Definitions and characteristics of soft patches in the euro area

Published as part of the ECB Economic Bulletin, Issue 4/2019.

Following an exceptionally strong performance in 2017, growth slowed in 2018, raising the question of whether this was just a temporary “soft patch” or should have been seen as pointing to a more prolonged period of weakness. The term “soft patch” is used widely in the media and elsewhere to describe a temporary period of slower growth during an expansionary phase characterised by higher trend growth rates.[1] However, there appears to have been relatively little analysis of such periods, particularly for the euro area.

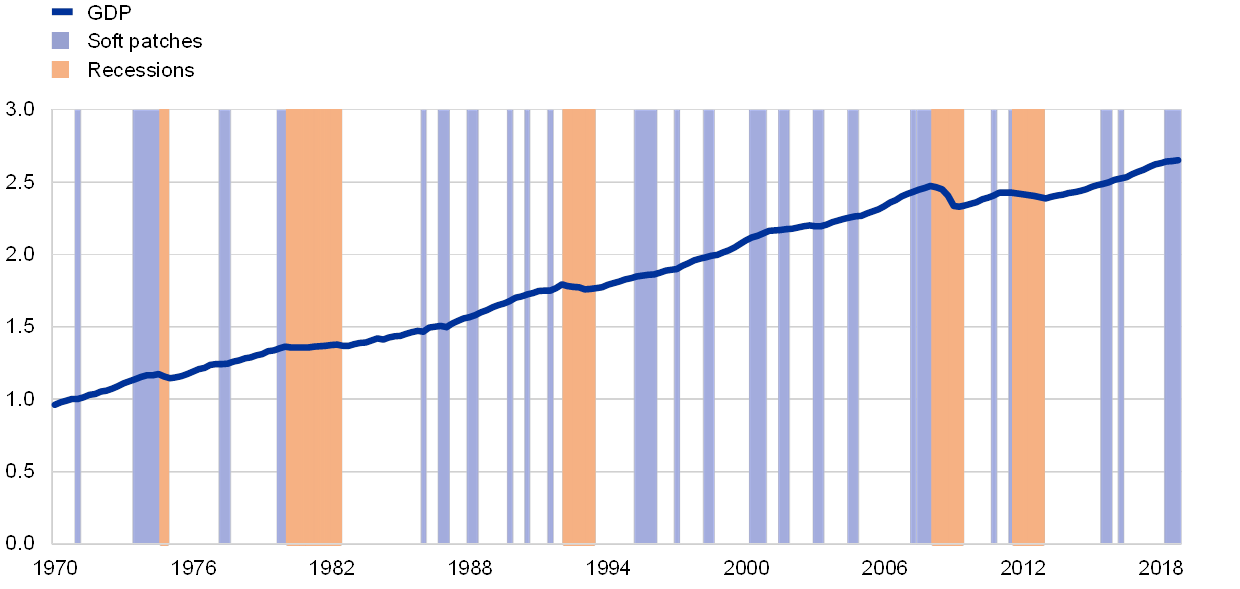

The euro area economy has experienced five peaks and troughs since the beginning of the 1970s.[2] The concept of a “soft patch” is only relevant during expansions, i.e. the periods between troughs and peaks. Chart A plots the five expansionary periods in the euro area since the beginning of the 1970s, as identified by the CEPR Euro Area Business Cycle Dating Committee (where the trough is indexed to 100).[3] It is important to note that the latest expansionary phase, which started in the first quarter of 2013, has not as yet come to an end.[4] Looking at these expansionary phases, including the current one, it becomes clear that they differ substantially in terms of both duration and strength. At the same time, a common feature across the various expansionary phases is that they have been characterised by relatively low volatility. Despite this, there are short periods within each of these expansionary phases when output growth has slowed temporarily.

Chart A

Euro area recoveries

(trough = 100)

Sources: Eurostat, AWM database and ECB staff calculations.

Notes: The chart displays the five expansionary periods in the euro area since the beginning of the 1970s (as identified by the CEPR). The lines start with the trough (indexed to 100) and end with the peak. The latest expansionary phase, which started in the first quarter of 2013, has as yet not come to an end.

