- 19 MARCH 2024 · RESEARCH BULLETIN NO. 117

Shocked to the core: a new model to understand euro area inflation

The pandemic's disruption of global supply chains and the spike in natural gas prices following Russia’s invasion of Ukraine were significant drivers of surging inflation. Traditional inflation models often ignore such supply-side shocks, even though they can have a significant and persistent impact on core inflation in the euro area (as measured by rates of change in the Harmonised Index of Consumer Prices excluding the energy and food components). In response, we propose a new model that takes these and other factors into account, particularly as future inflation dynamics could be shaped by the impact of geopolitical tensions on supply chains and the role of gas in the green transition.

New inflationary drivers come to the fore after the pandemic

Simple models that employ a handful of variables have traditionally proven effective in explaining developments in core inflation. However, the inflationary landscape that unfolded after the COVID-19 pandemic was unprecedented, with price pressures from many different sources hitting the economy at the same time. “Old” culprits, such as oil prices and developments in aggregate demand, played an important role, but “new” types of inflation drivers also gained prominence, most notably those related to gas prices and global supply chain bottlenecks.

Gas price rises used to be largely overlooked as a source of inflation and only came to the fore following the Russian invasion of Ukraine. In the past, in gas supply contracts in Europe prices were indexed to oil prices, and thus typically not considered as inflationary drivers in their own right. However, a gradual shift towards a deregulated gas market in recent years has increased the likelihood of idiosyncratic gas price shocks, with those that occurred following the invasion being a prominent example.

Global supply chain disruptions are another type of inflationary shock that was largely disregarded prior to the pandemic. However, as Carrière-Swallow et al. (2023) argue, shocks to shipping costs have inflationary impacts similar to those of oil and food price shocks. Additionally, Liu and Nguyen (2023) go so far as to say that supply chain pressures accounted for about 60% of the post-pandemic inflation surge in the United States. Therefore, distinguishing global supply chain bottlenecks from more generic supply shocks related to advances in technology might offer useful insights for understanding inflation developments.

A new model for inflation

The multitude of inflationary pressures that arose in the post-pandemic period created the need to expand the information set and employ models incorporating a broader array of variables.

To disentangle the drivers of core inflation, in Bańbura, Bobeica and Martínez Hernández (2023) we employ a Bayesian vector autoregressive model that uses monthly data on 17 variables and identifies eight shocks. On the demand side, these comprise a domestic demand shock and a foreign demand shock, whereas on the supply side we identify shocks related to oil supply, oil-specific demand, gas prices, global supply chain bottlenecks, domestic supply and labour markets.

The identification of “new” shocks comes with the challenge of how to best isolate them from other more standard demand-side and supply-side shocks. For example, the high correlation between oil and gas prices in the past makes it challenging to identify separate shocks in these markets. We assume that positive shocks related to gas price developments increase wholesale gas prices and energy producer prices contemporaneously, and negatively affect economic activity. At the same time, crude oil prices are assumed not to react contemporaneously to gas price shocks, based on previous results in the literature which find that oil prices tend not to be affected by shocks specific to natural gas markets (Rubaszek, Szafranek and Uddin, 2021). Using these restrictions we can distinguish gas price shocks from oil-related shocks.

In order to identify shocks linked to global supply chain bottlenecks, they must be isolated from other influences, particularly those related to developments in energy commodities, which affect shipping costs. Our identification approach relies on restrictions related to the Global Supply Chain Pressure Index (Benigno, di Giovanni, Groen and Noble, 2022) and the euro area Purchasing Managers’ Index for suppliers’ delivery times.

Other shocks are also identified by restricting the contemporaneous reaction of appropriate variables. In order to overcome computational difficulties related to many identifying restrictions, we follow Korobilis (2022), modifying the model to make it fit for a sample including post-pandemic observations. The model’s parameters are estimated with Bayesian techniques, which also helps to avoid overfitting.

What explains the post-pandemic surge in core inflation?

