The euro area capital stock since the beginning of the COVID-19 pandemic

Published as part of the ECB Economic Bulletin, Issue 2/2021.

This box examines the latest developments in the euro area stock of capital and its main drivers. More specifically, it discusses the role played by investment and the depreciation and retirement of fixed assets in explaining capital stock developments. It also shows the extent to which recent developments are similar to those experienced during the great financial crisis and the subsequent euro area sovereign debt crisis.[1] The analysis relies primarily on European Central Bank (ECB) quarterly estimates of capital stock, which are based on a constrained optimisation model using annual data from Eurostat (with a lag of two years) and temporal disaggregation techniques.[2] Therefore, especially the recent data and analysis should be considered with caution and may be subject to significant revisions in the future.

The stock of capital is a pivotal factor in supply side analysis. Hence, the analysis of the changes in the capital stock is critical in order to estimate how potential growth has been affected during the coronavirus (COVID-19) crisis.[3] Moreover, capital per worker – or capital intensity – is also key to assessing labour productivity trends. Therefore, understanding the evolution of the capital stock in the recent period matters for the analysis of the medium-term and long-term effects of the COVID-19 crisis on supply factors and potential growth.

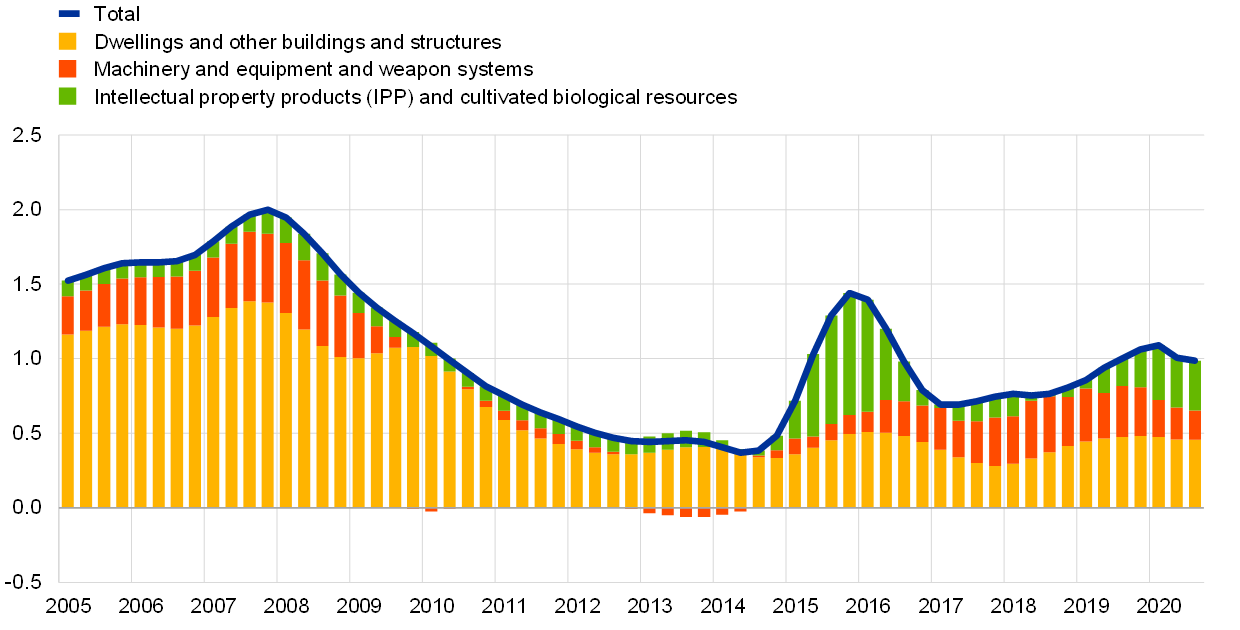

The real capital stock growth is estimated to have decreased moderately in the wake of the COVID-19 crisis. After having risen steadily since the beginning of 2017, the euro area real stock of capital increased by 1.0%, on a year-on-year basis, in the second and third quarters of 2020, after a 1.1% increase in the first quarter of 2020 (Chart A). This relative stability of the stock of capital hides the effects that the crisis may have on the value of the stock. The asymmetric sectoral nature of the pandemic shock may mean significant capital stock value losses at the sectoral level. For instance, airlines have already written down value of some assets.[4] This valuation effect is not visible, at least in the short term, on the volume of the capital stock. Moreover, the limited effect of the crisis on the stock of capital conceals large heterogeneity across assets. At the asset level, machinery and equipment on the one hand, intellectual property products (IPP) on the other hand, contributed significantly to the decline in real capital stock. By contrast, the contribution of dwellings and other buildings and structures to the deceleration was more muted (Chart A).

Chart A

Resilient capital stock growth so far

Asset contributions to real capital stock growth

(annual percentage change)

