Interest rate-growth differential and government debt dynamics

Published as part of the ECB Economic Bulletin, Issue 2/2019.

The difference between the average interest rate that governments pay on their debt and the nominal growth rate of the economy is a key variable for debt dynamics and sovereign sustainability analysis. The change in government debt between two years equals the interest paid on the stock of debt, the primary deficit (excess of expenditure, excluding interest payments, over revenue), and other factors (deficit-debt adjustments). For ratios to GDP, the change in debt is then mainly determined by the primary balance and the difference between the interest rate and the GDP growth rate. If the interest rate-growth differential ( ) is strictly positive, a primary fiscal surplus is needed to stabilise or reduce the debt-to-GDP ratio. The higher the initial debt level, the higher the primary surplus will need to be. Conversely, a persistently negative on government debt would imply that debt ratios could be reduced even in the presence of primary budget deficits (lower than the debt effect induced by the differential).[1]

Recently, has turned negative in most advanced economies, including euro area sovereigns. According to the European Commission’s Autumn 2018 forecast, all euro area countries except Italy had negative in 2017. The differential is projected to increase in 12 euro area countries by 2020, but to remain in negative territory for all countries except Italy.

The debate on the role of fiscal policy with a persistently negative interest rate-growth differential has been revived by Olivier Blanchard in his 2019 AEA Presidential address.[2] Using the US example, Blanchard makes the point that the costs of government debt may be smaller than generally assumed in the policy discussion. This is because the (US) safe interest rate (a proxy of marginal bond rates) is below the nominal GDP growth rate and this is more the historical norm rather than the exception. With a negative differential, public debt may have no fiscal cost. It may still have welfare costs, but these may also be lower than typically assumed. An implication of this proposition would be that the US can sustain (roll-over) high(er) debts without significant costs. The author stresses, however, that the purpose of the lecture is not to argue for higher debt per se, but to allow for a richer discussion of debt policy and appropriate debt rules than is currently the case.

Theoretical models do not provide clear cut conclusions with respect to the sign and size of the interest rate-growth differential on government debt. In general, models are based on the assumption that the inter-temporal budget constraint holds, i.e. the present value of future primary surpluses should equal the current level of debt (no explosive debt paths). While standard growth theory implies a positive for economies that operate at their steady state (along a balanced growth path), including for the safe rate, in overlapping-generation models with non-diversifiable uncertainty or models with rational bubbles, a negative on government debt could co-exist with a dynamically efficient economy.[3] Moreover, it must be recognised that such models analyse the “risk-free rate”, while accounting for sovereign credit risk or possibility of default would raise the cost of public debt.[4]

