- 30 OCTOBER 2024 · RESEARCH BULLETIN NO. 124

Banks Lose – someone gains: Households’ unequal exposure to financial distress

Is the burden of distress in the banking sector shared equally among households, or is it distributed unevenly? This question has been on top of policymakers’ minds since the global financial crisis. Our analysis of how temporary banking sector losses affect households of different income levels reveals that low-income households are disproportionally affected. While a few high-income individuals exposed to bank dividends may suffer losses, those who can adjust their portfolios earn high returns going forward, and overall benefit from distress in the financial sector.

Banking sector losses and their uneven impact

Disruptions in the banking sector can have a severe impact on the real economy.[2] They reduce financial intermediation, resulting in higher interest rate spreads, volatile asset prices and lower economic activity. However, the ultimate effects on households are not distributed uniformly. The impact on a given household depends on its income sources and the combination of the assets it owns. For instance, low-income households feel the pinch more from higher borrowing costs and lower wages, while high-income households are more exposed to changes in asset prices or returns on assets.

In Mendicino, Nord and Peruffo (2024), we highlight the importance of considering household heterogeneity when evaluating the impact of banking sector distress. Our analysis uses a quantitative model economy in which households are heterogeneous in several dimensions and the banking sector is subject to financial intermediation frictions. Households earn income and make portfolio choices between liquid deposits and less liquid capital (see for example Bayer et al., 2019). Banks collect deposits, issue loans to households and invest in capital subject to financial intermediation frictions which arise due to an agency problem between intermediaries and their depositors modelled as in Gertler and Kiyotaki (2010).[3] The model matches several important features of U.S. macroeconomic and banking data. It also replicates relevant facts of micro-level data on income and wealth inequality, computed from the U.S. Survey of Consumer Finance.

The model predicts that bank equity losses reduce banks’ capacity to intermediate, resulting in higher borrowing costs and falling asset prices. This ultimately results in a decline in consumption and productive investment, leading to a recession. To see how the effects vary across households, we looked at changes in consumption for households across the income distribution. We find that consumption declines by relatively more for low-income households.

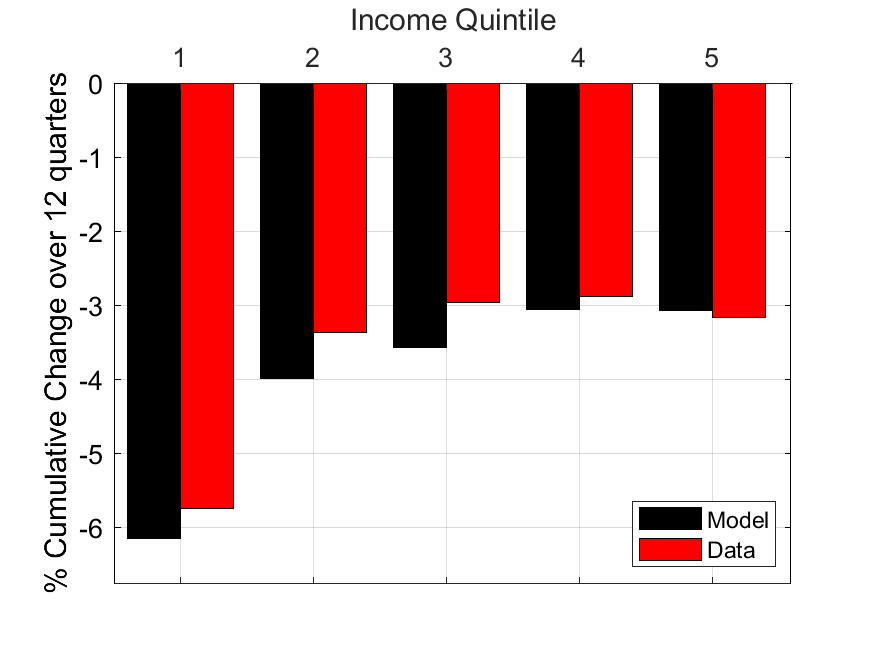

Chart 1

Model vs data consumption responses groups

Breakdown of household consumption response by income group (cumulative percentage change over 12 quarters)

Sources and notes: 12-quarter cumulative response of consumption to a 10% decline in bank equity. The model-implied and data-implied responses are represented as cumulative-log changes. Income quintiles by 1 to 5 refer, respectively, to the lowest, second lowest, middle, second highest and highest income group.

