1 Overview

The euro area economy weakened in the second half of 2023, dragged down by tighter financing conditions, subdued confidence and competitiveness losses. It is now expected to recover at a slightly slower pace than foreseen in the September 2023 ECB staff macroeconomic projections. Short-term indicators suggest weak economic activity in the fourth quarter of 2023. However, growth is expected to strengthen from early 2024, as real disposable income rises – supported by declining inflation, robust wage growth and resilient employment – and export growth catches up with improvements in foreign demand. The impact of the ECB’s monetary policy tightening and adverse credit supply conditions continues to feed through to the economy, affecting the near-term growth outlook. These dampening effects are expected to fade later in the projection horizon, supporting growth. Overall, annual average real GDP growth is expected to slow down from 3.4% in 2022 to 0.6% in 2023, before recovering to 0.8% in 2024 and stabilising at 1.5% in 2025 and 2026. Compared with the September 2023 projections, the outlook for GDP growth has been slightly revised down for 2023-2024, on the back of the recent data releases and weak survey data, whereas it is unrevised for 2025.[1]

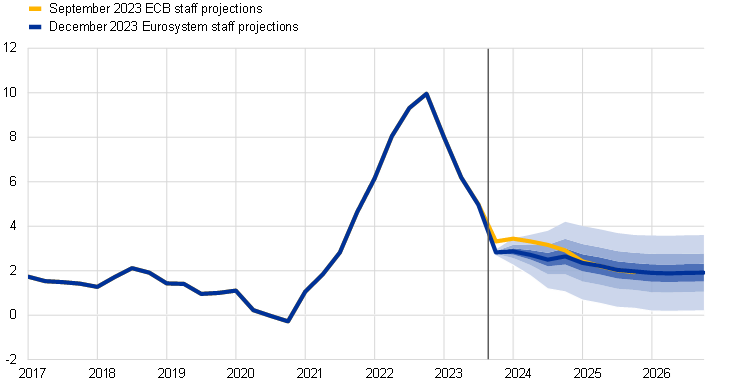

Inflation has continued to decline owing to falling energy inflation, the impact of monetary policy tightening and the ongoing easing of pipeline pressures and supply bottlenecks. Having dropped to 2.4% in November 2023, HICP inflation is expected to temporarily pick up in the short term owing to a rebound in energy inflation. The underlying disinflationary process is, however, expected to continue, despite strong increases in labour costs, which are increasingly the dominant driver of HICP inflation excluding energy and food. Despite some cooling, the labour market is projected to remain tight which, together with compensation effects from past high inflation, should keep nominal wage growth high. However, wage growth is expected to ease over the projection horizon as the upward impacts from inflation compensation gradually fade. Profits expanded notably in 2022, but are set to weaken over the projection horizon and provide a buffer to the pass-through of labour costs. Overall, with medium-term inflation expectations assessed to remain anchored at the ECB’s 2% inflation target, headline HICP inflation is expected to decrease from 5.4% in 2023 to an average of 2.7% in 2024, 2.1% in 2025 and 1.9% in 2026. Compared with the September 2023 projections, HICP inflation has been revised down for 2023 and 2024, mainly owing to lower than expected recent data outturns and lower assumptions for energy commodity prices, whereas it is unrevised for 2025.

Table 1

Growth and inflation projections for the euro area

(annual percentage changes)

December 2023 | September 2023 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

2022 | 2023 | 2024 | 2025 | 2026 | 2022 | 2023 | 2024 | 2025 | |

Real GDP | 3.4 | 0.6 | 0.8 | 1.5 | 1.5 | 3.4 | 0.7 | 1.0 | 1.5 |

HICP | 8.4 | 5.4 | 2.7 | 2.1 | 1.9 | 8.4 | 5.6 | 3.2 | 2.1 |

Notes: Real GDP figures refer to annual averages of seasonally and working day-adjusted data. Historical data may differ from the latest Eurostat publications owing to data releases after the cut-off date for the projections. Data are available for downloading, also at quarterly frequency, from the Macroeconomic Projection Database on the ECB website.

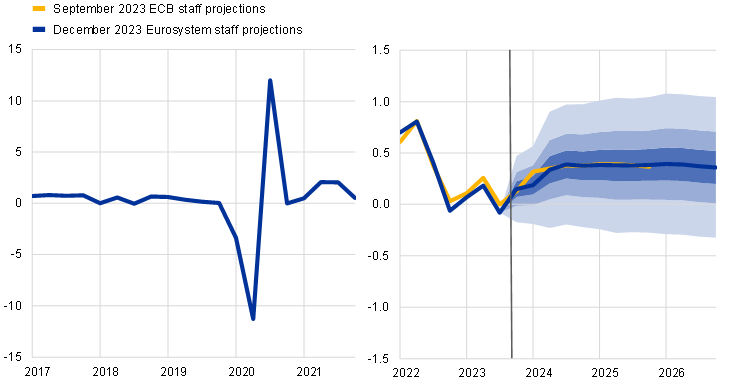

The economic outlook continues to be surrounded by high uncertainty as reflected in the uncertainty bands surrounding the growth and inflation projections (Charts 1, 4 and 7). This report contains a scenario assessing the implications for the euro area economy of a potential escalation of the conflict in the Middle East (Box 3) and a number of sensitivity analyses related to alternative paths for energy and food commodity prices (Box 4).

2 Real economy

Economic activity in the euro area marginally declined in the third quarter of 2023, reflecting a negative contribution to growth from destocking which was counterbalanced by a positive contribution from domestic demand (Chart 1). Euro area growth in the third quarter of 2023 was -0.1%, which is slightly below the zero growth expected in the September 2023 projections.[2] Manufacturing and construction value added continued to decline in the third quarter, while services value added increased. As regards demand components, private consumption increased in the third quarter, in particular for services, likely supported by contact-intensive services during the summer season, and for durable goods. In contrast, competitiveness losses owing to both exchange rate developments and energy price developments have led to a drop in exports.

Chart 1

(quarter-on-quarter percentage changes, seasonally and working day-adjusted quarterly data)

Notes: Historical data may differ from the latest Eurostat publications (see also footnote 2). The vertical line indicates the start of the current projection horizon. The ranges shown around the central projections provide a measure of the degree of uncertainty and are symmetric by construction. They are based on past projection errors, after adjustment for outliers. The bands, from darkest to lightest, depict the 30%, 60% and 90% probabilities that the outcome of real GDP growth will fall within the respective intervals. For more information, see Box 6 of the March 2023 ECB staff macroeconomic projections for the euro area.

Real GDP growth is expected to be weak in the fourth quarter of 2023, amid tight financing conditions, and to recover gradually from the first quarter of 2024, supported by increases in real income and foreign demand. The boost to activity from the post-pandemic reopening of the economy and the unwinding of supply bottlenecks is fading, while the drag from tight financing conditions and elevated consumer uncertainty remains significant. Survey indicators suggest very weak or contracting domestic economic activity in the fourth quarter of 2023, with some tentative signs of a bottoming-out. Moreover, declining inflation and rising wages, in the context of a still tight labour market, should support households’ purchasing power around the turn of the year. In addition, export growth, albeit still muted, is expected to recoup some of the export market share losses seen in recent quarters. Overall, while economic activity is expected to remain subdued in the fourth quarter of 2023, it should gradually strengthen thereafter, driven by further increases in real disposable income and foreign demand, and thus by rising private consumption and exports, amid a likely recovery in confidence in the absence of any new adverse shocks.

Over the medium term, GDP growth is projected to stabilise at rates broadly in line with the pre-pandemic average, supported by increasing real incomes and strengthening foreign demand. Real GDP growth is expected to strengthen in 2024-2025 and to stabilise in 2026 (Table 2). While recent tailwinds are waning, growth is projected to be driven by abating inflationary pressures, helped by the unwinding of the energy shock, as well as by robust income growth. These factors, in the context of resilient labour markets, provide for a strong recovery in private consumption. Nevertheless, the withdrawal of energy and inflation compensatory fiscal support measures introduced since 2022 will have a small negative impact on growth in 2024-26.

