Assessing the systemic footprint of euro area banks

Assessing the systemic footprint of euro area banks

Published as part of Financial Stability Review, November 2019.

This special feature discusses several ways in which the measurement of banks’ systemic footprint can be complemented with new indicators. The international approach is largely mechanical, but is intended to be complemented by expert judgement. The proposed additional systemic footprint measures may help macroprudential authorities in exercising that judgement. Using loan-level data matched with individual corporate balance sheet information allows macroprudential authorities to gain a better understanding of how a bank’s failure may affect employment and economic activity. Similar data, used in a model of network contagion, help assess the impact of a bank’s failure on the rest of the system. While the measures proposed in this special feature are not embedded in O-SII or G-SII scores, some evidence suggests that the concepts discussed have informed decisions of macroprudential authorities.

1 Introduction

Large and complex banks can cause harm to the wider economy if they become distressed or fail. The extent and type of disruption that the distress or failure of an individual bank could cause to the financial system and economy is its systemic footprint. Mitigating the risks posed by systemically important banks, with large footprints, has been a key part of the post-crisis regulatory reforms. This has included establishing processes at the global and local levels to identify systemically important banks and set higher loss-absorbing capital requirements[1] for them to protect the financial system from the effect of their failure.

This special feature considers how new metrics can support the assessment of the systemic importance of individual banks. The economic costs of a bank’s distress or failure stem from, among other things, its size, complexity, substitutability or business model. As such, there is no single metric that captures systemic importance. In line with the definition of financial stability, measures of systemic importance should capture the impact on the real economy, including lending and economic growth. They should also account for the knock-on effects on other financial institutions and core financial markets.[2] Regulators have been relying on indicator-based scoring approaches to this end, which, however, may not give a full picture of the underlying dimensions of systemic importance. As more granular data on banks’ exposures to the economy and to other financial institutions become available, it becomes possible to develop new metrics of systemic importance to complement existing measures.

2 Regulatory approaches to assessing systemic importance

Every year, under the aegis of the Financial Stability Board (FSB), the Basel Committee on Banking Supervision (BCBS) coordinates the identification of global systemically important banks (G-SIBs).[3] The methodology approximates the impact of a bank’s failure with a score, which is defined as a weighted average of twelve indicators grouped within five categories: size, complexity, cross-border activity, interconnectedness and substitutability. Each indicator is presented in comparison to values for selected global banks.[4] The categories are equally weighted in the final score. Any bank with an overall score of at least 130 basis points is automatically designated as a G-SIB, and receives an additional capital requirement that increases step-wise with the score. In 2018, 29 banks were identified as G-SIBs globally, of which eight were headquartered in the euro area.

Within the European Union, national authorities designate systemically important banks and set capital buffers for them. In October 2012 the BCBS also published a principles-based framework for dealing with domestic systemically important banks.[5] The European Union implemented this framework in the Capital Requirements Directive (CRD IV) and the European Banking Authority adopted guidelines that recommend to the national macroprudential authorities the approach to follow for the identification of systemically important banks at the domestic level.[6] In line with the Single Supervisory Mechanism (SSM) Regulation, the ECB can object to decisions taken by national authorities, or set higher requirements for other systemically important institutions (O-SIIs) identified by national authorities in SSM countries.

While the mechanical scoring approach offers simplicity, transparency and predictability, it needs to be complemented with informed judgement. For example, the interconnectedness dimension of the G-SIB scoring methodology is proxied with stocks of intra-financial sector claims and liabilities, and securities issued. But a shortcoming of this approach is the lack of distinction between secured and unsecured instruments, or between types of financial sector counterparties. So, the resulting systemic footprint ranking may not present a full picture of the underlying risks. A mechanical scoring approach may also not be sufficient to understand the amplification mechanisms or interactions between financial sector agents.

Alternative metrics can support policymakers in exercising expert judgement. The use of expert judgement is expected to be rare, and the supporting evidence must be compelling. The case for additional evidence may be particularly strong for the interconnectedness and substitutability dimensions of the scores, which cover a broad range of concepts and possible transmission channels of a bank’s systemic footprint. It could be less relevant for more straightforward dimensions such as size and cross-border activity.

