Towards a green capital markets union: developing sustainable, integrated and resilient European capital markets

Published as part of the Macroprudential Bulletin 15, October 2021.

Capital markets are key to meeting the EU’s climate ambitions. A substantial amount of investment and funding is required to meet the important EU goal of carbon neutrality by 2050. The European Commission estimates that the EU will need €480 billion in additional investment per year over this decade to meet its 2030 emissions reduction target.[1] Capital markets are expected to act as a catalyst for mobilising and allocating financing, thus complementing bank lending and public investments.[2] This publication highlights that green capital markets are growing rapidly and appear to be more resilient and better integrated than traditional capital markets. However, without further efforts to enhance underlying capital market structures and standards, the risks of national fragmentation and greenwashing remain high and can inhibit the development of integrated and resilient green capital markets, further growth in green finance and ultimately the transition towards carbon neutrality. Enhancing the comparability and standardisation of sustainable finance products is urgently needed to alleviate these risks. Moreover, the development of sizeable, mature and integrated green EU capital markets also requires decisive action to strengthen capital markets beyond the sustainable finance segment notably by advancing on the EU Capital Markets Union.

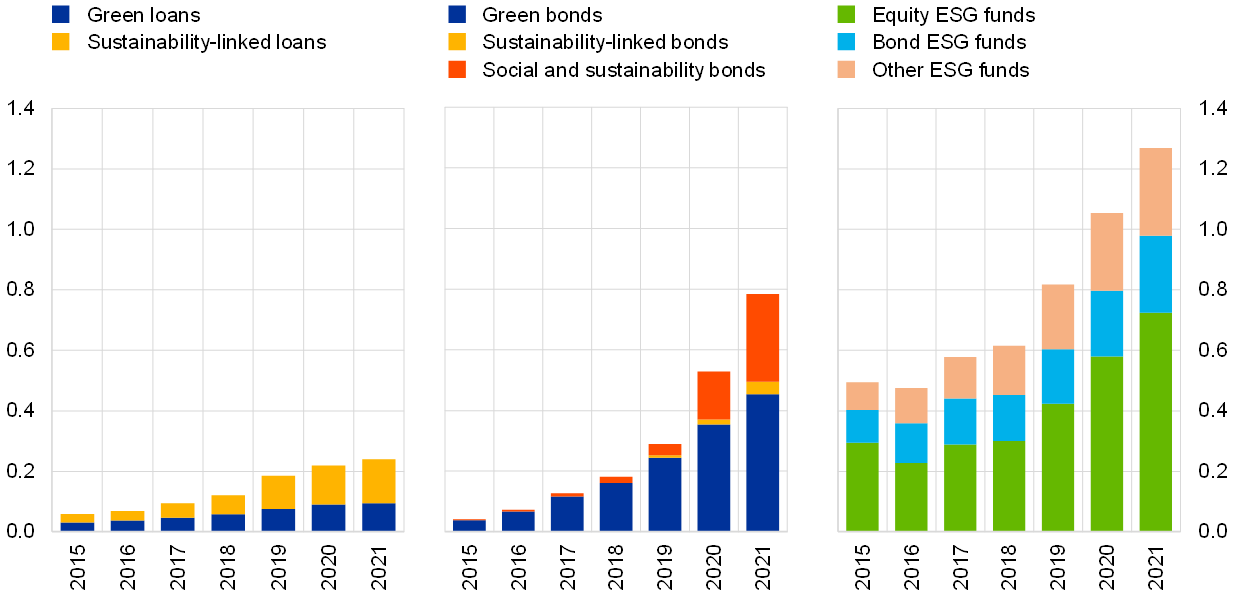

Euro area sustainable debt markets are developing rapidly and the issuance of sustainable bonds in 2020 was more than three times larger than the amount of green loans. Sustainable financial instruments – such as green, sustainable and sustainability-linked bonds, and environmental, social and governance (ESG) funds – still represent less than 10% of their respective markets in the euro area, but their outstanding amount has grown rapidly in the last six years (Chart A). The European Commission’s plan to issue up to €250 billion of green bonds between mid-2021 and 2026 as part of the EU recovery fund, NextGeneration EU, will further expand these markets.[3],[4] In addition, the assets under the management of investment funds and institutional investors with an explicit green/sustainable mandate has almost tripled since 2015, and the number of financial institutions that have committed to financing the net-zero transition is increasing sharply.[5]

Chart A

Sustainable capital market financing versus bank lending

Outstanding amount and assets under management (AUM) of euro area sustainable financial instruments

(EUR trillion, outstanding amount for bonds and loans, AUM for ESG funds, December 2015 to June 2021)

Sources: Bloomberg and ECB calculations.

