Measuring and interpreting the cost of equity in the euro area

Published as part of the ECB Economic Bulletin, Issue 4/2018.

Equity capital is among the main sources of funding for euro area non-financial corporations (NFCs), making it an important factor in the transmission of monetary policy. From a central bank perspective, improving the measurement and understanding of the cost of equity is therefore essential.

Unlike the cost of debt, which has declined substantially in recent years, the cost of equity has remained relatively stable at elevated levels. Results from the analysis performed in this article suggest that a persistently high “equity risk premium” (ERP) has been the key factor underpinning the high cost of equity for euro area NFCs. In fact, since the start of the global financial crisis, increases in the ERP have largely offset the fall in the yield of risk-free assets.

This article argues that the widely used workhorse model to derive the cost of equity and the ERP, namely the three‑stage dividend discount model, can be improved upon. In particular, incorporating short-term earnings expectations, discounting payouts to investors with a discount factor with appropriate maturity, and considering share buy-backs all yield beneficial refinements. This in turn would strengthen the theory and basis of the model and improve the robustness of its estimates. Most notably, share buy-back activity seems to matter, specifically for the level of the ERP. Notwithstanding such improvements in the modelling approach, estimating the ERP, particularly its level, remains subject to considerable uncertainty. Ultimately, such uncertainty advocates the use of a variety of models and survey estimates, as well as a focus on the dynamics, rather than on the level, of the ERP.

From an applied perspective, the article demonstrates that cost of equity modelling can be used to disentangle the different drivers of changes in equity prices. This is helpful from a monetary policy perspective, as changes in equity prices can contain important information about the economic outlook and warrant monitoring for financial stability purposes. Moreover, the article shows that adding an international perspective to the analysis of the ERP for the overall market may provide valuable insights for policymakers. For instance, the greater reliance on share buy-backs among companies in the United States than those in the euro area appears to be behind some of the recent steeper decline in the ERP in the United States when compared with the ERP in the euro area.

1 Introduction

While equity provides a substantial source of funding for euro area NFCs, calculating the actual cost of raising equity financing is challenging. Unlike the cost of debt, which can often be readily observed, the cost of equity, representing the required return investors demand for bearing the risk of equity ownership, has to be estimated. This leaves the magnitude and the trajectory of the cost of equity – a variable that is important from a corporate finance, investment or policy perspective – subject to considerable uncertainty. Advancing on strategies commonly employed to estimate the cost of equity would therefore be expected to yield considerable benefits for companies, investors and policymakers by allowing them to arrive at better informed decisions.

From the viewpoint of a central bank, improving estimates of the cost of equity are desirable, primarily for three, partly inter-related, reasons:

- The cost of equity is part of the monetary policy transmission mechanism. Changes in the monetary policy stance can affect equity prices and the cost of equity via three channels: the potential implications for future corporate profits; the interest rates employed to discount such profits; and perceptions of risk. The marginal cost of an additional unit of equity capital, contrasted with the marginal return of an additional unit of investment, can contribute to determine the viability of an investment project. As a result, changes to the cost of equity may dampen or stimulate corporate investment. Likewise, equity price developments can, to some extent, also influence the financial wealth of households and therefore their consumption decisions.

- Changes in the determinants of the cost of equity can reveal the views of market participants about the economic outlook, which explains why central banks use such changes as an indicator of the (expected) state of the economy. In particular, changing perceptions about the economy are likely to be mirrored in corresponding movements in equity prices which represent a discounted flow of future income. This role of equity prices as a gauge of economic activity also highlights why understanding their drivers is important for central banks.

- Equity prices and, by implication, the cost of equity need to be monitored from a financial stability perspective. Clearly, the cost of equity relative to the cost of debt may influence decisions about corporate capital structure and leverage. Moreover, equity prices that are out of line with macroeconomic fundamentals might trigger disorderly equity market corrections with possible adverse spillovers to other asset classes and the real economy. In extreme circumstances, this may also impair the monetary transmission mechanism. For this reason, the ECB’s Financial Stability Review regularly examines equity prices and equity valuations. Similarly, assumptions about future equity prices constitute an input to the ECB’s macroeconomic projection exercises and to the stress tests of euro area banks.

Against this background, this article examines various methods for estimating the cost of equity for euro area corporations, with a particular emphasis on the ERP which is the most difficult component to estimate. In Section 2, the article recalls the role of equity financing for euro area NFCs and reviews developments of the cost of equity and the ERP over time, including in comparison with other means of corporate financing. Section 3 presents a range of approaches for estimating the ERP, including the Fed model, the Gordon growth model and the dividend discount model. While presenting each model with its underlying rationale, the section also shows a practical application of the dividend discount model and Box 1 introduces an improved version of the dividend discount model which aims at addressing several of its shortcomings. Finally, Section 5 puts the euro area ERP into perspective by contrasting developments in the euro area with those in the United States. Section 6 concludes.

