The resurgence of protectionism: potential implications for global financial stability

Published as part of the Financial Stability Review November 2018.

The intensification of trade tensions this year has raised concerns about the potential adverse impact on global growth and asset prices. So far, the isolated effects of introducing tariffs on selected goods on asset prices have been adverse mainly for specific companies that rely heavily on international trade. At the same time, global financial markets have overall been fairly resilient to the announcements and implementation of tariff measures. This special feature finds that an escalation of trade tensions could trigger a global repricing in asset markets. For the euro area, asset prices would be strongly affected in the event of a full-blown global trade war, in which all countries impose tariffs on each other, while the impact of a regionally contained trade dispute escalation would be rather subdued.

1 Introduction

Increasing global trade tensions have raised concerns about the potential adverse impact on global growth and asset prices. The US administration has introduced several protectionist measures in the form of tariffs on goods produced in China, which has promptly retaliated. Across a wide range of public institutions[1], the consensus view put forward is that trade barriers can slow down economic growth in the short term and productivity growth in the longer term. In particular, a further escalation of trade tensions to a broader set of countries has been assessed to have significant adverse effects on the global economy. However, less light has been shed on the potential impact of an escalation of trade protectionist measures on financial stability more generally and asset prices in particular.

Trade tensions have quickly evolved in recent months amid actions and rhetoric by the United States and its main trading partners. After introducing steel and aluminium import tariffs on almost all its trading partners in March and tariffs on countries that were initially exempt, such as those in the European Union, in June, the US administration applied further tariffs on imports of goods from China (see Chart B.1). The tariffs, which amount to USD 50 billion and took effect in two tranches in July and August, were levied following an investigation into China’s acts, policies and practices related to technology transfer, intellectual property and innovation. China announced retaliation in kind on the same day. Further to this, the US administration then imposed additional tariffs on USD 200 billion worth of Chinese goods pertaining to 5,745 products in September. In parallel to this trade dispute with China, the US administration initiated an investigation into the impact of truck, automobile and auto part imports on US national security. This investigation could result in additional import tariffs of 25% on the value of imported cars.

US imports subject to proposed and implemented tariffs in 2018

(Jan. 2018-Oct. 2018, USD billions)

Sources: Peterson Institute for International Economics, USTR and ECB calculations.Notes: Values of imports affected by the tariffs on washing machines and solar panels and steel and aluminium refer to estimates produced by the Peterson Institute for International Economics. Tariffs on USD 200 billion of Chinese imports will initially be 10%. Starting on 1 January 2019 the level of tariffs will increase to 25%. The percentages in brackets indicate the size of the applied tariffs.

This special feature analyses the implications of a potential emergence of more broad-based global protectionism for global financial stability. The main aim of this special feature is to trace out how a widespread escalation of the emerging trade dispute could lead to an abrupt decompression of global risk premia and a fall in equity prices. The special feature is organised as follows. First, the channels through which the announcements and implementation of tariffs may affect asset prices are described. Second, a box illustrates how the risk component of market price reactions to the trade policy uncertainty can be extracted. Third, three scenarios assuming further escalations of trade protectionism are used to determine the potential implications for global financial stability.