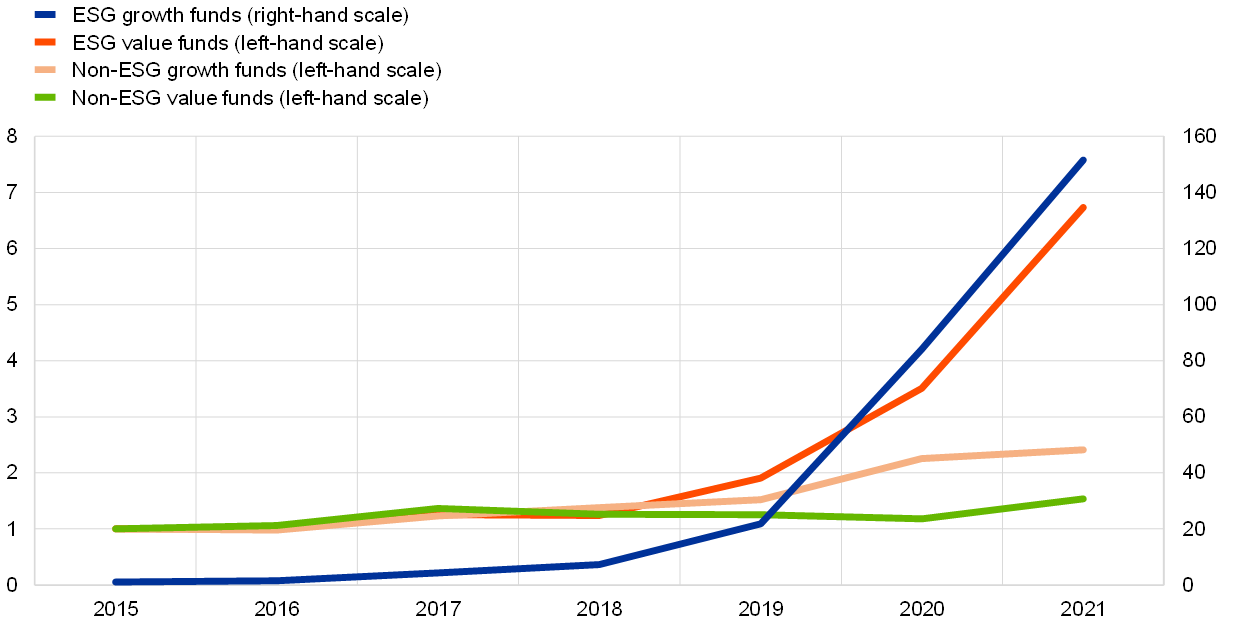

Further development of green equity markets may be particularly valuable given that countries with a higher share of equity funding tend to reduce their carbon footprint more rapidly.[6] The reasons for this stem from the propensity of equity investors to fund innovative sectors rich in intangible projects, and their typically longer-term investment horizon. Both factors make them more successful in funding green innovation and supporting the reallocation towards green sectors. The development of euro area-domiciled ESG equity funds is thus encouraging, as their growth involves large investments in innovative sectors. Since 2019 the assets of ESG growth funds, which invest mainly in young and innovative companies, have grown over four times faster than those of non-ESG growth funds (Chart B). Around 40% of European ESG equity fund holdings in 2020 were invested in the EU and developing a more integrated and resilient European equity market as well as boosting venture capital and start-up financing could further increase this share.

Chart B

Rapid increase in growth ESG equity funds

Rebased total net assets (TNA) of euro area equity funds

(TNA, rebased to 1 in 2015, December 2015 to June 2021)

Sources: EFPR and ECB calculations.

Note: The chart is based on a representative sample of equity funds in EPFR.

