Is taxpayers’ money better protected now? An assessment of banking regulatory reforms ten years after the global financial crisis

This study analyses whether the ability of the euro area banking system to withstand potential shocks while minimising taxpayers’ costs has changed in the ten years since the financial crisis as a consequence of the impact of post-crisis reforms on bank capital and loss-absorbing capacity. The results show that the average probability of default of banks decreased from 3.5% in 2007 to 1.1% in 2017, less than a third of its pre-crisis value. In addition, under conservative assumptions on the scope of liabilities affected by the bail-in tool, banks’ loss-absorbing capacity has increased from 7.2% to 12.0% of total assets owing to the introduction of larger capital buffers and the new resolution framework, which enhances banks’ loss-absorbing capacity via the bail-in tool. Finally, the potential intervention of the Single Resolution Fund has further increased the loss-absorbing capacity of the system to 16.9% of total assets. Considering all these three factors, the ability of the banking system to absorb losses while minimising costs to taxpayers has increased more than 3-fold over the last ten years. When considering a broader scope for the bail-in tool, the system’s loss-absorbing capacity has increased to 55.5% of total assets, which corresponds to an overall 12-fold increase in its ability to absorb losses while minimising taxpayers’ costs.

1 Introduction

This paper compares the ability of euro area banks to absorb potential shocks before the 2008 global financial crisis and ten years later, taking into account the impact of post-crisis reforms on bank capital and loss-absorbing capacity, including the new, post-crisis resolution framework. Banking and financial crises can be costly and disruptive for the financial sector and the real economy; they may also entail costs to taxpayers and a heavy burden on public finances, which may in turn cause or exacerbate problems for sovereigns. The ability of the banking sector to absorb losses while avoiding costs for taxpayers, which is the focus of this paper, is of the essence to avoid these risks.

Much has changed in the banking system since the global financial crisis. Large banks around the globe have more than doubled their risk-based capital ratios and doubled their leverage ratios – primarily by retaining earnings – since 2009.[1] The ratio of aggregate core capital to risk-weighted assets (RWA) of euro area banks was approximately 14% in the second quarter of 2018 – twice its 2007 value.[2] The new post-crisis resolution framework further increases banks’ loss-absorbing capacity by requiring them to hold liabilities that can be used to absorb losses and recapitalise resolved banks via the new bail-in tool. In the euro area in 2017, this stock of liabilities was equal overall to 33.8% of banks’ total risk exposure amounts, more than double the banks’ loss-absorbing capacity available via core capital alone.[3]

These figures offer an overall indication of the increase in banks’ resilience from a system-wide perspective. The quantitative analysis in this paper provides evidence on the increase in the system’s loss-absorbing capacity for a sample of euro area banks by conducting granular bank-by-bank simulations.

The analysis shows that the ability of the euro area banking system to absorb losses while minimising costs to taxpayers has increased between 3.5 and 12-fold over the last ten years, depending on the assumptions on the bail-in tool. This is the result of (i) a significant reduction in the average probability of default of banks from 3.5% in 2007 to 1.1% in 2017, less than a third of its pre-crisis value; (ii) an increase in banks’ loss-absorbing capacity from 7.2% to between 12.0% and 50.6% of total assets, owing to the introduction of larger capital buffers and the new resolution framework, which enhances banks’ loss-absorbing capacity via the bail-in tool; and (iii) the potential intervention of the Single Resolution Fund (SRF), which further enhances the loss-absorbing capacity of the system by 4.9% of total assets.

2 Methodology, data and assumptions

The analysis compares the impact of simulated losses on the loss-absorbing capacity of the euro area banking system under the pre-crisis and post-crisis regulatory frameworks. The objective is to capture the impact of higher capital held by banks (resulting both from mandatory buffers introduced by the Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD IV)[4] and from voluntary buffers), of the Bank Recovery and Resolution Directive (BRRD)[5] and of the Single Resolution Mechanism (SRM) Regulation (including the bail-in tool and the SRF)[6] on banks’ ability to absorb losses, compared to the pre-crisis framework. The CRR and CRD IV increased not only the quantity but also the quality of the required capital, which further strengthens the resilience of the system. However, this analysis does not take into account the increase in the quality of capital, since, for the sake of simplicity, it assumes that CET1, Additional Tier 1 and Tier 2 capital are equally loss-absorbing.

In line with the objectives of the BRRD and SRM Regulation, the aim of this study is to focus on the loss-absorbing capacity of the banking system while minimising costs to taxpayers, rather than costs to banks’ creditors. Accordingly, the focus is on the ability of the banking system to absorb losses while minimising the impact on public finances due to extraordinary government support.[7]

First, we compare the system’s loss-absorbing capacity (SLAC) (i.e. capital and, where applicable, bail-inable liabilities and the contribution of the SRF and, in the case of liquidation, all uncovered and non-secured liabilities) in 2007 and 2017, normalising the amounts by total assets (TA) (eq. 1) and risk-weighted assets (RWA) (eq. 2).

(1)

(2)

Second, we subject banks to simulated losses (SL) to see how well they can be absorbed by the banks’ available loss-absorbing liabilities. We do so by calculating loss-absorbing score (LAS) for each of the two periods. The LAS is obtained as the ratio of the SLAC to the SL (eq. 3).

(3)

Third, we quantify the amount of (i) outstanding losses remaining once the SLAC has been exhausted (leftover losses, LL), and (ii) the amount of resources needed for banks to continue to meet their minimum required capital (MRC) following the simulated loss event (recapitalisation needs, RN). As a result of the loss-absorbing process, three broad scenarios can occur:

- The difference between a bank’s loss absorbing capacity (LAC) and the SL is higher than its MRC. The bank is able to absorb all losses without breaching the minimum requirements on capital, and thus its LL and RN are equal to zero (LL=0, RN=0).

- The difference between a bank’s LAC and the SL is higher than zero but lower than the MRC. The bank is able to absorb all losses (LL=0), but needs to restore some capital to meet the minimum requirements, so its RN would be positive (RN=MRC-(LAC-SL)).

- The SL exceed the bank’s LAC. The bank has leftover losses (LL=SL-LAC), and also needs to restore its capital to meet the minimum requirements (RN=MRC).

Please note that the results above apply only to banks which are not liquidated. For liquidated banks, the recapitalisation needs are zero in all cases, while their loss-absorbing capacity is equal to their entire liabilities excluding covered deposits and secured liabilities. Sections 2.3 and 2.4 describe in detail the process for obtaining leftover losses and recapitalisation needs applicable in 2007 and 2017.