2 Trade protectionism and asset prices

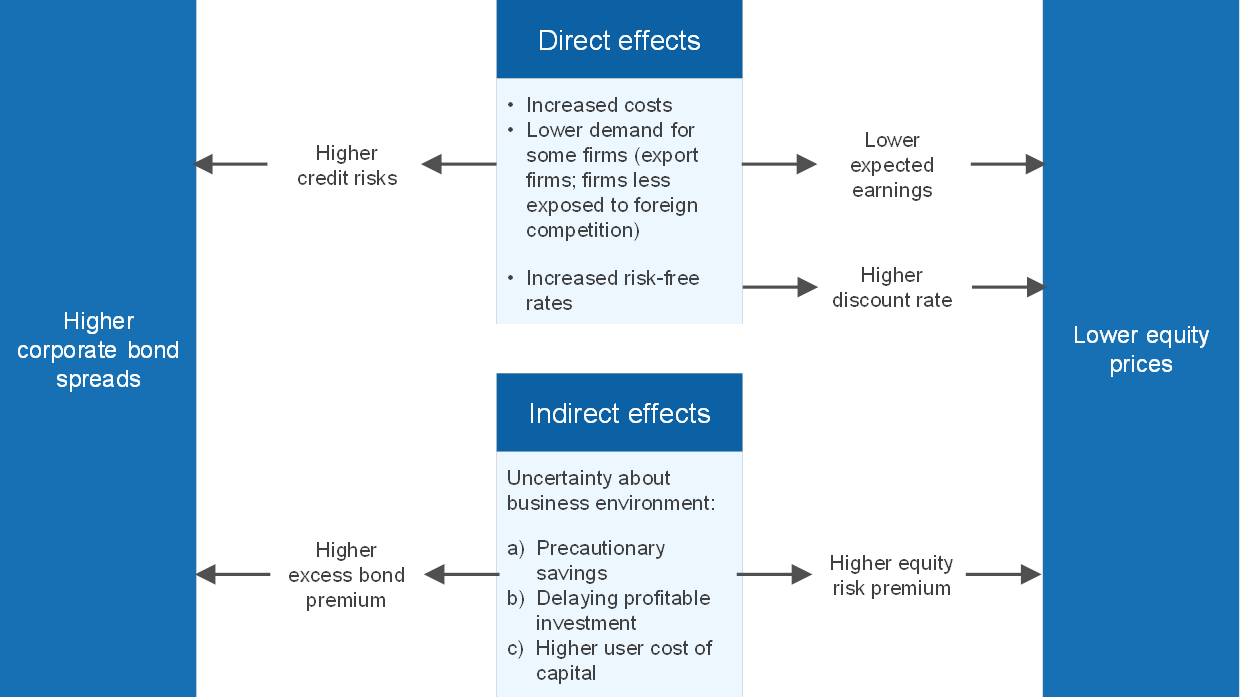

The introduction of import duties affects economic activity and asset prices directly and indirectly. The direct effects of higher tariffs increase the prices of imported goods, driving domestic demand in opposite directions. On the one hand, higher import prices induce consumers to switch to domestically produced goods, increasing domestic demand. On the other hand, higher import prices reduce real disposable income, leading to a decrease in domestic demand. The relative importance of the two channels, and consequently the final impact on GDP and asset prices, depends on the degree of substitutability between domestically produced goods and imported goods.[2] From a firm’s perspective, the direct effects of higher import tariffs materialise via increased costs, lower product demand and potentially higher risk-free rates. As for the firm’s asset prices, equity prices would be expected to decline owing to lower expected earnings, and higher credit risk should exert upward pressure on bond spreads (see Figure B.1).

Direct and indirect effects of tariff announcements on asset prices

Source: ECB.

Uncertainty about future trade regimes in general, confidence effects and adverse financial spillovers may amplify the adverse effects on asset prices. In addition to the direct effects of tariff measures, indirect effects may materialise through higher uncertainty about future trade policy, lower confidence, financial stress and lower productivity. In response to higher uncertainty, agents may consume less (precautionary saving) and put investment plans on hold, adopting a wait-and-see approach.[3] Uncertainty about trade policies could increase risk premia and trigger a more fundamental reassessment of stock and bond prices. The associated tightening of financing conditions would negatively affect investments (through a higher cost of capital). In addition, higher tariffs may change the allocation of productive resources across firms, with a reallocation of domestic market share towards less-efficient domestic producers, lowering aggregate productivity.[4] These indirect channels are commonly not included in standard models, but are added in an ad hoc manner, thereby introducing a degree of arbitrariness to the size and choice of these additional shocks, as they are difficult to link directly to protectionist policies.

Other than the channels above, financial markets in emerging market economies (EMEs) may come under additional strain in response to the implied higher financial market volatility. The materialisation of a global uncertainty shock, such as a trade war, may lead to portfolio shifts to safe-haven currencies such as the US dollar, the Japanese yen or the Swiss franc. The resulting appreciation of these currencies may trigger capital outflows from EMEs, particularly for those with weaker fundamentals. A number of studies have shown that during periods of financial stress in EMEs, investors typically rebalance their portfolio towards financial assets in advanced economies. However, adverse financial spillovers stemming from EMEs, as well as the decline in foreign demand from these countries, may more than offset these positive safe-haven effects.