Source: ECB staff calculations based on Eurostat data

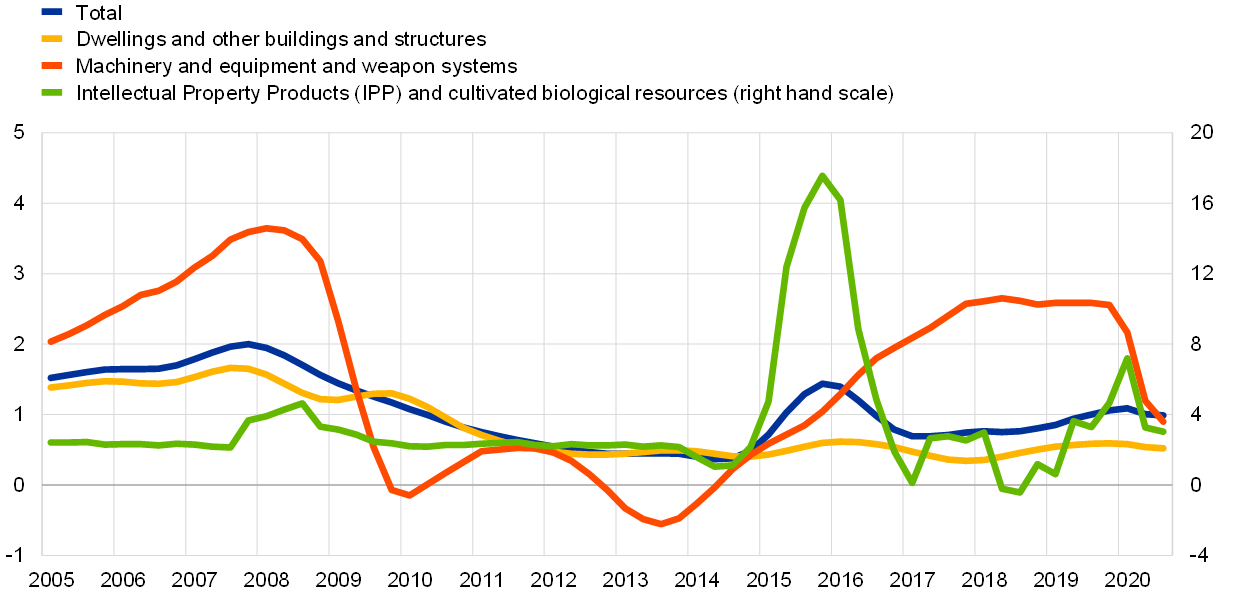

Overall, the growth of the real stock of capital has remained relatively stable since the pandemic hit. Looking at the first quarters of 2020 and trying to draw some comparisons with what occurred during the crises of 2008 and 2011 is a challenging exercise. The COVID-19 crisis is not over yet and is of a different nature from the great financial crisis and the sovereign debt crisis, which were both economic crises arising from financial crises. The pandemic is hitting service activities more severely, while it affects the most capital-intensive sectors, like manufacturing, somewhat less heavily. Following the great financial crisis, the growth of the stock of capital gradually fell from an annual average of more than 1.5% before 2008 to around 0.4% in the period from 2011 to 2014 (Chart A). The recovery in capital stock growth only began at the beginning of 2014, driven by the combined rebound in machinery and equipment and IPP assets. However, these medium-term to long-term developments are not yet visible in the aftermath of the COVID-19 crisis. Currently, as in 2008 and 2011, capital growth in machinery and equipment has been severely affected by the COVID-19 crisis (Chart B). Conversely, investments in dwellings and other buildings and structures remain resilient so far – to the same extent as in 2008 and 2011. However, in this regard, the 2008 crisis had long-term adverse effects. Finally, on IPP, comparisons with the great financial crisis are complicated by the relocation of sales proceeds and intangible assets of multinational enterprises in some countries in recent years.[5] After three observable quarters of crisis, the deceleration in the stock of capital in IPP is stronger than was observed in 2008 and in 2011, but the starting point is also higher (Chart B).

Chart B

Total capital stock growth and the growth heterogeneity across assets

Growth in real capital stock by asset

(annual percentage change)

Source: ECB staff calculations based on Eurostat data.

The muted fall in the growth of the capital stock is likely the result of lower investment partially offset by somewhat reduced depreciation.[6] Gross fixed capital formation dropped in the euro area in the first half of 2020, adversely affecting capital stock. The initial data available, albeit tentative, suggest that lower depreciation rates supported capital stock developments.

