Developments in the euro area current account during the pandemic

Published as part of the ECB Economic Bulletin, Issue 4/2021.

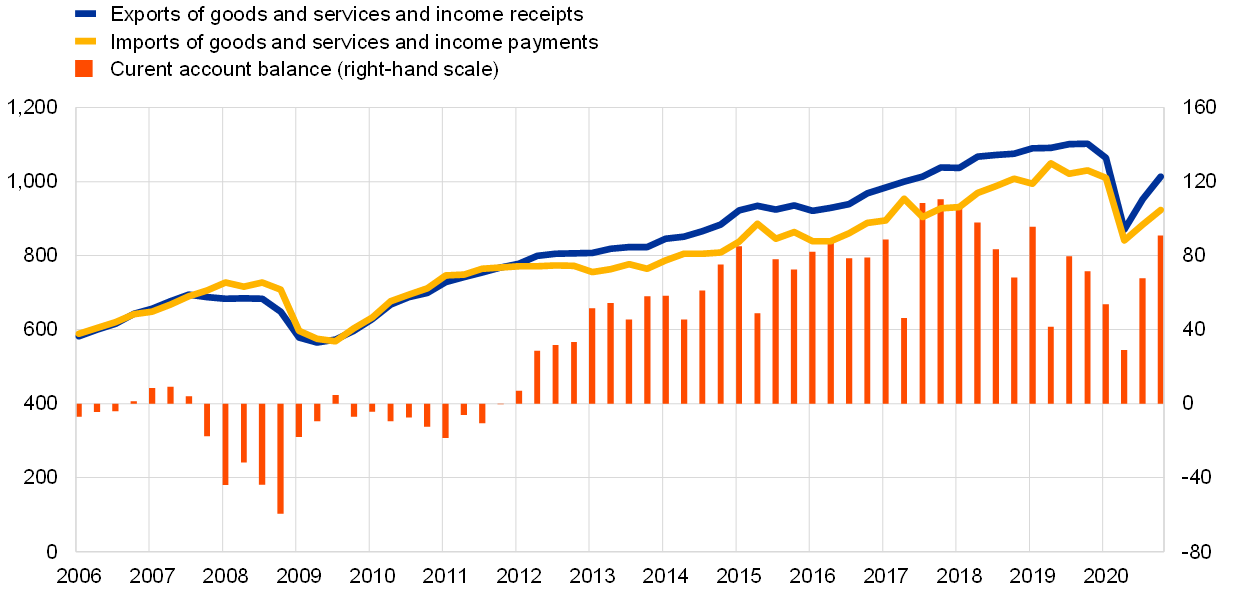

Amid elevated volatility in economic activity and international trade due to the coronavirus (COVID-19) pandemic, the euro area current account surplus narrowed only slightly in 2020 compared with 2019, from 2.3% to 2.2% of GDP (Chart A, panel a). However, the moderate decrease in the current account surplus in relation to GDP masks a sizeable decline in its value, from €280 billion in 2019 to €250 billion in 2020, as nominal GDP fell sharply over this period, Moreover, pronounced shifts took place in the trade composition and geographic breakdown of the surplus, as well as in the underlying gross external (credit and debit) transactions. This box reviews the main developments in the euro area current account in 2020, with a focus on how the pandemic affected its various components.

Chart A

Developments in the euro area current account

a) Euro area current account balance

(percentages of GDP)

b) Quarterly euro area current account transactions

(EUR billions; seasonally and working-day adjusted)

Sources: ECB and Eurostat.

External transactions in the euro area current account contracted sharply in the first half of 2020 following the outbreak of the pandemic and the introduction of measures to contain its spread (Chart A, panel b). In nominal terms the euro area current account surplus was €55 billion lower in the first half of 2020 than in the first half of 2019.[1] This resulted from a steep fall in gross credit flows, i.e. exports of goods and services and income receipts from abroad, which more than offset the contraction in gross debit flows, i.e. imports of goods and services and income payments to non-euro area residents. As external demand recovered during the second half of the year and euro area exports rebounded more strongly than imports, the current account surplus was €7 billion higher in the second half of 2020 than in the second half of 2019.[2] Overall, in nominal terms, the current account surplus was more than 10% lower in 2020 than in 2019.