3 Advances in measuring the systemic footprint

The increased availability of granular data on bilateral and common exposures of financial institutions opens up new ways to measure the systemic footprint. As discussed in the May 2019 FSR, data on large exposures and securities holdings of euro area banks provide a new perspective on contagion risks within the banking sector, and links to and from the real economy.[7] These loan-level data on exposures can provide new information on: (i) the impact of a bank’s failure on the real economy; and (ii) the impact of a bank’s failure on the rest of the financial system.

The importance of a bank’s lending to employment and economic value added can be analysed through granular data on loans to individual companies. The underlying economic intuition is that, should a bank fail or be in distress, its impact on the real economy would, in the first instance, manifest itself through lending relationships with non-financial firms. The bank’s borrowers may struggle to replace lost relationships, and to roll over or top up financing obtained from this particular bank. In turn, they may be forced to cut output and employment. As companies differ in terms of labour intensity and productivity per unit of finance, not only the size but also the portfolio composition of a bank determine its relevance to the real economy.[8] In principle, similar concepts may also be applied to lending to consumers and help quantify the possible impact of bank distress on consumption, should granular data be available.

Indices assessing employment and revenue relevance can capture these additional aspects of a bank’s economic importance. The employment relevance of a bank’s lending to non-financial businesses is measured by matching each credit exposure of a bank with balance sheet data of borrowing firms.[9] The loan amount is then divided by the total liabilities and equity of the borrower. This share in the firm’s funding structure is then multiplied by the number of employees of the borrower, and summed over all the exposures of a bank, thus measuring the number of jobs that would be directly affected by the default of the bank. Revenue relevance is measured in a similar fashion, by using revenues instead of employment data, thus measuring the amount of economic turnover that could potentially be disrupted by the distress of the bank.

Employment and revenue relevance measures do provide more information on economic importance than total assets of the bank alone (see Chart B.1). Generally, banks with more total assets also have higher employment and revenue relevance measures. But in extreme cases, two banks with similar total assets could differ, in terms of relevance for employment, by as much as a factor of one hundred. Such differences suggest that the economic impact of bank failures cannot be completely captured by measures which do not take into account counterparties’ characteristics. Instead, granular information about individual corporations and institutions, directly related to banks’ balance sheets, as well as the role played by these counterparties in the real economy, is crucial to gauge how macroeconomic variables are affected by systemic financial shocks and to link a single institution’s distress to real variables such as GDP growth and unemployment.

Economic importance of banks is correlated with size, but with wide dispersion

Sources: ECB calculations based on ECB and Bureau Van Dijk data.Notes: As both indices are computed based on the large exposure database for firms whose balance sheet and employment data are available, comparability across banks may be affected by varying shares of large exposures in the total lending portfolio. To improve readability, the charts have logarithmic scales. Data in both charts refer to exposures of a set of EU banks in the last quarter of 2015 and 2019.

