- Speech

Waiting for ESTER: the road ahead for interest rate benchmark reform

Speech by Benoît Cœuré, Member of the Executive Board of the ECB, at the ECB’s Money Market Contact Group meeting, Frankfurt am Main, 25 September 2018

Benchmark interest rates play an integral role in financial markets. Their widespread use across a range of financial market instruments, including deposits, fixed income and credit market products, as well as derivatives, permits standardisation and generates liquidity. There is currently an estimated €22 trillion of EONIA-linked derivatives contracts outstanding and €109 trillion linked to EURIBOR.[1] A further €1.6 trillion of debt securities are linked to EURIBOR.

Benchmark rates are also important for the conduct of monetary policy. In normal times, the ECB implements policy by steering very short-term interest rates. We evaluate the success of those operations by monitoring the evolution of a number of short-term interest rates, including various deposit, repo and swap interest rates in markets. But benchmark interest rates clearly carry a large weight in our operational assessments, given their interconnectedness with the rest of the financial system.

What ultimately matters for monetary policy, however, is the constellation of interest rates faced by households and businesses when making their decisions. While monetary policy can indirectly influence their financing conditions by affecting long-term interest rates, benchmark interest rates currently form the basis for a substantial share of retail borrowing in the euro area.

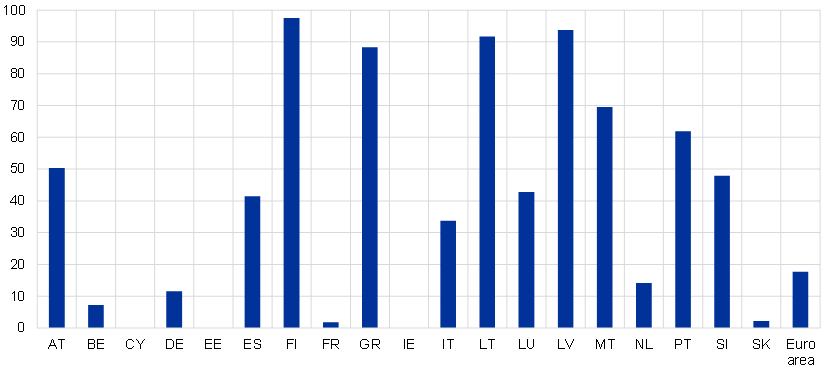

Variable rate loans are common in many euro area mortgage markets

Average share of new loans to households for house purchase with a floating rate

(Aug. 2016 – Jul. 2018; percentages)

Source: ECB.

As my first slide shows, in a number of euro area Member States variable rate mortgages account for almost all new borrowing. In the euro area as a whole, they account for nearly a fifth of all new mortgages. EURIBOR is the reference rate generally used in these contracts. Similarly, around four-fifths of lending to non-financial corporations is based on variable rates, and is principally priced off EURIBOR.

The need for new benchmarks

As you will be aware, the current benchmarks have encountered difficulties from two main sources. The first is the scandal surrounding fixing during the crisis. Given the potential for litigation and compliance risks, banks have become reluctant to remain on panels. A more concentrated panel in terms of membership threatens the representativeness of the benchmark.

