Public loan guarantees and bank lending in the COVID-19 period

Published as part of the ECB Economic Bulletin, Issue 6/2020.

Most euro area governments have launched large programmes of public loan guarantees to preserve access to bank loans for businesses. Demand from firms for bank loans has soared to record levels since March 2020 as firms have scrambled to bridge liquidity gaps originating from the coronavirus (COVID-19) shock. This increase in demand was driven by a decline in the capacity of firms to finance their ongoing costs via operating cash flows, owing to a sharp fall in their revenues during the lockdown period. This resulted in acute liquidity needs to finance working capital and necessary investments. Moreover, in a context of high uncertainty, firms sought loans with a view to building up precautionary liquidity buffers or adapting their business to the new environment. To help banks accommodate the surge in loan demand at favourable conditions, most euro area governments have implemented schemes to provide public guarantees for bank loans. These schemes transfer some of the credit risk and potential credit losses from banks to governments, thereby mitigating the costs for banks. This box first discusses the characteristics of these public loan guarantee schemes and their take-up across the large euro area countries. Then it examines how firms’ take-up of guaranteed loans is reflected in aggregate lending figures.

The features of the loan guarantee schemes vary across countries but they must all comply with the guidelines adopted by the European Commission.[1] Guarantee schemes aim at supporting firms and self-employed persons that have been affected by the COVID-19 crisis but had not been in financial difficulties at the end of 2019. The schemes generally apply to new lending and typically to medium and long-term loans (with an average maturity of five years).[2] The window for applying for loans covered by guarantee schemes is set to close at the end of 2020 in most cases. The maximum amount per borrower is typically 25% of the beneficiary’s turnover in 2019 or twice the wage bill in 2019. The share that is guaranteed ranges between 70% and 90% of the loan principal, although 100% guarantee schemes are also available in a few countries, including Italy and Germany, especially for smaller loans to small and medium-sized enterprises (SMEs) and the self-employed. The extent of the coverage is smaller in some other euro area countries. In some countries, firms benefiting from such programmes are subject to conditions, such as a prohibition on distributing dividends, limits on the remuneration of managers or a commitment to retaining employees.[3] The apparently complex design of such programmes reflects the trade-off between responding quickly to the crisis and maintaining a sufficient level of prudence in order to mitigate any undesirable behaviour on the part of banks, such as excessive risk-taking, or on the part of firms, for example shedding labour while receiving credit support from the government.[4]

