Euro area balance of payments in May 2011 and international investment position at the end of the first quarter of 2011

In May 2011 the seasonally adjusted current account of the euro area recorded a deficit of EUR 5.2 billion. In the financial account, combined direct and portfolio investment recorded net inflows of EUR 53 billion (non-seasonally adjusted).

At the end of the first quarter of 2011 the international investment position of the euro area recorded net liabilities of EUR 1.2 trillion vis-à-vis the rest of the world (approximately 13% of euro area GDP). This represented an increase of EUR 36 billion in comparison with the revised data for the end of the fourth quarter of 2010.

Balance of payments in May 2011

The seasonally adjusted current account of the euro area recorded a deficit of EUR 5.2 billion in May 2011 (see Table 1). This reflected deficits for current transfers (EUR 8.8 billion) and income (EUR 3.9 billion), which were partially offset by surpluses for services (EUR 3.9 billion) and goods (EUR 3.6 billion).

The 12-month cumulated seasonally adjusted current account recorded a deficit of EUR 55.3 billion in May 2011 (around 0.6% of euro area GDP; see Table 1 and Chart 1), compared with a deficit of EUR 15.5 billion a year earlier. This increase resulted from a decrease in the surplus for goods (from EUR 40.7 billion to EUR 3.1 billion), a switch in the balance for income from a surplus (EUR 2.5 billion) to a deficit (EUR 4.3 billion) and an increase in the deficit for current transfers (from EUR 94.1 billion to EUR 99.2 billion), which were partly offset by an increase in the surplus for services (from EUR 35.4 billion to EUR 45.0 billion).

In the financial account (see Table 2), combined direct and portfolio investment recorded net inflows of EUR 53 billion in May 2011 as a result of net inflows for portfolio investment (EUR 57 billion), which were, to a limited extent, offset by net outflows for direct investment (EUR 5 billion).

The net outflows for direct investment resulted almost entirely from net outflows for other capital (mostly inter-company loans) (EUR 6 billion).

The net inflows for portfolio investment were mainly accounted for by net purchases of euro area securities by non-residents (EUR 70 billion). More specifically, the developments in euro area securities resulted from net purchases of debt instruments by non-residents (EUR 83 billion), which exceeded net sales of equity by non-residents (EUR 13 billion).

The financial derivatives account recorded net inflows of EUR 3 billion.

Other investment recorded net outflows of EUR 36 billion, reflecting net outflows for MFIs excluding the Eurosystem (EUR 28 billion) and other sectors (EUR 28 billion), which were partially offset by net inflows for general government (EUR 13 billion) and the Eurosystem (EUR 7 billion).

The Eurosystem’s stock of reserve assets increased by EUR 21 billion in May 2011 (from EUR 572 billion to EUR 593 billion), of which EUR 3 billion was accounted for by transactions.

In the 12-month period to May 2011 combined direct and portfolio investment recorded cumulated net inflows of EUR 232 billion, compared with net inflows of EUR 175 billion in the preceding 12-month period. This increase was mainly the result of lower net outflows for direct investment (down from EUR 105 billion to EUR 23 billion), which in turn mainly reflected lower direct investment abroad.

International investment position at the end of the first quarter of 2011

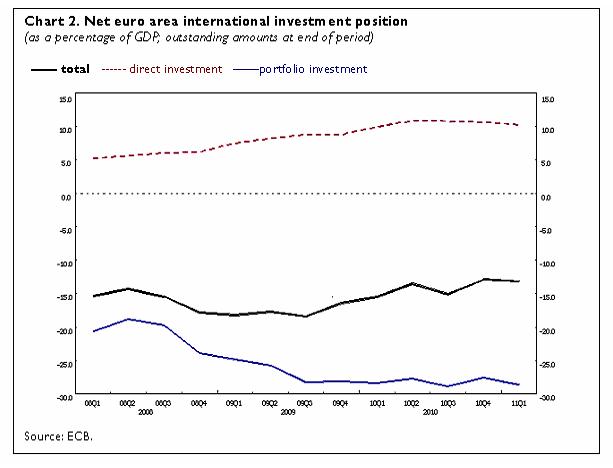

At the end of the first quarter of 2011 the international investment position of the euro area recorded net liabilities of EUR 1.2 trillion vis-à-vis the rest of the world (approximately 13% of euro area GDP; see Chart 2). This represented an increase of EUR 36 billion in comparison with the revised data for the end of the fourth quarter of 2010 (see Table 3).

The change in the net international investment position was mainly a result of a higher net liability position for portfolio investment (up from EUR 2,530 billion to EUR 2,658 billion) and a lower net asset position for direct investment (down from EUR 975 billion to EUR 948 billion), which were partly offset by a decrease in the net liability position for other investment (down from EUR 178 billion to EUR 67 billion). While the changes in the net position for portfolio investment and other investment were primarily driven by transactions, the changes in the net position for direct investment were mainly driven by “other changes” (predominantly revaluations on account of exchange rate and asset price changes).

At the end of the first quarter of 2011 the gross external debt of the euro area amounted to EUR 10.8 trillion (approximately 117% of euro area GDP), which represented a decrease of EUR 95 billion in relation to the revised data for the end of the previous quarter.

Data revisions

This press release incorporates revisions to the balance of payments for the period from October 2010 to April 2011, and to the international investment position for the end of the fourth quarter of 2010.

The revisions to the balance of payments in April 2011 did not significantly change the previously published data. The current account surplus in the last quarter of 2010 was revised downwards (from EUR 6.0 billion to EUR 2.2 billion), mainly owing to revisions in goods and income. In the financial account, revisions primarily affected direct investment in the last quarter of 2010 and portfolio investment in the first quarter of 2011. The revisions to the international investment position for the end of the fourth quarter of 2010 did not significantly change the previously published net liability position.

Additional information on the euro area balance of payments and international investment position

In this press release, the seasonally adjusted current account refers to working day and seasonally adjusted data. Data for the financial account are not working day or seasonally adjusted.

In line with the agreed allocation of responsibilities, the European Central Bank compiles and disseminates monthly and quarterly balance of payments statistics for the euro area, whereas the European Commission (Eurostat; see news releases for “Euro-indicators”) focuses on quarterly and annual aggregates for the European Union. These data comply with international standards, particularly those set out in the IMF’s Balance of Payments Manual (fifth edition). The aggregates for the euro area and the European Union are compiled consistently on the basis of transactions and positions vis-à-vis residents of countries outside the euro area and the European Union respectively.

A complete set of updated euro area balance of payments statistics (including a quarterly geographical breakdown for the main counterparts) and international investment position statistics is available in the “Statistics” section of the ECB’s website under the headings “Data services”/“Latest monetary, financial markets and balance of payments statistics”. These data, as well as historical euro area balance of payments time series, can be downloaded from the ECB’s Statistical Data Warehouse (SDW). Data up to May 2011 will also be published in the August 2011 issues of the ECB’s Monthly Bulletin and Statistics Pocket Book. Detailed methodological notes are available on the ECB’s website. The next press release on the euro area monthly balance of payments will be published on 17 August 2011.

Annexes

Table 1: Current account of the euro area

Table 2: Monthly balance of payments of the euro area

Table 3: Quarterly international investment position of the euro area

Bank Ċentrali Ewropew

Direttorat Ġenerali Komunikazzjoni

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, il-Ġermanja

- +49 69 1344 7455

- media@ecb.europa.eu

Ir-riproduzzjoni hija permessa sakemm jissemma s-sors.

Kuntatti għall-midja