Published as part of the Financial Stability Review, November 2025.

Episodes of high volatility in financial markets have raised concerns about the resilience of investment funds to liquidity shocks. Investment funds running a strategy focused on risky assets such as equities and high-yield bonds may suffer from large investor outflows during episodes of high volatility and declining market prices. Funds that operate with significant liquidity mismatches may thus be forced to sell less-liquid assets at unfavourable conditions.[1] The structure of the investor base can play a significant role in fund fragility during such stress episodes.[2] This box zooms in on the importance of household investors as a stabilising factor for investment fund liquidity during market downturns, with a focus on the April 2025 market turmoil.

Over the last decade, household investors have become the largest domestic investor group in euro area equity and high-yield bond funds, which means that they may increasingly be driving fund flow dynamics. The share of households holding euro area-domiciled equity and high-yield bond funds has increased by approximately 25% since 2017 (Chart A, panel a). Today, households’ holdings match those of the major domestic institutional investors combined, making them the largest type of domestic investor. Investor groups differ in their investment preferences and constraints, which has an impact on fund flow dynamics. Households typically pursue very long-term investment gains, so their investment behaviour is less responsive to temporary market shifts.[3] Moreover, the absence of leverage makes households’ portfolios less prone to liquidity shocks, while institutional investors may have to liquidate positions in times of sudden market downturns to service margin calls or reduce leverage.

Chart A

Households have become important investors in euro area investment funds over the past decade and demonstrated resilience during the recent tariff-related turmoil

a) Holdings of euro area-domiciled equity and high-yield corporate bond funds, by major holding sector | b) Cumulative flows in euro area-domiciled investment funds after tariff and tariff pause announcements, by holding sector |

|---|---|

(Q1 2017-Q2 2025, percentages of total net assets) | (24 Mar.-18 Apr. 2025, percentages of total net assets) |

|  |

Sources: ECB (SHS), EPFR Global and ECB calculations.

Notes: Panel b: cumulative flows are obtained at fund-share level for euro area-domiciled investment from EPFR Global at a daily frequency. We obtain information about the holder structure of fund shares from the SHS dataset. For each quarter, the investor group that holds the majority of the outstanding fund shares will be classified as the investor base for that fund share. The category “Institutionals” includes holdings of fund shares by investment funds, pension funds, insurance corporations, banks, public institutions and other financial institutions. We calculate the holdings of foreign investors as the residual between total net assets of the respective share class and euro area holdings from the SHS dataset (households + institutionals). Foreign sector holdings may be overstated under this approach, as the SHS dataset does not capture euro area holdings held via non-euro area custodians. However, Beck et al.* find that such holdings are likely very limited, and that the majority of assets held via non-euro area custodians can be attributed to non-euro area investors.

*) Beck, R., Coppola, A., Lewis, A., Maggiori, M., Schmitz, M. and Schreger, J., “The Geography of Capital Allocation in the Euro Area”, NBER Working Papers, No 32275, National Bureau of Economic Research, 2024.

Differences in investment behaviour across investor groups may be particularly pronounced in times of market downturns that trigger equity and bond sell-offs. After the global tariff announcement by the US Administration in April this year, redemptions of fund shares by institutional and foreign investors were more pronounced than those by households. Households also showed a stronger tendency to re-invest once it was announced that tariffs would not be implemented immediately (Chart A, panel b).

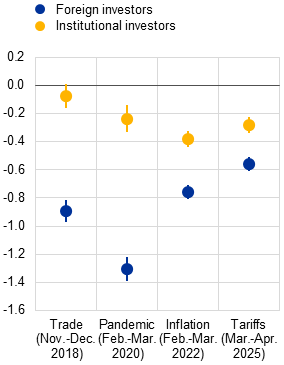

During recent episodes of market stress, households have sold lower volumes of equity and high-yield corporate bond fund shares than foreign and institutional investors. Regression analysis at the individual fund level suggests that outflows were significantly larger for funds primarily held by foreign or institutional investors than for funds primarily held by households. This holds true for all four episodes considered: the China-US trade tensions of 2018, the outbreak of the COVID-19 pandemic, market reactions to the 2022 Russian invasion of Ukraine and ensuing inflation spikes, and the most recent tariff announcement by the US Administration in April 2025. In the context of the 2018 trade tensions, for example, outflows from funds mainly held by foreign investors were about 0.9 percentage points of total net fund assets higher than those from funds mainly held by households (Chart B, panel a).

Chart B

Households’ behaviour in euro area investment funds is less procyclical during market downturns than that of institutional investors

a) Impact of foreign and institutional investors on fund flows relative to households | b) Positive impact of household investors on flows into equity funds in April 2025 | c) Positive impact of household investors on flows into high-yield bond funds in April 2025 |

|---|---|---|

(percentage points of total net assets) | (days before and after tariff announcement, percentage points) | (days before and after tariff announcement, percentage points) |

|  |  |

Sources: ECB (SHS), EPFR Global and ECB calculations.

Notes: For the regressions, we follow Allaire et al.* For all three panels, fund shares are classified as having a household investor base, an institutional investor base or a foreign investor base, in line with the approach adopted in Chart A, panel b. The regressions are set up as: , where is the cumulative daily flow in fund share i at time t relative to ten days before the tariff announcement, expressed as a percentage of fund share i’s total net assets under management. is a dummy that takes the value 1 in a stress period k. For panel a, k describes being before or after the breakout point of a stress episode, while for panels b and c, is a daily dummy variable. For panel a, takes the value 1 if the investor type is either foreign or institutional, making households the baseline investor group. For panels b and c, takes the value 1 if the investor type is households, making all other investor groups the baseline. We capture fund share and time specific fixed effects with .