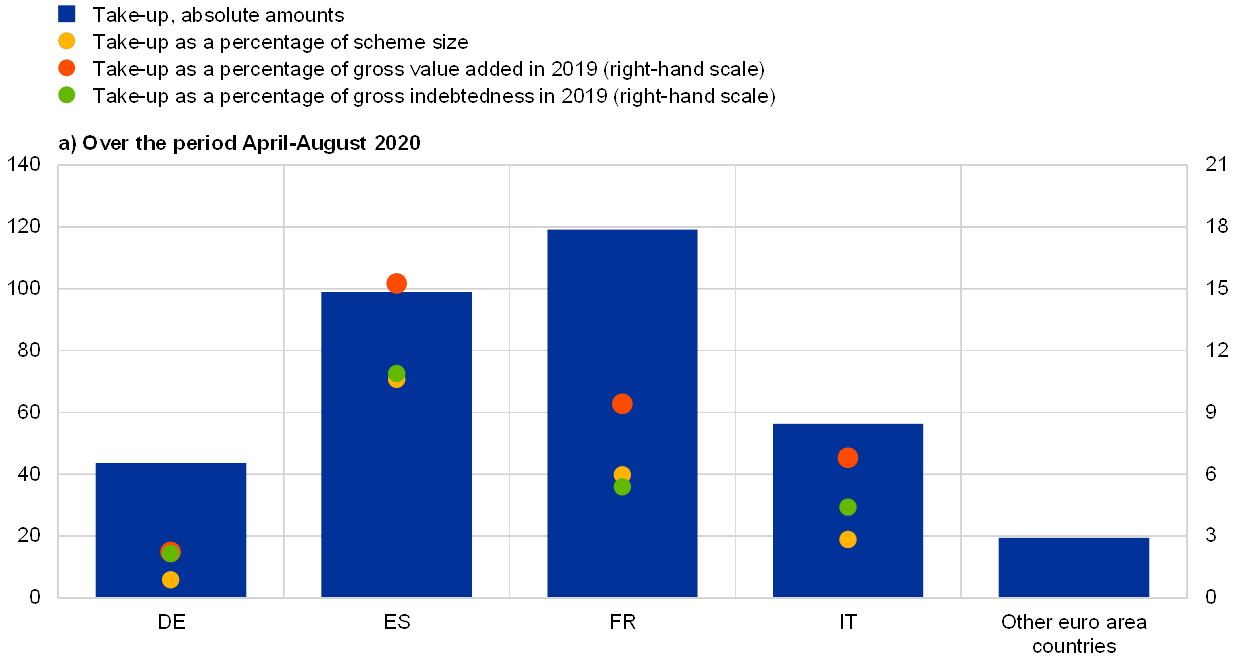

The use of public loan guarantees has been heterogeneous across countries, with higher take-ups being reported in Spain and France, while lower amounts have been taken up in Italy and Germany. Since the implementation of the programmes in April, firms have drawn down around €120 billion in guaranteed loans in France and around €100 billion in Spain (see Chart A, panel a). Relative to the gross indebtedness of non-financial corporations, the take-up has been highest in Spain (about 11% of gross indebtedness), followed by France (about 5% of gross indebtedness). By contrast, the take-up has been more moderate in Italy (around €55 billion, i.e. about 4% of gross indebtedness) and in Germany (around €45 billion, i.e. about 2% of gross indebtedness). In Spain, the greater recourse to guaranteed loans can be partly attributed to the lower availability of alternative fiscal relief measures for corporations (e.g. debt moratoria and direct grants of State aid). In France, the higher take-up of guaranteed loans reflects their very favourable pricing conditions, especially during the first year of the loan. In Germany, the relatively limited use of such loans mainly reflects: (i) lower financing needs of firms compared with other countries, owing to a less stringent lockdown and firms’ greater use of a combination of other policy measures, including direct grants and tax deferrals and short-time working schemes; (ii) less favourable conditions associated with the schemes (e.g. concerning the pricing of loans, a prohibition on distributing dividends and limits on the remuneration of managers); and (iii) some supply-side bottlenecks related to the risk assessment required for large loans. In Italy, the low recourse recorded so far mainly reflects operational bottlenecks that initially existed on the supply side. These bottlenecks have gradually receded and in July and August the monthly provision of these types of loan was higher in Italy than in the other countries (see Chart A, panel b).

Chart A

Take-up of loans under public guarantee schemes

(left-hand scale: EUR billions, percentages; right-hand scale: percentages)

Sources: Kreditanstalt für Wiederaufbau for Germany, Instituto de Crédito Oficial for Spain, Ministère de l'Économie et des Finances for France, Ministero dell’Economia e delle Finanze and Banca d’Italia for Italy, various national authorities for other euro area countries, news sources, Eurostat and ECB calculations.

Notes: The take-up data refer to approved amounts of guaranteed loans. As guaranteed loans can also be granted in the form of revolving credit facilities, the approved amount is higher than the amount actually disbursed. The overall size of the schemes is €757 billion for Germany, €140 billion for Spain, €300 billion for France and €300 billion for Italy.

(EUR billions)