The growth of sustainable finance also provides important impetus for further developing and integrating EU capital markets. For example, the green bond market currently displays a higher degree of integration across the euro area than the aggregate bond market[7], with euro area issued green bonds being roughly twice as likely to be held cross-border by euro area investors than euro area-issued bonds overall.[8] While this still constitutes a relatively small segment, there could be important lessons for the wider integration of European capital markets. The relatively low home bias in green bond markets suggests that financing the climate transition could help advance financial integration as green capital markets deepen further. Another example comes from ESG and “green” investment funds: their investors seem less likely to withdraw following negative performance than non-ESG investors.[9] This could reflect a more stable and committed investor base in sustainable assets.

At the same time, there is a risk that these positive developments are of a temporary nature as the fragmentation in underlying capital market structures and lack of standards become a constraint. One key risk for green capital markets is greenwashing, which may both inhibit further growth in green finance and impede the ability of such financing to effectively support the transition to a low-carbon economy. In particular, insufficient standardisation and a proliferation of ESG rating providers for firms and investment funds may create confusion and hamper market integration.[10] Also, ESG labels do not necessarily reflect a green investment focus. Therefore, clearer standards on green versus ESG products are needed to support the low-carbon transition. The absence of standardisation, transparent and consistent reporting and second-party verification of green bonds may also undermine trust and impede their market growth. Moreover, the reporting standards and second-party verification must help assure companies’ overall commitment to the transition to a greener economy. New instruments, such as sustainability-linked bonds and sustainability-linked loans, have been designed to link borrowing costs to specific company-level sustainability targets, and have in part been driven by investors’ concerns about greenwashing in existing sustainable financial products. However, they require further assessment of environmental performance of their issuers as well as standardisation, reporting and verification to efficiently foster the transition. Beyond greenwashing, there is the risk that green capital markets will ultimately hit the same limits that now restrict the integration and resilience of broader capital markets unless further action is taken to address structural impediments – such as national differences in insolvency rules, investor protection and taxation – and to strengthen cross-border supervision.

Current regulatory efforts to enhance the comparability and standardisation of sustainable finance products as well as to enhance their verification and supervision will help alleviate some of these risks. Full, timely and consistent implementation of reforms will be key in this regard. The European Commission’s proposal of a European green bond standard built on the EU taxonomy[11] should provide more assurance to investors. While the proposal for a voluntary standard seems appropriate in the short term as it avoids disrupting markets, a clear commitment to make it mandatory within a reasonable time period would help to combat greenwashing. Initiatives that ensure that relevant ESG risks are systematically captured by credit rating agencies will further increase methodological transparency around how credit ratings incorporate sustainability factors. In addition, the Commission’s planned assessment in cooperation with the European Supervisory Authorities of supervisory powers as regards greenwashing should aim to clarify the mandates of competent authorities and ensure effective enforcement tools and consistent application across the EU.[12] Also, the announced expansion of the EU Ecolabel framework to ESG funds is important in ensuring greater comparability of ESG funds across euro area countries. Provided that a clear distinction between green and ESG products is available, these measures should enhance trust in green finance and catalyse further investments towards a carbon-neutral economy. Enhancing the disclosure of forward-looking environmental data of firms, such as emission-reduction targets and green investments, could act as a catalyst, as these metrics will increasingly underpin the definition of ESG and green funds. Therefore, it will be key to develop consistent standards to make them easily comparable and consistently audited. Ultimately, as green capital markets develop and new innovative instruments are introduced, further standardisation will be essential should new greenwashing risks emerge. In developing such standards, regulators should aim to promote comparability and trust in the sustainable impact of green products, while ensuring sufficient flexibility to accommodate financial innovation, e.g. new types of derivatives, instrument characteristics and environmental performance metrics.[13]

The development of sizeable, mature and integrated green EU capital markets also requires decisive action to strengthen capital markets beyond the sustainable finance segment. The momentum around the EU’s sustainable finance agenda should be harnessed towards a “green capital markets union” by advancing measures under the EU capital markets union umbrella[14] that are particularly relevant for the development of green capital markets. One specific example is a forthcoming proposal on centralised access to financial and sustainability-related information through a single EU-wide platform, the European single access point. This will help channel investments towards green projects, including on a cross-border basis. The risks that go hand in hand with deeper and more integrated green capital markets will also require enhanced supervisory convergence and improved EU supervision, as well as further action to harmonise insolvency laws and investor protection rules. This will not only ensure that capital markets can more effectively support the transition to a low-carbon economy but could also have positive knock-on effects for European capital markets overall.