Once the leftover losses and recapitalisation needs are calculated, we focus on their evolution across the two periods, first as absolute amounts (eq. 4), and then as a percentage of simulated losses (eq. 5), for each bank i in the sample:

(4)

(5)

We also decompose equation 5 to show the individual evolution of leftover losses (eq. 6) and recapitalisation needs (eq. 7):

(6)

(7)

2.1 Data and sample

We use Bankscope to source yearly data on banks’ balance sheets, the ECB Statistical Data Warehouse to source yearly data on country-specific variables (macroeconomic and banking-sector specific data), data from the European Commission to identify banks that received state aid and the COREP-NSFR dataset for data on MREL-eligible and additional bail-inable liabilities for significant institutions (SIs) as at end-2017.

We start with the estimation of banks’ probability of default (PD), which is then used to calculate simulated losses. The sample for the PD estimation covers the period 2000-15 and includes approximately 2,900 euro area banks.

The analysis focuses on a subsample of euro area banks for which data are available for both 2007 and 2017. This prevents changes in the loss-absorbing capacity being driven (or biased) by different bank samples.[8] The final sample includes 171 banks representing 60% of the euro area’s banking system in terms of total assets. 67 banks in the sample are SIs, whose total assets account for 53% of the total assets of euro area banks.

2.2 PD estimation and simulation of losses

First, we derive banks’ default probabilities as at year-end 2007 and year-end 2017. We use a panel logit model to estimate the PD for the sample of banks discussed in Section 2.1 and for the time period 2000-15. Following Lang (2015) and Lang et al. (2018)[9], the dependent variable is a dummy that is set equal to 1 when a bank is considered in default/distress if at least one of the following conditions holds: (i) its Bankscope status is one of “bankruptcy”, “dissolved” or “in liquidation”; (ii) it has negative capital; (iii) it has been involved in a distressed merger; and (iv) it has received state aid.[10]

The independent variables used to estimate the model can be classified into (1) bank-specific, (2) banking-sector specific and (3) country-specific variables as follows:

- tangible equity over total assets (TA), reserves for NPLs over TA, interest expenses over total liabilities (TL), pre-tax income over TA, short-term investments over TL;

- financial assets over GDP, loans over deposits, issued debt over TL, annual change of issue debt over TL;

- house price index, annual change of interest rates on ten-year government bonds.

The confidence intervals associated with the estimated coefficients of the dependent variables are used to obtain a minimum and a maximum PD value for each bank, which are used (together with the estimated coefficients) to parametrise a truncated Gaussian distribution, from which we sample 1,000 outcomes to simulate the PD for each bank in 2007 and 2017.

After estimating the PDs, we calculate simulated losses for each bank i as a function of its PD, loss given default (LGD) and total assets (TA):

(8)

To obtain a continuous distribution of losses rather than a single value, for each bank we sample 1,000 values from the PD distribution. We then exogenously set ten values of LGD between 5% and 100% and obtain 10,000 data points on losses for each bank.

2.3 Loss-absorbing process for end-2007

We reflect the bank capital rules for end-2007 with the requirement that total capital (Tier 1 and Tier 2 capital) is at least 8% of RWA and that Tier 1 capital is at least 4% of RWA. Therefore, the loss-absorbing liabilities in 2007 are assumed to be equal to the total capital held by the bank.

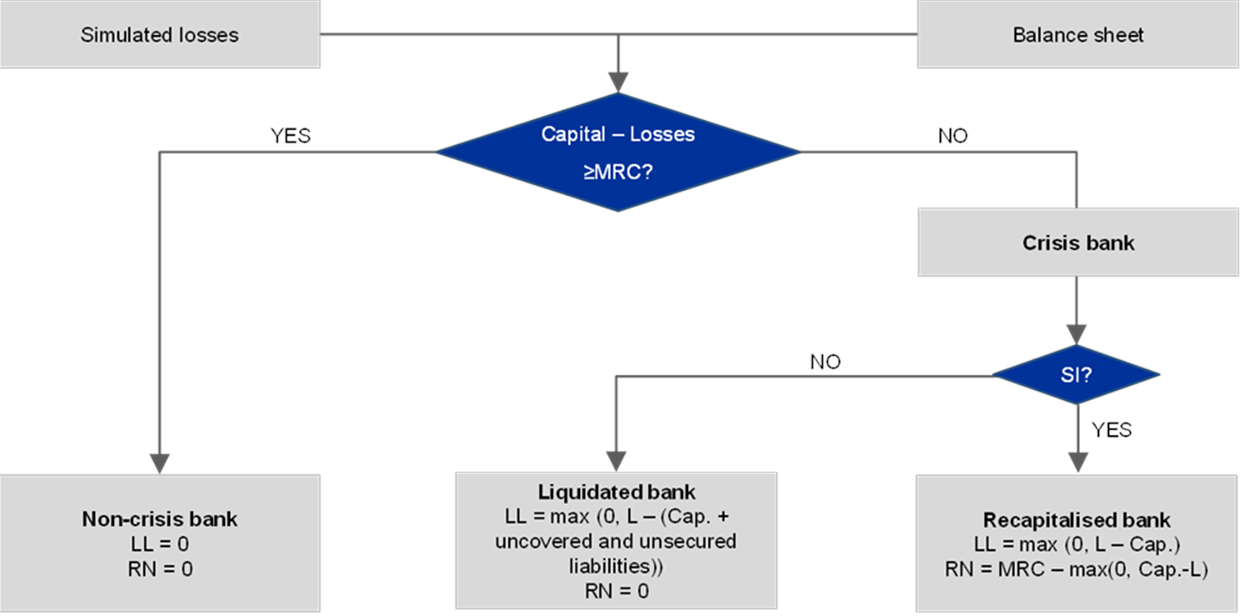

Figure 1 outlines the steps used to obtain the leftover losses and recapitalisation needs amounts in 2007.

Figure 1

Loss-absorbing process for 2007

Source: ECB staff, based on 2007 regulatory framework.

Notes: non-crisis banks are able to absorb losses while still meeting their minimum requirements. Less significant institutions (LSIs) are liquidated if they breach minimum requirements, while significant institutions (SIs) breaching minimum requirements are classified as crisis banks and are assumed not to be liquidated but to be recapitalised after loss absorption. Minimum requirements include the condition on Tier1 capital (at least 4% relative to RWA) and on total capital (at least 8% relative to RWA).

Following a loss event, if a bank is able to absorb all losses while still meeting its minimum requirements, it is considered a non-crisis bank and both its leftover losses and its recapitalisation needs are equal to zero. If a bank is not able to absorb all losses while still meeting its minimum requirements, the bank is defined as a crisis bank. To calculate leftover losses and recapitalisation needs, the outcome differs between SIs and LSIs.[11] For SIs, which we assume are not liquidated, leftover losses are the amount of losses that are left after all of the bank’s capital has been used[12] and their recapitalisation needs are equal to their minimum capital requirements minus the capital left (if any) after losses are incurred. Crisis LSIs are assumed to be liquidated and therefore their recapitalisation needs are always equal to zero and their leftover losses are equal to losses minus capital and uncovered and unsecured liabilities.