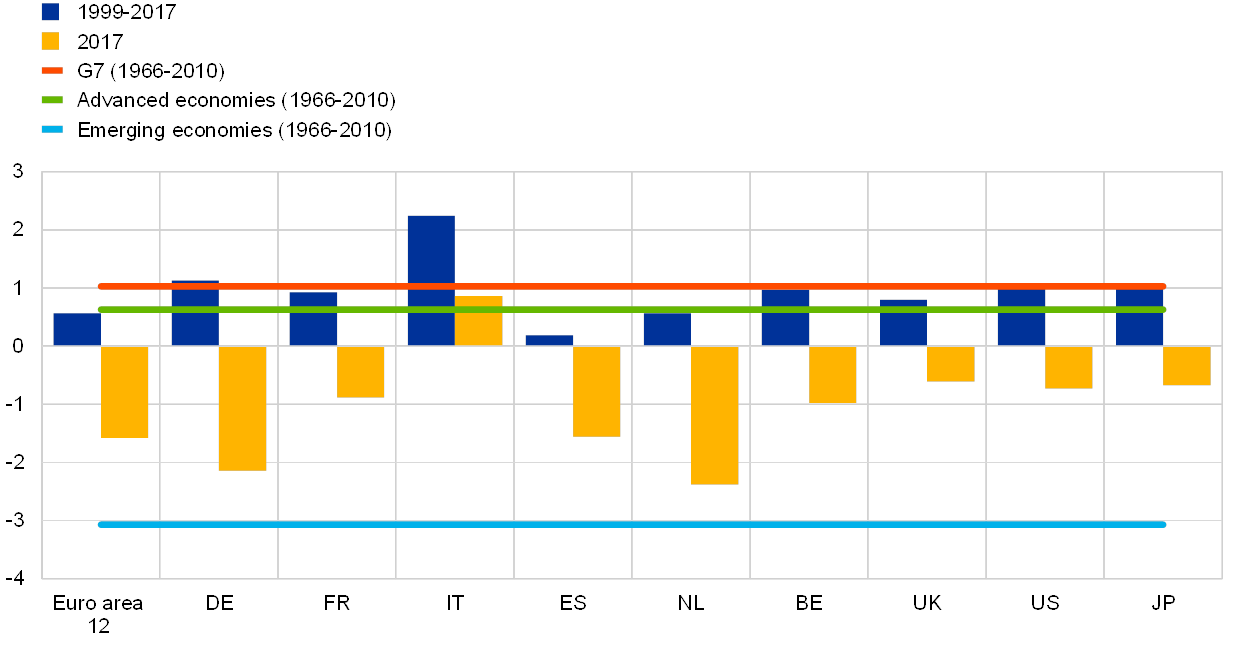

Empirically, the relevant interest rate-growth differential for public debt dynamics, as defined above, has been positive for advanced mature economies over longer periods. The value of for mature economies over extended periods of time has hovered around one percentage point.[5] Positive values are also typically observed for the largest euro area economies (see Chart A). On the other hand, negative values are observed for advanced economies during periods of overheating or, more generally, for emerging economies. As documented in the empirical literature[6], the main factors behind the “puzzle” of persistently negative differentials in emerging economies are financial repression, including during periods of hyperinflation, and to some extent also the income catch-up effect. Finally, the primary balance also plays an important role in debt dynamics. Even in the presence of negative , large enough primary deficits would prevent debt ratios from stabilising. In this respect, primary surpluses in most euro area countries have helped put debt ratios on a downward path.[7]

Moreover, while the interest rate has followed a clear downward trend since the 1980s, to a certain extent the GDP growth rate has done so as well. Since the 1980s in particular, real interest rates in advanced economies have declined and, in the wake of the global financial crisis, plummeted to exceptionally low levels. This development has often been associated with a decline in the estimated natural or neutral rate of interest, which in turn has been linked in many studies to a decline in potential output growth.[8] There is therefore still a question about the trend in the difference between the two variables, and specifically about the differential that applies to government borrowing.

Chart A

Interest rate-growth differential on government debt (𝑖−𝑔)

(percentage points) Sources: European Commission Autumn 2018 Economic Forecast (AMECO) for 1999-2017 data (bars) and Escolano et al. (2017) for 1966-2010 data (lines).

Notes: The chart depicts the difference between the average nominal interest rate charged on government debt (

and the nominal GDP growth rate (

. In annual terms,

is defined as the ratio between total interest payment at time t and the debt stock at t-1, then averaged over the periods shown in the chart. In general, AMECO series cover the general government debt according to the ESA-2010 definition (for the US, federal debt). The horizontal lines represent the average

over 1966-2010 (not all countries in the sample available for the entire period, as explained in Escolano et al., 2017). Countries shown are the six largest euro area economies. Euro area 12 includes Belgium, Germany, Ireland (excluding extreme outliers for the years 2015 and 2016), Greece, Spain, France, Italy, Luxembourg, the Netherlands, Austria, Portugal and Finland. The values shown in the chart for euro area 12 represent simple averages of

across the sample. The other country groups are as described in Escolano et al. (2017) and broadly according to the IMF definitions for advanced and emerging economies.

