Published as part of the ECB Economic Bulletin, Issue 2/2024.

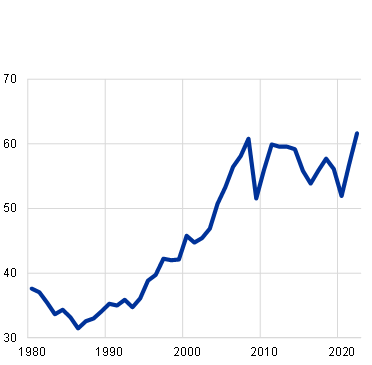

Rising trade tensions and a spate of policies aiming to bring national security concerns to bear in trade relations have sparked growing concern about the potential implications of geo-economic fragmentation.[1] Since the global financial crisis, trade has been growing more slowly than GDP, ushering in an era of “slowbalisation” (Chart A, panel a).[2] This process has been attributed, among other factors, to: diminishing marginal benefits of global value chain integration, a structural shift in demand from manufacturing to services, and weakening political support for open trade. Indeed, a surge in trade restriction measures has been evident in recent years.[3] Concerns about trade resilience and national security have been heightened in the wake of Russia's invasion of Ukraine, with growing debate about the need for protectionism, near-shoring, or friend-shoring. Some recent industrial policies contain provisions that aim at providing incentives to domestic producers, especially those in technologically advanced sectors – possibly to the detriment of foreign producers. At the same time, model-based assessments illustrate that restrictions on trade in intermediate inputs between countries belonging to opposing geopolitical blocs could entail sizeable economic costs in terms of lower trade and welfare as well as higher prices.[4]

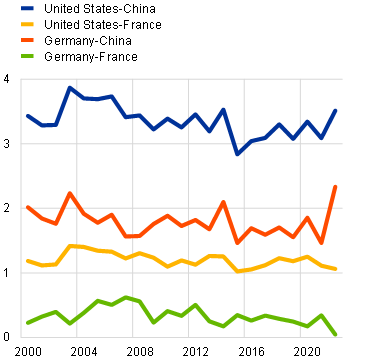

Chart A

Evolution of world trade and geopolitical distance between selected country pairs

a) World trade | b) Geopolitical distance |

|---|---|

(percentage of global GDP) | (index, ideal point distance) |

|

|

Sources: World Bank – World Development Indicators, Bailey et al. (2017).

Notes: Panel a): trade is measured as the sum of imports and exports, the latest observation is for 2022. Panel b): the ideal point distance measures countries’ observable behaviour on foreign policy issues, such as disagreements in their voting behaviour in the UN General Assembly. Higher values mean greater geopolitical distance. See Bailey et al. (2017), the latest observation is for 2022.

With so far only limited available empirical evidence that geopolitical concerns are already materially affecting trade patterns, this box investigates the role played by geopolitical tensions in shaping international trade over the last decade. The analysis uses a structural gravity model to assess the effect of geopolitical distance on international trade patterns. Trade gravity models assume that the level of trade between two countries is determined by their economic mass and relative trade frictions, which can be a function of both tariff and non-tariff barriers to trade.[5] Typically, non-tariff barriers are proxied by geographical distance between countries and other features that might promote or hinder trade between countries, such as a common language or trade agreements. In addition to these non-tariff variables, which are standard in the literature, this analysis introduces a proxy for the role of geopolitics. The analysis focuses on manufacturing goods and thus excludes energy products and trade in services.

A standard gravity model of international trade is augmented to include a measure of geopolitical distance. This variable, available over time and for country pairs, measures countries’ foreign policy misalignment, based on their voting patterns in the UN General Assembly. It does so by transforming the observed voting behaviours of countries into a bilateral geopolitical distance measure which reflects the average disagreement between any two countries in the UN General Assembly.[6] As an illustration, Chart A, panel b) plots the evolution over time of the geopolitical distance between four country pairs: United States-China, United States-France, Germany-China and Germany-France. This chart shows a consistently higher distance from China for both the United States and Germany, as well as a further increase in that distance over recent years.

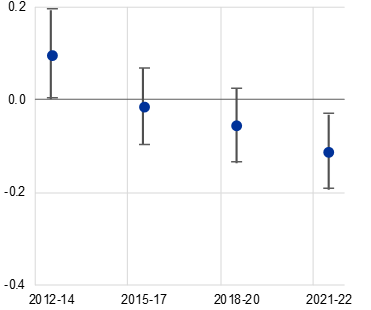

Geopolitical distance is found to play an increasingly important role in determining global trade flows (Chart B, panel a). The estimated elasticity of trade to geopolitical distance turns negative and significant from 2018 onwards, broadly at the time that trade disputes between the United States and China intensified.[7] The impact of geopolitical distance is economically significant: as an example, a 10% increase in geopolitical distance is found to decrease bilateral trade flows by about 2%, or about a tenth of the trade effect that can be attributed to a free trade agreement. The results are not exclusively driven by US trade patterns, as the estimates remain significant when excluding the United States from the sample (Chart B, panel b).