The surplus on trade in goods increased to 3.0% of GDP in 2020, as the drop in euro area exports was outweighed by an even sharper decrease in imports. In 2020 the surplus on the balance of trade in goods increased by €17 billion (or 0.3 percentage points in terms of GDP). This masked a significant decline in the value of goods exports, by €216 billion (or 0.8 percentage points in terms of GDP), which was more than offset by a stronger decrease in imports, by €234 billion (or 1.1 percentage points in terms of GDP). Statistics for trade in goods show a notable reduction in the euro area deficit in energy, linked to both favourable developments in energy prices and lower import volumes due to the fall in economic activity. On the other hand, the euro area’s surplus in manufactured goods decreased significantly amid the disruptions to global value chains, which were also reflected in a marked reduction in the euro area deficit in intermediate goods.[3]

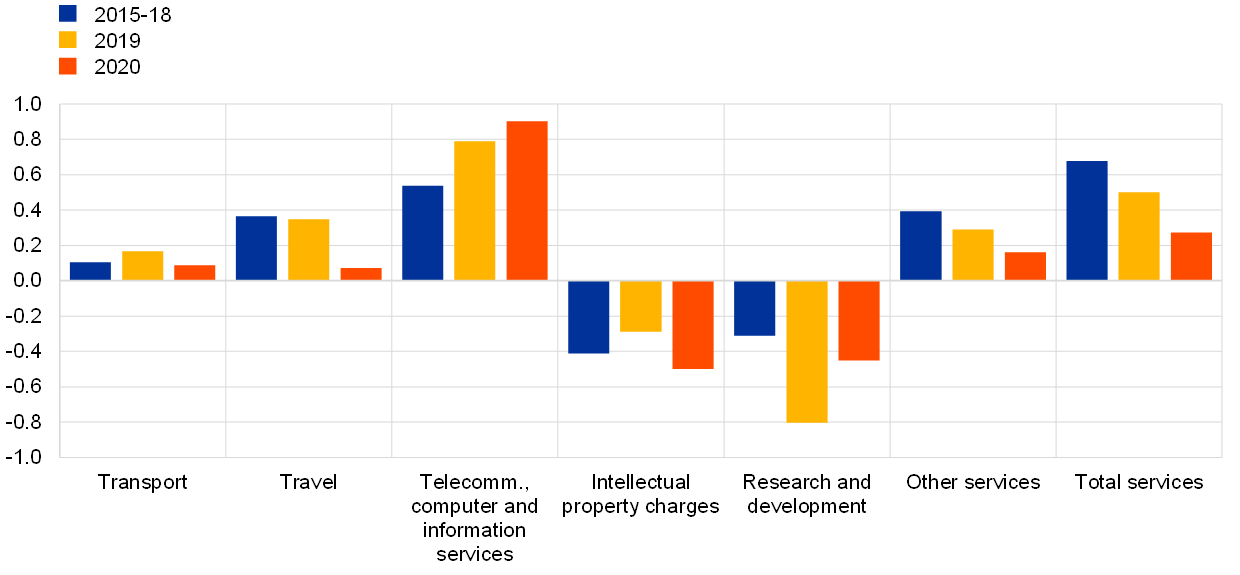

The economic repercussions of the pandemic are particularly visible in the balance of trade in services, where travel restrictions led to a sharp reduction in the euro area surplus on travel services (Chart B). The surplus on the balance of trade in services decreased in 2020 by €29 billion (or 0.2 percentage points in terms of GDP). This decline was mainly driven by lower surpluses for travel services (down from 0.3% of GDP in 2019 to 0.1% of GDP in 2020) and transport services (down from 0.2% of GDP to 0.1% of GDP). For travel services, this reflected a collapse in exports (by around 65% in nominal terms compared with 2019) due to the travel restrictions introduced to contain the pandemic.[4] On the other hand, the surplus for telecommunications, computer and information services increased (from 0.8% of GDP to 0.9% of GDP), driven by higher exports. The large shifts in the deficits for charges for the use of intellectual property (which increased by 0.2 percentage points in terms of GDP) and research and development services (which decreased by 0.4 percentage points in terms of GDP) reflected a pronounced volatility in euro area imports of these services in recent years, linked to the activities of large multinational enterprises.[5]

Chart B

Developments in the euro area services trade balance by main type of service

(percentages of GDP)

Source: ECB.

Note: “Other services” comprises the categories of trade in services not shown elsewhere in the chart.