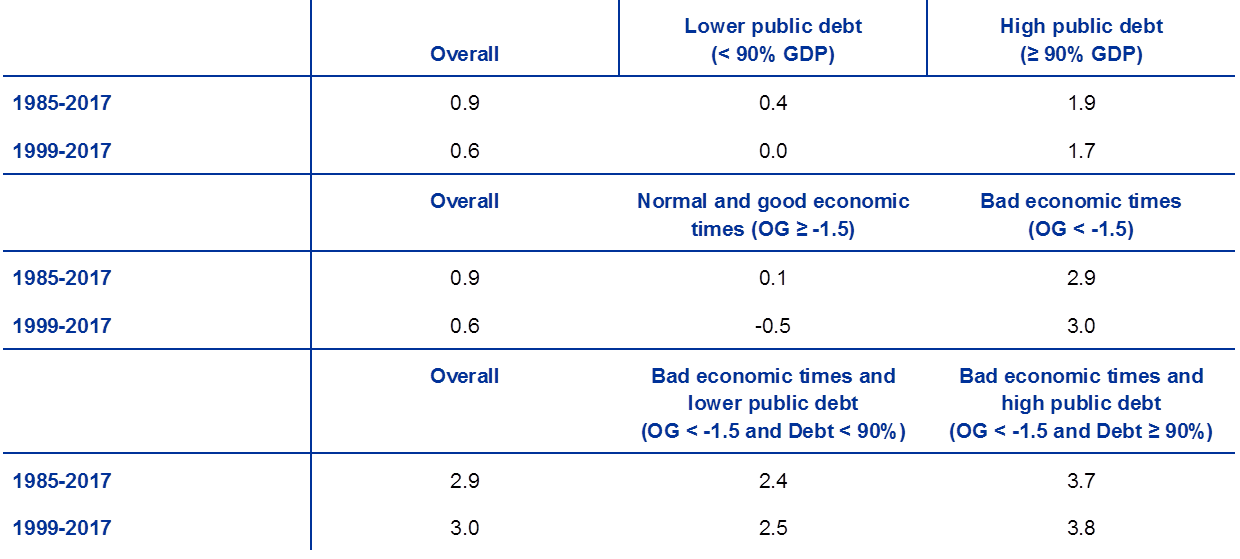

Empirical literature[9] identifies several factors that influence the dynamics of the differential. Population ageing has been found to be a relevant factor in the decline of the natural rate of interest, but also in the decline of potential GDP growth.[10] In addition, the literature identifies the “global savings glut” (as proxied by the current account surpluses of emerging economies) and the one-off effect of setting up the European Monetary Union[11] as relevant factors contributing to the decline of across advanced economies. Cyclical conditions and economic policies also seem to play an important role. The differential can increase quickly in recessions, especially in high-debt countries. More generally, weaker fiscal positions (higher debt and deficits) are found to be associated with higher . Table A presents historical averages for euro area 12, taking into account high public debt ratios and the position in the business cycle. The differential is higher, on average, when public debt is high (for the period 1999-2017,1.7 percentage point when debt is greater than or equal to 90% of GDP versus 0.0 when debt is lower than 90%; similar results are recorded for the longer period since 1985). This is partly explained by the position in the cycle: in bad economic times is much higher than in normal or good economic times (3.0 as opposed to -0.5 for the period 1999-2017). Nonetheless, in bad economic times, countries with higher debt have larger differentials (3.8 as opposed to 2.5).[12]

Table A

Historical average interest rate-growth differentials (𝑖−𝑔), taking into account public debt and business cycle effects

(percentage points, euro area 12)

Sources: European Commission AMECO database, extrapolated for the period 1985-2017, where needed, with other sources.

Notes: Interest rate-growth differentials shown are simple averages across euro area 12 countries (see Chart A) for the respective time periods. High debt is defined as a government debt-to-GDP ratio of at least 90%. An output gap of -1.5% is the threshold separating bad from normal economic times in the EC (2015) flexibility matrix. Results are similar for a sample of 24 advanced economies, which includes the 19 euro area countries, as well as Denmark, Sweden, the United Kingdom, the United States and Japan.

In the euro area, the current low interest rate-growth differentials on government debt should not be taken as an incentive for higher debt levels, especially where fiscal space is constrained. High government debt poses significant economic challenges.[13] While effective public spending and investment can increase a country’s medium-term growth potential and mitigate the negative cyclical effects of a downturn,[14] current high debt levels in many economies are restricting these channels, in particular the ability to conduct counter-cyclical fiscal policy in bad times. Country-specific and global economic and policy risks require policies to limit countries’ vulnerabilities.