Households at the bottom 20% of the income distribution experience a total drop in consumption over three years that is about twice that of households in the top 20%. The results from our model replicate the empirical evidence from local projection estimates based on the U.S. Consumer Expenditure Survey, as in Coibion et al. (2017), and bank equity returns, as in Baron et al. (2021). Chart 1 shows how consumption for each income group responded to the falls in returns on bank equity. The strong similarity validates our model’s ability to capture the distributive impact of banking sector distress. This allows us to use it to analyse the relevant transmission mechanisms and evaluate welfare implications.

Transmission channels and welfare effects

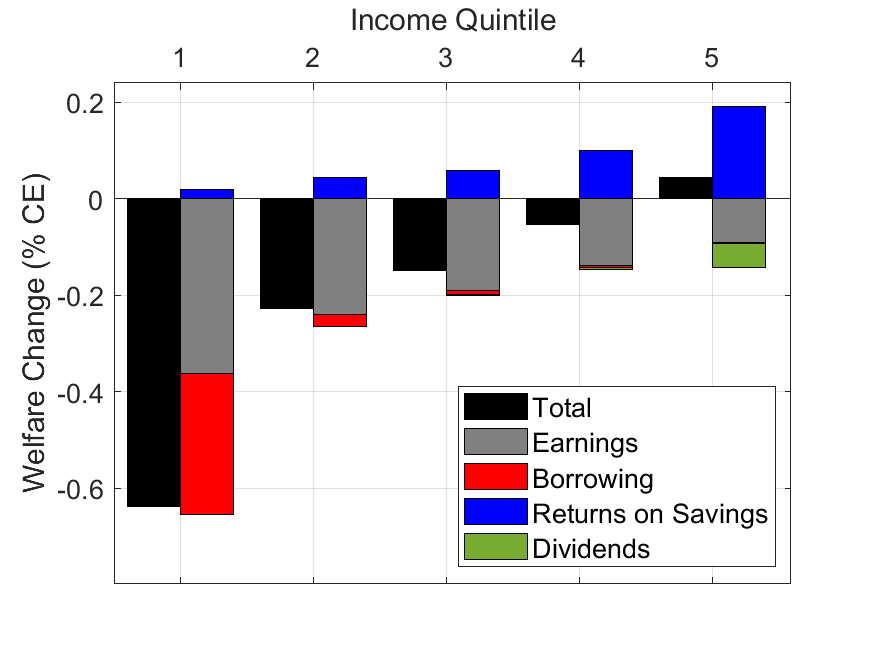

How do consumption responses to banking sector losses translate into welfare effects? Our analysis reveals that, on average, households lose from bank distress. A closer look also reveals considerable heterogeneity, with low-income households losing the most. Surprisingly, a considerably large share of high-income households – about 18% of the population – actually benefits from the bank distress.

Why do high income households suffer in terms of welfare much less than their consumption response, as shown in Chart 1, would suggest? And how can a considerable fraction of households in fact benefit from an adverse shock? To answer the above questions, and following Kaplan et al. (2018), we use the model to break down the responses of consumption and welfare into changes due to movements in earnings, interest rates and dividends.

For low-income households, the primary sources of welfare losses are fluctuations in borrowing costs and wages (see Chart 2). This owes to their reliance on labour income and limited savings. High-income households, on the other hand, are more affected by changes in financial income and asset returns. On average, the short-term decline in their consumption is partly offset by increased savings. This, coupled with higher future returns as the economy recovers from the recession, leads to an increase in their consumption over the medium term.