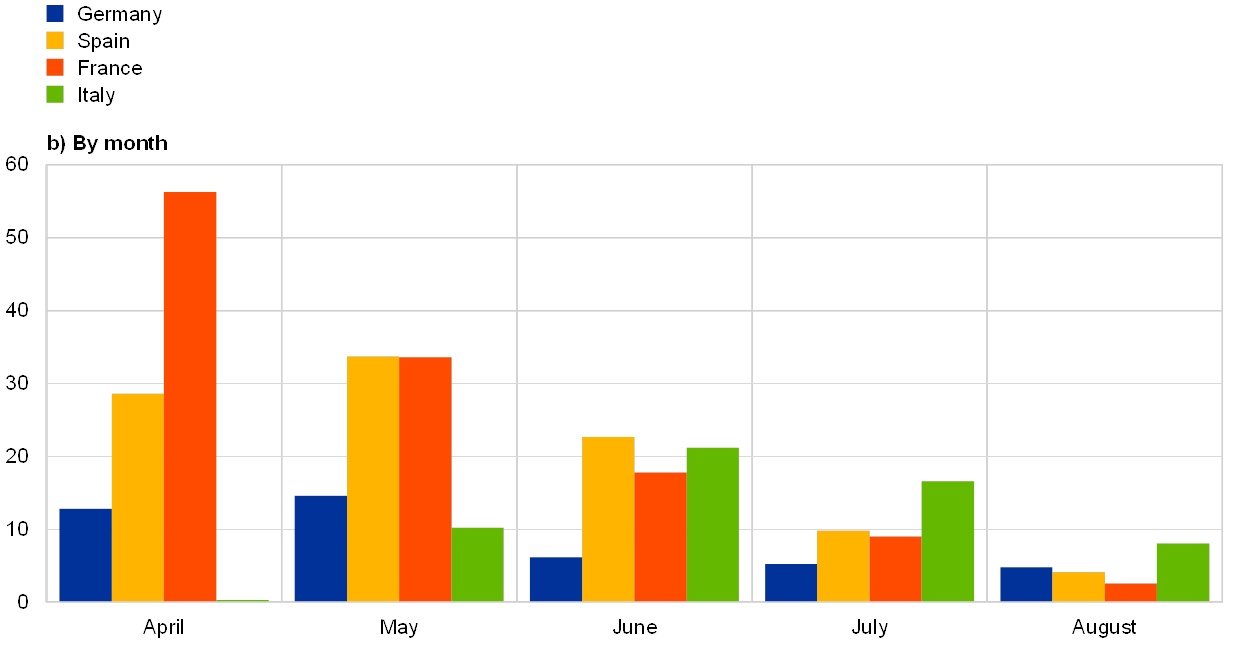

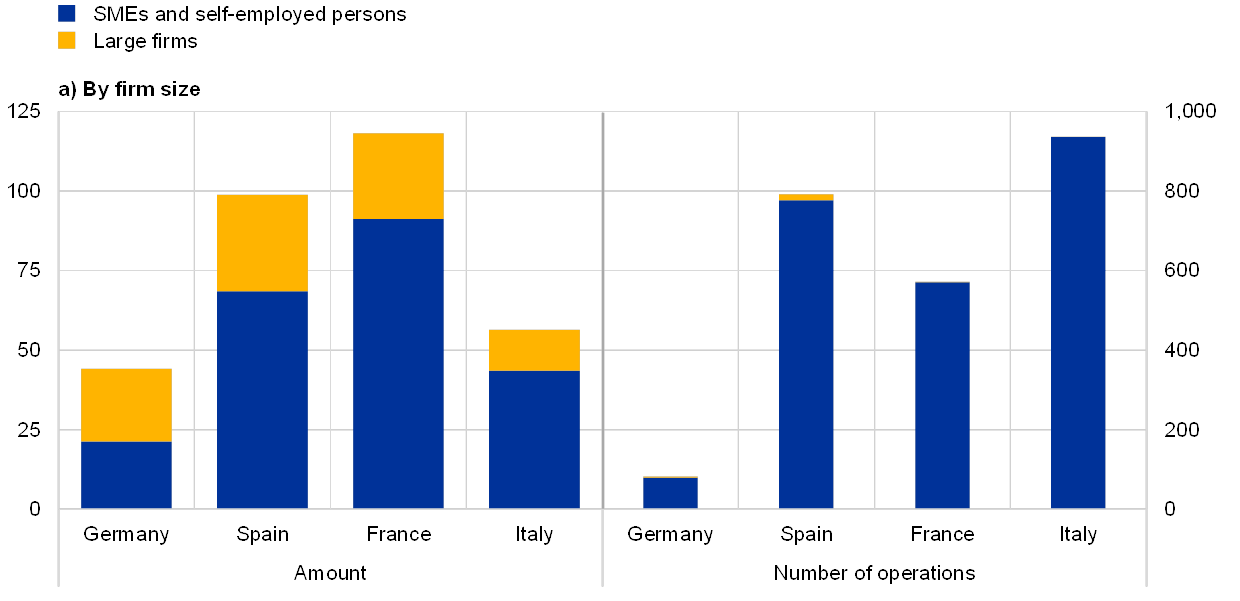

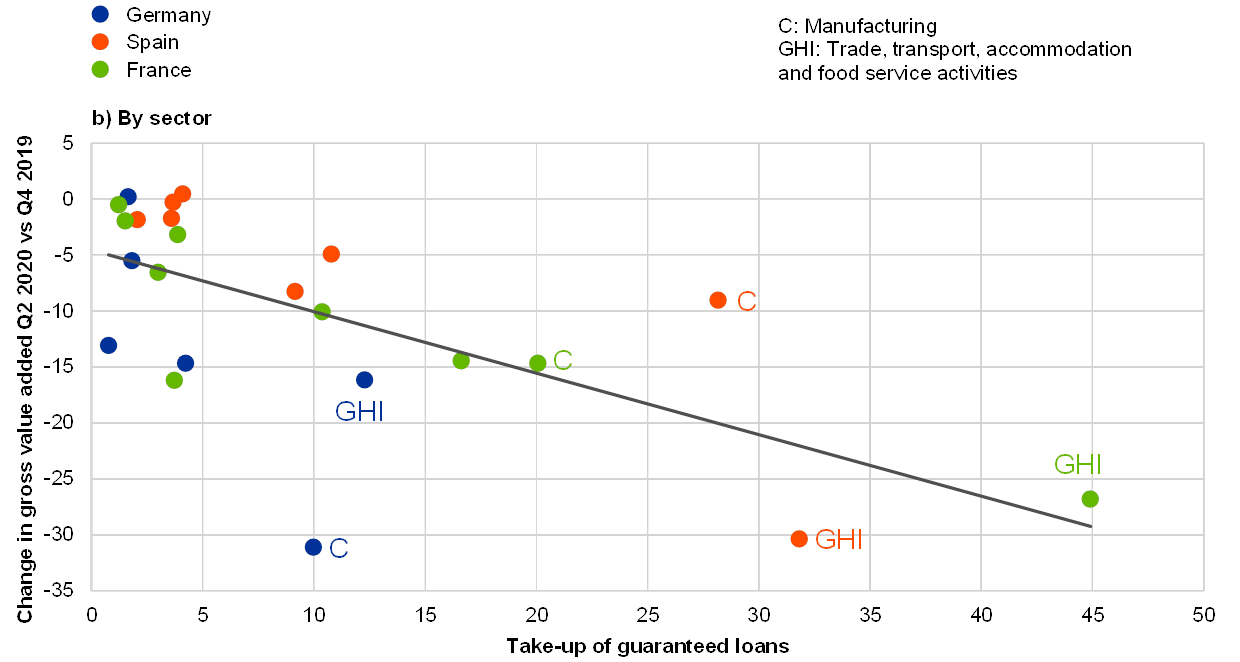

SMEs in the sectors that are most affected by the crisis (e.g. trade, tourism and transport) seem to have benefited the most from public loan guarantee schemes. The take-up of guaranteed loans has been significantly higher for SMEs and the self-employed than for large firms, except in Germany (see Chart B, panel a). The higher take-up by SMEs reflects their relatively greater emergency liquidity needs, their greater dependence on banks for financing and the fact that there are fewer bottlenecks in the banking sector affecting the provision of guaranteed loans for smaller amounts. In particular, while the amount of the take-up is relatively low in Italy, the highest number of guaranteed loans have been granted in this country, reflecting the predominance of very small loans. From a sectoral perspective, the take-up of guaranteed loans has been highest in the sectors hardest hit by COVID-19-related concerns about physical contact, and the concomitant lockdown policies, resulting in a sharp decline in their gross value added in the first half of 2020, with trade, transport and food services accounting for the highest take-up, followed by manufacturing (see Chart B, panel b).

Chart B

Take-up of loans under public guarantee schemes

(left-hand scale: EUR billions; right-hand scale: thousands)

Sources: Kreditanstalt für Wiederaufbau for Germany, Instituto de Crédito Oficial for Spain, Ministère de l'Économie et des Finances for France, Ministero dell’Economia e delle Finanze and Banca d’Italia for Italy, Eurostat and ECB calculations.

