Economic and monetary developments

Overview

At its monetary policy meeting on 4 June, the Governing Council decided to increase the envelope and extend the horizon for the pandemic emergency purchase programme (PEPP) and to reinvest its maturing principal payments, while continuing with the asset purchase programme (APP) and its reinvestments and keeping the key ECB interest rates unchanged. Incoming information confirms that the euro area economy is experiencing an unprecedented contraction. There has been an abrupt drop in economic activity as a result of the coronavirus (COVID-19) pandemic and the measures to contain it. Severe job and income losses and exceptionally elevated uncertainty about the economic outlook have led to a significant fall in consumer spending and investment. While survey data and real-time indicators for economic activity have shown some signs of a bottoming-out alongside the gradual easing of the containment measures, the improvement has so far been tepid compared with the speed at which the indicators plummeted in the preceding two months. The June 2020 Eurosystem staff macroeconomic projections for the euro area see growth declining at an unprecedented pace in the second quarter of this year, before rebounding again in the second half, crucially helped by the sizeable support from fiscal and monetary policy. Nonetheless, the projections entail a substantial downward revision to both the level of economic activity and the inflation outlook over the whole projection horizon, though the baseline is surrounded by an exceptional degree of uncertainty. While headline inflation is suppressed by lower energy prices, price pressures are expected to remain subdued on account of the sharp decline in real GDP and the associated significant increase in economic slack. Against this background, the Governing Council decided on a set of monetary policy measures to support the economy during its gradual reopening and to safeguard medium-term price stability.

Economic and monetary assessment at the time of the Governing Council meeting of 4 June 2020

The COVID-19 epidemic has caused a sharp deterioration in the global outlook, as embedded in the June 2020 Eurosystem staff macroeconomic projections. The COVID-19 pandemic has paralysed the global economy, with measures to contain the spread of the virus taken by governments across the globe being a driving factor behind the recent sharp decline in economic activity. Several countries have recently started easing containment measures, but this process is likely to be very gradual. Economic activity, especially in emerging market economies, has also been adversely affected by a sharp fall in commodity prices, tighter financial conditions and substantial capital outflows. Incoming data confirm that the economic fallout from containment measures will be sharp and deep. In view of these severe global disruptions, the June 2020 Eurosystem staff macroeconomic projections envisage that world real GDP (excluding the euro area) will contract by 4.0% this year. The pace of this contraction is faster and its magnitude greater than seen in the Great Recession. Following a sharp contraction in the first two quarters of 2020, global activity is projected to start to recover in the third quarter and to increase by 6.0% and 3.9% in 2021 and 2022, respectively. Global trade will be affected more severely, as logistics disruptions and closed borders amplify the impact of the fallout. Despite a sharp deterioration in the global outlook, as embedded in the June projections, risks to this outlook are still skewed to the downside. Most importantly, the impact of the pandemic may prove to be stronger and longer lasting than currently expected.

Although financial conditions in the euro area have loosened somewhat since the Governing Council’s meeting in March 2020, they have not returned to the levels seen before the global spread of COVID-19. Over the review period (12 March 2020 to 3 June 2020) the forward curve of the euro overnight index average (EONIA) shifted upwards. Its inversion at short maturities is still present, albeit less so than on 12 March, signalling that market participants’ expectations of further policy rate cuts have diminished and shifted further out into the future. Despite the monetary policy accommodation provided via the PEPP and other policy measures, long-term euro area sovereign bond yields increased over the review period. Prices of risky assets partly recovered from the losses incurred during February and March, mainly against the backdrop of an improvement in global risk sentiment and the perception that tail risks of an imminent global crisis have faded to some extent. In foreign exchange markets, the euro remained broadly stable in trade-weighted terms, with volatility in bilateral exchange rates reflecting uncertainty surrounding the COVID-19 pandemic.

Euro area real GDP decreased by 3.8%, quarter on quarter, in the first quarter of 2020, and incoming data point to a further significant contraction of real GDP in the second quarter. The latest economic indicators and survey results confirm a sharp contraction of the euro area economy and rapidly deteriorating labour market conditions. The coronavirus pandemic and the necessary containment measures have severely affected both the manufacturing and services sectors, taking a toll on the productive capacity of the euro area economy and on domestic demand. Most recent indicators suggest some bottoming-out of the downturn in May as parts of the economy gradually reopen. Accordingly, euro area activity is expected to rebound in the third quarter as the containment measures are eased further, supported by favourable financing conditions, an expansionary fiscal stance and a resumption in global activity, although the overall speed and scale of the rebound remains highly uncertain.

This assessment is also broadly reflected in the June 2020 Eurosystem staff macroeconomic projections for the euro area. In the baseline scenario of the projections, annual real GDP is expected to fall by 8.7% in 2020 and to rebound by 5.2% in 2021 and 3.3% in 2022. Compared with the March 2020 ECB staff macroeconomic projections, the outlook for real GDP growth has been revised substantially downwards by 9.5 percentage points in 2020 and revised upwards by 3.9 percentage points in 2021 and 1.9 percentage points in 2022. Given the exceptional uncertainty currently surrounding the outlook, the projections also include two alternative scenarios.[1] In general, the extent of the contraction and the recovery will depend crucially on the duration and effectiveness of the containment measures, the success of policies to mitigate the adverse impact on incomes and employment, and the extent to which supply capacity and domestic demand are permanently affected. Overall, the Governing Council sees the balance of risks around the baseline projection tilted to the downside.

According to Eurostat’s flash estimate, euro area annual HICP inflation decreased to 0.1% in May, down from 0.3% in April, mainly on account of lower energy price inflation. On the basis of current and futures prices for oil, headline inflation is likely to decline somewhat further over the coming months and to remain subdued until the end of the year. Over the medium term, weaker demand will put downward pressure on inflation, which will be only partially offset by upward pressures related to supply constraints. Market-based indicators of longer-term inflation expectations have remained at depressed levels. While survey-based indicators of inflation expectations have declined over the short and medium term, longer-term expectations have been less affected.

This assessment is also reflected in the June 2020 Eurosystem staff macroeconomic projections for the euro area, which foresee annual HICP inflation in the baseline scenario at 0.3% in 2020, 0.8% in 2021 and 1.3% in 2022. Compared with the March 2020 ECB staff macroeconomic projections, the outlook for HICP inflation has been revised downwards by 0.8 percentage points in 2020, 0.6 percentage points in 2021 and 0.3 percentage points in 2022. Annual HICP inflation excluding energy and food is expected to be 0.8% in 2020, 0.7% in 2021 and 0.9% in 2022.

The COVID-19 pandemic caused a sharp acceleration in monetary dynamics, driven by acute liquidity needs of businesses to finance ongoing payments and strong preferences for money holdings for precautionary reasons among economic agents. Broad money (M3) growth increased to 8.3% in April 2020, from 7.5% in March. The strong money growth reflects bank credit creation, which is being driven to a large extent by the acute liquidity needs in the economy. Moreover, high economic uncertainty is triggering a shift towards money holdings for precautionary reasons. The narrow monetary aggregate M1, encompassing the most liquid forms of money, continues to be the main contributor to broad money growth. Developments in loans to the private sector continued to be shaped by the impact of the coronavirus on economic activity. The annual growth rate of loans to non-financial corporations rose further to 6.6% in April 2020, up from 5.5% in March, reflecting firms’ need to finance their ongoing expenditure and working capital in the context of rapidly declining revenues. At the same time, the annual growth rate of loans to households decreased to 3.0% in April, from 3.4% in March, amid consumption constraints due to the containment measures, declining confidence and a deteriorating labour market. The Governing Council’s policy measures, in particular the very favourable terms for the targeted longer-term refinancing operations (TLTRO III), should encourage banks to extend loans to all private sector entities. Together with the measures adopted by national governments and European institutions, the Governing Council’s measures support ongoing access to financing, including for those most affected by the ramifications of the coronavirus pandemic.

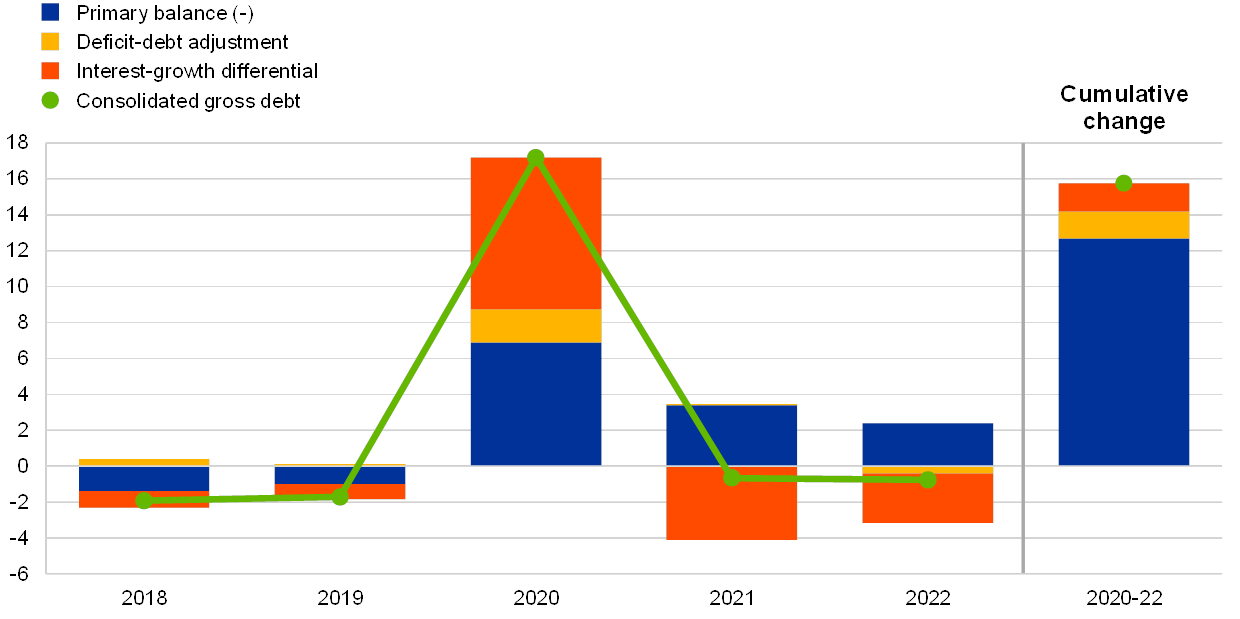

The COVID-19 pandemic is having a significant impact on fiscal policies in the euro area. Containment measures have also triggered unprecedented fiscal stimulus packages intended to cushion the economic fallout and to prepare for a swift recovery. As a result, the general government budget deficit in the euro area is projected to increase significantly in 2020, to 8.5% of GDP, compared with 0.6% in 2019. Although the deficit ratio is expected to shrink to 4.9% in 2021, it is still expected to stand at 3.8% of GDP in 2022. Overall the aggregate fiscal stance for the euro area is assessed to be strongly expansionary in 2020, but contractionary in 2021, as most support measures are expected to have been phased out by then. Notwithstanding the negative fiscal stance in 2021, the overall fiscal balance will remain substantially negative with fiscal instruments continuing to support the economic recovery, not least through automatic stabilisers. An ambitious and coordinated fiscal stance remains critical, in view of the sharp contraction in the euro area economy, although measures should be targeted and temporary. In this respect, both the €540 billion package of three safety nets endorsed by the European Council and the European Commission’s proposal for a recovery plan dedicated to supporting the regions and sectors most severely hit by the pandemic are strongly welcomed.

The monetary policy package

A combination of two main factors called for additional monetary policy action. First, the pandemic-related downward revision to the inflation outlook poses a threat to the Governing Council’s medium-term price stability mandate. Second, while conditions in financial markets have stabilised substantially since the PEPP announcement, financial conditions for the euro area as a whole remain significantly tighter today than in the pre-pandemic period, whereas the outlook for economic activity and inflation calls for easier financial conditions.

Against this background, on 4 June 2020, the Governing Council decided on a set of monetary policy measures to support the ongoing ample degree of monetary accommodation necessary for the robust convergence of inflation to levels that are below, but close to, 2% over the medium term, in line with its mandate.

- The Governing Council decided to increase the envelope for the PEPP by €600 billion to a total of €1,350 billion. In response to the pandemic-related downward revision to inflation over the projection horizon, the PEPP expansion will further ease the general monetary policy stance, supporting funding conditions in the real economy, especially for businesses and households. The purchases will continue to be conducted in a flexible manner over time, across asset classes and among jurisdictions. This allows the Governing Council to effectively stave off risks to the smooth transmission of monetary policy.

