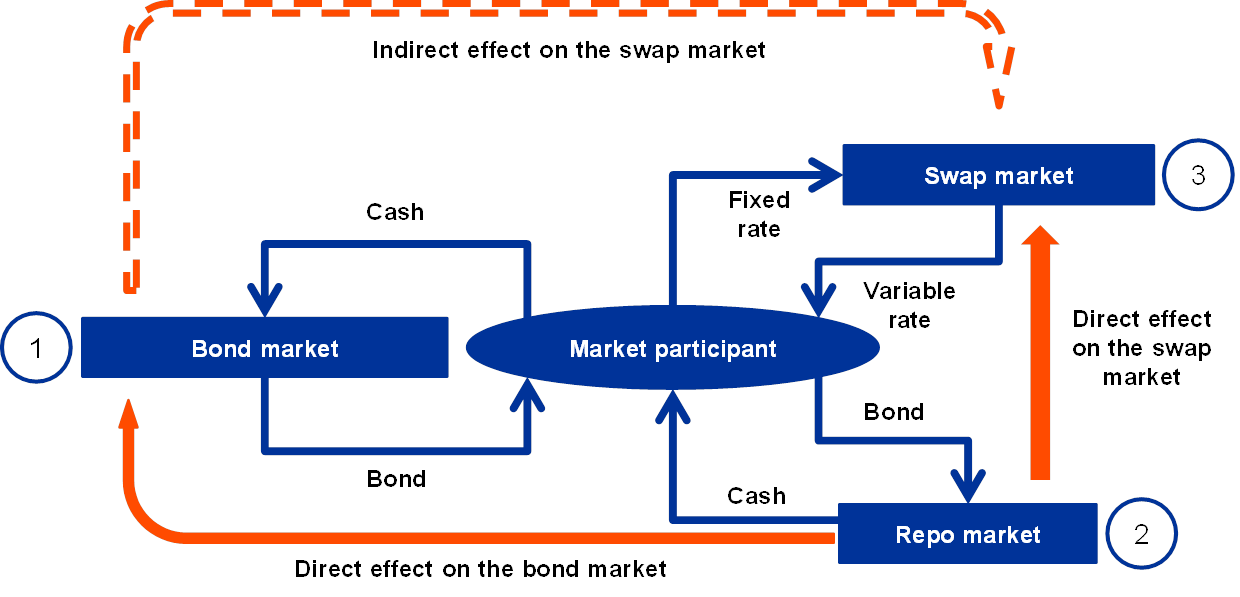

The second exercise looks at the impact of lower repo market liquidity on arbitrage opportunities in swap markets. Figure A depicts the interlinkages of the markets in a transaction where an arbitrage strategy is pursued to exploit a negative swap spread.[10] The market participant first buys a bond in the bond market, funded with liquidity from the repo market,[11] then enters a swap and pays a fixed rate. If, for example, the bond has a yield of 1%, the market participant can enter a swap with the obligation to pay a fixed rate of 0.9% and earn the 0.1 percentage point difference[12] (as a result of which the negative swap spread should ultimately disappear). This arbitrage scheme is, however, only economically viable if market participants can rely on well-functioning repo and bond markets.

Figure A

Stylised illustration of an arbitrage trade for negative swap spreads[13]

Source: ECB staff.

Notes: The diagram depicts a set of arbitrage transactions where a market participant first buys a bond in the bond market and then funds the transaction in the repo market. The market participant then enters a swap, pays a fixed rate and receives a variable rate.

Theory predicts that frictions in the repo markets will result in a decrease in the swap spread. Recent research would predict that a sudden reduction in repo market liquidity at the end of a quarter decreases arbitrage opportunities in swap markets.[14]

Swap traders can be affected by the repo market directly and indirectly. They may be affected directly when they use the repo market to fund a bond transaction, and they may be affected indirectly when the liquidity of the bond market changes as a result of changes in the liquidity of the repo market. Below, the effect on the swap market via the bond market is referred to as the indirect effect, and the effects from the repo market on the bond market are referred to as the direct effect.

The empirical analysis shows that swap spreads decrease significantly, even if they are already negative, when both repo markets and bond markets become less liquid. An estimated model shows that the swap spread for the treatment group decreases by up to 13 basis points relative to the control group, through the direct effect (see Table B). Notably, the indirect effect is more pronounced at some quarter-ends. This shows that a reduction in either repo or bond market liquidity leads to lower swap market efficiency.

Table B

Direct and indirect effects of repo market liquidity shortfalls on the swap spread per quarter

(basis points)

Source: ECB staff calculations

Notes: The table shows the result of a difference-in-differences type of regression on swap spreads. The direct effect measures the effect of repo market liquidity shortfalls on the swap spread, without taking the reaction of the bond market into account. The indirect effect measures the reaction of the swap spreads of the treatment group to bond market bid-ask spreads when repo market liquidity decreases. The coefficients imply that swap spreads decrease particularly when it is difficult to obtain the bond in the bond market and fund it in the repo market.

Controls: the life to maturity, the modified duration, the market value and the spread to a government benchmark of the bond. The regression also includes time fixed effects and bond fixed effects

*, ** and *** reflect significance at the 10%, 5% and 1% levels respectively.