Equity and bond prices in the sectors most exposed to the tariffs have underperformed (see Box A). The introduction of the tariffs has not had a significant impact on global stock markets to date. The main reason for the muted response is that the recently implemented tariffs affect only a small share of global trade and a relatively small fraction of US and other economies’ imports. Overall, the tariffs imposed so far only affect 8% of US total imports and about 1% of global trade volume. At the same time, companies directly affected by the tariffs (such as those in the steel and aluminium sector) have clearly underperformed the market. Looking ahead, trade disputes would have to spread to a significantly larger share of goods, as well as to a larger set of countries, before their direct effects would have a more visible impact on overall financial markets and asset prices.

Box AFinancial market reactions to tariff-related events in the United States and the euro area

As input for the calibration of one of the scenarios simulated in this special feature, this box provides estimates of the initial impact of trade tensions on euro area and US equity prices, corporate bond spreads and risk premia. It argues that the impact on aggregate financial asset prices has so far been limited. However, more severe corrections could be expected if the threat of tariffs were to be extended to a large share of traded products.

The impact of tariff-related news on financial markets can be gauged from movements in asset prices around selected events (see Chart A). Due to the high frequency of communication on the issue from various sides, however, a normative selection of events has to be made. Concerning the euro area, two of the most important tariff-related events in terms of market impact are chosen: first, around 21-23 March, when US tariffs on steel and aluminium imports took effect, and, second, around 15 June, when the Office of the United States Trade Representative (USTR) issued a press release announcing its intention to impose additional tariffs on products imported from China, which was subsequently matched by announcements of retaliation, sparking fears of a potential escalation of tariff increases to other products and countries. Turning to the United States, during the period from February to July 2018, when tariff-related rhetoric intensified the most, one further event, which was widely discussed in the financial press and had an impact on asset prices, is included. The event window here is placed around 10 July when, following a period of relative calm, fears of a renewed escalation emerged in response to the USTR issuing – in reaction to China’s retaliatory tariffs that took effect on 6 July – a proposed list of Chinese products amounting to an annual trade value of about USD 200 billion that would be subjected to an additional 10% in duties.

Chart A

Euro area equity prices of tariff-targeted sectors around selected events

Sectoral developments in euro area equity prices

(cumulative change, normalised to 100 on 2 Feb. 2018)

Sources: Thomson Reuters and ECB calculations.Notes: The grey event lines indicate 22 March, the day when US tariffs on steel and aluminium imports took effect (on 8 March, President Trump signed an order to impose these tariffs, effective after 15 days), and 15 June, when the USTR issued a press release announcing its intention to impose additional tariffs on products imported from China, which was subsequently matched by announcements of retaliation by China. EA stands for euro area. The latest observation is for 24 September 2018.

Cumulative changes in US and euro area equity prices in response to tariff-related announcements have been roughly comparable so far, amounting to around minus 7% (see Table A, first row). Judging from the changes in euro area and US equity prices and corporate bond spreads, the total market impact of tariff-related news appears to have remained relatively contained so far and balanced across areas. The impact on equity prices is measured by the cumulative change in the index within two days of the described events. Judging the impact of these events on corporate bond spreads is complicated by the slower movement of corporate bond spreads compared with equity prices. Segmentation between stock and bond markets can arise from a variety of frictions, such as regulations that inhibit certain classes of debt-market intermediaries like banks and insurance companies from also being active in the stock market. As a result, the corporate bond market reacts to the information flow more slowly. For this reason, movements over longer time periods are taken into account to measure the impact of tariff increases on corporate bond spreads. More concretely, movements in corporate spreads over the period from February to July 2018 are assumed to have mainly been driven by tariff-related concerns. Over this period, corporate bond spreads in the non-financial sector increased for both the euro area and the United States (see Table A, first row). Naturally, the assumption that corporate bond spreads over this period have only been affected by trade concerns is very strong and, in fact, it is likely that the somewhat larger increase in the euro area also reflected changes in political risk in the euro area, while the robust US expansion has possibly counteracted responses of corporate bond spreads to tariff-related events, making the estimation of the impact of trade effects on corporate bond spreads subject to considerably much more uncertainty than for equity prices.