- The Governing Council decided to extend the horizon for net purchases under the PEPP to at least the end of June 2021. This broadly aligns the purchase horizon with the horizons of the other monetary policy measures taken in response to the pandemic, such as TLTRO III and the pandemic emergency longer-term refinancing operations (PELTROs). In any case, the ECB will conduct net asset purchases under the PEPP until the Governing Council judges that the coronavirus crisis phase is over.

- The Governing Council decided to reinvest the maturing principal payments from securities purchased under the PEPP until at least the end of 2022. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance. The reinvestments will help to avoid the risk of an unwarranted tightening of financial conditions while the economy is still recovering from the pandemic shock. At the same time, it is appropriate that the reinvestment strategy for the PEPP reflects its temporary nature and link to the pandemic emergency.

- In addition, net purchases under the APP will continue at a monthly pace of €20 billion, together with the purchases under the additional €120 billion temporary envelope until the end of the year. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of the ECB’s policy rates, and to end shortly before the Governing Council starts raising the key ECB interest rates.

- The Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

- Finally, the Governing Council decided to keep the key ECB interest rates unchanged. These are expected to remain at their present or lower levels until the inflation outlook robustly converges to a level sufficiently close to, but below, 2% within the projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.

Together with the substantial monetary policy stimulus already in place, the Governing Council’s decisions will support liquidity and funding conditions in the economy, help to sustain the flow of credit to households and firms, and contribute to maintaining favourable financing conditions for all sectors and jurisdictions, in order to underpin the recovery of the economy from the coronavirus fallout. At the same time, in the current rapidly evolving economic environment, the Governing Council remains fully committed to doing everything necessary within its mandate to support all citizens of the euro area through this extremely challenging time. This applies first and foremost to the Governing Council’s role in ensuring that its monetary policy is transmitted to all parts of the economy and to all jurisdictions in the pursuit of the ECB’s price stability mandate. The Governing Council, therefore, continues to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.

1 External environment

The coronavirus (COVID-19) pandemic has paralysed the global economy. Measures taken by governments across the globe to contain the spread of the virus imply a sharp decline in economic activity in the near term. While several countries have recently started easing containment measures, this process is likely to be very gradual. Economic activity, especially in emerging market economies (EMEs), is also being adversely affected by sharply lower commodity prices, tighter financial conditions and substantial capital outflows. Incoming data confirm that the economic fallout from the pandemic and containment measures will be heavy and far-reaching. In view of these severe global disruptions, the June 2020 Eurosystem staff macroeconomic projections envisage that world real GDP (excluding the euro area) will contract by 4.0% this year. The pace of this contraction is faster and its magnitude greater than seen in the Great Recession. Following a sharp contraction in the first two quarters of 2020, global activity is projected to start to recover in the third quarter. This profile implies that global activity is projected to increase by 6.0% and 3.9% in 2021 and 2022 respectively. Global trade will be affected more severely, as logistics disruptions and closed borders amplify the impact of the fallout. Moreover, trade is procyclical, responding to developments in economic activity, especially in downturns. Despite a sharp deterioration in the global outlook, as embedded in the June projections, risks to this outlook are still skewed to the downside. Most importantly, the impact of the pandemic may prove to be stronger and longer lasting than currently expected. Other risks relate, for instance, to an increased sensitivity of financial markets to news, structural changes in supply networks for production and the risk of a rise in trade protectionism.

Global economic activity and trade

The COVID-19 pandemic has paralysed the global economy. Measures taken by governments across the globe to contain the spread of the virus imply a sharp decline in economic activity in the near term. Such measures were introduced in China in late January, while other countries enacted them later as the virus spread globally. While several countries have recently started easing containment measures, this process is likely to be very gradual. Economic activity, especially in EMEs, is being adversely affected by sharply lower commodity prices, tighter financial conditions and substantial capital outflows. These severe global shocks hit the world economy at a time when signs of a stabilisation, following a period of lacklustre performance last year, had been increasingly evident. In particular, a nascent recovery in manufacturing activity and trade, led by large EMEs, had been under way at the turn of the year. Moreover, the favourable global financial conditions prevailing at that time, as well as a partial de-escalation of the trade conflict between the United States and China following the signing of the “phase one” trade agreement, had had the potential to reinforce the recovery before the pandemic struck.

Survey data confirm that the economic fallout from the pandemic and containment measures will be heavy and far-reaching. Looking at sectoral data from the Purchasing Managers’ Index (PMI) survey, three patterns emerge. First, output plummeted across sectors as stringent containment measures were put in place. Second, the impact on the services sector was greater than the impact on manufacturing. With containment policies suppressing supply and demand globally, output in both the manufacturing and services sectors has deteriorated much more rapidly than occurred during the Great Recession (see Chart 1). Third, as production resumes, output recovers from its depressed levels – as seen recently in China. However, for several reasons, this recovery is only partial. These reasons relate to restrictions that still remain in place for businesses that require close social interaction; behavioural changes by consumers amid worries about a second wave of infections; and high uncertainty hindering investment decisions which, in turn, lowers demand in the near term and weighs on productive capacity in the longer term. The global composite output PMI (excluding the euro area) recovered somewhat in May, supported by better results for both the manufacturing and services sectors. However, it remains deep in contractionary territory.

Chart 1

Global manufacturing and services output PMI (excluding the euro area)

(diffusion indices)

Sources: Markit and ECB calculations.

Notes: The latest observations are for May 2020. The data cover the period from January 1999 to May 2020. The global financial crisis sample (yellow dots) denotes the period from December 2007 to June 2009. The COVID-19 pandemic sample (red dots) denotes the period from January 2020 to May 2020.

The more cautious behaviour of consumers is reflected in a sharp decline in global confidence indicators. Consumer confidence has deteriorated significantly in recent weeks, especially in advanced economies. In addition, the worsening labour market will lead consumers to adopt more cautious behaviour characterised by higher precautionary savings and lower consumption, particularly of durable goods.

Financial conditions tightened sharply, but some of this tightening has eased more recently. Initially, the tightening was swift and broad-based, affecting advanced economies and EMEs alike. In addition, EMEs have seen substantial financial outflows in both gross and net terms, although the latest data suggest that these outflows have moderated or even reversed in recent weeks. Despite these signs of a stabilisation, financial stress remains elevated, partly owing to an increase in the incidence of confirmed new cases of COVID-19 and deaths in EMEs. Notably, financial investors fled from EMEs indiscriminately in the initial phase of the crisis related to the pandemic, but differences in macroeconomic fundamentals and vulnerabilities across EMEs now seem to have become increasingly relevant for investment decisions.

Overall, financial conditions remain substantially tighter in both advanced economies and EMEs than before the pandemic struck. However, taking a longer-term perspective, they remain more favourable than in past global downturns, including the Great Recession and the recession that followed the bursting of the dot-com bubble in the early 2000s. In part, this may reflect the rapid and aggressive response of central banks around the world. Most notably, monetary policy interventions are likely to be the key factor behind the stabilisation in sovereign bond yields and term premia, despite the unprecedented level of global sovereign debt issuance necessitated by the pandemic. Uncertainty increased substantially and remains elevated. While it is still too early to judge what role elevated uncertainty has played in the current crisis, it is likely to weigh on the recovery prospects.

The June 2020 Eurosystem staff macroeconomic projections envisage that world real GDP (excluding the euro area) will decline by 4.0% this year. The pace of this contraction is faster and its magnitude much greater than seen in the Great Recession. Following a sharp contraction in the first two quarters of 2020, economic activity is projected to recover from the third quarter. As lockdowns are lifted, activity is projected to rebound initially, but the overall pace of the recovery is assumed to be gradual owing to social distancing measures kept in place and also owing to changing consumer behaviour. Looking further ahead, the June 2020 Eurosystem staff macroeconomic projections envisage that global activity will increase by 6.0% in 2021 and 3.9% in 2022. Compared with the March 2020 ECB staff macroeconomic projections, global growth has been revised significantly down for this year, while growth over the medium-term horizon is expected to be slightly stronger. These revisions also imply that the level of global output remains below the trajectory projected in the March 2020 ECB staff macroeconomic projections. For EMEs, the recovery is expected to be more subdued than those seen after previous downturns. This reflects the combination of negative shocks affecting EMEs at the current juncture, including the pandemic crisis, tight financial conditions, negative terms of trade shocks for commodity exporters, and substantial capital outflows.

In the United States, the pace of the contraction in economic activity is estimated to have accelerated in the second quarter of 2020. Real GDP declined by 5.0% on an annualised basis in the first quarter, according to the second estimate. This contraction was slightly larger than reported in the advance estimate. Higher frequency data suggest that the economic downturn deepened further in the second quarter, as strict containment measures were in place across the country in April. From late April US states started to gradually ease the containment measures, which should help to support a recovery in the second half of 2020. It will be led by a recovery in domestic demand backed by the strong economic policy support enacted to date. However, the recovery is projected to be gradual, as consumer confidence remains at depressed levels amid unprecedented job destruction recorded since late March. Employment decreased by more than 22 million jobs and the unemployment rate reached 14.7% in April. Annual headline consumer price inflation dropped sharply to 0.3% in April, from 1.5% in the previous month. Excluding food and energy, annual inflation declined to 1.4% in April from 2.1% in March. Inflation is expected to decline this year, as the disinflationary effects of the demand shock outweigh inflationary effects stemming from supply disruptions, and is projected to gradually increase to stand closer to the Federal Reserve System’s 2% target towards the end of the projection horizon.

In China, the recovery is proceeding amid strong headwinds. These include weak external demand prospects in the near term, as evidenced by the sharp fall in export orders, and a gradual recovery in domestic demand. The latter reflects the remaining social distancing measures in place, as well as generally more cautious consumer behaviour. The monetary and policy stimulus enacted by the authorities will help to support economic activity. Looking ahead, activity is projected to recover over the projection horizon. However, this recovery is assumed to remain muted compared with the level of activity foreseen in the March projections.

In Japan, the economy has slipped into a technical recession. Activity declined in the fourth quarter of last year owing to a confluence of negative shocks, including a fall in domestic demand as a result of the consumption tax hike, production disruptions caused by powerful typhoons in October, and weak external demand. Subsequently, amid the COVID-19 outbreak, real GDP contracted further, declining by 0.9% in the first quarter of 2020. Authorities’ efforts to contain the virus weighed on domestic demand, especially private consumption of services and semi-durable goods. Notably, exports of services fell markedly, reflecting lower spending by inbound tourists owing to the travel restrictions imposed in reaction to the outbreak. The Japanese authorities stepped up policy support for the ailing economy. In April the Bank of Japan raised the limits on purchases of commercial paper and corporate bonds, eased access to corporate funding facilities and purchased short-term and longer-term government bonds. At its emergency meeting in May it decided to launch a new fund-provisioning measure for banks to support lending to small and medium-sized enterprises. In late May the Japanese government approved a second fiscal stimulus package that is broadly comparable in size to the one implemented in April 2020. These measures should provide further stimulus to the economy, which is projected to gradually recover from the second half of this year.

In the United Kingdom, the economic situation has deteriorated significantly. Real GDP fell by 2% in the first quarter of 2020, even though the economy was locked down for just the last ten days of March, while annual consumer price inflation fell to 0.8% in April, down sharply from 1.5% in the previous month. While the furlough scheme has helped to maintain employment, the labour market situation has deteriorated markedly. Experimental ONS data on benefit claimants – covering the unemployed, as well as those receiving in-work benefits – showed that by mid-April more than two million citizens were claiming some form of benefit. This is around one-third more than the number observed during the Great Recession. High frequency data signal a further marked deterioration in the second quarter, which implies a much more severe recession than occurred in the aftermath of the global financial crisis. The government has announced a phased reopening of the economy, which is expected to support a gradual recovery in the coming months.

In central and eastern European countries, economic activity is expected to weaken substantially. A large number of countries in the region recorded negative growth in the first quarter of 2020, amid supply disruptions and weaker demand caused by containment measures. Looking ahead, a much deeper downturn is expected in the second quarter. This reflects the interplay of weaker domestic demand – as the containment measures remained in place throughout April – with weaker external demand, especially from the euro area countries.

Economic activity in large commodity-exporting countries is expected to fall precipitously. In Russia, the economy has been buffeted by recent energy market developments and by the COVID-19 pandemic, taking a toll on external demand. At the same time, there has been a steep rise in new domestic cases of infection, resulting in a tightening of measures to contain the spread of the virus. The production cuts agreed by OPEC+ to stabilise the global oil market, as well as lower commodity prices, are expected to dampen investment. In Brazil, economic activity deteriorated sharply owing to lockdowns, supply chain disruption, weaker external demand, significant capital outflows and a negative terms of trade shock reflecting falling commodity prices. Rising political tensions and the fact that the country is one of the worst-affected by the pandemic, may complicate the provision of effective policy support for the economy.