2 Vital but costly – equity financing in the euro area

2.1 The role of equity financing for euro area NFCs

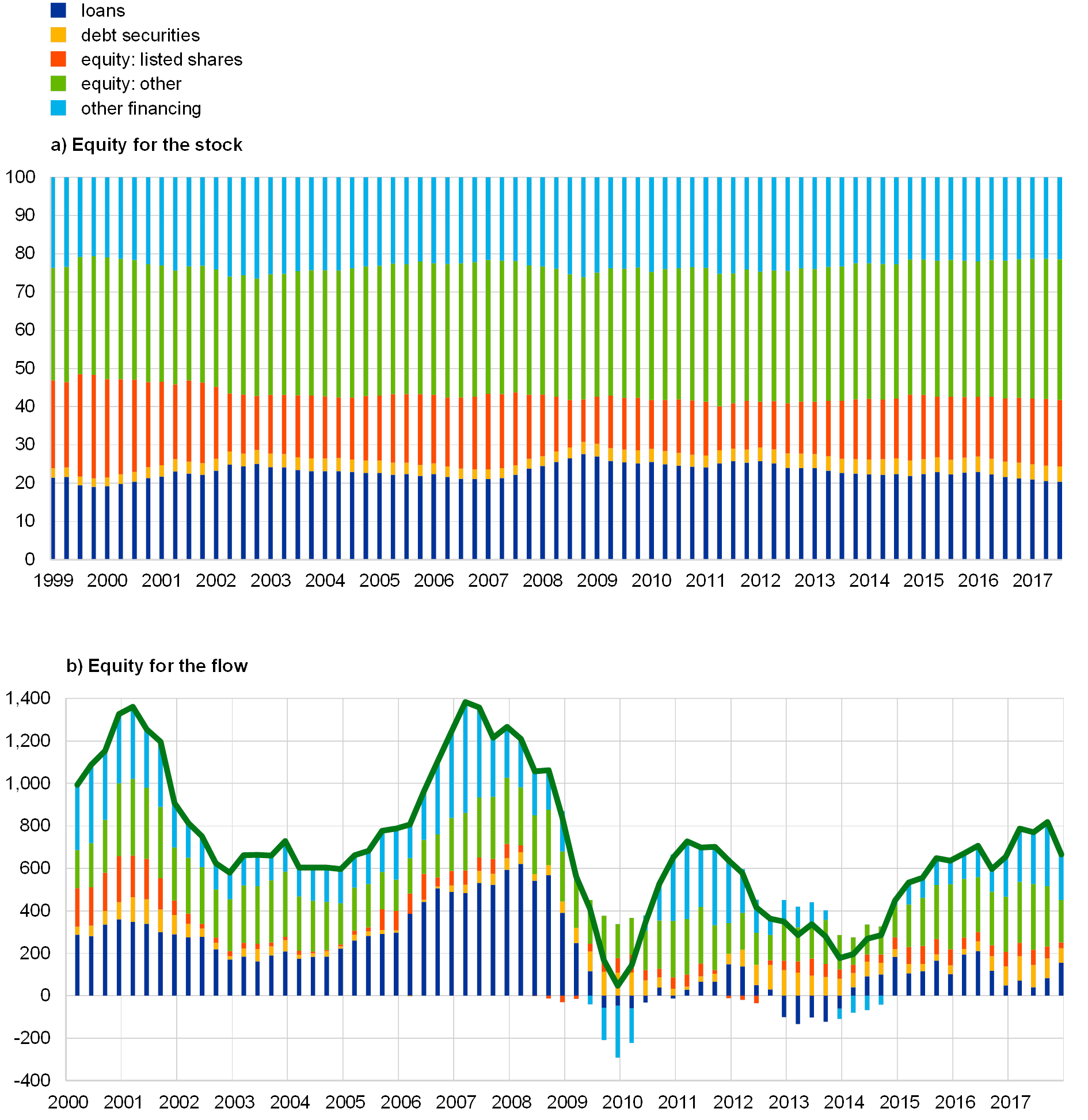

Various forms of equity financing have consistently provided a significant part of the funding structure of euro area NFCs. Owing to its perpetual nature, one euro of equity financing cannot be compared directly with one euro of debt financing. Since debt financing has to be rolled over frequently, it might be more appropriate to judge the importance of equity from a stock, rather than a flow, perspective. On aggregate, listed shares and other forms of equity financing, including the retention of earnings and the issuance of unquoted shares, accounted for 54% of the notional stock of outstanding corporate financing instruments in the fourth quarter of 2017 (see Chart 1a), putting it ahead of loans (20%), debt securities (4%) and other means of financing (22%). The share of equity financing in the outstanding stock of corporate financing instruments measured at market value has remained comparatively stable since 1999. It increased only slightly from 52% in the first quarter of 1999 to 54% by the fourth quarter of 2017. Over the same horizon, the share of loans declined from 22% to 20% and the share of debt securities rose from 3% to 4%.

Turning to the procurement of new funding by euro area NFCs, equity also constitutes a substantial source, albeit not always in the form of listed shares. Indeed, data capturing net financing flows to euro area NFCs attribute a comparatively minor role to issuing listed shares as a way of raising capital, particularly when compared with other funding instruments (see Chart 1b). Euro area NFCs have instead relied to a considerable extent on other forms of equity capital for their financing. Over certain periods such other forms even became the primary source of funding, for example in the wake of the global financial crisis, when new lending from monetary financial institutions became highly constrained. Although the provision of loans and the issuance of debt securities have noticeably recovered in recent years, other forms of equity have still accounted for a considerable share of net financing flowing to euro area NFCs.

Chart 1

The role of equity for the stock and flow of euro area NFC financing

(percentages; EUR millions, four-quarter sums)

Source: ECB.

Notes: The latest observations are for the fourth quarter of 2017. Loans include monetary financial institutions (MFI) loans, non-MFI loans and loans from the rest of the world. Other financing includes inter-company loans, trade credit and residual forms of financing. Figures are measured at market value.

2.2 Euro area NFCs’ cost of equity

In contrast to the cost of debt, the cost of equity, which represents the required return investors demand for the risk of equity ownership, has to be estimated. The cost of debt can usually be readily observed in the market, such as in the form of a bond yield or the interest rate charged on a loan, and consists of a risk-free rate of interest augmented by a credit risk premium that is determined by the riskiness of the borrower. The size of the credit risk premium is therefore relatively straightforward to obtain, by subtracting the observable risk‑free rate from the observable bond yield or the interest rate paid for a loan. Similarly, the cost of equity is commonly estimated by augmenting a risk-free rate of interest by an ERP. The ERP reflects the compensation investors demand for holding shares that entitle them to the (risky) residual claim on the profits of a company after all its other obligations have been met. However, unlike the cost of debt and the credit risk premium, neither the cost of equity nor the ERP are directly observable. For listed shares, the cost of equity and the ERP have to be estimated by applying a suite of different modelling approaches. These include the current share price, a risk-free rate and future streams of income, such as earnings or dividends, anticipated by investors. For unquoted shares and other forms of equity financing such as retained earnings, deriving the cost of equity is even more demanding because the current share price cannot be observed. Furthermore, additional risk premia may apply in these cases in order to capture, for example, the illiquidity of unquoted shares. For these reasons the remainder of this article only considers the cost of listed equity.

The cost of equity listed by euro area NFCs has remained relatively high in recent years. In particular, it has not declined in line with the cost of debt (see Chart 2), which has benefited more directly from the Eurosystem’s non-standard monetary policy measures. This has rendered equity financing, as opposed to borrowing from banks or the issuance of bonds, a comparatively expensive mean of corporate funding in recent years.

Chart 2

Nominal external financing costs of euro area NFCs

(percentages)

Source: ECB.

Notes: The latest observations are for February 2018 (short-term and long-term bank lending rates) and March 2018 (cost of listed equity and cost of market-based debt).

