- THE ECB BLOG

ETF approval for bitcoin – the naked emperor’s new clothes

22 February 2024

Bitcoin has failed on the promise to be a global decentralised digital currency. Instead it is used for illicit transactions. The latest approval of an ETF doesn’t change the fact that Bitcoin is not suitable as means of payment or as an investment.

On 10 January, the US Securities and Exchange Commission (SEC) approved spot exchange-traded funds (ETFs) for Bitcoin. For disciples, the formal approval confirms that Bitcoin investments are safe and the preceding rally is proof of an unstoppable triumph. We disagree with both claims and reiterate that the fair value of Bitcoin is still zero. For society, a renewed boom-bust cycle of Bitcoin is a dire perspective. And the collateral damage will be massive, including the environmental damage and the ultimate redistribution of wealth at the expense of the less sophisticated.*

A post on The ECB Blog in November 2022 debunked the false promises of Bitcoin and warned of the social dangers if not effectively addressed.

We argued that Bitcoin has failed to fulfil its original promise to become a global decentralised digital currency. We also showed that Bitcoin's second promise to be a financial asset, the value of which would inevitably continue to rise, was equally wrong. We warned about the risks to society and the environment if the Bitcoin lobby managed to re-launch a bubble with the unintended help of legislators, who could give a perceived blessing where a ban would be required (Bindseil, Schaaf and Papsdorf, 2022).

Alas, all these risks have materialised.

- Today, Bitcoin transactions are still inconvenient, slow, and costly. Outside the darknet, the hidden part of the internet used for criminal activities, it is hardly used for payments at all. The regulatory initiatives to combat the large-scale use of the Bitcoin network by criminals have not been successful yet.

- Likewise, Bitcoin is still not suitable as an investment. It does not generate any cash flow (unlike real estate) or dividends (stocks), cannot be used productively (commodities), and offers no social benefit (gold jewellery) or subjective appreciation based on outstanding abilities (works of art). Less financially knowledgeable retail investors are attracted by the fear of missing out, leading them to potentially lose their money.

- And the mining of Bitcoin using the proof of work mechanism continues to pollute the environment on the same scale as entire countries, with higher prices facilitating higher energy consumption as higher costs can be covered by miners.

But although this was all known, and the reputation of the entire crypto scene has been harmed by a long and growing list of further scandals,[1] Bitcoin has recovered big time since late December 2022 from just under $17,000 to more than $52,000. Small investors are easing back into crypto, although not yet rushing in headfirst as they did three years ago (Bloomberg, 2024).

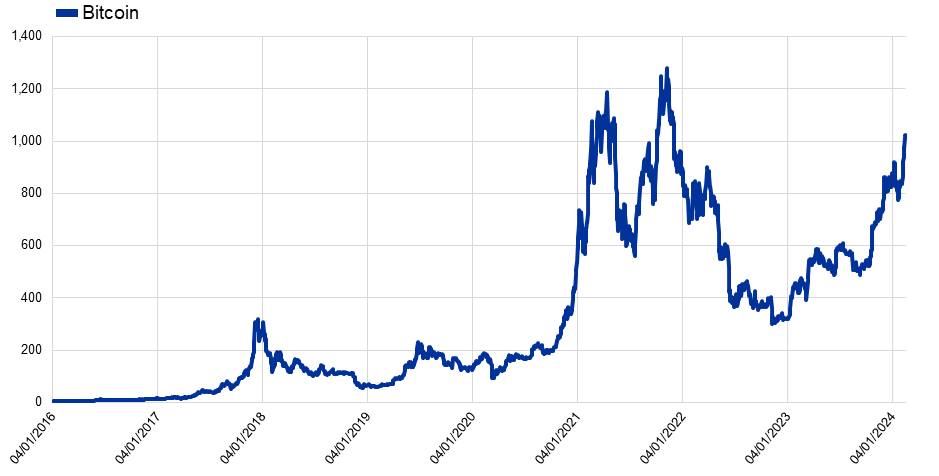

Chart 1

Market capitalisation of Bitcoin

Source: IntoTheBlock.

So why is this dead cat bouncing so high?

For many, the rally in the autumn of 2023 was initiated by the prospect of an imminent turnaround in the US Federal Reserve's interest rate policy, the halving of the BTC mining rewards in spring and later the approval of the Bitcoin spot ETF by the SEC.