Tight financing conditions are expected to continue to have a negative impact on growth, but this impact should gradually fade over the projection horizon. The impact of the monetary policy measures taken since December 2021 continues to feed through to the real economy, affecting the growth outlook, particularly for 2023 and 2024.[3] In addition, credit supply conditions, as reported in the ECB’s latest euro area bank lending survey, have tightened significantly since the start of the year and loan growth has decreased sharply. The negative credit supply effects are assumed to affect mostly business and housing investment, and, to a lesser extent, private consumption. Although there is considerable uncertainty surrounding the precise timing and magnitude of the impact of monetary policy and credit supply conditions on the real economy, on the basis of market expectations for the future path of interest rates (Box 1), the impact on economic growth is expected to start fading after 2024. Therefore, part of the projected increase in GDP growth over the medium term relates to the fading of these dampening effects.

Compared with the September 2023 projections, real GDP growth has been revised down by 0.1 percentage points for 2023 and by 0.2 percentage points for 2024, and it is unrevised for 2025. The revisions reflect the weaker data outturns for the third quarter of 2023 and deteriorating survey indicators. The recent more negative outturns and forward-looking indicators for exports imply downward revisions to net trade in 2023-2025, which are partly counterbalanced by small upward revisions to domestic demand.

Table 2

Real GDP, labour markets and trade projections

(annual percentage changes, unless otherwise indicated)

December 2023 | September 2023 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

2022 | 2023 | 2024 | 2025 | 2026 | 2022 | 2023 | 2024 | 2025 | |

Real GDP | 3.4 | 0.6 | 0.8 | 1.5 | 1.5 | 3.4 | 0.7 | 1.0 | 1.5 |

Private consumption | 4.2 | 0.5 | 1.4 | 1.6 | 1.4 | 4.1 | 0.3 | 1.6 | 1.6 |

Government consumption | 1.5 | 0.1 | 1.1 | 1.3 | 1.2 | 1.5 | -0.1 | 1.1 | 1.4 |

Gross fixed capital formation | 2.8 | 1.3 | 0.4 | 1.8 | 2.1 | 2.9 | 1.7 | -0.4 | 1.4 |

Exports1) | 7.4 | -0.4 | 1.1 | 2.9 | 3.0 | 7.3 | 1.3 | 2.5 | 3.1 |

Imports1) | 8.1 | -0.9 | 1.7 | 3.1 | 3.0 | 8.1 | 0.3 | 2.5 | 3.1 |

Employment | 2.3 | 1.4 | 0.4 | 0.4 | 0.4 | 2.3 | 1.2 | 0.2 | 0.2 |

Unemployment rate | 6.7 | 6.5 | 6.6 | 6.5 | 6.4 | 6.7 | 6.5 | 6.7 | 6.7 |

Current account balance | -0.7 | 1.2 | 1.0 | 1.0 | 1.1 | -0.8 | 1.1 | 1.4 | 1.6 |

Notes: Real GDP and components refer to seasonally and working day-adjusted data. Historical data may differ from the latest Eurostat publications owing to data releases after the cut-off date for the projections. Data are available for downloading, also at quarterly frequency, from the Macroeconomic Projection Database on the ECB website.

1) This includes intra-euro area trade.

Turning to the components of real GDP, real private consumption is expected to gradually recover and underpin economic growth, as uncertainty and inflation decline and real incomes and confidence improve. Private consumption stagnated in the first half of the year, amid a contraction in spending on goods, while spending on consumer services remained resilient. Reflecting the decline in inflation and still lingering post-pandemic reopening effects, coupled with a slight recovery in confidence in November, consumer spending is estimated to have strengthened in the second half of the year. Beyond the short term, as inflation and uncertainty recede further and real incomes improve, in the absence of any additional adverse shocks, consumption should further improve and underpin economic growth, notwithstanding the waning of reopening effects. Household consumption growth is expected to remain robust in 2026, supported by increases in both labour and non-labour income and the fading of earlier precautionary motives. Private consumption growth has been revised up by 0.2 percentage points for 2023, compared with the September 2023 projections, owing to upward data revisions for the first half of the year, but it has been revised down by 0.2 percentage points for 2024, on account of higher savings in the short term, while it is unrevised for 2025.

Real disposable income is estimated to have recovered in 2023 and is projected to increase at a faster pace over 2024-26, reflecting falling inflation and robust wage growth. After falling slightly in 2022, real disposable income is expected to recover in 2023, driven by strong labour and non-labour income growth and declining inflation. Together with the strong wage growth, non-labour income is expected to support households’ purchasing power in the near term. Net fiscal transfers are expected to make a broadly neutral contribution to real disposable income and consumption growth over the full horizon.

The household saving ratio is expected to remain elevated relative to its pre-pandemic level throughout the projection horizon. The saving ratio increased in the first half of 2023 and is expected to remain high for some time, reflecting strong non-labour income growth in the first half of the year (in part owing to the high propensity to save this type of income), still elevated uncertainty and strong saving incentives stemming from increasing interest rates. However, as uncertainty recedes, the household saving ratio should edge down from 2025, albeit remaining well above its pre-pandemic level, as higher interest rates counterbalance households’ desire to normalise their saving behaviour after the pandemic. The stock of excess savings is not expected to provide support to consumption growth, given that it is concentrated among wealthy households and mostly accumulated in illiquid assets, and as high inflation rates have had a dampening effect on the real value of this stock. The saving ratio has been revised up compared with the September 2023 projections, largely reflecting revisions to historical data, expected more cautious household behaviour and stronger incentives to save owing to high interest rates and tighter credit access.

Box 1

Technical assumptions about interest rates, commodity prices and exchange rates

Compared with the September 2023 projections, the technical assumptions include lower short-term euro area interest rates, lower energy prices and a depreciation of the euro. The technical assumptions about interest rates and commodity prices are based on market expectations, with a cut-off date of 23 November 2023. Short-term interest rates refer to the three-month EURIBOR and market expectations are derived from futures rates, while ten-year government bond yields are used to proxy long-term interest rates.[4] The assumptions for short-term interest rates have been revised down over the horizon, while ten-year government bond yields are broadly unrevised.

Table

Technical assumptions

December 2023 | September 2023 | |||||||

|---|---|---|---|---|---|---|---|---|

2023 | 2024 | 2025 | 2026 | 2022 | 2023 | 2024 | 2025 | |

Three-month EURIBOR | 3.4 | 3.6 | 2.8 | 2.7 | 0.3 | 3.4 | 3.7 | 3.1 |

Ten-year government bond yields | 3.2 | 3.2 | 3.3 | 3.4 | 1.8 | 3.1 | 3.3 | 3.4 |

Oil price (in USD/barrel) | 84.0 | 80.1 | 76.5 | 73.6 | 103.7 | 82.7 | 81.8 | 77.9 |

Natural gas prices (EUR/MWh) | 42 | 47 | 44 | 37 | 123 | 43 | 54 | 47 |

Wholesale electricity prices (EUR/MWh) | 105 | 117 | 111 | 98 | 258 | 115 | 143 | 123 |

Non-energy commodity prices, in USD | -13.2 | -2.3 | 2.4 | 1.7 | 6.6 | -13.6 | -3.1 | 3.2 |

EU Emissions Trading System allowances | 84.0 | 78.4 | 82.0 | 85.2 | 80.9 | 87.9 | 92.3 | 96.5 |

USD/EUR exchange rate | 1.08 | 1.08 | 1.08 | 1.08 | 1.05 | 1.09 | 1.09 | 1.09 |

Euro nominal effective exchange rate | 121.9 | 123.5 | 123.5 | 123.5 | 116.8 | 123.0 | 124.9 | 124.9 |

Note: Data are available for downloading from the Macroeconomic Projection Database on the ECB website.