Table A

Impact of trade tensions on financial asset prices

Sources: Bloomberg, Thomson Reuters and ECB calculations.Notes: Column 1 shows cumulative changes of total market equity indices in a two-day window around selected events. For the euro area, these are 21-23 March 2018 and 15 June 2018. For the United States, 10 July 2018 is also included. For corporate bond spreads, cumulative changes are shown over the period February-July 2018. Contributions of risk premia to price changes are estimated via a dividend discount model decomposition for equity prices and by estimating excess corporate bond premia. See “Measuring and interpreting the cost of equity in the euro area”, Economic Bulletin, Issue 4, ECB, 2018, and De Santis, R., “Credit spreads, economic activity and fragmentation”, Working Paper Series, No 1930, ECB, July 2016. The increase in US corporate bond risk premia exceeds the observed change in corporate bond spreads in Column 1 due to an improvement in estimated credit risk over the same period. Column 2 extrapolates changes in sectoral and individual company equity and corporate bond indices, as well as the decompositions thereof, as described in the main text, to the overall market.

The symmetric reaction between the United States and the euro area suggests that markets view increases in tariffs as a lose-lose situation for all parties involved. The reason for this likely lies in anticipated retaliation and second-round effects, which are mostly interpreted as a lose-lose situation for the global economy. Given the complex interconnectedness and value-chain system of production and adding in strategic interactions across countries triggered by the tariff war, the result is an increase in overall uncertainty which depresses all markets and sectors.

In contrast to the relatively moderate overall market reactions to tariff-related events, the reactions of equity prices of sectors and companies explicitly targeted by tariffs have been much more severe. In the euro area, equity prices of the iron and steel sector significantly underperformed the wider market on 21-23 March, while an even larger underperformance of the auto and parts sector could be observed around 15 June. In the United States, a selection of companies prone to be impacted most negatively by the proposed set of tariffs,[5] and industrials, which would be relatively strongly affected by Chinese retaliatory tariffs, have equally underperformed the wider US market during the events outlined above.

It is thus likely that, should the threat of an increase in tariffs be extended to cover products across all sectors of the economy, a larger overall market impact can be expected. In order to estimate the implications of wider trade tensions on the overall equity and bond markets, changes in asset prices of the main sectors which have so far either been directly affected or explicitly threatened by an increase in tariffs are extrapolated to the overall market (see Table A, second row).[6] For the euro area, the two main sectors to have been affected or threatened by a US tariff increase are the iron and steel and the auto and parts sectors. During the events outlined above, a cumulative equity price decline of around 12% could be witnessed for these sectors, as compared with 7% for the overall market. A broadly comparable cumulative impact could be observed during the events relevant for the United States across the above-mentioned sectors and companies. Judging from developments across the most-affected companies and sectors, and extrapolating them, gyrations in equity prices of the overall market are likely to be much more severe in the event of an escalation of trade tensions than what has been observed so far. Concerning corporate bonds, in the euro area, over the period from February to July 2018, spreads across the most-affected sectors and companies increased by 35 basis points (bps), compared with the 26bps observed for the overall market. In the same vein, in the United States, corporate bond spreads are assumed to increase moderately more in the case of tariff increases being announced on a larger range of products than has already been the case.

Our analysis suggests that equity and corporate bond price movements across the sectors affected by mere threats of tariff increases can be mainly accounted for by changes in risk premia (see Table A, second row). For the calibration of shocks in the models featured in the main part of this special feature, it is important to gauge the contribution of changes in risk premia to changes in asset prices. To do so, changes in euro area equity prices and corporate bond spreads between February and July 2018 are decomposed into the contributions from risk premia and fundamental factors.[7] The results suggest that, for sectors where threats of higher tariffs have been expressed but higher tariffs have not yet been implemented, changes in equity prices and corporate bond spreads can be traced back nearly exclusively to changes in risk premia, while fundamentals in the form of earnings expectations and credit risk have changed little. These insights suggest that, should the threat of an increase in tariffs be extended to a large share of traded products, this news would be expected to initially transmit to asset prices primarily via a rise in risk premia.

