Goodbye EONIA, welcome €STR!

Published as part of the ECB Economic Bulletin, Issue 7/2019.

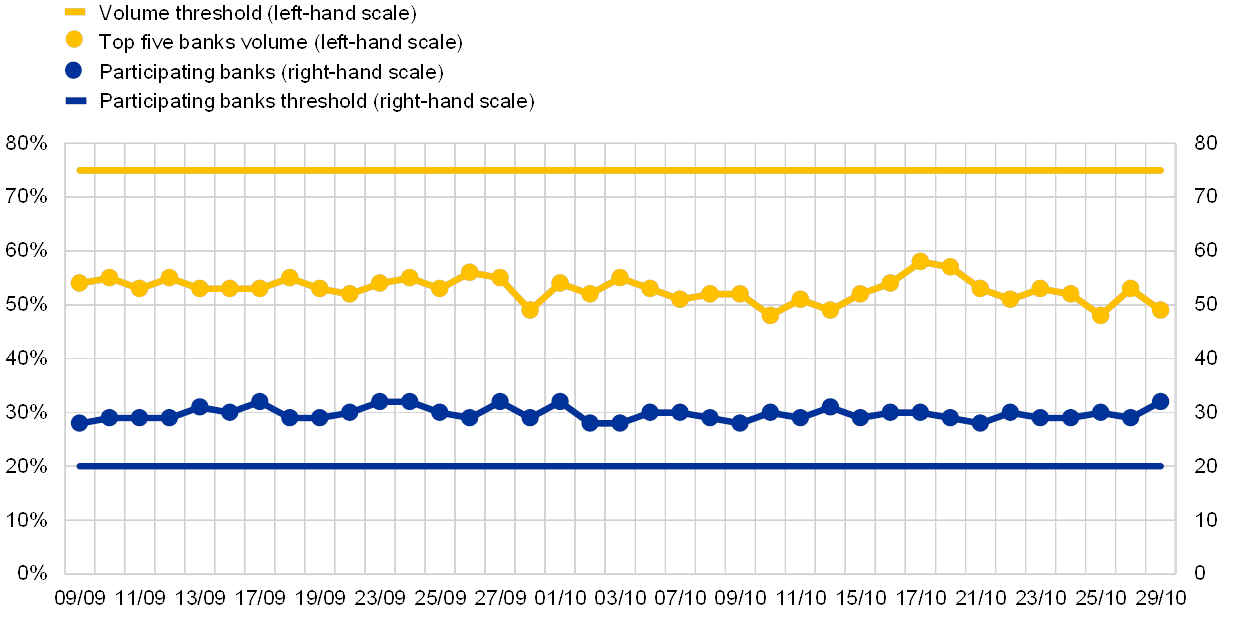

On 2 October 2019, the ECB began publishing the new overnight unsecured benchmark rate for the euro area, the euro short-term rate or €STR. The rate is computed entirely based on transactions in euro with financial counterparties as reported under the Money Market Statistical Reporting (MMSR) Regulation (Regulation (EU) No 1333/2014) and reflects the wholesale euro unsecured borrowing costs of euro area banks[1], in contrast to EONIA that measured interbank lending. The rate is published on each TARGET2 business day at 08:00 CET and is based on transactions conducted and settled on the previous TARGET2 business day. A data sufficiency policy ensures that the rate is representative by requiring that (a) at least 20 of the banks currently reporting under the MMSR Regulation should submit contributions and (b) the five largest reporting agents should not report more than 75% of a given day’s turnover.

On 2 October 2019, following the recommendations of a private sector working group[2] and a public consultation, the administrator of EONIA, the European Money Markets Institute, changed the EONIA methodology so that, until its discontinuation on 3 January 2022, it is determined as a fixed spread of 8.5 basis points over the €STR. This effectively puts an end to a 20-year period in which EONIA was the reference for short-term interest rates for the euro area.

The launch of the €STR was successful from both a technical and a market perspective. The launch of the new reference rate and the change to the EONIA methodology had been well communicated to and anticipated by the financial industry, resulting in no serious disruptions. For example, internal systems were adjusted to take into account the new timing for publishing the reference rate (in the morning of the day following the reference date). Moreover, the first transactions indexed to the €STR in the over-the-counter swap market took place, as did the first securities issuances.

The process for producing the €STR on a daily basis has worked smoothly and reliably thanks to the commitment of the entire Eurosystem and the banks reporting under the MMSR Regulation. Moreover, the €STR methodology has shown its reliability, as illustrated by two examples. First, the pass-through of the ECB’s deposit facility rate cut on 18 September was full and immediate, as shown by pre-€STR data, and since 1 October the rate and distribution of the underlying transactions at the 25th and 75th percentiles have remained fairly stable, with volumes ranging between €29 billion and €35 billion (see Chart A). Second, the bank holiday in Germany on 3 October 2019 had a negligible impact on the rate and its various metrics. While the volume declined by €4.3 billion on that day compared with the day before, a comfortable gap remained between the participation and concentration metrics and the contingency thresholds that define the data sufficiency policy as explained in paragraph one (see Chart B).

Chart A

€STR since 9 September 2019

(left-hand scale: EUR billions; right-hand scale: basis points)

Source: ECB.

Note: Pre-€STR until 30 September, €STR from 1 October onwards.

Chart B

€STR contingency metrics since 9 September 2019

(left-hand scale: percentages; right-hand scale: number of banks)

Source: ECB.

Note: Pre-€STR until 30 September, €STR from 1 October onwards.

- For more information on the €STR and the statement of methodology, see the ECB’s website.

- For information on the working group on euro risk-free rates, see the ECB’s website.