There is no precise definition of a soft patch. A soft patch is typically seen as one or more quarters of a slowdown in quarterly GDP growth. For the purpose of the analysis of this box, it is necessary to come up with a more precise definition. As presented in Table A, four alternative definitions of a soft patch are considered.[5] These are when the GDP growth rates during two or three consecutive quarters are less than during the quarter that preceded these quarters (Definitions 1 and 2, respectively) or, to avoid that the identification of a soft patch is determined by what could be an exceptionally strong growth rate in any one quarter, when the GDP growth rates during two or three consecutive quarters are less than the average of the two quarters that preceded these quarters (Definitions 3 and 4, respectively).[6]

The number of soft patches varies significantly depending on the precise definition. Table A shows the number of soft patches for every euro area business cycle expansion according to the different definitions applied. The figures reported are the number of quarters where a soft patch is identified according to the respective definition. This method implies that longer soft patches are recorded as a number of consecutive shorter soft patches (with the number varying depending on the definition). An alternative option, which is not considered here, would be to count consecutive soft patches as a single soft patch. This way of counting would lead to a lower number of soft patches for all definitions applied.[7]

Table A

Number of soft patches according to different definitions

(number of soft patches)

Sources: Eurostat, CEPR and ECB staff calculations.

Note: The first expansionary phase (Q2 1970 – Q3 1974) is incomplete due to data unavailability.

Soft patches during the expansionary phase of the business cycle are quite common and are not a reliable leading indicator of recessions. Chart B illustrates this by showing the level of euro area output alongside soft patches (according to Definition 3) and recession periods. This finding, which also holds true for the United States, suggests that it is not straightforward to draw any strong conclusions with regard to an imminent turning point. Although the analysis here identifies several soft patches that closely preceded a recession, many soft patches took place without the economy entering a recession in the following year.[8]

Chart B

Soft patches and recessions since 1970

(EUR trillions)

Sources: Eurostat, CEPR and AWM database.

Note: Shaded areas indicate recessions/soft patches.