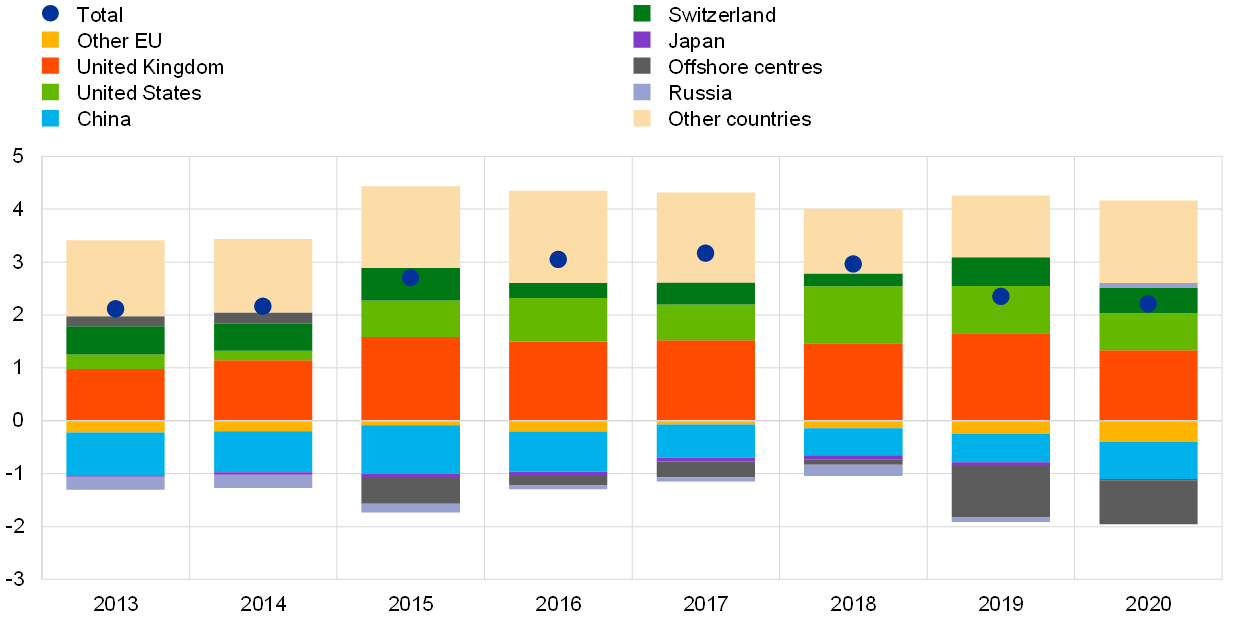

Data on the geographic counterparts of the euro area current account show that in 2020 the euro area recorded a decline in its largest bilateral surpluses (Chart C, panel a). As in recent years, the euro area’s largest bilateral surpluses in 2020 were vis-à-vis the United Kingdom, the United States and Switzerland (1.3%, 0.7% and 0.5% of GDP respectively). The group “other countries” – including major oil producers – also contributed positively to the euro area’s external surplus (with a surplus of about 1.6% of GDP), while the euro area ran a current account deficit vis-à-vis China (0.6% of GDP) and the group “offshore centres” (0.7% of GDP).

Chart C

Geographic breakdown of the euro area current account

a) Euro area current account by main geographic counterpart

(percentages of GDP)

b) Change in euro area bilateral current account balances between 2020 and 2019

(percentage points of GDP)

Sources: ECB and Eurostat.

Notes: “Other EU” comprises the non-euro area EU Member States and those EU institutions and bodies that are considered for statistical purposes as being outside the euro area, such as the European Commission and the European Investment Bank. “Offshore centres” comprises countries or jurisdictions outside the EU that provide financial services to non-residents on a scale that is disproportionate to the size of their domestic economy, including for example Hong Kong SAR and the Cayman Islands. “Other countries” includes all countries and country groups not shown in the chart, as well as unallocated transactions.

The most pronounced changes in the geographic breakdown of the euro area current account balance in 2020 were declining surpluses vis-à-vis the United Kingdom and the United States, and an increasing surplus vis-à-vis the group “other countries” (Chart C, panel b). The reductions in the surpluses vis-à-vis the United Kingdom and the United States were mainly driven by services. In the case of the United Kingdom this was primarily due to a significant decrease in euro area travel exports amid the pandemic travel restrictions, while for the United States it also reflected a marked increase in payments for the use of intellectual property, related to the operations of multinational enterprises.[6] The goods surplus vis-à-vis the group “other countries” increased strongly owing to the aforementioned decline in energy imports, which was also the driver of the shift from a bilateral current account deficit to a surplus vis-à-vis Russia. The goods deficit vis-à-vis China increased further in 2020, partly reflecting an increase in imports of medical supplies linked to the pandemic.