3 Escalation of trade protectionism: three scenarios

Global macro-financial models can shed light on the implications of a further escalation of trade tensions for global equity prices and global risk premia. To quantify the impact on financial markets in a globally consistent way, the IMF’s Global Integrated Monetary and Fiscal Model (GIMF) and the ECB-Global model are used.[8] The GIMF is particularly appealing for modelling the direct effects of tariffs, while ECB-Global takes into account the indirect effects and captures financial amplification and spillovers across the globe. In the following, three scenarios for a further escalation of trade tensions are simulated (see Table B.1).

Assumptions for scenario design

Source: ECB.

Two limited and one full-blown trade war scenarios are examined. The “limited trade war” scenarios are defined as the imposition of 10% import tariffs by the US administration on the rest of the world with full retaliation (while the rest of the world countries do not impose tariffs on each other). The “full-blown trade war” is defined as the imposition of 25% import tariffs by all countries on each other. While different sectors will have different impacts depending on their exposure to trade and their exposure and elasticity of substitution with respect to foreign goods competition, the models give an average effect on financial markets.

The effects on confidence and uncertainty could amplify substantially the impact of protectionist measures on global asset prices. As described above, credible protectionist announcements may lead to an increase in equity and bond risk premia, beyond the direct effects stemming from lower earnings, higher discount rates and increased credit risk. To quantify these indirect effects, there have not been enough recent episodes of major trade dispute escalations to enable a precise estimation of the effect of this trade policy uncertainty on the financial sector. This special feature offers alternative methods and case studies to calibrate these indirect effects. In the first scenario, the decomposition of equity and bond prices from Box A is used to quantify the equity risk, as well as the excess bond risk premium. In the second scenario, the indirect effects – or the uncertainty/confidence effects – are measured with macro models as the effects of agents’ expectations of a limited trade war (US against the rest of the world) on global financial variables. In the third scenario, the same logic is applied, but the expectation is of a full-blown trade war (every country imposes import tariffs on each other). In all scenarios, an additional EME-related financial stress shock is added.

The sectors targeted in the first round of protectionist measures provide an illustration of trade-related indirect effects. In the first scenario, the average equity risk premium changes of the most-affected companies and sectors are extrapolated to the overall market. For corporate bond spreads, the average of the excess bond premia of these companies is used. Using this methodology, the box in this special feature shows that in the United States higher equity risk premia would account for 10% of the 12% fall in equity prices and the corporate risk premium would increase by 21bps. In the euro area, the contribution from higher equity risk premia would be 11% and the corporate risk premium would increase by 35bps. These numbers are then used as the size of exogenous financial shocks in the ECB-Global model, reflecting the indirect trade policy uncertainty effects.

Alternatively, global macro models can illustrate the anticipation of an escalation of a regionally limited trade war, also translating into lower global financial market confidence. Using the IMF’s GIMF model as well as the ECB-Global model, the financial sector impacts can be simulated by assuming that agents with rational expectations anticipate a full-blown trade war. More precisely, it is assumed that producers and consumers expect an across-the-board imposition of import tariffs on final and intermediate goods in all countries. Just the expectation of such a full-blown trade war discourages forward-looking agents from consuming and investing today.[9] As in the first scenario, the resulting asset price reactions are then used as the size of exogenous financial shocks in the ECB-Global model, reflecting the indirect trade policy uncertainty effects.