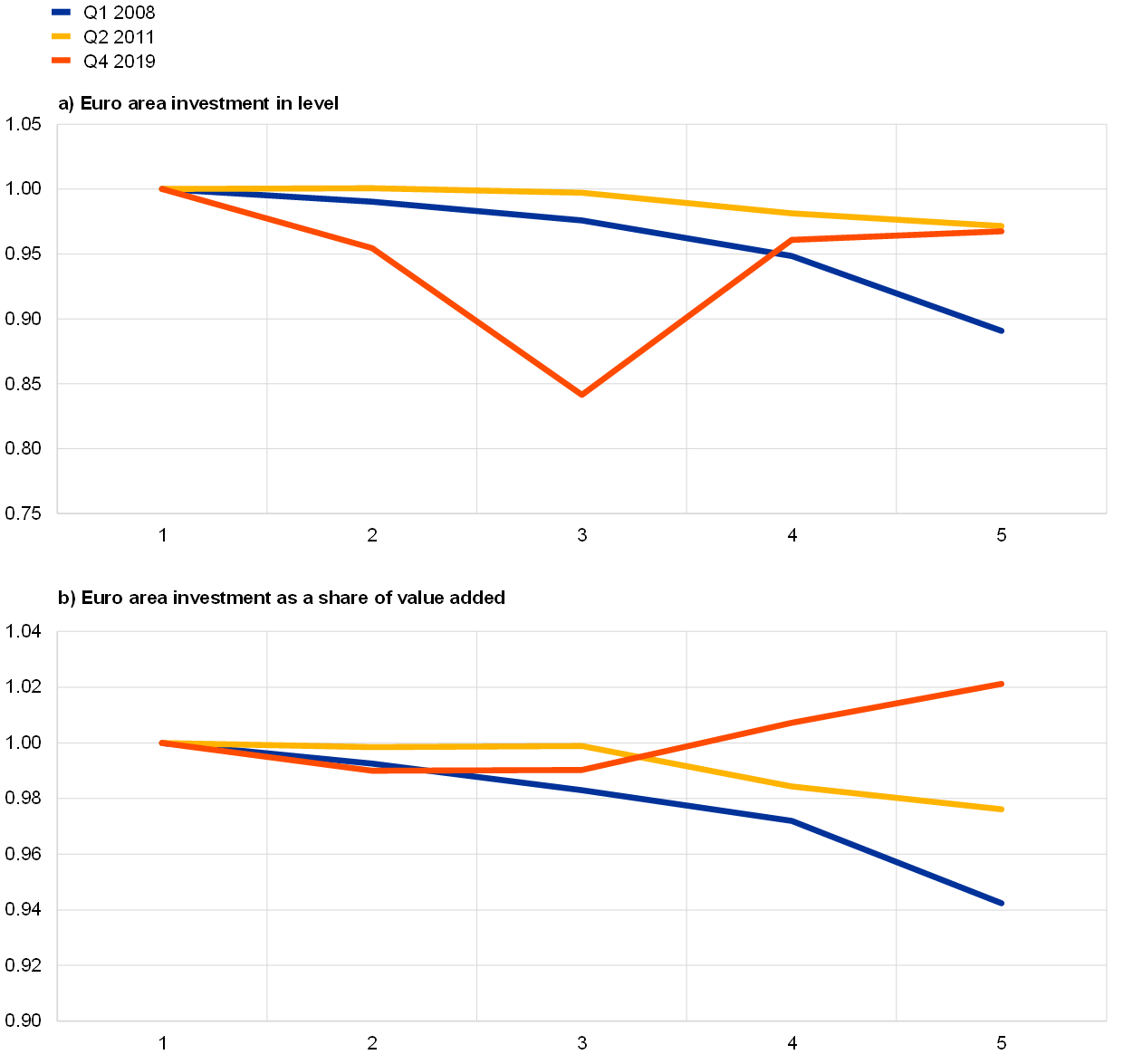

The COVID-19 shock negatively affected the capital stock in the euro area, mainly through lower investment. Despite supportive financing conditions, the high level of uncertainty adversely affects investment decisions, notably business investment. The decline in domestic demand and falling corporate margins dampen investment expenditures. Hence, on a year-on-year basis, total gross fixed capital formation dropped by 20% in the second quarter of 2020, and by 4.3% in the third quarter of 2020. The pandemic has sharply curbed investment, whereas during the great financial crisis the decline was slower and less steep (Chart C, panel a).

Despite the record low investment growth observed in the first half of 2020, the decline in investment growth has not been as strong as might have been expected. Changes in investment are typically of a magnitude larger than that of value added – a phenomenon commonly referred to as the “accelerator effect”. The accelerator effect did not hold during the COVID-19 crisis. In 2020, in the largest euro area countries, changes in investment were of a magnitude comparable to value added (Chart C, panel b).[7] Several explanations can be put forward to explain the resilience of gross fixed capital formation. Non-financial corporations have generally entered the pandemic with sound balance sheets and the credit channel has been kept open to them. Social distancing and teleworking are also likely to amplify the need for investment in digital technology. Furthermore, a need to reorganise supply chains may have led to the emergence of new investment opportunities. These factors contributed to the resilience of capital stock growth.

Chart C

The fall in euro area investment: a comparison with past recessions

(x-axis: quarters; y-axis: percentage points)

Source: ECB staff calculations.

