How competition and regulation drive bank and investment fund risk profiles and their market shares

The rapid growth of the asset management sector over recent years has raised questions about the interaction between traditional banks and investment funds, as well as the drivers behind this trend. Our analysis contributes to this debate by shedding light on the implications of increased competition between the two sectors. We first examine how competition between banks and investment funds drives the risk profiles and market shares of these two sectors. In a second step, we assess whether and how capital requirements for banks influence the relative market shares of the two sectors, contributing to both the analysis of the drivers behind the structural developments in the euro area financial sector and the work on the evaluation of the impact of post-crisis reforms.

1 Introduction

The last decade has brought about significant changes to the structure of the financial system in Europe, resulting in a much higher relevance of the asset management sector. On the one hand, the asset management sector experienced significant growth, with total net assets of European investment funds more than doubling from €6.1 trillion to €14.1 trillion between 2008 and the end of 2016.[2] At the same time, the size of the banking system has been relatively stable. On aggregate, the share of the asset management financial sector increased from 43% in 2008 to 55% in early 2017 in terms of total assets, while a corresponding decline took place in the share of the banking sector.[3]

A number of different drivers behind these developments have been identified. First, search-for-yield behaviour in a low interest environment has led investors to shift towards the asset management sector.[4] Second, changes in population structure, population ageing and a sharp rise in the ratio of global wealth to income have been named as further factors.[5] Third, higher regulatory requirements in the banking sector, alongside higher governance and risk management standards, have limited unsustainable growth in this sector. Moreover, as banks are adjusting to stricter capital requirements and higher governance and risk management standards, they have less appetite to invest in certain asset classes, creating market space for competitors in the non-bank sector. More specifically, banks and investment funds maximise their profits by competing in securities markets and thus by optimally allocating their portfolios across asset classes, conditional on their credit and liquidity risks. The resulting expected profits of the two sectors determine whether individual investors/depositors allocate their units of wealth to banks or investment funds. This, in turn, determines the sector market shares and hence the total funding received by each sector.

The implications of these developments are threefold. First, the rapid growth of the asset management industry is leading to a significant structural shift in the financial system, where market-based finance is becoming a significant competitor for banks. These developments could further change market dynamics and modify the composition of assets across the two sectors. Second, the rapid growth of the asset management industry is leading to a change in the distribution of risk in the financial system. The transfer of risks outside the banking sector into the non-bank sector has implications for the way the financial system manages risk and its overall resilience. Third, as a consequence, regulatory bodies need to take into account the higher potential of the non-bank sector to create systemic risks. In this context, broadening the macroprudential toolkit beyond the banking sector would be of major importance to provide competent authorities with pre-emptive tools to address such systemic risks.

This chapter first shows stylised facts on the distribution of credit and liquidity portfolio risk of banks and investment funds. In a second step, it closely examines how competition between banks and investment funds drives risk profiles and market shares across the two sectors, providing insights into the risk distribution across banks and the asset management sector. In a third step, it assesses whether and how capital requirements for banks influence banks’ portfolio choice of assets, contributing to both the analysis of the drivers behind the structural developments in the euro area financial sector and the work on the evaluation of the impact of post-crisis reforms. Finally, the article draws its conclusions.

2 Stylised facts for the credit and liquidity portfolio risk of banks and investment funds

Structural changes in the euro area financial sector may have led to changes in the distribution of risk across the banking and asset management sectors. It is important to understand whether there is evidence for such changes in the aggregate. Accordingly, we determine the credit and liquidity portfolio risk for securities in the Securities Holdings Statistics (SHS) database to arrive at representative aggregate measures for both sectors.

For our analysis we use the data from the SHS database, which contains quarterly ISIN-level securities holdings by deposit-taking corporations and non-MMF investment funds in the 19 euro area countries between the first quarter of 2014 and the first quarter of 2017. For each security, we know the issuing sector, issuing country, instrument type and securitisation status. In addition, we merge these data with the ECB's Ratings Database, which contains historical ratings from four rating agencies, namely Standard & Poor's, Fitch, Moody's and DBRS. We add, for example, information on bank-specific variables, such as the average deposits to total liabilities ratio, the loans to total assets ratio and the cash to total assets ratio of euro area banks, from the ECB Statistical Data Warehouse.

We capture credit and liquidity risks through credit risk and liquidity risk index variables. The credit risk variable is equal to the current asset risk weights in the standardised approach of the Basel III framework. Our dataset contains detailed asset-specific information, such as instrument type (long-term debt, short-term debt, equity, etc.), issuing sector (governments and central banks, non-financial corporations, financial corporations, etc.), issuer rating, security rating, securitisation status, etc. This allows us to identify the corresponding risk weights with a high degree of accuracy. The liquidity index variable is identified closely following Hanson et al. (2015), ranking the securities according to the size of their haircut. To this end, we closely follow the ranking imposed for high-quality liquid assets in the Basel III framework. More specifically, we assign the index value based on issuing sector and instrument type.