2.4 Loss-absorbing process for end-2017

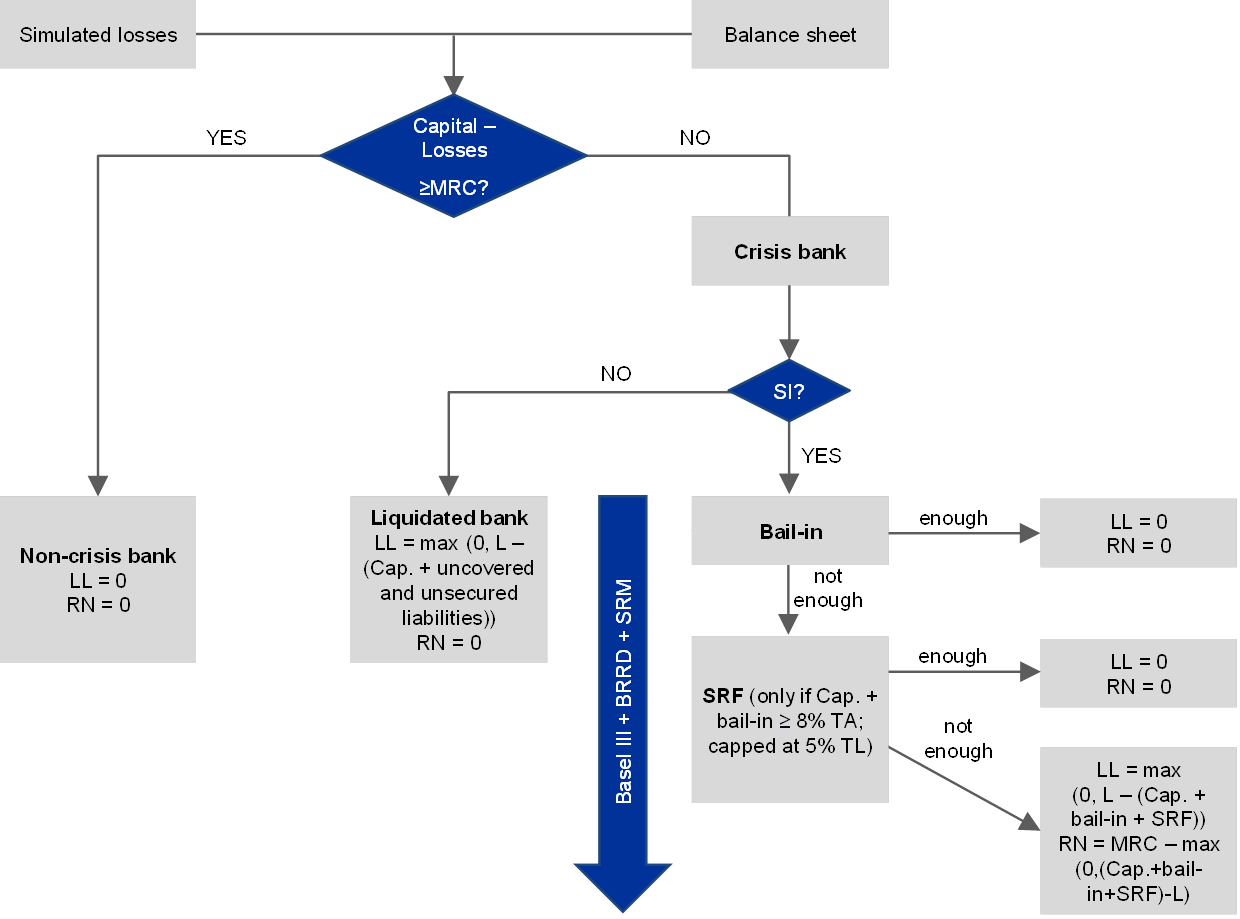

Compared to 2007, the loss-absorbing process for end-2017 is adapted to reflect not only the broader set of requirements that banks have to comply with, but also the additional tools available to banks when they breach the minimum requirements.[13] These include bail-in and the Single Resolution Fund (SRF),[14] pre-financed by credit institutions with the objective of ensuring an efficient application of the resolution tools. The process is outlined in Figure 2 below.

Figure 2

Loss-absorbing process for 2017

Source: ECB staff, based on current regulatory framework.

Notes: Impact of potential losses on the balance sheets of banks in 2017. Non-crisis banks are able to absorb losses while still meeting their minimum requirements. Less significant institutions (LSIs) are liquidated if they breach minimum requirements, while significant institutions (SIs) breaching minimum requirements are classified as crisis banks. In the latter situation, if capital conversion is not sufficient, the bail-in tool and the potential intervention of the SRF are considered. Minimum requirements include the condition on CET1 (at least 4.5% relative to RWA), Tier 1 (at least 6% relative to RWA), total capital (at least 8% relative to RWA), leverage ratio (at least 3% relative to total assets) and Pillar 2 (bank-specific).

Following a loss event, if the bank is able to absorb all losses while still meeting its minimum requirements, it is considered a non-crisis bank and both its leftover losses and its recapitalisation needs are equal to zero.

If the bank is not able to absorb all losses while still meeting all its minimum requirements on capital, the bank is defined as a crisis bank. In this case, if the minimum requirement on total capital (T1+T2 ≥ 8% of RWA) is fulfilled but at least one of the minimum requirements on CET1 (CET1 ≥ 4.5% of RWA) or Tier 1 (CET1+AT1 ≥ 6% of RWA) is breached, then the bank’s Additional Tier 1 and Tier 2 capital can be converted into CET1 with the aim of restoring the minimum requirements on CET1 and/or T1. If this is enough to absorb all losses and restore the minimum required capital, no liquidation or resolution is needed. If this is not enough (or if the minimum requirement on total capital is breached) and the bank is an LSI, the bank is liquidated, and its recapitalisation needs are equal to zero, while its leftover losses are the amount of losses that are left after all of the bank’s capital and uncovered or unsecured liabilities have been used.

For crisis SIs, the bail-in tool and the intervention of the SRF may be used. If, after the conversion of bail-inable liabilities, the bank still does not meet the minimum requirements, and if the 8% minimum bail-in condition is verified,[15] then the SRF may be used, with a cap set at 5% of each bank’s total assets. The effect of the SRF is to reduce the amount of leftover losses (if any) and recapitalisation needs of crisis SIs in resolution.

In summary, for crisis LSIs both in 2007 and 2017 leftover losses consist of losses that a bank cannot absorb through (i) its regulatory capital and (ii) its unsecured and uncovered liabilities; their recapitalisation needs are zero in all cases because crisis LSIs are assumed to be liquidated. Please note that the assumption that all SIs are resolved and all LSIs are liquidated is a theoretical simplification for the purpose of this analysis. In practice, the resolution authority plays the key role regarding the choice of resolution or liquidation, taking into account the public interest.

