PRESS RELEASE

8 October 2015 - Euro area quarterly balance of payments and international investment position (second quarter of 2015)

- The current account of the euro area showed a surplus of €294.4 billion (2.9% of euro area GDP) in the four quarters to the second quarter of 2015.

- At the end of the second quarter of 2015 the international investment position of the euro area recorded net liabilities of €0.9 trillion (approximately 9% of euro area GDP).

Current account

The current account of the euro area showed a surplus of €67.1 billion in the second quarter of 2015, compared with €35.9 billion in the same quarter of 2014 (see Table 1). The increase in the current account surplus was due to an increase in the surplus for goods (from €61.2 billion to €86.4 billion) and a decrease in the deficits for primary income (from €13.2 billion to €9.3 billion) and secondary income (from €33.6 to €29.4 billion). This was partly offset by a decrease in the surplus for services (from €21.4 billion to €19.4 billion).[1]

The decrease in the surplus for services resulted mainly from a deterioration in the balances for the insurance, pension and financial services (a decrease in the surplus from €4.1 billion to €3.4 billion) and “other” (an increase in the deficit from €3.8 billion to €8.2 billion) components. This was partly offset by an improvement in the balance for the telecommunication, computer and information services component, where the surplus rose from €11.4 billion to €14.3 billion.

The decrease in the primary income deficit resulted primarily from an increase in the investment income surplus for direct investment.

In the four quarters to the second quarter of 2015 the current account of the euro area showed a surplus of €294.4 billion (2.9% of euro area GDP), compared with a surplus of €195.7 billion (1.9% of euro area GDP) a year earlier. The rise resulted from increases in the surpluses for goods (from €216.5 billion to €295.4 billion) and primary income (from €49.0 billion to €69.9 billion), and from a decrease in the deficit for secondary income (from €145.7 billion to €135.8 billion). It was partly offset by the decrease in the surplus for services (from €75.8 billion to €64.7 billion).

The geographical breakdown

The increase in the surplus for the euro area goods account in the four quarters to the second quarter of 2015 resulted from improvements in the trade balance vis-à-vis most euro area trading partners (see Table 2). This was particularly visible in the increase in the surplus vis-à-vis the United States (from €82.7 billion to €104.9 billion) and in the change from a deficit (of €11.9 billion) to a surplus (of €34.2 billion) vis-à-vis “other countries”. The increase in the deficit vis-à-vis China (from €69.3 billion to €89.2 billion) partly offset this. The decrease in the surplus for services resulted mainly from an increase in the deficit vis-à-vis “offshore financial centres” (from €20.9 billion to €33.4 billion).

In the four quarters to the second quarter of 2015 non-euro area EU Member States (excluding the United Kingdom) remained the euro area’s main partners for trade in goods, accounting for approximately 19% of all euro area imports and exports, followed by the United Kingdom for exports and China for imports (see Chart 2). As regards euro area trade in services, the United Kingdom was the largest recipient of exports (accounting for 19% of the total) and the United States the largest provider, accounting for over 22% of total euro area imports of services.

International investment position

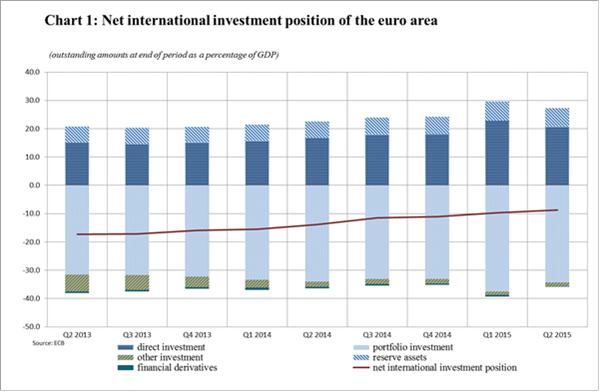

At the end of the second quarter of 2015 the international investment position of the euro area recorded net liabilities of €0.9 trillion vis-à-vis the rest of the world (approximately 9% of euro area GDP; see Chart 1). This represented a decrease of €101 billion in net liabilities compared with the first quarter of 2015 (see Table 3).

This decrease resulted from lower net liability positions for portfolio investment (€3,526 billion, down from €3,830 billion) and financial derivatives (€22 billion, down from €69 billion). These movements were partly offset by (i) lower net asset positions for direct investment (€2,131 billion, down from €2,329 billion) and reserve assets (€658 billion, down from €690 billion) and (ii) a higher net liability position for other investment (€135 billion, up from €114 billion).

The change in the net international investment position of the euro area is mostly attributable to large revaluations – changes in exchange rates and asset prices – and other volume changes (see Chart 3). However, transactions were the main contributor to the increase in direct investment liabilities, as well as the decreases in other investment assets and liabilities.

At the end of the second quarter of 2015 the gross external debt of the euro area amounted to €12.6 trillion (approximately 123% of euro area GDP), which represents a decrease of over €340 billion compared with the previous quarter. The net external debt also decreased by approximately €40 billion.

The geographical breakdown

At the end of the second quarter of 2015 the stock of euro area direct investment abroad (assets) was €8.8 trillion, 26% of which was invested in the United States and 19% in the United Kingdom (see Table 4). The stock of foreign direct investment in the euro area (liabilities) was €6.7 trillion, with 28% coming from residents in the United States and 20% from offshore financial centres.

As regards portfolio investment, euro area holdings of foreign securities amounted to €7.1 trillion at the end of the second quarter of 2015, largely reflecting holdings of securities issued by residents in the United States (which accounted for 35% of the total), as well as by residents in the United Kingdom (16%). Non-residents’ holdings of securities issued by euro area residents stood at €10.6 trillion at the end of the second quarter of 2015.

As regards other investment, euro area residents’ holdings of assets abroad amounted to €4.8 trillion at the end of the second quarter of 2015, with 34% vis-à-vis residents in the United Kingdom and 16% vis-à-vis residents in the United States. Other investment liabilities came to €5.0 trillion, with residents in the United Kingdom accounting for 33% of the total and residents in the United States for 14%.

Data revisions

This press release incorporates large revisions to the data for all the reference periods between the first quarter of 2009 and the first quarter of 2015. These revisions reflect improvements in the national contributions to the euro area aggregates following the introduction of the new statistical standards.

Additional information

- Time series data: ECB’s Statistical Data Warehouse (SDW).

- Methodological information

- Next press releases:

- Monthly balance of payments: 20 October 2015 (reference data up to August 2015).

- Quarterly balance of payments and international investment position: 13 January 2016 (reference data up to the third quarter of 2015)

Annexes

- Table 1: Current account of the euro area

- Table 2: Current and capital account of the euro area – geographical breakdown

- Table 3: International investment position of the euro area

- Table 4: International investment position of the euro area – geographical breakdown

For media queries, please contact Philippe Rispal, Tel.: +49 69 1344 5482.

Notes

[1] In broad terms, the new BPM6 concept of “primary income” corresponds to the old BPM5 concept of “income”, and the new concept of “secondary income” corresponds to the old concept of “current transfers”.

Europejski Bank Centralny

Dyrekcja Generalna ds. Komunikacji

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Niemcy

- +49 69 1344 7455

- media@ecb.europa.eu

Przedruk dozwolony pod warunkiem podania źródła.

Kontakt z mediami