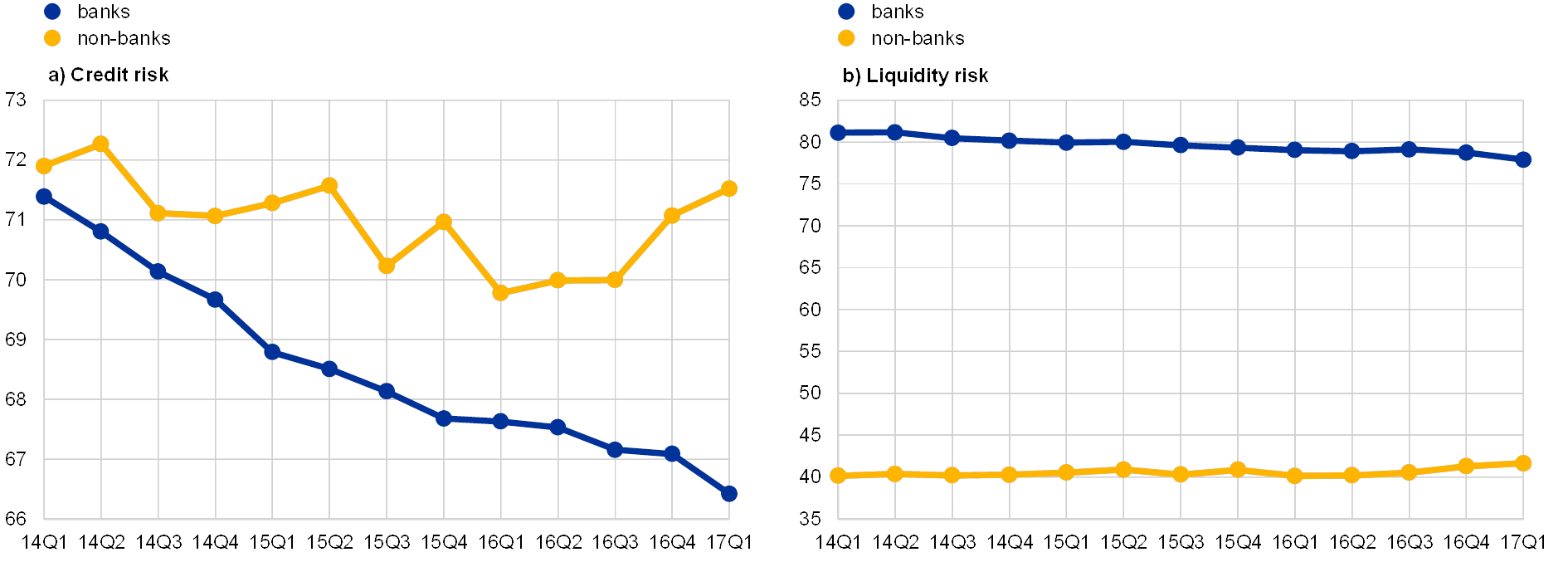

Our measure of credit risk suggests that banks have decreased the average credit risk of their securities portfolio, while the average credit risk of investment funds has been moving around a two-year trend (see Figure 1). It appears that banks in the euro area have, on average, shifted their holdings into safer assets (see Figure 1).[6]

Figure 1 also provides (new) evidence on developments in the average liquidity risk of holdings by the banking and investment fund sectors. First of all, when comparing the portfolio liquidity risk of the two sectors, significant differences in levels can be observed. On average, banks take on significantly more liquidity risk than investment funds. Investment funds are reluctant to hold high liquidity risk, so they need to sell assets only at a modest discount if investors decide to redeem. Moreover, incentives to hold less liquidity risk are amplified, as investors are very likely to redeem in times of stress.[7]

Figure 1

Average credit and liquidity portfolio risk for banks and investment funds

(credit risk and liquidity risk index)

Source: Authors’ calculations based on SHS data.

Notes: Comparison of the average credit risk (CR) and liquidity risk (LR) for banks and investment funds, calculated as

and

. The normalised portfolio shares (p_share) of each sector are calculated in two steps. First, the raw share of security i in each sector’s portfolio at time t is calculated as the holding of security i by sector f, divided by the sector's total holding over all securities at time t. It is important to note that scales differ for CR and LR. The credit risk variable is equal to the current asset risk weights in the standardised approach of the Basel III framework assigned per security. The liquidity index variable is identified closely following Hanson et al. (2015), ranking the securities according to the size of their haircut. To this end, we closely follow the ranking imposed for high-quality liquid assets in the Basel III framework. More specifically, we assign the index value based on the issuing sector and instrument type.