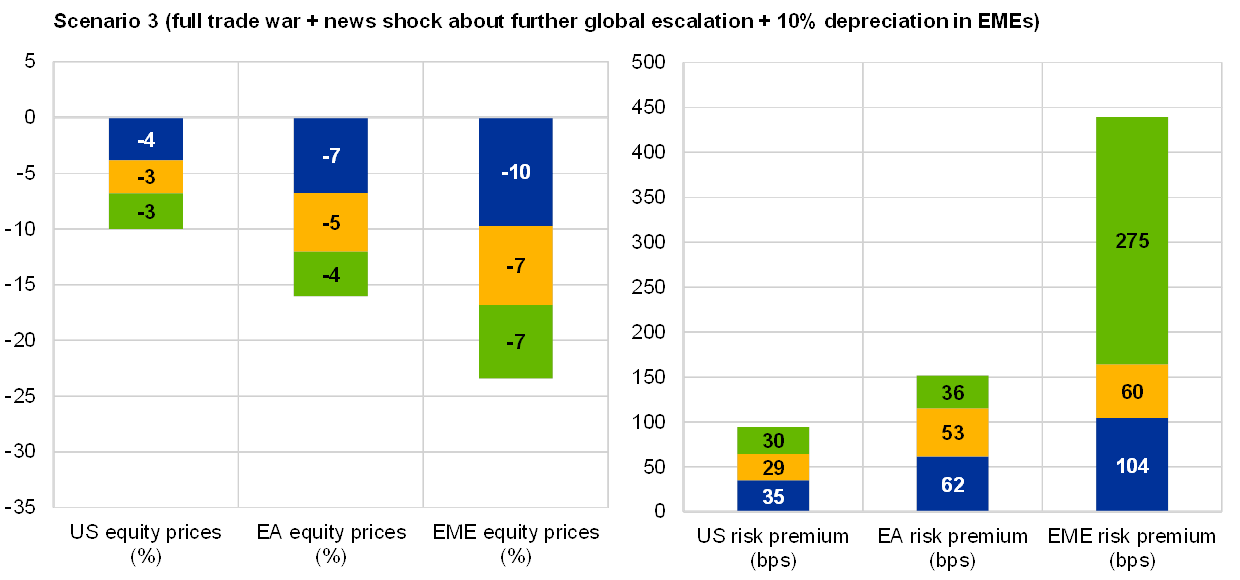

In all scenarios, it is assumed that EME corporates’ currency mismatches lead to an amplification of the financial effect for these economies. EME currency depreciation, which could be triggered by safe-haven capital flows, is assumed to lead to corporate distress and runs of wholesale corporate deposits from the domestic banking system in vulnerable EMEs. The increase in corporates’ external finance premium would lead to a decline in corporate capital expenditures, feeding directly into a slowdown in economic growth and thereby further amplifying economic stress. To quantify the magnitude of this financial stress in EMEs, this effect is simulated using the ECB-Global model, where it is assumed that capital outflows lead to a currency depreciation of 5% (in the limited trade war scenarios) and 10% (in the full-blown trade war scenario) in emerging market economies. This depreciation pushes EMEs’ risk premium up and leads to a drop in equity prices.

While global equity prices fall and global corporate bond spreads rise in all three scenarios, a regionally limited trade war would not give rise to major financial stability risks (see Chart B.2). The intensity of the impact depends in the first place on the scenario design. The direct effects of a limited trade war would be particularly adverse for US asset prices, as its export position would deteriorate substantially. In fact, the direct effects for the euro area as well as for EMEs would even be positive, as trade diversion effects come into play. As the euro area and EMEs gain competitiveness relative to US exporting companies, their trade with the rest of the world would increase, which would lead to a rise in equity prices and a slight decline in risk premia in those regions. However, the indirect effects, which materialise through increased uncertainty and negative confidence effects, more than outweigh the direct effects and lead to a decline in equities and a rise in risk premia around the world. In the scenario where the extrapolation from the sectors to the whole market is used, equity price reactions are slightly stronger, as it assumes that all companies (also the companies not exposed to international trade) would be affected in a similar manner to the companies that are directly exposed. In the limited trade war scenarios, euro area equity prices would fall by up to 10% and euro area corporate bond spreads would rise by more than 30bps.

Asset price reactions after an escalation of global trade tensions

Contributions of direct and indirect effects to changes in equity prices (left-hand side) and corporate bond spreads (right-hand side)

(percentage deviations, basis points)

Sources: ECB and ECB calculations.