The technical assumptions for energy commodity prices have been revised down since the September 2023 projections.[5] After a period of higher oil prices in September and October, amid the extension of the OPEC+ supply cut until the end of 2023 and risks to the Middle East supply from the conflict in the region, weakening demand in advanced economies following macroeconomic headwinds have led to lower oil prices. Overall, the oil futures curve has shifted downwards since the September 2023 projections (by 2.1% for 2024 and by 1.7% for 2025) and remains downward-sloping. The oil price is assumed to fall from USD 84 per barrel in 2023 to USD 73.6 per barrel in 2026. Gas prices have been revised down more substantially. The impact on prices from low gas consumption at the beginning of the European heating season and full storage facilities outweighed the impact of risks to supply stemming from the closure of an Israeli gas field after the terrorist attacks and a leak from a gas pipeline between Finland and Estonia. Overall, the gas futures curve has shifted downwards since the September projections (by 12.6% for 2024 and by 6.9% for 2025). Electricity price futures have also been revised down by 18.3% for 2023 and by 10.1% for 2025. As regards carbon emissions allowances on the EU Emissions Trading System (ETS), price futures now stand on average around 11% below the path assumed in the September 2023 projections, but ETS prices are assumed to increase by around €8 per tonne from the fourth quarter of 2023 to the fourth quarter of 2026.

The non-energy commodity price assumptions have been revised up for 2024 and down for 2025 since the September 2023 projections, amid mixed developments in international metal and raw food prices. Metal prices have increased, mainly owing to positive economic news from China. The upward revision to international food commodity prices for 2024 and the downward revision for 2025 reflect different developments in individual food commodities. Cocoa and sugar prices have increased owing to crop damage from the ongoing effects of El Niño, while wheat and corn prices have declined significantly following a period of very high global supply, especially from Russia.

Bilateral exchange rates are assumed to remain unchanged over the projection horizon, at the average levels prevailing in the ten working days ending on the cut-off date. This implies an exchange rate of USD 1.08 per euro over the projection horizon, which is 0.9% lower than assumed in the September 2023 projections. The assumption for the effective exchange rate of the euro implies a depreciation of 1.1% compared with the assumption in the September 2023 projections.

Housing investment is expected to continue to decline in 2024 before recovering in 2025 and 2026, as the dampening effects of the tightening in financing conditions fade. In line with the signals from short-term indicators, such as the continuing decline in the number of building permits granted and the deterioration in the confidence of construction companies, housing investment is expected to continue its downward trend for some time and is only seen to return to positive growth in 2025. The persistent weakness in housing investment is due to the considerable tightening of financing conditions, including the sharp rise in mortgage interest rates and the tightening of banks’ lending conditions. However, as the negative effects of the tightening of financing conditions subside and income growth strengthens, housing investment is expected to gradually increase again in 2025 and 2026. The adverse impact of tighter bank lending conditions (including both demand and supply factors) on housing investment growth is likely to be strong in 2023-24, and still notable in 2025.

Business investment is foreseen to grow weakly in 2024 owing to tight financing conditions, thus lagging the expansion of demand, with a projected recovery in 2025-2026, reflecting the fading of the negative impact from financing conditions and support from the Next Generation EU (NGEU) programme. Following an increase in the third quarter, business investment is expected to contract in the fourth quarter of 2023 and to broadly stagnate in the first quarter of 2024, as weak economic activity, tight financing conditions and restrictive credit conditions weigh on investment. The dampening impact of tighter bank lending conditions entailed in the December 2023 projections on business investment is estimated to have been strongest in 2023, while a still significant drag is seen in the pipeline for 2024 and 2025. The fading of these negative impacts, as well as a broad rebound in domestic and foreign demand, and the green and digital transition, supported by NGEU funds, are seen to contribute to a recovery in business investment over the medium term.

Box 2

The international environment

The global economy grew at a moderate but steady pace in 2023, supported by resilient labour markets and strong private consumption, but the pace is expected to moderate somewhat. Global growth in 2023, estimated at 3.3%, was underpinned by emerging market economies, including China, and by the United States.[6] In the United States, solid domestic demand and a strong labour market delivered robust growth, despite the significant tightening of monetary policy. In China, the lifting of pandemic-related containment measures at the start of the year and a broader recovery in consumption compensated for the weakness in the residential real estate sector. Across large countries, recent data provide mixed signals. In both China and the United States, real GDP growth accelerated in the third quarter, whereas in the United Kingdom it remained flat and in Japan it contracted amid high inflation weighing on economic activity and consumption in both countries. Global real GDP growth is projected to be 3.1% in 2024 and 3.2% in both 2025 and 2026, which is broadly in line with the September projections but below its pre-pandemic average of 3.6% (recorded in 2012-2019). In the United States, growth has been revised upwards, reflecting expectations of a softer landing and a smoother disinflationary process. In the United Kingdom, the economy is assessed to avoid a recession, but growth in 2024 and 2025 has been revised down, reflecting weaker data and the delayed impact of monetary policy tightening amid high inflation. The growth outlook is broadly unrevised for emerging Asia and China.

Global trade growth remained weak in 2023, amid a normalisation of consumption patterns after the pandemic, but trade is projected to recover and start growing more in line with global economic activity in the medium term. Annual average trade growth likely slowed to 1.1% in 2023, affected by a negative carryover effect, but it had already started to regain momentum in the second quarter. The weak performance in annual terms is explained by (i) a less trade-intensive composition of global growth, given a higher consumption share in domestic demand; (ii) a larger contribution to global growth from emerging market economies, which have a lower trade elasticity; and (iii) the normalisation of some pandemic-related factors that supported trade growth until 2022. The latter factors relate to the rotation of demand from goods back to services, as pandemic-related containment measures were fully relaxed. Compared with the September projections, global trade growth and euro area foreign demand growth have been revised up for 2023, owing to a better performance, especially in the second quarter, in the United Kingdom, China and India. Global trade growth is expected to regain momentum over the rest of the projection horizon and to increase broadly in line with economic activity. Global trade is projected to grow by 3.0% in 2024 and 2025 and by 3.2% in 2026. It has been revised down compared with the September 2023 projections, reflecting a reassessment of the speed at which the global trade elasticity is seen to return to its expected long-term value. Euro area foreign demand is projected to grow by 2.6% in 2024, 2.9% in 2025 and 3.1% in 2026, which is also lower than the previous projections.

Table

The international environment

(annual percentage changes)

December 2023 | September 2023 | |||||||

|---|---|---|---|---|---|---|---|---|

2023 | 2024 | 2025 | 2026 | 2022 | 2023 | 2024 | 2025 | |

World real GDP (excluding the euro area) | 3.3 | 3.1 | 3.2 | 3.2 | 3.3 | 3.2 | 3.0 | 3.2 |

Global trade (excluding the euro area)1) | 1.1 | 3.0 | 3.0 | 3.2 | 5.3 | 0.2 | 3.2 | 3.3 |

Euro area foreign demand2) | 0.8 | 2.6 | 2.9 | 3.1 | 6.5 | 0.1 | 3.0 | 3.0 |

World CPI (excluding the euro area) | 5.0 | 4.4 | 3.4 | 2.9 | 7.6 | 4.8 | 4.2 | 3.2 |

Export prices of competitors in national currency3) | -0.3 | 3.2 | 2.7 | 2.6 | 16.0 | 0.4 | 2.8 | 2.5 |

Note: Data are available for downloading from the Macroeconomic Projection Database on the ECB website.

1) Calculated as a weighted average of imports.

2) Calculated as a weighted average of imports of euro area trading partners.

3) Calculated as a weighted average of the export deflators of euro area trading partners.

Annual headline inflation at the global level is projected to decline over the projection horizon, and export prices of euro area competitors are projected to normalise. World headline consumer price index (CPI) inflation is projected to reach 5.0% this year and then to decline gradually to stand at 2.9% in 2026. Global inflation projections have been revised upwards slightly compared with the September 2023 projections, mainly reflecting upward revisions to Türkiye’s inflation outlook. Export prices of euro area competitors (in national currencies) are estimated to have dropped below their long-term average growth rates in the second quarter of 2023, as commodity prices continued to fall and domestic and foreign pipeline pressures eased. They are projected to rebound as the decline in commodity prices exerts less drag, and have been revised downwards for 2023 and upwards for 2024-25 compared with the September 2023 projections.