3 Implications of competition between banks and investment funds

While Section 2 provided illustrative evidence regarding banks’ and investment funds’ tolerance for credit and liquidity risk, this section first empirically tests the implications behind increased competition between investment funds and banks on the portfolio allocation of assets across the two sectors, taking into account the composition of risk. Second, this section assesses how capital requirements in the banking sector affect portfolio allocations of banks in risky assets.

This assessment is conducted against the background that banks and investment funds differ regarding their tolerance towards credit and liquidity risk. Open-end investment funds face the risk of broad-based redemptions by investors, which may lead to fire sales if investment funds are illiquid.[8] Consequently, investment funds have a preference for holding more liquid assets.

On the other hand, banks protected by deposit insurance are less prone to conduct a fire sale of their assets and more likely to hold illiquid assets, such as long-term securities.[9] At the same time they are subject to capital requirements and are thus more concerned about the credit risk they take.

This set-up allows us to study the differences in portfolio allocation and in credit/liquidity risks taken on by banks and investment funds, as well as the impact of policy changes, such as capital requirements, on sector market shares.

3.1 Bank and investment fund risk profiles and implications for sector market shares

The stylised facts in Section 2 suggest that banks should hold a higher market share in illiquid assets, while investment funds should hold a higher market share in liquid assets. More specifically, banks should overweigh illiquid assets, investment funds should overweigh liquid assets, and the difference between banks’ and investment funds’ portfolio shares in a given asset should be positively correlated with the liquidity risk of that specific asset. Conversely, keeping liquidity risk constant, banks overweigh safer assets, investment funds overweigh riskier assets, and the difference between banks’ and investment funds’ portfolio shares in a given asset should be negatively correlated with the credit risk of that specific asset.

Thus, in the empirical analysis, the relationship between credit and liquidity risk and banks’ and investment funds’ optimal portfolio allocation is examined by testing the following hypotheses:

Hypotheses 1: In the presence of competition between the two sectors, banks should be less exposed to credit risk, whereas for investment funds the opposite should be true.

Hypotheses 2: In the presence of competition between the two sectors, banks should be more exposed to liquidity risk, whereas for investment funds the opposite should be true.

We test the influence of credit risk and liquidity risk on banks’ and investment funds’ market shares in liquid and risky assets by estimating the following model in the cross section for each year and holding sector:

where and represent the normalised portfolio shares of securities in the respective sector’s portfolio. Normalised portfolio shares for each sector are calculated following two steps. First, the raw share of security i in each sector’s portfolio at time t is calculated as the holding of security i by sector f, divided by the sector's total holding over all securities at time t:

where is sector f’s holding of security i at time t. We normalise the raw portfolio shares since it is likely that securities with very large issues make up a larger share of the portfolio compared with securities with very small markets. In addition, the sensitivity of portfolio allocation to credit and liquidity risks is likely to vary with the market size of a given security. Therefore, we normalise the raw portfolio share variable by dividing it by the total holding volume of the given security by banks and investment funds together. This normalisation is meant to approximate the overall size of the market: we capture the total volume held in a given asset at a given point in time by using the absolute values of the holding of banks and investment funds in a given security.

Finally, credit risk (CR) and liquidity risk (LR) are captured through credit risk and liquidity risk index variables, as explained in more detail in the second chapter of this article. Table 1 presents the estimation results for this regression.