Lower interest rates would have increased the risk appetite of investors[2] and the spot ETF approval would have opened the floodgates to Wall Street for Bitcoin. Both promised large inflows of funds – the only effective fuel in a speculative bubble.

Still, this could turn out to be a flash in the pan. While in the short run the inflowing money can have a large impact on prices irrespective of fundamentals, prices will eventually return to their fundamental values in the long run (Gabaix and Koijen, 2022). And without any cash flow or other returns, the fair value of an asset is zero. Detached from economic fundamentals every price is equally (im)plausible – a fantastic condition for snake oil salesmen.

Likewise, the use of ETFs as financing vehicles does not change the fair value of the underlying assets. An ETF with only one asset turns its actual financial logic on its head (although there are others in the United States). ETFs normally aim to diversify risk by holding many individual securities in a market. Why would anybody pay fees to an asset manager for the custody service of only one asset – instead of using the custodian directly, which is in most cases one huge crypto exchange, or even holding the coins for free without any intermediary? Moreover, there were already other easy ways to gain listed exposure to Bitcoin or to buy Bitcoins without any intermediation. The problem has never been a lack of possibilities to speculate using Bitcoin – but rather that it is only about speculation (Cohan, 2024). Finally, it is incredibly ironic that the crypto unit that had set out to overcome the demonised established financial system should need conventional intermediaries to spread to a broader group of investors.

The halving of the BTC mining rewards will take place in mid-April. After the bitcoin network mines 210,000 blocks, roughly every four years, the block reward given to Bitcoin miners for processing transactions is cut in half. The current limit of 900 BTC per day will then be cut to 450. Halving reduces the bitcoin rewards for mining, even though it remains costly. In the past such halvings were followed by rising prices. But if this was a reliable pattern, the rise would already be fully priced in (some say that this was the case).

While the current rally is fuelled by temporary factors, there are three structural reasons that may explain its seeming resilience: the ongoing manipulation of the “price" in an unregulated market without oversight and without fair value, the growing demand for the “currency of crime”, and shortcomings in the authorities’ judgments and measures.

Price manipulation since the start of Bitcoin

The history of Bitcoin has been characterised by price manipulation and other types of fraud. This may not be very surprising for an asset that has no fair value. Crypto exchanges were shut down and operators were prosecuted because of scams during the very first cycles.[3] And pricing has remained dubious in last year’s upswing. One analysis (Forbes, 2022) of 157 crypto exchanges found that 51% of the daily bitcoin trading volume being reported is likely bogus.[4]

Manipulation may have become more effective as the trading volumes diminished significantly during the recent marked downturn called ”crypto winter” as market interference has more of an impact when liquidity is low. According to one estimate the average trading volume of Bitcoin between 2019 and 2021 was about 2 million Bitcoins, compared to a meagre 500,000 in 2023 (Athanassakos and Seeman, 2024).

The currency of crime: financing evil

As critiques often point out: a key utility offered by crypto is the financing of terrorism and crimes like money laundering and ransomware. The demand for this infamous benefit is large – and growing.

Despite the market downturn, the volume of illicit transactions has continued to rise. The range of possible applications is broad.

- Bitcoin remains the top choice for money laundering in the digital world, with illicit addresses transferring $23.8 billion in crypto in 2022, marking a 68.0% increase from the previous year. Approximately half of these funds were funnelled through mainstream exchanges, which, despite having compliance measures, serve as conduits for converting illicit crypto into cash. (Chainanalysis, 2024).[5]

- Furthermore, crypto continues to be the preferred means for ransomware payments, with attacks on hospitals, schools, and government offices yielding $1.1 billion in 2023, compared to $567 million in 2022 (Reuters, 2024b).

Misjudgment by authorities

The international community initially acknowledged Bitcoin's lack of positive social benefits. Legislators hesitated to concretise regulations due to the abstract nature of guidelines and concerns over Bitcoin's divergence from traditional financial assets. However, pressure from well-funded lobbyists and social media campaigns prompted compromises, having been understood as a partial approval of Bitcoin investments (The Economist, 2021).

In Europe, the Markets in Crypto Assets Regulation (MiCA) of June 2023 aimed to curb fraudulent issuers and traders of crypto units with, despite the initial intentions towards genuine crypto assets, an eventual focus on stablecoins and service providers, although without regulating and constraining Bitcoin per se. At the same time, less informed outsiders might have the false impression that with MiCA in place, Bitcoin would be also regulated and safe.

