Card payments in Europe – current landscape and future prospects

April 2019

Most people see payment cards as a quick and easy way of making retail payments. They are the most widely used and fastest growing electronic payment instrument in Europe, accounting for slightly more than half of all non-cash transactions by European citizens and businesses in 2017.

In support of the move towards a Single Euro Payments Area (SEPA) for cards, the ECB has issued a new report on the European cards market entitled “Card payments in Europe – current landscape and future prospects: a Eurosystem perspective”.

SEPA for cards - the missing element

SEPA is an EU initiative to create an integrated market for payments in euro. Its ultimate goal is to eliminate the distinction between national and cross-border euro payments within the EU so that all payments are treated as domestic.

Running for over a decade, SEPA has brought many benefits to European citizens and businesses by unifying credit transfers and direct debits across 36 European countries. However, as SEPA for cards has not yet been accomplished, cardholders and merchants have not fully benefited from the single EU market.

National and international card schemes

Cards are popular everywhere, but their usage varies widely across European countries and the percentage of cross-border card payment transactions is still relatively low in overall volumes. This points to a vast potential for growth in card usage, both within many individual countries and across European borders.

Chart 1

Number of card payments per inhabitant (2014-2017)

Source: ECB Statistical Data Warehouse.

Note: The chart shows card payments with cards issued by EU-resident payment service providers, except cards with an e-money function only.

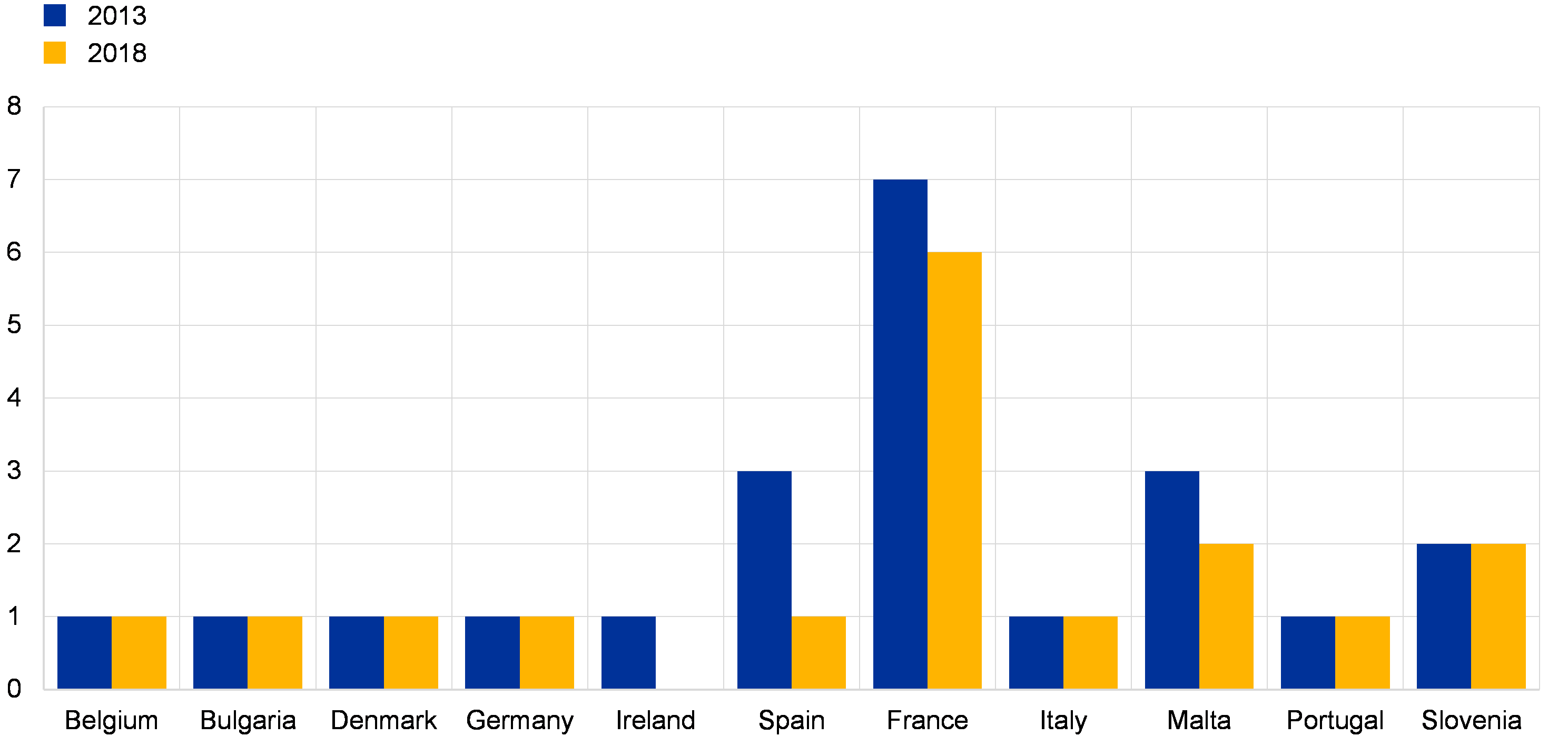

While new legislation and substantial technological progress have indeed reshaped the card payment environment, they have so far not led to a harmonised, competitive and innovative European cards payment area. National card markets remain somewhat fragmented. While European cardholders are generally able to use their national cards at any terminal in Europe, the European-wide acceptance of cards issued under national card schemes is entirely reliant on co-badging with international card payment schemes, namely MasterCard and Visa. Increasingly, payment service providers only issue cards from international card schemes. In addition, the steady decline in the number of national card schemes (from 22 in 2013 to 17 in 2018) means that international card schemes are taking over the national markets alongside the European cross-border card market.