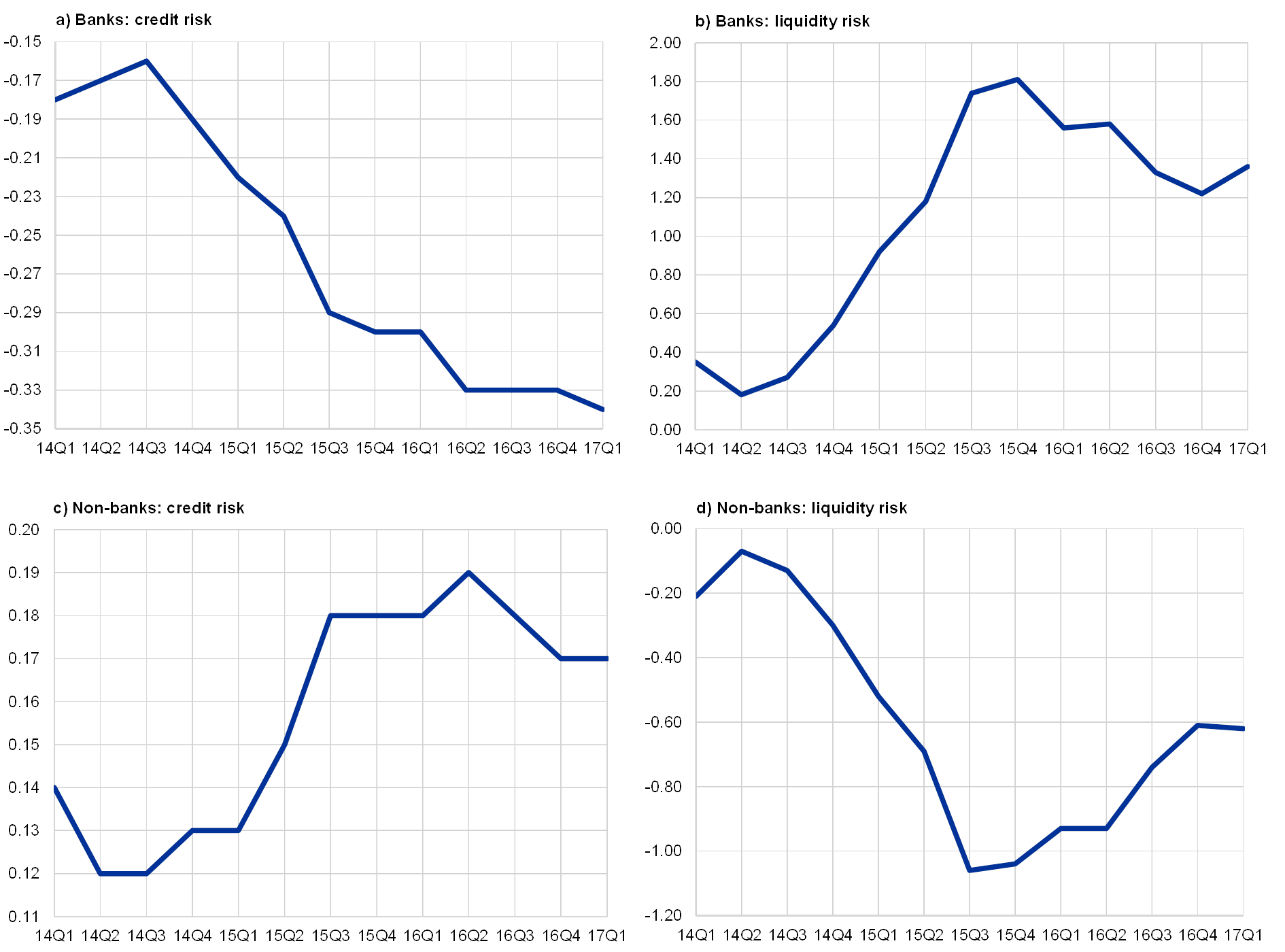

Figure 2 and Table 1 illustrate the results. Figure 2 shows coefficients for credit and liquidity risks for banks and investment funds estimated in a single linear regression at each point in time, whereas Table 1 reports the regression estimates. Testing for the tolerance of both sectors towards credit and liquidity risk, it can be observed that banks and investment funds have different preferences for credit and liquidity risk, which has implications for the composition of risk and market share across the two sectors. While banks are more prone to take on liquidity risk, investment funds are less concerned about holding assets with higher credit risk. The empirical analysis suggests that an increase in the asset’s credit risk is associated with a decline in bank holdings of that asset, while the opposite is true for banks’ holdings with respect to liquidity risk. For investment funds, the empirical model suggests an inverse relationship: a negative coefficient for liquidity risk and a positive coefficient for credit risk. These findings confirm Hypotheses 1 and 2.

Figure 2

Bank and investment fund portfolio allocations

(coefficient estimates; cross-section, normalised portfolio shares)

Source: Authors’ calculations based on SHS data.

Notes: The figure illustrates cross-section coefficients from Table 1, which reflect the influence of credit risk and liquidity risk on banks’ (upper row) and investment funds’ (bottom row) market shares. The p-values are extremely small, so the confidence bands are not visible in the figure.

