Published as part of the ECB Economic Bulletin, Issue 3/2024.

This box summarises the findings of recent contacts between ECB staff and representatives of 57 leading non-financial companies operating in the euro area. The exchanges took place between 11 and 19 March 2024.[1]

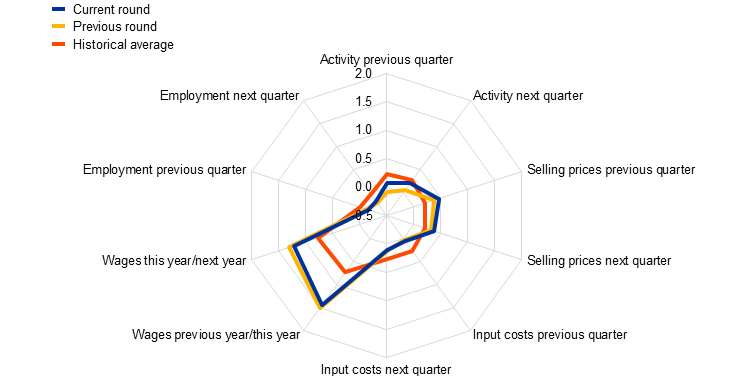

Contacts reported a subdued start to the year for activity, but also a slight uptick in demand (Chart A and Chart B, panel a). In the first months of 2024 activity was affected, to some extent, by industrial unrest and by production delays due to the continuing attacks on shipping in the Red Sea area, but this was more than offset by some recovery in demand for manufactured goods. Perceptions continued to vary significantly, however, both across and within sectors. An increasing number of contacts also stressed differences between growth rates in southern Europe and the more subdued activity in northern Europe, especially Germany.

Chart A

Summary of views on activity, employment, prices and costs

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of contacts’ statements about quarter-on-quarter developments in activity (sales, production and orders), input costs (material, energy, transport, etc.) and selling prices, and their statements about year-on-year wage developments. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. For the current round, previous quarter and next quarter refer to the first and second quarters of 2024 respectively, while for the previous round these refer to the fourth quarter of 2023 and the first quarter of 2024. Discussions with contacts in January and in March/April regarding wage developments normally focus on the outlook for the current year compared with the previous year, while discussions in June/July and September/October focus on the outlook for the next year compared with the current year. The historical average reflects an average of scores compiled using summaries of past contacts extending back to 2008.

Chart B

Evolution of views on developments in and the outlook for activity and prices

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of what contacts said about quarter-on-quarter developments in activity (sales, production and orders) and selling prices. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. The dotted line refers to expectations for the next quarter.

There was a slight overall pick-up in demand as the recent destocking cycle came to an end, along with tentative signs of improving consumer confidence. After several quarters of contraction, contacts in the intermediate goods sector reported demand stabilising or even growing as their customers were no longer destocking. Contacts in the consumer goods sector reported reasonable growth overall. Segments that had been performing well recently – such as personal care and luxury goods – saw ongoing positive momentum, while demand for household appliances seemed to be stabilising, albeit at a low level. There were also reports that demand for consumer electronics was starting to recover. Retailers were nevertheless still quite downbeat about the overall outlook for the retail sector. Moreover, contacts in the agri-food industry saw no reversal yet in the “downtrading” spending pattern of food consumers but neither further deterioration. Growth in demand for consumer services – in particular tourism (based, for example, on hotel bookings and on airlines’ reserved take-off and landing slots) – looked set to continue, albeit with notable variation across countries.

The investment outlook remained more subdued. Contacts in, or supplying, the capital goods industry pointed mostly to still declining demand and falling production, which were reflecting the effect of the recent monetary policy tightening and diminishing order backlogs. Suppliers of machinery and equipment expected at least another one or two quarters of contraction. In the automotive sector, disappointing EV sales were having a dampening effect on passenger car production, while commercial vehicle production was undergoing a downward correction from previously high levels. The outlook for construction remained bleak, with the ongoing sharp decline in residential activity only partly offset by growth in infrastructure spending. Most contacts in, or supplying, the industry did not expect residential investment to start recovering before 2025. Uncertainty about house prices amid low transaction volumes was an important factor holding back business, although there were signs of transactions starting to pick up as mortgage rates eased somewhat.

Contacts generally concurred with a baseline narrative of a gradual but modest recovery in activity over the course of the year. Whether or not they saw evidence of this yet, most contacts agreed that lower inflation and hence rising real wages should lead to some recovery in consumer spending. In spite of the still widespread geo-political uncertainty, growth in consumption would then be followed by higher investment. Several contacts nonetheless considered that lower interest rates would be important to stimulate demand. Moreover, some stressed that growth in the euro area would still lag that in other regions, owing to adverse demographics, various regulatory headwinds and investment that, in some sectors, was increasingly geared to delivering climate goals rather than raising productive capacity.