Chart B

Time-varying effect of geopolitical distance on bilateral trade flows

a) Effect on bilateral trade | b) Effect on bilateral trade excluding the United States |

|---|---|

(elasticities of trade to geopolitical distance, percentages) | (elasticities of trade to geopolitical distance, percentages) |

|

|

Sources: Trade Data Monitor (TDM), IMF, Bailey et al. (2017), World Integrated Trade Solution (WITS), Eurostat and ECB calculations.

Notes: Dots represent the coefficient of geopolitical distance interacted with a time dummy, using three-year averages of data, and based on a gravity model estimated for 67 countries from 2012 to 2022. Geopolitical distance is measured by the logarithm of the ideal point distance proposed by Bailey et al. (2017). The whiskers represent 95% confidence bands. The dependent variable is nominal trade in manufacturing goods, excluding energy. Estimation is performed using the Poisson pseudo-maximum likelihood (PPML) estimator. The estimation accounts for bilateral time-varying controls, exporter/importer-year fixed effects and pair fixed effects. Standard errors are clustered by country pair and year. Estimations in panel b) are based on a sample of 66 countries, since the United States is excluded.

Geopolitics appears to have a heterogeneous impact on trade patterns. To understand the heterogeneity in the impact of geopolitics, bilateral trade flows are regressed on a set of four dummy variables that identify the four quartiles of the distribution of geopolitical distance across country pairs. In addition, to capture the effect of growing geopolitical tensions over time, each quartile dummy is interacted with a time dummy that equals one in the post-2017 period. Geopolitics has boosted trade among “friends” (i.e. the first quartile) in the post-2017 period. By contrast, it has hampered trade among “rivals” (i.e. fourth quartile; Chart C, panel a). Trade between “rivals” is about 4% lower than it would have been if geopolitical tensions had not increased after 2017, while trade between “friends” is around 6% higher. Overall, while geopolitics reduces trade between geopolitically distant countries it may also strengthen trade links between geopolitically aligned countries.

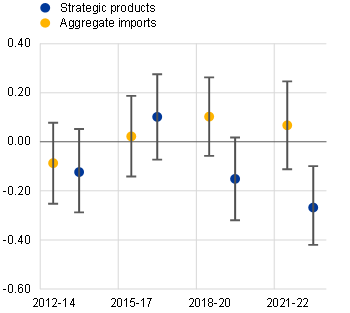

Chart C

Effect of geopolitical distance on country groups and on EU imports

a) Effect on country groups since 2017 | b) Effect on EU imports |

|---|---|

(semi-elasticity of trade to country group) | (elasticity of trade to geopolitical distance) |

|

|

Sources: TDM, IMF, Bailey et al. (2017), Egger and Larch (2008), WITS, Eurostat, European Commission and ECB calculations.

Notes: Results based on a structural gravity model, estimated for 67 countries for the period 2012-22 using annual data. Please refer to Chart B for details on the estimation. Panel a): the effects on each group are identified based on a dummy for quartiles of the distribution of geopolitical distance across country pairs. The dummy becomes 1 in the case of trade between country pairs belonging to the same quartile since 2017. A semi-elasticity β corresponds to a percentage change of 100*(exp(β)-1). Panel b): dots represent the coefficient of geopolitical distance interacted with a time dummy and with a dummy for EU imports, using three-year averages of data. Yellow dots refer to estimates based on bilateral trade as the dependent variable. Blue dots refer to estimates based on bilateral trade in strategic products, defined by the European Commission. The lines represent 95% confidence bands.

There is limited evidence of significant near-shoring or friend-shoring trends in EU aggregate imports. Within the same gravity model, the impact of time-varying effects of geopolitical distance for the EU is isolated by interacting geopolitical distance with a dummy for EU imports. The estimation controls for effects relative to the impact of EU trade integration across countries. It is found that EU imports of manufacturing goods are not significantly affected by geopolitics (Chart C, panel b). This result is robust to alternative specifications and may reflect the EU’s high degree of global supply chain integration, the fact that production structures are highly inflexible to changes in prices, at least in the short-term, and that such rigidities increase when countries are deeply integrated into global supply chains.[8]

Nonetheless, there is evidence of de-risking in the EU in strategic sectors. Strategic goods (military equipment, raw materials, battery packs, high-tech and medical goods, etc.) represent around 9% of total extra-EU imports and are particularly relevant for areas such as security, public health, and the green and digital transition. When trade in strategic products, as defined by the European Commission, is used as the dependent variable, geopolitical distance is found to significantly reduce EU imports (Chart C, panel b). The empirical evidence suggests that the EU is selectively decoupling by reducing its dependency on geopolitically distant suppliers in strategic sectors.