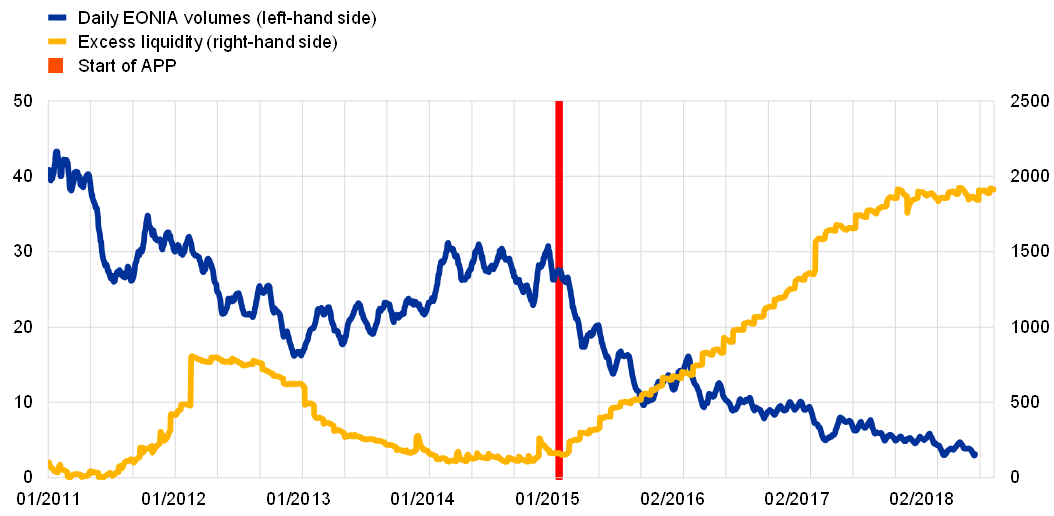

The second problem encountered by current benchmarks is the significant drop in underlying transaction volumes. In part, this reflects the side effects of the unconventional policy measures that we took to maintain price stability in the euro area.[2] As you can see on my next slide, declining transaction volumes in EONIA over the past three years coincide with the start of our large-scale asset purchases and the associated mounting excess liquidity in the system.

Benchmarks have suffered from a significant drop in transaction volumes

Evolution of excess liquidity and EONIA volumes

(EUR billion)

Source: ECB.

But part of the decline also reflects a stronger role of non-banks in managing liquidity. I will come back to this in a minute. These two factors together have lowered the ability of EONIA to accurately reflect banks’ borrowing costs.

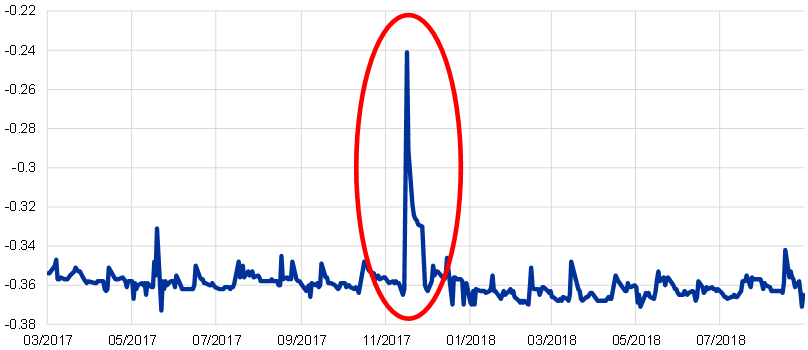

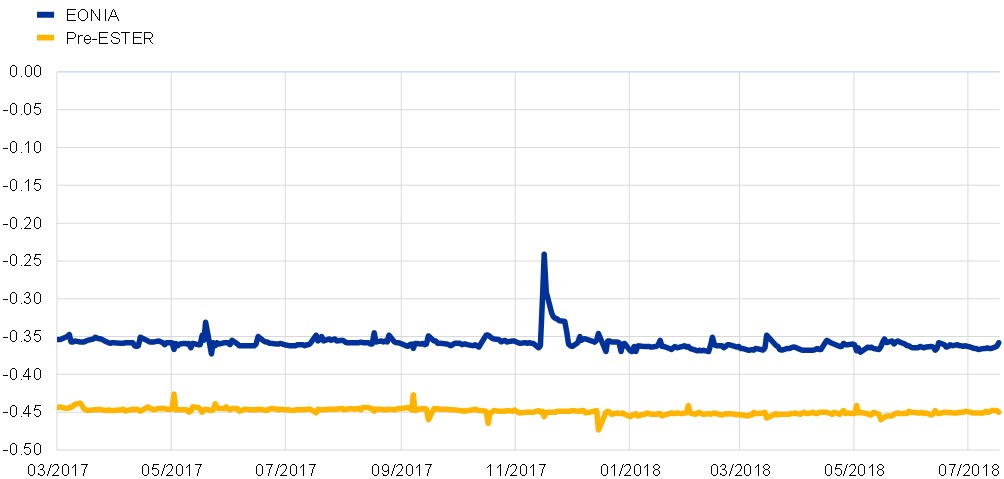

On my next slide you can see how exposed EONIA has become to sudden fluctuations in this environment: in November last year we observed that, amid thin liquidity conditions, comparatively small changes in transaction amounts can cause pronounced volatility in the level of EONIA.

EONIA prone to volatility shocks

EONIA

(percentage per annum)

Source: ECB.