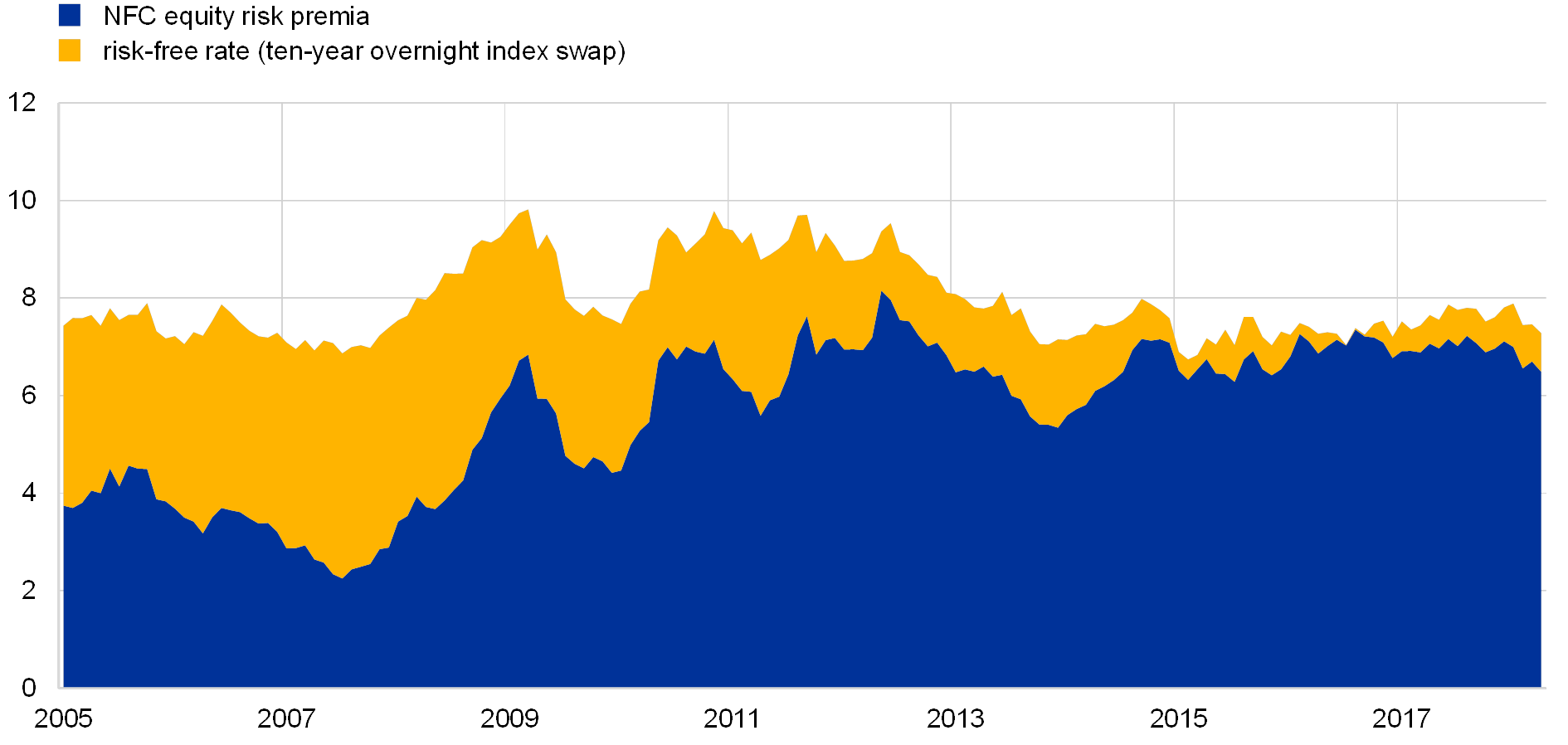

A persistently elevated ERP has been the key factor underpinning the high cost of equity for euro area NFCs. The cost of equity usually defines the required rate of return on equity at which future dividends are discounted and is calculated as the sum of the ERP and the long‑term risk-free rate. While risk-free rates have declined to historic lows, the ERP has continued to fluctuate around its level of early 2009 when the slump in equity prices accelerated after the collapse of Lehman Brothers in the previous autumn (see Chart 3). In fact, the portfolio rebalancing channel of the Eurosystem’s non-standard monetary measures seems to have had much less of an effect on equity markets than on debt markets. Whereas there is copious evidence that the various asset purchase programmes of the Eurosystem have contributed to investors seeking higher duration or credit risk,[1] evidence concerning this channel being at play in equity markets remains more scarce.

Chart 3

Decomposition of NFCs’ cost of equity

(percentages)

Sources: Thomson Reuters and ECB calculations.

Notes: Monthly data. The latest observations are for April 2018.

3 Modelling the ERP

Unlike the credit risk premium, the ERP by its nature cannot be observed, meaning that it has to be estimated on the basis of a model and by making a series of assumptions. Various models have been proposed to estimate the ERP, ranging from the simple assumption that the ERP is the difference between the current equity yield and its historical mean, to regression-based approaches and dividend discount models (DDMs).[2] Arguably, the most common and theoretically sound approaches to estimate the ERP include a notion of estimating and discounting future dividend streams – the foundation of DDMs – which is the main focus of this section.

