Development of the euro area monetary financial institutions sector

On 1 January 2007 the total number of monetary financial institutions (MFIs [1] ) resident in the countries of the euro area stood at 7,646. Of these MFIs, more than 80% were credit institutions and most of the remainder were money market funds. Since 1 January 1999 the number of MFIs in the euro area has decreased by 22% (2,210 MFIs), despite the enlargement of the euro area on 1 January 2001 and 1 January 2007. Two countries (Germany and France) account for almost 50% of all euro area MFIs.

The European Central Bank (ECB) is today publishing updated versions of the “List of monetary financial institutions” and the “List of monetary financial institutions and institutions subject to minimum reserves” on its website. Both lists relate to the MFI sectors of the euro area and the European Union as at 1 January 2007.

The “List of monetary financial institutions” serves as a register and is updated on a daily basis on the ECB’s website. From 1 January 2007 it classifies MFIs resident in Slovenia as euro area MFIs and categorises MFIs resident in Bulgaria and Romania as European Union MFIs. The “List of monetary financial institutions and institutions subject to minimum reserves” is updated on the last business day of every month on the ECB’s website.

Number of MFIs

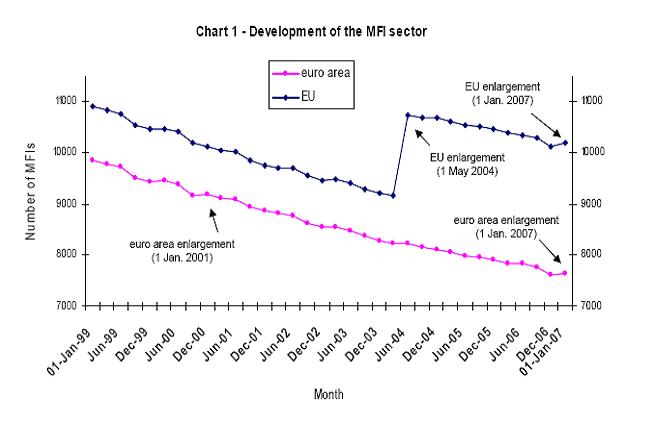

- On 1 January 2007 there were 7,646 MFIs resident in the euro area. This represents a decrease of 264 units (3.4%) compared with 1 January 2006. At the start of Stage Three of Economic and Monetary Union on 1 January 1999 there were 9,856 MFIs in the euro area. This represents a net decrease of 2,210 units (22.4%) in eight years, despite the inclusion of 105 MFIs when the euro was adopted by Greece on 1 January 2001 and 30 MFIs when the euro was adopted by Slovenia on 1 January 2007. This trend is clearly visible in Chart 1 below.

- Similarly, the number of MFIs resident in the European Union declined from 10,909 on 1 January 1999 to 10,191 on 1 January 2007, despite the inclusion of 1,608 MFIs on 1 May 2004, when ten new Member States acceded to the European Union, and the inclusion of 72 MFIs on 1 January 2007, when Bulgaria and Romania joined the EU.

Structure of the MFI sector

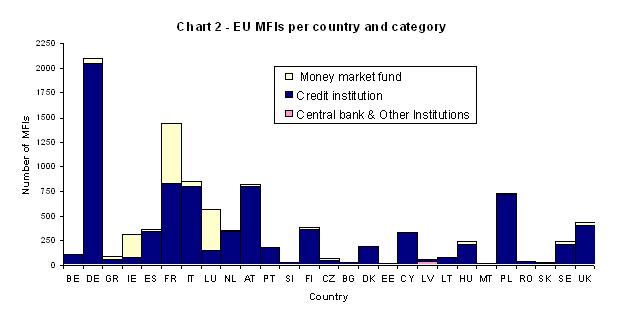

- On 1 January 2007 credit institutions accounted for 80.5% (6,157 units) of all euro area MFIs, while money market funds accounted for 19.3% (1,472 units). Central banks including the ECB (14 units), and other institutions (3 units), together accounted for 0.2% of all euro area MFIs.

- In the European Union as a whole, the shares of credit institutions and money market funds were 83.5% and 15.7% respectively.

Country breakdown

- On 1 January 2007 two countries accounted for almost 50% (3,546) of all MFIs in the euro area: Germany (27%) and France (19%). Italy and Austria each accounted for around 11% of the euro area total. While Ireland is the only euro area country where the number of MFIs has increased in the past eight years, the largest decreases in relative terms have occurred in Spain and the Netherlands (declines of 29% and 27% respectively between 2004 and 2007).

