High-frequency data developments in the euro area labour market

Published as part of the ECB Economic Bulletin, Issue 5/2020.

This box provides an overview of the impact of the coronavirus (COVID-19) pandemic on euro area labour markets by examining high-frequency indicators. The first part of the box analyses information from Indeed’s daily job postings and LinkedIn’s daily hiring rates for the five largest euro area countries. The number of job postings from Indeed can be used as a proxy for changes in labour demand. The LinkedIn hiring rate provides information both at the aggregate and sectoral levels about the number of job hires in the euro area. The second part of the box illustrates how the LinkedIn hiring rate can be used to perform a nowcasting of the job finding rate and make an assessment of the unemployment rate, thereby providing more timely information about labour market developments than that derived from more traditional statistical sources. That said, the information contained in these high-frequency indicators should be viewed with caution and used to complement official statistics, given that the available samples are mostly concentrated in white-collar jobs and in certain sectors.

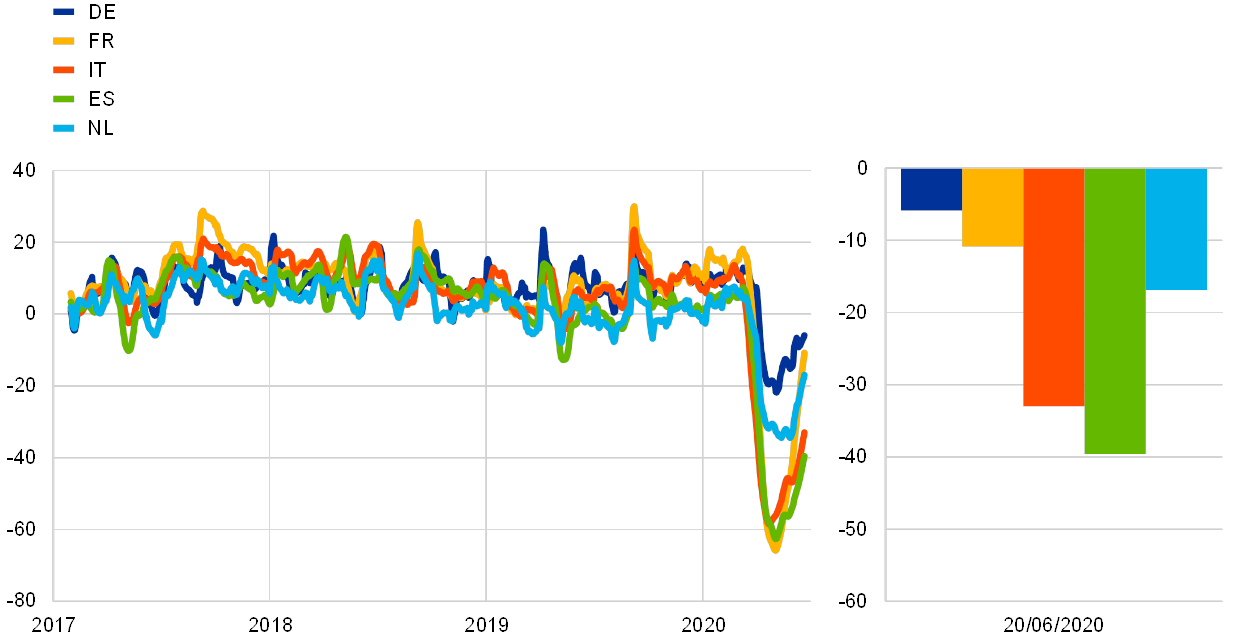

The hiring rate has declined significantly since the onset of the COVID-19 crisis, with it bottoming out in May 2020 (see Chart A). At the start of the lockdowns, the year-on-year increases in the hiring rate stood at 8.9% in Germany (22 March), 13.4% in France (17 March), 13.4% in Italy (21 February), 5.4% in Spain (14 March), and at 4.0% in the Netherlands (15 March). The bottoming-out of the hiring rate in May 2020 may reflect the fact that some of these hires transpire based on past vacancies or through referrals, which can help reduce firms’ uncertainty during the hiring process. The decline in both of the high-frequency indicators reveals the severity of the impact of the COVID-19 pandemic on the euro area labour market, amidst the implementation of short-time work schemes.[2]

Chart A

High-frequency indicator of hiring rates for the euro area labour market

(LinkedIn hiring rate; year-on-year growth rates, percentages)

Sources: LinkedIn and ECB staff calculations.