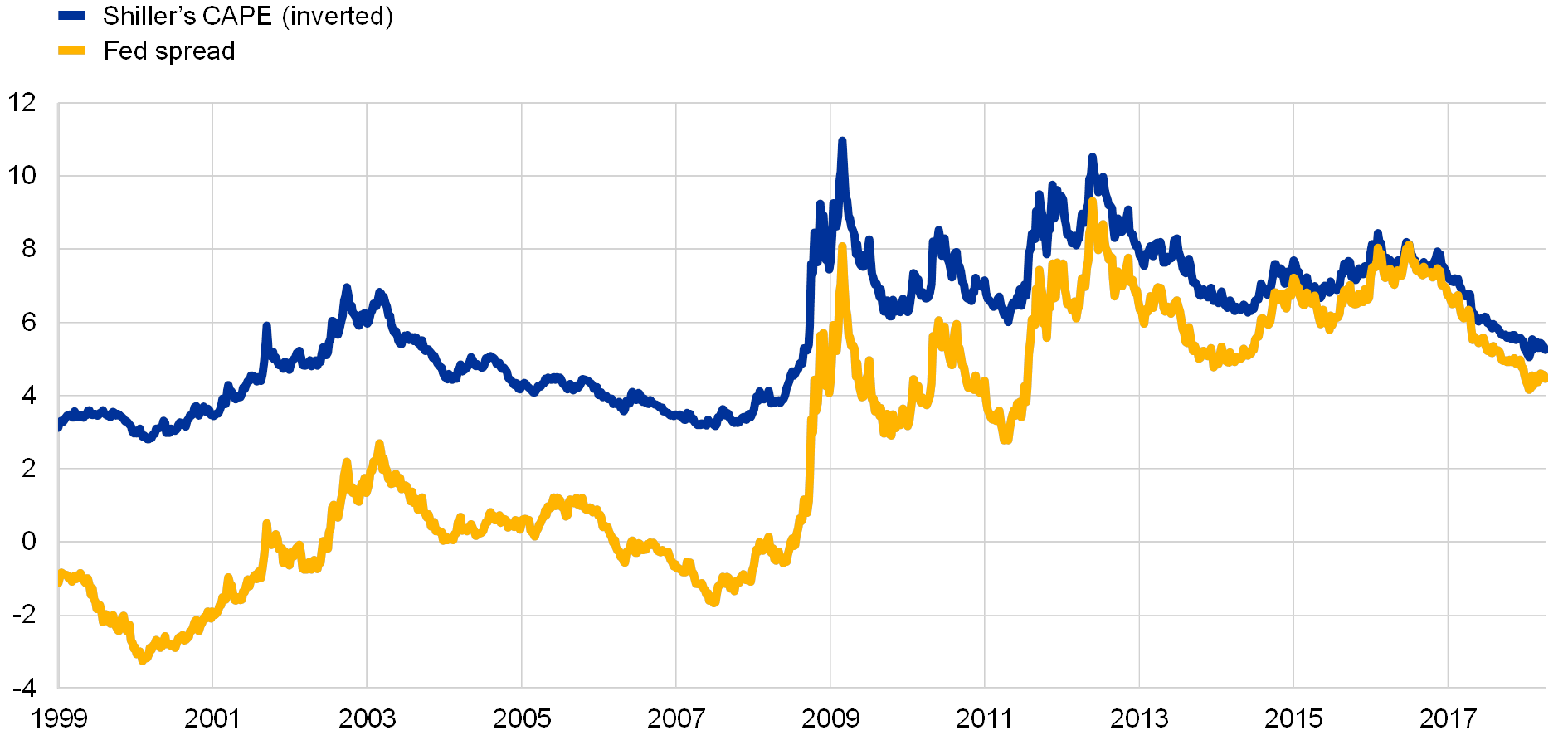

The cyclically adjusted price/earnings (CAPE) ratio suggested by Shiller only provides indirect and imprecise information on the ERP. The CAPE is calculated as the ratio of stock prices to the ten‑year moving average of earnings. When inverted, it gives the average earnings to current prices, also known as the historical earnings yield or the “inverse Shiller’s CAPE ratio” (see Chart 4). This metric is used as a benchmark for determining the value of equities relative to earnings through a (ten-year) cycle: when the metric is high, equity prices are comparatively low and the equity risk compensation is high, making it attractive to buy equity. Besides the obvious flaw of comparing past earnings with forward-looking yields, the historical earnings yield might be a misleading valuation benchmark in environments where earnings and interest rates are not moving together in line with past regularities. In particular, the historical earnings yield does not capture the fact that a given stream of earnings has a larger discounted value in a low interest rate environment than in one with a high interest rate. In this respect, it is also clear that the inverse CAPE ratio measures the absolute return on equity and not the excess return over the risk‑free rate. Therefore, even if the inverse CAPE ratio may provide some useful information on the ERP, it cannot be seen as an estimate for the ERP.

One proposal for estimating the ERP is the Fed model, where the longer-term risk-free yield is subtracted from the inverse CAPE ratio – resulting in the so‑called Fed spread (see Chart 4). A low level of the Fed spread suggests that equity prices are high relative to realised earnings and risk-free yields. It follows that the difference between the Fed spread and the inverse of the CAPE should be large in times of high interest rates, such as between 2002 and 2007, while it has been relatively small in recent years.

Chart 4

Common simple metrics of equity yield and the ERP: the CAPE and the Fed spread

(percentages)

Sources: Thomson Reuters and ECB calculations.

Note: The latest observations are for 13 April 2018.

The Fed spread however is subject to some practical and theoretical shortcomings. Most importantly, the Fed spread compares past earnings with present prices, which is inconsistent with the notion of forward-looking economic agents, and provides a reason for turning towards DDMs – the class of models presented below. As a result, the Fed spread often turns negative for prolonged periods, especially in times of relatively high interest rates, implying that market participants should be willing to hold equities at a negative premium compared with a risk-free asset. This observation is not in line with surveys and fundamental asset pricing theory.[3]