Notes: The chart shows developments in total gross fixed capital formation over the course of each recession, where the first quarter preceding the recession is set equal to one. The quarter preceding the recession is displayed in the legend. Ireland is excluded from the sample, given the large volatility affecting investment in Ireland in recent years.

The lower depreciation rate partially offset the decline of investment’s implication for the capital stock. Theoretically, capital retirement and depreciation might have been affected differently by COVID-19. On the one hand, company liquidations may lead to some of the capital assets being retired before the end of their service life. However, on the other hand, the lifespan of existing assets may be extended thanks to less intensive utilisation, for example if they were idle during the lockdown. It has also been argued that capital depreciation would be procyclical and linked to periods of higher maintenance of the capital in downturn periods.[8] During the first three quarters of 2020, some evidence suggests that the effect of a lower wear and tear of the capital dominated, leading to a decrease in the depreciation of the stock of capital. From the data on capital stock and investment, it is possible to extract a rate of depreciation, which, albeit with some degree of uncertainty, seems to have declined in the euro area and its largest countries in the first quarters of 2020. Moreover, the consumption of fixed capital, which does not, however, account for capital scrapping[9], has decelerated over 2020 (Chart D). It reflects the lower use and wear and tear of production capacities. Meanwhile, existing policy measures, in the form of loan guarantees and a partial sharing of wage costs in the context of short-time work schemes, has likely shielded companies from liquidation and prevented capital retirement. Therefore, it looks as if, at least temporarily, the rate of depreciation has also supported the evolution of the capital stock.