For crisis Sis, leftover losses in 2017 consist of losses that a bank cannot absorb through its regulatory capital, through its bail-inable liabilities or through the potential intervention of the SRF. By contrast, in 2007 SIs could only absorb losses via their regulatory capital. Recapitalisation needs are equal to minimum capital requirements minus the capital left (if any) after losses are incurred. Moreover, in 2017 banks are also assumed to suffer the losses deriving from direct contagion through bail-in.[16]

It must be noted that regulators may choose to exclude some liabilities from the bail-in process on financial stability or economic grounds. To account for this, we consider two different options for the analysis for 2017:

- Only regulatory capital and MREL-eligible bonds with remaining maturity ≥ 1 year are included in the bail-in process, while all additional MREL-eligible liabilities and bail-inable liabilities are excluded from bail-in (bail-in option 1);[17]

- All MREL-eligible liabilities and all additional bail-inable liabilities are bailed in (bail-in option 2).

3 Empirical results

In this section, we summarise the empirical results of the analysis. First, we discuss the estimation of banks’ default probabilities and the derivation of simulated losses. We then summarise and compare the results on the loss-absorbing capacity of the banking system, as well as leftover losses and recapitalisation amounts for the two time periods considered. Finally, we show how much the amount of absorbed losses has increased in the recent time period.

3.1 PD estimation and simulation of losses

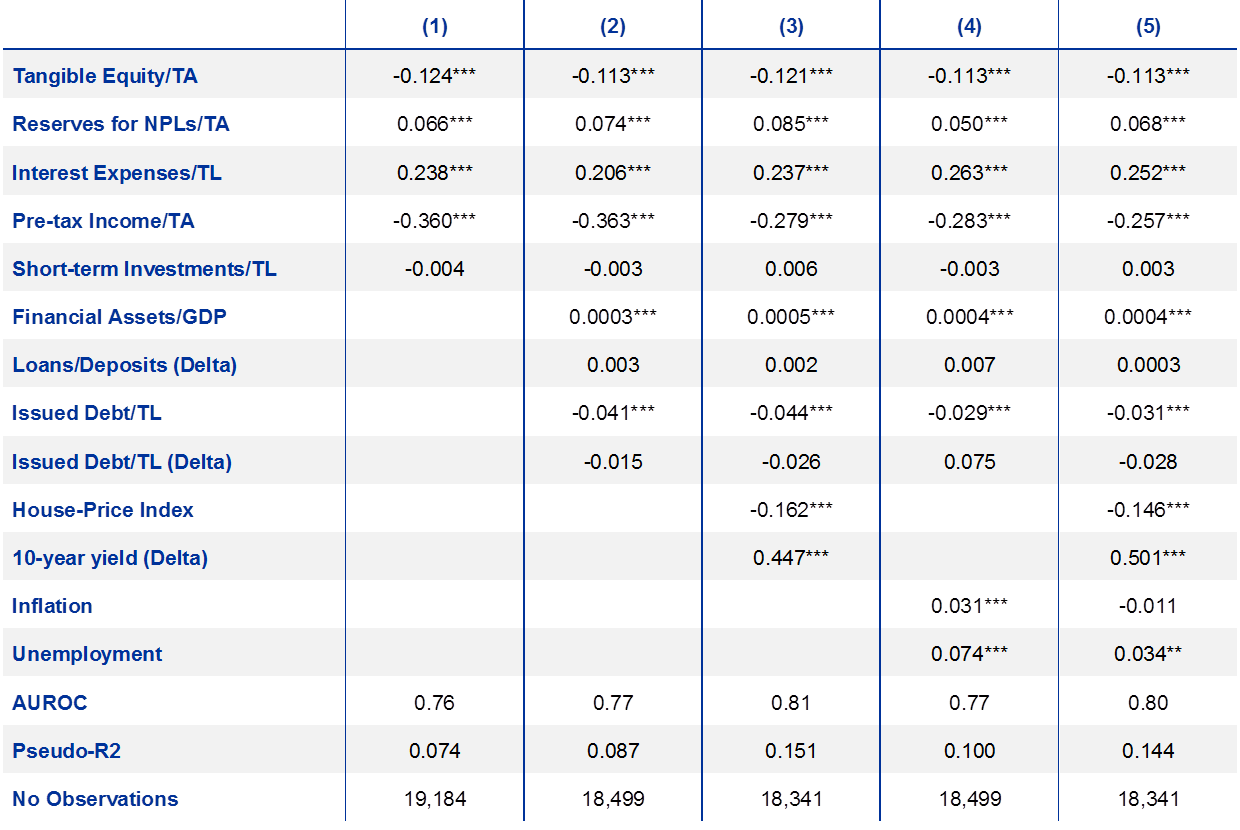

The parameters obtained through the logit model described in Section 2.2 are reported in Table 1. For robustness purposes, Table 1 shows the results for five different model specifications: only bank-specific variables (column (1)), bank- and banking sector-specific variables (column (2)) and three different combinations of macroeconomic variables (columns (3), (4) and (5)).

Table 1

Multivariate logit regression, 2000-2015

Source: ECB staff, based on COREP; data from 2000 to 2015.

Notes: *** refers to 1% significance level, ** refers to 5% significance level, * refers to 10% significance level.

Table 1 shows that equity, pre-tax income, issued debt over total liabilities and the house price index are significantly and negatively correlated with banks’ PDs; on the other hand, reserves for NPLs, interest expenses, financial assets over GDP and interest rates on ten-year government bonds are significantly positively correlated with the default probabilities of the banks in the sample. We note that reserves for NPLs are included as a proxy for the level of NPLs (due to data availability). Finally, Table 1 also shows that the results are robust with respect to different model specifications: given the higher model performance, both in terms of AUROC and R2, we have focused on specification (3) to estimate the PDs that will be used in the subsequent part of the analysis.

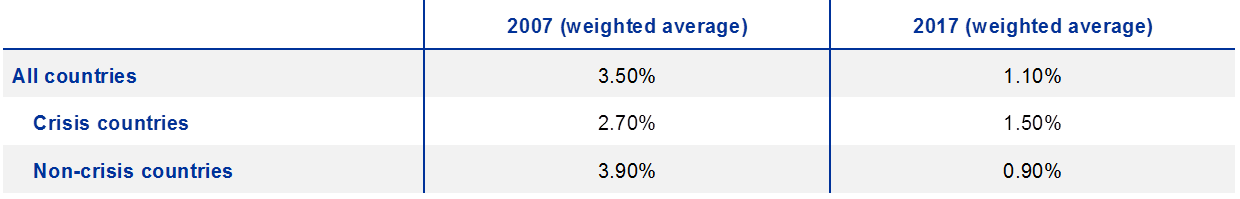

The PDs estimated in 2007 and 2017 according to the coefficients reported above are summarised in Table 2.[18] The weighted average values refer to the mean PDs in the two time periods weighted by banks’ total assets. The last two rows distinguish between the average PDs in crisis and non-crisis countries.