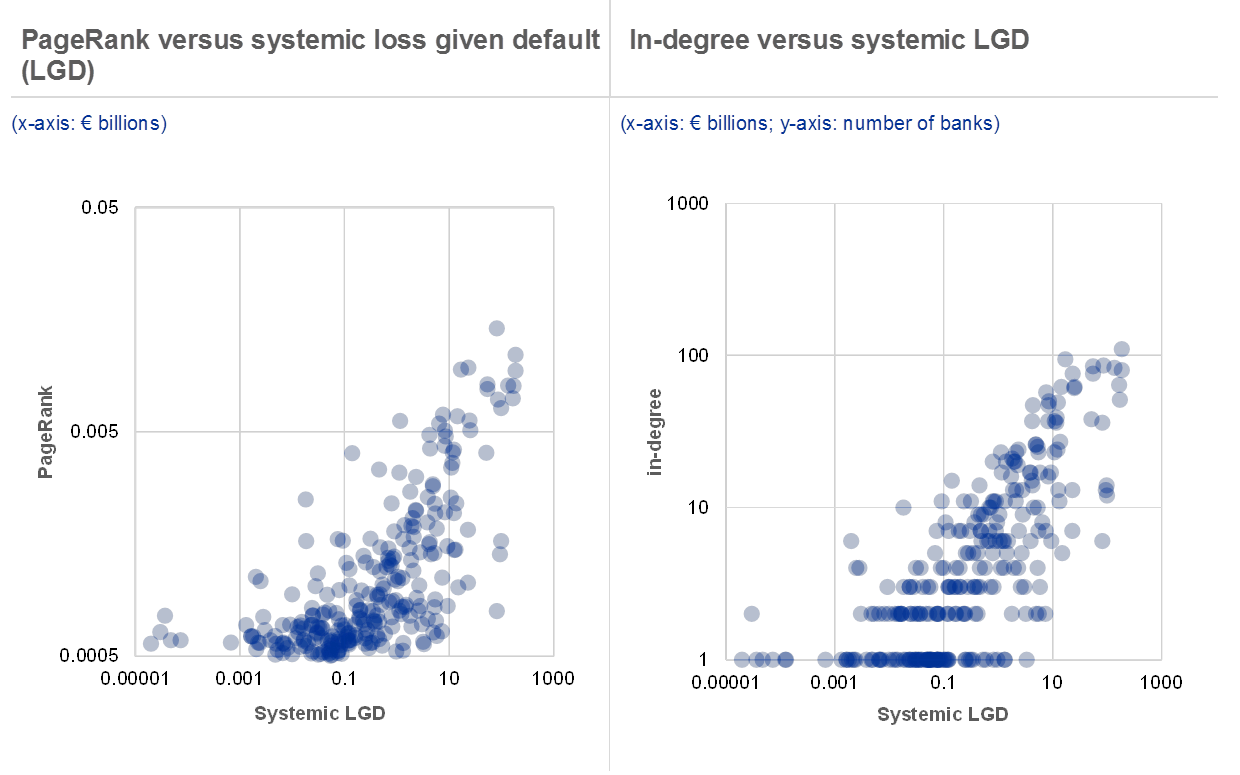

Granular data on exposures to other banks and financial institutions can enhance the understanding of the impact of a bank’s distress on its counterparties. Bilateral exposures between financial institutions can be used to construct a network, and the topology of that network can help identify the most important participants of an interbank network.[10],[11] This may be done on the basis of out-degree and in-degree, which measure the number and value of interbank loans originated and interbank deposits collected by a given bank. PageRank is an indicator of the relative importance not only of a specific bank, but also of its interbank lenders and borrowers. In the past, owing to data constraints, such models were often calibrated using simulated networks. Granular large exposure data have removed some of these constraints and have made it possible to distinguish between various types of exposures: loans and securities, short-term and long-term claims, or secured and unsecured claims.

Contagion models complement other network-based measures with additional information about systemic risk

Source: ECB calculations.Notes: To improve readability, the charts have logarithmic scales. Systemic LGD represents the losses incurred by the banking system conditional on the default of a single financial institution, when taking into account contagion dynamics due to direct bilateral exposures among banks, fire sales and liquidity hoarding. For more details on the methodology, see Covi, Montagna and Torri (2019), op. cit.

As measures of connectivity may provide an ambiguous signal about the systemic footprint, they can be complemented with contagion models. A highly interconnected bank may amplify systemic risk by spreading losses to its counterparties if it is not adequately resilient to shocks. Conversely, a very resilient bank may act as a firebreak, absorbing incoming losses from the failure of its counterparties. It follows that, while the most connected banks contribute most to systemic risk, other banks which are also critical from the perspective of shock propagation may not be among those that are the most connected. Several of these critical nodes have fewer than ten counterparties, less than one-tenth of the links of the most connected banks (see Chart B.2). A model of contagion within the network, which takes into account the varying resilience of the network members, as well as building on behavioural assumptions with respect to their response to shocks, is therefore an essential part of the risk assessment.

Risks associated with bank interconnectedness can be tracked with contagion losses and Shapley values. Contagion losses triggered by a single bank default are, however, typically limited, owing to large exposure limits. Fire-sale mechanisms, and the associated impact on the rest of the financial sector through mark-to-market accounting requirements, can nonetheless amplify even small outright losses from a default event. Furthermore, joint defaults by several banks, caused for example by an exogenous shock to common exposures that these banks hold, are potentially more sizeable (see Chart B.3). Shapley values, originating in game theory and portfolio management, decompose the losses from a joint default by multiple banks into the individual banks’ contributions to systemic risk.

These measures, which use bank exposure data, can be complemented by market-based information. Co-movements in market prices of firms’ equity and debt have often been proposed in the literature as proxies for potential contagion risk, partly owing to the accessibility of market data. Some of these measures, such as SRISK and MES, also incorporate limited information about balance sheet structure and the resilience of intermediaries, and are more closely aligned with the results of the scoring approaches than measures using solely market price data such as ΔCoVaR (see Chart B.3). Overall, market-based measures could provide insights into risk perception by key market participants, which itself may be a vulnerability of specific banks, in particular during periods of heightened market uncertainty.