All regressions are estimated within a period of ten days before and after the breakout of an episode of market stress. The time periods considered are (i) the trade tensions between China and the United States in November/December 2018, (ii) the outbreak of the COVID-19 pandemic in February and March 2020, (iii) Russia’s invasion of Ukraine and the resulting energy price inflation during February and March 2022, and (iv) the announcement of global tariffs by the US Administration during March and April 2025. The precise cut-off dates used for the regressions were determined by volatility in total fund flows.

*) Allaire, N., Breckenfelder, J. and Hoerova, M., “Fund fragility: the role of investor base”, Working Paper Series, No 2874, ECB, 2023.

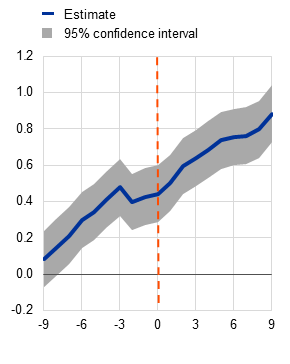

A larger household investor base provided significantly better funding stability for euro area investment funds than other investor groups during the tariff turmoil seen in spring 2025. The differential impact of a prevailing household investor base proved to be positive for investment fund flows during the recent market turmoil. Household flows into investment funds holding global equities were significantly more positive than those of other investors both before and after the tariff announcement (Chart B, panel b). The household sector also provided more resilience to the funding stability of high-yield corporate bond funds during the April 2025 market stress (Chart B, panel c).

The stability benefit of a household investor base is not observed for households investing through more complex fund of funds structures. During the April tariff turmoil, euro area-domiciled investment funds held by funds of funds faced similar flow dynamics, irrespective of the ultimate investor base (Chart C, panel a). Such funds of funds may make more frequent use of active fund management tools and leverage, increasing their procyclicality.

Chart C

Further deconstructing household investor dynamics reveals pockets of procyclicality through indirect investment both via funds of funds and by speculative retail investors

a) Cumulative flows into euro area-domiciled investment funds held by funds of funds, by ultimate holder structure | b) Retail investor sentiment and its correlation with global equity markets |

|---|---|

(24 Mar.-18 Apr. 2025, percentages of total net assets) | (1 Jan. 2018-31 Oct. 2025; upper panel: difference between positive and negative sentiment z-scores and MSCI World z-scores, lower panel: correlation coefficients) |

|  |

Sources: ECB (CSDB, SHS), EPFR Global, LSEG Lipper, Reddit (Academic Torrents), OpenAI, Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: funds of funds are identified via LSEG Lipper as investment funds that hold euro area equity or high-yield corporate bond funds included in the regression sample. To capture the main indirect holders, we focus on equity and high-yield bond funds whose shares are predominantly held by other investment funds. We then apply a look-through approach, using granular portfolio data to identify which funds hold these shares. For each equity or high-yield fund, we then aggregate the investor base of the funds of funds that invest in it, weighting each fund by the size of its holdings. This provides a proxy for the investor base of euro area equity and high-yield corporate bond funds in the sample. The analysis is restricted to cases where at least 25% of a fund’s indirect investor base can be identified using LSEG Lipper portfolio data. Panel b: net retail sentiment is constructed from post titles on Reddit’s r/wallstreetbets subreddit from 2018 onwards. Posts are classified into market-related topics (equities, funds, macro, options, commodities, geopolitics, tariffs and crypto) using OpenAI’s GPT-4o model, with unrelated content, such as community posts, excluded. The dataset comprises around 1.8 million posts which the AI model labels as positive, negative or neutral. Net sentiment is defined as the difference between the 365-day z-scores of positive and negative posts, where each post is weighted by the logarithm of its comments and upvotes to proxy its relative importance in the forum. The MSCI World series shows the 365-day z-score of daily index levels. The lower panel reports the 365-day rolling correlation between net retail sentiment and MSCI World z-scores.

Speculative retail activity may contribute to pockets of procyclicality within household investment patterns during periods of increased market volatility. While many households invest their savings regularly in equity and bond funds independently of market developments, some pursue more speculative strategies that are more sensitive to short-term market swings. A novel sentiment indicator derived from Reddit discussions on financial assets shows that retail investor sentiment tends to move in line with global equity prices. This correlation strengthens during episodes of market stress, suggesting that retail speculators may display procyclical dynamics and reflect aspects of herding behaviour, whereas the link is weaker in more tranquil periods (Chart C, panel b). This highlights the potential for speculative retail activity to reinforce market dynamics. However, the footprint of retail speculators in euro area markets remains limited at present.

Greater household participation in euro area financial markets, including in the context of advancing the savings and investments union, can be beneficial for financial stability. Prudential policy arrangements to limit vulnerabilities from liquidity mismatch should take the role of investor behaviour into account. Recent market stress episodes have shown the positive impact a broad household investor base can have on fund resilience, while risks from speculative retail traders remain limited. Accordingly, swift progress on the savings and investments union could strengthen investment funds’ funding stability in periods of stress by broadening households’ access to euro area markets.

For procyclical outflows from euro area investment funds after tariff announcements, see the chapter entitled “Non-bank financial sector”, Financial Stability Review, ECB, May 2025.

See Allaire, N., Breckenfelder, J. and Hoerova, M., “Fund fragility: the role of investor base”, Working Paper Series, No 2874, ECB, 2023.

Based on monthly data since 2018 for euro area equity and high-yield corporate bond funds, households’ investments are approximately 40% less sensitive to changes in fund performance relative to other investors.