At the very top of the income distribution, individuals who receive bank dividends are negatively affected by their direct exposure to the banking sector. Nonetheless, on average, households in the top 20% of the income distribution still benefit from banking sector distress overall. In particular those with high incomes and large capital holdings actively buy assets when the price temporarily declines. This allows them to reap the high returns during the economic recovery, and, thus, sustain a higher level of consumption in the medium run.

A salient feature of our model is the role of household portfolio adjustments in shaping the distributional consequences of banking sector losses. In addition to our distributional results, we show that allowing households to invest directly in productive capital also has key implications for the response of the aggregate economy to standard business cycle shocks. In particular, a larger share of productive capital that is intermediated through the (frictional) financial sector means that investment becomes more volatile relative to consumption in response to aggregate fluctuations.

Chart 2

Transmission channels of welfare effects

Breakdown of welfare changes by income group

(percentage change in welfare)

Sources and notes; Decomposition obtained by simulating the model economy under a subset of equilibrium price paths, fixing all other prices at their steady state values. Income quintiles by 1 to 5 refer, respectively, to the lowest, second lowest, middle, second highest and highest income group

Conclusions

Our findings underscore the importance of considering household heterogeneity when assessing the impact of banking sector distress. A clear assessment of these heterogeneous effects is critical for understanding which households are impacted the most by banking sector disruptions, and consequently who ultimately benefits from government support to distressed financial institutions. Only by fully understanding these dynamics we can design effective interventions to protect vulnerable households from the fallout of banking crises. More broadly, policy interventions (see e.g Beck et al. 2024 for a discussion of possible policy options) aiming at restoring banks’ intermediation capacity during crisis can also improve welfare and mitigate the uneven effects of banking sector distress.

References

Baron, M., Verner, E. and W. Xiong (2021): “Banking Crises Without Panics.” Quarterly Journal of Economics, Vol. 136, pp. 51–113.

Bayer, C., Lutticke, R., Pham-Dao, L. and V. Tjaden (2019): “Precautionary savings, illiquid assets, and the aggregate consequences of shocks to household income risk.” Econometrica, Vol. 87, No. 1, pp. 255–290.

Beck, T, V Ioannidou, E Perotti, A Sánchez Serrano, J Suarez and X Vives (2024b), "Addressing banks’ vulnerability to runs, part 2: Policy options," VoxEU.org, 10 October.

Coibion, O., Gorodnichenko, Y., Kueng, L. and Silvia, J. (2017): “Innocent bystanders? Monetary policy and inequality.” Journal of Monetary Economics, Vol. 88: pp. 70–89.

Gertler, M. and Kiyotaki, N. (2010): “Financial intermediation and credit policy in business cycle analysis.” In “Handbook of monetary economics,” Vol. 3, pp. 547–599. Elsevier.

Kaplan, G., Moll, B. and Violante, G. L., (2018): “Monetary policy according to HANK.” American Economic Review Vol. 108, No. 3, pp. 697–743.

Laeven, L. and Valencia, F., (2013): “Systemic Banking Crises Database,” IMF Economic Review, Vol. 61, pp. 225–270.

Manaresi, F., Sette, E. and F. Cingano (2016): “The real effects of shocks to bank balance sheets: Evidence from Italy during the Great Recession,” VoxEU.org, 24 June 2016.

Mendicino, C., Nord, L. and M. Peruffo (2024): “Distributive Effects of Banking Sector Losses,” ECB Working Papers Series, forthcoming.

Reinhart, C. and Rogoff, K. (2009): This Time Is Different: Eight Centuries of Financial Folly, Princeton NJ, Princeton University Press.

This article was written by Caterina Mendicino (Directorate General Monetary Policy, European Central Bank). Lukas Nord (University of Pennsylvania) and Marcel Peruffo (University of Sydney). The authors gratefully acknowledge the comments of Luc Laeven, Alexander Popov, Gareth Budden, and Zoë Sprokel. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

See e.g. Reinhart and Rogoff (2009Laeven and Valencia (2013); ), Manaresi, Sette, Cingano (2016), Baron, Werner and Xiong, (2021).

This agency issue limits the leverage ratios of intermediaries in an endogenous manner, linking overall credit to the equity capital of the intermediary sector.