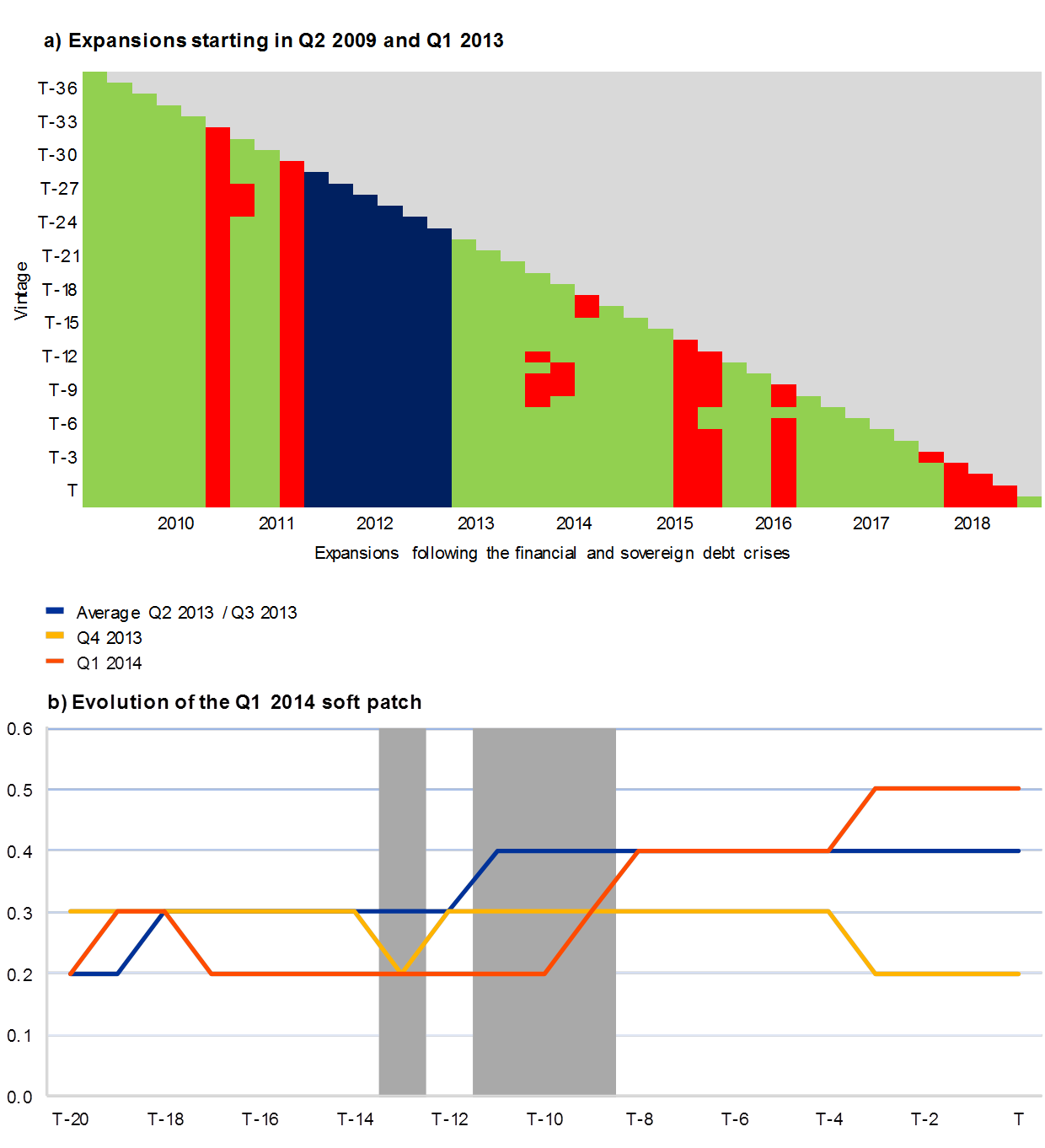

An important caveat relates to data revisions, which may change the identification of a soft patch over time. This is illustrated in Chart C, where the top panel shows the two expansionary phases starting in the second quarter of 2009 and the first quarter of 2013 for different vintages of data releases (the green areas represent “normal” growth in an expansion, the red areas represent “soft patches” according to Definition 3, and the blue area represents the recession following the sovereign debt crisis between the third quarter of 2011 and the first quarter of 2013). The bottom row (T) represents the latest release with the publication of national accounts for the first quarter of 2019, whereas the rows above represent earlier data vintages. The bottom panel shows the impact of data revisions on the assessment of a soft patch occurring around the turn of the year 2013/2014 (according to Definition 3). In the first and latest releases, no soft patch is identified. However, with the data releases for GDP towards the end of 2015 and later with the releases during the latter part of 2016, a soft patch was indeed identified (as illustrated by the grey areas). This illustrates that revisions in later data releases are a factor that may change the real-time assessment of the latest cyclical position.

Chart C

Impact of data revisions on soft patches

Sources: Eurostat and ECB/Eurosystem staff macroeconomic projections.

Notes: In the top panel, the green areas represent “normal” growth in an expansion, the red areas represent “soft patches” according to Definition 3, and the blue area represents the recession following the sovereign debt crisis between the third quarter of 2011 and the first quarter of 2013. The bottom row (T) represents the latest release with the publication of national accounts for the first quarter of 2019, whereas the rows above represent earlier data vintages. The bottom panel shows the impact of data revisions on quarterly GDP growth for the first quarter of 2014, for the fourth quarter of 2013 and for the average of the second and third quarters of 2013. The grey areas represent periods when a soft patch was identified. The GDP growth rates are rounded to one decimal place.

Overall, soft patches are not a reliable indication of a forthcoming turning point in the business cycle. The slowdown in growth in 2018 serves as a good example, as growth picked up again in the first quarter of this year. This is consistent with the finding that soft patches are much more common than recessions. More generally, caution is warranted when analysing soft patches and their information content given that alternative definitions yield different results and data revisions may imply significant changes in the assessment of the current cyclical position of the economy.

- See, for example, Draghi, M., “Monetary policy in the euro area”, speech at the conference “The ECB and Its Watchers XX”, Frankfurt am Main, 27 March 2019.

- GDP data obtained from the area-wide model database. See Fagan, G., Henry, J. and Mestre, R., “An area-wide model (AWM) for the euro area”, Working Paper Series, No 42, ECB, January 2001.

- For further information on this committee, see the website of the Centre for Economic Policy Research (CEPR).

- See, for instance, the box entitled “The measurement and prediction of the euro area business cycle”, Monthly Bulletin, ECB, May 2011.

- An exception is Anderson, R. G. and Liu, Y., “On the Road to Recovery, Soft Patches Turn Up Often”, The Regional Economist, Federal Reserve Bank of St. Louis, January 2012. The first two definitions of a soft patch are in line with this earlier analysis.

- An alternative approach, not considered here, would be to consider the trend growth rate during the expansionary phase, and to look at consecutive quarterly growth rates that were below this trend. One disadvantage of this approach relates to the uncertainty surrounding the estimation of trend growth, particularly towards the end of the sample period.

- In order to make the identification of soft patches more robust and less sensitive to marginal differences, the computations are conducted on data rounded to one decimal place.

- Looking at the breakdown of GDP, all expenditure components tended in the past to contribute to soft patches. However, investment and private consumption have been the major contributors. The resilience of these two components during the recent soft patch in 2018 supported the assessment that this period was a temporary slowdown.