Notes: The latest observation is for 20 June 2020. Daily hiring rates are calculated as the percentage of LinkedIn members who started a job on a given day of the month and added a new employer to their profile in that month, divided by the total number of LinkedIn members in that country. To adjust for seasonal patterns and spikes due to specific calendar dates, the LinkedIn hiring rate indicator is transformed using a 30-day moving average and is presented in terms of its year-on-year growth rate.

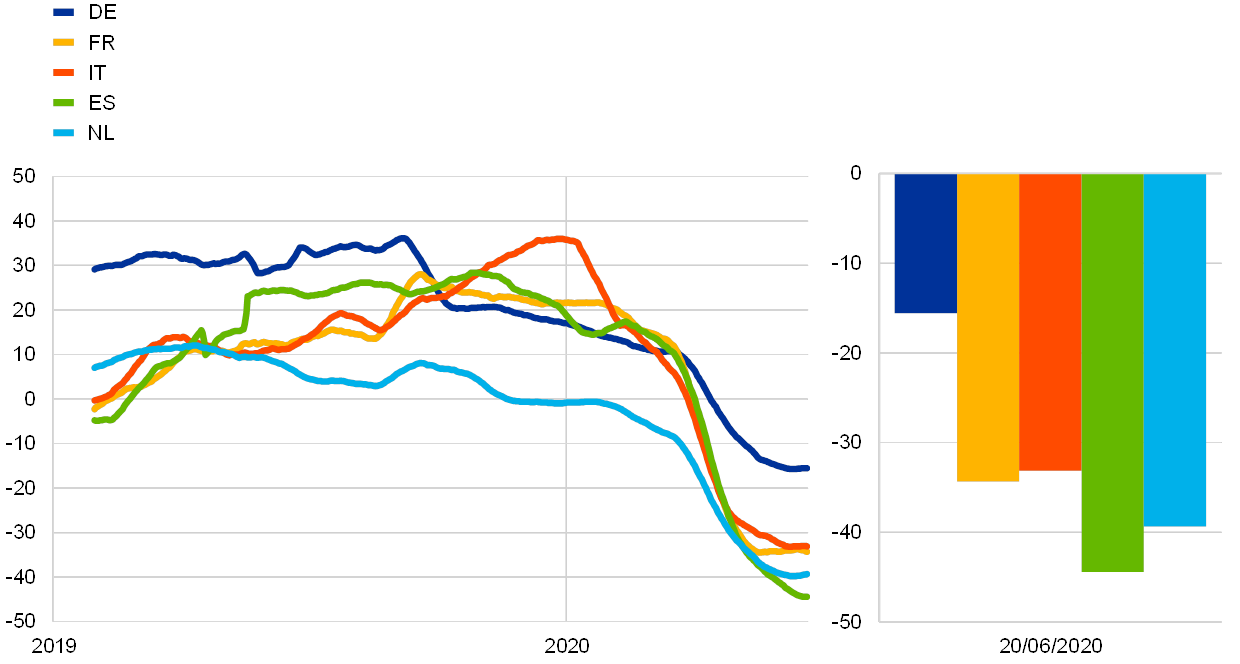

Data on job postings have declined significantly since the COVID-19 crisis (see Chart B) and continue to signal weak labour demand conditions. At the start of the lockdowns, the year-on-year increases in the job postings indicator stood at 9.8% in Germany (22 March), 11.9% in France (17 March), 14.2% in Italy (21 February), 11.0% in Spain (14 March), and at -8.2% in the Netherlands (15 March). On 20 June, however, the decline in the yearly growth rate of the job postings remained in deep negative territory and stood at -15.6% in Germany, -34.3% in France, -33.1% in Italy, ‑44.4% in Spain, and at -39.3% in the Netherlands. While job hires have now bottomed out, job postings remain subdued, as this relationship is not perfectly aligned, since some job matches are made through referrals without any vacancies being posted or there can be a time lapse in the search and matching process. The Indeed job postings indicator reflects developments in labour demand and may be regarded as an indicator of vacancies, while the LinkedIn hiring rate indicator is more closely related to the job-to-job transitions and to the job finding rate.

Chart B

High-frequency indicator of job postings for the euro area labour market

(Indeed job postings; year-on-year growth rates, percentages)

Sources: Indeed and ECB staff calculations.

Notes: The latest observation is for 20 June 2020. To adjust for seasonal patterns and spikes due to specific calendar dates, the Indeed job postings indicator is transformed using a 30-day moving average and is presented in terms of its year-on-year growth rate.