Contagion losses and market-based measures offer another perspective on contributions of individual banks to systemic risk

Source: ECB calculations.Notes: Left panel: Sample of 12 euro area G-SIBs and near G-SIBs. Loss measures include losses from fire sales. Right panel: Sample of all listed euro area banks in the group of 75 global banks for which G-SIB scores are available. SRISK and ΔCoVaR have been normalised by dividing by each respective maximum value.

These advances notwithstanding, further work is necessary to investigate other aspects of bank interconnectedness and substitutability. Beyond the tools discussed here, the assessment of bank substitutability should take the competitive landscape of the banking system and available balance sheet, liquidity and operational capacity into account. It should also consider the role of a specific firm in banking markets and key market infrastructures. With respect to interconnectedness, a more systemic view of the links between systemic banks and the rest of the financial system would also be beneficial for understanding their systemic footprint.

4 Scope for application to structural capital buffer-setting

The indicators discussed in this special feature may be relevant for setting capital buffers for systemically important banks. Although they are not used in scoring approaches, they carry new information about a bank’s systemic importance. As such, they may in principle contain useful information for the calibration of bank-specific structural macroprudential capital buffers. In particular, such indicators may help operationalise the expert judgement exercised by macroprudential authorities.[12]

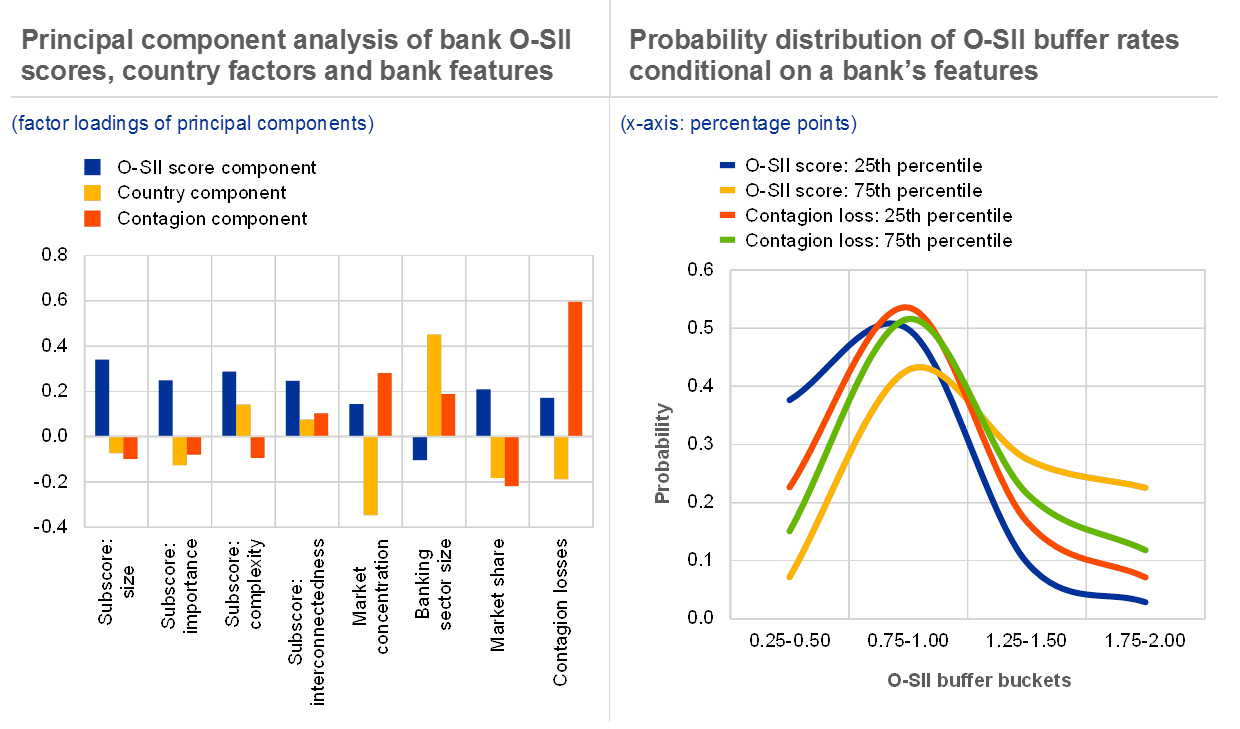

Judgements exercised by national authorities in the euro area are already implicitly taking some of these elements into account. The European Systemic Risk Board has documented the wide dispersion of O-SII capital buffers, and of the O-SII designation practices.