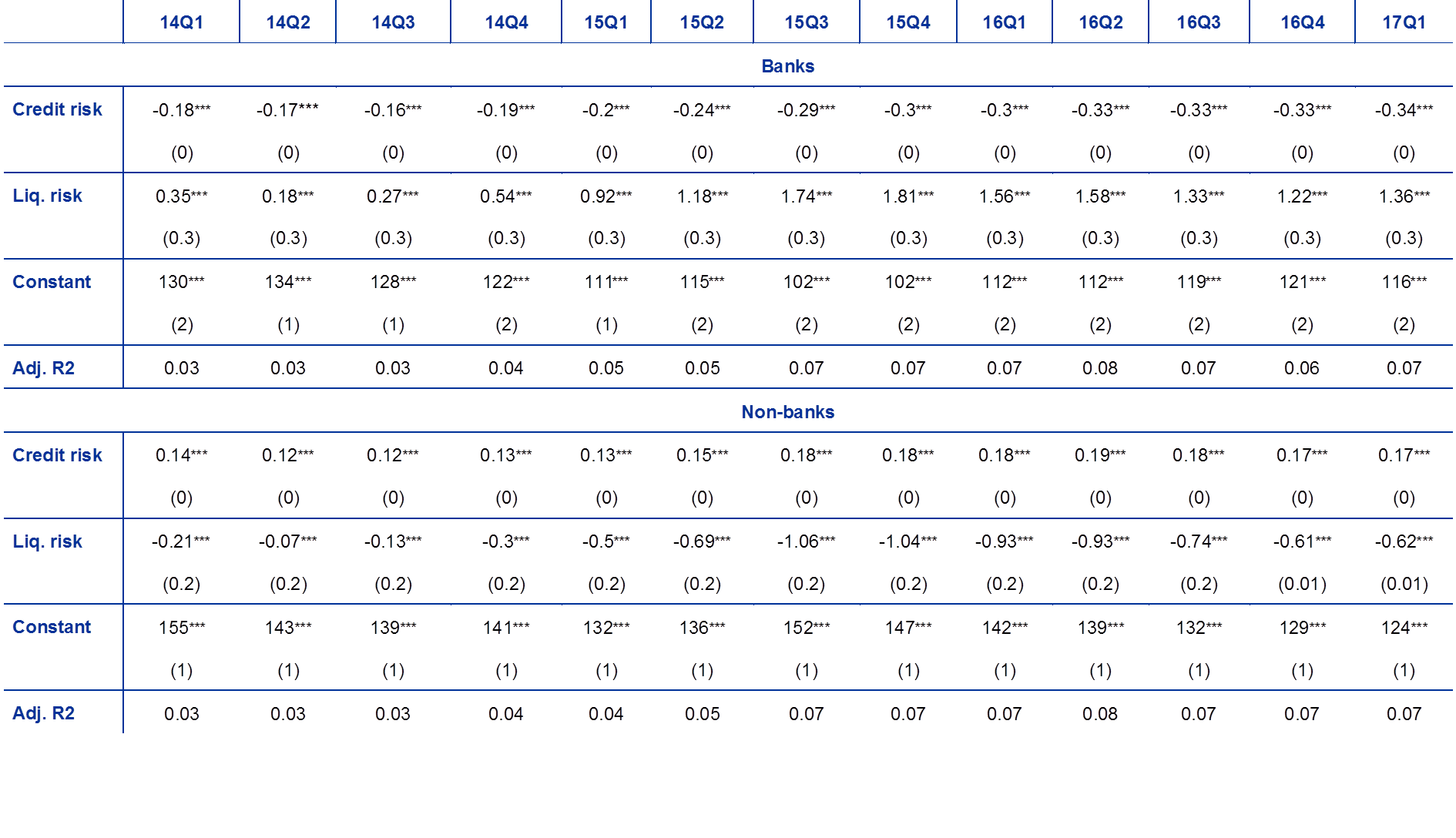

Table 1

Cross-sectional ordinary least square regression coefficients for portfolio shares of banks and investment funds

Source: Authors’ calculations.

Notes: This table shows results for regressions of Equation 1 and Equation 2, which test the influence of credit risk and liquidity risk on banks’ (upper row) and investment funds’ (bottom row) market shares. The ***, ** and * denote significant coefficients at the 1%, 5% and 10% levels respectively.

In addition to testing the portfolio allocation within each sector, as above, we also test for relative differences in portfolio allocation between the two sectors. To assess the influence of credit risk and liquidity risk on the relative differences between banks' and investment funds’ market shares, a probit model is estimated in the cross section. The dependent variable is binary, equal to 1 if banks’ portfolio share in a given asset is higher than that of investment funds and 0 otherwise.

Thus, the following model estimates the probability that banks allocate a higher share to a given asset than investment funds:

where is the cumulative distribution function of the standard normal distribution. The explanatory variables are the credit risk and liquidity risk indices.