References

Alessi, L., Battiston, S., Melo, A.S. and Roncoroni, A. (2019), “The EU Sustainability Taxonomy: A Financial Impact Assessment”, Technical Report, European Commission.

Alessi, L., Battiston, S., and Melo, A.S. (2021), “Travelling down the green brick road: a status quo assessment of the EU taxonomy”, ECB, Macroprudential Bulletin, October.

Alogoskoufis, S., Carbone, S., Coussens, W., Fahr, S., Giuzio, M., Kuik, F., Parisi, L., Salakhova, D., and Spaggiari, M.(2021), “Climate-related risks to financial stability”, ECB, Financial Stability Review, May.

Boffo, R. and Patalano, R. (2020), “ESG Investing: Practices, Progress and Challenges”, OECD Paris.

Capota, L., Giuzio, M., Kapadia, S. and Salakhova, D. “Are ethical and green investment funds more resilient?”, mimeo.

De Haas, R. and Popov, A. (2019), “Finance and carbon emissions,” Working Paper Series, No 2318, ECB, September.

European Central Bank (2020), Financial Stability Review, November.

European Commission Communication “Strategy for Financing the Transition to a Sustainable Economy” COM/2021/390 final, 6.7.2021.

See the European Commission Communication “Strategy for Financing the Transition to a Sustainable Economy” COM/2021/390 final, 6.7.2021.

See Alessi, L., Battiston, S., Melo, A.S. and Roncoroni, A. (2019), “The EU Sustainability Taxonomy: a Financial Impact Assessment”, Technical Report, European Commission – Joint Research Centre, as well as the article entitled “Travelling down the green brick road: a status quo assessment of the EU taxonomy” in this issue of the Macroprudential Bulletin, both of which show the enormous growth potential for EU green financial markets, considering the additional investment needs to achieve the targets associated with the low-carbon transition and other sustainability objectives.

See the European Commission’s NextGeneration EU green bonds factsheet.

Similarly, the European Commission’s issuance of €85 billion of social bonds under the Support to mitigate Unemployment Risk in an Emergency (SURE) programme helped develop the social and sustainability bond market, representing around 30% of the total outstanding amount as of July 2021.

See the Glasgow Financial Alliance for Net Zero (GFANZ), which encompasses the UN-convened Net-Zero Banking Alliance, Net-Zero Asset Owner Alliance and Net-Zero Insurance Alliance and the Net Zero Asset Manager Initiative. The GFANZ aims at mobilising the necessary capital to build a global zero-emissions economy and deliver on the goals of the Paris Agreement.

See De Haas, R. and Popov, A. (2019), “Finance and carbon emissions,” Working Paper Series, No 2318, ECB, September.

The aggregate bond market comprises both green and non-green euro area issuances. The comparison is robust regardless of whether bonds issued outside the euro area are included or excluded from the sample (in relative terms).

European Central Bank (2020), Financial Stability Review, November. This analysis is based on Securities Holdings Statistics by Sector (SHSS) data.

See Capota, L., Giuzio, M., Kapadia, S. and Salakhova, D. “Are ethical and green investment funds more resilient?”, mimeo, and Section 5 in Alogoskoufis et al. (2021), “Climate-related risks to financial stability”, ECB, Financial Stability Review, May.

Currently, ESG ratings for firms vary strongly depending on the provider. See Boffo, R. and Patalano, R. (2020), “ESG Investing: Practices, Progress and Challenges”, OECD Paris. Similarly, ESG-fund labels vary both across providers and countries.

For details on the taxonomy, see the article entitled “Travelling down the green brick road: a status quo assessment of the EU taxonomy” in this issue of the Macroprudential Bulletin.

European Commission Communication “Strategy for Financing the Transition to a Sustainable Economy” COM/2021/390 final, 6.7.2021.

In its new Strategy for Financing the Transition to a Sustainable Economy, the European Commission announced that it will work on further bond labels such as transition or sustainability-linked bonds by 2022, as well as on a more general framework for labels for financial instruments, to help bring clarity, transparency and coherence to sustainable finance markets.

On 24 September 2020 the European Commission adopted a new capital markets action plan. For an overview of actions proposed, see the Commission’s website.