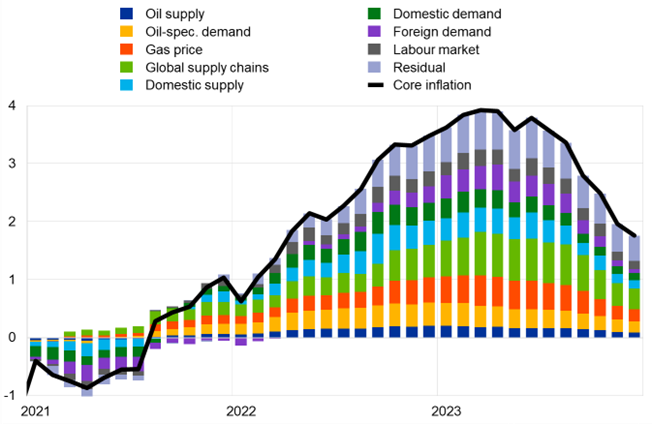

Focusing on the post-pandemic surge, Chart 1 shows the historical decomposition of core inflation.

Chart 1

The drivers of euro area core inflation

Annual percentage changes, in deviations from the mean and from the contribution of initial conditions

Sources: Eurostat and authors’ calculations.

Notes: The chart shows the point-wise mean of the posterior distribution of the historical decomposition of core inflation.

Our findings indicate that core inflation in the euro area was largely driven by supply-side shocks during the post-pandemic recovery. We show that global supply chain shocks, gas price shocks and oil price shocks all pushed inflation in the same direction, supporting the narrative that the high inflation episode was due to “bad luck”. In particular, shocks linked to global supply chain pressures and to gas prices made a much larger contribution than in past inflation episodes. Energy-related shocks played a particularly prominent role and accounted for roughly one-quarter of the surge in core inflation from the beginning of 2021 until the peak in early 2023. Gas price shocks comprised about half of that contribution, whereas in the past they typically had little effect on core inflation. Global supply chain shocks made a significant contribution to core inflation, especially from the second half of 2022, although in contrast to e.g. De Santis (2024), we do not find that these shocks made a greater contribution than that of the energy-related supply shocks.

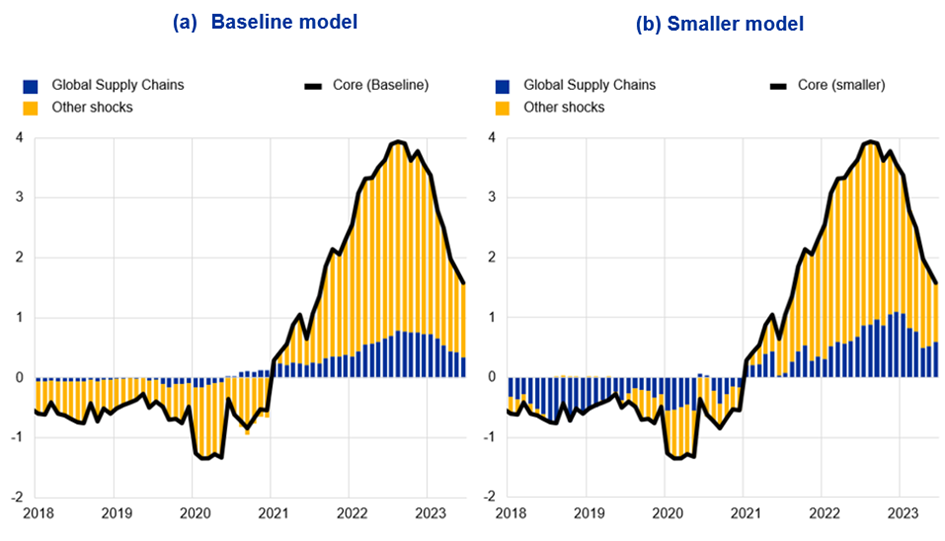

An important finding is that relying on an overly limited set of shocks and variables might exaggerate the importance of certain selected drivers in the post-pandemic period, when many economic series featured simultaneous upward dynamics. As illustrated in Chart 2, the contribution of global supply chain shocks is larger when derived from a smaller model compared with the baseline specification in our paper. The smaller model also overestimates the absolute contribution from these shocks in the low-inflation period.

Chart 2

Global supply chain shocks – contributions to core inflation based on the baseline model and on a smaller model

Annual percentage changes, in deviations from the mean and from the contribution of initial conditions

Sources: Eurostat and authors’ calculations.

