Published as part of the ECB Economic Bulletin, Issue 2/2024.

This box describes liquidity conditions and the Eurosystem monetary policy operations during the seventh and eight reserve maintenance periods of 2023. Together, these two maintenance periods ran from 1 November 2023 to 30 January 2024 (the “review period”).

Excess liquidity in the euro area banking system continued to decline during the review period. This was due to the maturing of the sixth operation under the third series of targeted longer-term refinancing operations (TLTRO III.6) and early repayments by banks of other TLTRO funds on 20 December 2023. Liquidity provision also declined, owing to lower asset purchase programme (APP) holdings as a result of the discontinuation of APP reinvestments at the beginning of July 2023. The reduction in liquidity provision was partly offset by the continuing fall in net autonomous factors – owing mainly to lower government deposits – seen since the ECB’s policy rates were lifted out of negative territory in July 2022.

Liquidity needs

The average daily liquidity needs of the banking system, defined as the sum of net autonomous factors and reserve requirements, decreased by €104.1 billion to €1,630.9 billion over the review period. This was due almost entirely to a €102.3 billion fall in net autonomous factors to €1,467.7 billion (see the section of Table A entitled “Other liquidity-based information”), driven by a decline in liquidity-absorbing autonomous factors and an increase in liquidity-providing autonomous factors. Minimum reserve requirements fell by €1.8 billion to €163.2 billion.

Liquidity-absorbing autonomous factors decreased by €67.1 billion to €2,653.5 billion over the review period, owing primarily to a decline in government deposits and other autonomous factors. Government deposits (see the section of Table A entitled “Liabilities”) fell by €40.3 billion on average over the review period, down to €182.3 billion. This reflects the continued normalisation of the overall volume of cash buffers held by national treasuries and their greater propensity to place those holdings in the market in response to changes in the remuneration of government deposits with the Eurosystem, as well as lower government deposits, which typically decline at the end of the year. The normalisation of repo market conditions and higher repo rates relative to the euro short-term rate (€STR) also made market investment a more attractive option than deposits with the Eurosystem. The average value of banknotes in circulation decreased by €6.1 billion over the review period to €1,553.7 billion, reflecting the ongoing reduction in banknote holdings observed since the ECB’s policy rates were lifted out of negative territory in July 2022.

Liquidity-providing autonomous factors rose by €35.4 billion, to stand at €1,186.2 billion (see the section of Table A entitled “Assets”).[1] Net assets denominated in euro increased by €18.1 billion over the review period. This was largely the result of a continued fall in liabilities to non-euro area residents denominated in euro. This, in turn, reflects changes in the cash management strategies of customers of the Eurosystem reserve management services (ERMS), given the downward revision on 1 May 2023 of the remuneration of deposits held under the ERMS framework. Net foreign assets increased by €17.3 billion, reflecting the reallocation by some national central banks of own assets to foreign reserves.

Table A

Eurosystem liquidity conditions

Liabilities

(averages; EUR billions)

Current review period: 1 November 2023-30 January 2024 | Previous review period: | |||||||

|---|---|---|---|---|---|---|---|---|

Seventh and eighth maintenance periods | Seventh maintenance period: | Eighth maintenance period: | Fifth and sixth maintenance periods | |||||

Liquidity-absorbing autonomous factors | 2,653.5 | (-67.1) | 2,656.2 | (-47.1) | 2,650.3 | (-5.8) | 2,720.6 | (-83.0) |

Banknotes in circulation | 1,553.7 | (-6.1) | 1,551.1 | (-3.6) | 1,556.7 | (+5.6) | 1,559.8 | (-5.5) |

Government deposits | 182.3 | (-40.3) | 194.1 | (-28.6) | 168.4 | (-25.7) | 222.6 | (-32.8) |

Other autonomous factors | 917.5 | (-20.7) | 910.9 | (-14.9) | 925.1 | (+14.2) | 938.2 | (-44.7) |

Current accounts above minimum reserve requirements | 8.1 | (-1.4) | 8.1 | (-1.9) | 8.1 | (+0.0) | 9.5 | (-5.1) |

Minimum reserve requirements2) | 163.2 | (-1.8) | 163.9 | (-0.7) | 162.3 | (-1.6) | 165.0 | (-0.0) |

Deposit facility | 3,520.5 | (-94.6) | 3,548.8 | (-28.6) | 3,487.4 | (-61.4) | 3,615.1 | (-300.3) |

Liquidity-absorbing fine-tuning operations | 0.0 | (+0.0) | 0.0 | (+0.0) | 0.0 | (+0.0) | 0.0 | (+0.0) |

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in parentheses denote the change from the previous review or maintenance period.

1) Computed as the sum of the revaluation accounts, other claims and liabilities of euro area residents, capital and reserves.

2) Memo item that does not appear on the Eurosystem balance sheet and should therefore not be included in the calculation of total liabilities.