In Turkey, the pandemic gave rise to financing pressures, amid high external imbalances and financing needs. Activity remained robust until late March. Thereafter, sentiment started to erode rapidly, as containment measures were introduced and external demand contracted sharply. At the same time, foreign investors became increasingly risk-averse vis-à-vis EMEs and signs of financing pressures for Turkey appeared. The Turkish lira has weakened and central bank reserves have dropped sharply. A steep contraction in activity is expected in the first half of 2020, while the ensuing recovery is projected to be very gradual.

Global trade will be affected more severely than activity, as logistics disruptions and closed borders amplify the impact of falling demand. Moreover, the procyclical response of trade to developments in economic activity tends to intensify in downturns. The collapse in global merchandise trade is likely to be amplified by disruptions in regional and global value chains, as the significant share of trade in intermediate goods – accounting for around 40% of world trade – has important implications for the international transmission of demand and supply shocks. A sharp decline in trade is already visible in global merchandise imports, which contracted by 2.9% in the first quarter of 2020 (see Chart 2) – the largest quarterly drop since the Great Recession. At the same time, the pace of the decline in merchandise imports was broadly comparable across advanced economies and EMEs.

Chart 2

Surveys and global trade in goods (excluding the euro area)

(left-hand scale: three-month-on-three-month percentage changes; right-hand scale: diffusion indices)

Sources: Markit, CPB Netherlands Bureau for Economic Policy Analysis and ECB calculations.

Notes: The latest observations are for May 2020 for the PMI data and March 2020 for global merchandise imports. The indices and data refer to the global aggregate excluding the euro area.

Owing to the nature of the shock, services trade has been particularly hard hit. Incoming data on tourism and transportation, which together account for the bulk of global services trade, indicate an unprecedented decline. International tourist arrivals declined by more than 50% in March. Similarly, the volume of passengers on international flights has more than halved compared with the same period last year.

According to the June 2020 Eurosystem staff macroeconomic projections, global import growth (excluding the euro area) is expected to decline by 12.9% this year, before increasing by 8.0% and 4.3% in 2021 and 2022 respectively. Euro area foreign demand is projected to contract by 15.1% this year and to grow by 7.8% and 4.2% in 2021 and 2022 respectively. The pandemic has had a substantial impact on trade – world imports (excluding the euro area) are not projected to return to the levels recorded in the fourth quarter of 2019 until towards the end of the projection horizon. Euro area foreign demand remains below this level over the whole projection horizon.

The degree of uncertainty about the future course of the global economy remains unprecedented. It relates to the evolution of the pandemic and its impact on economic behaviour, as well as the associated containment measures and the success of the policy measures. To illustrate the range of possible impacts of the COVID-19 pandemic on the global economy, in the June 2020 Eurosystem staff macroeconomic projections the baseline projection is complemented by two scenarios – the mild and severe scenarios. These scenarios can be seen as providing an illustrative range around the baseline projection.[2] The COVID-19 pandemic has also put in motion a number of developments which could weigh on the projected recovery of the global economy. They include, for instance, increased sensitivity of financial markets to news, or structural changes to supply networks for production. These risks, in addition to other downside risks related to the Brexit negotiations and the risk of a rise in trade protectionism, remain relevant, although they are also likely conditional on the future course of the COVID-19 pandemic and the policy measures taken.

Global price developments

The sharp deterioration in global demand prospects has caused oil prices to fall dramatically. Brent crude oil prices have recently recovered somewhat to stand above USD 30 per barrel, having plunged below USD 20 per barrel in early April. The partial recovery in oil prices appears to be driven by hopes of a reversal of the sudden collapse in global oil demand associated with the pandemic, as China recovers and lockdowns in other countries are gradually eased. Oil prices have also been supported by the gradual response of oil supply as the OPEC+ agreement came into effect at the beginning of May and oil production in the United States and Canada declined owing to extensive shutdowns. Compared with the March 2020 ECB staff macroeconomic projections, the crude oil price assumptions in the June 2020 Eurosystem staff macroeconomic projections are 36.0%, 33.1% and 26.6% lower for 2020, 2021 and 2022. Since the cut-off date for the June projections, the price of crude oil has increased, with Brent crude standing at USD 38.3 per barrel on 3 June. Looking ahead, crude oil prices are likely to remain volatile. This is a reflection of the fact that the economic outlook remains highly uncertain and storage capacity utilisation is exceptionally high.

Global inflation is being dampened by a sharp decline in oil prices. Annual headline consumer price inflation in OECD countries slowed sharply to 0.9% in April, from 1.7% in March, driven by a sharp fall in oil prices and lower core inflation (see Chart 3). Following a collapse in crude oil prices associated with the pandemic, annual energy price inflation had already turned negative in March and the pace of this decline accelerated sharply to 10.8% in April, marking the biggest drop since September 2015. In contrast, annual food price inflation accelerated further to 6.4% in April, from 3.5% in the previous month. At the same time, annual core CPI inflation (excluding food and energy) decreased to 1.6% in April, from 2.1% in the previous month.

Looking ahead, global inflation will decrease amid lower oil prices and weaker demand. These factors outweigh any potential inflationary impact from lower supply caused by bottlenecks in production and logistics. Weak demand, a sharp deterioration in labour markets and greater slack are likely to weaken underlying inflation pressures globally. Lower oil prices explain much of the downward revision to euro area competitors’ export prices (in national currency) in 2020. As the price of crude oil is expected to gradually increase over the projection horizon, this impact will dissipate and euro area competitors’ export prices are projected to return to their long-term average towards the end of 2021.

Chart 3

OECD consumer price inflation

(year-on-year percentage changes; percentage point contributions)

Sources: OECD and ECB calculations.

Note: The latest observations are for April 2020.

2 Financial developments

Although financial conditions in the euro area have loosened somewhat since the Governing Council’s meeting in March 2020, they have not returned to the levels seen before the global spread of the coronavirus (COVID-19). Over the review period (12 March 2020 to 3 June 2020) the forward curve of the euro overnight index average (EONIA) shifted upwards. A slight inversion at short maturities is still present, albeit less so than on 12 March, and signals that market participants’ expectations of further policy rate cuts have diminished and shifted further into the future. Despite the monetary policy accommodation provided via the pandemic emergency purchase programme (PEPP) and other policy measures, long-term euro area sovereign bond yields increased over the review period owing to an increase in risk-free rates and a widening of sovereign spreads. Prices of risk assets partly recovered from the losses incurred during February and March, mainly against the backdrop of an improvement in global risk sentiment and the perception that tail risks of an imminent global crisis have faded to some extent. In foreign exchange markets, the euro remained broadly stable in trade-weighted terms, with volatility in bilateral exchange rates reflecting uncertainty around the COVID-19 pandemic.

The EONIA and the new benchmark euro short‑term rate (€STR) averaged -45 and -54 basis points respectively over the review period.[3] Excess liquidity increased by €398 billion in the period under review to around €2,163 billion.[4] This change mainly reflects the introduction of the PEPP alongside the asset purchase programme (APP), as well as the take-up of targeted longer-term refinancing operations (TLTRO III) and LTRO bridge operations.

The short end of the EONIA forward curve shifted upwards over the review period, although the curve remains slightly inverted (see Chart 4). The short end of the curve flattened following the Governing Council meeting on 12 March, as markets postponed expectations of an imminent reduction in the deposit facility rate. Nevertheless, the inversion in the short end of the curve contrasts with the flat curve observed before the spread of the virus, which indicates that market participants continue to expect some further reductions in policy rates.

Chart 4

EONIA forward rates

(percentages per annum)

Sources: Thomson Reuters and ECB calculations.

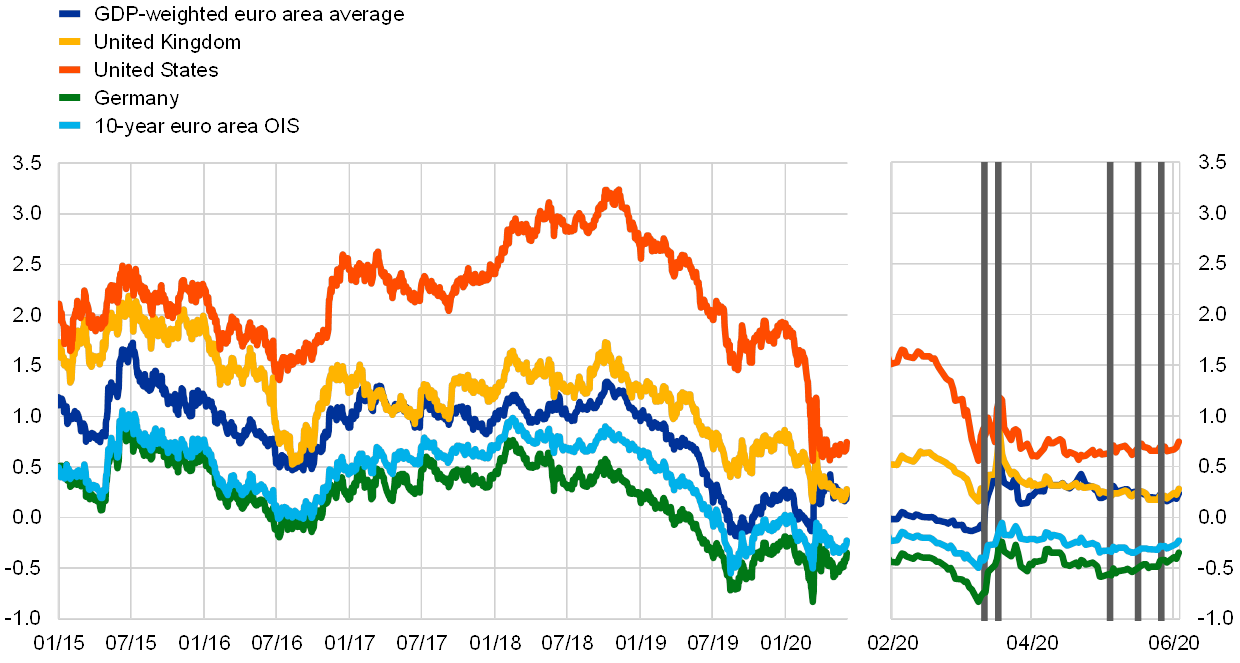

Despite the further monetary policy accommodation provided via the PEPP and other measures, long-term sovereign bond yields in the euro area increased over the review period (see Chart 5). The GDP-weighted euro area ten‑year sovereign bond yield increased by 36 basis points to 0.24%. Sovereign yields were affected by the overall increase in risk-free rates over the review period. In addition, increases in sovereign spreads over risk-free rates also pushed up the ten‑year GDP‑weighted sovereign bond yield over the review period. In contrast to rising euro area sovereign bond yields, ten-year sovereign bond yields in the United States decreased to 0.75% (down 13 basis points) and remained stable in the United Kingdom at 0.28% (up 1 basis point).

Chart 5

Ten-year sovereign bond yields

(percentages per annum)

Sources: Thomson Reuters and ECB calculations.

Notes: Daily data. The vertical grey lines denote (from left to right) the March Governing Council meeting (12 March 2020), the PEPP announcement (18 March 2020), the German Federal Constitutional Court ruling (5 May 2020), the Franco-German proposal for a €500 billion European recovery fund (18 May 2020) and the European Commission proposal for a €750 billion “Next Generation EU” recovery instrument (27 May 2020). The latest observations are for 3 June 2020.

The spreads of euro area sovereign bonds relative to overnight index swap (OIS) rates narrowed following the announcement of the PEPP, but remain above the values observed at the time of the Governing Council meeting of 12 March (see Chart 6). The ten-year German, French, Italian, Spanish and Portuguese sovereign spreads increased by 20, 16, 14, 18 and 5 basis points to reach -0.12, 0.24, 1.78, 0.85 and 0.82 percentage points respectively. Consequently, the GDP-weighted euro area ten-year sovereign spread increased by 16 basis points to 0.47 percentage points. This overall increase is accompanied by some volatility. Sovereign rating actions such as the downgrade of Italy from BBB to BBB- by Fitch on 28 April, the German Federal Constitutional Court ruling regarding the public sector purchase programme and hesitant progress vis-à-vis the financing of a common fiscal response to the coronavirus contributed to a widening of most spreads. Most recently, sovereign spreads declined for France, Italy, Spain and Portugal against the backdrop of the Franco-German recovery fund proposal and the European Commission’s “Next Generation EU” proposal.