[13] To show that this variation may be explained by potential contagion generated by O-SIIs, principal component analysis has been applied to O-SII scores and other indicators of systemic relevance of 108 euro area O-SIIs to identify common trends. The resulting principal components were then used as predictors of the O-SII buffer rates in an ordered probit set-up. The first principal component, capturing the O-SII score, and the component corresponding to contagion losses (see Chart B.4, left panel) are found to be statistically significant in these regressions. The impact of contagion losses on the setting of buffer rates is positive, although their weight is much lower than that of O-SII scores. For example, the probability that an O-SII would receive a buffer rate of 1.75% or 2.0% increases by about 5 percentage points when the systemic LGD moves from the 25th to the 75th percentile of the distribution (see Chart B.4, right panel). It also confirms that contagion losses provide fresh information to policymakers, which is not embedded in the O-SII score.

Contagion losses provide new information about systemic relevance that is not embedded in the O-SII score, and more contagious banks face higher capital buffers

Source: ECB calculations.Notes: Right panel: Probability distributions are obtained using an ordered probit model that uses the three principal components presented in the left panel as explanatory variables for the level of the O-SII buffer. These distributions are generated for a bank with the value of each component set to the in-sample median, with the exception of the respective O-SII score and contagion component which are set to either the 25th or the 75th percentile of the observed distribution.

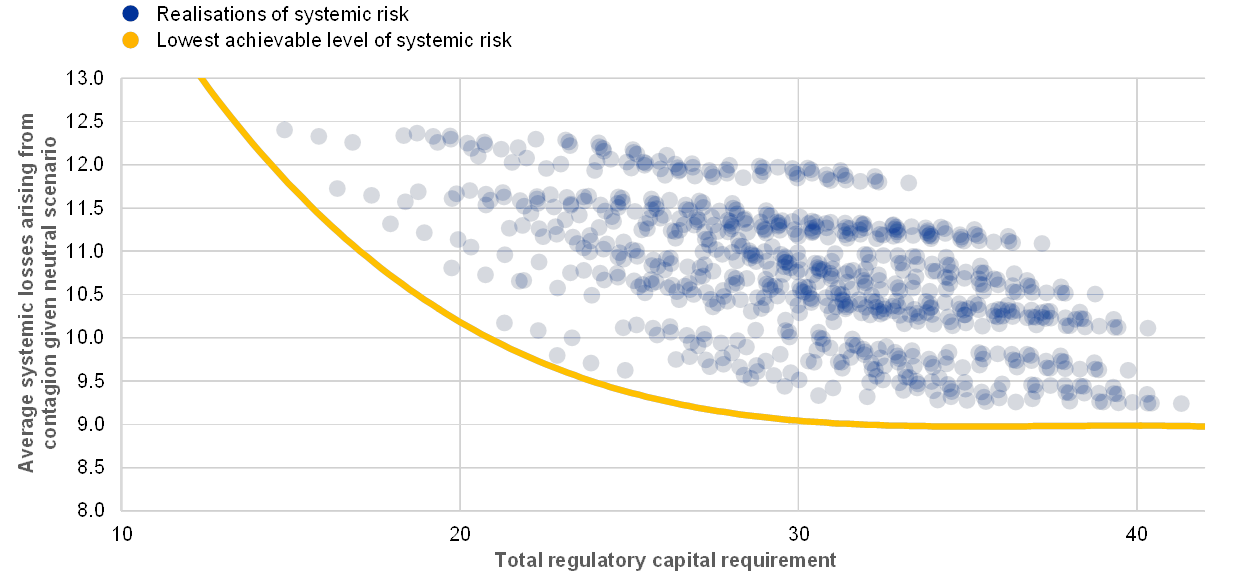

Contagion models may also inform the distribution of additional capital within the banking system. Given the extent of common exposures and interlinkages, changes to the capital requirements of each individual bank can affect the stability of their counterparties and the entire system. Network contagion models could enable regulators to assess more clearly how the distribution of capital requirements amongst banks could reduce the probability of contagion spreading in a stress event.