Chart D

The fall in consumption of fixed capital: a comparison with past recessions

Consumption of fixed capital per unit of value added in the largest euro area countries

(x-axis: quarters; y-axis: percentage points)

Source: ECB staff calculations

Notes: The chart shows the cumulated changes in consumption of fixed capital per unit of value added, where the first quarter preceding the recession is set equal to one. The quarter preceding the recession is displayed in the legend. Due to the volatility of some series or the absence of data in some countries, this chart represents the overall change observed in Germany, France, Italy and Spain.

Looking ahead, the long-term effects of the COVID-19 crisis on the capital stock are very uncertain, notably in a context of major structural changes. The time lag of two years for the release of official statistical data on capital stock makes the assessment of recent and current changes difficult. On the one hand, it cannot be ruled out that the pandemic could have long-term scarring effects on the stock of capital. The end of targeted support policy measures could lead to increasing business failures and capital retirement as well as lower investment growth. On the other hand, the pandemic might also trigger, or accelerate, structural change in the economy. The Next Generation EU package, for instance, will further underpin national investment efforts. Other long-term factors could also affect the stock of capital to a large extent. For instance, climate change is expected to lead to a renewal of the capital stock. The recent European Investment Bank (EIB) annual corporate survey finds that two in three EU firms have either made, or are planning on making, investments to tackle the impacts of weather events and reduce carbon emissions.[10]

- In this box, the focus is on both public and private capital stock. However, most of the euro area capital stock and investment are made up of private assets (about 85% for both investment and capital stock).

- See Hofmeister, Z. and van der Helm, R., “Estimating non-financial assets by institutional sector for the euro area”, Statistics Paper Series, No 23, ECB, May 2017. The methodology is mainly based on a temporal disaggregation of the annual capital stock using quarterly Gross Fixed Capital Formation (GFCF) as a quarterly profile indicator. The temporal disaggregation is applied at the first difference of the annual capital stock; the resulting quarterly capital stock (including the forecasted most recent quarters) is subsequently balanced as required to ensure balanced asset by sector matrix. Regarding the cases where annual data for capital stock is not available given its two-year publication lag, these annual figures are derived using a Permanent Inventory Method (PIM) or the so called “capital accumulation equation”. The coefficients for the most recent years, where not available, are extrapolated based on past developments, “inverse” PIM, or expert information.

- See the article entitled “The impact of COVID-19 on potential output in the euro area”, Economic Bulletin, Issue 7, ECB, 2020.

- See “All you need to know about aircraft values in 2021”, International Bureau of Aviation, February 2021.

- In recent years several large multinational companies have relocated their corporate activities, in particular their underlying IPP, to Ireland. As a result, the sales (output) generated using intellectual property contributed strongly to Irish investment and capital stock. See Khder, M. and Montornès, J., “The impact of multinationals’ transfers on Irish GDP”, Eco Notepad, No 202, Banque de France, February 2021.

- The net capital stock estimates are generally based on the perpetual inventory method (PIM), which can be approximated by the capital accumulation equation that links the net capital stock ( ) to investment ( ), retirement and depreciation rates and revaluation : . For the sake of simplicity, in this box, the so-called depreciation rate includes both scrapped (or retired) assets and consumption of fixed capital, which accounts for the wear and tear of the capital required for production.

- See “Economic outlook - February 2021”, Institut national de la statistique et des études économiques, Paris, p. 30-31.

- Albonico, A., Pappa, E. and Sarantis, K., "Capital maintenance and depreciation over the business cycle", Journal of Economic Dynamics and Control, Vol. 39, Issue C, Elsevier, 2014, pp. 273-286.

- On average, for the euro area, the consumption of fixed capital accounts for half of the capital depreciation, the rest being made up of scrapping capital.

- See “EIB Group survey on investment and investment finance 2020”, European Investment Bank, 1 December 2020.