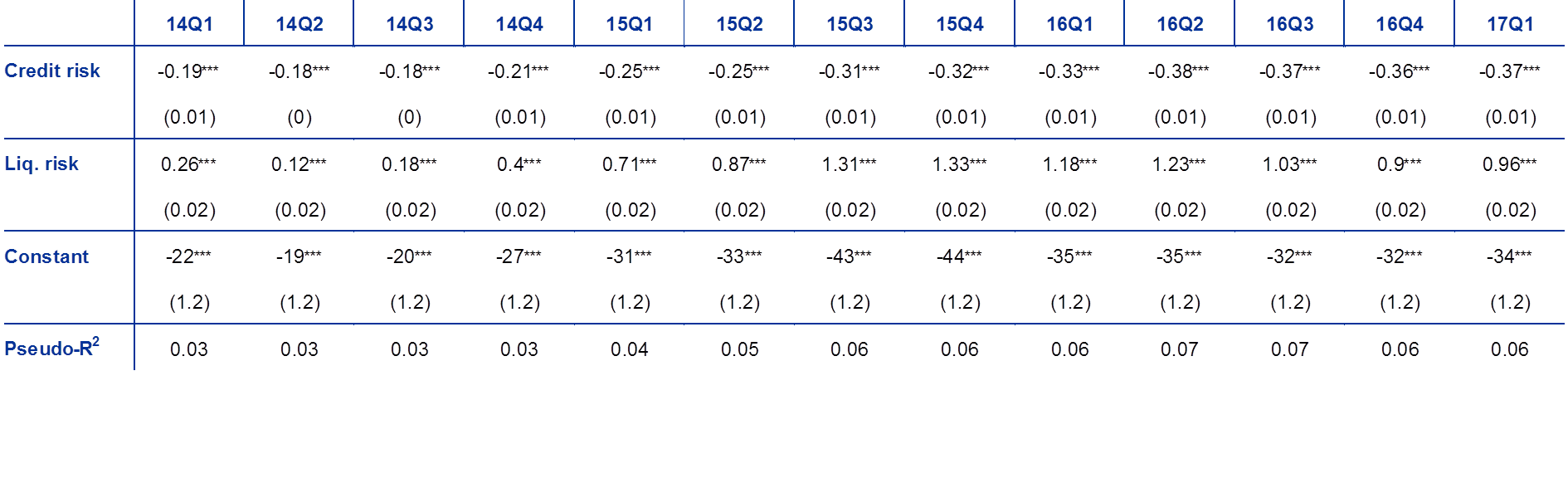

Figure 3 and Table 2 illustrate the results. Coefficients for credit and liquidity risk reported in Figure 3 and regression estimates shown in Table 2 are very similar to those in Figure 2.

Finally, the development of the coefficients in Figure 2 and Figure 3 over time suggests that the impact of credit and liquidity risks in absolute terms has strengthened over time. Increases in the absolute value of all coefficients between the first quarter of 2014 and the first quarter of 2017 are likely associated with policy changes, such as the newly introduced liquidity requirements or (increases in) regulatory pressure to comply with new capital ratios.

Figure 3

Bank and investment fund portfolio allocations

(coefficient estimates; probit regression, relative differences in portfolio shares)

Source: Authors’ calculations based on SHS data.

Notes: The figure illustrates cross-sectional coefficients from Table 2, which reflect the influence of credit risk and liquidity risk on relative differences in portfolio allocation between the two sectors. The p-values are extremely small, so the confidence bands are not visible in the figure.

Table 2

Cross-sectional probit regression for differences in portfolio shares

Source: Authors’ calculations.

Notes: This table shows results for a regression of Equation 3, which tests the influence of credit risk and liquidity risk on relative differences in portfolio allocation between the two sectors. The dependent variable is binary, equal to 1 if banks’ portfolio share in a given asset is higher than that of investment funds and 0 otherwise. The ***, ** and * denote significant coefficients at the 1%, 5% and 10% levels respectively.

3.2 Assessing the impact of capital on banks’ holdings of safe assets

A comprehensive analysis of the full set of drivers behind the changes in the distribution of market shares across banks and investment funds is beyond the scope of this article. Nevertheless, this section presents analysis that aims to capture the contribution of one important driver, namely higher capital ratios, while controlling for other relevant factors, such as monetary policy, the macroeconomic environment and bank-specific variables (e.g. the deposits to total liabilities ratio, the loans to total assets ratio and the cash to total assets ratio). In our analysis, we use average levels of the Tier 1 ratio in the euro area to proxy for the stringency of risk-based capital requirements.

More stringent capital requirements have been cited as one of the reasons for the relative shrinking of the traditional banking sector and the growth of investment fund sector. Over the past decade, it has been observed that competitive pressures have led the financial sector to adapt continually to the new regulatory environment in an effort to reduce and evade regulatory requirements.[10]

Against this background, we assess whether stronger capital requirements contribute to these structural shifts in the market by increasing banks' portfolio share in safe assets, testing the following hypothesis and the linear panel fixed-effects model similar to Hanson et al. (2015) below.

Hypotheses 3: Overall capital requirements should be negatively correlated with banks’ incentives to hold risky assets, leading to a reduction in these bank portfolio shares in euro area asset markets.

where represents normalised portfolio shares, is the level of capital represented by the Tier 1 ratio based on the euro area average at time t. Credit risk (CR) and liquidity risk (LR) are captured through credit risk and liquidity risk index variables. is a vector of control variables, including GDP growth in the euro area; bank-specific variables, such as the average deposits to total liabilities ratio, the loans to total assets ratio and the cash to total assets ratio of euro area banks; indicators for monetary policy actions, such as the deposit facility rate, the marginal lending facility rate and the log of assets acquired under the ECB asset purchase programme; and variables to capture the regulatory environment in which the bank operates, e.g. the implementation date of the liquidity requirements captured by a dummy variable amounting to 0 before the first quarter of 2015 in the first quarter of 2015 and 1 thereafter. Individual and interacted effects of the main explanatory variables omitted in the presentation of the model are indicated as “…”. We also include security-level fixed effects in the model. Finally, is the idiosyncratic error term. Moreover, to account for heterogeneity among security types, we use clustered standard errors at the security level.

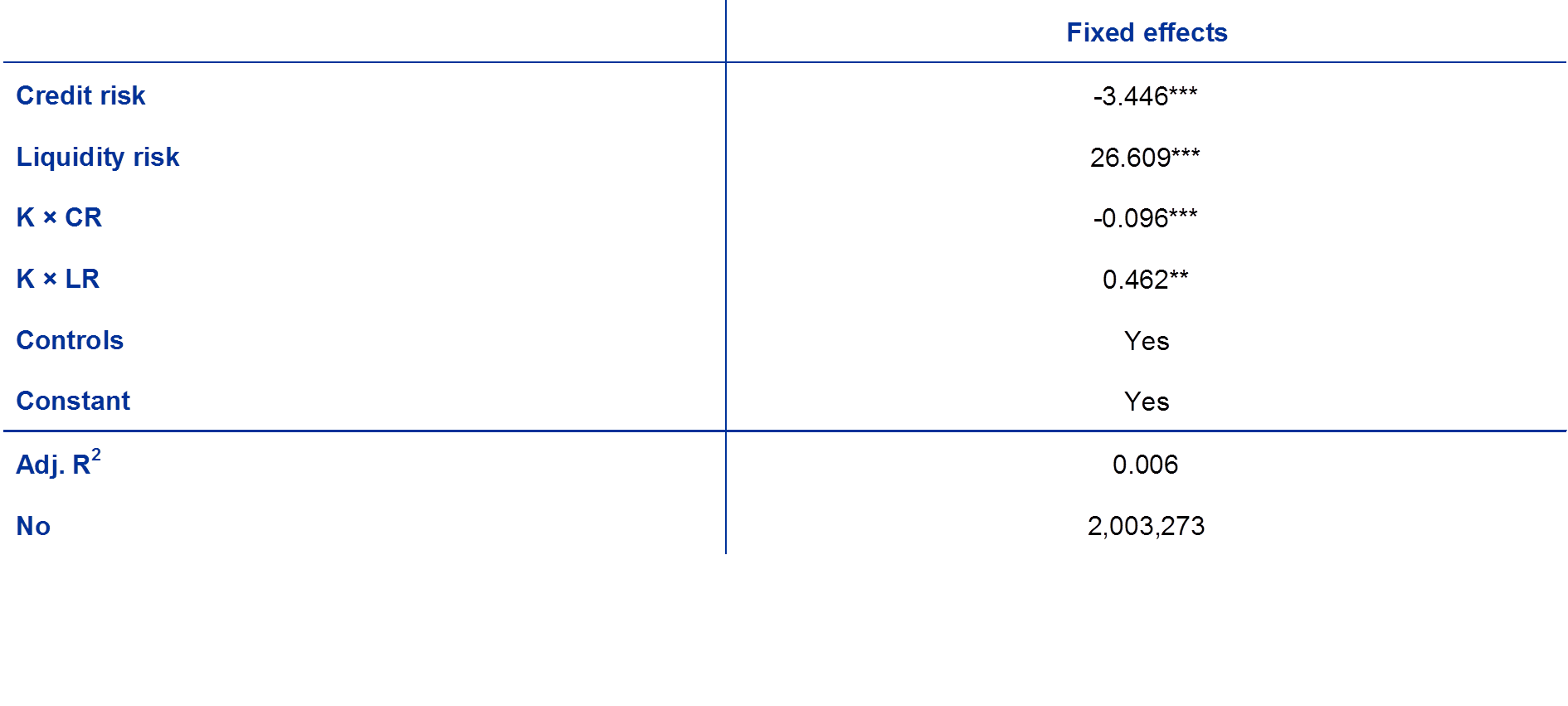

Regression estimates in Table 3 illustrate the results. It is shown that higher capital ratios amplify the effects of an increase in an asset’s credit risk on banks’ holdings of that asset. It turns out that the joint effect of an increase in credit risk and an increase in the level of capital requirements is negative and statistically significant. Stronger capital requirements seem to make banks more reluctant to hold risky assets for a given level of liquidity risk, which confirms Hypothesis 3. This finding shows that, while capital requirements contribute to a safer banking sector, they also contribute to the shift in market shares and change in the composition of assets across the financial system.

Table 3

Relevance of capital requirements on banks’ portfolio share

Source: Authors’ calculations based on SHS data.

Notes: This table shows results for a regression of Equation 4, which tests whether stronger capital requirements increase banks' portfolio share in safe assets. The ***, ** and * denote significant coefficients at the 1%, 5% and 10% levels respectively. The adjusted R2 only indicates the level of variation explained by the main regressors and not the individual securities’ specific fixed effects (which we also include in our model).

Our econometric setting does not allow us to establish a causal relation between the change in capital requirements and banks’ market share of safe assets. Nevertheless, the correlation results obtained in our analysis are in line with the observation that the shift in market shares from banks to investment funds occurred at the same time as capital requirements strengthened. In addition, illustrative/univariate evidence, showing that banks' average portfolio credit risk has fallen over time, supports the findings (see Figure 1).

4 Conclusions

The share of the asset management sector in the EU financial system has risen significantly in the past decade, while the size of the banking sector has stagnated. A number of drivers have been identified behind these secular trends, including changes in the regulatory framework, monetary policy and search for yield. As a result, banks and investment funds increasingly compete for assets.

The article provides two contributions to the ongoing debate on the structural changes in the European financial system. First, it provides insight into the effects of increased competition between investment funds and banks. Our empirical analysis finds that an increase in an asset’s credit risk is associated with a decline in bank holdings of that asset, while the opposite is true for banks’ holdings with respect to liquidity risk.

Secondly, our analysis provides further evidence on the effects of changes in capital requirements. Our empirical findings suggest that higher capital requirements make the banking sector as a whole more reluctant to hold risky assets and thereby contribute to increase banks' portfolio share in safe assets.

Moreover, while higher capital requirements are crucial for the resilience of the banking sector, our analysis suggests that they may also contribute to the shift in market shares and change in the composition of assets across the financial system. Our findings therefore highlight the need to monitor these structural shifts in the market, in particular the migration of systemic risk to the non-bank financial sector, and the need to adequately regulate this sector, also through macroprudential policies.

Literature

Bai, J., Krishnamurthy, A. and Weymuller, C.-H., “Measuring liquidity mismatch in the banking sector” The Journal of Risk Finance, forthcoming.

Chen, Q., Goldstein, I. and Jiang, W., “Payoff complementarities and financial fragility: Evidence from mutual fund outflows”, Journal of Financial Economics, Vol. 97, No 2, 2010, pp. 239-262.

Financial Stability Review, ECB, Frankfurt am Main, November 2017.

Hanson, S.G., Shleifer, A., Stein, J.C. and Vishny, R.W., “Banks as patient fixed-income investors”, Journal of Financial Economics, 117(3), 2015, pp. 449-469.

IMF, Global Financial Stability Report, 2014.

Wehinger, G., “Bank deleveraging, the move from bank to market-based financing, and SME financing”, OECD Journal: Financial Market Trends, 2012(1), 65-79.

© European Central Bank, 2018

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

ISSN 2467-1770 DOI 10.2866/351597

ISBN 978-92-899-3195-3 EU catalogue No QB-CA-18-001-EN-Q

- Swiss Finance Institute and University of Lausanne

- Financial Stability Review, ECB, November 2017 and Report on Financial Structures, ECB, October 2017.

- Report on Financial Structures, ECB, October 2017.

- See Macroprudential policy issues arising from low interest rates and structural changes in the EU financial system, European Systemic Risk Board, November 2016.

- See Haldane, A., “The Age of Asset Management?”, speech, April 2014.

- See the November 2017 issue of the Financial Stability Review and the October 2017 issue of the Report on Financial Structures.

- Empirical evidence suggests that investors’ redemption decisions are largely procyclical, depending on past fund returns. Recent studies show that the sensitivity of investor flows to poor performance is stronger for funds that hold a higher share of less liquid assets (see Chen, Goldstein and Jiang (2010)). A possible explanation for this finding is that less liquid assets are harder to sell and that investors anticipate higher costs associated with portfolio adjustments following redemptions.

- Empirical evidence suggests that investors’ redemption decisions are largely procyclical, depending on past fund returns. New findings for a large sample of European alternative investment funds indicate that open-ended leveraged funds experience greater investor outflows after bad performance than unleveraged funds.

- See Hanson et al. (2015).

- See the IMF’s Global Stability Report, 2014, and Wehinger, G., “Bank deleveraging, the move from bank to market-based financing, and SME financing”, 2012.