Euro area balance of payments (December 2005 and preliminary overall results for 2005)

In December 2005 the deficit on the seasonally adjusted current account of the euro area was EUR 5.3 billion. In the financial account, combined direct and portfolio investment showed net outflows of EUR 23 billion.

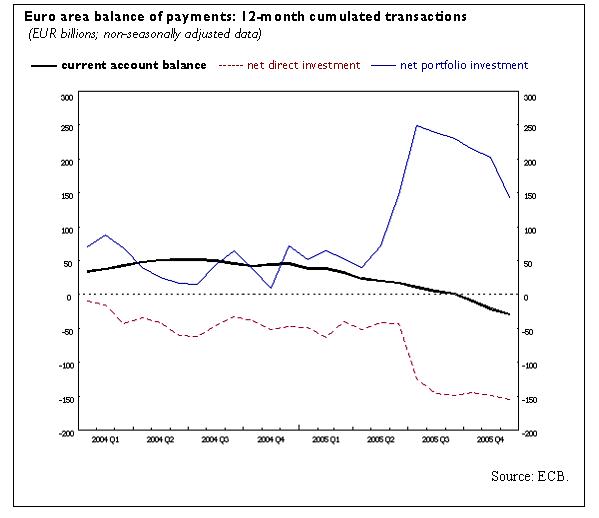

In 2005 the euro area current account shifted to a deficit of EUR 29.0 billion, from a surplus of EUR 43.5 billion in 2004, mainly as a result of a decline in the goods surplus and an increase in the income deficit. Combined direct and portfolio investment showed net outflows of EUR 13 billion in 2005, compared with net inflows of EUR 24 billion in 2004.

Current account

The seasonally adjusted current account of the euro area showed a deficit of EUR 5.3 billion in December 2005 (corresponding to a deficit of EUR 0.3 billion without seasonal adjustment). This reflected deficits in income (EUR 4.7 billion) and current transfers (EUR 6.2 billion), which were only partly offset by surpluses in goods (EUR 2.3 billion) and services (EUR 3.3 billion).

In 2005 as a whole, the deficit on the euro area current account amounted to EUR 29.0 billion (around 0.3% of GDP), as compared with a surplus of EUR 43.5 billion in 2004. This shift was mainly due to a decline in the goods surplus (from EUR 105.8 billion to EUR 58.2 billion) and an increase in the income deficit (from EUR 34.0 billion to EUR 54.0 billion).

Financial account

In the financial account, combined direct and portfolio investment recorded net outflows of EUR 23 billion in December 2005, reflecting net outflows in both direct investment (EUR 7 billion) and portfolio investment (EUR 16 billion).

The net outflows in direct investment resulted from net outflows in investment abroad on equity capital and reinvested earnings (EUR 13 billion), which were partly counterbalanced by net inflows in inter-company loans (EUR 6 billion).

In portfolio investment, net inflows in equity (EUR 31 billion) were surpassed by net outflows in debt instruments (EUR 47 billion). The net outflows in debt instruments were mainly accounted for by net sales of euro area securities by non-residents, in particular money market instruments.

Other investment recorded net outflows of EUR 23 billion as a result of net outflows by monetary financial institutions (MFIs) excluding the Eurosystem (EUR 29 billion), general government (EUR 5 billion) and the Eurosystem (EUR 4 billion), which were partly offset by inflows in other sectors, i.e. non-MFI corporations and households (EUR 15 billion).

Reserve assets decreased by EUR 7.4 billion (excluding valuation effects). The stock of the Eurosystem’s reserve assets stood at EUR 320.2 billion at the end of December 2005.

In 2005 as a whole, combined direct and portfolio investment showed net outflows of EUR 13 billion, compared with net inflows of EUR 24 billion in 2004. This shift resulted from higher net outflows in direct investment (increasing from EUR 47 billion to EUR 155 billion) that were only partly offset by increased net inflows in portfolio investment (from EUR 71 billion to EUR 143 billion). Net outflows in direct investment increased on account of both higher investment abroad by euro area residents and lower investment in the euro area by non-residents. The increase in net portfolio investment inflows mainly resulted from higher investment in euro area equities by non-residents.

Data revisions

In addition to the monthly balance of payments data for December 2005, this press release incorporates revisions for November 2005. These revisions were not very significant.

Additional information on the euro area balance of payments and international investment position

A complete set of updated euro area balance of payments and international investment position statistics is available on the ECB’s website in the “Statistics” section under the heading “Data services”/“Latest monetary, financial markets and balance of payments statistics”. The results up to December 2005 will also be published in the March 2006 issue of the ECB’s Monthly Bulletin. A detailed methodological note [pdf] is available on the ECB’s website The next press release on the euro area monthly balance of payments will be published on 23 March 2006.

Annexes

Table 1: Current account of the euro area – seasonally adjusted data.

Table 2: Monthly balance of payments of the euro area – non-seasonally adjusted data.

Európai Központi Bank

Kommunikációs Főigazgatóság

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Németország

- +49 69 1344 7455

- media@ecb.europa.eu

A sokszorosítás a forrás megnevezésével engedélyezett.

Médiakapcsolatok