Overall, the analysis presents evidence on the links from repo markets to bond and swap markets. It shows the potential of repo market disruptions to spill over to other markets by increasing volatility of bid-ask spreads in bond markets and limiting the potential for arbitrage in swap markets. From a financial stability perspective, ensuring the resilience and sustainability of repo markets in order to limit the potential for sudden disruptions and the amplification of stress in key markets such as the bond and swap market is therefore a relevant goal for policymakers. The potential for repo market turmoil to spill over to other markets matters also from a monetary policy perspective, as interest rate volatility can impair the transmission mechanism. Finally, the results reinforce the need to implement the recent recommendations of the Basel Committee on Banking Supervision aimed at reducing window-dressing incentives by using quarter averages for the reporting and disclosure of the leverage ratio.[15]

- See “Repo market functioning”, CGFS Papers, No 59, Committee on the Global Financial System, 2017.

- Bond market liquidity plays a crucial role in the conduct of monetary policy and the stability of the financial system. Monitoring bond market liquidity conditions as well as the factors that determine how they are affected by market stress is of vital importance. See “Fixed income market liquidity”, CGFS Papers, No 55, Committee on the Global Financial System, 2016. Swaps represent the largest derivative market in terms of the notional amount of outstanding trades and play an important role in particular for the hedging of interest rate risk. See, e.g., Fontana, S., Holz auf der Heide, Pellizon, L. and Scheicher, M., “The anatomy of the euro area interest rate swap market”, Working Paper Series, No 2242, ECB, Frankfurt am Main, February 2019, for a discussion of the significance of this market.

- See Brunnermeier, M.K. and Pedersen, L.H., “Market Liquidity and Funding Liquidity”, The Review of Financial Studies, Vol. 22, No 6, 2009, pp. 2201-2238 as one of the earliest papers and Huh, Y. and Infante, S., “Bond Market Intermediation and the Role of Repo”, Finance and Economics Discussion Series, 2017-003, Board of Governors of the Federal Reserve System, Washington, 2017 for a more explicit link between repo markets and the bid-ask spread of bonds.

- See e.g. “What is the role of repo in the financial markets”, International Capital Market Association, 2019.

- For example, the reporting and disclosure of the Basel III leverage ratio at quarter-ends and the calculations of banks’ scores in the global systemically important bank (G-SIB) framework at year-end are based on snapshots of balance sheets on a single day. This provides incentives to reduce balance sheets around these dates. See Basel Committee on Banking Supervision, “Statement on leverage ratio window-dressing behaviour”, October 2018, and Behn, M., Mangiante, G, Parisi, L. and Wedow, M., “Behind the scenes of the beauty contest: window dressing and the G-SIB framework”, Working Paper Series, No 2298, ECB, Frankfurt am Main, July 2019.

- See e.g. Grill, M., Jakovicka, J., Lambert, C., Nicoloso, P., Steininger, L. and Wedow, M., “Recent developments in euro area repo markets, regulatory reforms and their impact on repo market functioning”, Financial Stability Review, ECB, Frankfurt am Main, November 2017.

- The treatment and control groups are identified using transaction-level repo data for the 50 largest euro area banks from the ECB’s money market statistical reporting (MMSR) database. For each quarter, the 500 bonds most frequently used as collateral in the repo market are identified as the treatment group. For this set of bonds, the repo market can be considered an important provider of funding liquidity. The control group comprises bonds used so infrequently as collateral that they do not benefit from any funding liquidity provided by the repo market. The dataset contains both general collateral and special collateral trades. All transactions where an International Securities Identification Number (ISIN) is reported for the collateral – the large majority – are considered.

- On the basis of the treatment and control groups defined above, a difference-in-differences estimation technique conditional on propensity score matching is employed. While there are structural differences in the liquidity of the bonds in the two groups, these structural factors are constant over time and the difference-in-differences approach is able to control for the time-invariant factors. The matching procedure ensures that the two groups of bonds are similar before quarter-ends and thus that the results do not reflect systematic differences between them. In particular, bonds are matched on the basis of key characteristics that determine liquidity such as life to maturity, the modified duration, the yield, the market value and the spread to a government benchmark of the bond. The difference-in-differences model also includes time fixed effects and bond fixed effects.

- These results are in line with Munyan, B., Regulatory Arbitrage in Repo Markets, Office of Financial Research Working Paper Series, No 15-22, 2015, where similar effects on the bid-ask spread are found for US agency bonds.

- The swap spread is defined as the difference between the fixed rate of an interest rate swap and the yield of the underlying bond.

- The bond can be pledged as collateral in a repo.

- This is abstracting from counterparty risk, default risk, the hedging costs and transaction costs.

- A more detailed diagram can be found in Boyarchenko, N., Gupta, P., Steele, N. and Yen, J., “Negative Swap Spreads”, Federal Reserve Bank of New York Economic Policy Review, Vol. 24, No 2, October 2018.

- The model presented in Jermann, U., Negative Swap Spreads and Limited Arbitrage, The Review of Financial Studies, Vol. 33, No 1, 2020, incorporating frictions for bond holding and repo financing, would predict that lower liquidity in the repo markets at quarter-ends decreases the arbitrage opportunities in the interest rate swap markets and allows the swap spread to decrease, even into negative territory (see also the references in that paper). Similarly, Boyarchenko, N. et al., op. cit. examines in detail how much swap spreads would need to decrease before a bond-swap trade to arbitrage away negative swap spreads becomes profitable.

- See “Revisions to leverage ratio disclosure requirements”, Basel Committee on Banking Supervision, June 2019.