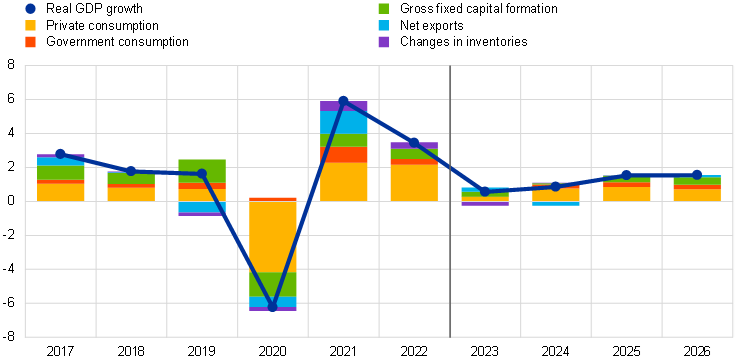

The outlook for euro area trade remains subdued as high energy prices and the lagged impact of the effective appreciation of the euro over the past year hinder competitiveness. Euro area real exports performed very poorly in the second quarter and are estimated to have continued retrenching in the third quarter of 2023, despite the recovery in euro area foreign demand. The prospects for export market shares are now assessed to be notably below those entailed in the September 2023 projections. Export growth is projected to recover from the fourth quarter of 2023. However, export price competitiveness remains under pressure, reflecting the effective appreciation of the euro since the second half of 2022 and the high energy prices faced by euro area firms. Surveys point to declining new export orders in both services and manufacturing, while order backlogs have fallen to historical lows. As a result, euro area exports are projected to remain subdued, broadly in line with foreign demand over the projection horizon and consistent with post-pandemic dynamics that suggest that the elasticity of exports to foreign demand has declined. Euro area imports also seem to have become less sensitive to demand. After an estimated contraction in the third quarter of 2023, imports should grow more modestly than in the past, relative to import demand, over the projection horizon. The lower trade elasticities could reflect various factors, such as a reorientation of domestic demand toward less trade-intensive components (for imports) – for example services – or competitiveness challenges facing euro area firms (for exports). Overall, net trade is expected to make a negative contribution to GDP growth in 2024, to turn broadly neutral in 2025 and to provide modest support for growth in 2026 (Chart 2). The surplus in the euro area current account is projected to stabilise at around 1% of GDP, well below the level prevailing before the pandemic.

Chart 2

Euro area real GDP – decomposition into the main expenditure components

(annual percentage changes, percentage point contributions)

Notes: Data are seasonally and working day-adjusted. Historical data may differ from the latest Eurostat publications owing to data releases after the cut-off date for the projections. The vertical line indicates the start of the projection horizon.

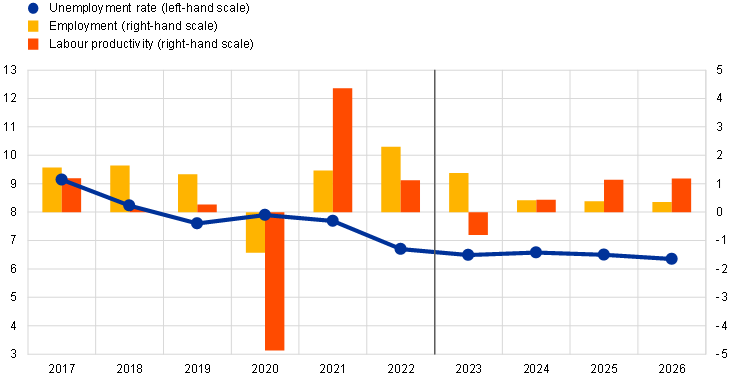

The labour market is expected to remain resilient, despite cooling somewhat, with more moderate employment growth (vis-à-vis GDP) than seen in 2023. Growth in total employment is expected to slow down but remain in positive territory, falling from 2.3% in 2022 to 1.4% in 2023, and then to stabilise at 0.4% over the period 2024-2026 (Chart 3). Compared with the September 2023 projections, employment growth has been revised up by 0.6 percentage points over the whole projection horizon (in cumulative terms), implying a downward revision to labour productivity growth. This pattern reflects the assumption of labour hoarding in the current environment of weak economic growth, which is unwound in the later years of the projection horizon when the economy strengthens again. Overall, labour productivity growth is expected to strengthen over the projection horizon, but productivity levels will remain significantly below their long-term linear trend. The unemployment rate is expected to slightly increase in the short term to stand at 6.6% in 2024, before decreasing over the rest of the projection horizon to an average of 6.5% in 2025 and 6.4% in 2026. While this contrasts with the slightly increasing path foreseen in the September 2023 projections, the general assessment of a tight labour market remains valid.

Chart 3

The euro area labour market

(percentage of labour force (left-hand scale), annual percentage changes (right-hand scale))

Note: The vertical line indicates the start of the projection horizon.

Box 3

Scenario analysis of a potential further escalation of the conflict in the Middle East

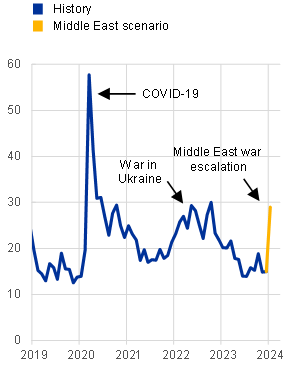

This scenario analysis explores tail risks to the December 2023 baseline projections stemming from a potential further escalation of the conflict in the Middle East. The December 2023 baseline projection assumes that the current conflict will be contained geographically and therefore is not expected to have significant economic effects on the euro area economy beyond those already observed. The reaction of the global financial markets following the outbreak of the conflict has been muted, with a modest initial increase in oil prices and economic uncertainty, in line with the limited trade and financial linkages of the euro area with the affected areas. The scenario in this box assumes a major and prolonged escalation of the conflict and a partial closure of the Strait of Hormuz, which would entail stronger repercussions for the global economy and the euro area relative to the December 2023 baseline projection. This would imply disruptions in economic activity, particularly for countries directly involved in the conflict, as well as higher energy commodity prices, and a rise in broader economic uncertainty and financial market disruptions (Chart A). Such a scenario is considered a tail risk scenario and, given the high uncertainty surrounding the evolution of the conflict, the estimates should be treated with great caution.

Chart A

Scenario of a potential escalation of the conflict in the Middle East

a) Synthetic energy price index | b) US stock market volatility index (VIX) | c) Euro area foreign demand growth |

|---|---|---|

(USD/MWh) | (index) | (percentage point deviation from baseline) |

|  |  |

Notes: The Synthetic Energy Commodity Price Index is calculated as a weighted average of oil and gas prices. The oil price scenario is constructed based on the elasticity of the oil price to oil supply shocks as estimated in Caldara, D., Cavallo, M. and Iacoviello, M., “Oil price elasticities and oil price fluctuations”, Journal of Monetary Economics, Vol. 103, 2019; while the gas price scenario is constructed based on the elasticity of the gas price to gas supply shocks as estimated in Albrizio, S., Bluedorn, J., Koch, C., Pescatori, A. and Stuermer, M., “Sectoral Shocks and the Role of Market Integration: The Case of Natural Gas”, AEA Papers and Proceedings, American Economic Association, Vol. 113, pp. 43-46, May 2023. The volatility index is based on the VIX from the Chicago Board Options Exchange. The impact on euro area foreign demand is computed using the ECB-Global Model and covers energy prices, uncertainty and trade effects.

In a hypothetical escalation of the conflict, oil and gas prices could increase substantially, particularly in case of a partial blockage of the Strait of Hormuz. The scenario assumes that about one third of the oil and gas in transit via the Strait of Hormuz is disrupted, contributing to a tightening in the global energy markets. As a result, in the second quarter of 2024 oil prices would rise to almost 130 USD per barrel and gas prices would surge to €83 per MWh (57% and 74% respectively above the levels assumed in the baseline projections). Overall, a synthetic energy price index (which combines oil and gas prices) is assumed to be 64% above the baseline in the second quarter of 2024 and to remain 36% above the baseline in 2026 (Chart A, panel a). Such a scenario is an extreme one, as it would push energy prices above the 75th percentile of the option-implied distribution for energy futures (see also Box 4). The Strait of Hormuz has never been truly blocked, while the assumed oil and gas supply shock is more persistent than historical supply shocks, as energy markets tend to rebalance more quickly.