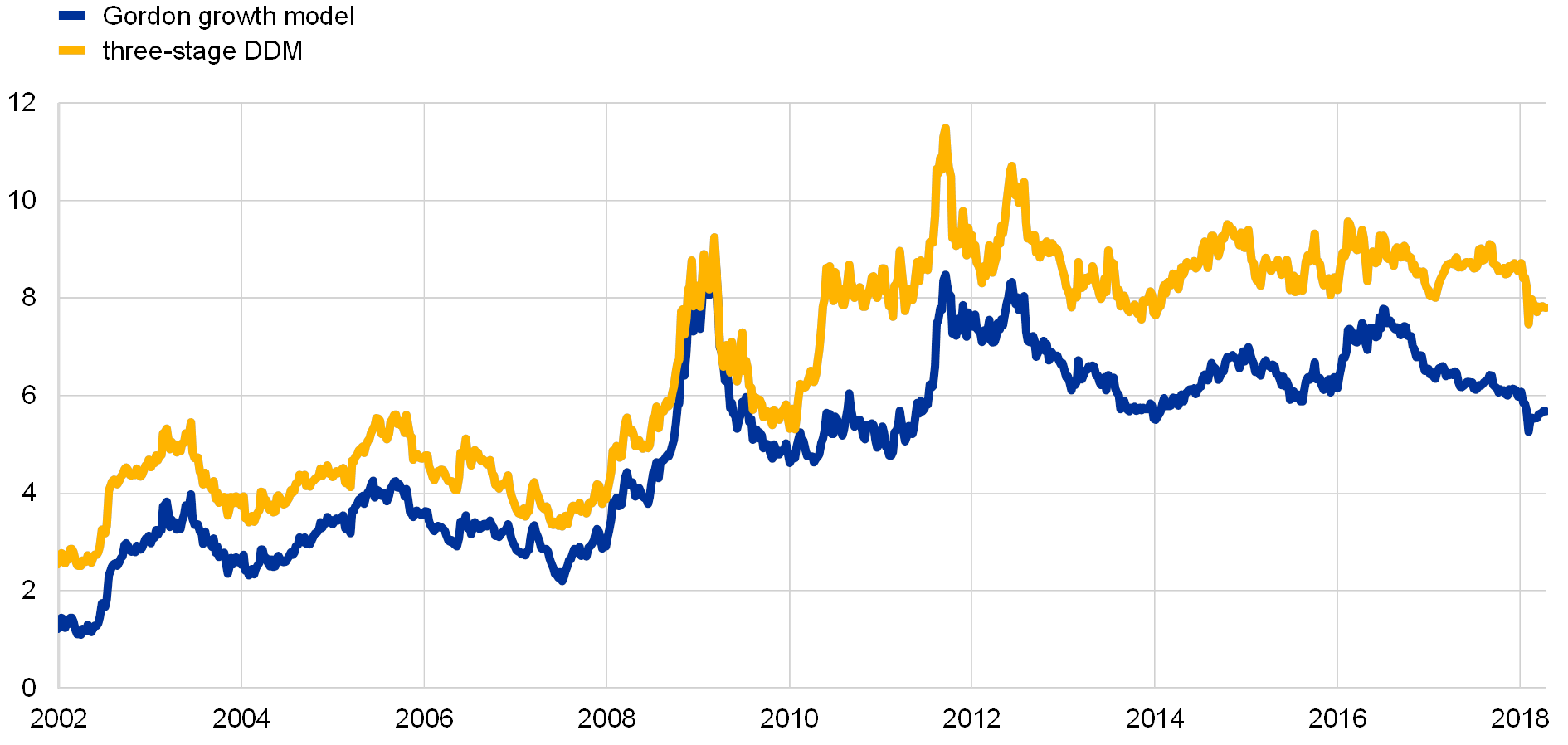

The origin of a forward-looking approach to equity valuation can be found in the Gordon growth model (see Chart 5). The model augments the concept of the Fed spread by the basic intuition that the value of a stock is determined by the value of all discounted future cash flows it produces for shareholders.[4] Historical dividends are only relevant to the extent that they contain information on future dividends. In the original representation of the Gordon growth model, payouts to shareholders are simply assumed to grow at a constant rate over time, equal to the expected growth rate of the economy. The difference in the notion of a backward-looking estimation of the ERP, such as the Fed spread, and a forward‑looking one, such as the Gordon growth model, can for example be seen during times of economic recovery, as observed in the euro area in recent years. While the ERP implied by the Fed spread declined from around 8% in 2016 to close to 4% at the current juncture, the improvement in earnings expectations, as judged by an improvement in expected long-term economic growth, resulted in a much lesser degree of implied ERP tightening as a result of the Gordon growth model.

As such, the Gordon growth model is the foundation and the simplest form of the class of DDMs – which link equity prices to expected future shareholder payouts, risk-free interest rates and an additional compensation for risk. DDMs conveniently allow for changes in equity prices to be broken down into contributions from three factors: (i) changes in expected future cash flows from equities in the form of dividends; (ii) changes in the long-term risk-free rate; and (iii) changes in the ERP.

To the extent that expected dividends, long-term risk-free interest rates and equity prices can be observed via financial market data, the ERP can be found by equating the discounted sum of future cash flows to the prevailing stock prices. The path of future expected dividends, however, is inherently unobservable and would need to be proxied on the basis of observable indicators combined with economically plausible assumptions.

One common refinement to the Gordon growth model is the three-stage DDM, which assumes that the expected dividend growth rate varies over the course of different phases and converges to a constant long-term value. In the three‑stage model, three separate phases for the dividend growth rate are commonly assumed: (i) an initial period during which dividends grow constantly at a rate of ; (ii) an intermediate period over which the initial growth rate converges linearly towards a long-term growth rate ( ); and (iii) a final indefinite period, where dividends grow at the constant annual long-term rate ( ). With the current dividend in place, this assumed sequence of growth rates identifies the complete evolution of expected future dividends.

This workhorse model allows for an easy estimation of the ERP, which can be readily obtained from observed dividend yields and the risk-free rate.[5] It can be calculated using the expression shown in the equation below, which is an approximation of the three-stage DDM, also known as the “H‑model”.[6] In the equation, denotes the required rate of return on a stock (or stock price index), the risk-free long-term rate, the ERP, and the current dividend yield, while and are the two dividend growth parameters. The parameter is the length of the initial period (first stage) plus half the length of the intermediate period (second stage). For the implementation of the model, the initial (first stage) dividend growth rate ( ) can be approximated by I/B/E/S “long-term” earnings projections[7] and the long-term growth rate ( ) (third stage) by long-term year-on-year GDP growth expectations, as reported by Consensus Economics. Stock prices and initial dividends are taken directly from financial markets, while the long-term risk-free rate is gauged from the ten-year overnight index swap rate. The latter is subtracted from the required rate of return in order to calculate the ERP. Changes to the equity price index can then be broken down into changes in growth expectations (as captured by changes in the g‑parameters), changes in the long‑term risk-free rate, or changes in the calculated equity premium.

- Since short to medium-term earnings expectations are often higher than longer-term economic growth estimates, the resulting ERP from the H‑model approximation is higher compared with that resulting from the simple Gordon growth model (see Chart 5). This regularity can easily be observed by the increasing difference in level between both ERP estimates since the height of the financial crisis. At the same time, this observation highlights the sensitivity of the ERP estimate to changes in assumptions surrounding future payouts to shareholders (see also Box 1).

- In practice, gauging estimates of expected future dividend growth is difficult and using aggregated analysts’ forecasts to capture shorter‑term growth expectations seems questionable. On the one hand, aggregate analysts’ expectations have been criticised by some for the reason that they lag, rather than lead, the economic cycle at times and are overly optimistic.[8] This is problematic if, at the same time, equity prices reflect a more up-to-date view of the economy going forward as perceived by stock market participants. On the other hand, a better gauge for earnings and dividend expectations than analysts’ expectations is hard to come by. Most importantly, one can observe that at least some firms do, over short to medium-term horizons, grow faster than the economy. For this reason data from aggregated shorter-term dividend growth expectations are used to capture earnings expectations at maturities between one and five years ahead. In fact, these data constitute the most widely used source of forward-looking earnings expectations for practitioners.