In the case of a full-blown trade war, asset prices would fall substantially across the globe, also strongly affecting euro area asset prices. Of the three illustrative scenarios, the most significant asset price correction would materialise if trade tensions were to escalate into a full-blown trade war, with all countries imposing tariffs on each other. As there would be no trade diversion, the direct effects would be negative in all countries. Also, as agents anticipate a full-blown trade war, the effects on confidence are stronger, which is reflected in lower equity prices and tighter financial conditions across the globe. In this scenario, US equity prices would fall by about 10% and US corporate bond spreads would increase by up to 100bps in the first year. In the euro area, equity prices would fall by 15% and corporate bond spreads would increase by 150bps in the first year.

4 Conclusion

The recent implementation of protectionist measures poses no imminent risk to global financial stability. The share of goods that are subject to tariffs in global trade volume is relatively small. In addition, the nature of the trade dispute, which has so far mostly been contained to a bilateral tariff conflict between the United States and China, has only led to financial market reactions in some market segments. In the short term, overall euro area asset prices are therefore not imminently exposed to a further bilateral trade conflict between the United States and China.

However, an escalation to a more generalised trade war could lead to a significant decompression of risk premia and strongly declining equity prices in the euro area. Strong financial market corrections related to protectionism are globally only likely in the event of a significant broadening of the countries involved or of an application of sizeable tariff rates to a considerable additional share of goods. If this were to materialise, factors such as financial stress in EMEs could act as an amplifier. For the euro area, financial variables would be severely affected in the case of a full-blown trade war, in which all countries would start to impose tariffs on each other. These effects would be transmitted directly (e.g. through lower corporate earnings and higher credit risk), as well as indirectly (e.g. through higher uncertainty and adverse effects on international investors’ confidence).

- [1]See, for example, the box entitled “Macroeconomic implications of increasing protectionism”, Economic Bulletin, Issue 6, ECB, 2018, and World Economic Outlook, International Monetary Fund, October 2018.

- [2]More substitutability would imply that switching consumption to domestic goods is less costly for consumers, rendering the expenditure switching channel more important. If trading partners retaliate, exports also become more expensive in foreign markets, thereby reducing external demand, domestic output and asset prices.

- [3]Uncertainty shocks can potentially generate short, sharp recessions and swift recoveries as firms may temporarily pause their investment and hiring. In addition, productivity growth may also fall because this pause in activity freezes factor reallocations (see Bloom, N., “The Impact of Uncertainty Shocks”, Econometrica, Econometric Society, Vol. 77(3), May 2009, pp. 623-685).

- [4]However, this channel mostly captures the permanent losses and the effects on long-term growth which are normally beyond the relevant policy horizon.

- [5]See, for example, Kaiser et al., “Trade Wars II – How are companies likely to react to a trade war scenario? A bottom-up view”, UBS, Global Macro Strategy, Q-Series (Revised), 2018, for a company-by-company discussion.

- [6]The potential impact on overall equity prices is estimated assuming that the losses observed for the individual sectors apply to the overall market. The same extrapolation applies to corporate bond spreads.

- [7]A decomposition of price changes on the precise dates around the events identified above is not possible due to data constraints.

- [8]For a description of the models, see Kumhof, M., Laxton, D., Muir, D. and Mursula, S., “The Global Integrated Monetary and Fiscal Model (GIMF) – Theoretical Structure”, IMF Working Papers, No 10/34, February 2010, and Dieppe, A., Georgiadis, G., Ricci, M., Van Robays, I. and van Roye, B., “ECB-Global: Introducing the ECB’s global macroeconomic model for spillover analysis”, Economic Modelling, Vol. 72, June 2018, pp. 78-98. With regard to how these models are used in the context of the global macroeconomic implications of an escalation of trade tensions, see “Macroeconomic implications of increasing protectionism”, Economic Bulletin, Issue 6, ECB, 2018.

- [9]This escalation expected by the agents does not actually occur and therefore this shock represents a pure deterioration in sentiment. Any financial sector reaction in this case reflects a reaction from the model-based deterioration in the macro environment caused by this deterioration in sentiment. In the economic literature, this is called a “news shock”.