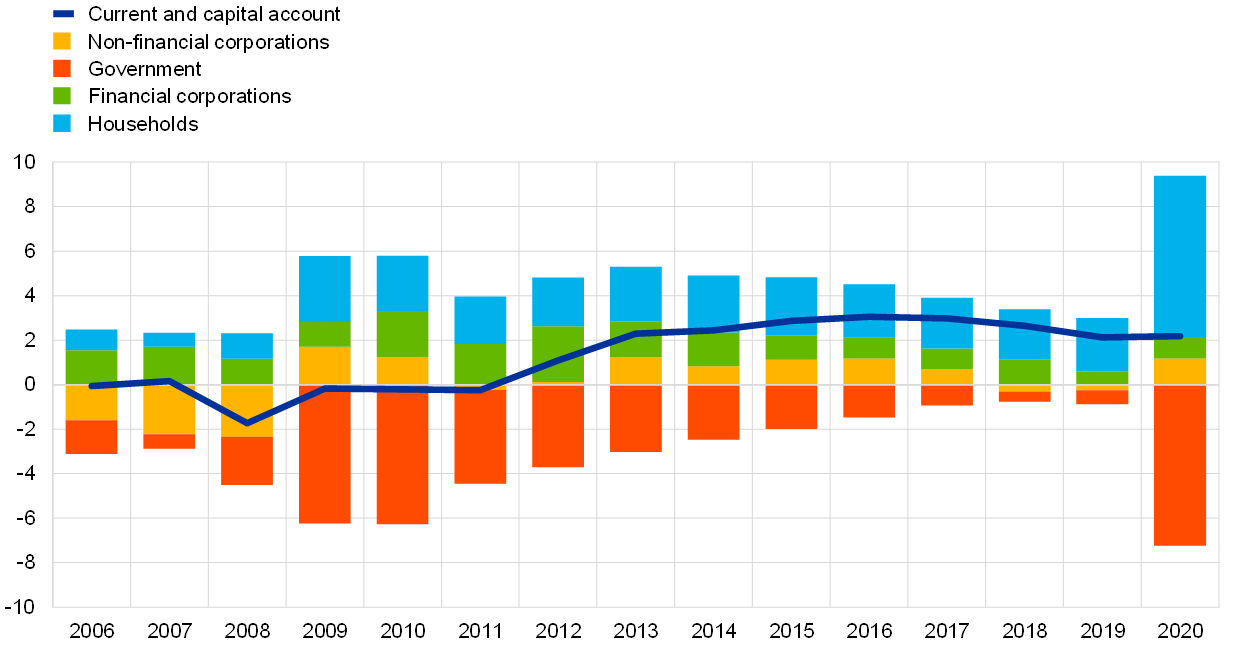

From a saving/investment perspective, the stability of euro area net lending to the rest of the world in 2020 masked unprecedented increases in net lending by the household sector and in net borrowing by the general government sector (Chart D). The need to contain the repercussions of the pandemic on the economy abruptly halted the steady reduction in the net borrowing of the general government sector observed in recent years, with euro area governments’ net borrowing increasing to 7.3% of GDP in 2020. However, this was almost fully offset by a strong increase in euro area households’ net lending (to 7.3% of GDP), reflecting both precautionary and forced savings.[7] As net lending of both the non-financial and financial corporation sectors also increased in 2020 – albeit more modestly – euro area net lending to the rest of the world was stable overall at around 2.2% of GDP.

Chart D

Euro area sectoral net lending/borrowing and the current and capital account balance

(percentages of GDP)

Sources: ECB and Eurostat.

Notes: The sectoral decomposition of euro area net lending/borrowing reflects the euro area domestic sectoral balances taken from the non-financial sectoral accounts data. The euro area current and capital account reflects the euro area’s net lending/borrowing to/from the rest of the world as included in the balance of payments data. Minor discrepancies may exist between the two indicators as a result of discrepancies between the data sources.