- Among the non-euro area countries, Poland has by far the largest number of MFIs (729), representing 7% of European Union MFIs. The United Kingdom and Cyprus have 440 and 337 respectively. In the last three years the number of MFIs has notably increased in Malta (by 35%), Latvia (by 25%) and Slovakia (by 21%), while the largest decreases in relative terms have occurred in the Czech Republic and Cyprus (declines of 16% and 18% respectively).

Table 1 - Number of MFIs per country and percentage changes in recent periods

| Number of MFIs | Percentage changes | ||||||

|---|---|---|---|---|---|---|---|

| Country | 1 Jan. 1999 | 1 Jan. 2001 | 1 May 2004 | 1 Jan. 2007 | 1 Jan. 1999 to 1 Jan. 2001 | 1 Jan. 2001 to 1 May 2004 | 1 May 2004 to 1 Jan. 2007 |

| ECB | 1 | 1 | 1 | 1 | 0 | 0 | 0 |

| BE | 153 | 142 | 126 | 120 | -7 | -11 | -5 |

| DE | 3280 | 2782 | 2268 | 2106 | -15 | -18 | -7 |

| GR | 102 | 105 | 100 | 93 | 3 | -5 | -7 |

| IE | 96 | 211 | 294 | 318 | 120 | 39 | 8 |

| ES | 608 | 571 | 512 | 366 | -6 | -10 | -29 |

| FR | 1938 | 1764 | 1577 | 1440 | -9 | -11 | -9 |

| IT | 944 | 884 | 854 | 856 | -6 | -3 | 0 |

| LU | 676 | 662 | 586 | 565 | -2 | -11 | -4 |

| NL | 668 | 620 | 484 | 355 | -7 | -22 | -27 |

| AT | 910 | 866 | 827 | 822 | -5 | -5 | -1 |

| PT | 228 | 223 | 205 | 183 | -2 | -8 | -11 |

| SI | - | - | 27 | 30 | - | - | 11 |

| FI | 354 | 362 | 396 | 391 | 2 | 9 | -1 |

| CZ | - | - | 79 | 66 | - | - | -16 |

| BG | - | - | - | 33 | - | - | - |

| DK | 216 | 213 | 206 | 194 | -1 | -3 | -6 |

| EE | - | - | 25 | 26 | - | - | 4 |

| CY | - | - | 409 | 337 | - | - | -18 |

| LV | - | - | 52 | 65 | - | - | 25 |

| LT | - | - | 74 | 80 | - | - | 8 |

| HU | - | - | 238 | 241 | - | - | 1 |

| MT | - | - | 17 | 23 | - | - | 35 |

| PL | - | - | 659 | 729 | - | - | 11 |

| RO | - | - | - | 39 | - | - | - |

| SK | - | - | 28 | 34 | - | - | 21 |

| SE | 179 | 177 | 255 | 238 | -1 | 44 | -7 |

| UK | 556 | 541 | 457 | 440 | -3 | -16 | -4 |

| Euro area | 9856 | 9193 | 8230 | 7646 | -7 | -10 | -7 |

| EU | 10909 | 10124 | 10756 | 10191 | -7 | 6 | -5 |

Foreign branches

- On 1 January 2007 543 branches of foreign credit institutions were resident in the euro area. These accounted for 8.8% of all euro area credit institutions. The largest percentage of such foreign branches was located in Germany (17%), with Italy and Spain following closely behind with approximately 13% each. Belgium had the largest number of foreign branches as a percentage of total credit institutions in the country (50%). For the majority of foreign branches in euro area countries, the head office was located either in another euro area country (68%) or in the United Kingdom (15%).

- 212 branches of foreign credit institutions were resident in non-euro area countries on 1 January 2007. Of these, the largest percentage was resident in the United Kingdom (39%). The head offices of the majority of foreign branches in non-euro area countries were located either in euro area countries (61%) or in other non-euro area EU Member States (25%).

The “List of monetary financial institutions” and the “List of monetary financial institutions and institutions subject to minimum reserves” can be downloaded from the “Statistics” section of the ECB’s website, under “Money, banking and financial markets / List of Monetary Financial Institutions / MFI data access” (http://www.ecb.europa.eu/stats/money/mfi/elegass/html/index.en.html).

-

[1] Monetary financial institutions are credit institutions as defined in Community law and other resident financial institutions whose business is to receive deposits and/or close substitutes for deposits from entities other than MFIs, and to grant credit and/or make investments in securities on their own account.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts