Euro area house price developments during the coronavirus pandemic

Published as part of the ECB Economic Bulletin, Issue 4/2021.

Aggregate euro area house price dynamics have remained robust during the coronavirus (COVID-19) pandemic. Year-on-year house price growth increased from 4.3% at the end of 2019 to stand at 5.8% in the last quarter of 2020 – the highest growth rate since mid-2007. This box reviews recent developments in euro area house prices and their relation to macroeconomic conditions from different angles (across countries, types of housing and location).

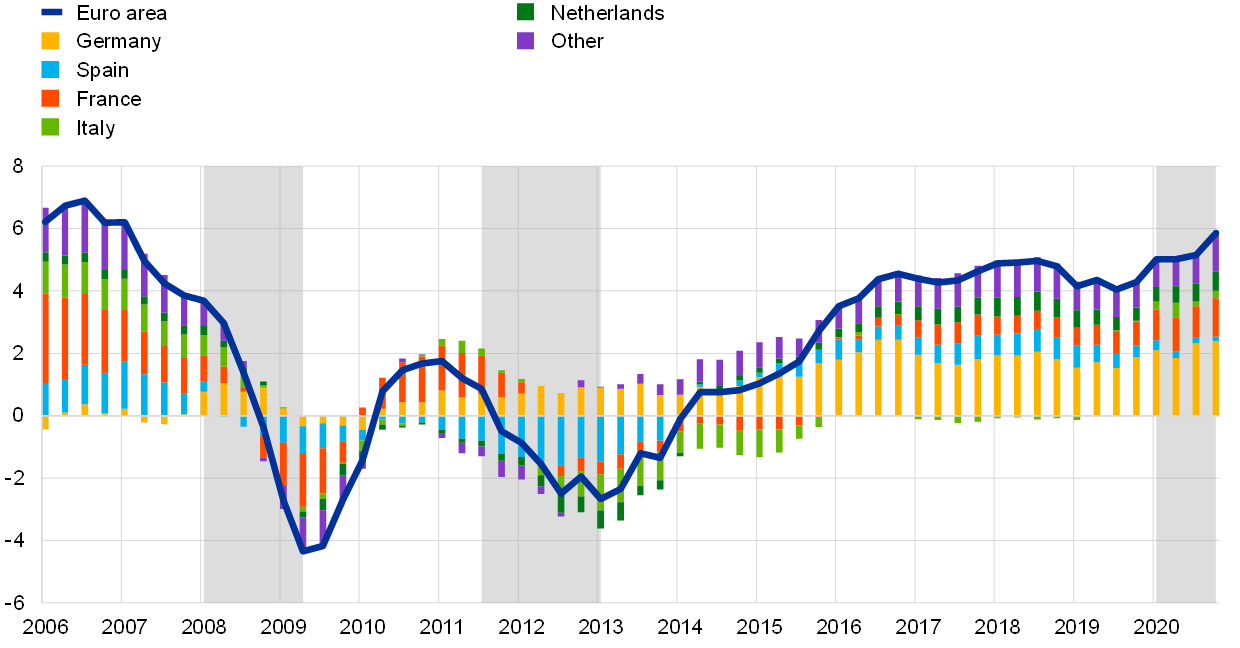

The pandemic is different from previous crises. The global financial crisis of 2008 originated in the US housing market and the sovereign debt crisis starting in 2010 had adverse implications for financing conditions in several euro area countries. In both cases, euro area house prices declined relatively quickly (Chart A, shaded areas). The COVID-19 crisis hit households at a time when income and employment were relatively strong, and while growth contracted sharply house prices held up and have even increased since the start of the pandemic.

Chart A

Euro area residential property prices and contributions by countries

(year-on-year percentage changes and percentage point contributions)

Sources: ECB, own calculations and Eurostat. The latest observations are for the fourth quarter of 2020.

Note: The shaded areas indicate periods of recession in the euro area.

A first angle from which to assess aggregate euro area house price developments is by looking at underlying country contributions. The observed resilience in house prices in 2020 was broad-based and all large euro area countries contributed positively to the annual increase in euro area house prices. Germany, France and the Netherlands accounted for around 73% of the total increase in the last quarter of 2020 (Chart A), which is more than their weight in the overall house price index. In the case of Germany, the positive contribution to euro area house prices started in mid-2010, also reflecting some catching up after a period of subdued house price developments.

The resilience in euro area residential property prices reflects a combination of factors. First, the negative impact of the COVID-related shock is associated with a sharp fall in housing transaction volumes in the second quarter of 2020 owing to lockdown measures.[1] This shift continued to some extent in the third quarter of 2020 and generally entailed a quantity adjustment rather than a price adjustment. Second, moratoria on loan repayments and job retention schemes cushioned, to some extent, falls in household income and an increase in unemployment. Third, loans for house purchase continued to grow in 2020 and financing conditions remained favourable, with the composite lending rate for house purchase at an all-time low of 1.3% at the end of 2020. In addition, a period of forced saving associated with the pandemic may have loosened liquidity constraints for some households, especially in countries with large down payment requirements. Finally, amid considerable economic uncertainty and a low-yield environment, private and institutional investors have contributed to housing demand for investment motives.

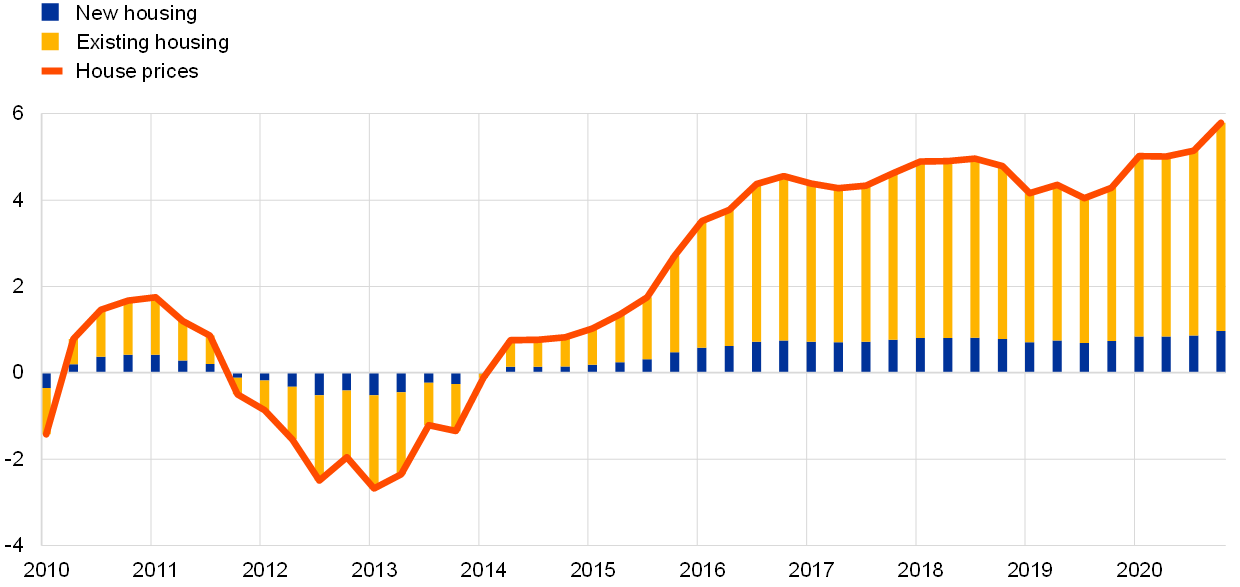

A second angle from which to assess aggregate euro area house price developments is by disentangling prices of new and existing housing. In a buoyant housing market, one would expect the prices of existing housing to rise more than those of new build, as demand may be partly redirected to the existing stock to compensate for the scarce supply of new housing. Indeed, prices of existing properties have been particularly dynamic in the pandemic period and, given their large weight in house price indices, they have contributed significantly to house price increases (Chart B).[2] According to Eurostat data, in the course of 2020, prices of existing housing in the euro area increased 0.8 percentage points more, in annual terms, than prices of new housing.

Chart B

Euro area residential property prices and contributions by types of housing

(year-on-year percentage changes and percentage point contributions)

Sources: ECB, own calculations and Eurostat. The latest observations are for the fourth quarter of 2020.

Notes: Euro area weights for new and existing housing are a weighted average of country weights based on GDP weights. For Greece, weights of new and existing housing were approximated using the euro area average excluding Greece. Euro area house prices refer to the ECB’s residential property price indicator.

Developments varied considerably across euro area countries, but those countries experiencing strong house price dynamics (i.e. Germany, France and Austria) were generally associated with higher price increases for existing housing. This could suggest that the contraction in euro area housing investment observed in 2020 (in excess of 5% in annual terms) may have weighed on the supply of new build, thus putting additional upward pressure on the prices of existing housing. The contraction in approvals of building permits seen in the course of 2020 could prolong this phenomenon, thus continuing to support house prices.

Aggregate euro area house price developments can be assessed from a third angle by comparing developments in capital cities with developments in the rest of the country.[3] Different house price developments at the regional level could be justified by fundamentals, such as differences in regional income, employment, population dynamics and amenities, but they could also signal the exuberance of house prices in certain areas.[4] The recent resilience of the housing market appears to be broad-based and not limited to capital cities (Chart C). According to ECB estimates, in the course of 2020, euro area house prices in selected capital cities increased 0.7 percentage points less, year on year, than the euro area aggregate. This may reflect some natural deceleration in price dynamics given the strong house price increases in capital cities in previous years, and that the elevated price levels reached in some jurisdictions triggered some price spillovers or shifts in demand to areas outside capital cities. The observed rise in house prices outside capital cities may also reflect a preference shift associated with increased possibilities for working from home. Whether and to what extent such mobility to less central locations is permanent needs to be corroborated by further evidence once the pandemic has ended.

Chart C

Residential property prices for a synthetic euro area aggregate and selected euro area capital cities

(year-on-year percentage changes)

Sources: ECB, own calculations, Eurostat and national sources. The latest observations are for the fourth quarter of 2020.

Notes: The euro area synthetic aggregate series is a weighted average based on 2019 GDP weights. The aggregate includes Belgium, Germany, Estonia, Ireland, Spain, France, Italy, Netherlands, Austria Slovenia and Finland. The aggregation for the fourth quarter of 2020 does not include Belgium and Slovenia.

Overall, an assessment of recent house price developments from different angles points to resilient and broad-based growth across jurisdictions, types of housing and locations. House price dynamics remain highly dependent on the recovery path in an environment that is characterised, on the one hand, by favourable financing conditions and, on the other, by pandemic-related uncertainties.

- The availability of housing transaction data is limited to selected euro area countries (Eurostat and national sources) and does not include the euro area aggregate. Nevertheless, available data generally point to sharp declines in the annual rate of change in transactions in the second quarter of 2020 (from falls in excess of 40% in Spain and Ireland, to an increase close to 7% in the Netherlands), followed by a gradual normalisation in the third quarter of 2020.

- The weight of existing housing in the euro area is approximately 83%.

- Euro area house prices can be decomposed into developments in selected euro area capital cities and compared with those of a synthetic euro area aggregate The synthetic euro area aggregate includes euro area countries for which house prices in capital cities are available and accounts for around 95% of the euro area (see the notes under Chart C). Developments in official and synthetic euro area house prices in the period considered are broadly comparable.

- For a discussion, see the box entitled “Residential real estate prices in capital cities: a review of trends”, Financial Stability Review, May, ECB, 2017.