Notes: The data on the take-up of guaranteed loans are for the period April-August 2020. In the absence of a breakdown by firm size for Italy, it is assumed that guaranteed loans to SMEs are those granted via the Fondo di Garanzia, while guaranteed loans to large firms are those granted via SACE (the Italian export credit agency). In panel (b), the sector classifications are those of NACE Rev. 2.

(EUR billions)

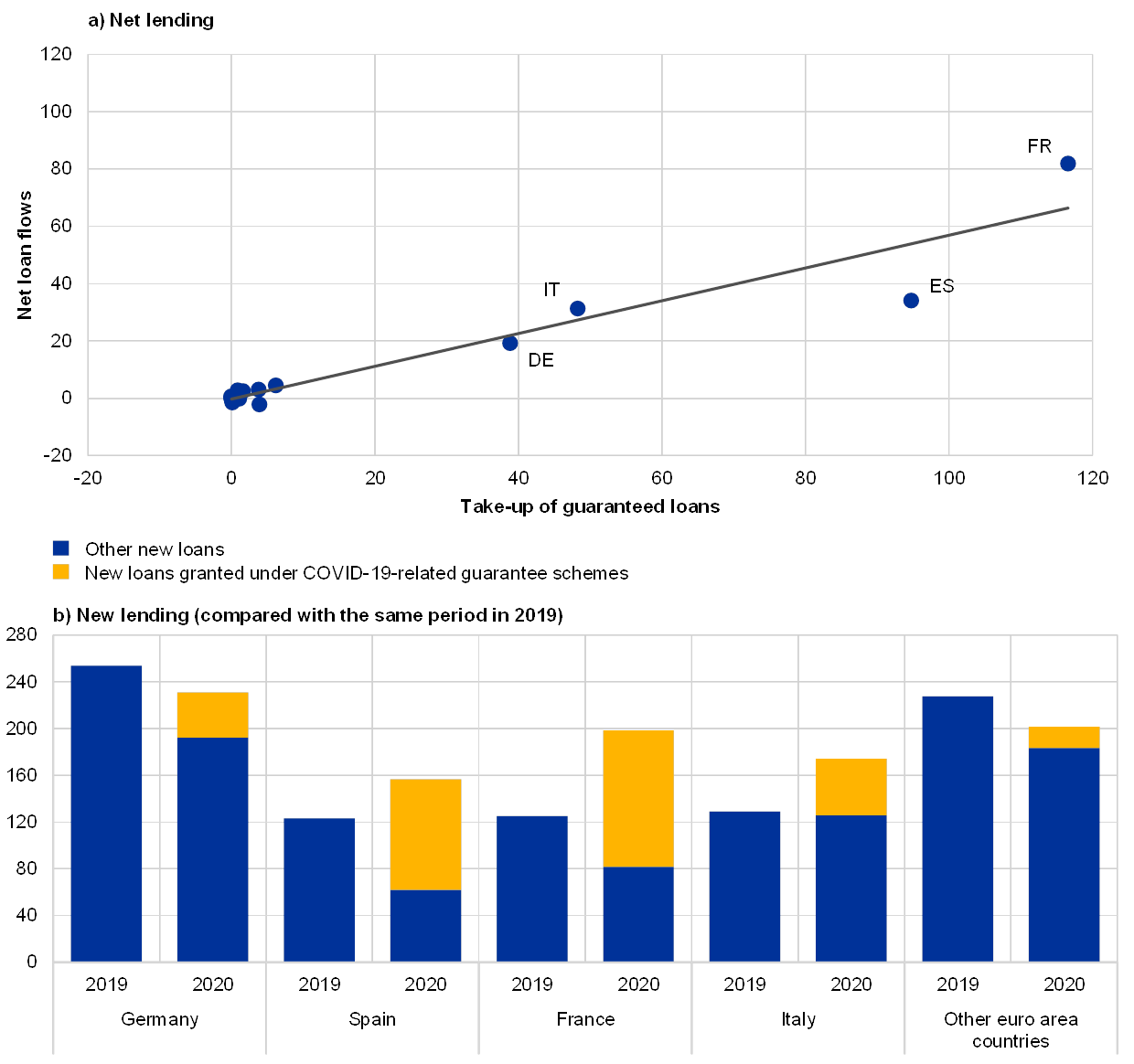

Public loan guarantee schemes have played a key role in supporting corporate lending dynamics since April, especially in Spain and France. Bank lending flows to euro area firms have surged since the outbreak of the COVID-19 pandemic in Europe, owing to acute emergency liquidity needs during the lockdown period. In March 2020 this increase was facilitated by drawing down previously agreed credit lines, but in later months the substantial lending flows largely reflected the take-up of loans covered by public guarantees. Over the period April-July gross flows of guaranteed loans were higher than overall net lending flows in all large euro area countries, implying a shift from non-guaranteed loans into guaranteed loans (see Chart C, panel a). Moreover, lending dynamics were proportionally stronger in countries with a higher take-up of guaranteed loans.[5] Focusing on gross new lending, in Spain and France, where fiscal support for firms was delivered mainly via guarantee schemes, about 65% and 70% respectively of new business volumes in the period April-July consisted of guaranteed loans (see Chart C, panel b). In Germany and Italy, guaranteed loans represented about 20% of new lending flows over this period, while they comprised a negligible share of new lending in other euro area countries.

Chart C

Take-up of guaranteed loans and loans to non-financial corporations and the self-employed over the period April-July 2020

(EUR billions)

Sources: Kreditanstalt für Wiederaufbau for Germany, Instituto de Crédito Oficial for Spain, Ministère de l'Économie et des Finances for France, Ministero dell’Economia e delle Finanze and Banca d’Italia for Italy, various national authorities for other euro area countries, news sources, ECB and ECB calculations.

Notes: Net lending refers to loans net of repayments, as reported in the MFI balance sheet statistics. New lending refers to pure new loans, as reported in the MFI interest rate statistics. Net and new loan flows are non-seasonally adjusted. Net loan flows are adjusted for sales, securitisation and loan transfers.