Assets

(averages; EUR billions)

Current review period: 1 November 2023-30 January 2024 | Previous review period: | |||||||

|---|---|---|---|---|---|---|---|---|

Seventh and eighth maintenance periods | Seventh maintenance period: | Eighth maintenance period: | Fifth and sixth maintenance periods | |||||

Liquidity-providing autonomous factors | 1,186.2 | (+35.4) | 1,159.2 | (-4.8) | 1,217.7 | (+58.4) | 1,150.8 | (+18.0) |

Net foreign assets | 944.8 | (+17.3) | 933.3 | (+2.0) | 958.3 | (+25.1) | 927.5 | (-10.5) |

Net assets denominated in euro | 241.4 | (+18.1) | 226.0 | (-6.8) | 259.3 | (+33.4) | 223.3 | (+28.5) |

Monetary policy instruments | 5,159.4 | (-200.0) | 5,218.2 | (-73.2) | 5,091.0 | (-127.3) | 5,359.5 | (-406.7) |

Open market operations | 5,159.4 | (-200.0) | 5,218.2 | (-73.2) | 5,090.9 | (-127.3) | 5,359.4 | (-406.7) |

Credit operations | 457.4 | (-110.8) | 503.2 | (-20.4) | 404.1 | (-99.0) | 568.2 | (-329.3) |

MROs | 7.6 | (+0.8) | 7.3 | (-0.9) | 7.9 | (+0.6) | 6.8 | (+0.5) |

Three-month LTROs | 4.4 | (-3.8) | 4.7 | (-2.7) | 4.0 | (-0.7) | 8.2 | (+4.3) |

TLTRO III | 445.5 | (-107.8) | 491.2 | (-16.8) | 392.3 | (-98.9) | 553.3 | (-334.2) |

Outright portfolios1) | 4,702.0 | (-89.3) | 4,715.0 | (-53.0) | 4,686.8 | (-28.2) | 4,791.2 | (-77.3) |

Marginal lending facility | 0.0 | (+0.0) | 0.0 | (+0.0) | 0.0 | (+0.0) | 0.0 | (+0.0) |

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in parentheses denote the change from the previous review or maintenance period. MROs denotes main refinancing operations, LTROs denotes longer-term refinancing operations and TLTRO III denotes the third series of targeted longer-term refinancing operations.

1) With the discontinuation of net asset purchases, the individual breakdown of outright portfolios is no longer shown.

Other liquidity-based information

Current review period: 1 November 2023-30 January 2024 | Previous review period: | |||||||

|---|---|---|---|---|---|---|---|---|

Seventh and eighth maintenance periods | Seventh maintenance period: | Eighth maintenance period: | Fifth and sixth maintenance periods | |||||

Aggregate liquidity needs1) | 1,630.9 | (-104.1) | 1,661.2 | (-42.9) | 1,595.5 | (-65.8) | 1,735.0 | (-101.3) |

Net autonomous factors2) | 1,467.7 | (-102.3) | 1,497.3 | (-42.2) | 1,433.1 | (-64.2) | 1,570.0 | (-101.3) |

Excess liquidity3) | 3,528.5 | (-96.0) | 3,556.9 | (-30.5) | 3,495.4 | (-61.5) | 3,624.5 | (-305.3) |

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in parentheses denote the change from the previous review or maintenance period.

1) Computed as the sum of net autonomous factors and minimum reserve requirements.

2) Computed as the difference between autonomous liquidity factors on the liabilities side and autonomous liquidity factors on the assets side. For the purposes of this table, items in the course of settlement are also added to net autonomous factors.

3) Computed as the sum of current accounts above minimum reserve requirements and the recourse to the deposit facility minus the recourse to the marginal lending facility.

Interest rate developments

(averages; percentages and percentage points)

Current review period: | Previous review period: | |||||||

|---|---|---|---|---|---|---|---|---|

Seventh maintenance period: | Eighth maintenance period: | Fifth maintenance period | Sixth maintenance period | |||||

MROs | 4.50 | (+0.00) | 4.50 | (+0.00) | 4.25 | (+0.25) | 4.50 | (+0.25) |

Marginal lending facility | 4.75 | (+0.00) | 4.75 | (+0.00) | 4.50 | (+0.25) | 4.75 | (+0.25) |

Deposit facility | 4.00 | (+0.00) | 4.00 | (+0.00) | 3.75 | (+0.25) | 4.00 | (+0.25) |

€STR | 3.903 | (+0.002) | 3.901 | (-0.002) | 3.652 | (+0.250) | 3.900 | (+0.248) |

RepoFunds Rate Euro | 3.945 | (+0.019) | 3.905 | (-0.040) | 3.687 | (+0.286) | 3.926 | (+0.239) |

Sources: ECB, CME Group and Bloomberg.

Notes: Figures in parentheses denote the change in percentage points from the previous review or maintenance period. MROs denotes main refinancing operations and €STR denotes the euro short-term rate.