Chart 2

Number of national card schemes active in individual Member States in 2013 and 2018

Source: ECB.

Note: Member States with no national schemes in 2013 or 2018 are not included in the chart.

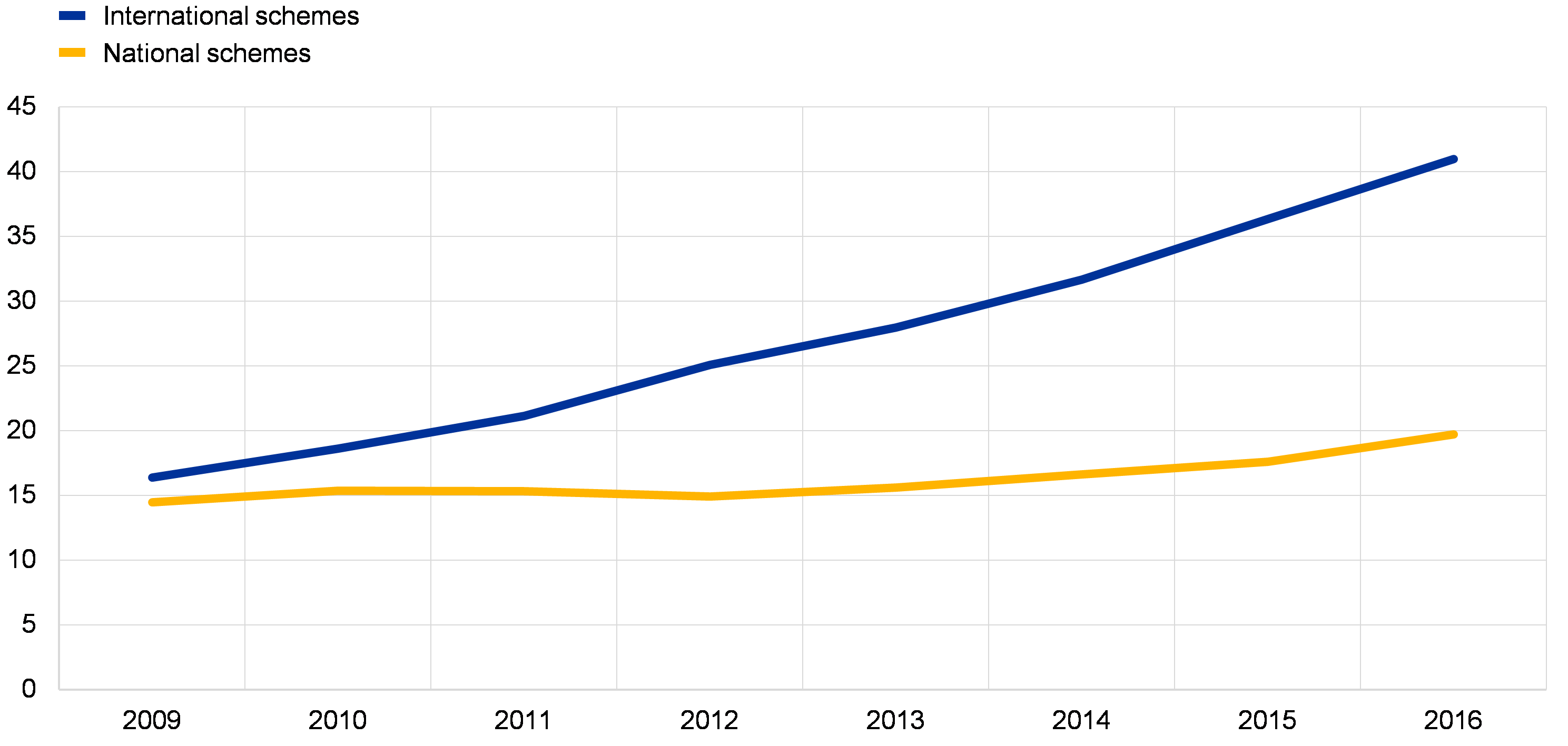

As derived from Chart 3 , at the end of 2016, the share of transactions made with international card schemes on payment cards issued in EU was 67.5%. Such an arrangement calls into question market efficiency in terms of costs, competition and governance, as European payment service providers have little or no influence on the market’s development.

Chart 3

Number of transactions made with national and international card schemes on payment cards issued in the EU (in billions)

Source: Reporting by card schemes for oversight purposes to the ECB.

Payments innovation as a possible way forward

Past attempts to establish a European card scheme or to achieve European-wide cross-border coverage of national card schemes have not borne any fruit so far. However, the implementation of a European instant payment scheme and the development of common or interoperable instant payments infrastructure may present new opportunities. The new instant payments infrastructure could help ensure the interoperability of national card schemes. If full pan-European coverage is ensured, the use of this infrastructure may present an alternative to establishing a European card scheme. To promote the use of such national cards, it would be helpful to have a common European logo indicating that they can be used in other EU Member States.

Furthermore, the report notes that innovative technologies will increase competition in the cards market and offer consumers more choice. Also, the EU legislation (the Interchange Fee Regulation and the revised Payment Service Directive) aims to support a harmonised, competitive and innovative cards market. The Eurosystem welcomes the implementation of a clear legal framework and encourages innovative solutions that enable efficient, convenient and secure card payments. In principle, these should be designed to:

- enable pan-European reach, even if initially targeting national environments;

- avoid further fragmentation of the card market.

The Eurosystem strongly supports deeper cooperation and dialogue among relevant market players, in particular between incumbents and newcomers. Innovative and standardised industry-driven solutions based on open standards could enable pan-European reach of card-based and other payment products and services and ensure European technological independence.