Table 2

Estimated PDs, 2007 and 2017

Source: ECB staff, based on COREP.

Notes: Crisis countries include Cyprus, Spain, Greece, Ireland, Italy, Portugal and Slovenia; Non-crisis countries include Austria, Belgium, Germany, Finland, France, Lithuania, Latvia, Malta and the Netherlands. The distinction between crisis and non-crisis countries follows the classification proposed in the 2017 ECB Financial Integration Report, and is based on the deterioration of the credit rating.

The results indicate that banks’ PDs have on average significantly decreased in the last ten years, from 3.5% in 2007 to 1.1% in 2017 – a third of the pre-crisis value. PDs in non-crisis countries have decreased significantly more than banks’ default probabilities in crisis countries, mostly because of the sovereign crisis that affected some crisis countries during that period.

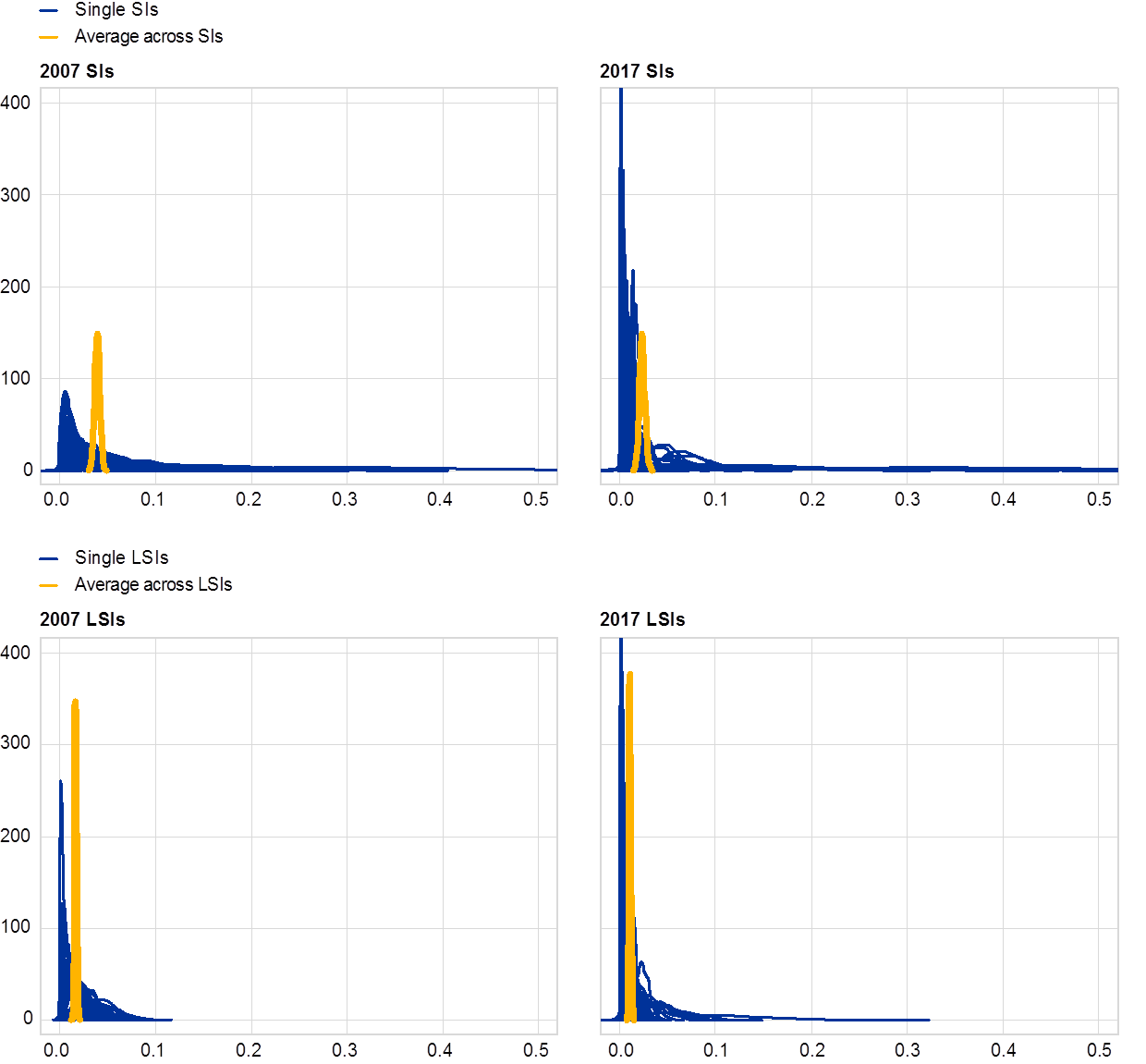

We use the coefficients shown in Table 1 (specification 3) to build the estimated PD distributions, extracted from a truncated Gaussian distribution and based on 1,000 simulation runs for each bank. Figure 3 shows the results for 2007 and 2017, for both SIs and LSIs. Each black line represents the PD distribution of one bank, while the red line shows the average default probability across all banks. Given the asymmetry in the confidence intervals of PDs, the resulting distributions are right fat-tailed in both years.

At the aggregate level, the distribution of default probabilities across countries has significantly decreased from 2007 to 2017. In addition, at both points in time, the PDs appear to be significantly higher for SIs than for LSIs, which have both a lower average PD (red line) and less right fat-tailed PD distributions.

Figure 3

Estimated default probability density functions

(x-axes: LGD; y-axes: density function)

Sources: ECB staff calculation based on Bankscope and ECB Statistical Data Warehouse data.

Notes: PD density functions refer to 2007 (left panels) and 2017 (right panels), and to SIs (top panels) and LSIs (bottom panels). Each black line represents the PD of a bank; the red line has been obtained by averaging, in each simulation run, the sampled PDs of all banks.