The problems faced by benchmarks have resulted in a notable regulatory effort to establish improved benchmark rates. At a global level, this has resulted in the adoption in 2013 of IOSCO’s Principles for Financial Benchmarks, which have been endorsed by the Financial Stability Board (FSB). The FSB coordinates international work to review and reform benchmarks and has encouraged public authorities and the private sector to identify robust overnight risk-free rates.[3] In the EU, these efforts have resulted in the adoption of the EU Benchmarks Regulation, which lays down requirements to ensure accuracy and integrity.[4]

The Regulation requires benchmarks to be reliable and robust, and underpinned by observable transactions in an active market determined by competitive supply and demand forces. EONIA and EURIBOR in their current form do not comply with these requirements, and may therefore be prohibited for use, at least in new contracts, from January 2020, unless reformed in the case of EURIBOR.

It is also uncertain whether their use in legacy contracts will be permissible. The volume of such legacy contracts with maturities beyond 2019 is substantial. A quarter of outstanding interest rate derivatives using EONIA and more than half using EURIBOR have maturities in 2020 or later. 80% of floating-rate debt securities using EURIBOR – worth almost €1.5 trillion – also extend beyond 2019. And as mentioned above, a substantial share of mortgages are referenced to EURIBOR. Inadequate preparation by the private sector could result in market dislocation once current benchmarks become obsolete.

Progress in creating a new euro area benchmark

New benchmarks are therefore needed.

In September 2017, the ECB, the Belgian Financial Services and Markets Authority (as lead supervisor of both EONIA and EURIBOR), the European Securities and Markets Authority and the European Commission launched a new private sector working group. The group was tasked with the identification and adoption of risk-free rates to serve as a basis for an alternative to the current benchmarks.[5]

The progress made in a very short period of time has been impressive. The working group developed key criteria, consistent with the IOSCO principles for financial benchmarks and the requirements of the EU Benchmarks Regulation, to shortlist potential candidates for an alternative euro risk-free rate.

The main criteria included the need for broad-based and reliable market data, an easily understandable concept that the index seeks to measure, and a trustworthy administrator.

The working group shortlisted three candidates: (i) the euro short-term rate, ESTER, to be produced by the ECB, reflecting euro area banks’ borrowing costs in the wholesale unsecured overnight market; (ii) GC Pooling Deferred, a one-day secured, centrally cleared, general collateral repo rate produced by STOXX; and (iii) the RepoFunds Rate, a one-day repo rate secured by general and specific collateral and centrally cleared, produced by NEX Data Services Limited.

Only two weeks ago, on 13 September, the working group recommended ESTER as the euro risk-free rate to replace EONIA. A public consultation was launched ahead of the vote, the outcome of which provided valuable input for decision-making. 88% of responses viewed ESTER as the most appropriate future euro risk-free rate.

Overall, the ECB welcomes the recommendation of the working group. ESTER is a reliable and robust rate and it reflects financing conditions in money markets better than secured rates, which could be influenced by regulatory and collateral factors unrelated to bank borrowing.

While ESTER represents an alternative benchmark for the short-term segment of the money market, progress towards the development of alternatives for longer tenors is yet to be seen. Although longer-tenor instruments are not turned over as frequently as overnight ones, they are economically relevant as they represent a significant share of outstanding amounts. You can see this on my next slide.

Long-term contracts account for relevant share of outstanding amounts

Left: average daily turnover. Right: average daily outstanding amounts (broken down by maturity bucket)

(EUR billion)

Source: ECB.Notes: Outstanding amount stands for all trades that have settled but not yet matured for each day. The T/N and S/N as well as the 9M and 12M maturities were aggregated for confidentiality reasons

For EURIBOR, work is currently ongoing under the auspices of the European Money Markets Institute (EMMI) which will hopefully result in a new, compliant benchmark, based on a hybrid methodology using actual transactions whenever available, and relying on other related market prices when required. In other words, current proposed solutions are likely to continue to require expert judgement in order to sustain daily benchmark publications on longer tenors.

I draw two implications from this.

First, under this approach the ECB would not be well placed to produce term rates (as opposed to overnight rates), as the central bank may not have the same overview of the prevailing market conditions and funding costs as banks. Moreover, expert judgement provided by the central bank may create, or be perceived as creating, a conflict of interest.

And second, even if a satisfactory solution can be found by the industry, there is a need for market participants to reflect on whether a solution based on EURIBOR is sustainable also in the long run, in particular should other jurisdictions decide to abandon similar rates. For that reason it is important that the working group continues its work on the construction of credible term rates as fallback rates for EURIBOR.