The escalation scenario would likely also make the economic outlook more uncertain, causing a drop in private consumption, investment and trade and translating into a significant repricing of financial market instruments. The escalation scenario assumes that the VIX volatility index, a proxy for global uncertainty, would increase by around 14 points in the beginning of 2024 (Chart A, panel b), a magnitude similar to the developments seen following the onset of the Ukraine war and at the time of past geopolitical events in the Middle East. Thereafter, it is assumed to gradually return to pre-conflict levels, in line with historical regularities. High financial market volatility would be associated with a sharp deterioration in business, consumer and financial market confidence.

The resulting impact on global economic activity and euro area foreign demand would be considerable. Even assuming a sharp drop in domestic economic activity in Israel, Palestine, Lebanon, Syria and Iran, the direct impact on global GDP and euro area foreign demand would be limited owing to the small trade weights of the region. However, higher oil and gas prices as assumed in the scenario would raise global price pressures and dampen global GDP, thereby further reducing demand for euro area exports, though with some delay. An increase in global uncertainty would also dampen global economic activity. Overall, euro area foreign demand growth would decline by 1.2 percentage points in 2024 relative to the December 2023 baseline (Chart A, panel c).

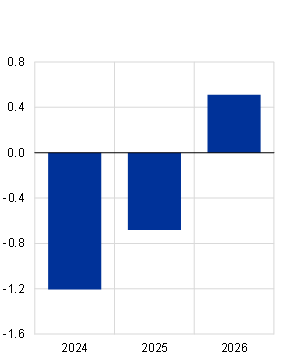

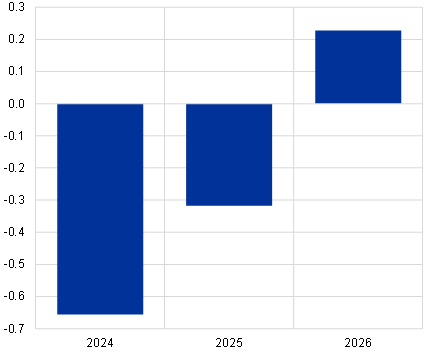

Euro area economic growth would weaken owing to higher energy prices, uncertainty effects and international spillovers, while consumer price inflation would rise mainly as a result of higher energy prices (Chart B). As with the global economy, the higher oil and gas prices and heightened uncertainty would also directly impede euro area economic activity, as households and firms would curtail real consumption and investment in response to the shock. Furthermore, international spillovers would have a negative impact on foreign demand for euro area exports, further reducing aggregate demand. Overall, euro area real GDP growth is estimated to be 0.7 percentage points lower in 2024 and 0.3 percentage points lower in 2025 than in the December 2023 baseline projection, and is estimated to rebound in 2026 as uncertainty effects are assumed to gradually unwind at that horizon. Euro area HICP inflation would increase by 0.9 percentage points in 2024 and 0.4 percentage points in 2025, mainly on account of higher global energy prices.

Chart B

Impact of the scenario on euro area real GDP growth and HICP inflation

(percentage point deviation from baseline annual growth)

Real GDP growth | HICP inflation |

|---|---|

|  |

Sources: Simulations using the ECB-BASE model and ECB staff calculations.

Notes: Simulations were conducted under a forecast setting with backward-looking expectation formation and with exogenous monetary and fiscal policy. The exchange rate incorporates the impact on the EUR/USD exchange rate as well as the nominal effective exchange rate of the euro. The overall impact on euro area economic growth and inflation includes energy, uncertainty and trade effects. The impact of the uncertainty shocks is estimated outside the model in a similar way as in the box entitled “The impact of the Russian invasion of Ukraine on euro area activity via the uncertainty channel”, Economic Bulletin, Issue 4, ECB, 2022.

3 Fiscal outlook

The fiscal stance is projected to tighten over the projection horizon, in particular in 2024 (Table 3). The level of fiscal support in the euro area remains largely accommodative, reflecting past measures – especially those taken in the context of the coronavirus (COVID-19) pandemic in 2020 and the energy support measures taken from 2022. However, the partial withdrawal of this support results in a tightening of the fiscal stance (which is defined as the change in the cyclically adjusted primary balance[7]) over the projection horizon – especially in 2024 when a large share of the energy and inflation compensatory support expires. In 2025 and 2026 the fiscal stance slightly tightens on account of a further scaling-down of the remaining support measures and increases in indirect taxes. Compared with the September 2023 projections, some additional tightening is projected at the euro area level in 2023 and 2025, but marginally less tightening is now expected in 2024. An upward revision to the fiscal costs of existing energy measures explains about half of the revision to the fiscal stance for 2024. In particular, lower energy taxes paid by electricity companies in France and new measures adopted in Spain outweigh an earlier than previously expected end of the electricity and gas price ceilings in Germany (this early termination results from the recent judgment by the German Federal Constitutional Court on the use of emergency credits). In addition to changes in energy price measures, the revisions to the total discretionary measures stem from somewhat higher transfers and government consumption. These two factors partly reflect wage and pension growth as they are explicitly or implicitly indexed – with a lag – to prices.

Table 3

Fiscal outlook for the euro area

(percentage of GDP)

December 2023 | September 2023 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

2022 | 2023 | 2024 | 2025 | 2026 | 2022 | 2023 | 2024 | 2025 | |

Fiscal stance (adjusted for NGEU grants)1) | 0.5 | 0.3 | 0.7 | 0.1 | 0.1 | 0.7 | 0.1 | 0.8 | 0.0 |

General government budget balance (percentage of GDP) | -3.6 | -3.1 | -2.8 | -2.7 | -2.6 | -3.6 | -3.2 | -2.8 | -2.9 |

Structural budget balance (percentage of GDP)2) | -3.6 | -3.2 | -2.7 | -2.6 | -2.7 | -3.2 | -3.0 | -2.4 | -2.5 |

General government gross debt (percentage of GDP) | 90.9 | 88.7 | 88.3 | 88.1 | 88.1 | 91.4 | 89.0 | 88.6 | 88.5 |

Note: Data are available for downloading from the Macroeconomic Projection Database on the ECB website.

1) The fiscal policy stance is measured as the change in the cyclically adjusted primary balance net of government support to the financial sector. The figures shown are also adjusted for expected grants under the Next Generation EU (NGEU) programme on the revenue side. A negative figure implies a loosening of the fiscal stance.

2) Calculated as the government balance net of transitory effects of the economic cycle and measures classified under the European System of Central Banks definition as temporary.

The euro area fiscal outlook is set to improve over the projection horizon. The budget deficit is projected to decline in 2024 to 2.8% of GDP and remain below the 3% reference value for the rest of the projection horizon. In 2026 the budget deficit is projected to be 1.0 percentage point below the 2022 figure. This is mainly due to a decrease in the cyclically adjusted primary deficit in 2023-26 outweighing an increase in interest payments, which is, however, expected to be moderate compared with the increase in market interest rates, as the pass-through is gradual on account of the relatively high residual sovereign debt maturity in the euro area. Compared with the September projections, the euro area budget balance projection for 2024 remains unchanged, as the upward revisions for a few countries are counterbalanced by larger projected deficits for most other countries. The euro area debt-to-GDP ratio is projected to continue to decline to stand at 88.1% in 2026, driven by negative interest rate-growth differentials that more than compensate for primary deficits and expected positive deficit-debt adjustments. The debt-to-GDP ratio has been revised down compared with the September 2023 projections, on account of a level shift owing to an upward revision to GDP in 2021 for several countries.