3.2 Loss-absorbing capacity

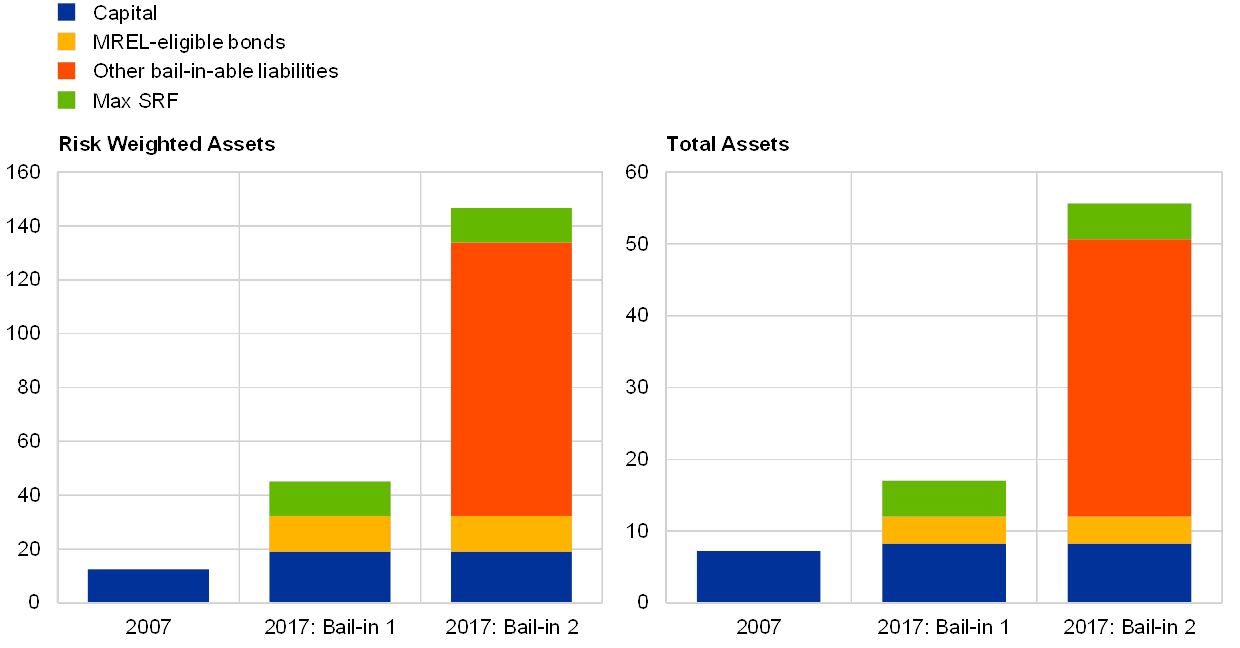

Figure 4 shows the simple average SLAC over RWA (left-hand side) and over total assets (right-hand side) as at end-2007 and end-2017 (as described in eq. 1 and eq. 2 respectively). The observed improvement in SLAC is first due to capital, which has increased from 7.2% to 8.2% of total assets, corresponding to an increase in capital from 12.5% to 19.0% of RWA. The additional increase is due to the new resolution framework that introduced the bail-in as a resolution tool.

Under bail-in option 1, bail-inable liabilities (restricted to MREL-eligible bonds) further increase SLAC to 12.0% of total assets in 2017. Under bail-in option 2 (where all bail-inable liabilities are assumed to be within the scope of the bail-in tool), SLAC increases to 50.6% of total assets in 2017. Under both options, the possible intervention of the SRF further contributes to increasing SLAC by 4.9% of total assets.

Figure 4

System’s Loss-Absorbing Capacity (SLAC) in 2007 and 2017, over RWA and Total Assets

(percentages)

Sources: ECB staff calculation based on Bankscope, ECB Statistical Data Warehouse data and COREP-NSFR data.

Notes: bail-in option 1 means that only MREL-eligible bonds (on top of regulatory capital) can be bailed in; option 2 means that all bail-inable liabilities can be bailed in. The results shown are simple average across all banks.

Figure 5 plots the average loss-absorbing score (LAS, equal to SLAC over simulated losses; eq. 3) across all banks and simulations for a range of LGD values for 2007 and 2017 under the two different bail-in options. When considering only MREL-eligible bonds (bail-in option 1), the LAS score has increased approximately 3.5-fold in the last ten years. When considering all bail-inable liabilities (bail-in option 2), the LAS score has increased almost twelvefold. The results are quite homogeneous across all LGD values.

To place LGD figures in context, the Financial Stability Board[19] found that for Global Systemically Important Banks losses as a fraction of total assets ranged from less than 1% to 4.7%, with most banks in a 2-4% range. The European Commission estimated average losses for 23 banks over the period 2007-2010 to be 2.5% of total liabilities.[20] Therefore, average LGD values above 5% across all banks were not observed even during the global financial crisis.

Figure 5

Loss-absorbing score (sample average)

Sources: ECB staff calculations based on Bankscope, ECB Statistical Data Warehouse data and COREP-NSFR data.

Notes: Bail-in option 1 means that only MREL-eligible liabilities (on top of regulatory capital) can be bailed in; option 2 means that all bail-inable liabilities can be bailed in. The results shown are a simple average across all banks and simulations.