From a historical perspective, and despite some decline over the past few years, the current estimate for the ERP from the H-model in the euro area remains fairly elevated (see Chart 5), indicating that equities are not particularly highly valued relative to bonds. As estimated by the H-model, the euro area ERP increased significantly to levels between 6% and 8% in the wake of the collapse of Lehman Brothers in 2008 and it has not declined notably since then. Although a degree of uncertainty surrounds these estimates, they nonetheless suggest that equity markets have not increased in line with interest rate decreases in recent years.

Chart 5

ERP resulting from the Gordon growth model and the three‑stage DDM

(percentages)

Sources: Thomson Reuters and ECB calculations.

Note: The latest observations are for 13 April 2018.

4 Applying the H-model: dissecting changes in euro area equity prices

As demonstrated in the previous section, part of the appeal of the H‑model derives from the possibility of dissecting drivers of changes in equity prices. For policymakers, this feature is important for gaining insights into how market participants judge the current economic environment and for drawing potential conclusions for monetary policy. For example, the rise in equity prices over the last year could reflect a decrease in risk premia, a decline in risk-free rates, or an improvement in earnings expectations – all of which lead to very different policy conclusions.

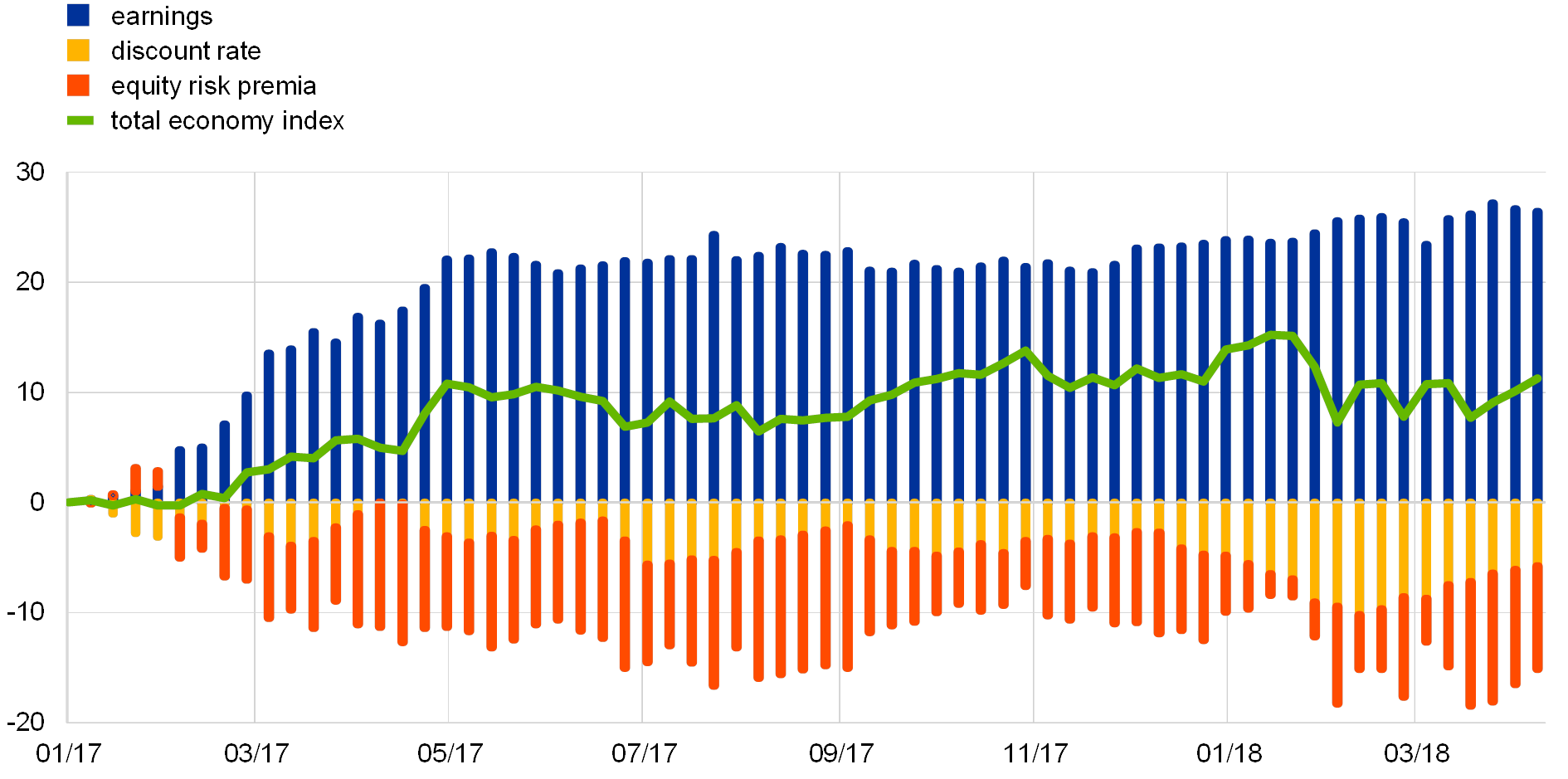

By decomposing changes since early 2017 with the help of the H-model, it can be observed that price increases in euro area equities mainly reflect improvements in earnings growth expectations for euro area firms, despite some bouts of volatility in recent months (see Chart 6).[9] At the same time, increases in the discount factor have, according to this decomposition, contributed negatively over the period, especially since late January 2018, when interest rates started to increase more substantially on the back of strengthening signs of rising inflation on a global scale. During this time, equity prices have often reacted more strongly to changes in interest rates than would normally have been implied by DDMs. The underlying economic reason for these reactions is a tug-of-war for equity prices between two mutually offsetting forces depicted in Chart 6: on the one hand, earnings expectations are still rising amid an ongoing economic expansion, warranting further price increases. On the other hand, market expectations of tightening monetary policy on the back of inflation normalisation and, therefore, higher bond yields depress the present value of future dividends – resulting in turn in lower equity valuations.

Chart 6

DDM decomposition of cumulative changes in euro area equity prices

(percentages, cumulative change)

Sources: Thomson Reuters and ECB calculations.

Note: The latest observations are for 13 April 2018.