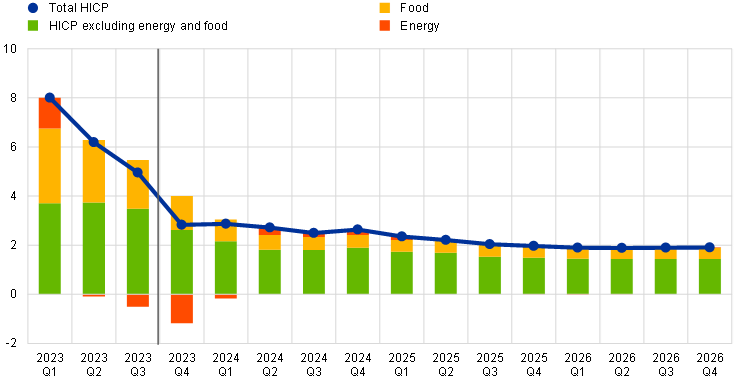

4 Prices and costs

HICP inflation is projected to decrease from an average of 5.4% in 2023 to 2.7% in 2024 and 2.1% in 2025, and then to stand at 1.9% in 2026 (Chart 4). Following the strong decline in HICP inflation to stand at 2.4% in November, in the very short term a temporary rebound is expected, related predominantly to upward base effects in the energy component and the reversal of some fiscal support measures (Chart 5). As a result, energy inflation should increase in 2024, partly offsetting further declines in food inflation and HICP inflation excluding energy and food (HICPX). This implies that headline inflation will fall only gradually during the course of 2024. From the end of 2024 all the main inflation components are expected to continue to ease, supporting headline HICP inflation in reaching the ECB’s target in the second half of 2025 (Chart 6).

Chart 4

Euro area HICP inflation

(annual percentage changes)

Notes: The vertical line indicates the start of the current projection horizon. The ranges shown around the central projections for HICP inflation are based on past projection errors, after adjustment for outliers. The bands, from darkest to lightest, depict the 30%, 60% and 90% probabilities that the outcome of HICP inflation will fall within the respective intervals. For more information, see Box 6 of the March 2023 ECB staff macroeconomic projections for the euro area.

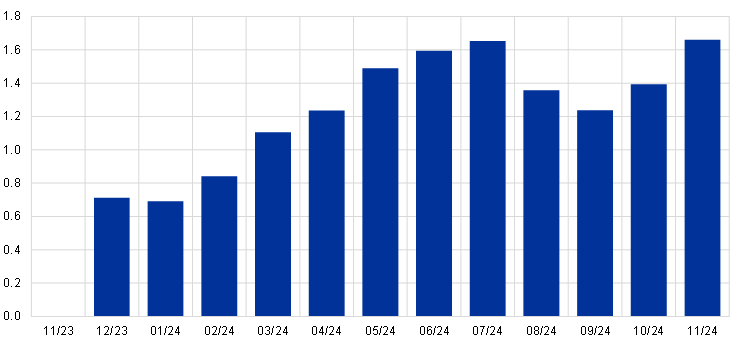

Chart 5

Cumulative impact of base effects from the energy component on headline HICP inflation from November 2023

(percentage points)

Sources: Eurostat and ECB calculations.

Notes: Base effects refer to the impact on changes in the annual inflation rate owing to exceptional price movements 12 months ago relative to a long-term average month-on-month rate. The cumulative impact of base effects is shown relative to a specific reference month. For example, energy base effects would imply a 1.6 percentage point increase in headline HICP inflation in June 2024 compared with the inflation rate in November 2023. While the cumulative base effects shown in this chart are positive, HICP inflation is projected to decline during 2024 (see Chart 4) as the declines in the annual inflation rates for the food and HICPX components more than offset the base effect-driven upward movement in HICP energy inflation.

Energy inflation is projected to temporarily rise strongly, before declining again in the second half of 2024 and moving to around zero in 2025 and 2026. The increase in the annual energy inflation rate in the near term reflects predominantly an upward base effect for December 2023 (Chart 5) and the reversal of energy inflation compensatory fiscal measures in 2024 (with a particularly strong impact on gas and electricity prices). Changes in these measures from December 2023 are estimated to lift headline HICP inflation in 2024 by around 0.4 percentage points. The upward impacts from base effects and the expiry of government measures are likely to more than offset recent declines in energy commodity prices (oil, gas and electricity prices), as well as in carbon emission prices. Once these impacts fade, the slight downward trend in energy commodity price futures is seen to be the main driver of a slight decline in HICP energy inflation towards the end of the projection horizon.

Food inflation is projected to decline sharply in the course of 2024, owing to easing pipeline price pressures, and to decrease more gradually thereafter. Food inflation is envisaged to continue its recent significant decline, falling from a still elevated level of 6.9% in November 2023 to stand at 2.6% in the last quarter of 2024. This reflects a significant easing in pipeline pressures owing to decreases in food and energy commodity prices. Thereafter, food inflation is expected to gradually slow to 2.3% in 2026, which is still somewhat above the long-term pre-COVID-19 average rate of 2.1%, as continued high labour cost pressures are envisaged to prevent a faster unwinding.

Chart 6

Euro area HICP inflation – decomposition into the main components

(annual percentage changes, percentage points)

Note: The vertical line indicates the start of the current projection horizon.

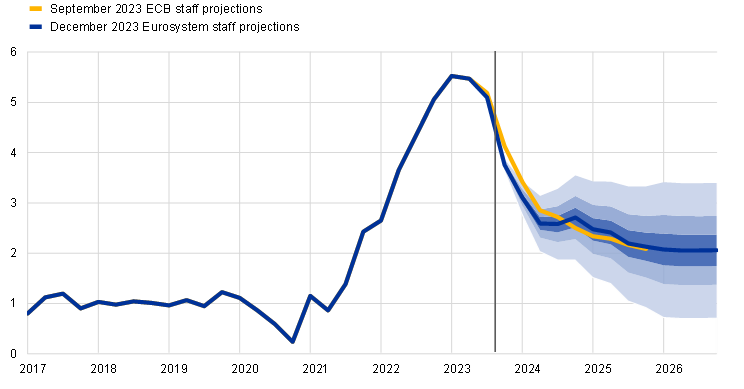

HICPX inflation is expected to gradually decline over the projection horizon (Chart 7). It is envisaged to fall from 3.6% in November 2023 to 2.7% in the fourth quarter of 2024 and then to decline further to average rates of 2.3% and 2.1% in 2025 and 2026. Over the near term, receding pipeline price pressures are expected to have a strong downward impact, whereas elevated labour cost pressures are expected to support HICPX inflation. The profile for HICPX inflation over the whole projection horizon reflects fading impacts from earlier pipeline pressures and supply bottlenecks, the normalisation of demand after post-COVID-19 reopening effects, and the ECB’s monetary policy tightening. A faster decline in HICPX inflation over the horizon is hindered by declining but still elevated upward pressures from labour cost developments which are seen to be only partially buffered by unit profits.

Chart 7

Euro area HICP inflation excluding energy and food

(annual percentage changes)

Notes: The vertical line indicates the start of the current projection horizon. The ranges shown around the central projections for HICPX inflation are based on past projection errors, after adjustment for outliers. The bands, from darkest to lightest, depict the 30%, 60% and 90% probabilities that the outcome of HICPX inflation will fall within the respective intervals. For more information, see Box 6 of the March 2023 ECB staff macroeconomic projections for the euro area.

Compared with the September 2023 projections, the outlook for HICP inflation has been revised down by 0.2 percentage points for 2023 and by 0.5 percentage points for 2024, but it is unrevised for 2025. The downward revision for 2024 is mainly due to recent data surprises in the energy and HICPX components, together with lower futures for energy commodity prices. Over the course of 2024 higher domestic cost pressures (reflected in an upward revision to unit labour cost growth) and the assumed depreciation of the euro are expected to gradually gain traction and eventually dominate, leading to a slight upward revision to HICPX inflation for 2025. However, headline inflation is unrevised for 2025, as the upward revision to HICPX inflation is seen to be offset by downward revisions to energy inflation, owing to the slightly steeper downward-sloping oil and gas price futures curves.