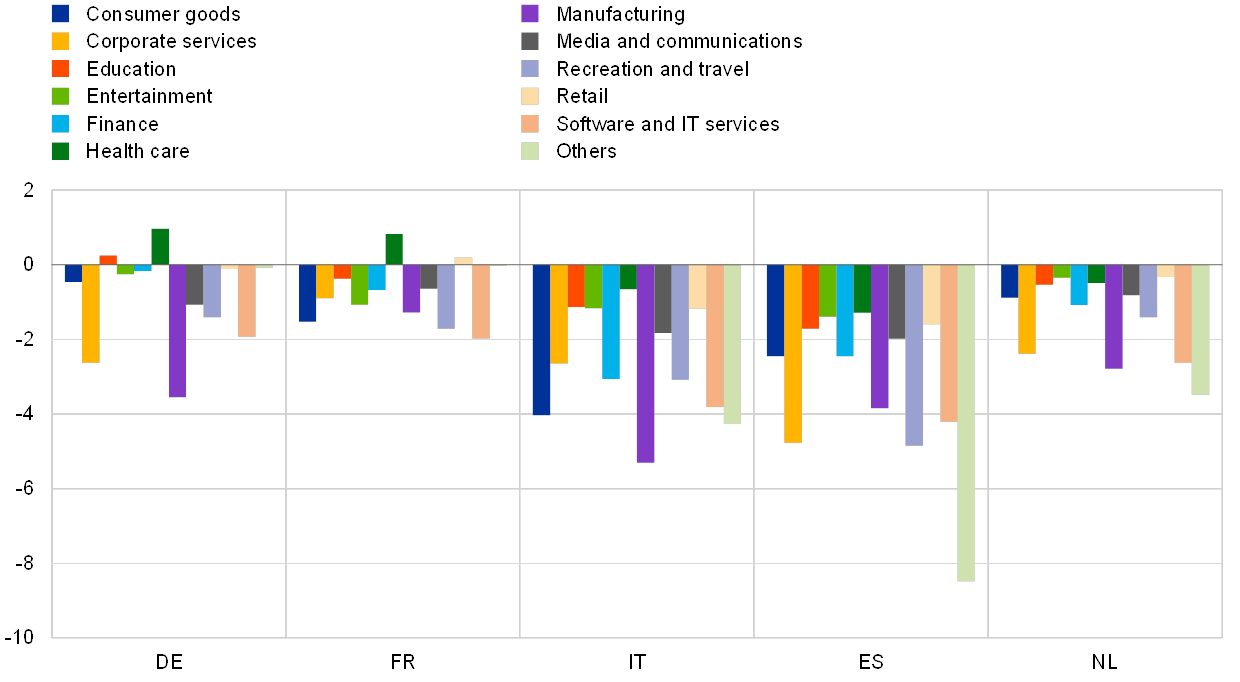

Sectoral data on hiring rates reveal a broadly based decline across all sectors of the five largest euro area countries (see Chart C). We use sectoral information at a monthly frequency to decompose the decline in the LinkedIn hiring rate and to identify the sectors that may have been most affected during the COVID-19 crisis.[3] In particular, we analysed 12 sectors: the consumer goods, corporate services, education, entertainment, finance, healthcare, manufacturing, media and communications, recreation and travel, retail, and software and IT services sectors, with the remaining sectors of the economy being bundled into a residual sector. The aforementioned sectors encompass over 70% of the total number of job changes recorded in LinkedIn for the five largest euro area countries. In June 2020, the majority of the sectors of the five largest euro area countries denoted yearly declines in their hiring rates, with the largest sectoral contributions to the decline being observed in the aggregate hiring rate stemming from the manufacturing, corporate services, software and IT services, and recreation and travel sectors.[4]

Chart C

Sectoral decomposition of the yearly decline in the hiring rate in June 2020

(contributions to the year-on-year growth rate of the hiring rate; percentages)

Sources: LinkedIn and ECB staff calculations.

Notes: The latest observation is for June 2020. The hiring rate at the industry level is available at a monthly frequency. The industry-specific monthly hiring rates are calculated as the percentage of LinkedIn members who started a job in a given industry and in a given month and added a new employer to their profile in that month, divided by the total number of LinkedIn members in that country. To adjust for seasonal patterns and spikes due to specific calendar dates, the industry hiring rate indicator is presented in terms of its year-on-year growth rate.