Chart 6

Ten-year euro area sovereign bond spreads vis-à-vis the OIS rate

(percentage points)

Sources: Thomson Reuters and ECB calculations.

Notes: The spread is calculated by subtracting the ten-year OIS rate from the ten-year sovereign bond yield. The vertical grey lines denote (from left to right) the March Governing Council meeting (12 March 2020), the PEPP announcement (18 March 2020), the German Federal Constitutional Court ruling (5 May 2020), the Franco-German proposal for a €500 billion European recovery fund (18 May 2020) and the European Commission proposal for a €750 billion “Next Generation EU” recovery instrument (27 May 2020). The latest observations are for 3 June 2020.

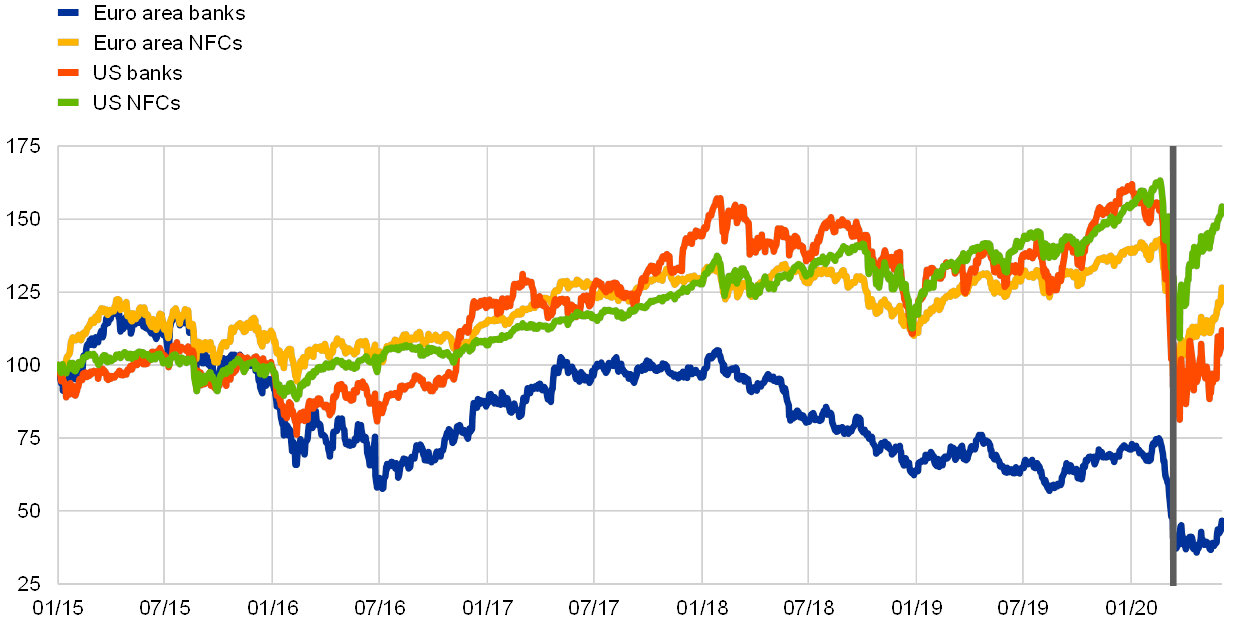

Equity price indices for euro area non-financial corporations (NFCs) increased, recouping a significant share of the losses registered in February and March (see Chart 7). Equity prices of euro area NFCs increased by 14% over the review period, supported by a recovery in risk sentiment and the perception that tail risks of an imminent global crisis have faded to some extent. The recovery in risk sentiment more than offset other factors which weighed on equity prices, such as a reduction in earnings growth expectations at all horizons.[5] Globally, the rebound was strongest for US NFCs, with equity prices increasing by 16%. By contrast, bank equity prices in the euro area decreased by 5% over the review period, while they increased by 8% in the United States.

Chart 7

Euro area and US equity price indices

(index: 1 January 2015 = 100)

Sources: Thomson Reuters and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 12 March 2020. The latest observations are for 3 June 2020.

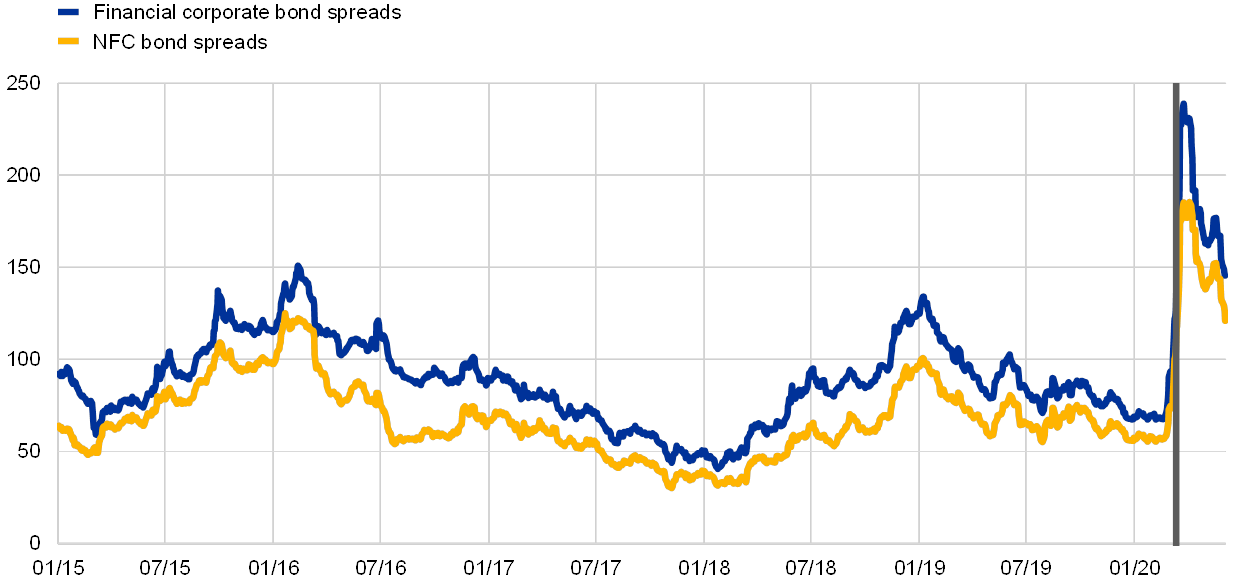

Euro area corporate bond spreads widened until mid-March but have since partly reverted following the adoption of the PEPP (see Chart 8). Spreads on investment-grade NFC bonds and financial sector bonds relative to the risk-free rate increased by 81 and 112 basis points, respectively, between the beginning of the review period and 24 March to reach an intra-period high of 185 and 239 basis points. Since then, corporate bond spreads have been slowly declining to reach 121 and 146 basis points. Overall, the widening largely reflects an increase in excess bond premia, but credit fundamentals, as measured by ratings and expected default frequencies, have also deteriorated.

Chart 8

Euro area corporate bond spreads

(basis points)

Sources: Markit iBoxx indices and ECB calculations.

Notes: Spreads are calculated as asset swap spreads to the risk-free rate. The indices comprise bonds of different maturities (but at least one year remaining) with an investment-grade rating. The vertical grey line denotes the start of the review period on 12 March 2020. The latest observations are for 3 June 2020.

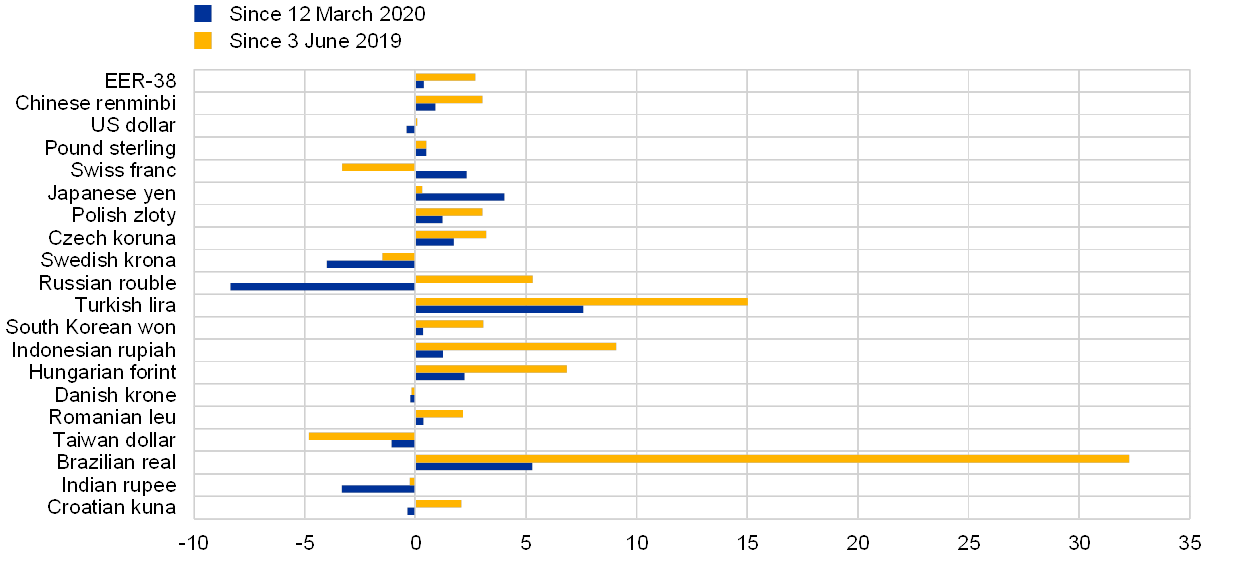

In foreign exchange markets, the euro was broadly unchanged in trade-weighted terms (see Chart 9). The nominal effective exchange rate of the euro, as measured against the currencies of 38 of the euro area’s most important trading partners, appreciated by 0.4% over the review period. Regarding bilateral exchange rate developments, the euro appreciated against most major currencies, in particular the Japanese yen (by 4.0%) and the Swiss franc (by 2.3%). The euro also appreciated vis-à-vis the currencies of Brazil, Turkey and the majority of currencies of non-euro area EU Member States. These developments were partially offset by a slight depreciation against the US dollar (by 0.4%). The euro fell against the Russian rouble (by 8.4%) and the Swedish krona (by 4.0%), reversing to some extent an earlier strong appreciation following the uncertainty triggered by the COVID-19 pandemic.

Chart 9

Changes in the exchange rate of the euro vis-à-vis selected currencies

(percentage changes)

Source: ECB.

Notes: EER-38 is the nominal effective exchange rate of the euro against the currencies of 38 of the euro area’s most important trading partners. A positive (negative) change corresponds to an appreciation (depreciation) of the euro. All changes have been calculated using the foreign exchange rates prevailing on 3 June 2020.

3 Economic activity

Euro area real GDP growth declined on an unprecedented scale in the first quarter of 2020, in a context of stringent lockdown measures implemented by euro area countries to contain the spread of the coronavirus (COVID-19). Although high-frequency indicators and the latest survey results have recently pointed to some modest improvements in levels of economic activity as countries have started to relax their lockdown measures, the severe impact on activity in April and May point to a further decline in the second quarter of 2020. Looking ahead, a rebound in euro area economic activity is expected in the second half of 2020, supported by favourable financing conditions, an expansionary fiscal stance and a resumption in global activity, although the overall speed and scale of the rebound remain highly uncertain. In the baseline scenario of the June 2020 Eurosystem staff macroeconomic projections for the euro area, annual real GDP is expected to fall by 8.7% in 2020 and to rebound by 5.2% in 2021 and by 3.3% in 2022. Compared with the March 2020 ECB staff macroeconomic projections, the outlook for real GDP growth has been revised substantially downwards by 9.5 percentage points in 2020 and revised upwards by 3.9 percentage points in 2021 and 1.9 percentage points in 2022.

Euro area activity saw an unprecedented fall in the first quarter of 2020, amid COVID-19 containment measures and the associated extreme uncertainty. Real GDP declined by a record 3.8%, in quarter-on-quarter terms, in the first quarter of 2020, in a context of stringent lockdown policies implemented by most euro area countries from mid-March onwards. The contraction caused by COVID-19 was heterogeneous across countries and sectors. Among the largest euro area economies, there were stronger declines in economic activity in France, Italy and Spain than in Germany and the Netherlands. Economic growth in euro area countries in the first quarter of 2020 was negatively correlated with the restrictiveness of social distancing measures and the lockdowns to contain the spread of COVID-19 (Chart 10). Overall, the impact of the lockdown measures translated into a marked contraction in euro area industrial production, which declined by an unprecedented 11.3%, month on month, in March 2020, and by 3.3% in quarter-on-quarter terms in the first quarter of 2020. Similarly, capacity utilisation dropped sharply by 11 percentage points to 69.7% in the manufacturing sector and by around 5 percentage points to 85.6% in the services sector, according to survey data for the first quarter of 2020.