In the USA, the SEC's approach to Bitcoin ETFs initially involved compromises, favouring futures ETFs due to their perceived lower volatility and lower risk of price manipulation. However, a court ruling in August 2023 compelled the SEC to authorise spot ETFs, leading to a significant market rally.[6]

Neither the United States nor the EU have so far taken any effective steps to address Bitcoin's energy consumption, despite evidence of its huge negative environmental impact.

The decentralised nature of Bitcoin presents challenges for authorities, sometimes leading to unnecessary regulatory fatalism. But Bitcoin transactions offer pseudonymity rather than complete anonymity, as each transaction is linked to a unique address on the public blockchain. Therefore, Bitcoin has been a cursed tool for anonymity, facilitating illicit activities and leading to legal action against offenders by the tracing of transactions (Greenberg, 2024).

Moreover, it seems wrong that Bitcoin should not be subject to strong regulatory intervention, up to practically forbidding it. The belief that one is protected from the effective access of law enforcement authorities can be quite deceptive, even for decentralised autonomous organisation (DAO). DAOs are member-owned digital communities, without central leadership, that are based on blockchain technology. A recent case involved BarnBridge DAO, which was fined more than $1.7 million by the SEC for failing to register the offer and sale of crypto securities. Despite claiming autonomy, the DAO settled following SEC pressure on its founders. When administrators of decentralised infrastructures are identified, authorities can effectively prosecute them, highlighting the limitations of claimed autonomy.

This principle also applies to Bitcoin. The Bitcoin network has a governance structure in which roles are assigned to identified individuals. Authorities could decide that these should be prosecuted in view of the large scale of illegal payments using Bitcoin. Decentralised finance can be regulated as forcefully as the legislator considers necessary.

Recent developments, such as increased fines for lax controls (Noonan and Smith, 2024). and the EU's agreement to strengthen anti-money laundering rules for crypto-assets[7], suggest a growing recognition of the need for tighter regulation in the crypto unit space.

Conclusion

Bitcoin’s price level is not an indicator of its sustainability. There are no economic fundamental data, there is no fair value from which serious forecasts can be derived. There is no “proof of price” in a speculative bubble. Instead, a reflation of the speculative bubble shows the effectiveness of the Bitcoin lobby. The “market” capitalisation quantifies the overall social damage that will occur when the house of cards collapses. It is important for authorities to be vigilant and protect society from money laundering, cyber and other crimes, financial losses for the financially less educated, and extensive environmental damage. This job has remains to be done.

References

Athanassakos, G. and B. Seeman (2024), “Here’s what’s really behind bitcoin’s recent rally”, Globe and Mail, 4 January.

Bindseil, U., P. Papsdorf and J. Schaaf (2022), “The encrypted threat: Bitcoin’s social cost and regulatory responses”, SUERF Policy Note, No. 262, 7 January.

Bloomberg (2024), “Mom-and-Pop Investors Are Starting to Tip-Toe Back Into Crypto”., by O. Kharif and Y. Yang, Bloomberg News, 18 February.

Chainanalysis (2024), “2024 Crypto Crime Trends: Illicit Activity Down as Scamming and Stolen Funds Fall, But Ransomware and Darknet Markets See Growth”, 18 January.

Cohan, W. (2024), “Bitcoin ETFs miss the point”, in Financial Times, 6 January

Cong, W. et al. (2023), “Crypto Wash Trading”, 69 Mgmt. Sci. 6427.

Dunn, W. (2021), “Bitcoin’s gold rush was always an illusion”, in: The New Statesman, 20 July.

Forbes (2022), “More Than Half Of All Bitcoin Trades Are Fake”, 26 August.

Gabaix, X. and R.S.J. Koijen (2022), “In Search of the Origins of Financial Fluctuations: The Inelastic Markets Hypothesis”, Swiss Finance Institute Research Paper No. 20-91, posted 23 October 2020; last revised: 13 May.

Gandal, N., J.T. Hamrick, T. Moore and T. Obermana (2018), “Price manipulation in the Bitcoin ecosystem”, Journal of Monetary Economics, Volume 95, May 2018, Pages 86-96.

Greenberg, A. (2024), “Child abusers are getting better at using crypto to cover their tracks”, Wired, 11 January.

Griffin, J. M. and A. Shams (2020), “Is Bitcoin Really Un-Tethered?”, 15 June.