Notes: The chart shows the point-wise mean of the posterior distribution of the contributions to the historical decomposition of core inflation. The smaller model is based on the identification of four shocks using 13 variables while our baseline model uses 17 variables and identifies eight shocks. The bars in yellow (other shocks) show the sum of the contributions of other shocks identified in each model and of the idiosyncratic component.

How central banks look at core inflation

Given the volatility of headline inflation rates, several central banks place special emphasis on core inflation in their communications, as a useful gauge of more domestic and more persistent inflation dynamics. However, core inflation can at times be affected by sizeable supply-side shocks, as happened after the pandemic (see also Lane, 2023).

An important feature of the framework we propose is that we can estimate how core inflation would have developed in the absence of certain shocks, which allows policymakers to “look through” these shocks. A counterfactual measure of core inflation that excludes the effects of energy shocks and global supply chain shocks has been more stable after the pandemic, although it too increased to record levels. The same is true of other popular measures of underlying inflation (see Appendix in Bańbura et al., 2023, and for details on the underlying inflation measures see also Bańbura, Bobeica, Bodnár, Fagandini, Healy and Paredes, 2023).

Conclusions

We argue that a sizeable part of the recent surge in inflation has been driven by supply-side factors, with those related to gas prices and global supply chain bottlenecks playing a prominent role. Such factors are likely to continue to be relevant in explaining future inflation dynamics. Natural gas could be used increasingly in the green transition process, after being classified as a sustainable energy source by the European Commission in 2022. Similarly, disruption along the production chain is likely to reoccur, such as the elevated shipping costs associated with the current tensions in the Red Sea.

For these reasons, inflation models should incorporate shocks to gas prices on top of more traditional oil price shocks. They should also integrate supply chain bottlenecks, in addition to more generic aggregate supply developments. New types of inflation drivers may materialise in the future. An important feature of the model we propose is its adaptability in incorporating new variables and shocks as they become relevant.

References

Bańbura, M., Bobeica, E., Bodnár, K., Fagandini, B., Healy, P. and Paredes, J. (2023), “Underlying inflation measures: an analytical guide for the euro area”, Economic Bulletin, Issue 5, ECB.

Bańbura, M., Bobeica, E. and Martínez Hernández, C. (2023), “What drives core inflation? The role of supply shocks”, Working Paper Series, No 2875, ECB.

Benigno, G., di Giovanni, J., Groen, J.J.J. and Noble, A.I. (2022), “The GSCPI: A new barometer of global supply chain pressures”, Staff Reports, No 1017, Federal Reserve Bank of New York, May.

Carrière-Swallow, Y., Deb, P., Furceri, D., Jiménez, D., and Ostry, J. D. (2023), “Shipping costs and inflation”, Journal of International Money and Finance, Vol.130, p.102771, February.

Korobilis, D. (2022), “A new algorithm for structural restrictions in Bayesian vector autoregressions”, European Economic Review, Vol.148, p.104241, September.

Lane, P.R. (2023), “Underlying inflation”, lecture at Trinity College Dublin, 6 March.

Liu, Z. and Nguyen, T. L. (2023), “Global Supply Chain Pressures and US Inflation”, FRBSF Economic Letter, Federal Reserve Bank of San Francisco, No 2023-14, pp.1-6, June.

Rubaszek, M., Szafranek, K. and Uddin, G. S. (2021), “The dynamics and elasticities on the U.S. natural gas market. A Bayesian Structural VAR analysis”, Energy Economics, Vol. 103, p.105526, November.

De Santis, R. (2024), “Supply chain disruption and energy supply shocks: impact on euro area output and prices”, Working Paper Series, No 2884, ECB.

This article was written by Marta Bańbura, Elena Bobeica and Catalina Martínez Hernández (all Directorate General Economics, European Central Bank). The authors gratefully acknowledge the comments of Gareth Budden, Alexandra Buist, Matteo Ciccarelli, Sarah Holton and Alex Popov. It is based on the paper entitled “What drives core inflation? The role of supply shocks” by the same authors, which was published as an ECB Working Paper. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.