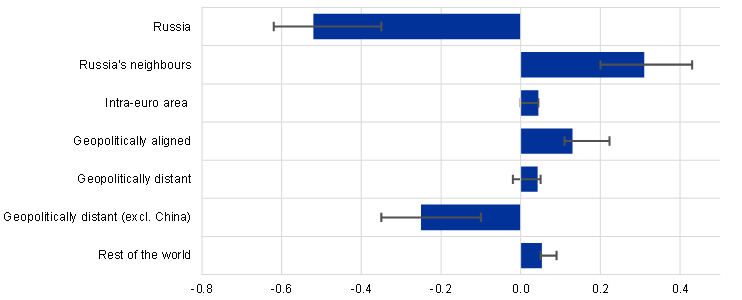

The reorientation of euro area exports toward geopolitically aligned countries has been accelerated by Russia’s invasion of Ukraine. An event analysis suggests that Russia’s invasion of Ukraine has resulted in a reduction of euro area exports to Russia by more than half (Chart D). At the same time, trade flows to Russia’s neighbours have picked up, possibly due to a re-ordering of supply chains. Euro area trade with geopolitically aligned countries is estimated to have been about 13% higher following the war compared with the counterfactual scenario of no war, mostly driven by the increase in trade with the United States. At the same time, there is moderate evidence of near-shoring, as the level of intra-euro area trade is estimated to have risen by around 4% in response to Russia’s invasion of Ukraine relative to the counterfactual scenario. Yet there are no signs of trade reorientation away from China, possibly reflecting China’s market power in a number of key industries. However, when China is dropped from the group of geopolitically distant countries, the impact of Russia’s invasion of Ukraine on euro area exports becomes strongly significant and negative.

Chart D

Effect of Russia’s invasion of Ukraine on euro area exports

(semi-elasticity)

Sources: TDM, IMF, UN, Eurostat and ECB calculations.

Notes: Estimated coefficients of a gravity model, quarterly data for 2012-22. The sample includes 67 exporters and 118 importers. Effects on the level of euro area exports are identified by a dummy variable for dates after Russia’s invasion of Ukraine. Trading partners are Russia; Russia’s neighbours Armenia, Kazakhstan, the Kyrgyz Republic and Georgia; geopolitical friends, distant and neutral countries are respectively those countries that voted against or in favour of Russia or abstained at both fundamental UN resolutions, 7 April and 11 October 2022. Intra-euro area trade is also included. Estimation performed using Poisson pseudo-maximum likelihood (PPML). The estimation accounts for bilateral time-varying controls, exporter/importer-time fixed effects and exporter-importer fixed effects. Standard errors are clustered by country pair and time. The bars represent average effects for significant coefficients. The whiskers represent minimum and maximum coefficients estimated across several robustness checks.

See, for example, Aiyar, S., Chen, J., Ebeke, C. H., Garcia-Saltos, R., Gudmundsson, T., Ilyina, A. and Trevino, J. P. (2023), “Geoeconomic Fragmentation and the Future of Multilateralism”, Staff Discussion Notes, No 2023/001, International Monetary Fund, Washington, DC.

See Antràs, P. (2021), “De-globalisation? Global Value Chains in the Post-COVID-19 Age”, in Central Banks in a Shifting World: Conference Proceedings – ECB Forum.

See ICC (2023), “ICC 2023 Trade Report: A fragmenting world”, International Chamber of Commerce.

See Attinasi, M. G., Boeckelmann, L., and Meunier, B. (2023), “The economic costs of supply chain decoupling”, Working Paper Series, ECB, No 2023/2389.

See Anderson, J. and Van Wincoop, E. (2003), “Gravity with Gravitas: A Solution to the Border Puzzle”, American Economic Review, Vol. 93(1), pp. 170-192.

See Bailey, M.A., Strezhnev, A. and Voeten, E. (2017), “Estimating Dynamic State Preferences from United Nations Voting Data”, Journal of Conflict Resolution, Vol. 61(2), pp. 430-456.

These results are robust to all global shocks, such as the COVID-19 pandemic, due to the inclusion of time-varying border effects in trade costs, which controls for all global unobservable factors affecting international trade as compared with domestic trade (see Beverelli, C., Keck, A., Larch, M., and Yotov, Y. V. (2023), “Institutions, trade, and development: identifying the impact of country-specific characteristics on international trade”, Oxford Economic Papers).

See for example Bayoumi, T., Barkema, J. and Cerdeiro, D. (2019), “The Inflexible Structure of Global Supply Chains”, IMF Working Papers, No 2019/193. International Monetary Fund.