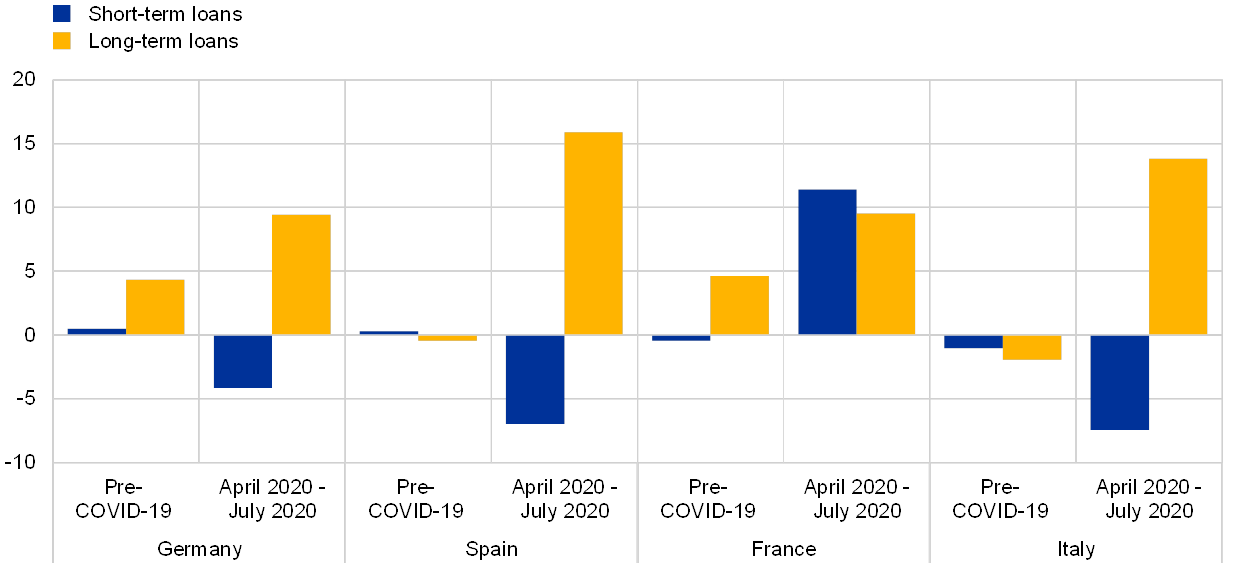

The impact of loan guarantee schemes can also be detected in the maturity and loan size of recent bank lending flows, the positive flows of undrawn credit lines and the preservation of favourable lending conditions. First, while short-term loan flows have been generally negative during the COVID-19 period, the flows of medium and long-term loans – maturities which are typically backed by guarantees – have increased notably (see Chart D). This contrasts with historical regularities, as acute liquidity needs for working capital are typically associated with higher demand for short-term loans, while long-term loans are used to finance fixed investment projects.[6] Second, strong new lending flows have been recorded for small loans (below €1 million), especially in Spain, France and Italy, in line with the greater take-up of guaranteed loans by SMEs in these countries. Third, evidence of increased volumes of undrawn credit in the second quarter of the year suggests that only a part of the approved guaranteed loans has actually been disbursed, likely reflecting the precautionary build-up of liquidity buffers by firms and pointing to ample funds remaining available for firms to meet their financing needs in the near term. Fourth, public loan guarantees have also contributed to preserving favourable financing conditions, as reflected in the fact that lending rates still remain at historically low levels (especially for the types of loan typically backed by guarantees),[7] and broadly unchanged credit standards, as shown in the euro area bank lending survey for the second quarter of 2020.

Chart D

Loans to non-financial corporations and the self-employed broken down by maturity

(monthly averages in EUR billions)

Sources: ECB and ECB calculations.

Notes: Non-seasonally adjusted flows (not adjusted for sales and securitisation). Short-term loans are those with a maturity of up to one year. Long-term loans are those with a maturity of over one year. The pre-COVID-19 period refers to March 2019-February 2020.

The phasing-out of public loan guarantee schemes needs to be carefully assessed against corporate financing needs in the months ahead, while their potential side effects warrant monitoring. The loan guarantee schemes were crucial for supporting the financing needs of firms in the early COVID-19 period, contributing, jointly with other bold policy measures, to preventing viable businesses from becoming illiquid. Terminating these schemes prematurely and too abruptly may risk precipitating severe liquidity squeezes for firms and triggering bankruptcies, which would, in turn, deplete bank capital. This would possibly result in a sudden reduction in credit flows and a tightening of credit conditions, thereby