An illustrative exercise shows that the reallocation of capital may lead to a considerable reduction in systemic risk. Assuming that the regulators have set a sufficient amount of capital for the system as a whole,[14] the actual distribution of capital amongst banks could be set so as to minimise probability-weighted system-wide losses. With buffers allowed to change in increments of 25 basis points, a grid search algorithm can help to find the distribution of capital buffers that minimises systemic risk.[15] This exercise shows that higher aggregate capital buffers decrease the level of contagion and systemic risk in the system, but the relationship between these variables is far from linear, and the distribution of capital influences total systemic risk. Above a certain level of aggregate capital requirements, the marginal gain in terms of reducing systemic risk becomes negligible (see Chart B.5), showing that the distribution of capital requirements may in such circumstances be more relevant from a contagion perspective than the total level of requirements. This exercise does not, however, account for the costs of imposing higher aggregate capital requirements, which may be sizeable and could lead to net effects being negative.

Allocation of capital to systemic banks influences distribution of contagion losses

(€ billions)

Source: ECB calculations.Notes: Realisations of systemic risk represent contagion losses to the banking system estimated using 50,000 iterations in a Monte Carlo simulation of bank failures. The yellow line corresponds to the efficient frontier, where no further reduction in systemic risk can be achieved for a given aggregate amount of capital.

- [1]See Reducing the moral hazard posed by systemically important financial institutions, Financial Stability Board, 20 October 2010.

- [2]See “Measurement challenges in assessing financial stability”, Financial Stability Review, ECB, December 2005; “Identifying large and complex banking groups for financial system stability assessment”, Financial Stability Review, ECB, December 2006; and “The concept of systemic risk”, Financial Stability Review, ECB, December 2009.

- [3]See Global systemically important banks: Assessment methodology and the additional loss absorbency requirement, BCBS, November 2011 (subsequently amended in 2013 and 2018).

- [4]The sample consists of the 75 largest global banks (as determined by the Basel III leverage ratio exposure measure), along with all banks that were designated as G-SIBs in the previous year.

- [5]See A framework for dealing with domestic systemically important banks, BCBS, October 2012.

- [6]That approach takes into account the general criteria specified in the CRD IV and the criteria set out in the BCBS framework for dealing with domestic systemically important banks. See Guidelines on the criteria to determine the conditions of application of Article 131(3) of Directive 2013/36/EU (CRD) in relation to the assessment of other systemically important institutions, European Banking Authority, EBA/GL/2014/10, December 2014.

- [7]See Covi, G., Montagna, M. and Torri, G., “Economic shocks and contagion in the euro area banking sector: a new micro-structural approach”, Financial Stability Review, ECB, May 2019.

- [8]See Gabaix, X., “The Granular Origins of Aggregate Fluctuations”, Econometrica, Vol. 79(3), pp. 733-772, May 2011, for a rigorous approach to computing granular contributions of corporations to GDP volatility.

- [9]Owing to limited data availability, the examples presented in this special feature only use large exposures; however, the indices can be computed using a full set of exposure-level data.

- [10]See Glasserman, P. and Young, H. P., “Contagion in Financial Networks”, Journal of Economic Literature, Vol. 54(3), 2016, pp. 779-831.

- [11]See Bisias, D., Flood, M. D., Lo, A. W. and Valavanis, S., “A Survey of Systemic Risk Analytics”, Office of Financial Research Working Paper, U.S. Department of the Treasury, 2012.

- [12]Among the euro area countries, Luxembourg has included indicators of interconnectedness between banks and investment funds in its O-SII methodology. See Gehrend, M., “Bank-investment fund interconnections and systemically important institutions in Luxembourg”, Revue de stabilité financière, Banque centrale du Luxembourg, 2017.

- [13]For example, the share of bank assets held by O-SIIs varies between countries from about one-third to over 90%. See Final report on the use of structural macroprudential instruments in the EU, European Systemic Risk Board, 2018.

- [14]This might be done on the basis of aggregate cost-benefit analysis, for example using the approach employed in An assessment of the long-term economic impact of stronger capital and liquidity requirements, BCBS, August 2010.

- [15]See Covi, Montagna and Torri (2019), op. cit.