The intensity of the COVID-19 shock is asymmetric across sectors (see Chart D). While the decline in the hiring rate was broad-based across sectors, some sectors are more affected by the COVID-19 shock than others. Two polar cases of this asymmetry of the shock across sectors are the recreation and travel and the healthcare sectors. On the one hand, the recreation and travel sector has been particularly affected by the crisis and by the lockdowns, with the hiring rate in the sector decreasing year on year in June 2020 by 44.0% in Germany, 28.8% in France, 77.9% in Italy, 50.1% in Spain, and by 28.3% in the Netherlands. On the other hand, the healthcare sector seems to be relatively more insulated from the COVID-19 shock in terms of the yearly increase in the relative number of job changes in the sector, driven partially by the increasing demand for healthcare services to contain the pandemic. The hiring rate in this sector increased year on year in June 2020 by 18.0% in Germany and by 20.7% in France, and decreased year on year in June 2020 by 9.9% in Italy, 22.5% in Spain, and by 3.6% in the Netherlands. In general, the consumer goods, manufacturing, and recreation and travel sectors are more affected by the COVID-19 crisis than the rest of the economy, while other sectors such as healthcare, finance, and software and IT services remain more insulated from the COVID-19 shock.

Chart D

Sectoral asymmetry in the yearly decline in the hiring rate in June 2020

(difference between the year-on-year growth rate of the hiring rate for each sector and the year-on-year growth rate of the hiring rate for the total economy in June 2020; percentage points)

Sources: LinkedIn and ECB staff calculations.

Notes: The latest observation is for June 2020.The hiring rate at the industry level is available at a monthly frequency. The industry-specific monthly hiring rates are calculated as the percentage of LinkedIn members who started a job in a given industry and in a given month and added a new employer to their profile in that month, divided by the total number of LinkedIn members in that country. To adjust for seasonal patterns and spikes due to specific calendar dates, the industry hiring rate indicator is presented in terms of its year-on-year growth rate. Sectors with negative values observe larger declines in their hiring rates than the remaining sectors, while sectors with positive values observe smaller declines in the hiring rate than the remaining sectors.