-

Equation 1 (the typical debt accumulation equation) provides a simple accounting framework to decompose the change in the government gross debt-to-GDP ratio ( ) into its key drivers, consisting of: (i) the “snowball effect”, i.e. the impact of the difference between the average nominal interest rate charged on government debt ( ) and the nominal GDP growth rate ( ) multiplied by the debt-to-GDP ratio in the previous period ( ); (ii) the primary budget balance (surplus) ratio ( ); and (iii) the deficit-debt adjustment as a share of GDP ( ) or the stock-flow adjustment, comprising factors that affect debt but are not included in the budget balance (such as acquisitions or sales of financial assets). - “Public Debt and Low Interest Rates”, 2019 AEA Presidential Address by Olivier Blanchard (Atlanta, 5 January 2019). The lecture was essentially a presentation of his recent academic work entitled “Public Debt and Low Interest Rates”.

- Blanchard, O. and Fischer, S., Lectures on Macroeconomics, The MIT Press, Cambridge, 1989, and Blanchard (2019), op. cit.

- For a summary of this literature, see D’Erasmo, P., Mendoza, E. and Zhang, J., “What is a Sustainable Public Debt?”, Handbook of Macroeconomics, Vol. 2B, 2016, pp. 2557-2588.

- See Escolano, J., “A Practical Guide to Public Debt Dynamics, Fiscal Sustainability, and Cyclical Adjustment of Budgetary Aggregates”, IMF Technical Notes and Manuals, Washington DC, 2010. A seminal OECD paper on measures for public debt sustainability (Blanchard et al., 1990) concludes that even if the configuration of a negative differential being easily rejected based on theoretical or empirical grounds remains “a theoretical curiosum [,…] Still, there is general agreement that the condition of an excess in the interest rate over the growth rate probably holds, if not always, at least in the medium and long run.” (pp. 15). See Blanchard, O., Chouraqui, J.-C., Hagemann, R. and Sartor, N., “The Sustainability of Fiscal Policy: New Answers to an Old Question”, Economic Studies, No 15, OECD, Paris, 1990.

- See, for instance: Escolano, J., Shabunina, A. and Woo, J., “The Puzzle of Persistently Negative Interest-Rate–Growth Differentials: Financial Repression or Income Catch-Up?”, Fiscal Studies, Vol. 38(2), 2017, pp. 179–217.

- According to the Commission’s Autumn 2018 forecast, the euro area primary balance is projected to be in surplus (+1.2% of GDP) in 2018, as opposed to deficits in the US (-2.1% of GDP) and Japan (-1.5% of GDP). All euro area countries apart from France, Spain and Latvia are projected to have recorded a primary surplus in 2018.

- See Brand, C., Bielecki, M. and Penalver, A., “The natural rate of interest: estimates, drivers, and challenges to monetary policy”, Occasional Paper Series, No 217, ECB, Frankfurt am Main, 2018.

- See, for instance, Escolano et al., op. cit. and Turner, D. and Spinelli, F., “Explaining the interest-rate-growth differential underlying government debt dynamics”, OECD Economics Department Working Papers, No 919, OECD, Paris, 2011.

- See the article entitled “The economic impact of population ageing and pension reforms”, Economic Bulletin, Issue 2, ECB, 2018.

- While the spread compression at the start of EMU depressed i-g in parts of the euro area, the financial and sovereign debt crises triggered very steep reversals of the differential for a period of time.

- An empirical analysis for the euro area 12 sample finds that government debt and deficits (contemporaneous, one-year lagged, five-year averages) are significant determinants of after controlling for output gap, TFP growth, old-age dependency ratio, population growth, short-term interest rate, US , country and year fixed effects.

- For a review of the risks associated with regimes of high debt, see the article entitled “Government debt reduction strategies in the euro area”, Economic Bulletin, Issue 3, ECB, 2016.

- For more details, see the article entitled “The composition of public finances in the euro area”, Economic Bulletin, Issue 5, ECB, 2017.