New York Times (2024), “Bitcoin E.T.F.s Come With Risks. Here’s What You Should Know”, by Tara Siegel Bernard, published 19 January, updated 21 January.

Noonan, L. and A. Smith (2024), “Crypto and fintech groups fined USD 5.8 bn in global crackdown on illicit money”, 9 January.

Reuters (2024), “SEC account hack renews spotlight on X's security concerns”, by Zeba Siddiqui and Raphael Satter, 10 January.

Reuters (2024a), “Tougher EU money laundering rules target cryptoassets and dealers in luxury cars”, by Huw Jones, published 18 January.

Reuters (2024b), “Crypto ransom attack payments hit record $1 billion in 2023 – Chainalysis”, by Medha Singh, 7 February.

Rosen, P. (2024), “BlackRock chief Larry Fink sees crypto ETFs as 'stepping stones to tokenization”, Business Insider, 12 January.

The Economist (2021), “Crypto lobbying is going ballistic – As regulators toughen up, companies hope to influence where the rules end up”, 12 December.

UNODC (2024), “Casinos and cryptocurrency: major drivers of money laundering, underground banking, and cyberfraud in East and Southeast Asia”, Regional Office for Southeast Asia and the Pacific, Bangkok (Thailand), 15 January.

* In a previous version "Chainalysis” was misspelled and a reference to a Chainalysis report showed the wrong year. Both have been corrected in this version.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Recent prominent examples are the collapse of crypto exchange FTX and the criminal conviction of its founder Sam Bankman-Fried, Binance’s $4.3 billion fine for money laundering and breaching sanctions, the Luna/TerraUSD crash, the shutdown of Three Arrows Capital, or the liquidation of Voyager Digital.

The contradictions within the original narrative are obvious: like gold, Bitcoin was supposed to be a hedge against volatile financial markets and act as a safe haven in bear markets – and not positively correlate with the riskiest speculative investments. And it is difficult to see why ETFs would be “stepping stones to tokenization” as BlackRock chief Larry Fink framed the approval of the ETF, though it is a recourse to conventional financial products from the pre-crypto era (Rosen 2014).

Dunn (2021) attributes the first Bitcoin bubble in 2013 to the Mt Gox exchange. Its bankruptcy resulted in a loss of 650,000 Bitcoins, as it hosted 70 percent of Bitcoin trading. Gandal et al. (2021) suggest the initial boom, soaring from $100 to $1,000 in two months, was also manipulated via trading software. Griffin (2020) connects the second and third booms to Tether's launch and rise. Tether, a stablecoin, aims to maintain a stable value, backed by fiat currency. Griffin's findings on the 2017 boom indicate that 50 percent of the price increase resulted from Tether manipulation.

In the crypto sphere many manipulation techniques can be seen: 1) Wash trading entails repeated buying and selling of crypto units by the same owners, inflating trading volumes and deceiving investors about supply and demand, thereby impacting price discovery. One study based on a sample of almost 30 big crypto exchanges, including Bitcoin, found that wash trading accounts for 77.5% of the total trading volume on unregulated exchanges (Cong 2023). 2) Pump-and-dump schemes involve manipulators using false information, often via social media augmented by algorithms, to artificially increase the price and attract buyers, allowing them to sell at a profit. On 9 January the US SEC’s official account on X (formerly Twitter) was comprised. Hackers posted false news about the anticipated SEC approval of a spot ETF containing bitcoin. Bitcoin’s price spiked – and dropped sharply when the SEC deleted the post about 30 minutes later (Reuters 2024). 3) “Whale manipulation” occurs when large holders influence a crypto's price to strategically buy or sell significant amounts.

More recently Tether, a huge cryptocurrency platform, has emerged as one of the leading payment methods for money launderers in south-east Asia (UNODC 2024). But just because Tether is being increasingly used for money laundering does not mean that Bitcoin is being used less.

It should be noted that SEC Chair Gary Gensler said the agency’s approvals were not an endorsement of Bitcoin, and he called it “primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion and terrorist financing.” Moreover, Caroline Crenshaw, a Democratic commissioner who voted to deny approval, ran through a list of investor safety concerns in her dissent, ranging from inadequate oversight of the markets to wash trading (New York Times 2024).

Cryptoasset service providers must make checks on customers who carry out transactions worth €1,000 or more and report suspicious activity. Cross-border cryptoasset firms must make additional checks (Reuters 2024a).