Box 1Refinements to the three-stage dividend discount model: the role of earnings, share buy‑backs and the yield curve

Although the dividend discount model (DDM) is often implemented by approximating via the H‑model, refinements are possible, as demonstrated in this box.[10]

First, instead of solving the model via the H-model approximation as shown in the main text, a more demanding yet more precise approach is to find the implied equity risk premium (ERP) to minimise the difference between the model-implied equity price and the observed market price. Doing so has little impact on the level of the estimated ERP (see Chart A, left-hand side) and provides a basis for implementing three further changes.

Chart A

Changes in the ERP resulting from refinements to the three‑stage DDM (H-model)

(percentages)

Sources: Thomson Reuters and ECB calculations.

Notes: The left-hand side chart shows the ERP resulting from the H-model approximation in comparison with the modifications to the DDM suggested in this box. The right-hand side chart compares the final resulting ERP from the DDM, including all modifications proposed in this box, with the H-model approximation. The latest observations are for 13 April 2018.

The second modification is based on the notion that very short-term earnings expectations should also be reflected in the DDM. In the three‑stage DDM, earnings expectations were observed at only two points in time and interpolated between these two points. However, we now build a path of earnings expectations for the first five years by using both the one and five-year growth rates, thus effectively allowing for a larger share of price movements being driven by fluctuations in (shorter-term) earnings expectations. In the longer term, the assumption that expected dividend growth converges to the expected nominal long-term growth rate of the economy remains intact.

Third, all expected future dividends should be discounted along the yield curve to match the discount factor with the respective timing of the expected payout. Specifically, we discount each of the first 10 years of future earnings with 1 to 10-year overnight index swap rates. Dividends 11 years ahead or later are discounted using the 15‑year yield.

The impact of these refinements is very small (see Chart A, left-hand side). This however does not preclude the possibility that their impact might be relevant in the future. For example, if the yield curve were to steepen significantly, this would provide more vigour to the estimated results.

The impact on the estimated ERP is greater if payouts to shareholders, in addition to dividends, also include share buy-backs (see Chart A, right-hand side). Dividends make up the lion’s share of payouts to shareholders in the euro area, accounting for 86% of all payouts in 2017. This number lies considerably lower in other jurisdictions, such as the United States. Although buy‑backs are currently of secondary importance in the euro area, they constituted a larger part of total payouts prior to the financial crisis. As a result, estimates of the risk premium including share buy-backs reduce the size of the increase in the euro area ERP from the pre-crisis to the post-crisis period.

Although from a theoretical perspective it is important to include share buy-backs, doing so is relatively complex. In its original form, the DDM did not directly include share buy-backs because these did not play a large role, particularly as virtually all payouts to shareholders were in the form of dividends. Furthermore, in theory share buy-backs are of little significance, since they should be reflected in an increase in the value of future dividends to remaining shareholders. However, the data suggest that expected dividend growth estimates only account imperfectly for changes in share buy-backs.[11] Moreover, expected dividend growth appears to be a relatively poor estimate of the growth in share buy-backs. In fact, the data suggest that it would be sensible to assume that a firm’s total payout to shareholders, be it in the form of dividends or share buy-backs, is a roughly constant fraction of earnings. Consequently, current observed dividends and share buy‑backs in this model are assumed to grow in the short term with the expected growth rate of earnings, rather than dividends.