Contacts described a weak employment outlook amid limited recruitment needs and a continued focus on cost containment. While there was considerable variation across countries and sectors, the aggregate employed trend described was negative, with reductions particularly focused in the more energy-intensive parts of the intermediate goods sector, the automotive supply chain, agriculture and retail. In these sectors, employment was being adjusted to lower levels of demand. More generally, firms were seeking efficiency savings where possible, to contain unit labour costs in a context of rising wages. This adjustment could generally be achieved by limiting vacancies in light of high retirement rates, so forced lay-offs were rare. Employment agencies corroborated the perception of an overall weak job market, with firms reluctant to offer new positions and potential candidates also increasingly unwilling to change jobs. Notwithstanding, contacts in sectors with increasing employment needs still found recruitment a challenge, either generally (in the case of labour-intensive services) or for specific skills (e.g. those needed to deliver the energy transition).

Contacts reported a slight uptick in price growth, mainly due to a rebound in the prices of some intermediate goods and services, but growth in prices closer to the final consumer continued to ease gradually (Chart A and Chart B, panel b). The prices of intermediate goods such as steel, chemicals and paper had fallen to extremely low levels in late 2023 and, despite the aforementioned pick-up in demand supporting a partial recovery in these prices, they still stood at low levels. At the same time, the disruption to shipping in the Red Sea area and the application of the EU Emissions Trading System to shipping to and from ports within the European Union were factors pushing up transport costs, albeit from low levels. The overall price and cost environment in the industrial sector was nevertheless reported to be rather stable overall. Contacts in the consumer goods and retail sectors described an increasingly challenging pricing environment, characterised by tough negotiations between suppliers and retailers, although this environment remained more favourable for luxury goods and personal care products. Food prices had largely stabilised and in some cases were even falling, although specific products continued to be affected by climate-induced shortages. Growth in selling prices remained robust in the labour-intensive services sectors (e.g. travel and tourism, hospitality and employment services) and in areas such as media, telecoms and software, but had started to moderate slightly.

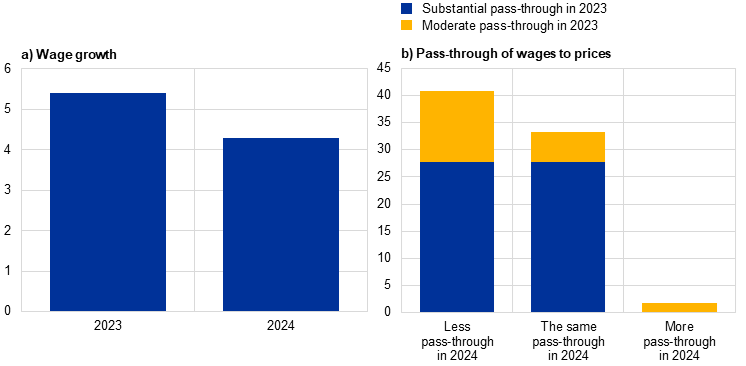

Chart C

Quantitative assessment of wage growth and pass-through of wages to prices

(panel a: percentages, panel b: percentage of respondents)

Source: ECB.

Notes: Panel a – Contacts’ perception of wage growth in their sector in 2023 and their expectation for 2024. Panel b – Contacts’ assessment of the extent to which wage costs were passed through to selling prices in their sector in 2023 and whether they expect the pass-through to be smaller, the same or larger in 2024. The chart excludes respondents (around one-quarter) who said that there was no pass-through of wages to prices in either 2023 or 2024 because this did not reflect the pricing model or strategy in their sector.

Contacts continued to expect wage growth to ease somewhat this year and indicated that the pass-through to selling prices would be weaker than last year (Chart C). Taking a simple average of the quantitative indications provided, contacts expected wage growth to decrease from around 5.4% in 2023 to 4.3% in 2024. This was in line with the indications from the January 2024 survey round. As stated at the time, there was still an element of catch-up in actual or expected wage agreements for 2024 for some companies and sectors. However, most contacts now saw the easing of inflation and subdued demand as factors contributing to a moderation, or even normalisation, of wage growth. In 2023, a still dynamic pricing environment had supported the pass-through of rising wage costs to prices. In the industrial sectors, especially, the falling prices of other inputs (e.g. materials, energy and transport) had made it possible to maintain or even increase profit margins in spite of rising unit labour costs. In 2024, however, a more stable price and cost environment and increased competition meant that rising wage costs would have to be offset through productivity gains or be absorbed by profit margins to a greater extent.

For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.