instigating more bankruptcies and also hampering the financing of surviving firms’ adjustment towards a “new normal” way of conducting business. At the same time, if the policy support provided in the current crisis were to lead to a permanent large-scale expansion of the role of government in steering economic outcomes, it may hamper allocative efficiency and reduce the productive capacity of the euro area economy over a longer horizon by artificially keeping afloat firms that are not viable or sufficiently profitable. Moreover, the specific design and calibration of guarantee schemes may entail side effects, for instance in the form of incentives for excessive indebtedness and imprudent risk allocation. These side effects will require close monitoring over the coming months and, once the economic and financial fallout of the COVID-19 crisis abates, a careful and well-timed phasing-out strategy.

- See Section 3.2 of the Communication from the European Commission on the “Temporary Framework for State aid measures to support the economy in the current COVID-19 outbreak”. In some countries, governments have simply enhanced existing guarantee schemes. While this box focuses on guarantee programmes launched by governments, similar schemes have also been implemented at the regional level as well as at the supranational level, for example the Pan-European Guarantee Fund managed by the European Investment Bank.

- In some countries, guarantees also apply to refinancing and loans granted in the months immediately preceding the COVID-19 outbreak.

- Typically the conditions are stricter for guaranteed loans granted to big companies and may include conditions related to business investment plans, governance, competition and transparency. This is because the guarantees are often part of large aid plans that may also include recapitalisation by the State.

- For more details on the key parameters of the schemes and the channels through which they operate, see the box entitled “Potential impact of government loan guarantee schemes on bank losses”, Financial Stability Review, ECB, May 2020.

- For recent developments in the growth of loans to non-financial corporations, see Chart 22 in this issue of the Economic Bulletin.

- For more details on the drivers of loan demand during the COVID-19 pandemic, see the box entitled “Drivers of firms’ loan demand in the euro area – what has changed during the COVID-19 pandemic?”, Economic Bulletin, Issue 5, ECB, 2020.

- See Chart 24 in this issue of the Economic Bulletin. For example, bank lending rates in France have dropped significantly since April. This decline was driven by small loans and reflects the massive demand by SMEs for public guaranteed loans, which banks grant at rates very close to zero in France.