Chart 10

Real GDP and COVID-19 government response stringency in the first quarter of 2020

(quarter-on-quarter percentage changes and weighted stringency index)

Sources: Eurostat, Oxford COVID-19 Government Response Tracker and ECB calculations.

Note: The daily index for each country is weighted by the number of days at different stringency levels in the first quarter of 2020. In this chart, the euro area represents a daily, GDP-weighted average of countries for which data are available.

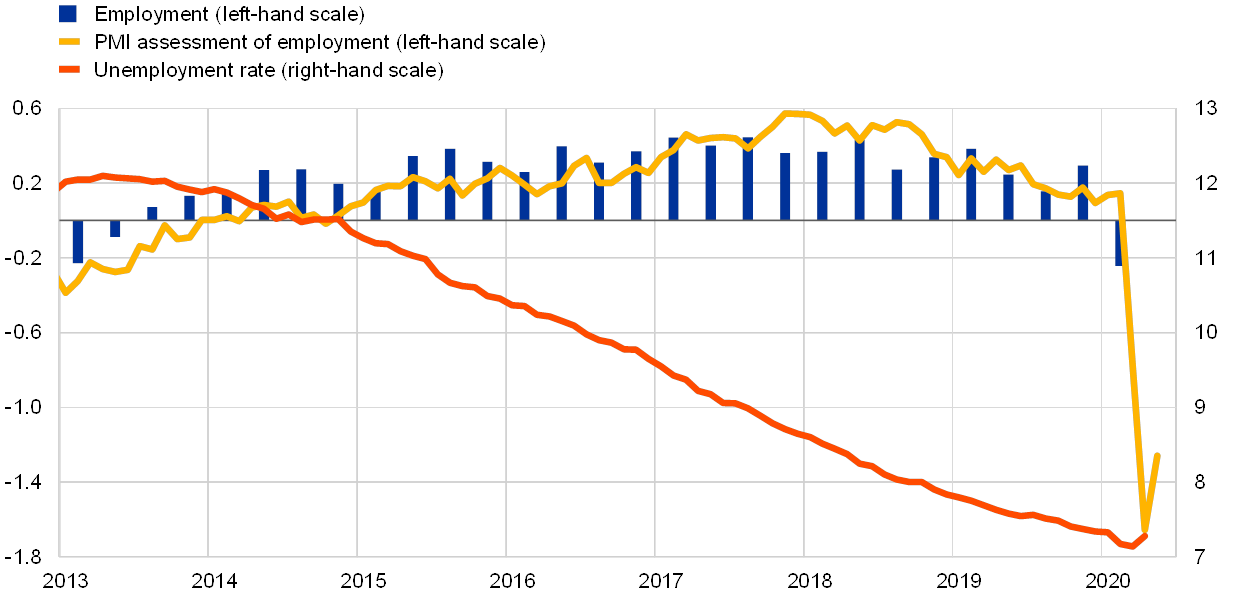

Euro area labour markets have been severely affected by COVID-19 containment measures. Employment declined by 0.2% in the first quarter of 2020, following an increase of 0.3% in the fourth quarter of 2019. The muted decline in employment is mostly explained by policy measures[6], such as the introduction of short-time work schemes and a complementary policy package aimed at preventing redundancies and supporting self-employed workers. Short-time work schemes limit increases in the number of unemployed workers while allowing for an increase in the flexibility of the labour market to face cyclical fluctuations. At the current juncture, this involves a substantial reduction in hours worked per person employed for a predetermined length of time.[7] The decline in employment recorded during the first quarter of 2020 is therefore less than the decline in GDP, implying a marked 3.5% decline in labour productivity per person employed in the first quarter of 2020.

Recent short-term labour market indicators point to a sharp deterioration in the labour market, while the slight increase in the unemployment rate also reflects statistical issues linked to the lockdowns and the mitigating impact of the unprecedented policy measures to support employment. The euro area unemployment rate increased to 7.3% in April 2020, from 7.1% in March. The increase in the unemployment rate does not fully capture the adverse impact of the pandemic, as it reflects the impact of the COVID-19 containment policies on the labour market (with lockdowns implemented in various countries only by mid-March), the adoption of labour market policies to bolster employment and prevent permanent lay-offs, and statistical classification issues during the lockdown period. Recent survey outcomes provide a more timely indication of labour market developments and suggest that the labour market is now deep in contractionary territory. There was, however, a limited rebound in May 2020, reflecting some initial easing of the lockdown measures during that month (Chart 11).

Chart 11

Euro area employment, PMI assessment of employment and unemployment

(quarter-on-quarter percentage changes; diffusion index; percentages of the labour force)

Sources: Eurostat, Markit and ECB calculations.

Notes: The Purchasing Managers' Index (PMI) is expressed as a deviation from 50 divided by 10. The latest observations are for the first quarter of 2020 for employment, May 2020 for the PMI and April 2020 for the unemployment rate.

A large share of private consumption has collapsed since mid-March. Euro area retail trade declined by 11%, month on month, in March 2020. These data only partly reflect the drop in spending during the lockdowns, which were only introduced in mid-March in most euro area countries. Monthly retail sales in April dropped further by 12%, month on month, with an almost complete collapse in other expenditure categories such as cars and holidays. In May 2020 euro area consumer confidence started to bottom out as lockdowns were gradually relaxed. While the drop in household income has been limited, the saving ratio is likely to rise sharply.[8] This reflects standard channels such as (countercyclical) precautionary savings and credit constraints, but there is some evidence that it is also driven by “forced savings”. Households whose income was unaffected started to accumulate significant bank deposits, as they were unable to buy non-essential goods and services.[9] Accumulated savings could finance a strong rebound in non-essential consumption in the second half of 2020. However, this is highly dependent on the remaining uncertainty surrounding the health crisis and labour market conditions, which could lead to further precautionary savings.

Business investment is expected to have contracted in the first quarter of 2020 to a larger extent than GDP, and a further decline is expected in the second quarter. Faced with severe supply disruptions since mid-March owing to the outbreak of COVID-19 in Europe, the production of capital goods in the euro area fell by 6.4%, quarter on quarter, in the first quarter of 2020 and capacity utilisation also contracted. Non-construction investment declined, in quarter-on-quarter terms, by 4.1% in Germany, 9.3% in France (referring to investment by non-financial corporations), 8.3% in Italy, 2.4% in Spain and 6.6% in the Netherlands. Furthermore, the latest euro area bank lending survey[10] shows a large increase in euro area firms’ demand for loans and credit lines in the first quarter of 2020, as companies used bank financing to secure emergency liquidity to cover ongoing payments (e.g. rents and salaries) amid a collapse in revenues. At the same time, demand for loans for investment purposes declined strongly. Going forward, the sharp declines in confidence and production expectations and falls in order books and sales in the capital goods sector in April, together with prevailing elevated uncertainty, point to a pronounced contraction in investment in fixed capital in the second quarter.

Following a marked deterioration in the first quarter of 2020, euro area housing investment may experience an even larger contraction in the second quarter. Looking at the available country data for the first quarter, construction investment experienced major declines in France (‑13.8%, quarter on quarter), Italy (‑7.9%) and Spain (‑9.6%), while it surprisingly improved in Germany (4.1%) and the Netherlands (5.6%). This evidence points to a major decline in euro area housing investment in the first quarter. As the survey-based Purchasing Managers’ Index (PMI) for residential construction output and the European Commission’s indicator for construction confidence plummeted in April, the deterioration in euro area housing markets may even intensify in the second quarter. On the supply side, construction activity has been limited, as lockdown measures have led to the closure of construction sites in several countries and the cost of materials has increased. On the demand side, this deterioration has been accompanied by a sharp decline in the European Commission’s indicator of intentions to spend on renovations as well as the demand for housing loans according to the euro area bank lending survey. This weakening demand has affected even those countries which have implemented the least stringent lockdown measures, such as Germany and the Netherlands.

The contraction in euro area trade is expected to have steepened in the second quarter of 2020. In the first quarter, intra-euro area trade in goods contracted more than extra-euro area trade as a result of the COVID-19 containment measures adopted by euro area countries. An unprecedented decline is expected for the second quarter of 2020, as suggested by the collapse of the new export orders index to 18.9 in April (compared with 49.5 at the beginning of 2020). The same leading indicator’s recovery to 28.7 in May points to early signs of a very gradual expansion thereafter. Euro area trade is particularly exposed to the COVID-19 shock owing to some specific features. First, Europe is an important tourist destination, accounting for 30% of global tourism receipts. Consequently, the region has been particularly affected by travel bans, restrictions on movement and lockdown measures. The implications are, of course, most severe in euro area countries where tourism accounts for a large share of GDP. Second, the extraordinary degree of uncertainty and the ensuing postponement of investment decisions have weighed in particular on trade in durables, a core component of euro area exports. Third, spillover and spillback effects via regional production networks transmit and magnify shocks across euro area economies, and may lead to a sharper contraction in intra-euro area flows than in total trade flows.

In the near term, a larger decline in euro area growth is expected in the second quarter of 2020. Although most countries have started to loosen the strict lockdown measures since early May, high-frequency data suggest only some modest improvements in activity. Electricity consumption and mobility indicators, for example, have picked up only modestly since early May (Chart 12). More conventional survey indicators also show a similar trend. The European Commission’s Economic Sentiment Indicator (ESI) improved slightly to 67.5 in May, up from its historical low of 64.9 in April but remaining in average terms well below the 100.6 recorded in the first quarter of 2020. Moreover, despite the rebound from its record low at 13.6 in April, the May flash composite PMI at 31.9 suggested that activity remained in contractionary territory in the second quarter of 2020. There were, however, some differences across sectors, as the manufacturing index jumped to 35.6 in May from 18.1 in April, while services business activity remained weaker at 30.5, up from 12.0 in April. The European Commission’s business survey indicators also point to continued subdued activity in the months ahead, albeit with some improvement in the sectors most affected by the COVID-19 containment measures, including food and beverages, accommodation and motor vehicles.

Chart 12

Mobility in the largest euro area countries

(percentage changes compared with baseline data on 13 January 2020; seven-day moving average)

Source: Apple Mobility Trends Reports.

Notes: Requests submitted to Apple Maps for driving, public transport and walking in Germany, France, Italy, Spain and the Netherlands. The latest observation is for 1 June 2020.