Liquidity provided through monetary policy instruments

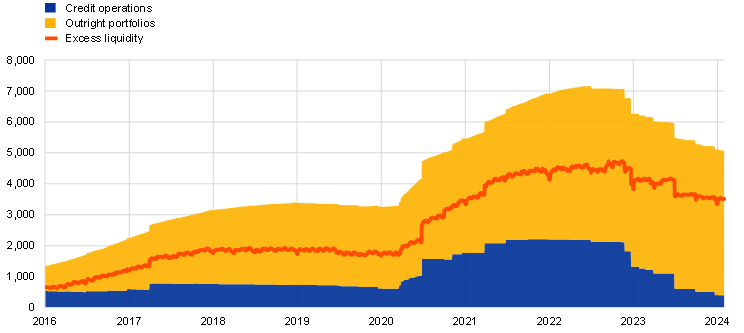

The average amount of liquidity provided through monetary policy instruments decreased by €200 billion to €5,159.4 billion over the review period (Chart A). This decline is attributable to both a reduction in the amount of liquidity provided through credit operations and the roll-off of monetary policy portfolios.

The average amount of liquidity provided through credit operations fell by €110.8 billion to €457.4 billion over the review period. This decrease largely reflects the decline in outstanding TLTRO III amounts as a result of the maturing of TLTRO III.6 (€37.3 billion), together with early repayments of other TLTRO funds (€61.7 billion) on 20 December 2023, i.e. at the beginning of the eighth maintenance period. At the same time, the overall outstanding amounts of standard Eurosystem refinancing operations – main refinancing operations (MROs) and three-month longer-term refinancing operations (LTROs) – fell slightly. This decline is mainly attributable to the outstanding amounts for three-month LTROs falling by €3.8 billion, on average, while those for MROs remained broadly unchanged, at €7.6 billion, compared with the fifth and sixth maintenance periods of 2023. Banks’ limited participation in these operations, together with their ability to repay sizeable amounts of TLTRO funds without switching to regular refinancing operations, reflects their comfortable liquidity positions, on aggregate, and the availability of alternative funding sources at attractive rates.

The average amount of liquidity provided through holdings of outright portfolios decreased by €89.3 billion over the review period. This decline was due to the discontinuation, on 1 July 2023, of reinvestments of principal payments from maturing securities under the APP. Under the pandemic emergency purchase programme, the principal payments from maturing securities have been fully reinvested since net purchases were discontinued at the end of March 2022.[2] In December 2023 the Governing Council announced that full reinvestment of principal payments would come to an end in the second half 2024.

Chart A

Changes in liquidity provided through open market operations and excess liquidity

(EUR billions)

Source: ECB.

Note: The latest observations are for 30 January 2024.

Excess liquidity

Average excess liquidity decreased by €96 billion, to reach €3,528.5 billion (Chart A) over the review period. Excess liquidity is the sum of the reserves that banks hold in excess of their reserve requirements and their recourse to the deposit facility net of their recourse to the marginal lending facility. It reflects the difference between the total liquidity provided to the banking system and the liquidity needs of banks to meet their minimum reserves requirements. After peaking in November 2022 at €4,748 billion, average excess liquidity has declined steadily, owing mainly to the maturing and early repayment of TLTRO III operations, with the discontinuation of reinvestments under the APP also being a contributing factor since July 2023.

Interest rate developments

The Governing Council kept the three key ECB interest rates unchanged during the review period. The rates on the deposit facility, the MROs and the marginal lending facility stood at 4.00%, 4.50% and 4.75% respectively.

The average €STR remained broadly unchanged during the review period, while maintaining a stable spread with the key ECB interest rates. The €STR traded, on average, 10.2 basis points below the deposit facility rate throughout the review period, close to the average of 9.9 basis points for the reserve maintenance periods of 2023. The lower excess liquidity has therefore not had any upward impact on the €STR so far. The 1.8 basis point end-of-year decline in the €STR was only slightly more pronounced than the 2022 end-of-year effect (-1.5 basis points).

The average euro area repo rate, as measured by the RepoFunds Rate Euro index, continued to trade closer to the deposit facility rate, except around the year-end. The repo rate was, on average, 7.3 basis points below the deposit facility rate over the review period. The 2023 end-of-year decline of 25.5 basis points was significantly less than the 226.8 basis point fall seen at the end of 2022. This reflects the orderly functioning of the repo market, which is due to several factors, including higher net issuance since the beginning of the year, the release of mobilised collateral on the back of maturing TLTROs, a change in market positioning that resulted in lower demand for securities in the repo market, and the decline in outstanding APP holdings.

For further details on autonomous factors, see the article entitled “The liquidity management of the ECB”, Monthly Bulletin, ECB, Frankfurt am Main, May 2002.

Securities held in the outright portfolios are carried at amortised cost and revalued at the end of each quarter, which also has an impact on the total averages and the changes in the outright portfolios.