3.3 Leftover losses and recapitalisation needs

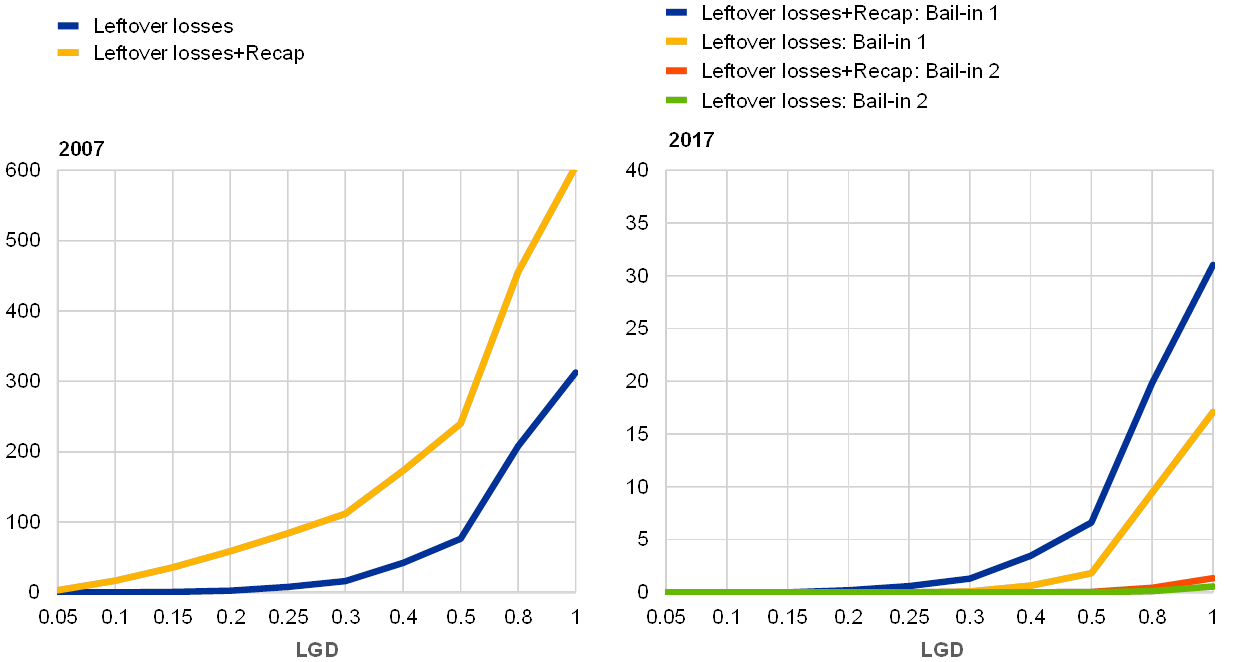

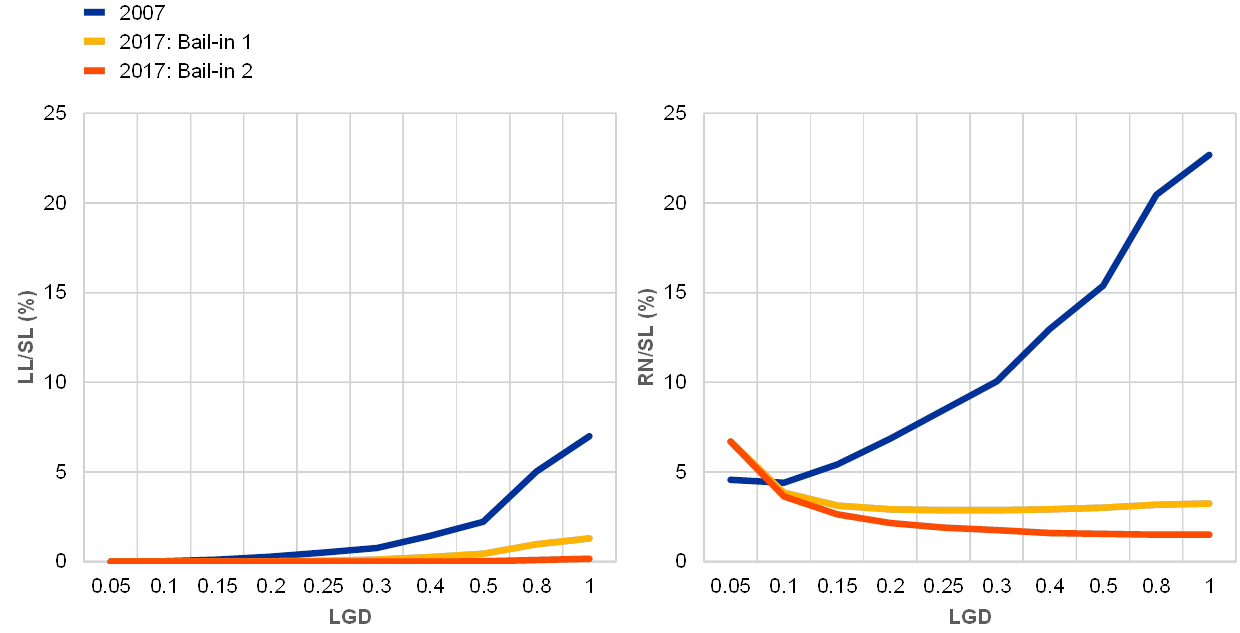

Figure 6 shows the leftover losses and recapitalisation needs (as outlined in eq. 4) in 2007 (left) and 2017 (right) in billions of euro for the whole sample. To put these figures into context, Figure 7 shows LL and RN as a percentage of simulated losses (as outlined in eq. 6 and 7), averaged across all banks and simulation runs.

Both LL and RN are significantly lower in 2017 than in 2007, especially for high LGD values. For example, for LGD = 50%, total LL and RN amount to €240 billion in 2007, but only €6.5 billion under bail-in option 1 and €0.03 billion under bail-in option 2 in 2017. The decrease is very significant even for low LGD values, e.g. for LGD = 10%, LL and RN amount to €16 billion in 2007, but are zero in 2017 (under both bail-in options).

Looking at LL and RN individually, LL are positive in 2007 for LGD values above 5%, while in 2017 LL become positive only when LGD exceeds 20% under bail-in option 1 and when LGD exceeds 50% under bail-in option 2. Moreover, absolute recapitalisation needs have also decreased substantially between the two periods: for LGD = 50%, RN are €164.8 billion in 2007 and €4.7 billion and €0.03 billion under bail-in options 1 and 2 respectively in 2017. The results clearly suggest that the ability of the banking system to withstand potential shocks while minimising taxpayers’ costs has significantly increased in the last ten years.

Figure 6

Leftover losses and recapitalisation needs in 2007 and 2017

(y-axes: EUR bn)

Sources: ECB staff calculations based on Bankscope, ECB Statistical Data Warehouse data and COREP-NSFR data.

Notes: Bail-in option 1 means that only MREL-eligible bonds (on top of regulatory capital) can be bailed in; option 2 means that all bail-inable liabilities can be bailed in. The results shown are cumulated over all the banks included in the sample, and averaged across all simulation runs.

Figure 7

Leftover losses and recapitalisation needs over simulated losses

(LL: leftover losses, RN: recapitalisation needs, SL: simulated losses)

Sources: ECB staff calculation based on Bankscope, ECB Statistical Data Warehouse data and COREP-NSFR data.

Notes: Bail-in option 1 means that only MREL-eligible bonds (on top of regulatory capital) can be bailed in; option 2 means that all bail-inable liabilities can be bailed in. The results shown are a simple average across all banks and simulations. Notably, the ratio of recapitalisation needs over simulated losses in 2017 (red lines) decreases for LGD values between 5% and 25%. This effect is due to the fact that, up to a certain level of losses, the increase in the amount of losses banks are able to absorb is larger than the increase in the LGD (and therefore in the simulated losses), after which the ratio starts increasing. This is a non-linear effect introduced by higher regulatory requirements in 2017 compared to 2007.

4 Conclusions

The analysis clearly shows a significant increase in the ability of the euro area banking system to withstand potential shocks without costs for taxpayers after the global financial crisis and the post-crisis wave of reforms. This has been achieved through a combination of three factors.

First, the estimated average probability of default of euro area banks has significantly decreased from 3.5% in 2007 to 1.1% in 2017 – a third of its pre-crisis value.

Second, under conservative assumptions on the scope of liabilities affected by the bail-in tool, banks’ loss-absorbing capacity has increased from 7.2% to 12.0% of total assets. This is the product of (i) the increase in capital due to the introduction of new regulatory buffers and larger voluntary buffers, and (ii) the introduction of the bail-in framework and the resulting increase in banks’ loss-absorbing liabilities.

Third, the introduction of the Single Resolution Fund has further contributed to enhancing the loss-absorbing capacity of the system by 4.9% of total assets in 2017.

As a result, the ability of the banking system to absorb losses while minimising costs to taxpayers has increased 3.5-fold between 2007 and 2017 when assuming that only MREL-eligible bonds can be bailed-in. Assuming that all bail-inable liabilities are bailed in, the banking system’s loss-absorbing capacity increases to 55.5% of total assets, an almost 12-fold increase between 2007 and 2017.