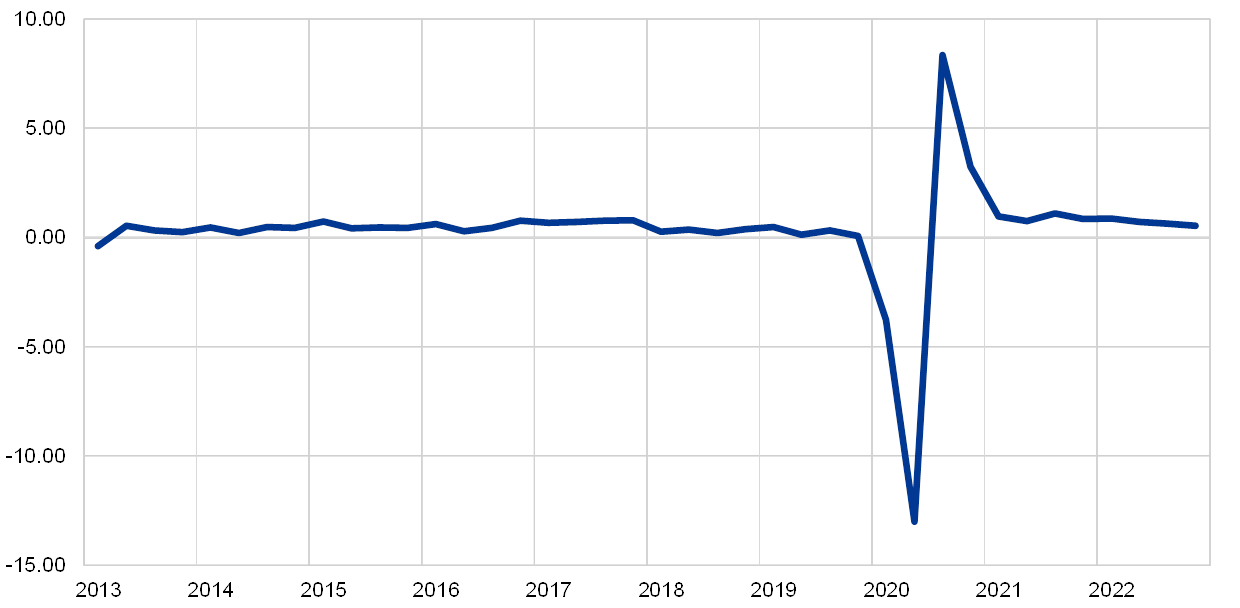

Looking ahead, a rebound in euro area economic activity is expected in the second half of 2020, provided that the containment measures are relaxed. Euro area activity is expected to rebound from the third quarter as the containment measures are eased further, supported by favourable financing conditions, an expansionary fiscal stance and a resumption in global activity, although the overall speed and scale of the rebound remain highly uncertain. In the baseline scenario of the June 2020 Eurosystem staff macroeconomic projections for the euro area, annual real GDP is expected to fall by 8.7% in 2020 and to rebound by 5.2% in 2021 and by 3.3% in 2022 (Chart 13). Compared with the March 2020 ECB staff macroeconomic projections, the outlook for real GDP growth has been revised substantially downwards by 9.5 percentage points in 2020 and revised upwards by 3.9 percentage points in 2021 and 1.9 percentage points in 2022. Nevertheless, elevated global uncertainty around the implementation of post-lockdown plans and the extent of the contraction and subsequent recovery will depend crucially on the duration and the effectiveness of the containment measures, the success of policies to mitigate the adverse impact on incomes and employment, and the extent to which supply capacity and domestic demand are permanently affected. In this context, two alternative scenarios illustrate the potential impact of the COVID-19 pandemic in addition to the Eurosystem staff baseline macroeconomic projections. Under the mild scenario, which assumes that the virus is successfully contained, annual real GDP would decline by 5.9% in 2020, before rebounding by 6.8% in 2021 and increasing by 2.2% in 2022. In the severe scenario, involving a strong resurgence of the pandemic and the implementation of further containment measures, annual real GDP would fall by 12.6% in 2020, rebound by 3.3% in 2021 and increase by 3.8% in 2022.[11]

Chart 13

Euro area real GDP (including projections)

(quarter-on-quarter percentage changes)

Sources: Eurostat and the article entitled “Eurosystem staff macroeconomic projections for the euro area, June 2020”, published on the ECB’s website on 4 June 2020.

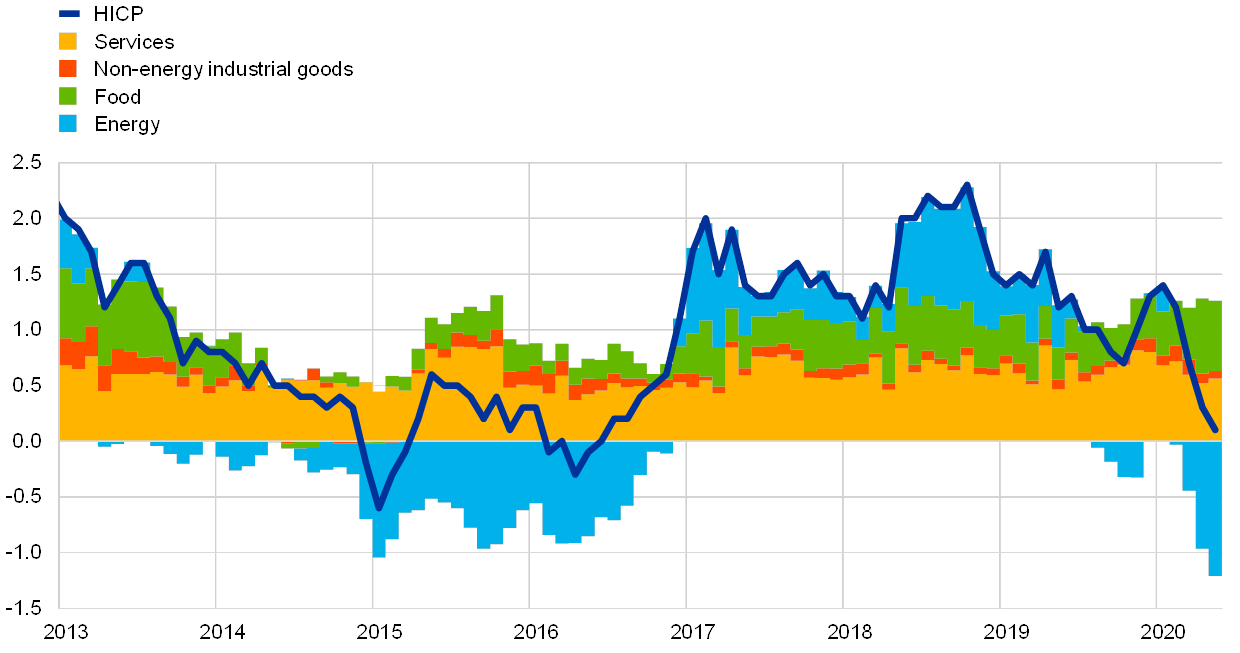

4 Prices and costs

According to Eurostat’s flash estimate, euro area annual HICP inflation decreased to 0.1% in May 2020, from 0.3% in April. On the basis of current and futures prices for oil, headline inflation is likely to decline somewhat further over the coming months and remain subdued until the end of the year. Over the medium term, weaker demand will put downward pressure on inflation, which will be only partially offset by upward pressures related to supply constraints. This assessment is also broadly reflected in the June 2020 Eurosystem staff macroeconomic projections for the euro area, which foresee annual HICP inflation at 0.3% in 2020, 0.8% in 2021 and 1.3% in 2022. Compared with the March 2020 ECB staff macroeconomic projections, the outlook for HICP inflation has been revised down by 0.8, 0.6 and 0.3 percentage points respectively. Annual HICP inflation excluding energy and food is expected to be 0.8% in 2020, 0.7% in 2021 and 0.9% in 2022.

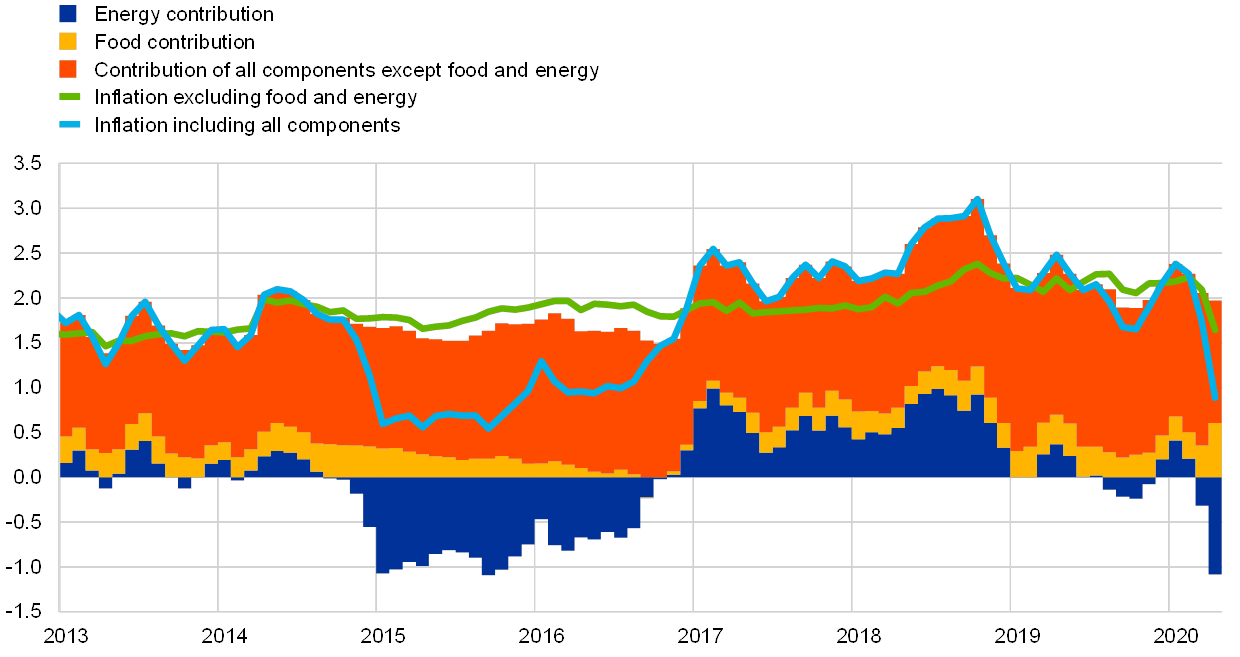

According to Eurostat’s flash estimate, HICP inflation continued to decrease in May. The decrease from 0.3% in April to 0.1% in May reflected mainly a decline in energy and unprocessed food price inflation, while HICP inflation excluding energy and food remained broadly unchanged. Falling energy price inflation remained the main driver of inflation dynamics, still reflecting the sharp drop in oil prices after the onset of the global coronavirus (COVID-19) pandemic. In contrast, food price inflation – in particular unprocessed food price inflation – has surged in the context of the various COVID-19 containment measures. In April it increased to 3.6% and, while it fell back somewhat, to 3.3% in May, it is still at a high level. According to Eurostat, there continued to be price data collection difficulties for some countries and some products, leading to a higher share of imputations than usual. However, this imputation share declined in May, compared with April: prices of around one-quarter of the underlying basket for the euro area HICP flash estimate were imputed owing to the COVID-19 crisis, compared with around one-third in April.[12]

Chart 14

Contributions of components of euro area headline HICP inflation

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: The latest observations are for May 2020 (flash estimates). Growth rates for 2015 are distorted upwards owing to a methodological change (see the box entitled “A new method for the package holiday price index in Germany and its impact on HICP inflation rates”, Economic Bulletin, Issue 2, ECB, 2019).

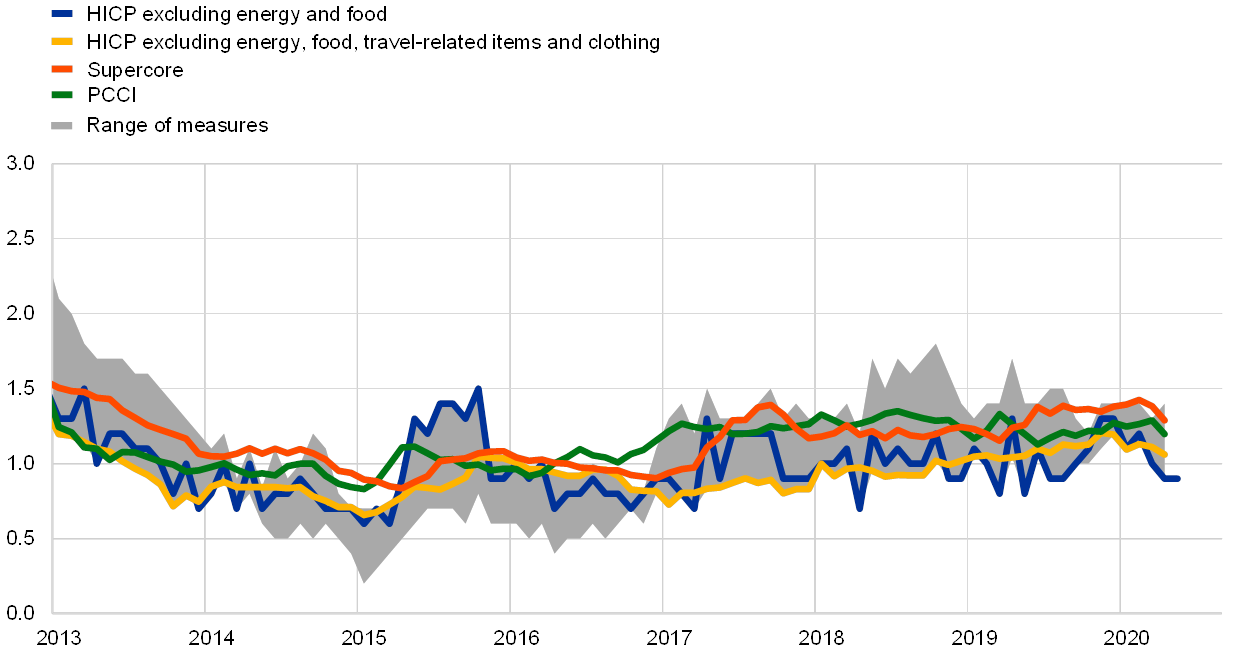

Measures of underlying inflation have shown more resilience so far. HICP inflation excluding energy and food remained at 0.9% in May, unchanged from April, after declining from1.0% in March and 1.2% in February. Other measures of underlying inflation have provided mixed signals (data are only available up to April; see Chart 15). While HICP inflation excluding energy, food, travel-related items and clothing remained broadly unchanged, the Persistent and Common Component of Inflation indicator and the Supercore indicator[13] moved slightly down. However, as mentioned above, all derived measures of underlying inflation are currently surrounded by additional uncertainty as their source data may be affected by the HICP data collection and measurement issues.

Chart 15

Measures of underlying inflation

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Notes: The latest observations are for May 2020 for the HICP excluding energy and food (flash estimate) and for April 2020 for all other measures. The range of measures of underlying inflation consists of the following: HICP excluding energy; HICP excluding energy and unprocessed food; HICP excluding energy and food; HICP excluding energy, food, travel-related items and clothing; the 10% trimmed mean of the HICP; the 30% trimmed mean of the HICP; and the weighted median of the HICP. Growth rates for the HICP excluding energy and food for 2015 are distorted upwards owing to a methodological change (see the box entitled “A new method for the package holiday price index in Germany and its impact on HICP inflation rates”, Economic Bulletin, Issue 2, ECB, 2019).

Pipeline price pressures for the HICP non-energy industrial goods component indicate some weakening at the later stages of the supply chain. Producer price inflation for domestic sales of non-food consumer goods, which is an indicator of price pressures at the later stages of the supply chain, fell further to 0.5%, year on year, in April, from 0.6% in March and 0.7% in February. The corresponding annual rate of import price inflation decreased to 0.1% in March, after 0.5% in the previous month, which may in part reflect some downward pressure from the recent appreciation of the euro effective exchange rate. Earlier in the domestic pricing chain, intermediate goods price inflation weakened sharply, reflecting the pass-through of lower oil prices as well as the effects of a stronger euro. For intermediate goods, producer price inflation declined to -2.7% in April, from ‑1.8% in March and ‑1.2% in February, while import price inflation fell sharply to ‑1.3% in March, after ‑0.1% in February.

Wage growth declined. Annual growth in compensation per employee stood at 1.7% in the fourth quarter of 2019, down from 2.1% in the third quarter (see Chart 16). Looking ahead, the impact on wage growth measures from labour market policies activated in response to the pandemic, such as short-time work schemes, will depend on how such schemes are treated in official statistics.[14] Annual growth in negotiated wages in the euro area stood at 2.0% in the first quarter of 2020, slightly down from 2.1% in the fourth quarter of 2019. Negotiated wage growth may be holding up so far because it reflects agreements made in the past, while any changes in actual wage growth will show in corresponding wage drift.

Chart 16

Contributions of components of compensation per employee

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the first quarter of 2020 for negotiated wages and the fourth quarter of 2019 for the other components.

After falling to historical lows around mid-March, market-based indicators of longer-term inflation expectations recovered to stand slightly above the level prevailing at the beginning of the review period, thus remaining very subdued (see Chart 17). After reaching an all-time low of 0.72% on 23 March 2020, the five-year forward inflation-linked swap rate five years ahead recovered somewhat to stand at 1.02% on 3 June 2020. The option-implied (risk-neutral) probability of deflation occurring over the next five years spiked to unprecedented levels in March 2020. Despite some recent improvement, this measure remains around the highs observed in 2015-16. Part of the increase in this probability reflects the recent large decreases in the price of oil. At the same time, the forward profile of market-based indicators of inflation expectations continues to indicate a prolonged period of low inflation. According to the ECB Survey of Professional Forecasters for the second quarter of 2020, conducted in the first week of April 2020, as well as the latest releases from Consensus Economics and the Euro Zone Barometer, survey-based longer-term inflation expectations remained at or close to historically low levels in April.

Chart 17

Market-based indicators of inflation expectations

(annual percentage changes)

Sources: Thomson Reuters and ECB calculations.

Note: The latest observations are for 3 June 2020.

The June 2020 Eurosystem staff macroeconomic projections foresee a significantly weaker outlook for inflation over the projection horizon. The baseline projections expect headline HICP inflation to average 0.3% in 2020, 0.8% in 2021 and 1.3% in 2022. These represent downward revisions of 0.8, 0.6 and 0.3 percentage points respectively, compared with the March 2020 ECB staff macroeconomic projections (see Chart 18). In the short term, the recent collapse in oil prices implies a sharp drop in headline HICP inflation to levels around zero for the coming quarters, before base effects in the energy component cause a mechanical rebound in early 2021. HICP inflation excluding energy and food is also expected to decline over the short term but by less than headline inflation. Disinflationary effects are expected to be broad-based across the prices of services and goods as demand will remain weak. However, these effects are expected to be offset, in part, by cost pressures related to supply-side disruptions and shortages. Over the medium term, inflation is expected to increase as the oil price is assumed to pick up and as demand recovers. HICP inflation excluding energy and food is expected to decline to 0.8% on average in 2020 and to fall further to 0.7% in 2021, before increasing to 0.9% in 2022. Finally, given the high level of uncertainty, two alternative scenarios for inflation have been prepared by Eurosystem staff.[15] Under the mild scenario, headline inflation would reach 1.7% by 2022 while, under the corresponding severe scenario, headline inflation would be 0.9% at the end of the projection horizon.

Chart 18

Euro area HICP inflation (including projections)

(annual percentage changes)

Sources: Eurostat and the article entitled “Eurosystem staff macroeconomic projections for the euro area, June 2020”, published on the ECB’s website on 4 June 2020.

Notes: The latest observations are for the first quarter of 2020 (data) and the fourth quarter of 2022 (projection). The ranges shown around the central projections are based on the differences between actual outcomes and previous projections carried out over a number of years. The width of the ranges is twice the average absolute value of these differences. The method used for calculating the ranges, involving a correction for exceptional events, is documented in the “New procedure for constructing Eurosystem and ECB staff projection ranges”, ECB, December 2009. The cut-off date for data included in the projections was 25 May 2020.

5 Money and credit

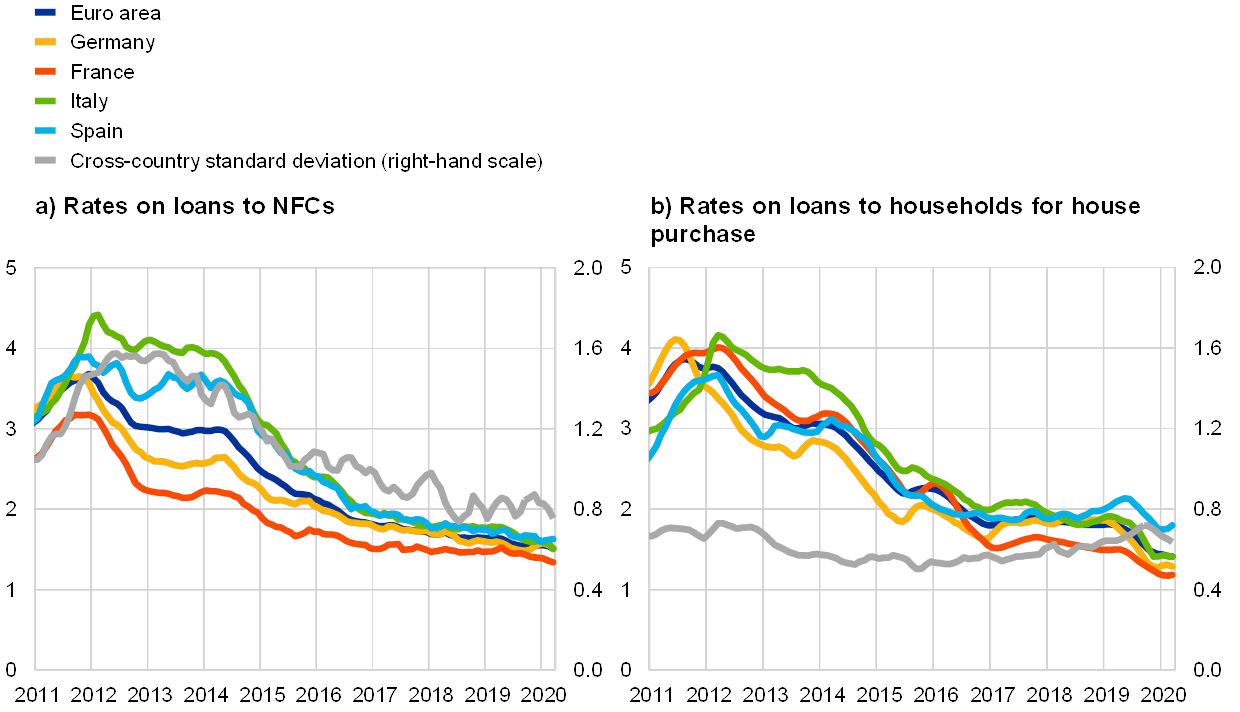

The coronavirus (COVID-19) pandemic caused a sharp acceleration in monetary dynamics, driven by the acute liquidity needs of firms to finance ongoing payments and a strong preference for liquidity for precautionary reasons among economic agents owing to the great uncertainty surrounding the pandemic. Domestic credit was the main source of money creation, driven by loans to non-financial corporations (NFCs) and net purchases of government bonds by monetary financial institutions (MFIs). The timely and sizeable measures by monetary, fiscal and supervisory authorities supported the extension of bank credit on favourable terms to the euro area economy. This also buoyed euro area firms’ total external financing in the first quarter of 2020, while market-based financing was more modest, as the cost of market-based debt increased significantly in the first quarter. Bank lending rates reached historical lows, which kept firms’ overall cost of debt financing favourable.

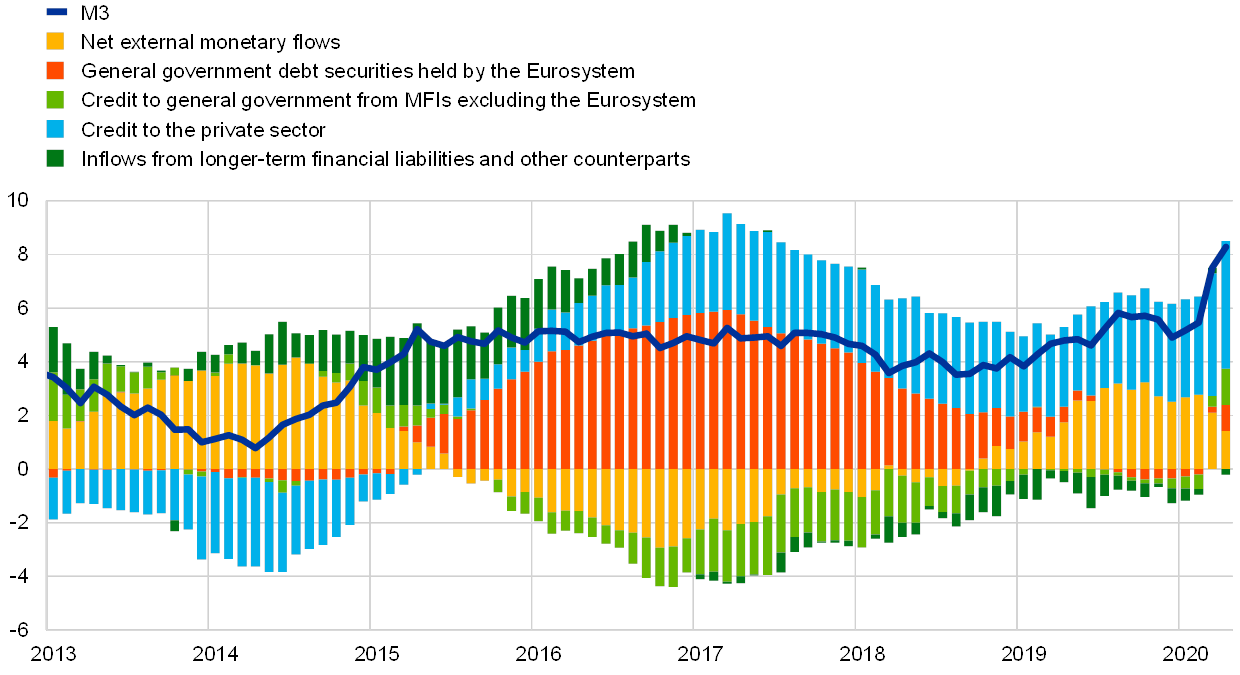

Precautionary liquidity holdings and acute liquidity needs led to a strong acceleration in monetary dynamics. The annual growth rate of M3 surged further to 8.3% in April, from 7.5% in March, and was around 3 percentage points above the growth rate in February, i.e. before the wider spread of the COVID-19 pandemic in the euro area (see Chart 19). This increase was on account of large monthly flows in March (which saw the largest flows since the beginning of Stage Three of Economic and Monetary Union) and in April. Monetary dynamics were driven by a combination of factors, including liquidity needs of firms, a preference for holding liquidity for precautionary reasons in a period of great uncertainty, and the need among institutional investors for liquidity buffers to cope with possible redemptions. High money growth was also the result of sizeable support measures from monetary and fiscal policymakers and regulatory and supervisory authorities to ensure sufficient liquidity in the economy to deal with the COVID-19 pandemic. In this environment, the annual growth rate of the most liquid monetary aggregate, M1, which comprises overnight deposits and currency in circulation, reached 11.9% in April, after 10.4% in March, and was almost 4 percentage points higher than in February.

