ECB publishes Consolidated Banking Data for Dec-2014

- Inclusion of newly harmonised supervisory data facilitates richer statistical analysis

- New data set based on harmonised definition of non-performing-loans

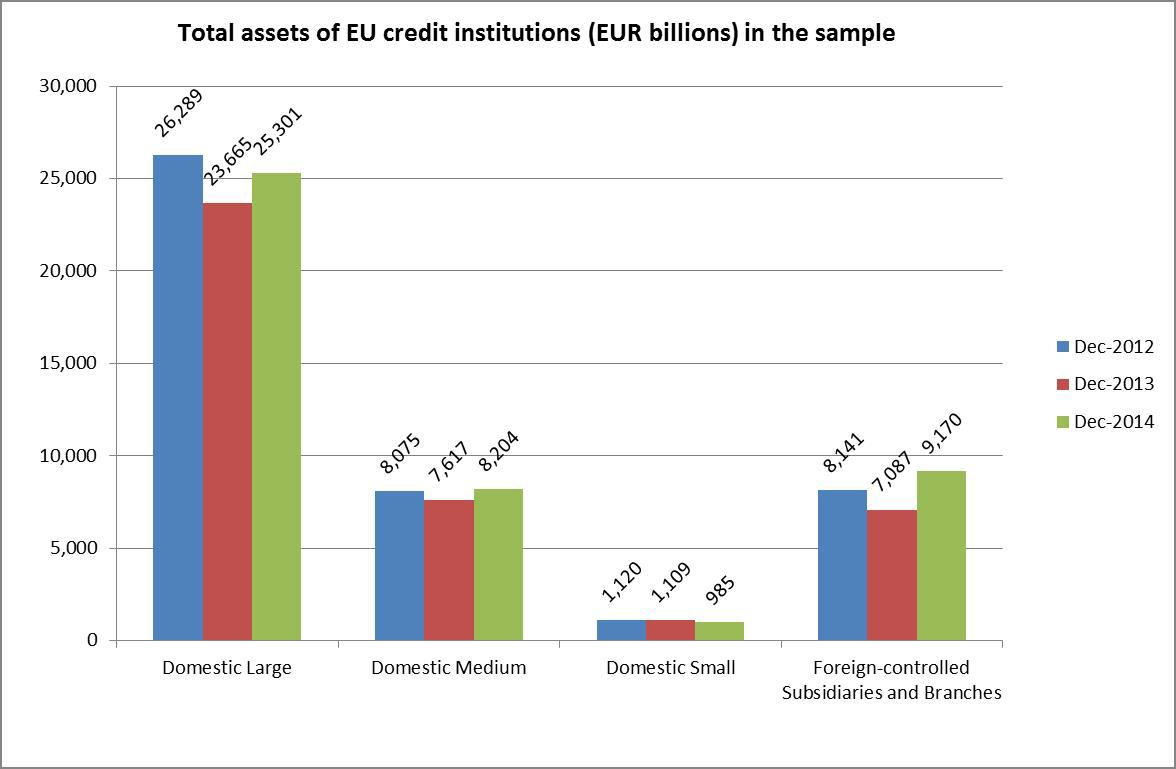

- Total assets of credit institutions in the euro area increased in 2014 by €496bn to €28,085bn

The European Central Bank (ECB) has published the December-2014 Consolidated Banking Data (CBD), a data set of the EU banking system on a consolidated basis. In comparison to the previous releases, the Consolidated Banking Data published today are significantly enhanced, drawing on the substantial increase in the availability and extent of harmonised supervisory data from across the EU. This has been possible due to the entry into force of the European Banking Authority’s Implementing Technical Standards on Supervisory Reporting (ITS). In particular, the indicators on asset quality have largely been replaced by new data based on a harmonised definition of non-performing loans as well as key items on forbearance. New statistics are also provided to measure liquidity, funding and encumbered assets.