ESTER as a new benchmark

This notwithstanding, the ECB looks forward to taking on its new role as administrator of ESTER. Given the critical role of risk-free rates for market functioning and monetary policy, the ECB attaches high importance to the smooth production of ESTER, which must be guaranteed even in times of unforeseen stress or disruption. This includes building the infrastructure, defining processes and governance, and testing operations. Staff are working intensively to complete all these steps.

Developing ESTER within a tight time frame means that there is a trade-off involved: the better market participants are prepared for and understand the properties of ESTER, the faster the transition to a liquid market is likely to be. I can therefore understand the arguments of those pushing for a speedy release of the new rate.

But too fast a publication might entail operational risks. A sufficient period of testing is required to make sure that the technical set-up achieves the highest degree of reliability to guarantee the smooth production of ESTER. Robust business continuity and contingency plans must be developed.

We have therefore communicated that we will publish ESTER by October 2019 at the latest. In other words, we aim at releasing ESTER as early as possible, but only once we are confident that it meets our requirements regarding reliability and robustness.

We have tried to partly resolve this trade-off by providing market participants with a series called pre-ESTER, using existing MMSR data.[6] Pre-ESTER is calculated using the same methods as defined for ESTER but it differs in that it is based on final data and includes all revisions in terms of cancellations, corrections and amendments submitted by reporting agents in the 10 days following the reference date used for calculating the rate.

ESTER, by contrast, will be published every morning and take into account only the data received by the submission deadline of 07:00 CET the same morning. Internal analyses have shown that over the review period since mid-March 2017 an ESTER rate calculated on the basis of data as submitted by reporting banks by 7:00 CET would not have been significantly different from a rate based on final (i.e. pre-ESTER) data. In other words, while the republication risks for mistakes larger than 2 basis points always remain possible and is catered for, the likelihood of this happening is currently assessed to be very low.

This result is reassuring from a methodology viewpoint. But to achieve a constant high accuracy also during the actual production phase requires reporting agents to consistently deliver, on a daily basis, timely data submissions and to comply with the high data quality standards that ESTER demands. The overall quality of ESTER is therefore a collective endeavour highly depending on the commitment of reporting agents that the ECB as administrator will support and monitor on a daily basis.

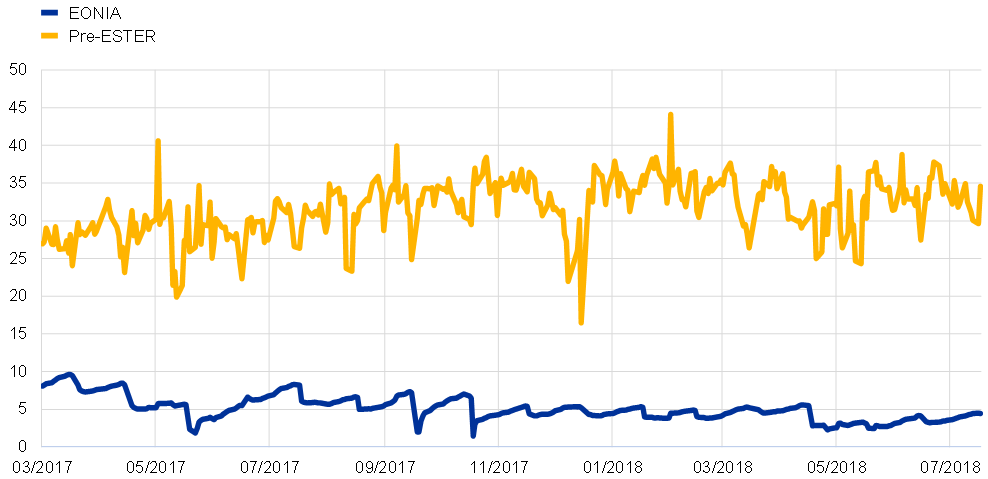

On my next slide you can see some of the key properties of pre-ESTER that have ultimately led the working group to choose ESTER.

Pre-ESTER volumes markedly above those of EONIA

Transaction volumes of EONIA and pre-ESTER

(EUR billion)

Sources: ECB and EMMI.

Despite growing excess liquidity levels, pre-ESTER displays significant and steady volumes, markedly above EONIA volumes. Daily volumes, based on actual transactions, average €30 billion and range from €6.8 billion to €41 billion. On average, around 30 banks report data each day out of a pool of 52 MMSR reporting banks, which ensures that there is sufficient underlying data to calculate a reliable rate.[7]

MMSR data show that even on days with reduced activity on account of major holidays, including the year-end period, volumes remain sufficiently high and concentration sufficiently low to calculate an unbiased rate.[8] It will therefore not be necessary for the calculation methodology to be enriched with historical data, or to rely on other market segments or even expert judgement.