Notwithstanding the significant improvements observed in this analysis, the post-crisis regulatory work is not yet complete. Recent and outstanding regulatory reforms, in particular the finalisation of the Basel III package and the MREL requirements, should be properly implemented to further strengthen the resilience of banks, especially outlier institutions. The implementation of MREL requirements is forthcoming, while the transposition of the final Basel III rules in Europe is still to come.

- Financial Stability Board, “Implementation and Effects of the G20 Financial Regulatory Reforms: Fourth Annual Report”, 28 November 2018.

- De Guindos, L., “Euro area banking sector – current challenges”, keynote speech at the Annual General Meeting of the Foreign Bankers’ Association, Amsterdam, 15 November 2018.

- European Commission Services, European Central Bank and Single Resolution Board, “Monitoring report on risk reduction indicators”, November 2018.

- Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (OJ L 176, 27.6.2013, p. 1); and Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC (OJ L 176, 27.6.2013, p. 338).

- Directive 2014/59/EU of the European Parliament and of the Council of 15 May 2014 establishing a framework for the recovery and resolution of credit institutions and investment firms and amending Council Directive 82/891/EEC, and Directives 2001/24/EC, 2002/47/EC, 2004/25/EC, 2005/56/EC, 2007/36/EC, 2011/35/EU, 2012/30/EU and 2013/36/EU, and Regulations (EU) No 1093/2010 and (EU) No 648/2012, of the European Parliament and of the Council (OJ L 173, 12.6.2014, p. 190).

- Regulation (EU) No 806/2014 of the European Parliament and of the Council of 15 July establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Resolution Fund and amending Regulation (EU) No 1093/2010 (OJ L 225, 30.7.2014, p. 1).

- Looking at the euro area, the United States and the United Kingdom, the cumulative amount of all interventions to support the banking systems exceeded USD 14 trillion, almost a quarter of world GDP (see Alessandri, P. and Haldane, A.G., “Banking on the State”, Bank of England, 6 November 2009). For euro area banks only, between 2008 and 2010 public recapitalisations and impaired assets measures amounted to €297 billion (source: the European Commission’s state aid database).

- To allow a comparison between the two periods, credit institutions that underwent structural changes, such as those resulting from acquisition by or merger with another banking group, are excluded from the sample (with only a few exceptions, such as BPCE Group).

- Lang, J.H. (2015), “A bank-level early warning model and its uses in macroprudential policy”, Macroprudential Bulletin, ECB, March 2016. Lang, J.H., Peltonen, T.A., Sarlin, P. (2018), “A framework for early-warning modelling with an application to banks”, Working Paper Series, No 2182, ECB, October 2018.

- This classification of defaulting/distressed banks is also consistent with the methodology used in Betz at al., “Predicting distress in European banks”, Journal of Banking and Finance, No 45(C), pp. 225-241, 2014 and Carmassi et al., “Completing the Banking Union with a European Deposit Insurance Scheme: who is afraid of cross-subsidisation”, Occasional Paper Series, No 208, ECB, Frankfurt am Main, April 2018.

- For simplicity, we refer to SIs and LSIs also for 2007, although this categorisation was only introduced under Council Regulation (EU) No 1024/2013 of 15 October 2013 conferring specific tasks on the European Central Bank concerning policies relating to the prudential supervision of credit institutions (OJ L 287, 29.10.2013, p. 63).

- We assume that creditors do not take losses, based on the experience of the 2008 global financial crisis when bailouts shielded them from losses.

- The set of Basel III requirements applied in this work are: 1) CET1 capital ≥ 4.5% of RWA; 2) Tier 1 capital ≥ 6% of RWA; 3) total capital (i.e. Tier 1 + Tier 2 capital) ≥ 8% of RWA; 4) leverage ratio ≥ 3%; 5) Pillar 2 requirements fixed at 2% of RWA for all banks (this value is in line with the 2017 SREP, which reports 2% of RWA as the average of Pillar 2 requirements for euro area banks. Under Basel III rules and European rules on bank capital requirements, banks are also required to hold additional capital buffers: in this analysis, the combined buffer requirement under European rules is applied (CCyB + CCoB + max(O-SII, G-SII, SRB)). As such buffers are meant to be dipped into in a loss event, they do not form part of the “minimum” capital requirements, but form part of the regulatory capital used to absorb losses in our simulations.

- The SRF is currently at the phase-in stage: at the steady state (2024) it will reach the target level corresponding to 1% of covered deposits at the banking union level.

- SRF intervention is possible for banks whose shareholders and creditors have already borne losses and recapitalisation costs at least equal to 8% of the bank’s total assets. The SRF’s intervention is capped at 5% of the bank’s total assets. For both the 8% threshold and the 5% cap, the BRRD and the SRM Regulation refer to total liabilities and own funds (which take into account derivatives netting): owing to data issues, total assets are used as a proxy in this study.

- The contagion effects considered in this paper arise from the direct exposures that banks have towards other credit institutions if the latter are subject to bail-in. In terms of calibration, data are available on the portion of bail-inable liabilities held by credit institutions at the country level: these bank-to-country data are then transformed into a bank-to-bank matrix, proportionally with respect to banks’ total assets. In terms of results, the inclusion of direct contagion effects via bail-in seems to not significantly impact the final outcomes. Finally, please note that contagion effects resulting from fire sales and market price movements are not considered in this analysis.

- The decision to bail-in MREL-eligible bonds first is a simplified assumption and therefore may not be fully aligned with the pari passu principle, which would require the simultaneous bail-in of senior unsecured bonds with a remaining maturity of less than 12 months and all other bail-inable liabilities with the same ranking in the insolvency hierarchy. Therefore, on one hand, the assumption is conservative, because it might underestimate the actual loss-absorbing capacity. However, on the other hand, it might overestimate the loss-absorbing capacity, since it does not account for the subordination requirement, which would address the risk of having bail-inable instruments ranking pari passu with other operational liabilities. It should also be stressed that, in all steps of the bail-in process in this analysis, eligible resources are bailed in to the extent necessary to meet the minimum capital requirements.

- Please note that our methodology for estimating PD is different from the approach used by rating agencies to evaluate financial institutions, which, in addition to a bank’s financial situation and its economic environment (captured in this study by the bank-specific, banking-sector specific and macroeconomic variables), also accounts for qualitative factors (such as company profiles and management), the capacity of shareholders and/or government authorities to support the bank in the event of distress, and the impact of the bank’s failure on the expected losses of its creditors (also taking into account different resolution schemes).

- See Financial Stability Board, “Historical Losses and Recapitalisation Needs: Findings Report”, November 2015.

- Commission staff working document impact assessment, pages 143-144.