5 The ERP in the euro area and the United States

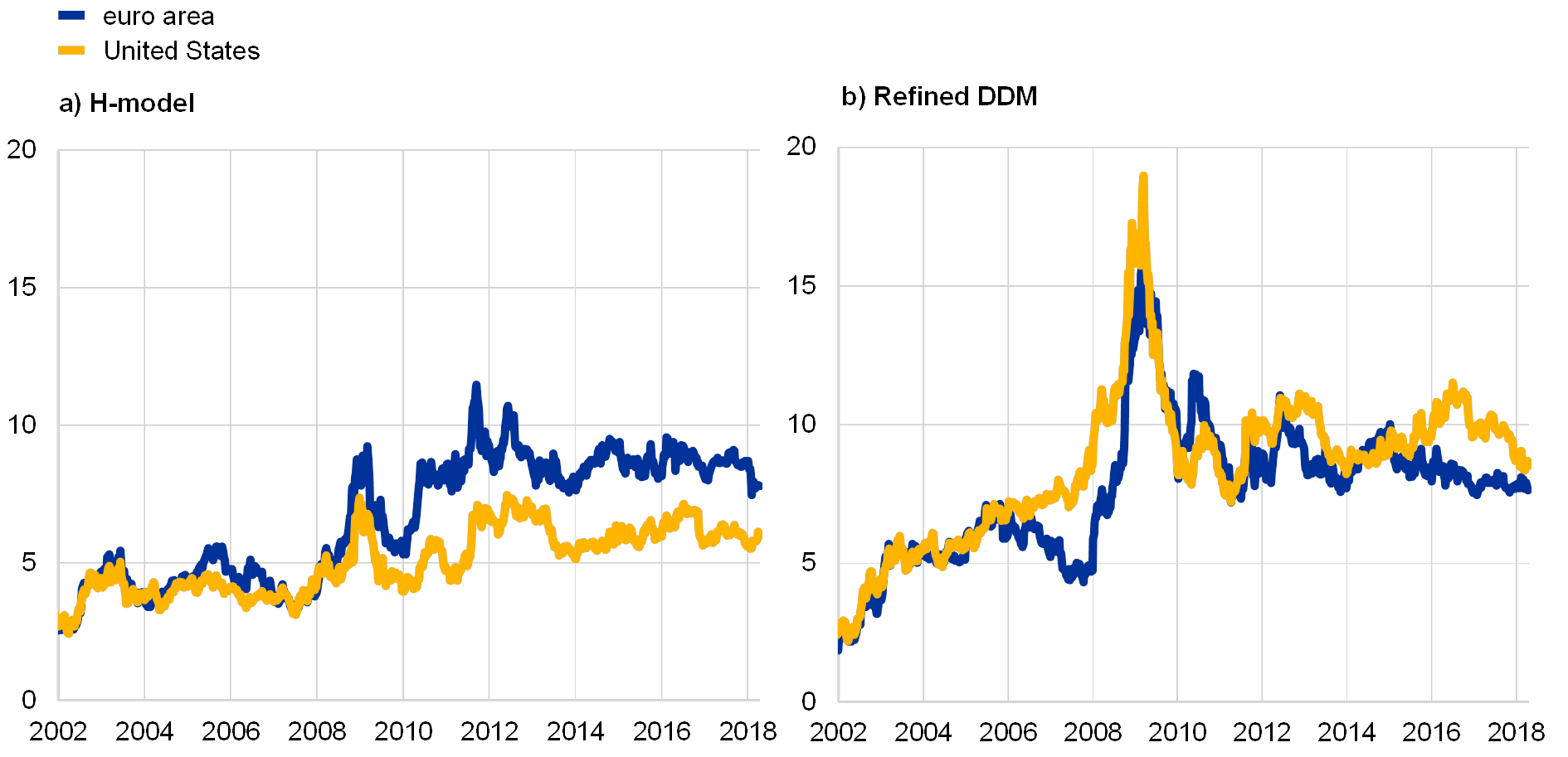

Turning to a comparison of developments in the ERP in the United States and the euro area, the H-model suggests they moved roughly in tandem prior to the financial crisis, and diverged afterwards (see Chart 7a). Since 2010 the H‑model shows a gap opening up between the two locations, with the ERP much higher in the euro area than in the United States. However, as explained in Box 1, the H‑model approximation does not include share buy-backs, which can be regarded as future income for equity holders, thus heavily underestimating the ERP should share buy-backs be substantial.

Chart 7

ERP estimates for the euro area and the United States using the H-model and the refined DDM

(percentages)

Sources: Thomson Reuters and ECB calculations.

Note: The latest observations are for 13 April 2018.

Estimating the ERP with the help of the refined model, which includes share buy-backs, leads to a somewhat different picture, highlighting the relevance of share buy-backs, particularly in US equity markets (see Chart 7b). Before the crisis, share buy-backs were common in the euro area and the United States, lifting the level of the ERP in both jurisdictions. Share buy-backs then declined during the financial crisis, and subsequently recovered much faster in the United States. When share buy-backs are included, an upward shift in the ERP can be observed for both jurisdictions (including for most of the post-crisis period). Since autumn 2016, when equity prices started their longest nearly uninterrupted rally to date, it is interesting to observe that the ERP in the United States has declined by around 4 percentage points, while that in the euro area has declined by around 2 percentage points.

Overall, it must be emphasised that the estimation, especially of the level of the ERP, remains subject to modelling and data uncertainties. The wide range of model and survey estimates of the ERP in the literature, as well as the changes in the ERP resulting from adjustments to the same class of models shown above, highlight this uncertainty. For example, while the euro area ERP is estimated to currently stand at around 8% according to the H-model, it stands somewhat below 7% according to the refined DDM. In addition, small changes in parameter assumptions, such as growth estimates, can result in relatively large changes in ERP levels. For this reason, most practitioners maintain a number of ERP models and place greater emphasis on dynamics, rather than level estimates.

6 Conclusions

Equity provides a substantial source of funding for euro area NFCs, rendering the cost of equity relevant from a monetary policy perspective. The cost of equity for euro area corporations, in comparison with the cost of debt, has stayed relatively high since the onset of the global financial crisis, underpinned by an elevated ERP.

However, quantifying the cost of equity is challenging. The suite of estimates presented in this article suggests that – even when considering the proposed model refinements – the level of the ERP still remains subject to considerable uncertainty. This advocates using a range of models for policy purposes and placing a stronger focus on the interpretation of the dynamics of the ERP. Improving upon existing modelling approaches for the cost of equity has value for policy purposes, as demonstrated by the comparison that this article draws of equity risk premia in the euro area and the United States. Indeed, a consideration of share buy-backs when estimating the cost of equity can account for some of the differences seen in the level and dynamics of equity risk premia across both jurisdictions.

- See, for example, Altavilla, C., Carboni, G. and Motto, R., “Asset purchase programmes and financial markets: lessons from the euro area”, Working Paper Series, No 1864, ECB, November 2015, or Andrade et al., “The ECB’s asset purchase programme: an early assessment”, Working Paper Series, No 1956, ECB, September 2016.

- For a complete review across different classes of ERP models, see Duarte, F. and Rosa, C., “The Equity Risk Premium: A Review of Models”, Economic Policy Review, Federal Reserve Bank of New York, 2015.

- The model is sometimes adjusted to equate real earnings to the real yield, which however does not address the shortcomings of a backward-looking valuation metric; see Gordon, M.J., The Investment, Financing, and Valuation of the Corporation, R.D. Irwin, Homewood, Illinois, 1962.

- However, as shown in Box 1, it should be noted that while dividends represent the largest share cash flows to investors, buy-backs also form an important part of shareholder compensation.

- For an in-depth discussion of the three-stage DDM, see the Box entitled “Recent drivers of euro area equity prices”, Economic Bulletin, Issue 5, ECB, 2017.

- See Fuller, R.J. and Hsia, C.-C., “A simplified common stock valuation model”, Financial Analysts Journal, Vol. 40, No 5, September-October 1984, pp. 49‑56.

- The Institutional Brokers Estimate System (I/B/E/S) provides composite estimates of the anticipated annual growth rate of earnings per share over a period of between three and five years.

- See e.g. Wright et al., “The Equity Risk Premium when growth meets rates”, Goldman Sachs Global Strategy Paper, No 26, 2017, and Dison, W. and Rattan, A., “An improved model for understanding equity prices”, Bank of England Quarterly Bulletin, 2017 Q2.

- For an earlier version of this decomposition, see the Box entitled “Recent drivers of euro area equity prices”, Economic Bulletin, Issue 5, ECB, 2017.

- For an implementation of the six-stage DDM, where several stages of shorter-term earnings are estimated from survey data, see Damodaran, A., “Equity Risk Premiums (ERP): Determinants, estimation and implication – the 2012 edition” in Roggi, Oliviero and Altman, Edward I. (eds.), Managing and Measuring Risk: Emerging Global Standards and Regulations After the Financial Crisis, 2013, pp. 343‑455. Broadly comparable refinements in terms of including buy-backs and discounting earnings with appropriate maturities as with the ones proposed in this box have also recently been implemented by other central banks (see, for example, Dison, W. and Rattan, A., “An improved model for understanding equity prices”, Bank of England Quarterly Bulletin, 2017 Q2 or “Stock market valuations – theoretical basics and enhancing the metrics”, Deutsche Bundesbank Monthly Report, April 2016).

- See, for example, Lamdin, Douglas J., “Handle with care: cost of equity estimation with the discounted dividend model when corporations repurchase”, Applied Financial Economics, Vol. 11, Issue 5, 2001, pp. 483‑487 and Stowe, John D., McLeavey, Dennis W. and Pinto, Jerald E., Share Repurchases and Stock Valuation Models, SSRN, 2007.