The next slide compares ESTER’s performance with that of EONIA over the period mid-March 2017 to end-July 2018. You can see two things. First, pre-ESTER is very stable with an average daily volatility of just 0.4 basis point. Low volatility in part reflects the way ESTER is computed. Specifically, the methodology relies on a volume-weighted mean with trimming applied at the 25% level, which ensures the best compromise between allowing the rate to sufficiently react to market factors and filtering out transactions conducted at outlying rates.

Pre-ESTER trading at a stable spread below EONIA

EONIA and pre-ESTER

(percentage per annum)

Sources: ECB and EMMI.

At the same time, ESTER is based purely on deposit transactions, which are the most frequent means of conducting arm’s length transactions on the basis of a competitive quote procedure. This ensures that the rate reflects actual market moves, rather than idiosyncratic factors.

The second thing you can see is that over this period, pre-ESTER was trading at a stable spread of around 9 basis points below EONIA. The spread itself is a reflection of the fact that ESTER is a borrowing rate, and not a lending rate as is the case for EONIA, and that it includes transactions with a broad range of financial corporations, not just banks.

And as a large share of these institutions do not have access to the ECB’s deposit facility, they might have different opportunity costs. In the current environment of excess liquidity and high demand for high quality liquid assets, this means they might be willing to extend credit in the money market at rates below our deposit facility rate.[9]

Conclusion

Let me conclude.

New benchmark measures need to be in place by 1 January 2020. Given the importance of these benchmarks for monetary policy, the ECB on its part is working diligently on publishing a new, robust and reliable euro short-term rate by October 2019 at the latest.

Financial market participants, on their part, should redouble their efforts to ensure a smooth transition. They should examine and propose credible paths for the transition away from EONIA and towards ESTER. Contracts should be checked for consistency with the new regulations and robust fallback rates should be specified to ensure continuity in the event of disruption. For EURIBOR, while the private sector is currently reforming the benchmark, sufficient safeguards should be established in all contracts to mitigate the risk of potential adverse scenarios.

Last but not least, market participants should spread the word to ensure that in particular smaller and less sophisticated market participants are aware of the need to prepare for the new benchmarks and to take active steps to adjust systems, processes and contracts. Time is running short.

Thank you.

- [1]See the presentation entitled Update on quantitative mapping exercise on the ECB’s website.

- [2]See Cœuré, B. (2017), Asset purchases, financial regulation and repo market activity, speech at the ERCC General Meeting on “The repo market: market conditions and operational challenges”, Brussels, 14 November.

- [3]See Financial Stability Board (2018), Interest rate benchmark reform – overnight risk-free rates and term rates, 12 July.

- [4]See Regulation (EU) 2016/1011 of the European Parliament and of the Council of 8 June 2016 on indices used as benchmarks in financial instruments and financial contracts or to measure the performance of investment funds and amending Directives 2008/48/EC and 2014/17/EU and Regulation (EU) No 596/2014 (OJ L 171, 29.6.2016, p. 1).

- [5]See Cœuré, B. (2018), The importance of euro interest rate benchmark reforms, welcome address at the first meeting of the Working Group on Euro Risk-Free Rates, at the ECB, Frankfurt am Main, 26 February.

- [6]The published daily figures are based on time-lagged historical time series for the reserve maintenance periods starting 15 March 2017 and cover the period until 31 July 2018. The update of the pre-ESTER series is done every maintenance period.

- [7]See also Cœuré, B. (2017), Policy analysis with big data, speech given at the conference on “Economic and Financial Regulation in the Era of Big Data”, organised by the Banque de France, Paris, 24 November.

- [8]Testing pre-ESTER data between March 2017 and May 2018 against contingency thresholds shows that concentration rates were sufficiently low to ensure rate robustness.

- [9]See Cœuré, B. (2018), The future of central bank money, speech at the International Centre for Monetary and Banking Studies, Geneva, 14 May.

Banc Ceannais Eorpach

Stiúrthóireacht Cumarsáide

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, an Ghearmáin

- +49 69 1344 7455

- media@ecb.europa.eu

Ceadaítear atáirgeadh ar choinníoll go n-admhaítear an fhoinse.

An Oifig Preasa