Table 4

Price and cost developments for the euro area

(annual percentage changes)

December 2023 | September 2023 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

2022 | 2023 | 2024 | 2025 | 2026 | 2022 | 2023 | 2024 | 2025 | |

HICP | 8.4 | 5.4 | 2.7 | 2.1 | 1.9 | 8.4 | 5.6 | 3.2 | 2.1 |

HICP energy | 37.0 | -1.9 | 1.2 | 0.3 | -0.1 | 37.0 | -1.3 | 5.6 | 1.4 |

HICP food | 9.0 | 10.9 | 3.2 | 2.5 | 2.3 | 9.0 | 10.9 | 3.1 | 2.3 |

HICP excluding energy | 5.1 | 6.3 | 2.8 | 2.4 | 2.1 | 5.1 | 6.4 | 2.9 | 2.2 |

HICP excluding energy and food | 3.9 | 5.0 | 2.7 | 2.3 | 2.1 | 3.9 | 5.1 | 2.9 | 2.2 |

HICP excluding energy, food and changes in indirect taxes1) | 3.9 | 5.0 | 2.7 | 2.3 | 2.1 | 3.9 | 5.1 | 2.9 | 2.2 |

GDP deflator | 4.6 | 5.6 | 2.9 | 2.5 | 1.9 | 4.6 | 5.7 | 3.1 | 2.5 |

Import deflator | 17.4 | -2.9 | 1.0 | 2.3 | 2.0 | 17.4 | -2.2 | 1.6 | 1.7 |

Unit labour costs | 3.3 | 6.1 | 4.1 | 2.6 | 2.0 | 3.2 | 5.8 | 3.5 | 2.4 |

Compensation per employee | 4.4 | 5.3 | 4.6 | 3.8 | 3.3 | 4.3 | 5.3 | 4.3 | 3.8 |

Labour productivity2) | 1.1 | -0.8 | 0.4 | 1.1 | 1.2 | 1.1 | -0.5 | 0.8 | 1.3 |

Notes: The GDP and import deflators, unit labour costs, compensation per employee and labour productivity refer to seasonally and working day-adjusted data. Historical data may differ from the latest Eurostat publications owing to data releases after the cut-off date for the projections. Data are available for downloading, also at quarterly frequency, from the Macroeconomic Projection Database on the ECB website.

1) The sub-index is based on estimates of actual impacts of indirect taxes. This may differ from Eurostat data, which assume a full and immediate pass-through of indirect tax impacts to the HICP.

2) Measured as real GDP per person employed.

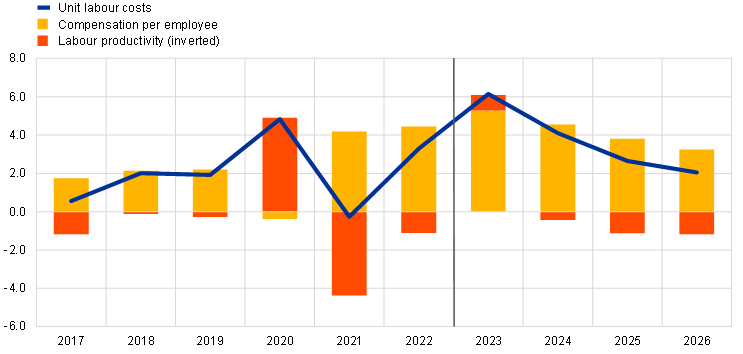

While nominal wage growth is expected to remain strong, supported by still tight labour markets, it is projected to gradually decline over time, as pressure linked to inflation compensation and increases in minimum wages fades. Growth in compensation per employee is projected to decline from 5.3% in 2023 to 3.3% in 2026. Compared with the September projections, the growth rate has been revised up for 2024 but is unrevised for 2025. The upward revision for 2024 reflects a tighter labour market and expected stronger increases in negotiated wages in the near term. Stronger wage growth also implies that losses in purchasing power incurred since the surge in inflation are expected to be recovered by the end of 2024, which is slightly earlier than expected in the September projections. Growth in unit labour costs is expected to have peaked and is projected to decline notably, benefitting in part from the projected rise in productivity growth (Chart 8), which is nonetheless expected to remain below the level implied by the historical trend.

Chart 8

Decomposition of euro area unit labour costs

(annual percentage changes; percentage points)

Note: The vertical line indicates the start of the current projection horizon.

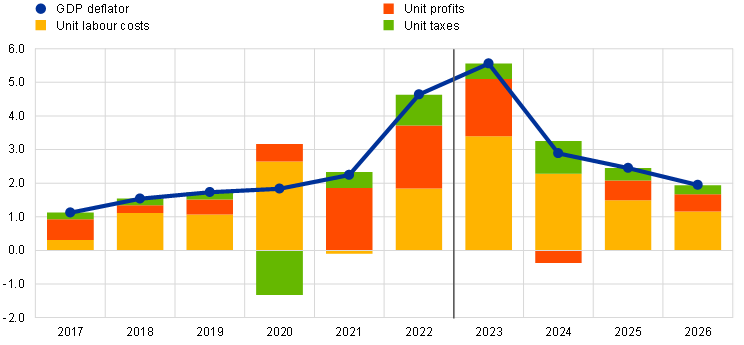

Domestic price pressures, as measured by the growth of the GDP deflator, are projected to decrease gradually from their current historical highs as first profit growth and then unit labour cost growth declines (Chart 9). The annual growth rate of the GDP deflator peaked at 6.1% in the first half of 2023 and is projected to recede quickly to 2.6% by the end of 2024, before declining more gradually thereafter to an average of 1.9% in 2026. Unit profit growth also peaked in early 2023 and is projected to turn negative in 2024. Such a profile implies that from the second half of 2023 profits will in part buffer the relatively strong labour cost growth.[8] As growth in unit labour costs moderates, unit profit growth will strengthen from 2025, supported by an improving growth outlook and recovering productivity growth.

Chart 9

Euro area GDP deflator – income side decomposition

(annual percentage changes, percentage points)

Note: The vertical line indicates the start of the current projection horizon.

Following a surge in 2022, the annual growth rate of import prices declined into negative territory in 2023, but is expected to rebound as base effects from commodity prices fade before normalising later in the horizon. Growth in the import deflator is expected to have dropped sharply from 17.4% in 2022 to -2.9% in 2023. It is then expected to turn positive and stand at 1.0% in 2024 and 2.3% in 2025, before moderating to 2.0% in 2026 broadly in line with the projected path for export competitors’ prices (Box 2).

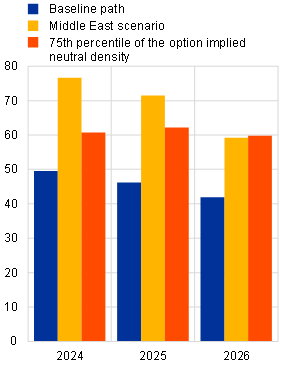

Box 4

Sensitivity analysis: alternative energy and food price paths

Given the significant uncertainty surrounding future energy commodity price developments, the implications for the economic outlook of assuming alternative paths for oil and gas commodity prices are assessed in this analysis. While the staff projections are based on the technical assumptions outlined in Box 1, in this analysis alternative downside and upside paths are derived from the 25th and 75th percentiles of the options-implied neutral densities for both oil and gas prices on 23 November 2023 (the cut-off date for the technical assumptions). Both the oil and gas price distributions point to upside risks to the technical assumptions entailed in the December 2023 projections, as the baseline assumptions are closer to the 25th percentiles than to the 75th percentiles. These risks are very pronounced in the case of gas price futures. In addition, a constant price assumption is considered for both oil and gas prices. In each case, a synthetic energy price index (a weighted average of the oil and gas price paths) is computed and the impacts of the alternative paths are assessed with a range of ECB and Eurosystem macroeconomic models used in the projections. The average impacts on real GDP growth and HICP inflation across these models are shown in Table A.