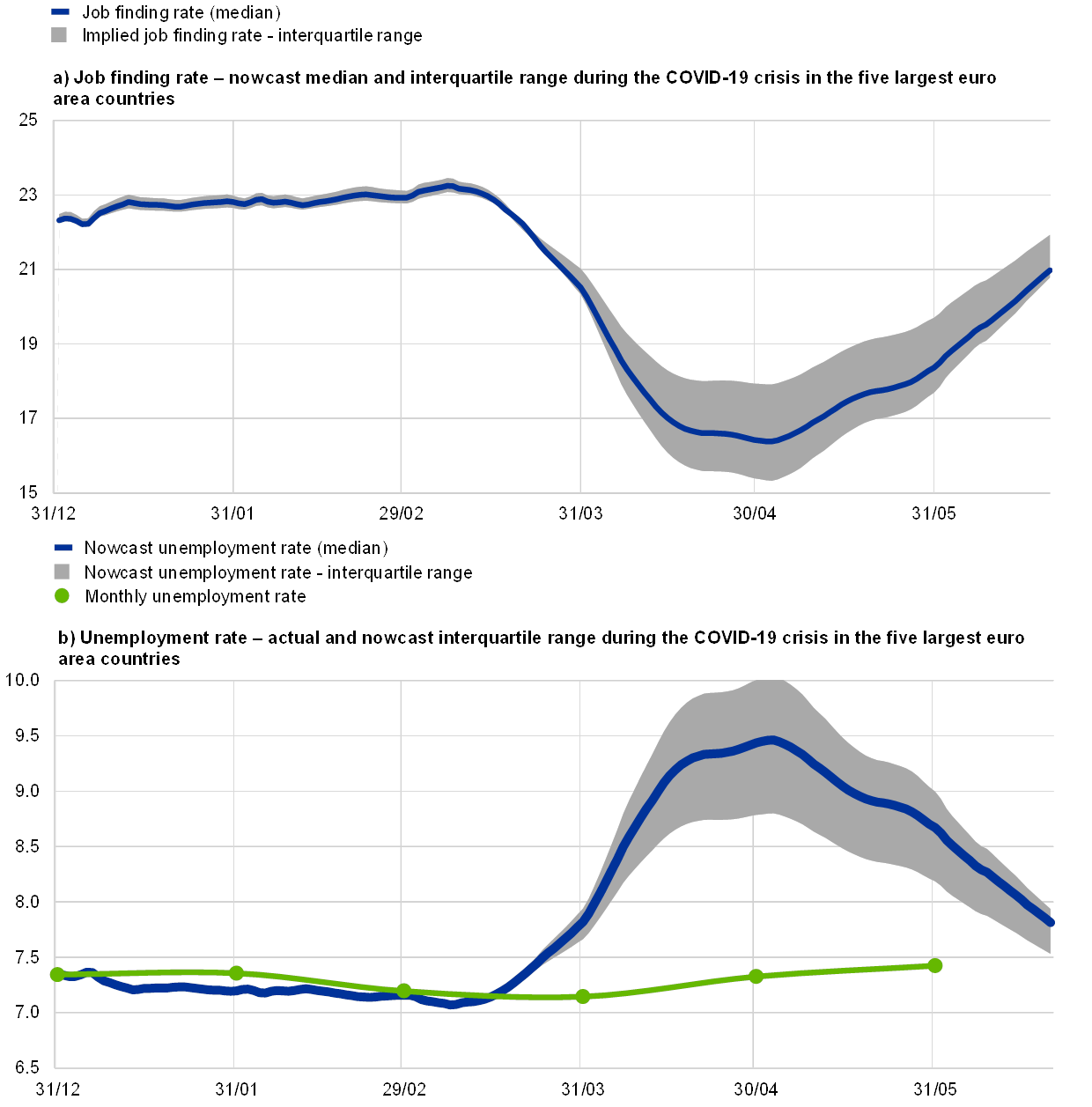

The hiring rate can proxy quite well for the aggregate job finding rate in the sample and can be used to nowcast the job finding rate during the crisis. The LinkedIn hiring rate encompasses both job-to-job transitions and transitions from unemployment into employment and can be thought of as a proxy for the aggregate job finding rate.[5] To measure the empirical elasticity between the hiring rate and the job finding rate, a panel co-integration model is estimated across the five largest euro area countries from 2016 to 2019 in the spirit of Stock and Watson (1993) and Pesaran and Smith (1995). Depending on the underlying estimation assumptions, the long-run elasticity is estimated between 0.39 and 0.63, being always statistically significant.[6] With the LinkedIn hiring rate available until June 2020, these elasticities can thus be used to construct the implied path of the aggregate job finding rate in 2020 during the COVID-19 crisis (see Chart E, panel a).

A nowcasting of the unemployment rate during the COVID-19 crisis may be computed using the implied path of the aggregate job finding rate. Using estimates of the inflow, and outflow rates, from unemployment, it is possible to derive a proxy of the point-in-time steady-state unemployment rate, .[7] A nowcasting of the unemployment rate can be derived in two steps. First, a nowcasting of the job finding rate, , is based on the estimated relationship with the LinkedIn hiring rate. In the second step, a nowcast of the changes in the unemployment rate can be derived using the changes in . To increase the robustness of the exercise, several profiles of are derived depending on the estimated long-term coefficients for and on the assumptions of the job separation rates.

Chart E

Euro area-5: implied job finding rate and unemployment rate

Sources: Eurostat, LinkedIn and ECB staff calculations.

Notes: The latest observation is for 20 June 2020. Daily hiring rates are calculated as the percentage of LinkedIn members who started a job on a given day of the month and added a new employer to their profile in that month, divided by the total number of LinkedIn members in that country. The monthly unemployment rate is in line with the ILO definition. The nowcast of the unemployment rate is derived using a simple updating recursive rule across several possible profiles for the natural rate of unemployment, depending on the estimated long-term coefficients, on the relationship between the job finding rate and the hiring rate and on the set of assumptions for the job separation rates.

The unemployment rate is expected to peak during the second quarter of 2020 and to be around 2.3 percentage points higher than in February (see Chart E, panel b). The nowcast of the unemployment rate based on the implied path of the job finding rate in the five largest euro area countries is foreseen to peak around the beginning of May 2020 at 9.5%, driven by the large decline in job hires during the COVID-19 crisis. The gradual normalisation of the hiring rate suggests higher outflows from unemployment in May and June 2020, but with the unemployment rate still remaining higher than at its pre-pandemic levels. The dynamics of the nowcast unemployment rate also rest on the assumption that the job separation rate increased only moderately during the COVID-19 crisis.[8] Euro area governments have implemented a set of labour market policies that are halting the number of permanent lay-offs following the COVID-19 shock. Short-time work schemes may be able to minimise the possible inefficiencies arising from a sudden and temporary adverse shock by limiting the job reallocation effects in the economy.[9] However, if recalls from temporary unemployment do not occur in full, a jump in the job separation rate may lead to a further deterioration in labour market conditions and to a higher unemployment rate than that nowcast in Chart E. Finally, when comparing the nowcast unemployment rate with the actual unemployment rate, it should also be highlighted that the current relatively low unemployment figures stem partially from the fact that COVID-19 and related lockdown measures meant that people did not actively search for work (e.g. due to limited job opportunities) or were not available for work at short notice (e.g. due to childcare obligations or care of the elderly). They are, hence, classified as being outside of the labour force and do not count as unemployed according to the ILO definition of unemployment.[10]

