Euro area monthly balance of payments (January 2018)

- In January 2018 the current account of the euro area recorded a surplus of €37.6 billion.[1]

- In the financial account, combined direct and portfolio investment recorded net acquisitions of assets of €122 billion and net incurrences of liabilities of €80 billion.

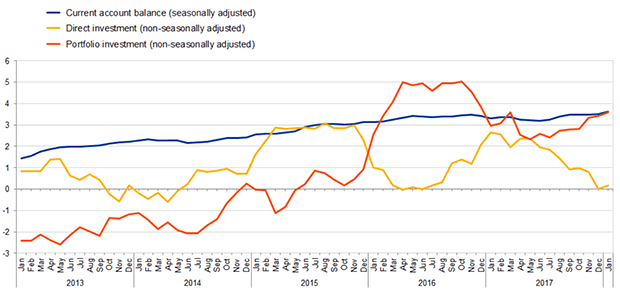

Chart 1: Balance of payments of the euro area: 12-month cumulated transactions

(as a percentage of GDP)

Source: ECB.

Current account

The current account of the euro area recorded a surplus of €37.6 billion in January 2018 (see Table 1). This reflected surpluses for goods (€27.1 billion), primary income (€10.7 billion) and services (€9.6 billion), which were partly offset by a deficit for secondary income (€9.8 billion).

The 12-month cumulated current account for the period ending in January 2018 recorded a surplus of €406.1 billion (3.6% of euro area GDP), which compares with €356.5 billion (3.3% of euro area GDP) in the 12 months to January 2017 (see Table 1 and Chart 1). This development was due to increases in the surpluses for services (from €36.6 billion to €87.5 billion) and primary income (from €99.4 billion to €113.3 billion). These were partly offset by a decrease in the surplus for goods (from €365.8 billion to €351.9 billion) and, to a lesser extent, an increase in the deficit for secondary income (from €145.2 billion to €146.5 billion).

Financial account

In January 2018 combined direct and portfolio investment recorded net acquisitions of assets of €122 billion and net incurrences of liabilities of €80 billion (see Table 2).

Euro area residents recorded net acquisitions of €35 billion of direct investment assets as a result of net investments in equity (€29 billion) and debt instruments (€6 billion). Direct investment liabilities increased by €8 billion as a result of net investments in euro area debt instruments (€59 billion) by non-euro area residents, which were partly offset by net withdrawals of euro area equity by non-euro area residents (€51 billion).

As regards portfolio investment assets, euro area residents made net purchases of foreign securities amounting to €88 billion. The net acquisitions of equity (€51 billion) and long-term debt securities (€40 billion) were only marginally offset by net sales/amortisations of short-term debt securities (€4 billion). Portfolio investment liabilities increased by €73 billion as a result of non-euro area residents’ net purchases of euro area long-term debt securities (€41 billion) and short-term debt securities (€18 billion), as well as equity (€14 billion).

The euro area net financial derivatives account (assets minus liabilities) was close to balance.

Other investment recorded net acquisitions of assets amounting to €182 billion and net incurrences of liabilities of €217 billion. The net increase in assets was mainly due to MFIs (excluding the Eurosystem) (€156 billion) and, to a lesser extent, to other sectors (€36 billion). These were partly offset by decreases in the net assets of the Eurosystem (€8 billion) and general government (€2 billion). The net increase in liabilities was mainly attributable to MFIs (excluding the Eurosystem) (€290 billion) and, to a lesser extent, to other sectors (€48 billion). These were partly offset by decreases in the liabilities of the Eurosystem (€115 billion) and, to a lesser extent, of general government (€6 billion).

In the 12 months to January 2018, combined direct and portfolio investment recorded net acquisitions of assets of €733 billion and net incurrences of liabilities of €310 billion, compared with €863 billion and €257 billion respectively in the 12 months to January 2017.

In direct investment, there was a decrease in the net investments of both euro area residents abroad and non-residents in the euro area. The net acquisitions of equity by euro area residents dropped from €430 billion to €55 billion and the net investments of non-euro area residents shifted from a net investment of €208 billion to a net disinvestment of €115 billion.

Concerning portfolio investment, the net purchases of foreign equity by euro area residents increased from €47 billion to €207 billion. On the liability side, the net purchases of euro area equity by non-euro area residents increased from €159 billion to €438 billion.

According to the monetary presentation of the balance of payments, the net external assets of euro area monetary financial institutions (MFIs) decreased by €98 billion in the 12 months to January 2018, compared with a decrease of €218 billion in the 12 months to January 2017. This was mainly due to developments in portfolio investment.

In January 2018 the Eurosystem’s stock of reserve assets decreased to €663.1 billion from €669.7 billion in the previous month (see Table 3). This reduction (€6.6 billion) was mainly due to negative exchange rate changes (€6.8 billion) and price changes (€1.9 billion), which were partly offset by net acquisitions of assets (€2.3 billion).

Data revisions

This press release incorporates revisions to the data for October to December 2017. These revisions have not significantly altered the figures previously published.

Additional information

Time-series data: the ECB’s Statistical Data Warehouse (SDW)

Methodological information Monetary presentation of the balance of payments Next press releases:- quarterly balance of payments and international investment position: 6 April 2018[2] (reference data up to the fourth quarter of 2017)

- monthly balance of payments: 19 April 2018 (reference data up to February 2018).

Annexes

- Table 1: Current account of the euro area

- Table 2: Balance of payments of the euro area

- Table 3: Reserve assets of the euro area

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

[1] References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are neither seasonally nor working day-adjusted.

[2] The quarterly press release on 6 April 2018 will incorporate revisions (up to December 2017) to the monthly data published with this present monthly press release.

Europese Centrale Bank

Directoraat-generaal Communicatie

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Duitsland

- +49 69 1344 7455

- media@ecb.europa.eu

Reproductie is alleen toegestaan met bronvermelding.

Contactpersonen voor de media