- ECB publishes new report on “Card payments in Europe – a renewed focus on SEPA for cards”

- Card usage and card-spending statistics underline the large growth potential for card payments in all EU countries, and particularly in central and south-eastern Europe

- Market participants need to put efforts into establishing a competitive card processing market as well as developing and subsequently implementing technical standards

Following the near completion of the migration of the first two payment instruments, credit transfers (CTs) and direct debits (DDs), to the Single Euro Payments Area (SEPA), the Eurosystem is now turning its attention to the harmonisation of the largest electronic retail payment instrument: card payments. A new and comprehensive report entitled “Card payments in Europe – a renewed focus on SEPA for cards”, prepared by the European Central Bank (ECB), explains the basic concepts, provides aggregate statistics at the European Union (EU) level, and presents the Eurosystem’s views and policies on SEPA for cards. The ultimate aim of SEPA for cards is a harmonised, competitive and innovative European card payments area.

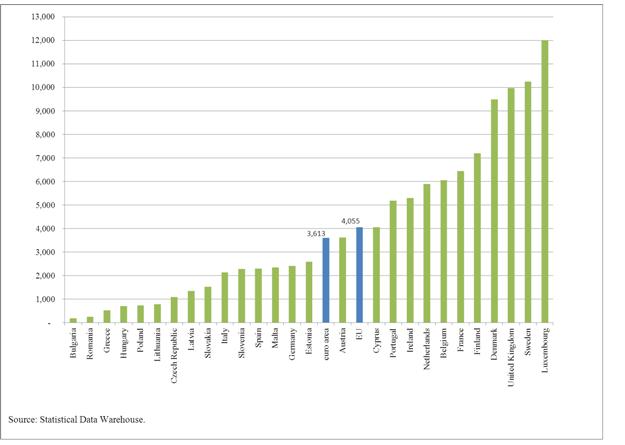

Card payments are the most frequently used and fastest-growing retail payment instrument in Europe. While in 2000, the three instruments (cards, CTs and DDs) were almost equal in volume, with each amounting to around 13 billion transactions per year, in 2012 there were 40 billion card payments, around 26 billion CTs and 23 billion DDs (see Chart 1). Moreover, the number of card payments per capita continues to increase in each and every EU country.

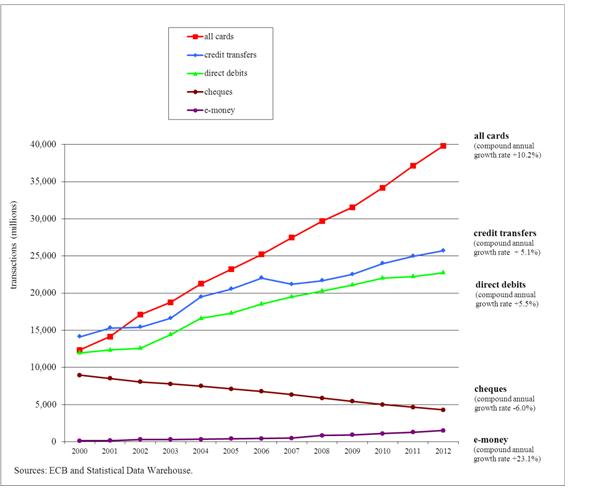

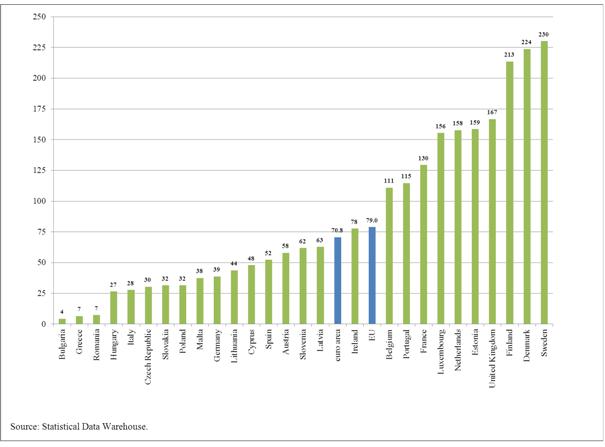

The report further shows that card usage in the EU is still below its potential, despite being efficient, safe and reliable, and that a number of factors point to a significant potential for growth. The number of card payments per inhabitant per year shows wide discrepancies: the average Swede makes 230 card payments per year, while Bulgarians, Romanians and Greeks make less than 10 (see Chart 2). Portuguese consumers spend more than twice as much per year (€5,200) using their cards than Spaniards (€2,300) and Italians (€2,100) (see Chart 3). In general, the use of card payments in most central and south-eastern European countries is extremely low, showing a significant potential for growth. However, even a card-minded country such as France would need to increase its number of card payments by 72% in order to catch up with the three leading countries.

“SEPA for cards is the next logical step in European retail payments integration”, says Yves Mersch, Member of the Executive Board of the ECB. “The euro banknotes and coins in everyone’s wallets are the same in the whole euro area. Very soon, credit transfers and direct debits in euro will follow the same schemes throughout Europe. Now it’s time to further harmonise and integrate card payments.”

Studies show that countries that make a higher number of card and other electronic retail payments incur significantly lower social costs for their retail payment services as a percentage of GDP. An ECB report has shown that the social costs of making retail payments amount to 1% of GDP, which equates to around €130 billion per year for the whole of the EU. It is a considerable, yet largely invisible, operational cost for the economic machinery. Promoting the use of efficient retail payment services is a key objective for the ECB and the national central banks of the Eurosystem and it can provide concrete economic benefits.

“It’s difficult to believe, but to this day, consumers and merchants, but also banks and other payment service providers, still encounter obstacles or experience geographical differences that stem from before the introduction of the euro when making and accepting card payments”, says Mr Mersch.

Eurosystem’s objectives for SEPA for cards

SEPA for cards aims at harmonising the principles, business practices and rules, as well as the technical standards relating to card payments. In this respect, the ECB has welcomed both the proposed regulation on interchange fees for card-based payment transactions and the proposed directive on payment services in the internal market, as the regulation confirms a key principle of SEPA for cards – the separation of the card scheme from the processing – and both the regulation and the directive address several obstacles to integration stemming from the current business practices and rules.

Market participants and other stakeholders will still need to play an active role in this venture, in particular in defining high-level principles for the European cards market, in the creation of a competitive card processing market and in the development and implementation of technical standards. The Eurosystem will continue to provide guidance and facilitate cooperation in this respect.

Chart 1: Use of payment instruments in the EU (2000-12)

Chart 2: Number of card payments per inhabitant and per year (2012)

Chart 3: Total value (in euro) of card payments per inhabitant and per year (2012)