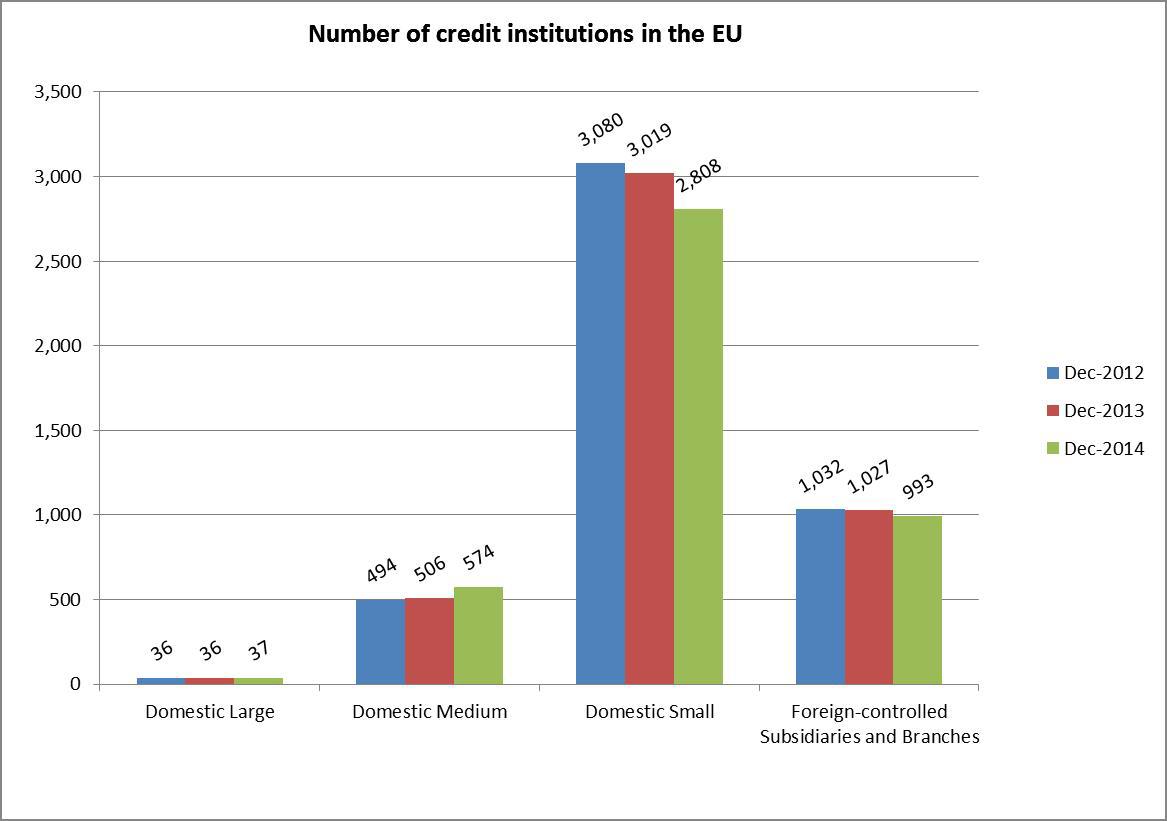

The Consolidated Banking Data include statistics on individual EU Member States and on the European Union and Euro Area as a whole. The data refer to 440 banking groups together with 3,972 stand-alone credit institutions, and include data for 993 foreign-controlled branches and subsidiaries operating in the EU, covering nearly 100% of the EU banking sector balance sheet. This data set includes an extensive range of indicators on profitability and efficiency, balance sheets, liquidity and funding, asset encumbrance, non-performing loans developments and capital adequacy and solvency.

The previous CBD framework and data points already provided a comprehensive set of data and the continuity of key items and indicators has been ensured to the extent possible.

Disclosed aggregates and indicators are published for the full sample of the banking industry, which comprises reporters (data sources) applying IFRS and the EBA ITS on supervisory reporting (IFRS-FINREP), reporters applying national accounting standards and the EBA ITS (GAAP-FINREP) and reporters not applying the EBA ITS at all (Non-FINREP”). Aggregates and indicators are published also for FINREP (IFRS-FINREP and GAAP-FINREP reporters) or IFRS-FINREP reporters, based on the availability of the underlying items.

As this is the first time CBD data are reported based on the new reporting framework, data have to be viewed as provisional and may in certain instances be subject to revisions. Furthermore, the reporting is subject to a short phasing-in; therefore some data is necessarily incomplete.

The CBD series for EU banking groups is available on a cross-border and cross-sector basis, where “cross-border” refers to branches and subsidiaries located outside the domestic market and “cross-sector” to affiliates of banking groups that can be classified as other financial institutions. Insurance companies are not included within the consolidation perimeter.

The CBD data are separately reported for domestic banking groups (broken down into small, medium-sized and large groups). Information is also provided on foreign-controlled institutions active in EU countries.

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes:

- The Consolidated Banking Data are available in the ECB Statistical Data Warehouse: [ http://sdw.ecb.europa.eu/browse.do?node=9689600].

- The data and more information about the methodology behind the data compilation are available on the ECB’s website: http://www.ecb.int/stats/money/consolidated/html/index.en.html.

Európai Központi Bank

Kommunikációs Főigazgatóság

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Németország

- +49 69 1344 7455

- media@ecb.europa.eu

A sokszorosítás a forrás megnevezésével engedélyezett.

Médiakapcsolatok