Table A

Impacts of alternative energy price paths

Path 1: 25th percentile | Path 2: 75th percentile | Path 3: constant prices | |||||||

|---|---|---|---|---|---|---|---|---|---|

2024 | 2025 | 2026 | 2024 | 2025 | 2026 | 2024 | 2025 | 2026 | |

(deviation from baseline levels, percentages) | |||||||||

Oil prices | -16.5 | -26.6 | -30.4 | 13.2 | 21.7 | 28.7 | 7.1 | 12.1 | 16.6 |

Gas prices | -20.5 | -31.2 | -33.3 | 25.3 | 44.7 | 56.0 | -8.1 | -1.4 | 18.1 |

Synthetic energy price index | -17.7 | -25.8 | -27.5 | 22.6 | 34.4 | 42.5 | 0.7 | 6.5 | 17.1 |

(deviations from baseline growth rates, percentage points) | |||||||||

Real GDP growth | 0.1 | 0.2 | 0.1 | -0.1 | -0.2 | -0.1 | 0.0 | 0.0 | 0.0 |

HICP inflation | -0.7 | -0.7 | -0.4 | 0.8 | 0.9 | 0.7 | 0.1 | 0.2 | 0.4 |

Notes: In this sensitivity analysis, a synthetic energy price index that combines oil and gas futures prices is used. The 25th and 75th percentiles refer to the option-implied neutral densities for the oil and gas prices on 23 November 2023. The constant oil and gas prices take the respective value as at the same date. The macroeconomic impacts are reported as averages of a number of ECB and Eurosystem staff macroeconomic models.

A similar sensitivity analysis is conducted with alternative paths for international food prices, which are slightly tilted to the upside. This analysis assumes that from the first quarter of 2024 international food commodity prices for wheat and maize follow the 10th and 90th percentiles of option-implied prices on 23 November 2023. The distributions are slightly tilted to the upside, likely reflecting a combination of climate change-related risks and the El Niño phenomenon which might amplify the frequency of extreme weather events resulting from climate change in general, as well as continued uncertainty about global grain supplies stemming from the war in Ukraine. The impacts of the alternative paths on the euro area inflation projections are assessed using elasticities from the Eurosystem macroeconomic models used in the projections and are shown in Table B. The impacts on euro area real GDP growth from these alternative food price paths would be negligible.

Table B

Impacts of alternative food price paths

(deviations from baseline growth rates, percentage points)

Path 1: 10th percentile | Path 2: 90th percentile | |||||

|---|---|---|---|---|---|---|

2024 | 2025 | 2026 | 2024 | 2025 | 2026 | |

International wheat price | -14.2 | -9.1 | 0.4 | 24.3 | 4.9 | 0.1 |

International maize price | -14.6 | -7.7 | -0.6 | 22.8 | 11.5 | 4.5 |

HICP inflation | -0.1 | -0.1 | -0.1 | 0.1 | 0.2 | 0.1 |

Notes: In this sensitivity analysis, the 10th and 90th percentiles refer to the option-implied neutral densities for the wheat and maize prices on 23 November 2023. The paths from option-implied densities are transformed into an impact on euro area farm gate prices. The macroeconomic impacts are computed using elasticities from the Eurosystem macroeconomic models used in the projections.

Box 5

Comparison with forecasts by other institutions and the private sector

The December 2023 Eurosystem staff projections are largely within the range of other forecasts. The Eurosystem staff growth projection for 2024 is above the most recent survey of private sector forecasts published by Consensus Economics, but below the forecasts of other international institutions. It is in the middle of a narrower range for 2025, and for 2026 it is at the bottom of the range of the few forecasts available for that year. As regards HICP inflation, the Eurosystem staff projection for 2024 is in the lower part of the range, above the December Consensus Economics forecast, and below those of the international institutions. For 2025, it is in the middle of the range while for 2026, it is slightly below the other available forecasts for that year.

Table

Comparison of recent forecasts for euro area real GDP growth and HICP inflation

(annual percentage changes)

| Date of release | Real GDP growth | HICP inflation | ||||

|---|---|---|---|---|---|---|---|

2024 | 2025 | 2026 | 2024 | 2025 | 2026 | ||

Eurosystem staff projections | December 2023 | 0.8 | 1.5 | 1.5 | 2.7 | 2.1 | 1.9 |

Consensus Economics | December 2023 | 0.5 | 1.4 | 1.5 | 2.4 | 1.9 | 2.0 |

OECD | November 2023 | 0.9 | 1.5 | - | 2.9 | 2.3 | - |

European Commission | November 2023 | 1.2 | 1.6 | - | 3.2 | 2.2 | - |

Survey of Professional Forecasters | October 2023 | 0.9 | 1.5 | - | 2.7 | 2.1 | - |

IMF | October 2023 | 1.2 | 1.8 | 1.7 | 3.3 | 2.2 | 2.0 |

Sources: Consensus Economics Forecasts, 7 December 2023 (data for 2025 and 2026 are taken from the October 2023 survey); OECD November 2023 Economic Outlook 114, 29 November 2023; European Commission Autumn 2023 Economic Forecast, 15 November 2023; ECB Survey of Professional Forecasters, 27 October 2023; IMF World Economic Outlook, 10 October 2023.

Notes: These forecasts are not directly comparable with one another or with the Eurosystem staff macroeconomic projections, as these were finalised at different points in time. Additionally, these projections use different methods to derive assumptions for fiscal, financial and external variables, including oil, gas and other commodity prices. The Eurosystem staff macroeconomic projections report working day-adjusted annual growth rates for real GDP, whereas the European Commission and the IMF report annual growth rates that are not adjusted for the number of working days per annum. Other forecasts do not specify whether they report working day-adjusted or non-working day-adjusted data.

© European Central Bank, 2023

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

PDF ISBN 978-92-899-5765-6, ISSN 2529-4687, doi:10.2866/915826, QB-CF-23-002-EN-N

HTML ISBN 978-92-899-5771-7, ISSN 2529-4687, doi:10.2866/682, QB-CF-23-002-EN-Q

The cut-off date for technical assumptions, such as those for oil prices and exchange rates, was 23 November 2023. The projections for the global economy were finalised on 23 November and the macroeconomic projections for the euro area were finalised on 30 November 2023. The HICP flash estimate for November 2023 was included in the projections. The current projection exercise covers the period 2023-26. Projections over such a long horizon are subject to very high uncertainty, and this should be borne in mind when interpreting them. See the article entitled “The performance of the Eurosystem/ECB staff macroeconomic projections since the financial crisis”, Economic Bulletin, Issue 8, ECB, 2019. For an accessible version of the data underlying selected tables and charts, see http://www.ecb.europa.eu/pub/projections/html/index.en.html. A full database of past ECB and Eurosystem staff macroeconomic projections is available from the Macroeconomic Projection Database on the ECB website. This database also includes more variables than are presented in this report and many at quarterly frequency.

Eurostat released national accounts data on 7 December 2023, after the cut-off date for the December 2023 projections. It included, inter alia, a downward revision of the figure for quarterly growth in the second quarter of 2023 from 0.2% to 0.1%.

See the box entitled “A model-based assessment of the macroeconomic impact of the ECB’s monetary policy tightening since December 2021”, Economic Bulletin, Issue 3, ECB, 2023.

The assumption for euro area ten-year nominal government bond yields is based on the weighted country average of ten-year benchmark bond yields, weighted by annual GDP figures and extended by the forward path derived from the ECB’s euro area all-bonds ten-year par yield, with the initial discrepancy between the two series kept constant over the projection horizon. The spreads between country-specific government bond yields and the corresponding euro area average are assumed to be constant over the projection horizon.

The technical assumptions for commodity prices are based on the path implied by futures markets, taking the average of the two-week period ending on the cut-off date of 23 November 2023.

References to world and/or global aggregates of economic indicators throughout this box exclude the euro area.

The fiscal stance is also adjusted for NGEU grants. See the notes to Table 3.

For more information on the GDP deflator decomposition and the role of unit profits for inflation analysis, see the box by E. Hahn, entitled “How have unit profits contributed to the recent strengthening of euro area domestic price pressures?”, Economic Bulletin, Issue 4, ECB, 2023; as well as Arce, O., Hahn, E. and Koester, G., “How tit-for-tat inflation can make everyone poorer”, ECB Blog, 30 March 2023.

- 14 December 2023

- 28 December 2023