Overnight deposits remained the main contributor to money growth. The annual growth rate of overnight deposits increased to 12.5% in April, from 10.9% in March. The growth in deposits was mainly driven by deposit holdings of firms. This accumulation of deposits, which reflects a precautionary build-up of liquidity buffers given the great uncertainty surrounding the pandemic, was the result of substantial borrowing from banks, issuance of corporate bonds and, to some extent, direct liquidity support from governments. At the same time, there is heterogeneity in deposit holdings of firms across jurisdictions which may hint at differences in the extent to which the liquidity needs of firms have already materialised, partly related to differences in the timing of the spread of the pandemic across countries. Both financial intermediaries other than MFIs (which includes investment funds) and households also increased their deposit holdings, the former to build up their liquidity buffers in case of redemptions and the latter mainly for precautionary reasons, but also owing to more limited opportunities to consume during the lockdown period. The annual growth rate of currency in circulation increased further to 8.0% in April, up from 7.0% in March, reflecting the tendency to hoard cash in a period of great uncertainty. Marketable instruments (i.e. M3 minus M2) contributed negatively overall to monthly M3 dynamics in April. Following outflows from money market funds and an increase in holdings by non-monetary financial institutions (non-MFIs) of short-term debt securities issued by banks in March, these portfolio shifts were partly reversed in April.

Chart 19

M3, M1 and loans to the private sector

(annual percentage changes; adjusted for seasonal and calendar effects)

Source: ECB.

Notes: Loans are adjusted for loan sales, securitisation and notional cash pooling. The latest observations are for April 2020.

Domestic credit to both the private and the public sector fuelled money creation. Following a marked rise in March, the annual growth rate of credit to the private sector increased somewhat further in April (see the blue portion of the bars in Chart 20) on account of sizeable loan growth to firms as well as a higher acquisition of corporate bonds, while negative flows in loans to non-MFIs partly offset the large lending flow to firms. In addition to credit to the private sector, the annual growth rate of credit from the banking sector (excluding the Eurosystem) to the public sector increased substantially in April (see the light green portion of the bars in Chart 20). In spite of the stepping-up of Eurosystem asset purchase programmes, in net terms euro area banks (excluding the Eurosystem) acquired large amounts of government bonds, mainly of domestic origin, partly reflecting the sizeable increase in net issuance of government debt to cope with the pandemic. In addition, monetary outflows from the euro area increased in April, owing to sales of euro area sovereign bonds by non-residents. The relatively moderate net external monetary flows are consistent with a combination of repatriation outflows for non-euro area residents and repatriation inflows for euro area residents, in line with the typical home bias of investors during periods of great uncertainty (see the yellow portion of the bars in Chart 20). In addition to the increase in credit to euro area governments from MFIs (excluding the Eurosystem), Eurosystem net purchases of government securities in the context of the ECB’s asset purchase programme (APP) and especially the pandemic emergency purchase programme (PEPP) contributed strongly to M3 growth (see the red portion of the bars in Chart 20), reflecting the large monetary policy support to stabilise financial markets and to alleviate risks to monetary policy transmission and the euro area macroeconomic outlook during the pandemic. Longer-term financial liabilities had a broadly neutral impact on money growth (see the dark green portion of the bars in Chart 20).

Chart 20

M3 and its counterparts

(annual percentage changes; contributions in percentage points; adjusted for seasonal and calendar effects)

Source: ECB.

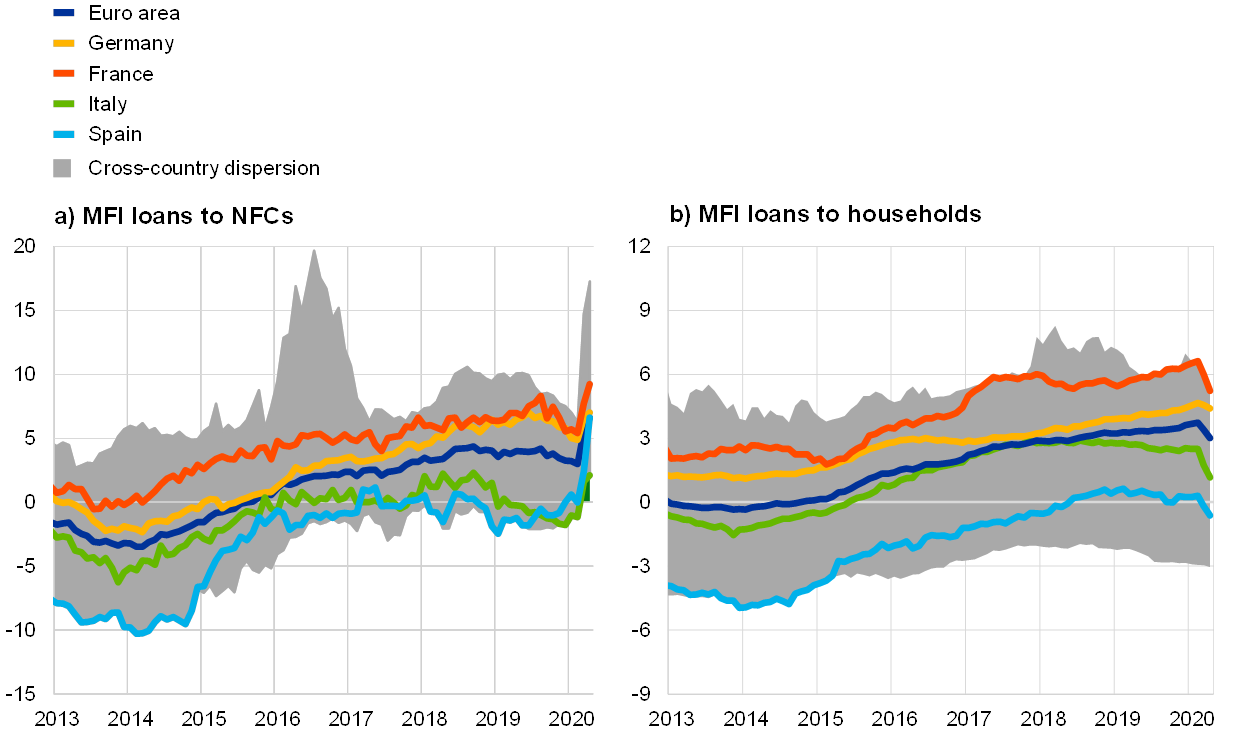

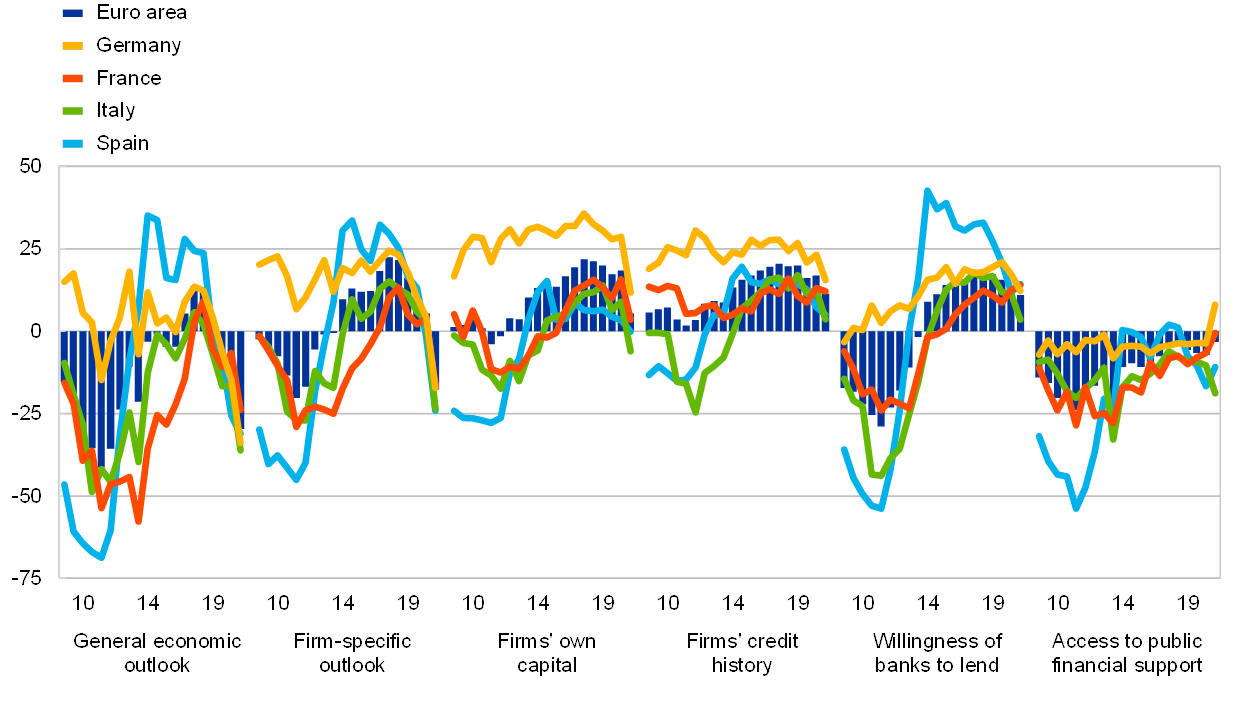

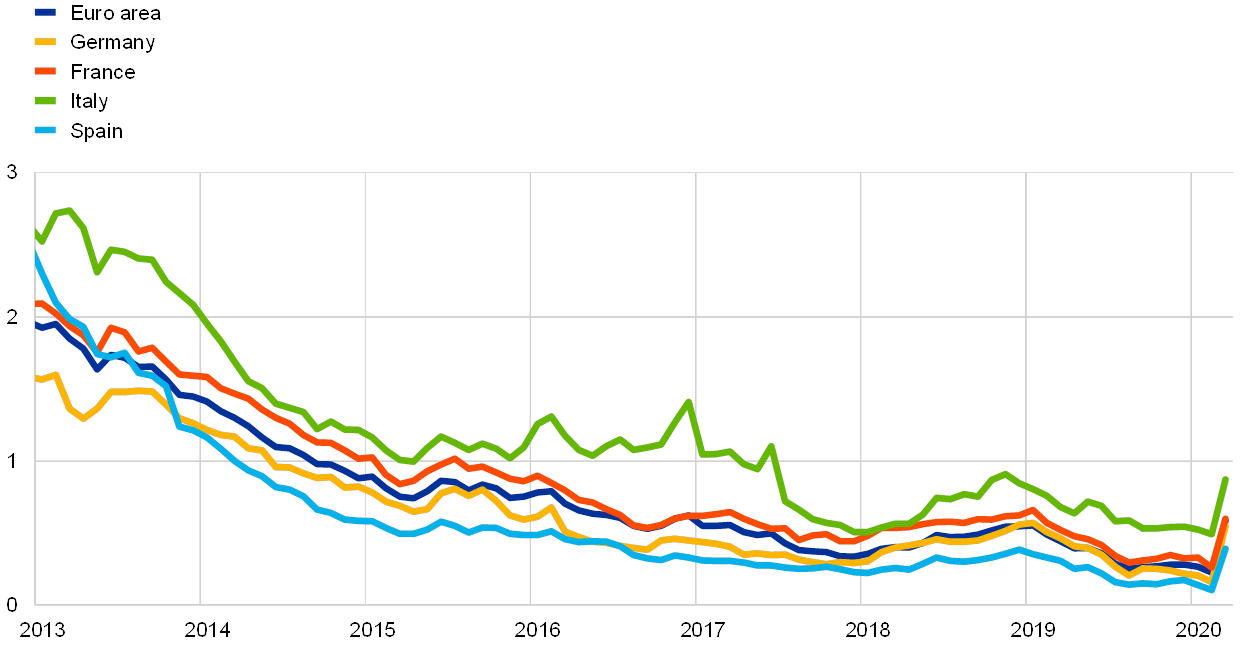

Notes: Credit to the private sector includes MFI loans to the private sector and MFI holdings of debt securities issued by the euro area private non-MFI sector. As such, it also covers purchases by the Eurosystem of non-MFI debt securities under the corporate sector purchase programme. The latest observations are for April 2020.