Overall, the methodology and the high-frequency data used in this box allow for a timely assessment of the euro area labour market. The use of job flows in and out of unemployment can help to enhance our understanding of the labour market adjustment during the current COVID-19 crisis. Previous analyses based on job flows were restricted by the lack of available timely data. This box provides an initial and preliminary analysis of how to combine timely experimental data sources with official statistics. Furthermore, these data provide timely signals of current labour market conditions, with the LinkedIn hiring rates showing a rebound in firms’ hires and with the Indeed job postings continuing to point towards a weakness in labour demand. In the current unprecedented circumstances, these high-frequency data provide valuable insights into the path towards economic recovery, shedding light on the asymmetric performance across sectors of the economy by allowing for a deeper understanding of the co-movements in hiring patterns across major sectors of economic activity.

- The authors would like to acknowledge the contributions from Mariano Mamertino, Séin Ó Muineacháin and Mirek Pospisil in providing the aggregate and sectoral high-frequency LinkedIn data used in this box, which are based on a joint research project. We would also like to thank Colm Bates (European Central Bank), together with Tara Sinclair and Adhi Rajaprabhakaran (Indeed), for providing the data on job postings.

- See the box entitled “A preliminary assessment of the impact of the COVID-19 pandemic on the euro area labour market” in this issue of the Economic Bulletin.

- This box is based on the industry mapping that is also used by the World Bank. The industry mapping between LinkedIn industries and the International Standard Industrial Classification (ISIC) can be found here, while the US Workforce report can be found here.

- The exceptions to the broad sectoral decline in the hiring rates recorded in June 2020 are the healthcare sector in both Germany and France, the education sector in Germany and the retail sector in France.

- In the remaining part of the analysis, we use the hiring rate instead of job postings, because the former is closer to the concept of the job finding rate. For further details about the job finding rate and its historical relationship with labour market concepts such as the Beveridge curve and labour market tightness, refer to the article entitled “The euro area labour market through the lens of the Beveridge curve”, Economic Bulletin, Issue 4, ECB, Frankfurt am Main, 2019. The job finding rate is estimated using the methodology in Shimer (2007) and Elsby et al. (2013) and using LFS data up to December 2019.

- As a robustness exercise, we also estimate the elasticity between the hiring rate and the job finding rate across the individual countries. These country-specific elasticities are somewhat more heterogeneous across countries, being around 0.12 and 0.17 for Germany, 0.37 and 0.51 for France, 0.26 and 0.52 for Italy, 0.73 and 0.85 for Spain, and between 0.71 and 0.80 for the Netherlands.

- Similar to Shimer (2005), our simplified job flow approach does not explicitly account for flows in and out of the labour force. For a full description of this labour market model, see Pissarides (2000) or Box 3 in the article entitled “The euro area labour market through the lens of the Beveridge curve”, Economic Bulletin, Issue 4, ECB, Frankfurt am Main, 2019.

- The main focus of this box is job creation, while job separation rates are assumed to follow a path similar to that of the global financial crisis. Three scenarios are used for the job separation rate in this box: (i) no change with respect to the fourth quarter of 2019; (ii) an increase in the job separation rate comparable to that observed during the average quarter in the global financial crisis; and (iii) half of the increase in the job separation rate observed during the average quarter during the global financial crisis.

- Overall, labour market policies are also aimed at halting lay-offs and supporting self-employment. With regard to the effects of short-time work schemes and temporary lay-offs on labour income and on disposable income, refer to the box entitled “Short-time work schemes and their effects on wages and disposable income”, Economic Bulletin, Issue 4, ECB, Frankfurt am Main, 2020.

- For further details, see Eurostat’s methodological note on “Data collection for the EU-Labour Force Survey in the context of the COVID-19 crisis”.