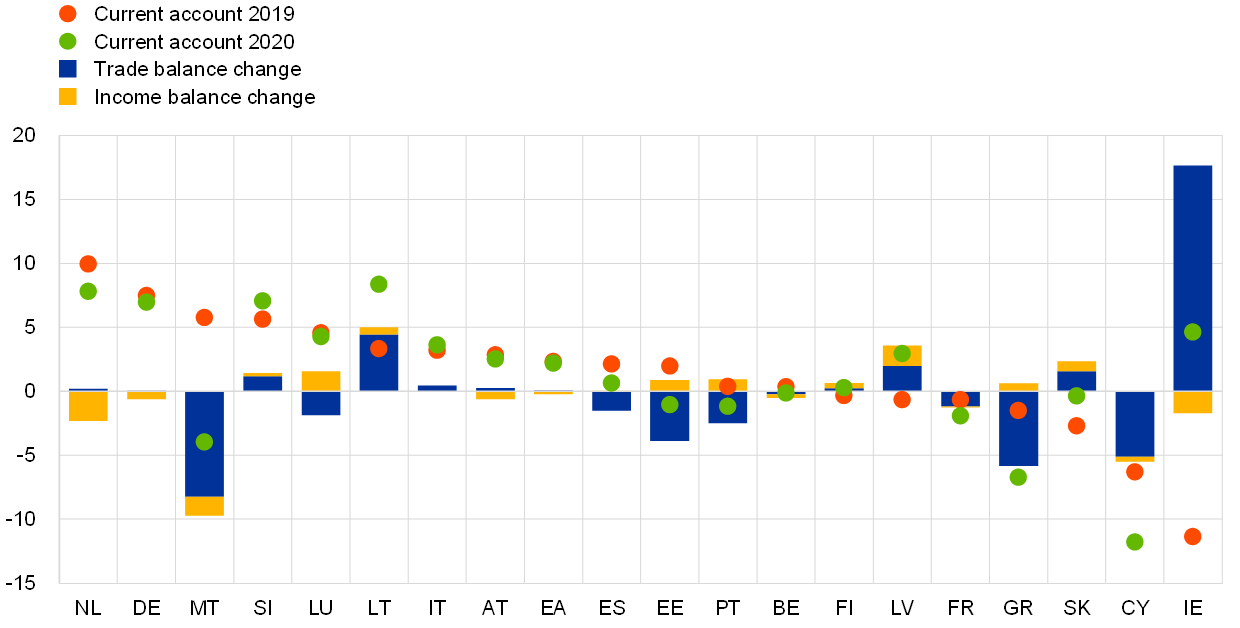

The current account balances of euro area countries developed heterogeneously in 2020, with countries highly dependent on tourism experiencing large deteriorations in their trade balances (Chart E). These sharp movements, mainly linked to a pronounced drop in travel exports, led to a sizeable deterioration in the current account balances of Spain (from 2.1% to 0.7% of GDP), Portugal (from 0.4% to -1.2% of GDP) and Greece (from -1.5% to -6.7% of GDP). Malta and Cyprus also recorded sharp deteriorations in their current account balances, mainly due to declining net exports in travel and other services. At the same time, Ireland recorded a strong improvement in its current account balance, driven by changes in services trade – and to a lesser extent in goods trade – reflecting mainly the activities of large multinational enterprises.[8]

Chart E

Current account changes in euro area countries between 2020 and 2019

(percentages of GDP; percentage points)

Sources: ECB and Eurostat.

Notes: The trade balance incorporates the goods and services balances. The income balance incorporates the primary and secondary income balances. “EA” stands for “euro area”.

- Data on intra-annual developments are presented in seasonally and working day-adjusted terms.

- While the trade balance improved in the second half of the year, the income balance deteriorated further. The contraction of the euro area income balance in 2020 was due to a worsening of the deficit in secondary income and a decrease in the surplus on investment income. The investment income balance reflects the euro area’s earnings on net foreign assets. Developments in the euro area’s net foreign assets (the net international investment position) were in recent years driven not only by the current account balance but also by the valuation channel (i.e. fluctuations in the valuations of external assets and liabilities due to exchange rate and other asset price changes). For further details see the box entitled “Factors driving the recent improvement in the euro area’s international investment position”, Economic Bulletin, Issue 3, ECB, 2018.

- See also the box entitled “The great trade collapse of 2020 and the amplification role of global value chains”, Economic Bulletin, Issue 5, ECB, 2020.

- See also the box entitled “Developments in the tourism sector during the COVID-19 pandemic”, Economic Bulletin, Issue 8, ECB, 2020.

- For additional information on the impact of multinationals’ operations on the euro area’s external accounts see the article entitled “Multinational enterprises, financial centres and their implications for external imbalances: a euro area perspective”, Economic Bulletin, Issue 2, ECB, 2020; and Lane, P.R., “Maximising the user value of statistics: lessons from globalisation and the pandemic”, speech at the European Statistical Forum (virtual), 26 April 2021.

- These operations are also reflected in a corresponding reduction in the euro area services deficit vis-à-vis offshore centres.

- See also the box entitled “COVID-19 and the increase in household savings: precautionary or forced?”, Economic Bulletin, Issue 6, ECB, 2020.

- The exceptional improvement in Ireland’s services balance in 2020 was due to a strong decrease in research and development services imports, in the context of pronounced volatility in Ireland’s external accounts due to the very large impact of the operations of multinationals.